Revelation Biosciences Inc. (NASDAQ: REVB) (the “Company” or

“Revelation”), a life sciences company that is focused on the

development of immunologic based therapies for the prevention and

treatment of disease, today reported its three months ended March

31, 2023 financial results and highlighted recent corporate

progress.

Corporate Highlights

- Established strong scientific advisory team with extensive

preclinical experience using PHAD to prevent disease.

- Initiated additional nonclinical studies to further study PHAD

in treatment and prevention of CKD and AKI in order to inform

future clinical study designs in patients.

- IND and clinical enabling studies under way for anticipated

Phase 1 clinical study starting in Q4 2023.

“We are off to a great start for 2023 and have commenced our IND

and clinical study enabling activities to advance REVTx-300 and

REVTx-100,” said James Rolke, Chief Executive Officer of

Revelation. “We are laser-focused and on track to file our IND and

initiate clinical studies of REVTx-300 and REVTx-100 in Q4 of this

year.”

Results of Operations

As of March 31, 2023, Revelation had $17.7 million in cash and

cash equivalents, compared to $5.3 million as of December 31, 2022.

The increase in cash and cash equivalents was primarily due to net

cash received from financing activities, offset primarily by cash

used for operating activities. Based on current operating plans and

projections, Revelation believes that its current cash and cash

equivalents are sufficient to fund operations through June of

2024.

Revelation’s net cash used for operating activities for the

three months ended March 31, 2023 was $1.6 million compared to net

cash used for operating activities of $4.8 million for the same

period in 2022. Revelation’s net income for the three months ended

March 31, 2023 was $6.2 million, or $2.79 basic earnings per share

and $1.96 diluted earnings per share, compared to a net loss of

$6.6 million, or $15.09 basic and diluted loss per share for the

same periods in 2022.

Net income was primarily due to the change in fair value of the

warrant liability creating a $7.7 million gain. The changes in net

cash used for operating activities and the decrease in net loss in

2023 as compared to 2022 were primarily due to decreases clinical

study expenses associated with our Phase 2b viral challenge

clinical study (REVTx-99a) and our Phase 1b allergen challenge

study (REVTx-99b), legal fees, professional consulting service fees

and public company directors and officers insurance policy.

About Revelation Biosciences Inc.

Revelation Biosciences, Inc. is a life sciences company focused

on the development of immunologic-based therapies for the

prevention and treatment of disease. Revelation has multiple

product candidates in development that are based on the

well-established biology of phosphorylated hexaacyl disaccharide

(PHAD) and its effect on the innate immune system. REVTx‑300 is

being developed as a potential therapy for the treatment of acute

and chronic organ disease including CKD, AKI and myocarditis.

REVTx‑100 is being developed as a prevention and treatment of

infection. REVTx‑200 is being developed as an intranasal

immunomodulator adjunct to be used in combination with an

intramuscular vaccination for more complete immunity. REVTx‑99b is

being developed as a treatment for food allergies.

For more information on Revelation, please visit www.RevBiosciences.com.

Forward-Looking Statements

This press release contains forward-looking statements as

defined in the Private Securities Litigation Reform Act of 1995, as

amended. Forward-looking statements are statements that are not

historical facts. These forward-looking statements are generally

identified by the words "anticipate", "believe", "expect",

"estimate", "plan", "outlook", and "project" and other similar

expressions. We caution investors that forward-looking statements

are based on management’s expectations and are only predictions or

statements of current expectations and involve known and unknown

risks, uncertainties and other factors that may cause actual

results to be materially different from those anticipated by the

forward-looking statements. Revelation cautions readers not to

place undue reliance on any such forward looking statements, which

speak only as of the date they were made. The following factors,

among others, could cause actual results to differ materially from

those described in these forward-looking statements: the ability of

Revelation to meet its financial and strategic goals, due to, among

other things, competition; the ability of Revelation to grow and

manage growth profitability and retain its key employees; the

possibility that the Revelation may be adversely affected by other

economic, business, and/or competitive factors; risks relating to

the successful development of Revelation’s product candidates; the

clinical utility of an increase in intranasal cytokine levels as a

biomarker of viral infections; the ability to successfully complete

planned clinical studies of its product candidates; the risk that

we may not fully enroll our clinical studies or enrollment will

take longer than expected; risks relating to the occurrence of

adverse safety events and/or unexpected concerns that may arise

from data or analysis from our clinical studies; changes in

applicable laws or regulations; expected initiation of the clinical

studies, the timing of clinical data; the outcome of the clinical

data, including whether the results of such study is positive or

whether it can be replicated; the outcome of data collected,

including whether the results of such data and/or correlation can

be replicated; the timing, costs, conduct and outcome of our other

clinical studies; the anticipated treatment of future clinical data

by the FDA, the EMA or other regulatory authorities, including

whether such data will be sufficient for approval; the success of

future development activities for its product candidates; potential

indications for which product candidates may be developed; the

potential impact that COVID-19 may have on Revelation’s suppliers,

vendors, regulatory agencies, employees and the global economy as a

whole; the ability of Revelation to maintain the listing of its

securities on NASDAQ; investor sentiment relating to SPAC related

going public transactions; the expected duration over which

Revelation’s balances will fund its operations; and other risks and

uncertainties described herein, as well as those risks and

uncertainties discussed from time to time in other reports and

other public filings with the SEC by Revelation.

REVELATION BIOSCIENCES,

INC.

Condensed Consolidated

Statements of Operations

(Unaudited)

Three Months Ended March

31,

2023

2022

Operating expenses:

Research and development

$

525,273

$

3,680,280

General and administrative

1,094,574

2,906,020

Total operating expenses

1,619,847

6,586,300

Loss from operations

(1,619,847

)

(6,586,300

)

Other income (expense):

Change in fair value of warrant

liability

7,744,935

—

Other income (expense)

34,107

(30,241

)

Total other income (expense),

net

7,779,042

(30,241

)

Net income (loss)

$

6,159,195

$

(6,616,541

)

Net earnings (loss) per share,

basic

$

2.79

$

(15.90

)

Weighted-average shares used to compute

net earnings (loss) per share, basic

2,210,703

416,184

Net earnings (loss) per share,

diluted

$

1.96

$

(15.90

)

Weighted-average shares used to compute

net earnings (loss) per share, diluted

3,135,916

416,184

REVELATION BIOSCIENCES,

INC.

Condensed Consolidated Balance

Sheets

(Unaudited)

March 31, 2023

December 31, 2022

ASSETS

Current assets:

Cash and cash equivalents

$

17,702,818

$

5,252,979

Deferred offering costs

—

87,171

Prepaid expenses and other current

assets

332,387

73,132

Total current assets

18,035,205

5,413,282

Property and equipment, net

83,870

90,133

Total assets

$

18,119,075

$

5,503,415

LIABILITIES AND STOCKHOLDERS’

EQUITY

Current liabilities:

Accounts payable

$

705,089

$

554,205

Accrued expenses

973,925

985,497

Deferred underwriting commissions

2,911,260

2,911,260

Warrant Liability

3,511,155

—

Total current liabilities

8,101,429

4,450,962

Total liabilities

8,101,429

4,450,962

Stockholders’ equity:

Series A Preferred Stock, $0.001 par

value; zero and one shares authorized, issued and outstanding at

March 31, 2023 and December 31, 2022, respectively; liquidation

preference of $0 and $5,000 at March 31, 2023 and December 31,

2022, respectively

—

—

Common Stock, $0.001 par value;

500,000,000 and 11,000,000 shares authorized and 4,729,839 and

682,882 issued and outstanding at March 31, 2023 and December 31,

2022, respectively

4,730

683

Additional paid-in-capital

29,200,569

26,398,618

Accumulated deficit

(19,187,653

)

(25,346,848

)

Total stockholders’ equity

10,017,646

1,052,453

Total liabilities and stockholders’

equity

$

18,119,075

$

5,503,415

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230522005307/en/

Company Contacts Sandra Vedrick Vice President, Investor

Relations & Human Resources Revelation Biosciences Inc. Email:

svedrick@revbiosciences.com and Chester Zygmont, III Chief

Financial Officer Revelation Biosciences Inc. Email:

czygmont@revbiosciences.com

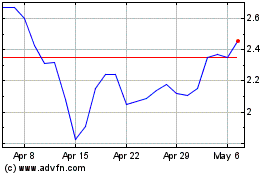

Revelation Biosciences (NASDAQ:REVB)

Historical Stock Chart

From Jan 2025 to Feb 2025

Revelation Biosciences (NASDAQ:REVB)

Historical Stock Chart

From Feb 2024 to Feb 2025