Filed Pursuant to Rule 424(b)(3)

Registration No. 333-260828

PROSPECTUS

Science

37 Holdings, Inc.

103,576,231

Shares of Common Stock

__________________________________

This prospectus relates to the offer and sale

from time to time by the selling securityholders named in this prospectus (the “Selling Securityholders”) of up to 103,576,231

shares of common stock, par value $0.0001 per share (the “common stock”), consisting of (i) up to 20,000,000 shares of

common stock (the “PIPE shares”) issued in a private placement pursuant to subscription agreements entered into on May 6,

2021; (ii) up to 2,002,260 shares of common stock originally issued in a private placement to LifeSci Holdings, LLC (the “Sponsor”)

and certain other holders of common stock of LifeSci Acquisition II Corp. (“LSAQ”); (iii) up to 3,146,453 shares originally

issued to the Sponsor in exchange for private warrants in connection with the Business Combination (as defined below); and (iv) up

to 78,427,518 shares of common stock issued or issuable to certain former stockholders and other securityholders of Legacy Science 37

(as defined below) in connection with or as a result of the consummation of the Business Combination, consisting of (a) up to 56,977,921

shares of common stock, (b) up to 12,500,000 shares of common stock (the “Earn-Out Shares”) that holders have the contingent

right to receive upon the achievement of certain stock price-based vesting conditions, and (c) 8,949,597 shares of common stock that

may be issued upon exercise of outstanding options.

On October 6, 2021, we consummated the

business combination (the “Business Combination”), contemplated by the Agreement and Plan of Merger, dated May 6, 2021,

by and among LSAQ, a Delaware corporation, LifeSci Acquisition II Merger Sub, Inc., a Delaware corporation and wholly-owned subsidiary

of LSAQ (“Merger Sub”), and Science 37, Inc., a Delaware corporation (“Legacy Science 37”) (the “Merger

Agreement”). Pursuant to the Merger Agreement, Merger Sub was merged with and into Legacy Science 37, with Legacy Science 37 surviving

the merger as a wholly owned subsidiary of LSAQ. Upon the closing of the Business Combination (the “Closing”), we changed

our name from LifeSci Acquisition II Corp. to Science 37 Holdings, Inc.

We will not receive any proceeds from the

sale of the shares by the Selling Securityholders. We will bear all costs, expenses and fees in connection with the registration of the

shares of common stock. The Selling Securityholders will bear all commissions and discounts, if any, attributable to their sales of the

shares of common stock. The Selling Securityholders and any of their permitted transferees may offer and sell the securities covered by

this prospectus in a number of different ways and at varying prices. Additional information on the Selling Securityholders, and the times

and manner in which they may offer and sell the securities under this prospectus, is provided under “Selling Securityholders”

and “Plan of Distribution” in this prospectus.

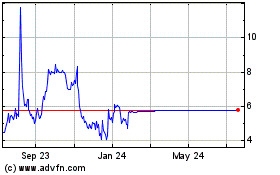

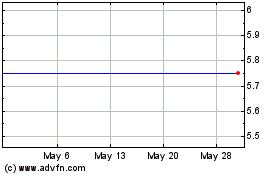

Our common stock is listed on The Nasdaq

Stock Market LLC (“Nasdaq”) under the symbol “SNCE”. On March 1, 2023, the closing sale price of our common

stock as reported on the Nasdaq was $0.3226.

We are an “emerging growth company”

as defined under U.S. federal securities laws and, as such, have elected to comply with reduced public company reporting requirements.

This prospectus complies with the requirements that apply to an issuer that is an emerging growth company.

Investing

in our securities involves a high degree of risk. You should review carefully the risks and uncertainties described in the section titled

“Risk Factors” beginning on page 10 of this prospectus, and under similar headings

in any amendments or supplements to this prospectus.

Neither the Securities and Exchange Commission

nor any state securities commission has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus.

Any representation to the contrary is a criminal offense.

The date of this prospectus

is March 8, 2023.

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement that we filed with

the Securities and Exchange Commission (the “SEC”) using the “shelf” registration process. Under this shelf registration

process, the Selling Securityholders may, from time to time, sell or otherwise distribute the securities offered by them as described

in the section titled “Plan of Distribution” in this prospectus. We will not receive any proceeds from the sale by such Selling

Securityholders of the securities offered by them described in this prospectus.

We may also file a prospectus supplement or post-effective amendment

to the registration statement of which this prospectus forms a part that may contain material information relating to these offerings.

The prospectus supplement or post-effective amendment may also add, update or change information contained in this prospectus with respect

to that offering. If there is any inconsistency between the information in this prospectus and the applicable prospectus supplement or

post-effective amendment, you should rely on the prospectus supplement or post-effective amendment, as applicable. Before purchasing any

securities, you should carefully read this prospectus, any post-effective amendment, and any applicable prospectus supplement, together

with the additional information described under the heading “Where You Can Find More Information; Incorporation by Reference.”

Neither we, nor the Selling Securityholders, have authorized anyone

to provide you with any information or to make any representations other than those contained in this prospectus, any post-effective amendment,

or any applicable prospectus supplement prepared by or on behalf of us or to which we have referred you. We and the Selling Securityholders

take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. We

and the Selling Securityholders will not make an offer to sell these securities in any jurisdiction where the offer or sale is not permitted.

You should assume that the information appearing in this prospectus, any post-effective amendment and any applicable prospectus supplement

to this prospectus is accurate only as of the date on its respective cover and that any information incorporated by reference is accurate

only as of the date of the document incorporated by reference, unless we indicate otherwise. Our business, financial condition, results

of operations and prospects may have changed since those dates. This prospectus incorporates by reference, and any post-effective amendment

or any prospectus supplement may contain or incorporate by reference, market data and industry statistics and forecasts that are based

on independent industry publications and other publicly available information. Although we believe these sources are reliable, neither

we nor the Selling Securityholders guarantee the accuracy or completeness of this information and neither we nor the Selling Securityholders

have independently verified this information. In addition, the market and industry data and forecasts that may be included or incorporated

by reference in this prospectus, any post-effective amendment or any prospectus supplement may involve estimates, assumptions and other

risks and uncertainties and are subject to change based on various factors, including those discussed under the heading “Risk Factors”

contained in this prospectus, any post-effective amendment and the applicable prospectus supplement, and under similar headings in other

documents that are incorporated by reference into this prospectus. Accordingly, investors should not place undue reliance on this information.

We own or have rights to trademarks, trade names and service marks

that we use in connection with the operation of our business. In addition, our name, logos and website name and address are our trademarks

or service marks. Solely for convenience, in some cases, the trademarks, trade names and service marks referred to in this prospectus

are listed without the applicable ®, ™ and SM symbols, but we will assert, to the fullest extent under applicable law, our rights

to these trademarks, trade names and service marks. Other trademarks, trade names and service marks appearing in this prospectus are the

property of their respective owners.

As used in this prospectus, unless otherwise indicated or the context

otherwise requires, references to “we,” “us,” “our,” the “Company” and “Science

37” refer to the consolidated operations of Science 37 Holdings, Inc. and its subsidiaries. References to “LSAQ”

refer to the Company prior to the consummation of the Business Combination and references to “Legacy Science 37” refer to

Science 37, Inc. prior to the consummation of the Business Combination.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus and the documents incorporated by reference herein

and any prospectus supplement delivered with this prospectus may contain forward-looking statements. We intend such forward-looking statements

to be covered by the safe harbor provisions for forward-looking statements contained in Section 27A of the Securities Act of 1933,

as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange

Act”). All statements other than statements of historical facts contained or incorporated by reference in this prospectus, including,

but not limited to, statements regarding our future results of operations and financial position, business strategy, plans and prospects,

existing and prospective products, research and development costs, timing and likelihood of success, and plans and objectives of management

for future operations and results, are forward-looking statements. These forward-looking statements can generally be identified by the

use of forward-looking terminology, including the terms “believes,” “can,” “could,” “estimates,”

“anticipates,” “expects,” “seeks,” “projects,” “intends,” “plans,”

“may,” “might,” “should,” “will” or “would” or, in each case, their negative

or other variations or comparable terminology, although not all forward-looking statements contain these identifying words. These statements

involve known and unknown risks, uncertainties and other important factors that may cause our actual results, performance or achievements

to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements.

Factors that may impact such forward-looking statements include:

| • | expectations regarding the Company’s strategies and future financial performance, including its future business plans or objectives,

prospective performance and opportunities and competitors, revenues, backlog conversion, products and services, pricing, operating expenses,

market trends, liquidity, cash flows and uses of cash, capital expenditures, and ability to invest in growth initiatives and pursue acquisition

opportunities; |

| • | risks related to the Company’s technology, intellectual property, data privacy and cybersecurity practices; |

| • | risks related to the Company’s reliance on third parties; |

| • | risks related to general economic and financial market conditions, including the impact of ongoing supply chain disruptions and inflationary

cost pressures and the possibility of an economic recession; political, legal and regulatory environment; and the industries in which

the Company operates; |

| • | the risk that the Company will need to raise additional capital to execute its business plan, which may not be available on acceptable

terms or at all; |

| • | limited liquidity and trading of the Company’s securities; |

| • | volatility in the price of Science 37’s securities due to a variety of factors, including changes in the competitive and highly

regulated industries in which Science 37 operates, variations in performance across competitors and changes in laws and regulations affecting

Science 37’s business; |

| • | geopolitical risk and changes in applicable laws or regulations; |

| • | the possibility that the Company may be adversely affected by other economic, business, and/or competitive factors; |

| • | litigation and regulatory enforcement risks, including the diversion of management time and attention and the additional costs and

demands resulting therefrom on the Company’s resources. |

Forward-looking statements contained in this

prospectus are based on the Company’s current expectations and beliefs and are based upon information available to us as of the

date of this prospectus, and while we believe such information forms a reasonable basis for such statements, that information may be limited

or incomplete. Our forward-looking statements should not be read to indicate that we have conducted an exhaustive inquiry into, or review

of, all relevant information. These forward-looking statements involve a number of risks, uncertainties (some of which are beyond the

Company’s control) or other assumptions that may cause actual results or performance to be materially different from those expressed

or implied by these forward-looking statements. Forward-looking statements are inherently uncertain, and investors are cautioned not to

unduly rely upon these statements.

These risks and uncertainties include, but

are not limited to, those factors discussed under the heading “Risk Factors” below. Should one or more of these risks or uncertainties

materialize, or should any of the assumptions prove incorrect, actual results may vary in material respects from those projected in these

forward-looking statements. Furthermore, we operate in an evolving environment. New risk factors and uncertainties may emerge from time

to time, and it is not possible for management to predict all risk factors and uncertainties.

We qualify all of our forward-looking statements

by these cautionary statements. The Company will not and does not undertake any obligation to update or revise any forward-looking statements,

whether as a result of new information, future events or otherwise, except as may be required by law.

WHERE YOU CAN FIND MORE INFORMATION; INCORPORATION

BY REFERENCE

Available Information

We have filed with the SEC a registration statement under the Securities

Act with respect to the shares of common stock offered hereby. This prospectus and any applicable prospectus supplement constitute a part

of the registration statement, but do not contain all of the information set forth in the registration statement or the exhibits and schedules

filed therewith. For further information about us and the common stock offered hereby, we refer you to the registration statement and

the exhibits and schedules filed thereto. Statements contained in this prospectus or any prospectus supplement regarding the contents

of any contract or any other document that is filed as an exhibit to the registration statement are not necessarily complete, and each

such statement is qualified in all respects by reference to the full text of such contract or other document filed as an exhibit to the

registration statement. We file periodic reports, proxy statements, and other information with the SEC pursuant to the Exchange Act. The

SEC maintains an Internet website that contains reports, proxy and information statements and other information about registrants, like

us, that file electronically with the SEC. The address of that site is www.sec.gov.

We also maintain an internet website at www.science37.com. Through

our website, we make available, free of charge, the following documents as soon as reasonably practicable after they are electronically

filed with, or furnished to, the SEC: our quarterly reports on Form 10-Q, annual reports on Form 10-K, current reports on Form 8-K,

and all amendments to those reports. The information contained on, or that may be accessed through, our website is not part of, and is

not incorporated into, this prospectus.

Incorporation by Reference

The SEC’s rules allow us to “incorporate by reference”

information into this prospectus, which means that we can disclose important information to you by referring you to another document filed

separately with the SEC. The information incorporated by reference is deemed to be part of this prospectus, and subsequent information

that we file with the SEC will automatically update and supersede that information. Any statement contained in this prospectus or a previously

filed document incorporated by reference will be deemed to be modified or superseded for purposes of this prospectus to the extent that

a statement contained in this prospectus or a subsequently filed document incorporated by reference modifies or replaces that statement.

This prospectus and any accompanying prospectus supplement incorporate

by reference the documents set forth below that have previously been filed with the SEC:

| • | the description of our common stock set forth in Exhibit 4.1

of our Annual Report on Form 10-K for the fiscal year ended December 31, 2021, together with any amendment or report filed with

the SEC for the purpose of updating such description. |

Notwithstanding the foregoing, information furnished under Items 2.02

and 7.01 of any Current Report on Form 8-K, including the related exhibits under Item 9.01, is not incorporated by reference in this

prospectus or any prospectus supplement.

All reports and other documents we subsequently file pursuant to Section 13(a),

13(c), 14 or 15(d) of the Exchange Act, prior to the termination of this offering, including all such documents we may file with

the SEC after the date of the initial registration statement of which this prospectus forms a part and prior to the effectiveness of the

registration statement, but excluding any information furnished to, rather than filed with, the SEC, will also be incorporated by reference

into this prospectus and deemed to be part of this prospectus from the date of the filing of such reports and documents.

You may obtain any of the documents incorporated by reference in this

prospectus from the SEC through the SEC’s website at the address provided above. You also may request a copy of any document incorporated

by reference in this prospectus (excluding any exhibits to those documents, unless the exhibit is specifically incorporated by reference

in this document), at no cost, by writing or telephoning us at the following address and phone number:

Science 37 Holdings, Inc.

Attn: Secretary

800 Park Offices Drive, Suite 3606

Research Triangle Park, North Carolina 27709

(984) 377-3737

SUMMARY

This summary highlights selected information from this prospectus

and does not contain all of the information that is important to you in making an investment decision. This summary is qualified in its

entirety by the more detailed information included in or incorporated by reference into this prospectus. Before making your investment

decision with respect to our securities, you should carefully read this entire prospectus, any applicable prospectus supplement and the

documents referred to in the section of this prospectus entitled “Where You Can Find More Information; Incorporation by Reference.”

Overview

Science 37 pioneered the concept of patient-centric clinical trials

with a very simple premise: that clinical trials should begin with the patient.

Through its patient-centric approach, Science 37 reduces the impact

of the geographic barriers associated with conventional physical clinical trial sites, enabling recruitment of virtually any patient.

Science 37 believes that centering the clinical trial around the patient with personalized support addresses current industry needs around

patient recruitment, retention, representation and engagement. To expand clinical trial access, Science 37 offers a unique model to existing

non-research focused healthcare networks to seamlessly participate without the traditional site infrastructure costs.

Science 37’s patient-centric model is powered by a proprietary

end-to-end unified technology platform and its team of approximately 460 employees with significant therapeutic and subject matter expertise.

As the backbone of Science 37’s offering, the proprietary unified technology platform standardizes and orchestrates the process

for clinical trials across Science 37’s specialized network of patient communities, telemedicine investigators, flexible mobile

nurse networks, remote coordinators, and robust network of technology integrations.

Background

We were incorporated as LifeSci Acquisition II Corp. on December 18,

2019. On October 6, 2021, we closed the Business Combination with Legacy Science 37, as a result of which Legacy Science 37 became

a wholly-owned subsidiary of ours, and we changed our name to Science 37 Holdings, Inc. While we are the legal acquirer of Legacy

Science 37 in the Business Combination, Legacy Science 37 is deemed to be the accounting acquirer, and the historical financial statements

of Legacy Science 37 became the historical financial statements of our Company upon the closing of the Business Combination.

Risk Factors

Our business is subject to a number of risks of which you should be

aware before making an investment decision. You should consider carefully the risks and uncertainties described below, together with all

of the other information contained in or incorporated by reference into this prospectus, including our consolidated financial statements

and related notes, before deciding to invest in our securities. These risks include the following:

| • | Science 37 has a limited operating history on which to assess the prospects for Science 37’s business, Science 37 has generated

limited revenue from sales of Science 37’s products and related services, and Science 37 has incurred losses since inception. As

such, you cannot rely upon its historical operating performance to make an investment decision regarding Science 37. Science 37 anticipates

that it will continue to incur significant losses as it continues to commercialize its existing products and services and seeks to develop

and commercialize new products and services. |

| • | Science 37 may need to raise additional funding to strengthen its core business, expand into additional markets, and extend the reach

of its operating system. This additional financing may not be available on acceptable terms, or at all. Failure to obtain this necessary

capital when needed may force Science 37 to delay, limit or terminate Science 37’s product commercialization or development efforts

or other operations. |

| • | The potential loss or non-renewal of Science 37’s contracts, any delay in its customers’ clinical trials or non-payment

by its customers for services that Science 37 has performed, could negatively affect its business, results of operations and financial

results. |

| • | Science 37 depends entirely on the clinical trial market, and a downturn in this market could cause its revenues to decrease. |

| • | Science 37 may face political, legal and compliance, operational, regulatory, economic and other risks associated with the international

expansion of its operations that Science 37 does not currently face or that are more significant than in its domestic operations. |

| • | Science 37’s business depends on the continued effectiveness and availability of its information systems, including the information

systems Science 37 uses to provide its services to its customers, and failures or breaches of these systems may materially limit or harm

its operations. |

| • | Science 37 relies on third parties for important products, services and licenses to certain technology and intellectual property rights,

and there might be problems with such products or services or it might not be able to continue to obtain such products, services and licenses. |

| • | Failure to comply with data privacy and security laws, regulations, and industry standards could have a material adverse effect on

our reputation, results of operations or financial condition, or have other adverse consequences. |

| • | Science 37 incurs significant costs and obligations as a result of being a recently public company. |

| • | The market price of our common stock has been and may continue to be highly volatile, and you may lose some or all of your investment.

In addition, we may be unable to regain compliance with Nasdaq’s continued listing requirements and could be delisted from Nasdaq. |

| • | Volatility in our share price could subject us to securities class action litigation. |

Corporate Information

Science 37’s principal office and mailing address is 800 Park

Offices Drive, Suite 3606, Research Triangle Park, North Carolina 27709, its telephone number is (984) 377-3737 and its website is

www.science37.com. The information contained on, or accessible through, Science 37’s website is not incorporated by reference

into this prospectus, and you should not consider any information contained on, or that can be accessed through, Science 37’s

website as part of this prospectus.

Emerging Growth Company and Smaller Reporting Company Status

We are an “emerging growth company,” as defined in the

Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”). As an emerging growth company, we are exempt from certain requirements

related to executive compensation, including, but not limited to, the requirements to hold a non-binding advisory vote on executive compensation,

to provide information relating to the ratio of total compensation of our Chief Executive Officer to the median of the annual total compensation

of all of our employees and to include the pay versus performance disclosure, each as required by the Dodd-Frank Wall Street Reform and

Consumer Protection Act.

Section 102(b)(1) of the JOBS Act exempts emerging growth

companies from being required to comply with new or revised financial accounting standards until private companies are required to comply

with the new or revised financial accounting standards. The JOBS Act provides that a company can choose not to take advantage of the extended

transition period and comply with the requirements that apply to non-emerging growth companies, and any such election to not take advantage

of the extended transition period is irrevocable. Science 37 previously elected to avail itself of the extended transition period. During

the extended transition period, it may be difficult or impossible to compare our financial results with the financial results of another

public company that complies with public company effective dates for accounting standard updates because of the potential differences

in accounting standards used.

We will remain an emerging growth company under the JOBS Act until

the earliest of (a) December 31, 2025, (b) the last date of our fiscal year in which we have a total annual gross revenue

of at least $1.235 billion, (c) the date on which we are deemed to be a “large accelerated filer” under the rules of

the SEC with at least $700.0 million of outstanding common stock held by non-affiliates or (d) the date on which we have issued more

than $1.0 billion in non-convertible debt securities during the previous three years.

We are also a smaller reporting company as defined in the Exchange

Act. We may continue to be a smaller reporting company even after we are no longer an emerging growth company. We may take advantage of

certain of the scaled disclosures available to smaller reporting companies and will be able to take advantage of these scaled disclosures

for so long as (i) our voting and non-voting common stock held by non-affiliates is less than $250.0 million measured on the last

business day of our second fiscal quarter or (ii) our annual revenue is less than $100.0 million during the most recently completed

fiscal year and our voting and non-voting common stock held by non-affiliates is less than $700.0 million measured on the last business

day of our second fiscal quarter.

The Offering

| Shares of common stock offered by the Selling Securityholders |

|

Up to 103,576,231 shares of common stock |

| |

|

| Use of proceeds |

|

We will not receive any proceeds from the sale of shares of common stock by the Selling Securityholders. |

| |

|

| Risk factors |

|

Before investing in our securities, you should carefully read and consider the information set forth in “Risk Factors,” and under similar headings in any amendments or supplements to this prospectus and the documents incorporated herein by reference. |

| |

|

| Nasdaq symbol |

|

“SNCE” |

RISK FACTORS

Investing in our securities involves a high degree of risk. Before

you make a decision to buy our securities, in addition to the risks and uncertainties discussed above under “Cautionary Note Regarding

Forward-Looking Statements,” you should carefully consider the risk factors incorporated by reference to our most recent Annual

Report on Form 10-K and any subsequent Quarterly Reports on Form 10-Q or Current Reports on Form 8-K, and all other information

contained in or incorporated by reference into this prospectus, as updated by our subsequent filings under the Exchange Act, and the risk

factors and other information contained in any applicable prospectus supplement before acquiring any of such securities. Additional risks

and uncertainties not presently known to us or that we currently believe to be immaterial may become material and adversely affect our

business. The occurrence of any of these risks might cause you to lose all or part of your investment in the offered securities.

USE OF PROCEEDS

All of the securities offered by the Selling Securityholders pursuant

to this prospectus will be sold by the Selling Securityholders for their respective accounts. We will not receive any of the proceeds

from these sales.

The Selling Securityholders will pay any underwriting discounts and

commissions and expenses incurred by the Selling Securityholders for brokerage, accounting, tax or legal services or any other expenses

incurred by the Selling Securityholders in disposing of the securities. We will bear the costs, fees and expenses incurred in effecting

the registration of the securities covered by this prospectus, including all registration and filing fees, Nasdaq listing fees and fees

and expenses of our counsel and our independent registered public accounting firm.

DESCRIPTION OF CAPITAL STOCK

General

The following description of our capital stock is not complete and

may not contain all the information you should consider before investing in our capital stock. The following description summarizes some

of the terms of our Second Amended and Restated Certificate of Incorporation (the “certificate of incorporation”) and Amended

and Restated By-Laws (the “bylaws”), and of the General Corporation Law of the State of Delaware (the “DGCL”).

This description is summarized from, and qualified in its entirety by reference to, our certificate of incorporation and bylaws, each

of which has been publicly filed with the SEC, as well as the relevant provisions of the DGCL.

Capital Stock

Our authorized capital stock consists of 400,000,000 shares of

common stock, par value $0.0001 per share, and 100,000,000 shares of preferred stock, par value $0.0001 per share. No shares of preferred

stock have been issued or are outstanding. Unless our board of directors determines otherwise, we will issue all shares of our capital

stock in uncertificated form.

Common Stock

Holders of shares of common stock are entitled to one vote for each

share held of record on all matters submitted to a vote of stockholders. The holders of common stock do not have cumulative voting rights

in the election of directors.

In the event of our liquidation, dissolution or winding up and after

payment in full of all amounts required to be paid to creditors and to any future holders of preferred stock having liquidation preferences,

if any, the holders of common stock will be entitled to receive pro rata our remaining assets available for distribution. Holders

of common stock do not have preemptive, subscription, redemption or conversion rights. There are no redemption or sinking fund provisions

applicable to the common stock. The rights, powers, preferences and privileges of holders of the common stock are subject to those of

the holders of any shares of preferred stock that the board of directors may authorize and issue in the future.

Preferred Stock

Under the terms of the certificate of incorporation, our board of directors

is authorized to direct us to issue shares of preferred stock in one or more series without stockholder approval. Our board of directors

has the discretion to determine the rights, powers, preferences, privileges and restrictions, including voting rights, dividend rights,

conversion rights, redemption privileges and liquidation preferences, of each series of preferred stock.

The purpose of authorizing our board of directors to issue preferred

stock and determine its rights and preferences is to eliminate delays associated with a stockholder vote on specific issuances. The issuance

of preferred stock, while providing flexibility in connection with possible acquisitions, future financings and other corporate purposes,

could have the effect of making it more difficult for a third party to acquire, or could discourage a third party from seeking to acquire,

a majority of the outstanding voting stock. Additionally, the issuance of preferred stock may adversely affect the holders of common stock

by restricting dividends on the common stock, diluting the voting power of the common stock or subordinating the liquidation rights of

the common stock. As a result of these or other factors, the issuance of preferred stock could have an adverse impact on the market price

of the common stock.

Dividends

Declaration and payment of any dividend is subject to the discretion

of our board of directors. The time and amount of dividends is dependent upon, among other things, our business prospects, results of

operations, financial condition, cash requirements and availability, debt repayment obligations, capital expenditure needs, contractual

restrictions, covenants in the agreements governing current and future indebtedness, industry trends, the provisions of Delaware law affecting

the payment of dividends and distributions to stockholders and any other factors or considerations our board of directors may regard as

relevant.

We currently intend to retain all available funds and any future earnings

to fund the development and growth of our business, and therefore do not anticipate declaring or paying any cash dividends on our common

stock in the foreseeable future.

Anti-Takeover Provisions

The certificate of incorporation and bylaws contain provisions that

may delay, deter or discourage another party from acquiring control of us. We expect that these provisions, which are summarized below,

will discourage coercive takeover practices or inadequate takeover bids. These provisions are also designed to encourage persons seeking

to acquire control of us to first negotiate with our board of directors, which may result in an improvement of the terms of any such acquisition

in favor of our stockholders. However, they also give our board of directors the power to discourage acquisitions that some stockholders

may favor.

Authorized but Unissued Shares

The authorized but unissued shares of common stock and preferred stock

are available for future issuance without stockholder approval, subject to any limitations imposed by the listing standards of the Nasdaq.

These additional shares may be used for a variety of corporate finance transactions, acquisitions and employee benefit plans. The existence

of authorized but unissued and unreserved common stock and preferred stock could make more difficult or discourage an attempt to obtain

control of us by means of a proxy contest, tender offer, merger or otherwise.

Classified Board of Directors

Our certificate of incorporation provides that our board of directors

is divided into three classes of directors, with each director serving a three-year term. As a result, approximately one-third of our

board of directors will be elected each year. The classification of directors has the effect of making it more difficult for stockholders

to change the composition of our board of directors.

Stockholder Action; Special Meetings of Stockholders

Our certificate of incorporation provides that stockholders may not

take action by written consent, but may only take action at annual or special meetings of stockholders. As a result, a holder controlling

a majority of capital stock would not be able to amend the bylaws or remove directors without holding a meeting of stockholders called

in accordance with the bylaws. Further, our certificate of incorporation provides that only the chairperson of our board of directors,

a majority of our board of directors, our Chief Executive Officer or our President may call special meetings of stockholders, thus prohibiting

a stockholder from calling a special meeting. These provisions might delay the ability of stockholders to force consideration of a proposal

or for stockholders controlling a majority of capital stock to take any action, including the removal of directors.

Advance Notice Requirements for Stockholder Proposals and Director

Nominations

In addition, our bylaws establish an advance notice procedure for stockholder

proposals to be brought before an annual meeting or special meeting of stockholders. Generally, in order for any matter to be “properly

brought” before a meeting, the matter must be (a) specified in a notice of meeting given by or at the direction of our board

of directors, (b) if not specified in a notice of meeting, otherwise brought before the meeting by our board of directors or the

chairperson of the meeting, or (c) otherwise properly brought before the meeting by a stockholder present in person who (A)(1) was

a stockholder both at the time of giving the notice and at the time of the meeting, (2) is entitled to vote at the meeting, and (3) has

complied with the advance notice procedures specified in our bylaws or (B) properly made such proposal in accordance with Rule 14a-8

under the Exchange Act and the rules and regulations thereunder, which proposal has been included in the proxy statement for the

annual meeting. Further, for business to be properly brought before an annual meeting by a stockholder, the stockholder must (a) provide

timely notice in writing and in proper form to the secretary and (b) provide any updates or supplements to such notice at the times

and in the forms required by our bylaws. To be timely, a stockholder’s notice must be delivered to, or mailed and received at, our

principal executive offices not less than 90 days nor more than 120 days prior to the one-year anniversary of the preceding

year’s annual meeting; provided, however, that if the date of the annual meeting is more than 30 days before or

more than 60 days after such anniversary date, notice by the stockholder to be timely must be so delivered, or mailed and received,

not later than the 90th day prior to such annual meeting or, if later, the 10th day following the day on which public disclosure of the

date of such annual meeting was first made.

Stockholders at an annual meeting or special meeting may only consider

proposals or nominations specified in the notice of meeting or properly brought before the meeting, as described above. These provisions

could have the effect of delaying stockholder actions that are favored by the holders of a majority of the outstanding voting securities

until the next stockholder meeting.

Amendment of Certificate of Incorporation or Bylaws

Our bylaws may be amended or repealed by a majority vote of our board

of directors or by the holders of at least sixty-six and two-thirds percent of the voting power of all of the then-outstanding shares

entitled to vote generally in the election of directors, voting together as a single class. The affirmative vote of a majority of our

board of directors and at least sixty-six and two-thirds percent of the voting power of all of the then-outstanding shares entitled

to vote, voting together as a single class, would be required to amend certain provisions of our certificate of incorporation.

Limitations on Liability and Indemnification of Officers and Directors

Our bylaws provide indemnification and advancement of expenses for

our directors and officers to the fullest extent permitted by the DGCL, subject to certain limited exceptions. We have entered into indemnification

agreements with each of our directors and officers. In some cases, the provisions of those indemnification agreements may be broader than

the specific indemnification provisions contained under Delaware law. In addition, as permitted by Delaware law, our certificate of incorporation

includes provisions that eliminate the personal liability of directors for monetary damages resulting from breaches of certain fiduciary

duties as a director. The effect of this provision is to restrict our rights and the rights of our stockholders in derivative suits to

recover monetary damages against a director for breach of fiduciary duties as a director.

These provisions may be held not to be enforceable for violations of

the federal securities laws of the United States.

Dissenters’ Rights of Appraisal and Payment

Under the DGCL, with certain exceptions, our stockholders have appraisal

rights in connection with a merger or consolidation of our Company. Pursuant to Section 262 of the DGCL, stockholders who properly

demand and perfect appraisal rights in connection with such merger or consolidation have the right to receive payment of the fair value

of their shares as determined by the Delaware Court of Chancery.

Stockholders’ Derivative Actions

Under the DGCL, any of our stockholders may bring an action in our

name to procure a judgment in its favor, also known as a derivative action, provided that the stockholder bringing the action is a holder

of our shares at the time of the transaction to which the action relates.

Forum Selection

Our bylaws provide that unless we consent in writing to the selection

of an alternative forum, the Court of Chancery of the State of Delaware, to the fullest extent permitted by applicable law, is the sole

and exclusive forum for: (i) any derivative action brought by a stockholder on behalf of the Company, (ii) any claim of breach

of a fiduciary duty owed by any of our directors, officers, or stockholders to the Company or our stockholders, (iii) any claim against

us arising under our certificate of incorporation, bylaws or the DGCL or (iv) any claim against us governed by the internal affairs

doctrine. Our bylaws designate the federal district courts of the United States of America as the exclusive forum for the resolution of

any complaint asserting a cause of action arising under the Securities Act.

Transfer Agent and Registrar

The transfer agent and registrar for the common stock is Continental

Stock Transfer & Trust Company.

Trading Symbol and Market

Our common stock is listed on the Nasdaq under the symbol “SNCE.”

SELLING SECURITYHOLDERS

The Selling Securityholders listed in the table below may from time

to time offer and sell any or all of the shares of common stock set forth below pursuant to this prospectus. When we refer to the “Selling

Securityholders” in this prospectus, we refer to the persons listed in the table below, and the pledgees, donees, transferees, assignees,

successors and other permitted transferees that hold any of the Selling Securityholders’ interest in the shares of common stock

after the date of this prospectus.

The following table sets forth certain information provided by or on

behalf of the Selling Securityholders concerning the common stock that may be offered from time to time by each Selling Securityholder

pursuant to this prospectus. The number of shares beneficially owned by each Selling Securityholder is determined under rules issued

by the SEC. Under these rules, beneficial ownership includes any shares as to which the individual or entity has sole or shared voting

power or investment power. Percentage ownership is based on 116,462,029 shares of common stock outstanding as of February 27, 2023.

In computing the number of shares beneficially owned by an individual or entity and the percentage ownership of that person, shares

of common stock subject to options, warrants or other rights held by such person that are currently exercisable or will become exercisable

or that will vest within 60 days of such date are considered outstanding, although these shares are not considered outstanding for

purposes of computing the percentage ownership of any other person. Each of the Selling Securityholders listed has sole voting and

investment power with respect to the shares beneficially owned by the Selling Securityholder unless noted otherwise, subject to community

property laws where applicable.

The Selling Securityholders identified below may have sold, transferred

or otherwise disposed of all or a portion of their securities after the date on which they provided us with information regarding their

securities. Any changed or new information given to us by the Selling Securityholders, including regarding the identity of, and the securities

held by, each Selling Securityholder, will be set forth in a prospectus supplement or amendments to the registration statement of which

this prospectus is a part, if and when necessary. A Selling Securityholder may sell all, some or none of such securities in this offering.

See “Plan of Distribution.” For purposes of this table, we have assumed that the Selling Securityholders will have sold all

of the securities covered by this prospectus upon the completion of the offering.

Former holders of shares of Legacy Science 37 common stock (including

shares received as a result of the conversion of Legacy Science 37 preferred stock) and former holders of options to purchase shares of

Legacy Science 37 are entitled to receive a pro rata share of the Earn-Out Shares, consisting of up to 12,500,000 additional shares of

our common stock, if, during the three years following the consummation of the Business Combination, the volume weighted average share

price of our common stock equals or exceeds the thresholds set forth below for a period of at least 20 days out of 30 consecutive trading

days (each, a “Triggering Event”). The number of Earn-Out Shares issued upon the occurrence of a Triggering Event will be

determined as follows:

| • | If the volume weighted average share price is equal to or greater than $15.00, a one-time aggregate issuance of 5,000,000 Earn-Out

Shares will be made; and |

| • | If the volume weighted average share price is equal to or greater than $20.00, a one-time aggregate issuance of 7,500,000 Earn-Out

Shares will be made. |

In respect of former holders of Legacy Science 37 options, receipt

of the Earn-Out Shares is subject to continued services to the Company or one of its subsidiaries at the time of the applicable Triggering

Event. If there is a change of control of Science 37 during the Earn-Out Period that will result in the holders of common stock receiving

a per share price equal to or in excess of any Triggering Event threshold, then immediately prior to such change of control, any Triggering

Event that has not previously occurred shall be deemed to have occurred and Science 37 shall issue the Earn-Out Shares to the former holders

of shares of Legacy Science 37 common stock and former holders of Legacy Science 37 options in accordance with their respective pro rata

shares.

| Selling Securityholder(1) |

|

Shares of Common

Stock Beneficially

Owned Prior to

Offering(2) |

|

Total Number of

Shares of

Common Stock

Offered(3) |

|

Shares of Common

Stock Beneficially

Owned After the

Offered Shares are

Sold |

|

Percentage of

Shares

Beneficially

Owned after

Shares are Sold |

| Alyeska Master Fund, L.P.(4) |

|

731,282 |

|

408,736 |

|

322,546 |

|

* |

| BlackRock, Inc.(5) |

|

1,500,000 |

|

1,500,000 |

|

— |

|

— |

| Casdin Partners Master Fund, L.P.(6) |

|

1,800,000 |

|

1,800,000 |

|

— |

|

— |

| Christopher Jon Ceppi(7) |

|

820,980 |

|

764,181 |

|

140,227 |

|

* |

| Chardan Healthcare Investments LLC(8) |

|

200,226 |

|

200,226 |

|

— |

|

— |

| Citadel CEMF Investments Ltd.(9) |

|

1,000,000 |

|

1,000,000 |

|

— |

|

— |

| David Coman(10) |

|

5,117,002 |

|

5,152,670 |

|

542,316 |

|

* |

| Jonathan Cotliar(11) |

|

1,074,315 |

|

953,304 |

|

228,703 |

|

* |

| FMB Research LLC(12) |

|

100,000 |

|

100,000 |

|

— |

|

— |

| Darcy Forman(13) |

|

857,172 |

|

458,713 |

|

448,887 |

|

* |

| Steven Geffon(14) |

|

1,362,548 |

|

1,030,016 |

|

447,611 |

|

* |

| John W. Hubbard(15) |

|

431,481 |

|

454,708 |

|

27,575 |

|

* |

| LifeSci Entities(16) |

|

1,945,897 |

|

2,184,647 |

|

— |

|

— |

| Stephanie Gajdjis |

|

10,000 |

|

10,000 |

|

— |

|

— |

| Matthew Joseph Margiotta |

|

50,000 |

|

50,000 |

|

— |

|

— |

| Bob Spivak |

|

50,000 |

|

50,000 |

|

— |

|

— |

| Patrick Dolezal |

|

50,000 |

|

50,000 |

|

— |

|

— |

| Samuel Slutsky |

|

100,000 |

|

100,000 |

|

— |

|

— |

| Adam Evertts |

|

50,000 |

|

50,000 |

|

— |

|

— |

| Paul Yook |

|

100,000 |

|

100,000 |

|

— |

|

— |

| David Dobkin(17) |

|

500,000 |

|

500,000 |

|

— |

|

— |

| Dobkin GST Trust |

|

139,403 |

|

139,403 |

|

— |

|

— |

| Yehuda Michael Rice(18) |

|

1,934,542 |

|

1,934,542 |

|

— |

|

— |

| Andrew McDonald(19) |

|

1,934,542 |

|

1,934,542 |

|

— |

|

— |

| Lux Entities(20) |

|

12,249,889 |

|

14,172,487 |

|

— |

|

— |

| MDC Capital Partners (Ventures) LP(21) |

|

2,345,897 |

|

2,584,647 |

|

— |

|

— |

| Novartis Pharma AG(22) |

|

5,461,650 |

|

6,135,730 |

|

— |

|

— |

| Perceptive Life Sciences Master Fund, Ltd.(23) |

|

1,500,000 |

|

1,500,000 |

|

— |

|

— |

| Christine Pellizzari(24) |

|

1,458,205 |

|

1,279,280 |

|

187,466 |

|

* |

| Pharmaceutical Product Development, LLC(25) |

|

17,379,797 |

|

19,563,047 |

|

— |

|

— |

| Pura Vida Investments, LLC and certain of its affiliates(26) |

|

1,006,400 |

|

1,000,000 |

|

6,400 |

|

* |

| Entities affiliated with Redmile Group, LLC(27) |

|

19,849,597 |

|

21,723,548 |

|

41,363 |

|

* |

| RTW Investments, LP(28) |

|

4,039,341 |

|

3,000,000 |

|

1,039,341 |

|

* |

| Samsara BioCapital, L.P.(29) |

|

800,000 |

|

800,000 |

|

— |

|

— |

| Velan Capital Partners LP(30) |

|

1,200,000 |

|

1,200,000 |

|

— |

|

— |

| Victory RS Science and Technology Fund, a series of Victory Portfolios(31) |

|

178,320 |

|

178,320 |

|

— |

|

— |

| Victory USAA Science & Technology Fund, a series of USAA Mutual Funds Trust(32) |

|

621,680 |

|

621,680 |

|

— |

|

— |

| Mike Zaranek(33) |

|

1,605,751 |

|

1,493,066 |

|

233,348 |

|

* |

| | * | Less

than 1%. |

| | | |

| (1) | Unless otherwise noted, the business address of each of the following entities or individuals is 800 Park Offices Drive, Suite 3606,

Research Triangle Park, North Carolina 27709. |

| (2) | Does not reflect the ownership of any Earn-Out Shares, which are issuable to certain of the Selling Stockholders if certain conditions

are met. |

| (3) | This registration statement includes the issuance of up to 12,500,000 Earn-Out Shares. This column gives effect to the issuance of

Earn-Out Shares. Each holder of Earn-Out Shares is entitled to receive a pro rata amount of any Earn-Out Shares issued. The number of

Earn-Out Shares that may be issued to each individual or entity is subject to change as a result of the fact that, in respect of former

holders of Legacy Science 37 options, receipt of the Earn-Out Shares is subject to continued services to the Company or one of its subsidiaries

at the time of the applicable Triggering Event. Any Earn-Out Shares that may be forfeited as a result of such provision will be re-allocated

to the remaining holders of Earn-Out Shares. The number of Earn-Out Shares disclosed in this table does not reflect any pro-rata adjustments

that may occur at any time after the Closing. Includes the following Earn-Out Shares: Mr. Ceppi, 83,428; Mr. Coman, 577,984;

Mr. Cotliar, 107,692; Ms. Forman, 50,428; Mr. Geffon, 115,079; Mr. Hubbard, 50,802; LifeSci Ventures Partners II,

LP, 238,750; Lux Co-Invest Opportunities, L.P., 414,654; Lux Ventures IV, L.P., 1,507,944; MDC Capital Partners (Ventures) LP, 238,750;

Novartis Pharma AG, 674,080; Ms. Pellizzari, 8,541; Pharmaceutical Product Development, LLC, 2,183,250; RAF, L.P., 495,249; Redmile

Capital Offshore II Master Fund, Ltd., 402,328; Redmile Private Investments II, L.P., 938,055; Redmile Strategic Master Fund, LP,

79,682; and Mr. Zaranek, 120,663. |

| (4) | Includes 408,736 PIPE shares held by Alyeska Master Fund, L.P. Alyeska Investment Group, L.P., the investment manager of Alyeska Master

Fund, L.P., has voting and investment control of the shares held by Alyeska Master Fund, L.P. Anand Parekh is the Chief Executive Officer

of Alyeska Investment Group, L.P. and may be deemed to be the beneficial owner of such shares. Mr. Parekh, however, disclaims any

beneficial ownership of the shares held by Alyeska Master Fund, L.P. The registered address of Alyeska Master Fund, L.P. is at c/o Maples

Corporate Services Limited, P.O. Box 309, Ugland House, South Church Street George Town, Grand Cayman, KY1-1104, Cayman Islands.

Alyeska Investment Group, L.P. is located at 77 W. Wacker, Suite 700, Chicago, IL 60601. |

| (5) | Represents 1,500,000 PIPE shares held by BlackRock Health Sciences Trust II, a fund under management by a subsidiary of BlackRock, Inc.

BlackRock, Inc. is the ultimate parent holding company of such subsidiary. On behalf of such subsidiary, the applicable portfolio

managers, as managing directors (or in other capacities) of such entity, and/or the applicable investment committee members of such fund,

have voting and investment power over the shares held by the fund which is the registered holder of the referenced shares. Such portfolio

managers and/or investment committee members expressly disclaim beneficial ownership of all shares held by such fund. The address of such

fund, such subsidiary and such portfolio managers and/or investment committee members is 55 East 52nd Street, New York, NY 10055 and 60

State Street, 19th/20th Floor, Boston, MA 02109. Shares shown include only the securities being registered for resale and may not incorporate

all shares of the Company deemed to be beneficially held by the registered holder or BlackRock, Inc. |

| (6) | Represents 1,800,000 PIPE Shares held by Casdin Partners Master Fund, L.P. The shares reflected as beneficially owned by Casdin Partners

Master Fund, LP are owned directly by Casdin Partners Master Fund, LP and may be deemed to be indirectly beneficially owned by (i) Casdin

Capital, LLC, the investment adviser to Casdin Partners Master Fund, LP, (ii) Casdin Partners GP, LLC, the general partner of Casdin

Partners Master Fund, LP, and (iii) Eli Casdin, the managing member of Casdin Capital, LLC and Casdin Partners GP, LLC. Each

of Casdin Capital, LLC, Casdin Partners GP, LLC and Eli Casdin disclaims beneficial ownership of such securities except to the extent

of their respective pecuniary interest therein. Casdin Partners Master Fund, L.P. is located at 1350 Avenue of the Americas, Suite 2600,

New York, NY 10019. |

| (7) | Includes 169,574 shares of common stock and 511,179 options to purchase shares of common stock that may be sold under this prospectus,

as well as 140,227 additional options to purchase shares of common stock that are exercisable within 60 days. Mr. Ceppi previously

served as Chief Technology Officer of the Company. |

| (8) | Represents 200,226 shares of common stock held by Chardan

Healthcare Investments LLC. The business address for Chardan Healthcare Investments LLC is c/o Chardan Capital Markets LLC, 17 State

Street, 21st Floor, New York, NY 10004. |

| (9) | Represents 1,000,000 PIPE shares held by Citadel CEMF Investments Ltd. (“CEMF”). Citadel Advisors LLC (“Citadel

Advisors”) is the portfolio manager of CEMF. Citadel Advisors Holdings LP (“CAH”) is the sole member of Citadel Advisors.

Citadel GP LLC (“CGP”) is the general partner of CAH. Kenneth Griffin owns a controlling interest in CGP. Mr. Griffin,

as the owner of a controlling interest in CGP, may be deemed to have shared power to vote and/or shared power to dispose of the securities

held by CEMF. This disclosure shall not be construed as an admission that Mr. Griffin or any of the Citadel related entities listed

above is the beneficial owner of any securities of the Company other than the securities actually owned by such person (if any). The business

address of Citadel CEMF Investments Ltd. is c/o Citadel Advisors LLC, 601 Lexington Avenue, New York, NY 10022. |

| (10) | Includes 726,137 shares of common stock and 3,848,549 options to purchase shares of common stock that may be sold under this prospectus,

as well as 542,316 additional options to purchase shares of common stock that are exercisable within 60 days. Mr. Coman is the Chief

Executive Officer and a director of the Company. |

| (11) | Includes 686,768 shares of common stock and 158,844 options to purchase shares of common stock that may be sold under this prospectus,

as well as 228,703 additional options to purchase shares of common stock that are exercisable within 60 days. Mr. Cotliar is the

Chief Medical Officer of the Company. |

| (12) | Represents 100,000 PIPE shares held by FMB Research LLC.

Franklin M. Berger is the sole member of FMB Research LLC and may be deemed to have beneficial ownership of the shares. Mr. Berger

disclaims beneficial ownership of the shares except to the extent of his pecuniary interest therein. FMB Research LLC is located at 257 Park

Avenue South, 15th Floor, New York, NY 10010. |

| (13) | Includes 110,456 shares of common stock and 297,829 options to purchase shares of common stock that may be sold under this prospectus,

as well as 448,887 additional options to purchase shares of common stock that are exercisable within 60 days. Ms. Forman is the Chief

Delivery Officer of the Company. |

| (14) | Includes 914,937 options to purchase shares of common stock that may be sold under this prospectus, as well as 447,611 additional

options to purchase shares of common stock that are exercisable within 60 days. Mr. Geffon is the former Chief Commercial Officer

of the Company and serves as a strategic advisor to the Company’s Chief Executive Officer. |

| (15) | Includes 403,906 options to purchase shares of common stock that may be sold under this prospectus, as well as 27,575 additional options

to purchase shares of common stock that are exercisable within 60 days. Mr. Hubbard is a member of the board of directors of the

Company. |

| (16) | Includes (a) 1 share of common stock owned by the Sponsor and (b) 1,945,896 shares of common stock owned by LifeSci Ventures

Partners II, LP, including 100,000 PIPE shares. Michael Rice and Andrew McDonald are the managing members of the Sponsor and the general

partners of LifeSci Ventures Partners II, LP. The address for these entities and individuals is c/o Science 37 Holdings, Inc., 800

Park Offices Drive, Suite 3606, Research Triangle Park, North Carolina 27709. |

| (17) | Mr. Dobkin was the Chief Financial Officer and served on the board of directors of the Company prior to the Closing. |

| (18) | Mr. Rice was our Chief Operating Officer and served on our board of directors prior to the Closing. |

| (19) | Mr. McDonald was our Chief Executive Officer and served on our board of directors prior to the Closing. |

| (20) | Includes (a) 3,505,890 shares of common stock held by Lux Co-Invest Opportunities, L.P., including 300,000 PIPE shares, and (b) 8,743,999

shares of common stock held by Lux Ventures IV, L.P. Lux Co-Invest Partners, LLC is the general partner of Lux Co-Invest Opportunities,

L.P. and exercises voting and dispositive power over the shares held by Lux Co-Invest Opportunities, L.P. Lux Venture Partners IV, LLC

is the general partner of Lux Ventures IV, L.P. and exercises voting and dispositive power over the shares held by Lux Ventures IV, L.P.

Peter Hebert and Joshua Wolfe are the individual managing members of Lux Venture Partners IV, LLC and Lux Co-Invest Partners, LLC (the

“Individual Lux Managers”). The Individual Lux Managers, as the sole managers of Lux Venture Partners IV, LLC and Lux Co-Invest

Partners, LLC, may be deemed to share voting and dispositive power for the shares held by Lux Ventures IV, L.P. and Lux Co-Invest Opportunities,

L.P. Each of Lux Venture Partners IV, LLC, Lux Co-Invest Partners, LLC and the Individual Lux Managers separately disclaims beneficial

ownership over the shares noted herein except to the extent of their pecuniary interest therein. The address for these entities and individuals

is c/o Lux Capital Management, 920 Broadway, 11th Floor, New York, NY 10010. |

| (21) | Includes 500,000 PIPE shares held by MDC Capital Partners (Ventures) LP. MDC Capital Partners (Ventures) GP, LP is the general partner

of MDC Capital Partners (Ventures) LP. MDC Capital Partners (Ventures) GP, LP has created an investment committee comprised of individual

members, which has the authority, by affirmative majority consent, to approve all investment and divestment decisions made with respect

to MDC Capital Partners (Ventures) LP. Each of the members of the investment committee expressly disclaims beneficial ownership of the

shares held by MDC Capital Partners (Ventures) LP. The address of the entities listed herein is c/o Mubadala Capital, 22nd Floor,

Al Sila Tower, Abu Dhabi Global Market, Al Maryah Island, Abu Dhabi, UAE. |

| (22) | Includes 250,000 PIPE shares held by Novartis Pharma AG. The business address for Novartis Pharma AG is Lichstrasse 35, Basel, Switzerland

4056. |

| (23) | Represents 1,500,000 PIPE shares held by Perceptive Life Sciences Master Fund, Ltd. Perceptive Advisors, LLC serves as the investment

advisor to Perceptive Life Sciences Master Fund, Ltd. Joseph Edelman is the managing member of Perceptive Advisors, LLC, and disclaims

beneficial ownership over the shares except to the extent of his pecuniary interest therein. The address of Perceptive Life Sciences Master

Fund, Ltd. is c/o Perceptive Advisors, LLC, 51 Astor Place, 10th Floor, New York, New York 10003. |

| (24) | Includes 1,270,739 options to purchase shares of common stock that may be sold under this prospectus, as well as 182,466 additional

options to purchase shares of common stock that are exercisable within 60 days. Ms. Pellizzari is the Chief Legal and Human Resources

Officer of the Company. |

| (25) | Includes 500,000 PIPE shares held by Pharmaceutical Product Development, LLC. Wildcat Acquisition Holdings (UK) Limited (“Wildcat”)

is the sole member of Pharmaceutical Product Development, LLC; Jaguar Holding Company II (“Jaguar II”) is the sole shareholder

of Wildcat; Jaguar Holding Company I, LLC (“Jaguar I”) is the sole shareholder of Jaguar II; Eagle Holding Company II, LLC

(“Eagle II”) is the sole member of Jaguar I; PPD, Inc. (“PPD”) is the sole member of Eagle II; Thermo Fisher

Scientific Powder US Holdings Corp. (“Powder Holdings”) is the sole shareholder of PPD; and Thermo Fisher Scientific Inc.

(“Thermo Fisher”), a Delaware corporation, is the ultimate parent entity of Powder Holdings. By virtue of such relationships,

each may be deemed to have beneficial ownership over such securities, and each disclaim beneficial ownership of such securities, except

to the extent of its or their pecuniary interest therein, if any. The principal office of Wildcat is 11 Granta Park, Cambridge CB21 6GQ,

United Kingdom, the principal office of each of PPD, Eagle II, Jaguar I, Jaguar II and Pharma LLC is 929 North Front Street, Wilmington,

North Carolina 28401 and the principal office of each of Thermo Fisher and Powder Holdings is 168 Third Avenue, Waltham, Massachusetts

02451. |

| (26) | Includes (i) 43,000 PIPE shares held by Sea Hawk Multi-Strategy Master Fund Ltd; (ii) 43,000 PIPE Shares held by Walleye

Manager Opportunities LLC; (iii) 6,400 common shares and 64,000 PIPE Shares held by Walleye Opportunities Master Fund Ltd (collectively,

the “Managed Accounts”); (iv) 241,000 PIPE Shares held by Highmark Limited, in respect of its Segregated Account

Highmark Long/Short Equity 20 (the “Additional Managed Account”); and (v) 609,000 PIPE Shares held by Pura Vida Master

Fund Ltd. (the “PV Fund”). Pura Vida Investments, LLC (“PVI”) serves as the sub-adviser to the Managed Accounts

and the investment manager to the Additional Managed Account and the PV Fund. Efrem Kamen serves as the managing member of PVI. By virtue

of these relationships, PVI and Efrem Kamen may be deemed to have shared voting and dispositive power with respect to the PIPE Shares

held by the Managed Accounts, the Additional Managed Account, and the PV Fund. This report shall not be deemed an admission that PVI and/or

Efrem Kamen are beneficial owners of the PIPE Shares for purposes of Section 13 of the Securities Exchange Act of 1934, as amended,

or for any other purpose. Each of PVI and Efrem Kamen disclaims beneficial ownership of the PIPE Shares reported herein except to the

extent of each PVI’s and Efrem Kamen’s pecuniary interest therein. The business address of Pura Vida Investments, LLC is 512

West 22nd Street, 7th Floor, New York, NY 10011. |

| (27) | Includes (a) 467,380 shares of common stock held by RAF, L.P., (b) 7,252,571 shares of common stock held by Redmile Private

Investments II, L.P., (c) 616,055 shares of common stock held by Redmile Strategic Master Fund, LP, and (d) 11,472,228 shares

of common stock, including 5,000,000 PIPE shares, held by RedCo II Master Fund, L.P. Redmile Group, LLC is the investment manager/adviser

to each of the private investment vehicles listed in items (a) through (d) (collectively, the “Redmile Funds”) and,

in such capacity, exercises voting and investment power over all of the securities held by the Redmile Funds and may be deemed to be the

beneficial owner of these securities. Jeremy C. Green serves as the managing member of Redmile Group, LLC and also may be deemed to be

the beneficial owner of these shares. Redmile Group, LLC, Mr. Green and Robert Faulkner each disclaim beneficial ownership of these

shares, except to the extent of its or his pecuniary interest in such shares, if any. Mr. Faulkner is a member of the board of directors

of the Company and was designated by certain affiliates of Redmile Group, LLC pursuant to a Director Nomination Agreement, dated October 6,

2021, between the Company and certain other parties. Also includes 41,363 options to purchase shares of common stock exercisable within

60 days held by Mr. Faulkner. Pursuant to the internal policies of Redmile Group, LLC, Mr. Faulkner holds these options as a

nominee on behalf, and for the sole benefit, of Redmile Group, LLC and has assigned all economic, pecuniary and voting rights in respect

of the stock options to Redmile Group, LLC. The address of the Redmile Funds, Mr. Green and Mr. Faulkner is c/o Redmile Group,

LLC, One Letterman Dr., Building D, Suite D3-300, San Francisco, CA 94129. |

| (28) | Includes (a) 59,567 PIPE shares held by RTW Venture Fund Limited; (b) 1,972,565 PIPE shares held by RTW Master Fund, LTD.;

and (c) 967,868 PIPE shares held by RTW Innovation Master Fund, LTD. The registered holders of the referenced shares are funds

under management by RTW Investments, LP. Roderick Wong, M.D. is the Managing Partner of RTW Investments, LP, and has voting and investment

power over the shares held by the funds, which are the registered holders of the referenced shares. Mr. Wong disclaims beneficial

ownership of the shares held by the funds, except to the extent of his pecuniary interest therein. The address of such funds and such

portfolio managers is 40 10th Avenue, Floor 7, New York, New York 10014. |

| (29) | Represents 800,000 PIPE shares held by Samsara BioCapital, L.P. (“Samsara LP”). Samsara BioCapital GP, LLC (“Samsara

LLC”) is the general partner of Samsara LP and may be deemed to beneficially own the shares held by Samsara LP. Dr. Srinivas

Akkaraju, M.D., Ph.D., has voting and investment power over the shares held by Samsara LP and, accordingly, may be deemed to beneficially

own the shares held by Samsara LP. Each of Samsara LLC and Dr. Akkaraju disclaims beneficial ownership of these shares except to

the extent of his or its respective pecuniary interest therein. The address of Samsara LP is 628 Middlefield Road, Palo Alto, CA 94301. |

| (30) | Represents 1,200,000 PIPE shares held by Velan Capital Partners LP. Velan Capital Investment Management LP, the investment manager

of Velan Capital Partners LP, has voting and investment control of the shares held by Velan Capital Partners LP. Balaji Venkataraman is

the Managing Partner of Velan Capital Investment Management LP and may be deemed to be the beneficial owner of such shares. Mr. Venkataraman

disclaims any beneficial ownership of the shares held by Velan Capital Partners LP, except to the extent of his pecuniary interest therein.

The registered address of Velan Capital Partners LP is at 1055 Powers Place, Suite B, Alpharetta, GA 30009. |

| (31) | Represents 178,320 PIPE shares held by Victory RS Science and Technology Fund (the “Fund”). Victory Capital Investment

Management Inc. (“Victory Capital”) serves as the investment adviser to the Fund. Victory Capital is an indirect wholly owned

subsidiary of Victory Capital Holdings, Inc., a publicly traded company with its principal address at 15935 La Cantera Parkway, San

Antonio, TX 78256. By delegation from the Fund and its Board of Trustees, Victory Capital has the power to dispose of the securities acting

through members of its investment franchise, RS Investments Growth, and to vote the securities in accordance with its proxy voting policy

through its proxy committee, which is composed of eight individuals. The address for the Fund is c/o Victory Capital Management Inc.,

4900 Tiedeman Road, 4th Floor, Brooklyn, OH 44144. |

| (32) | Represents 621,680 PIPE shares held by Victory USAA Science & Technology Fund (the “USAA Fund”). Victory Capital

serves as the investment adviser to the USAA Fund. Victory Capital is an indirect wholly owned subsidiary of Victory Capital Holdings, Inc.,

a publicly traded company with its principal address at 15935 La Cantera Parkway, San Antonio, TX, 78256. By delegation from the USAA

Fund and its Board of Trustees, Victory Capital has the power to dispose of the securities acting through members of its investment franchise,

RS Investments Growth, and to vote the securities in accordance with its proxy voting policy through its proxy committee, which is composed

of eight individuals. The address for the USAA Fund is c/o Victory Capital Management Inc., 4900 Tiedeman Road, 4th Floor, Brooklyn,

OH 44144. |

| (33) | Includes 1,372,403 options to purchase shares of common stock that may be sold under this prospectus, as well as 233,348 additional

options to purchase shares of common stock that are exercisable within 60 days. Mr. Zaranek is the Chief Financial Officer of the

Company. |

PLAN OF DISTRIBUTION

The Selling Securityholders, which as used herein includes donees,

pledgees, transferees, distributees or other successors-in-interest selling shares of our common stock or interests in our common stock

received after the date of this prospectus from the Selling Securityholders as a gift, pledge, partnership distribution or other transfer,

may, from time to time, sell, transfer, distribute or otherwise dispose of certain of their shares of common stock or interests in our

common stock on any stock exchange, market or trading facility on which shares of our common stock are traded or in private transactions.

These dispositions may be at fixed prices, at prevailing market prices at the time of sale, at prices related to the prevailing market

price, at varying prices determined at the time of sale, or at negotiated prices.

The Selling Securityholders may use any one or more of the following

methods when disposing of their shares of common stock or interests therein:

| • | purchases by a broker-dealer as principal and resale by such broker-dealer for its own account pursuant to this prospectus; |

| • | ordinary brokerage transactions and transactions in which the broker solicits purchasers; |

| • | block trades in which the broker-dealer so engaged will attempt to sell the shares as agent but may position and resell a portion

of the block as principal to facilitate the transaction; |

| • | in the over-the-counter market; |

| • | through trading plans entered into by a Selling Securityholder pursuant to Rule 10b5-1 under the Exchange Act, that are in place

at the time of an offering pursuant to this prospectus and any applicable prospectus supplement hereto that provide for periodic sales

of their securities on the basis of parameters described in such trading plans; |

| • | to or through underwriters or broker-dealers; |

| • | in “at the market” offerings, as defined in Rule 415 under the Securities Act, at negotiated prices, at prices prevailing

at the time of sale or at prices related to such prevailing market prices, including sales made directly on a national securities exchange

or sales made through a market maker other than on an exchange or other similar offerings through sales agents; |

| • | in transactions otherwise than on these exchanges or systems or in the over-the-counter market; |