Safe and Green Holdings Announces Preliminary Term Sheet to Refinance Waldron Facility

August 12 2024 - 8:30AM

Safe & Green Holdings Corp. (NASDAQ: SGBX) (“Safe &

Green Holdings” or the “Company”), a leading developer,

designer, and fabricator of modular structures, today announced

that it has received a term sheet from a premier lender to

refinance its Waldron facility. This potential refinancing

transaction is expected to be on highly favorable terms and is

being pursued in lieu of the previously planned sale-leaseback

transaction.

The favorable terms offered are intended to

allow Safe & Green to pay off more expensive existing debt and

is expected to result in over $1 million of additional working

capital for the Company. This strategic move underscores the

Company’s commitment to strengthening its financial position while

retaining ownership of its flagship facility.

Paul Galvin, Chairperson and CEO of Safe &

Green Holdings, commented, “This anticipated refinancing is

expected to be on very favorable terms and would enable us to

retain ownership of our Waldron facility, which is a cornerstone of

our operations. Moreover, this transaction would provide us

additional working capital to accelerate our growth strategy.”

Tricia Kaelin, Chief Financial Officer of Safe

& Green Holdings, further noted, “Monetizing our equity in the

asset in order to provide working capital is non-dilutive and these

terms are more favorable compared to our current financing.”

In addition to this potential refinancing, the

Company expects to receive the Employee Retention Tax Credit (ERTC)

payment within the next year, which would provide an additional

$1.4 million of non-dilutive working capital. This anticipated

inflow will further bolster Safe & Green’s financial

flexibility as it continues to execute its strategic

initiatives.

About Safe & Green Holdings Corp. Safe & Green

Holdings Corp., a leading modular solutions company, operates under

core capabilities which include the development, design, and

fabrication of modular structures, meeting the demand for safe and

green solutions across various industries. The firm supports

third-party and in-house developers, architects, builders, and

owners in achieving faster execution, greener construction, and

buildings of higher value. The Company’s subsidiary, Safe and Green

Development Corporation, is a leading real estate development

company. Formed in 2021, it focuses on the development of sites

using purpose-built, prefabricated modules built from both wood and

steel, sourced from one of SG Holdings’ factories and operated by

the SG Echo subsidiary.

For more information,

visit https://www.safeandgreenholdings.com/ and follow us

at @SGHcorp on Twitter.

Safe Harbor Statement

Certain statements in this press release

constitute "forward-looking statements" within the meaning of the

federal securities laws. Words such as "may," "might," "will,"

"should," "believe," "expect," "anticipate," "estimate,"

"continue," "predict," "forecast," "project," "plan," "intend" or

similar expressions, or statements regarding intent, belief, or

current expectations, are forward-looking statements. These

forward-looking statements are based upon current estimates and

assumptions and include statements regarding the Company’s term

sheet from a premier lender to refinance its Waldron facility, and

the Company’s expectation to receive the Employee Retention Tax

Credit (ERTC) payment within the next year, which would provide an

additional $1.4 million of non-dilutive working capital. While

the Company believes these forward-looking statements are

reasonable, undue reliance should not be placed on any such

forward-looking statements, which are based on information

available to us on the date of this release. These forward-looking

statements are subject to various risks and uncertainties, many of

which are difficult to predict that could cause actual results to

differ materially from current expectations and assumptions from

those set forth or implied by any forward-looking statements.

Important factors that could cause actual results to differ

materially from current expectations include, but are not limited

to, the Company’s ability to successfully refinance its Waldron

facility, its ability to successfully complete its Employee

Retention Tax Credit (ERTC), and the factors discussed in the

Company’s Annual Report on Form 10-K for the year ended December

31, 2023, and its subsequent filings with the SEC, including

subsequent periodic reports on Forms 10-Q and 8-K. The information

in this release is provided only as of the date of this release,

and we undertake no obligation to update any forward-looking

statements contained in this release on account of new information,

future events, or otherwise, except as required by law.

Investor Relations: Crescendo Communications,

LLC212-671-1020SGBX@crescendo-ir.com

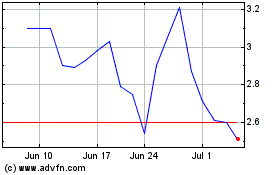

Safe and Green (NASDAQ:SGBX)

Historical Stock Chart

From Nov 2024 to Dec 2024

Safe and Green (NASDAQ:SGBX)

Historical Stock Chart

From Dec 2023 to Dec 2024