Selecta Biosciences, Inc. (NASDAQ: SELB) (the Company) today

announced that it has merged with Cartesian Therapeutics, Inc., a

clinical-stage biotechnology company pioneering RNA cell therapies

for autoimmune diseases. In connection with the merger, Selecta

announced a $60.25 million private financing led by Timothy A.

Springer, Ph.D., member of the Selecta Board of Directors.

With the cash from both companies at closing and

the proceeds of the concurrent private financing, the combined

company is expected to have over $110 million on hand to support

the development of the Cartesian pipeline through the Phase 3 study

of lead product candidate, Descartes-08, a potential first-in-class

RNA-engineered chimeric antigen receptor T-cell therapy (rCAR-T)

for the treatment of MG, as well as the advancement of additional

RNA cell therapy programs.

Concurrent with the merger, the combined company

has been renamed Cartesian Therapeutics, Inc. The Company’s Nasdaq

ticker symbol will change to “RNAC” effective prior to the opening

of trading tomorrow, November 14, 2023.

“We are thrilled to announce our merger with

Cartesian, a true pioneer in the RNA cell therapy space,”

said Carsten Brunn, Ph.D., who will continue to serve as

President and Chief Executive Officer of the combined company.

“With several potential value-driving milestones expected in the

near-term, including data from the ongoing Phase 2b study of

Descartes-08 in MG expected in mid-2024, we are confident that this

merger represents a significant opportunity for Selecta

stockholders. Cartesian’s mission aligns seamlessly with Selecta’s

commitment to advancing innovative therapies for the treatment of

autoimmune diseases, and we look forward to working toward

maximizing the potential of this robust pipeline and

technology.”

“RNA cell therapy has the potential to overcome

the challenges of using conventional, costly DNA-engineered cell

therapies to treat autoimmune diseases, including their toxicity

and the need for preconditioning chemotherapy,” said Murat

Kalayoglu, M.D., Ph.D., Co-Founder and former Chief Executive

Officer of Cartesian. “With a shared vision of bringing

meaningful therapeutic options to patients with autoimmune

diseases, we are confident that our novel approach can thrive under

Carsten’s leadership.”

Cartesian’s Portfolio and

Proprietary RNA Armory® Platform

Cartesian’s internally manufactured portfolio

includes RNA cell therapies that are purposefully designed to be

administered conveniently in an outpatient setting. Cartesian’s

RNA-engineering approach has the potential to expand the reach of

cell therapy to autoimmunity with potentially safer, potent, and

less expensive therapies versus DNA analogs.

Cartesian’s proprietary technology platform, RNA

Armory®, is designed to enable precision control and optimization

of engineered cells for diverse cell therapies leveraging multiple

modalities, including autologous, allogeneic, and in vivo

transfection. In addition, Cartesian’s wholly owned,

state-of-the-art GMP manufacturing and internal research and

development capabilities potentiates the optimization of processes

in a rapid and iterative manner.

Cartesian’s wholly owned pipeline includes:

- Descartes-08 is designed to be an

autologous anti-BCMA rCAR-T. Descartes-08 is currently in clinical

development for autoimmune diseases, including MG, a chronic

autoimmune disorder that causes disabling muscle weakness and

fatigue. Compared to conventional DNA-based CAR T-cell therapies,

rCAR-T is designed to not require preconditioning chemotherapy, to

have predictable and controllable pharmacokinetics, and to avoid

the risk of genomic integration. Descartes-08 has been granted

Orphan Drug Designation by the U.S. Food and Drug Administration

for the treatment of MG.Cartesian previously reported positive data

from its Phase 2a study of 14 patients with MG who received six

weekly infusions of Descartes-08 in the outpatient setting without

preconditioning chemotherapy. In the study, the results of which

were published in The Lancet Neurology, Descartes-08 was observed

to be safe and well-tolerated and to induce deep and durable

responses. Enrollment is ongoing in a Phase 2b randomized,

double-blind, placebo-controlled trial (NCT04146051) in patients

with MG, and topline results are expected in mid-2024.Beyond MG,

initiation of a Phase 2 study of Descartes-08 in patients with

systemic lupus erythematosus, a chronic autoimmune disease that

causes systemic inflammation which affects multiple organ systems,

is expected in the first half of 2024. In addition, initiation of a

Phase 2 ocular autoimmune basket study and a Phase 2 vasculitic

autoimmune basket study is planned for mid-2024 and the second half

of 2024, respectively.

- Descartes-15 is designed to be a

next-generation, autologous anti-BCMA rCAR-T. In preclinical

studies, Descartes-15 was observed to be significantly more potent

than Descartes-08. Cartesian plans to leverage its clinical

observations to date from its Descartes-08 clinical program to

inform the clinical strategy for Descartes-15 for the treatment of

autoantibody-associated autoimmune diseases (AAAD).

- Descartes-33 is designed to be an

off-the-shelf (allogeneic) mesenchymal stem cell therapy (rMSC) for

the treatment of AAAD. In preclinical studies, Descartes-33 was

observed to induce potent degradation of disease-enabling

neutrophil extracellular traps.

Management and Organization

The combined company will be led by Selecta’s

Chief Executive Officer, Carsten Brunn, Ph.D., and current Chief

Financial Officer, Blaine Davis, as well as several members of the

legacy Cartesian team, including Metin Kurtoglu, M.D., Ph.D., as

Chief Operating Officer, Milos Miljkovic, M.D., as Chief Medical

Officer, Chris Jewell, Ph.D., as Chief Scientific Officer, and

Emily English, Ph.D., as Vice President of Quality. Matthew

Bartholomae, J.D., Selecta’s General Counsel, will continue to

serve in this role.

The combined company’s Board of Directors will

be led by current Selecta Chairman Carrie S. Cox and will include,

among others, current Selecta board member Timothy Springer, Ph.D.,

as well as Cartesian Co-Founders Murat Kalayoglu, M.D., Ph.D., and

Michael Singer, M.D., Ph.D. All members of the Selecta Board of

Directors prior to the merger will continue to serve on the Board

of Directors following the closing of the transaction.

Merger Terms

The merger was structured as a stock-for-stock

transaction pursuant to which all of Cartesian's outstanding equity

interests were exchanged based on a fixed exchange ratio for

consideration as a combination of approximately 6.7 million shares

of Selecta common stock and approximately 0.38 million shares of

Selecta Series A Non-Voting Convertible Preferred Stock (“Series A

Preferred Stock”) (or approximately 385 million shares on an

as-converted-to-common basis). Concurrently with the acquisition of

Cartesian, Selecta entered into a definitive agreement for a PIPE

investment to raise $60.25 million in which the investors will be

issued approximately 0.15 million shares of Series A Preferred

Stock (or approximately 149.3 million shares on an

as-converted-to-common basis) at a price of $403.46851 per share.

Subject to approval of the Company’s stockholders, each share of

Series A Preferred Stock will automatically convert into 1,000

shares of common stock, subject to certain beneficial ownership

limitations. On a pro forma basis, based upon the number of shares

of Selecta common stock and Series A Preferred Stock issued in the

acquisition and prior to the private financing, stockholders of

Selecta immediately prior to the acquisition will own approximately

26.9% of the Company on an as-converted basis immediately after

giving effect to this transaction. The acquisition was approved by

the Board of Directors of Selecta and the Board of Directors and

stockholders of Cartesian. The closings of the transactions are not

subject to the approval of Selecta stockholders. On an as-converted

basis, assuming the approval of the Company’s stockholders of the

conversion of the Series A Preferred Stock into common stock, and

after accounting for these transactions, the total number of shares

of Selecta common stock will be approximately 696.2 million.

In connection with the transactions, a

transferrable contingent value right (a “CVR”) will be distributed

to Selecta stockholders and holders of Selecta’s warrants issued in

2022 (the “2022 Warrants”) of record as of the close of business on

December 4, 2023, but will not be distributed to holders of shares

of common stock or Series A Preferred Stock issued to Cartesian or

the PIPE investors in the transaction. Additionally, holders of

Selecta’s warrants other than the 2022 Warrants will be entitled to

receive CVRs when and if such warrants are exercised. Holders of

the CVR will be entitled to receive certain cash payments from

proceeds received by the Company, if any, from its legacy assets,

including SEL-212, following the closing of the transaction.

Leerink Partners is serving as exclusive

financial advisor and private placement agent to Selecta. Covington

& Burling LLP is serving as legal counsel to Selecta. Foley

Hoag LLP is serving as legal counsel to Cartesian.

Conference Call and Webcast

Selecta and Cartesian will host a conference

call today, Monday, November 13, 2023, at 9:00 am ET to discuss the

merger. To access the conference call, please dial (844) 845-4170

(local) or (412) 717-9621 (international) at least 10 minutes prior

to the start time and ask to be joined into the Selecta Biosciences

call. The live audio webcast, along with accompanying slides, can

be accessed on the Events & Presentations section of Selecta’s

website at https://ir.selectabio.com/events-presentations. A replay

of the webcast will be available for a limited time following the

event on Selecta’s website.

About Cartesian

Therapeutics

Cartesian Therapeutics is a clinical-stage

company pioneering RNA cell therapies for the treatment of

autoimmune diseases. The company’s lead asset, Descartes-08, is a

potential first-in-class, RNA-engineered chimeric antigen receptor

T-cell therapy (rCAR-T) in Phase 2b clinical development for

patients with generalized myasthenia gravis, with additional Phase

2 studies planned in systemic lupus erythematosus as well as ocular

autoimmune and vasculitic autoimmune basket trials. Cartesian

operates a wholly owned, state-of-the-art cGMP manufacturing

facility in Gaithersburg, MD.

About Selecta Biosciences,

Inc.

Prior to the merger discussed herein, Selecta

Biosciences Inc. (NASDAQ: SELB) was a clinical-stage

biotechnology company leveraging its ImmTOR™ platform to develop

tolerogenic therapies that selectively mitigate unwanted immune

responses. Selecta Biosciences is headquartered in

the Greater Boston area. For more information, please

visit www.selectabio.com.

Selecta Forward-Looking

Statements

Any statements in this press release about the

future expectations, plans and prospects of Selecta

Biosciences, Inc. (the “Company”), including without

limitation, statements regarding the merger, stockholder approval

of the conversion of the Series A Preferred Stock, the filing

of a resale registration statement pursuant to the Registration

Rights Agreement, and the timing thereof, the closing and timing of

the Financing, any future payouts under the CVR, the integration of

Selecta and Cartesian following the merger, the potential of RNA

Armory to enable precision control and optimization of engineered

cells for diverse cell therapies leveraging multiple modalities,

the potential of Descartes-08, Descartes-15, Descartes-33 and the

Company’s product pipeline to treat MG, systemic lupus

erythematosus, and AAAD, or any other disease, the anticipated

timing or the outcome of ongoing and planned clinical trials,

studies and data readouts, the anticipated timing or the outcome of

the FDA’s review of the Company’s regulatory filings, the Company’s

ability to conduct its clinical trials and preclinical studies, the

timing or making of any regulatory filings, the anticipated timing

or outcome of selection of developmental product candidates, the

ability of the Company to consummate any expected agreements and

licenses, the novelty of treatment paradigms that the Company is

able to develop, the potential of any therapies developed by the

Company to fulfill unmet medical needs, the Company’s ability to

grow and maintain its strategic partnerships, and enrollment in the

Company's clinical trials and other statements containing the words

“anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,”

“hypothesize,” “intend,” “may,” “plan,” “potential,” “predict,”

“project,” “should,” “target,” “would,” and similar expressions,

constitute forward-looking statements within the meaning of The

Private Securities Litigation Reform Act of 1995. Actual results

may differ materially from those indicated by such forward-looking

statements as a result of various important factors, including, but

not limited to, the following: the uncertainties inherent in the

initiation, completion and cost of clinical trials including proof

of concept trials, including uncertain outcomes, the availability

and timing of data from ongoing and future clinical trials and the

results of such trials, whether preliminary results from a

particular clinical trial will be predictive of the final results

of that trial and whether results of early clinical trials will be

indicative of the results of later clinical trials, the ability to

predict results of studies performed on human beings based on

results of studies performed on non-human subjects, the unproven

approach of the Company’s RNA Armory® technology, potential delays

in enrollment of patients, undesirable side effects of the

Company’s product candidates, its reliance on third parties to

manufacture its product candidates and to conduct its clinical

trials, the Company’s inability to maintain its existing or future

collaborations, licenses or contractual relationships, its

inability to protect its proprietary technology and intellectual

property, potential delays in regulatory approvals, the

availability of funding sufficient for its foreseeable and

unforeseeable operating expenses and capital expenditure

requirements, the Company’s recurring losses from operations and

negative cash flows, substantial fluctuation in the price of the

Company’s common stock, risks related to geopolitical conflicts and

pandemics and other important factors discussed in the “Risk

Factors” section of the Company’s most recent Annual Report on Form

10-K and Quarterly Reports on Form 10-Q, and in other filings that

the Company makes with the Securities and Exchange Commission

(the “SEC”). In addition, any forward-looking statements included

in this press release represent the Company’s views only as of the

date of its publication and should not be relied upon as

representing its views as of any subsequent date. The Company

specifically disclaims any intention to update any forward-looking

statements included in this press release, except as required by

law.

Contact:

Investor Relations:Melissa ForstArgot

PartnersSelecta@argotpartners.com

Media: David RosenArgot

PartnersSelecta@argotpartners.com

No Offer or Solicitation; Important

Information About the Merger and Where to Find It

This press release is not a proxy statement or

solicitation of a proxy, consent or authorization with respect to

any securities or in respect of the merger and shall not constitute

an offer to sell or a solicitation of an offer to buy the

securities of Selecta or Cartesian, nor shall there be any sale of

any such securities in any state or jurisdiction in which such

offer, solicitation, or sale would be unlawful prior to

registration or qualification under the securities laws of such

state or jurisdiction. No offer of securities shall be made, except

by means of a prospectus meeting the requirements of Section 10 of

the Securities Act of 1933, as amended, or an exemption

therefrom.

The Company expects to file a proxy statement

with the SEC relating to the proposals to be voted upon at an

upcoming meeting of stockholders (the “Meeting Proposals”). The

definitive proxy statement will be sent to all Company

stockholders. Before making any voting decision, investors and

security holders of the Company are urged to read the proxy

statement and all other relevant documents filed or that will be

filed with the SEC in connection with the Meeting Proposals as they

become available because they will contain important information

about the merger agreement and related transactions and the Meeting

Proposals to be voted upon. Investors and security holders will be

able to obtain free copies of the proxy statement and all other

relevant documents filed or that will be filed with the SEC by the

Company through the website maintained by the SEC at

www.sec.gov.

Participants in

Solicitation

Selecta, Cartesian, and their respective

directors, executive officers and employees may be deemed to be

participants in the solicitation of proxies in respect of the

merger. Information regarding the Company’s directors and executive

officers is available in the Selecta’s Annual Report on Form 10-K

for the year ended December 31, 2022 filed with the SEC on March 2,

2023. Information regarding the persons who may, under the rules of

the SEC, be deemed participants in the proxy solicitation and a

description of their direct and indirect interests, by security

holdings or otherwise, will be contained in the proxy statement and

other relevant materials to be filed with the SEC when they become

available.

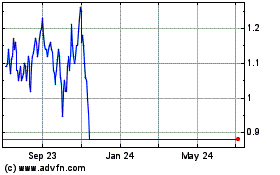

Selecta Biosciences (NASDAQ:SELB)

Historical Stock Chart

From Dec 2024 to Jan 2025

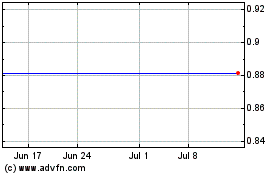

Selecta Biosciences (NASDAQ:SELB)

Historical Stock Chart

From Jan 2024 to Jan 2025