Safe & Green Holdings Corp. (NASDAQ: SGBX) (“Safe &

Green Holdings” or the “Company”), a leading developer,

designer, and fabricator of modular structures, reported results

for the three months ended June 30, 2024.

Key Highlights:

- Record sales

pipeline in excess of $25 million and positive outlook for H2

2024

- Gross profit

margin in Q2 2024 increased to 12.7% compared to 0.7% for Q2

2023

- Operating

expenses declined by $2.7 million in Q2 2024 versus the same period

last year

- Company

reaffirms guidance it is on track to achieve positive cash flow

before year-end

- Received a term

sheet from a premier lender to refinance the Waldron facility on

favorable terms; expected to provide non-dilutive working

capital

- Expected receipt

of Employee Retention Tax Credit (ERTC) payment within the next

year, which would provide $1.4 million of non-dilutive working

capital

- Promoted David

Cross to Executive Vice President of SG Echo, LLC

- Completed 2024

annual audit by International Code Council (ICC) Evaluation Service

and granted recertification of ESR for certification and use of

shipping containers in modular construction

- Expanded

agreement to manufacture seven additional container-based

electrical distribution centers as part of a multi-unit order for a

client serving the big box retailer market

- Granted an

expanded contract, valued in excess of $1 million, to construct an

additional 11 container modules and related services for a

government contractor to be used by a major U.S. government

agency

Paul Galvin, Chairperson and Chief Executive

Officer of Safe & Green Holdings commented, “We continue to

execute our business strategy with a focus on profitable revenue

growth and operational efficiency. I am pleased to report we have

been awarded several important contracts, including expanded

agreements with existing customers, that highlight both our quality

and exceptional customer service. In addition, I’m pleased to

report that our sales pipeline has grown significantly during the

quarter and is now in excess of $25 million—a record for the

Company, which we expect to be reflected, in part, in our revenue

during the second half of 2024. Moreover, by strategically managing

our resources and focusing on high-margin projects, we have

increased our gross profit more than four-fold and reduced our

operating expenses by 48%. We remain committed to driving

sustainable growth and delivering value to our shareholders.”

Tricia Kaelin, Chief Financial Officer of Safe

& Green Holdings, further noted, “The financial discipline we

have instilled across the organization is yielding tangible

results. Our ability to enhance gross profit while reducing

operating expenses is a clear indication of our focus on creating a

leaner, more profitable company. As a result, we remain on track to

achieve positive cash flow before year end. In addition, we will

continue to optimize our cost structure and prioritize investments

that drive long-term returns.”

Financial Results for the Three Months

Ended June 30, 2024

Revenue for the three months ended June 30,

2024, was $1.3 million, compared to $5.1 million for the three

months ended June 30, 2023, reflecting a decrease in construction

services revenue.

Gross profit for the three months ended June 30,

2024, was $159 thousand, compared to $34 thousand for three months

ended June 30, 2023.

Operating expenses for three months ended June

30, 2024 were $3.0 million, compared to $5.6 million for the 2023

comparable quarter.

The net loss attributable to common shareholders

was approximately ($3.9) million, or ($2.66) per share in the three

months ended June 30, 2024, compared to a net loss of ($5.6)

million, or $(7.46) per share for the three months ended June 30,

2023.

The Company’s Adjusted EBITDA loss for the three

months ended June 30, 2024, was approximately ($1.4) million as

compared to Adjusted EBITDA loss of approximately ($2.3) million

for the three months ended June 30, 2023. Both EBITDA and Adjusted

EBITDA are non-GAAP financial measures. The Company defines EBITDA

as GAAP net income (loss) attributable to common stockholders

before interest expense, income tax benefit (expense), depreciation

and amortization. Adjusted EBITDA is defined as EBITDA before

certain non-recurring, unusual or non-operational items, such as

litigation expense, stock issuance expense and stock compensation

expense. The Company believes that adjusting EBITDA to exclude the

effects of these items that are not closely associated with ongoing

corporate operations provides management and investors with a

meaningful measure that increases period-to-period comparability of

the Company’s operating performance.

The Company believes the presentation of EBITDA

and Adjusted EBITDA is relevant and useful by enhancing the

readers’ ability to understand the Company’s operating performance.

The Company’s management utilizes EBITDA and Adjusted EBITDA as a

means to measure performance.

The Company’s measurements of EBITDA and

Adjusted EBITDA may not be comparable to similar titled

measurements reported by other companies. EBITDA and Adjusted

EBITDA are not measurements of financial performance under GAAP and

should not be considered as an alternative to net income (loss)

attributable to common stockholders or as an indication of

operating performance or any other measures of financial

performance derived in accordance with GAAP. The Company does not

consider these non-GAAP measures to be substitutes for or superior

to the information provided by its GAAP financial results. The

non-GAAP information should be read in conjunction with our

consolidated financial statements and related notes. These measures

also should not be construed as an inference that our future

results will be unaffected by the non-recurring, unusual or

non-operational items for which these non-GAAP measures make

adjustments.

The following is a reconciliation of EBITDA and

Adjusted EBITDA to the nearest GAAP measure, net gain (loss)

attributable to common stockholders:

|

|

|

|

Three Months Ended June 30, 2024 |

|

|

|

Three Months Ended June 30, 2023 |

|

|

|

Six Months Ended June 30, 2024 |

|

|

|

Six Months Ended June 30, 2023 |

|

| Net loss attributable to

common stockholders of Safe & Green Holdings Corp. |

|

$ |

(3,858,693 |

) |

|

$ |

(5,555,524 |

) |

|

$ |

(8,528,857 |

) |

|

$ |

(9,074,964 |

) |

| Addback interest

expense |

|

|

1,889,328 |

|

|

|

523,971 |

|

|

|

3,172,084 |

|

|

|

811,343 |

|

|

Addback interest income |

|

|

— |

|

|

|

(9,454 |

) |

|

|

(9,570 |

) |

|

|

(18,816 |

) |

| Addback

depreciation and amortization |

|

|

15,125 |

|

|

|

160,455 |

|

|

|

91,512 |

|

|

|

298,767 |

|

| EBITDA (non-GAAP) |

|

|

(1,954,240 |

) |

|

|

(4,880,552 |

) |

|

|

(5,274,831 |

) |

|

|

(7,983,670 |

) |

| Common stock

deemed dividend |

|

|

- |

|

|

|

— |

|

|

|

670,881 |

|

|

|

— |

|

|

Addback litigation expense |

|

|

168,500 |

|

|

|

— |

|

|

|

312,245 |

|

|

|

17,361 |

|

| Addback stock issued for

services |

|

|

— |

|

|

|

47,500 |

|

|

|

251,361 |

|

|

|

484,825 |

|

| Addback

stock compensation expense |

|

|

348,308 |

|

|

|

2,554,262 |

|

|

|

527,336 |

|

|

|

3,210,631 |

|

| Adjusted EBITDA

(non-GAAP) |

|

$ |

(1,437,432 |

) |

|

$ |

(2,278,790 |

) |

|

$ |

(3,513,008 |

) |

|

$ |

(4,270,853 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

At June 30, 2024, the Company had cash and cash

equivalents of $1.0 million compared to $17 thousand at December

31, 2023. As of June 30, 2024, stockholders’ equity was ($4.8)

million compared to ($6.3) million as of December 31, 2023.

About Safe & Green Holdings Corp.

Safe & Green Holdings Corp., a leading

modular solutions company, operates under core capabilities which

include the development, design, and fabrication of modular

structures, meeting the demand for safe and green solutions across

various industries. The firm supports third-party and in-house

developers, architects, builders, and owners in achieving faster

execution, greener construction, and buildings of higher value. The

Company’s subsidiary, Safe and Green Development Corporation, is a

leading real estate development company. Formed in 2021, it focuses

on the development of sites using purpose-built, prefabricated

modules built from both wood and steel, sourced from one of SG

Holdings’ factories and operated by the SG Echo subsidiary. For

more information, visit

https://www.safeandgreenholdings.com/ and follow us at

@SGHcorp on Twitter.

Safe Harbor Statement

Certain statements in this press release

constitute "forward-looking statements" within the meaning of the

federal securities laws. Words such as "may," "might," "will,"

"should," "believe," "expect," "anticipate," "estimate,"

"continue," "predict," "forecast," "project," "plan," "intend" or

similar expressions, or statements regarding intent, belief, or

current expectations, are forward-looking statements. These

forward-looking statements are based upon current estimates and

assumptions and include statements regarding the Company’s

financial results for the three months ended June 30, 2024, the

Company’s guidance it is on track to achieve positive cash flow

before year-end, the Company’s receipt of a term sheet from a

premier lender to refinance the Waldron facility to provide

non-dilutive working capital, the Company’s expected receipt of the

Employee Tax Retention Credit (ERTC) payment within the next year,

which would provide $1.4 million of non-dilutive working capital,

the Company’s expanded agreement to manufacture seven additional

container-based electrical distribution centers as part of a

multi-unit order for a client serving the big box retailer market,

and the Company’s expanded contract, valued in excess of $1

million, to construct an additional 11 container modules and

related services for a government contractor to be used by a major

U.S. government agency. These forward-looking statements are

subject to various risks and uncertainties, many of which are

difficult to predict that could cause actual results to differ

materially from current expectations and assumptions from those set

forth or implied by any forward-looking statements. Important

factors that could cause actual results to differ materially from

current expectations include, among others, the Company’s ability

to achieve positive cash flow before year-end, the Company’s

ability to complete the refinance of its Waldron facility, the

Company’s receipt of the Employee Tax Retention Credit (ERTC)

payment within the next year, which would provide $1.4 million of

non-dilutive working capital the Company’s ability to fulfill the

expanded agreement to manufacture seven additional container-based

electrical distribution centers, the Company’s ability to fulfill

the expanded contract for a government contractor to construct an

additional 11 container modules to be used by a major U.S.

government agency, the effect of government regulation, the

Company’s ability to maintain compliance with the NASDAQ listing

requirements, and the other factors discussed in the Company’s

Annual Report on Form 10-K for the year ended December 31, 2023 and

its subsequent filings with the SEC, including subsequent periodic

reports on Forms 10-Q and 8-K. The information in this release is

provided only as of the date of this release, and we undertake no

obligation to update any forward-looking statements contained in

this release on account of new information, future events, or

otherwise, except as required by law.

Investor Relations:

Crescendo Communications, LLC(212)

671-1020sgbx@crescendo-ir.com

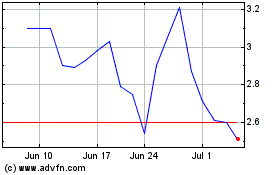

Safe and Green (NASDAQ:SGBX)

Historical Stock Chart

From Nov 2024 to Dec 2024

Safe and Green (NASDAQ:SGBX)

Historical Stock Chart

From Dec 2023 to Dec 2024