Rover Group, Inc. (Nasdaq: ROVR) (“Rover” or the “Company”), the

world’s largest online marketplace for pet care, today announced

that the applicable waiting period under the Hart-Scott-Rodino

Antitrust Improvements Act of 1976, as amended (the "HSR Act"),

expired at 11:59 p.m. Eastern Time on January 12, 2024. The

expiration of the waiting period under the HSR Act was one of the

conditions to the closing of the pending acquisition of Rover by

private equity funds managed by Blackstone Inc. ("Blackstone")

(such pending acquisition, collectively with the transactions

contemplated by the Merger Agreement, the “Merger”) contemplated by

the Agreement and Plan of Merger, dated as of November 29, 2023,

between Rover, Biscuit Parent, LLC and Biscuit Merger Sub, LLC (the

"Merger Agreement"). The transactions contemplated by the Merger

Agreement remain subject to other customary closing conditions,

including the adoption of the Merger Agreement and the approval of

the Merger by Rover stockholders.

About Rover Group, Inc.

Founded in 2011 and based in Seattle, Rover

(Nasdaq: ROVR) is the world’s largest online marketplace for pet

care. Rover connects pet parents with pet providers who offer

overnight services, including boarding and in-home pet sitting, as

well as daytime services, including doggy daycare, dog walking, and

drop-in visits. To learn more about Rover, please visit

www.rover.com.

Cautionary Statement Regarding

Forward-Looking Statements

This communication may contain forward-looking

statements, which include all statements that do not relate solely

to historical or current facts, such as statements regarding the

Merger and the expected timing of the closing of the Merger and

other statements that concern the Company’s expectations,

intentions or strategies regarding the future. In some cases, you

can identify forward-looking statements by the following words:

“may,” “will,” “could,” “would,” “should,” “expect,” “intend,”

“plan,” “anticipate,” “believe,” “estimate,” “predict,” “project,”

“aim,” “potential,” “continue,” “ongoing,” “goal,” “can,” “seek,”

“target” or the negative of these terms or other similar

expressions, although not all forward-looking statements contain

these words. These forward-looking statements are based on the

Company’s beliefs, as well as assumptions made by, and information

currently available to, the Company. Because such statements are

based on expectations as to future financial and operating results

and are not statements of fact, actual results may differ

materially from those projected and are subject to a number of

known and unknown risks and uncertainties, including, but not

limited to: (i) the risk that the Merger may not be completed on

the anticipated timeline or at all; (ii) the failure to satisfy any

of the conditions to the consummation of the Merger, including the

receipt of required approval from the Company’s stockholders and

required regulatory approval; (iii) the occurrence of any event,

change or other circumstance or condition that could give rise to

the termination of the Merger Agreement with private equity funds

managed by Blackstone, including in circumstances requiring the

Company to pay a termination fee; (iv) the effect of the

announcement or pendency of the Merger on the Company’s business

relationships, operating results and business generally; (v) risks

that the Merger disrupts the Company’s current plans and

operations; (vi) the Company’s ability to retain and hire key

personnel and maintain relationships with key business partners and

customers, and others with whom it does business; (vii) risks

related to diverting management’s or employees’ attention during

the pendency of the Merger from the Company’s ongoing business

operations; (viii) the amount of costs, fees, charges or expenses

resulting from the Merger; (ix) potential litigation relating to

the Merger; (x) uncertainty as to timing of completion of the

Merger and the ability of each party to consummate the Merger; (xi)

risks that the benefits of the Merger are not realized when or as

expected; (xii) the risk that the price of the Company’s Class A

common stock may fluctuate during the pendency of the Merger and

may decline significantly if the Merger is not completed; and

(xiii) other risks described in the Company’s filings with the U.S.

Securities and Exchange Commission (the “SEC”), such as the risks

and uncertainties described under the headings “Cautionary Note

Regarding Forward-Looking Statements,” “Risk Factors,”

“Management’s Discussion and Analysis of Financial Condition and

Results of Operations” and other sections of the Company’s Annual

Report on Form 10-K, the Company’s Quarterly Reports on Form 10-Q,

and in the Company’s other filings with the SEC. While the list of

risks and uncertainties presented here is, and the discussion of

risks and uncertainties presented in the preliminary proxy

statement on Schedule 14A filed by the Company with the SEC on

January 11, 2024 (the "Preliminary Proxy Statement") relating to

its special meeting of stockholders are, considered representative,

no such list or discussion should be considered a complete

statement of all potential risks and uncertainties. Unlisted

factors may present significant additional obstacles to the

realization of forward-looking statements. Consequences of material

differences in results as compared with those anticipated in the

forward-looking statements could include, among other things,

business disruption, operational problems, financial loss, legal

liability to third parties and/or similar risks, any of which could

have a material adverse effect on the completion of the Merger

and/or the Company’s consolidated financial condition. The

forward-looking statements speak only as of the date they are made.

Except as required by applicable law or regulation, the Company

undertakes no obligation to update any forward-looking statements,

whether as a result of new information, future events or

otherwise.

The information that can be accessed through

hyperlinks or website addresses included in this communication is

deemed not to be incorporated in or part of this communication.

Additional Information and Where to Find

It

On January 11, 2024, the Company filed the

Preliminary Proxy Statement with the SEC relating to its special

meeting of stockholders and may file or furnish other documents

with the SEC regarding the Merger. When completed, a definitive

proxy statement, together with a proxy card, will be mailed to the

Company’s stockholders. STOCKHOLDERS ARE URGED TO CAREFULLY READ

THE PROXY STATEMENT REGARDING THE MERGER (INCLUDING ANY AMENDMENTS

OR SUPPLEMENTS THERETO AND ANY DOCUMENTS INCORPORATED BY REFERENCE

THEREIN) AND ANY OTHER RELEVANT DOCUMENTS FILED OR FURNISHED WITH

THE SEC IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY

WILL CONTAIN IMPORTANT INFORMATION ABOUT THE MERGER. The Company’s

stockholders may obtain free copies of the documents the Company

files with the SEC from the SEC’s website at www.sec.gov or through

the Company’s website at investors.rover.com under the link

“Financials” and then under the link “SEC Filings” or by contacting

the Company’s Investor Relations department via e-mail at

investorrelations@rover.com.

Participants in the

Solicitation

The Company and its directors and executive

officers, which consist of Adam Clammer, Jamie Cohen, Venky

Ganesan, Greg Gottesman, Kristine Leslie, Scott Jacobson, Erik

Prusch, Megan Siegler, who are the non-employee members of the

Company’s Board of Directors, Aaron Easterly, the Company’s Chief

Executive Officer and Chairperson of the Board of Directors, Brent

Turner, the Company’s President and Chief Operating Officer, and

Charlie Wickers, the Company’s Chief Financial Officer, are

participants in the solicitation of proxies from the Company’s

stockholders in connection with the Merger. Information regarding

the Company’s directors and executive officers, including a

description of their direct or indirect interests, by security

holdings or otherwise, can be found under the captions "The

Merger—Interests of Rover’s Directors and Executive Officers in the

Merger" and “Security Ownership of Certain Beneficial Owners and

Management" in the Preliminary Proxy Statement. To the extent that

the Company’s directors and executive officers and their respective

affiliates have acquired or disposed of security holdings since the

applicable “as of” date disclosed in the Preliminary Proxy

Statement, such transactions have been or will be reflected on

Statements of Change in Ownership on Form 4 or amendments to

beneficial ownership reports on Schedules 13D filed with the SEC.

Other information regarding the participants in the proxy

solicitation and a description of their interests will be contained

in the definitive proxy statement and other relevant materials to

be filed with the SEC in respect of the Merger when they become

available. These documents and the Preliminary Proxy Statement can

be obtained free of charge from the sources indicated above.

Contacts

FOR ROVERInvestorsWalter

Ruddywalter.ruddy@rover.com(206) 715-2369

MediaKristin Sandbergpr@rover.com(360)

510-6365

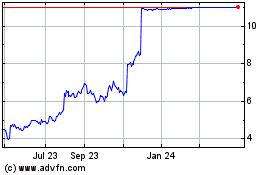

Rover (NASDAQ:ROVR)

Historical Stock Chart

From Jan 2025 to Feb 2025

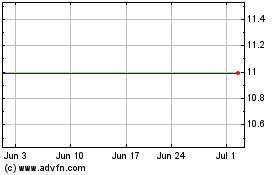

Rover (NASDAQ:ROVR)

Historical Stock Chart

From Feb 2024 to Feb 2025