false 0001479290 0001479290 2023-09-17 2023-09-17

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September 17, 2023

Revance Therapeutics, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

001-36297 |

|

77-0551645 |

(State or other jurisdiction

of incorporation) |

|

(Commission File No.) |

|

(I.R.S. Employer

Identification No.) |

1222 Demonbreun Street, Suite 2000, Nashville, Tennessee, 37203

(Address of principal executive offices and zip code)

(615) 724-7755

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, $0.001 par value |

|

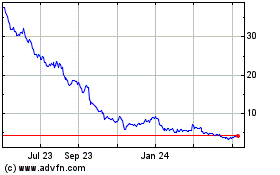

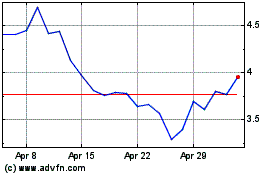

RVNC |

|

Nasdaq Global Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 2.05 |

Costs Associated with Exit or Disposal Activities. |

On September 17, 2023, Revance Therapeutics, Inc. (the “Company”) commenced a plan to exit the OPUL® payments business. Despite the value generated by OPUL®, the significant costs and resources required to support OPUL® no longer aligns with the Company’s capital allocation priorities. The exit and restructuring activities predominantly include a reduction in OPUL® personnel headcount, the termination of OPUL® research and development activities and a reduction of outside services expenses related to OPUL®. The Company intends to continue processing payments for current OPUL® customers through January 31, 2024. The Company also plans to continue to leverage OPUL®’s existing technical architecture and digital capabilities to execute on the Company’s loyalty and practice partnership priorities.

The Company expects to record a restructuring charge in connection with such activities of up to $7.0 million, primarily consisting of severance and other related costs. This amount excludes charges related to the material impairment charges described in Item 2.06 below. The Company expects that the restructuring charges will be incurred over time through the three months ended March 31, 2024. The Company further anticipates that the completion of the activities described above, including the implementation of the workforce reduction, and related cash payments, will be substantially complete by March 31, 2024.

| Item 2.06 |

Material Impairments. |

The information contained in Item 2.05 above is incorporated herein by reference. In connection with the above described measures, the Company currently estimates the total non-cash impairment charges from goodwill and other assets to be between an estimated $80 million and $100 million. The Company does not expect material cash expenditures in connection with the impairment charge.

| Item 7.01 |

Regulation FD Disclosure. |

On September 19, 2023, the Company issued a press release announcing key corporate updates and updated guidance. A copy of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K (this “Report”). On the same date, the Company posted an updated corporate presentation to its website at https://investors.revance.com/investors/events-and-presentations, which the Company expects to present to certain of its analysts and investors at an investor conference on September 19, 2023. A copy of the corporate presentation is attached as Exhibit 99.2 to this Report. Interested parties can attend the live webcast for the investor conference by registering on the “Events and Presentation” section of the Company’s Investor Relations webpage at https://investors.revance.com/investors/events-and-presentations/events.

The information in this Item 7.01, including Exhibits 99.1 and 99.2 hereto, is furnished pursuant to Item 7.01 and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that Section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended (the “Securities Act”) or the Exchange Act, except as expressly set forth by specific reference in such a filing. The Company’s submission of this Report shall not be deemed an admission as to the materiality of any information required to be disclosed solely to satisfy the requirements of Regulation FD.

Forward-Looking Statements

This Report and Exhibits 99.1 and 99.2 hereto contain forward-looking statements within the meaning of the federal securities laws.

Any statements in this Report and Exhibits 99.1 and 99.2 that are not statements of historical fact, including statements related to our 2023 guidance and guidance plans; our anticipated adjusted gross margins; our funding to cash flow breakeven; our capital requirements; the timing for reaching positive adjusted EBITDA; projected loss from the services segment; anticipated restructuring and impairment charges; the plans for the OPUL® business and anticipated cash to be freed up from the exit of the OPUL® payments business; our ability to successfully commercialize DAXXIFY®, drive adoption, take market share and grow; our blockbuster potential; DAXXIFY® cervical dystonia launch; our market opportunity, market growth and market resiliency; our therapeutics pipeline expansion; our potential to disrupt the market; our contract manufacturer plans; potential product margins; future innovations; injector, consumer and payer expectations, preferences and behavior; the impact of DAXXIFY® pricing on injectors, consumers and payers; our ability to deliver loyalty and practice partnership solutions; the potential benefits and performance of our products; the efficacy, duration and safety of DAXXIFY®; symptom reemergence in cervical dystonia patients; reimbursement expectations; our ability to optimize patient outcomes and practice integration; the infrastructure and key milestones related to DAXXIFY® for the treatment of cervical dystonia; the commercialization of DAXXIFY® through our Fosun partnership; anticipated approvals; international expansion; development of a biosimilar to onabotulinumtoxinA for injection with Viatris; our partnerships; and our business and marketing strategy, timeline and other goals, and plans and prospects, including our commercialization plans; constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act and Section 21E of the Exchange Act. You should not rely upon forward-looking statements as predictions of future events. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee that the future results, levels of activity, performance, events, circumstances or achievements reflected in the forward-looking statements will ever be achieved or occur.

Forward-looking statements are subject to risks and uncertainties that could cause actual results and the timing of events to differ materially from our expectations. These risks and uncertainties relate to, but are not limited to: our ability to obtain funding for our operations; the timing of capital expenditures; the accuracy of our estimates regarding expenses, revenues, capital requirements, our financial performance and the economics of DAXXIFY® and the RHA® Collection of dermal fillers; the extent of future impairment charges; our ability to comply with our debt obligations; the impact of macroeconomic factors on our manufacturing operations, supply chain, end user demand for our products, commercialization efforts, business operations, regulatory meetings, inspections and approvals, clinical trials and other aspects of our business and on the market; our ability to maintain approval of our products; our ability and the ability of our partners to manufacture supplies for DAXXIFY® and our drug product candidates; our ability to acquire supplies of the RHA® Collection of dermal fillers; the uncertain clinical development process; our ability to obtain, and the timing relating to, regulatory submissions and approvals with respect to our drug product candidates and third-party manufacturers; the risk that clinical trials may not have an effective design or generate positive results or that positive results would assure regulatory approval or commercial success; the applicability of clinical study results to actual outcomes; the rate and degree of economic benefit, safety, efficacy, commercial acceptance, market, competition and/or size and growth potential of DAXXIFY®, the RHA® Collection of dermal fillers, and our drug product candidates, if approved; our ability to successfully commercialize DAXXIFY® and to continue to successfully commercialize the RHA® Collection of dermal fillers; the timing and cost of commercialization activities; securing or maintaining adequate coverage or reimbursement by third-party payors for DAXXIFY®; the proper training and administration of our products by physicians and medical staff; our ability to gain acceptance from physicians in the use of DAXXIFY® for therapeutic indications; our ability to expand sales and marketing capabilities; the status of commercial collaborations; changes in and failures to comply with laws and regulations; our ability to continue obtaining and maintaining intellectual property protection for our products; the cost and our ability to defend ourselves in product liability, intellectual property, class action or other lawsuits; our ability to limit or mitigate cybersecurity incidents; the volatility of our

stock price; and other risks. Detailed information regarding factors that may cause actual results to differ materially from the expectations expressed or implied by statements in this Report and Exhibits 99.1 and 99.2 may be found in our periodic filings with the Securities and Exchange Commission (“SEC”), including factors described in the section entitled “Risk Factors” in our Form 10-K filed with the SEC on February 28, 2023, and including, without limitation, our Form 10-Qs for the quarters ended March 31, 2023 and June 30, 2023, filed with the SEC on May 9, 2023 and August 8, 2023, respectively. The forward-looking statements in this Report and Exhibits 99.1 and 99.2 speak only as of the date hereof. We disclaim any obligation to update these forward-looking statements.

| Item 9.01 |

Financial Statements and Exhibits. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

| Date: September 19, 2023 |

|

|

|

Revance Therapeutics, Inc. |

|

|

|

|

|

|

|

|

By: |

|

/s/ Tobin C. Schilke |

|

|

|

|

|

|

Tobin C. Schilke |

|

|

|

|

|

|

Chief Financial Officer |

Exhibit 99.1

Revance Provides Corporate Update at Investor Day

NASHVILLE, Tenn. – (BUSINESS WIRE) – September 19, 2023—Revance Therapeutics, Inc. (Nasdaq: RVNC) announced

that the company is hosting its Investor Day today, September 19, 2023, from 9:30am ET to 12:00pm ET.

The Investor Day will include management

presentations on Revance’s vision and strategy, Revance Aesthetics overview and launch progress, DAXXIFY® KOL panel, Revance Therapeutics commercial launch plans, future growth

opportunities, and financial review and outlook. The presentations will be followed by a Q&A session.

Key Corporate Updates

| |

• |

|

Real-world feedback reinforces DAXXIFY’s differentiated performance profile and continued opportunity for

long-term, broad-based adoption. |

| |

• |

|

New pricing program for DAXXIFY®, which became effective

September 1, 2023, positions the product to be priced competitively to Botox® Cosmetic for the provider, to further accelerate market share expansion. |

| |

• |

|

Expects long-term supply chain strategy to support U.S.

DAXXIFY® adjusted gross margin of over 80%. |

| |

• |

|

Continued confidence in blockbuster potential in U.S. aesthetics product portfolio. |

| |

• |

|

Provides update on DAXXIFY® cervical dystonia PrevU

program and commercial launch plans, early feedback from payers and market access dynamics. |

| |

• |

|

Exiting OPUL® payments business by the end of Q1 2024 to

prioritize capital allocation and streamline operations. Expects to free up approximately $20 million a year for reinvestment in DAXXIFY® aesthetics and therapeutic commercial

launches. |

| |

• |

|

The company provides additional updates to its 2023 financial guidance: |

| |

• |

|

With current cash, cash equivalents, and short-term investments of $319.7 million as of June 30, 2023,

and the additional $50 million in notes funded through Athyrium Capital in August 2023, the company is funded to breakeven and expects to be Adjusted EBITDA positive in 2025. |

| |

• |

|

Expects to provide product revenue guidance in first half of 2024. |

| |

• |

|

Q3 2023 product revenue has the potential to be around Q2 2023 levels based on the recent roll out of the new

pricing program and traditional seasonality in facial injectables. |

| |

• |

|

Revised 2023 GAAP and Non-GAAP operating expense guidance to reflect the

company’s exit of the OPUL® payments business: |

| |

• |

|

GAAP operating expenses updated from $460 million – $480 million to $545 million –

$585 million. |

| |

• |

|

Non-GAAP operating expenses updated from $320 million –

$340 million to $315 million – $335 million. |

| |

• |

|

Non-GAAP research and development expenses updated from $80 million

– $90 million to $75 million – $85 million. |

Interested parties can access the live webcast for this event from the Events and

Presentations section of the company’s Investor Relations webpage.

A webcast replay will be available beginning September 19,

2023, at 12:00 p.m. PT / 3:00 p.m. ET. To access the replay, please register via the webcast link on the events page.

About Revance

Revance is a biotechnology company setting the new standard in healthcare with innovative aesthetic and therapeutic offerings that enhance patient outcomes and

physician experiences. Revance’s portfolio includes DAXXIFY® (DaxibotulinumtoxinA-lanm) for injection and the RHA® Collection of

dermal fillers in the U.S. Revance has also partnered with Viatris Inc. to develop a biosimilar to onabotulinumtoxinA for injection and Shanghai Fosun Pharmaceutical to commercialize DAXXIFY®

in China.

Revance is headquartered in Nashville, Tenn., with additional office locations in Newark and Irvine, Calif. Learn more

at www.Revance.com, www.RevanceAesthetics.com, www.DAXXIFY.com, www.hcp.DAXXIFYTherapy.com, or connect with us on LinkedIn.

“Revance” and the Revance logo, and DAXXIFY® are registered trademarks of Revance

Therapeutics, Inc. Resilient Hyaluronic Acid® and RHA® are trademarks of TEOXANE SA.

BOTOX® is a registered trademark of Allergan, Inc.

Forward-Looking Statements

Any statements in this press release that are not statements of historical fact, including statements related to our adjusted gross margins; 2023 product

revenue, operating expenses and research and development expense guidance and our guidance plans; our funding to cash flow breakeven; our capital requirements; the timing for reaching positive adjusted EBITDA; projected loss from the services

segment; the plans for the OPUL® business and the anticipated cash to be freed up from the exit of the OPUL® payments business; our

ability to successfully commercialize DAXXIFY®, drive adoption, take market share and grow; our blockbuster potential; the competitive pricing of DAXXIFY®; the potential benefits and performance of our products; the efficacy, duration and safety of DAXXIFY®; our ability to set a new standard

of care; potential benefits of our products to physicians and patients; development of a biosimilar to onabotulinumtoxinA for injection with Viatris; and our business and marketing strategy, timeline and other goals, and plans and prospects,

including our commercialization plans; constitute forward-looking statements within the meaning of the Private Securities

Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. You should not rely upon

forward-looking statements as predictions of future events. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee that the future results, levels of activity, performance, events,

circumstances or achievements reflected in the forward-looking statements will ever be achieved or occur.

Forward-looking statements are subject to risks

and uncertainties that could cause actual results and the timing of events to differ materially from our expectations. These risks and uncertainties relate to, but are not limited to: our ability to obtain funding for our operations; the timing of

capital expenditures; the accuracy of our estimates regarding expenses, revenues, capital requirements, our financial performance and the economics of DAXXIFY® and the RHA® Collection of dermal fillers; the extent of future impairment charges; our ability to comply with our debt obligations; the impact of macroeconomic factors on our manufacturing operations, supply

chain, end user demand for our products, commercialization efforts, business operations, regulatory meetings, inspections and approvals, clinical trials and other aspects of our business and on the market; our ability to maintain approval of our

products; our ability and the ability of our partners to manufacture supplies for DAXXIFY® and our drug product candidates; our ability to acquire supplies of the RHA® Collection of dermal fillers; the uncertain clinical development process; our ability to obtain, and the timing relating to, regulatory submissions and approvals with respect to our drug product

candidates and third-party manufacturers; the risk that clinical trials may not have an effective design or generate positive results or that positive results would assure regulatory approval or commercial success; the applicability of clinical

study results to actual outcomes; the rate and degree of economic benefit, safety, efficacy, commercial acceptance, market, competition and/or size and growth potential of DAXXIFY®, the RHA® Collection of dermal fillers, and our drug product candidates, if approved; our ability to successfully commercialize DAXXIFY® and to

continue to successfully commercialize the RHA® Collection of dermal fillers; the timing and cost of commercialization activities; securing or maintaining adequate coverage or reimbursement by

third-party payors for DAXXIFY®; the proper training and administration of our products by physicians and medical staff; our ability to gain acceptance from physicians in the use of DAXXIFY® for therapeutic indications; our ability to expand sales and marketing capabilities; the status of commercial collaborations; changes in and failures to comply with laws and regulations; our

ability to continue obtaining and maintaining intellectual property protection for our products; the cost and our ability to defend ourselves in product liability, intellectual property, class action or other lawsuits; our ability to limit or

mitigate cybersecurity incidents; the volatility of our stock price; and other risks. Detailed information regarding factors that may cause actual results to differ materially from the expectations expressed or implied by statements in this press

release may be found in our periodic filings with the Securities and Exchange Commission (“SEC”), including factors described in the section entitled “Risk Factors” in our Form

10-K filed with the SEC on February 28, 2023, and including, without limitation, our Form 10-Qs for the quarters ended March 31,

2023 and June 30, 2023, filed with the SEC on May 9, 2023 and August 8, 2023, respectively. The forward-looking statements in this press release speak only as of the date hereof. We disclaim any obligation to update these

forward-looking statements.

Use of Non-GAAP Financial Measures

The Company has presented certain preliminary and unaudited non-GAAP financial measures in this press release,

including non-GAAP R&D expense, non-GAAP operating expense, adjusted gross margin and adjusted EBITDA. Non-GAAP R&D

expense excludes depreciation, amortization, non-cash stock-based compensation and restructuring charges. Non-GAAP operating expense excludes costs of revenue,

depreciation, amortization, stock-based compensation, and restructuring and impairment charges. Adjusted gross margin is defined as gross margin, excluding stock-based compensation, depreciation and amortization. Adjusted EBITDA is defined as

earnings before interest, taxes, depreciation and amortization, stock-based compensation and extraordinary items such as restructuring and impairment charges. Actual non-GAAP R&D expense, non-GAAP operating expense and adjusted EBITDA may exclude extraordinary items not indicative of our ongoing operating performance such as restructuring and impairment charges. The Company excludes costs of revenue,

depreciation, amortization, stock-based compensation and extraordinary items like restructuring and impairment charges because management believes the exclusion of these items is helpful to investors to evaluate the Company’s recurring

operational performance. Company management uses these non-GAAP financial measures to monitor and evaluate its operating results and trends on an ongoing basis, and internally for operating, budgeting and

financial planning purposes. The non-GAAP financial measures should be considered in addition to results prepared in accordance with GAAP but should not be considered a substitute for or superior to GAAP

results.

Certain non-GAAP measures included in this press release were not reconciled to the comparable GAAP

financial measures because the GAAP measures are not accessible on a forward-looking basis. The Company is unable to reconcile these forward-looking non-GAAP financial measures to the most directly comparable

GAAP measures without unreasonable effort because the Company is currently unable to predict with a reasonable degree of certainty the type and extent of certain items that would be expected to impact GAAP measures for these periods but would not

impact the non-GAAP measures. Such items include costs of revenue, depreciation, amortization, stock-based compensation as well as extraordinary items like restructuring and impairment charges. The unavailable

information could have a significant impact on the Company’s GAAP financial results.

Investors

Revance Therapeutics, Inc.:

Jessica Serra, 510-279-6886

jessica.serra@revance.com

or

Gilmartin Group, LLC.:

Laurence Watts, 619-916-7620

laurence@gilmartinir.com

Media

Revance Therapeutics, Inc.:

Sara Fahy, 949-887-4476

sfahy@revance.com

Exhibit 99.2 INVESTOR DAY 2023 The presentations today contain

information about Revance’s business for stockholders, potential investors, and financial analysts. The content shared is intended for this audience only.

INVESTOR DAY 2023 WELCOME MARK J. FOLEY – CHIEF EXECUTIVE OFFICER

Intended for investor audience

INVESTOR DAY 2023 PR O GR A M REVANCE AESTHETICS DAXXIFY® KOL PANEL

B R E AK REVANCE THERAPEUTICS Speakers: FUTURE GROWTH OPPORTUNITIES Mark J. Foley - Chief Executive Officer Dustin S. Sjuts – President FINANCIAL REVIEW Tobin C. Schilke – Chief Financial Officer CLOSING REMARKS David A. Hollander, MD

– Chief Medical Officer Taryn M. Conway – General Manager, Aesthetics Q&A PANEL Rob E. Bancroft – General Manager, Therapeutics Intended for investor audience

Forward-Looking Statement Forward-Looking Statements Any statements in

this presentation that are not statements of historical fact, including statements related to our 2023 guidance and guidance plans; our adjusted gross margins; our funding to cash flow breakeven; our capital requirements; the timing for reaching

positive adjusted EBITDA; projected loss from the services segment; anticipated restructuring and impairment charges; the plans for the OPUL® business and the anticipated cash to be freed up from the exit of the OPUL® payments business;

our ability to successfully commercialize DAXXIFY®, drive adoption, take market share and grow; our blockbuster potential; DAXXIFY® cervical dystonia launch; our market opportunity, market growth and market resiliency; our therapeutics

pipeline expansion; our potential to disrupt the market; our contract manufacturer plans; potential product margins; future innovations; injector, consumer and payer expectations, preferences and behavior; the impact of DAXXIFY® pricing on

injectors, consumers and payers; our ability to deliver loyalty and practice partnership solutions; the potential benefits and performance of our products; the efficacy, duration and safety of DAXXIFY®; symptom reemergence in cervical dystonia

patients; reimbursement expectations; our ability to optimize patient outcomes and practice integration; the infrastructure and key milestones related to DAXXIFY® for the treatment of cervical dystonia; the commercialization of DAXXIFY®

through our Fosun partnership and anticipated approvals; international expansion; development of a biosimilar to onabotulinumtoxinA for injection with Viatris; our partnerships; and our business and marketing strategy, timeline and other goals, and

plans and prospects, including our commercialization plans; constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, and Section 21E of

the Securities Exchange Act of 1934, as amended. You should not rely upon forward-looking statements as predictions of future events. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot

guarantee that the future results, levels of activity, performance, events, circumstances or achievements reflected in the forward-looking statements will ever be achieved or occur. Forward-looking statements are subject to risks and uncertainties

that could cause actual results and the timing of events to differ materially from our expectations. These risks and uncertainties relate to, but are not limited to: our ability to obtain funding for our operations; the timing of capital

expenditures; the accuracy of our estimates regarding expenses, revenues, capital requirements, our financial performance and the economics of DAXXIFY® and the RHA® Collection of dermal fillers; the extent of future impairment charges; our

ability to comply with our debt obligations; the impact of macroeconomic factors on our manufacturing operations, supply chain, end user demand for our products, commercialization efforts, business operations, regulatory meetings, inspections and

approvals, clinical trials and other aspects of our business and on the market; our ability to maintain approval of our products; our ability and the ability of our partners to manufacture supplies for DAXXIFY® and our drug product candidates;

our ability to acquire supplies of the RHA® Collection of dermal fillers; the uncertain clinical development process; our ability to obtain, and the timing relating to, regulatory submissions and approvals with respect to our drug product

candidates and third-party manufacturers; the risk that clinical trials may not have an effective design or generate positive results or that positive results would assure regulatory approval or commercial success; the applicability of clinical

study results to actual outcomes; the rate and degree of economic benefit, safety, efficacy, commercial acceptance, market, competition and/or size and growth potential of DAXXIFY®, the RHA® Collection of dermal fillers, and our drug

product candidates, if approved; our ability to successfully commercialize DAXXIFY® and to continue to successfully commercialize the RHA® Collection of dermal fillers; the timing and cost of commercialization activities; securing or

maintaining adequate coverage or reimbursement by third-party payors for DAXXIFY®; the proper training and administration of our products by physicians and medical staff; our ability to gain acceptance from physicians in the use of

DAXXIFY® for therapeutic indications; our ability to expand sales and marketing capabilities; the status of commercial collaborations; changes in and failures to comply with laws and regulations; our ability to continue obtaining and

maintaining intellectual property protection for our products; the cost and our ability to defend ourselves in product liability, intellectual property, class action or other lawsuits; our ability to limit or mitigate cybersecurity incidents; the

volatility of our stock price; and other risks. Detailed information regarding factors that may cause actual results to differ materially from the expectations expressed or implied by statements in this presentation may be found in our periodic

filings with the Securities and Exchange Commission (“SEC”), including factors described in the section entitled Risk Factors in our Form 10-K filed with the SEC on February 28, 2023, and including, without limitation, our Form 10-Qs for

the quarters ended March 31, 2023 and June 30, 2023, filed with the SEC on May 9, 2023 and August 8, 2023, respectively. The forward-looking statements in this presentation speak only as of the date hereof. We disclaim any obligation to update these

forward-looking statements. This presentation also contains estimates and other statistical data made by independent parties and by us relating to market shares and other data about our industry. This data involves a number of assumptions and

limitations, and you are cautioned not to give undue weight to such estimates. The trademarks included herein are the property of the owners thereof and are used for reference purposes only. Such use should not be construed as an endorsement of such

products. Use of Non-GAAP Financial Measures The Company has presented certain preliminary and unaudited non-GAAP financial measures in this presentation, including non-GAAP R&D expense, non-GAAP operating expense, adjusted gross margin and

adjusted EBITDA. Non-GAAP R&D expense excludes depreciation, amortization, non-cash stock-based compensation and restructuring charges. Non-GAAP operating expense excludes costs of revenue, depreciation, amortization, stock-based compensation,

and restructuring and impairment charges. Adjusted gross margin is defined as gross margin, excluding stock-based compensation, depreciation and amortization. Adjusted EBITDA is defined as earnings before interest, taxes, depreciation and

amortization, stock-based compensation. Actual non-GAAP R&D expense, non-GAAP operating expense and adjusted EBITDA may exclude extraordinary items not indicative of our ongoing operating performance such as restructuring and impairment charges.

The Company excludes costs of revenue, depreciation, amortization, stock-based compensation and extraordinary items like restructuring and impairment charges because management believes the exclusion of these items is helpful to investors to

evaluate the Company’s recurring operational performance. Company management uses these non-GAAP financial measures to monitor and evaluate its operating results and trends on an ongoing basis, and internally for operating, budgeting and

financial planning purposes. The non-GAAP financial measures should be considered in addition to results prepared in accordance with GAAP but should not be considered a substitute for or superior to GAAP results. Certain non-GAAP measures included

in this presentation were not reconciled to the comparable GAAP financial measures because the GAAP measures are not accessible on a forward-looking basis. The Company is unable to reconcile these forward-looking non-GAAP financial measures to the

most directly comparable GAAP measures without unreasonable effort because the Company is currently unable to predict with a reasonable degree of certainty the type and extent of certain items that would be expected to impact GAAP measures for these

periods but would not impact the non-GAAP measures. Such items include costs of revenue, depreciation, amortization, stock-based compensation as well as extraordinary items like restructuring and impairment charges. The unavailable information could

have a significant impact on the Company’s GAAP financial results. Intended for investor audience

We seek to disrupt large, established, and growing markets in aesthetics

and therapeutics through innovation 5 Intended for investor audience

® DAXXIFY anchors our portfolio st 1 true innovation in

neuromodulator formulation in >30 years Pipeline in a product totaling $5B U.S. market 1 opportunity 1. Market size as of 2022. Data on file. Decision Resources Group Therapeutic Botulinum Toxin Market Analysis Global, 2023. Intended for investor

audience

Our journey is rooted in >20 years of R&D $302M Cumulative

Product Revenue (Q2’23) 2020 - Today 2002 2007 2012-2021 2018-2020 Commercialization Injectable Topical Strategic Peptides + Botulinum Toxin Botulinum Partnerships Biologics RHA® Collection Teoxane SA Clinical Toxin Program Clinical Work

+ Viatris Program DAXXIFY® Fosun Intended for investor audience

We have a clear strategy to execute our vision Intended for investor

audience

PR OVI D E R - CE N T R I C GROWTH PIPELINE I N N OVA T IVE S TRATE GY

PR OD U CT S ® Leverage DAXXIFY Execute provider-centric Aesthetics, Therapeutics, ® and RHA Collection commercial strategy to International Expansion, to underpin growth maximize portfolio value Partnerships, Supply Chain Intended for

investor audience

With a roadmap to unlocking our blockbuster opportunity in U.S.

aesthetics and beyond Intended for investor audience

2023 2024 Beyond ® • DAXXIFY cervical dystonia •

Contract manufacturer addition ® DAXXIFY commercial launch launch ® • DAXXIFY international expansion ® Continued growth of RHA fillers • Anticipated approvals in aesthetics and therapeutics • Therapeutic pipeline

expansion ® FDA approval – DAXXIFY in China through Fosun cervical dystonia ® partnership • Anticipated biosimilar to Botox approval and launch through Contract manufacturer added ® • Additional DAXXIFY Viatris

partnership international regulatory Salesforce expansion filings $320M in cash as of Q2’23 + $50M in notes funded Intended for investor audience

INVESTOR DAY 2023 REVANCE AESTHETICS Intended for investor

audience

A GEND A U.S. Facial Injectables Landscape ® DAXXIFY Overview,

Launch Progress and Update ® RHA Collection Overview, Launch Progress and Update Loyalty and Practice Partnership ® DAXXIFY KOL Panel Intended for investor audience

U.S. FACIAL INJECTABLES LANDSCAPE Intended for investor

audience

The U.S. facial injectables market is robust and attractive 2 Market

penetrated <10% $2.5B N EUR O MO D UL A T O R S 1 0. 6 % CA GR Cash pay, high margins #1, #2 most performed minimally $3.9B 3 invasive cosmetic procedures 1 US MARKET OPPORTUNITY 9.5% CAGR Strong historic and forward CAGR >8% $1.4B DE R M A L

Historically resilient to macroeconomic F ILL E R S 7 .6% C A G R factors 1. Data on file. Market size as of 2022. CAGRs represent projected estimates (2022-2027). 2. From Extreme to Mainstream: The Future of Aesthetics Injectables. McKinsey &

Company, Dec. 2021. 3. American Society of Plastic Surgeons. “Surgery Statistics Report,” 2020. Pg. 6. Intended for investor audience

SURVEY QUESTION : If you had to reduce overall spending, what are the

three areas you are most likely to cut back on? Nail care 51.4% Aesthetic Clothing 49.7% treatments are Spa/massage 47.3% resilient; only 25% Fitness/ gym membership 38.5% of consumers Travel 30.7% would cut back if Cosmetics 29.5% they had to

Aesthetic treatments or procedures 24.7% reduce overall Hair care 16.2% spending Skin care 6.0% Other 5.9% Source: The State of Aesthetics – Summer 2023 by the Numbers, BeautyEngine Aesthetics Survey, (n=945). Intended for investor

audience

Three pillars to compete effectively in the facial injectables market:

N E U R OM OD U L ATOR F I LLER EN G A G EME N T Loyalty & Practice Partnership + + Intended for investor audience

® DAXXIFY OVERVIEW, LAUNCH PROGRESS & UPDATE Intended for

investor audience

® THE DAXXIFY DIFFERENCE Intended for investor audience

st 1 and only peptide formulated, long-lasting neuromodulator

Innovation foundation—proprietary TM Peptide Exchange Technology (PXT) Advantages of stabilizing BoNT/A with PXT: 1,2 • Prevents adsorption and aggregation of BoNT/A 3* • Enhances BoNT/A affinity for cell membranes 4 Proprietary,

synthetic, 35 amino acid, • Increases amount of cleaved SNAP-25 in neuronal cells stabilizing peptide excipient with a highly 3* • Anchors BoNT/A in its target tissue 5-7 positive charge 3 *Based on in vitro data. ™ 1.Malmirchegini

R, Too P, Oliyai C, Joshi A. Revance’s novel peptide excipient, RTP004, and its role in stabilizing daxibotulinumtoxinA (DAXXIFY ) against aggregation. Poster presented at: TOXINS 2019; January 16-19, 2019; Copenhagen, Denmark ™ 2. Smyth

T, Oliyai C, Joshi A. Stabilizing effect of RTP004 on nonspecific surface adsorption in drug product manufacturing of daxibotulinumtoxinA (DAXXIFY ). Poster presented at: TOXINS 2019; January 16-19, 2019; Copenhagen, Denmark 3. Solish et al. Drugs.

2021:81(18):2091-2101. 4. Pellett et al. mBio. 2018;9(2):e00089-16. 5. DAXXIFY®. Prescribing Information. Revance Therapeutics, Inc; 2022 Intended for investor audience 6. Waugh et al. Methods Mol Biol. 2011;683:553-572; 7. Fabi et al. Dermatol

Surg. 2020:47(1):48-54.

SURVEY QUESTION : On a scale from 1 to 5, how important are these

factors when deciding which neurotoxin to use? #1 Duration continues to be the most important factor for consumers when deciding which neuromodulator to use Source: The State of Aesthetics – Summer 2023 by the Numbers, Beauty Engine Aesthetics

Survey, (n=623). Intended for investor audience

® How is DAXXIFY different? ® Botox ® 1 ®3 ®4

®5 DAXXIFY Dysport Xeomin Jeuveau 2 Cosmetic Molecular weight 150 kDa 900 kDa ~400 kDa 150 kDa 900 kDa Glabellar line dose 40U 20U 50U 20U 20U 6 6 6 7 Core active ingredient (ng) 0.18 ng 0.18 ng 0.27 ng 0.08 ng 0.12 ng ✓ Peptide

excipient formulation No human serum albumin✓ No animal-derived components ✓ Manufactured in U.S.✓ 1. Revance Data on file (SAKURA 1 and 2 Phase 3 Trials with 4. Full details included in Xeomin product insert. *Mass of 150kDa

core neurotoxin contained within the glabellar line dose for DaxibotulinumtoxinA-Ianm 40 Units). 5. Full details included in Jeuveau product insert. each product. All other trademarks referenced herein are the property of 2. Full details included in

BOTOX® product insert. 6. Field, et al. AbobotulinumtoxinA (Dysport®), OnabotulinumtoxinA (BOTOX®), their respective owners. 3. Full details included in Dysport product insert, FDA Dysport and IncobotulinumtoxinA (Xeomin®)

Neurotoxin Content and Potential Summary Basis of Approval (CMC section). Implications for Duration of Response in Patients, Toxins 2018, 10(12), 535. 7. Full details included in Canadian Nucevia Product Monograph. Intended for investor

audience

® The differentiated duration profile of DAXXIFY is demonstrated

across clinical programs in aesthetics and therapeutics A ESTH ETI C S TH ER A P U ET I C S 20-24 weeks 24 weeks Median duration Median duration SAKURA pivotal trials and OLS – largest ASPEN-1 Phase 3 pivotal trial and OLS for Phase 3 clinical

program conducted cervical dystonia (24 weeks with 125U; for glabellar lines 20 weeks with 250U) Intended for investor audience

Launch Solid Encouraging Executing on Highlights Commercial Real-World

Opportunities Progress Learnings to Maximize on Product to Launch Performance Intended for investor audience

® DAXXIFY Commercial Timeline Measured launch strategy was

designed to inform optimal market positioning SALES FORCE EXPANSION & RAMP Sept 2022 Sept 2022 Dec 2022 Mar 2023 Now PrevU U.S. FDA PrevU FACULTY TARGETED 1 year approval PROGRAM APPROVAL TRAINING COMMERCIAL anniversary (~400 accounts) LAUNCH F

OCU S : F OCU S : Limited launch to focus on practice integration Leverage PrevU learnings to evolve and clinical performance in real-world setting messaging and strategy Intended for investor audience

ST 1 1 LAUNCH YEAR SALES BY BRAND ( $M ) $25 $49M $20 Most successful

neuromodulator $15 ® launch since Botox $10 1 Cosmetic $5 $0 Launch Qtr 1 Launch Qtr 2 Launch Qtr 3 Launch Qtr 4 ® ® ® ® Dysport Xeomin Jeuveau DAXXIFY 1. Based on Q4’22 to Q2’23 DAXXIFY sales and first year

launch sales of Dysport, Xeomin, Jeuveau. Intended for investor audience

% SHARE D A XXI FY® ® P RE - D A X X I FY % SHARE TAKE L AU N

C H (Past 3 Months) ® Botox Cosmetic HCPs have converted 51% 8% 16% of their patients to ® Dysport 28% 4% ® DAXXIFY , the majority ® coming from the Jeuveau 12% 2% leading competitor ® Xeomin 9% 2% 1-4 Brand split in past 3

months compared to before DAXXIFY® launch 1. To date, what percentage of your DAXXIFY patients switched from each of the following toxin brands? (N=225) 2. Before DAXXIFY’s launch, what percentage of your aesthetic neurotoxin patients

were injected with each of the following neurotoxin brands? (N=225) 3. Over the past 3 months, what percentage of your total aesthetic neurotoxin patients have you injected with DAXXIFY? (N=225) 4. Note that data has been normalized to represent

conversion of patients previously receiving another neurotoxin brand and does not account for changes in share or share gains from naïve patients *Source: Independent DAXXIFY survey (N=225), KX Advisors, August 2023. HCPs refer to healthcare

professionals. Intended for investor audience

Encouraging Real-World Learnings Intended for investor

audience

S ATI S F AC T I O N from Respondents >4 out of 5 HCPs and 82% of

HCPs are satisfied or very satisfied patients are satisfied ®1 with the results of DAXXIFY or very satisfied with the aesthetic results 84% ® ® of DAXXIFY patients are satisfied or from DAXXIFY 2 very satisfied with their results

Based on HCP perception 1. Do you feel very satisfied, satisfied, or not satisfied with the results of DAXXIFY® in your aesthetic toxin patients? (N=225) 2. What percentage of your DAXXIFY patients are very satisfied, satisfied, or not

satisfied with the results of DAXXIFY® Answers must sum to 100% (N=225) *Independent DAXXIFY® survey (N=225), Kx Advisors, August 2023. HCPs refer to healthcare professionals.. Intended for investor audience

® Real-world feedback on the duration of DAXXIFY is consistent

with our clinical trial data None or Mild Response Rates on 4-Point Investigator Assessment Over Time SAKURA 3 Cycle 1 (n=2380 treatments) 98 100 96 95 SAKURA 3 Cycle 2 (n=882 treatments) 88 88 90 86 90 86 SAKURA 3 Cycle 3 (n=568 treatments) 83 80

79 74 SAKURA 1 DAXXIFY 40U (n=201) 80 75 70 74 70 SAKURA 2 DAXXIFY 40U (n=204) 64 60 Dysport® USPI: GL-1 58 54 51 Dysport® USPI: GL-3 50 48 BOTOX® Cosmetic USPI 43 40 38 Jeuveau® : EV-001 29 30 29 25 21 20 23 16 9 10 14 Note: 6 7

3 0 Results drawn from multiple studies. Weeks 0 4 8 12 16 20 24 28 32 36 Caution should be used when Days 30 60 90 120 150 180 210 240 interpreting cross-study comparisons. United States Prescribing Information Phase 3 Studies in GL for Jeuveau

data from results published in Dermatologic Surgery March 2019. Non-responder imputation was used for visits post Week 24. each neuromodulator with data available through at least Day Note: In SAKURA 1 and 2 (ITT), missing data were imputed with the

worst BOTOX, Dysport and Jeuveau are registered trademarks of their 120 conducted separately and presented for reference only; USPI: US post-baseline outcome (or best outcome for Placebo arm) on visits up to respective companies Package Insert. Week

24. Intended for investor audience % OF SUBJECTS

® 1 % of HCPs who inject DAXXIFY in each treatment area GLABELLAR

LINES FOREHEAD LINES 98% 98% ® DAXXIFY is used UNDER THE EYES LATERAL BROW 40% 84% broadly across NOSE CROW’S FEET 72% 97% UPPER LIP LINE the face GUMMY SMILE 57% 33% MARIONETTE LINES JAWLINE 43% 43% CHIN NECK 57% 50% 1 Over the past 3

months, what percentage of your Daxxify patients were injected in the following treatment areas? (N=225) *Independent DAXXIFY survey (N=225), Kx Advisors, August 2023. Intended for investor audience

FAST TREATMENT ONSET IMPROVED SKIN SMOOTHNESS Based on patient diary

data from SAKURA 1 and 2 pivotal trials A quantitative image analysis demonstrated improved skin smoothness in patients who have been treated with ® 1 DAXXIFY in glabellar lines 90% of patients achieved improvement in skin texture 2 at week 2 B

A SE LI N E DAY 2 40U GL TREATMENT | AGE: 40 1. Revance poster presented at: DERM2023 NP/PA CME Conference; August 3-6, 2023, Las Vegas, NV. 2. in subjects that had more texturized skin at baseline Intended for investor audience

® Top 3 reasons why HCPs prefer DAXXIFY over first-choice

short-acting toxin Duration of effect 73% “DAXXIFY works faster, lasts longer, skin looks Quick onset of effect 70% better.” Aesthetic Physician Private Practice Skin quality 55% ® % of HCPs who rank DAXXIFY “Superior”

to first-choice 1 short-acting toxin 1. On a scale of 1 to 7, with 1 being highly inferior performance vs. your first-choice short-acting toxin and 7 being highly superior vs. your first-choice short-acting toxin, how does DAXXIFY® perform

across each of the following attributes? (N=225) *Source: Independent DAXXIFY survey (N=225), KX Advisors, August 2023. HCPs refer to healthcare professionals. Intended for investor audience

ADDITIONAL OBSERVATIONS… • Straight-forward reconstitution

• Similar glabellar lines injection technique • Importance of proper dosing • No human serum albumin (HSA) or animal proteins and U.S.-based manufacturing Intended for investor audience

st 1 true innovation in neuromodulator formulation in over 30 years 1 D

U RATI O N F O RM U LATI O N Long-lasting treatment of effect 1st and only peptide powered formulation (PXT) 2 1 EF F I CA C Y ON SE T 98% of patients achieved none or Clinical/visible results typically mild wrinkle severity at week seen within 48

hours 2 4 per investigator assessment 3 1 SKIN QUALITY S AF E TY Generally safe and well-tolerated Appearance of improved skin texture with low rate of adverse events . 1. Based on Phase 3 SAKURA clinical program. Onset based on patient diary data

from SAKURA 1 and 2 pivotal trials. 2. 74% of subjects achieved a > two-grade improvement in glabellar lines at week 4 per both investigator and patient assessment Intended for investor audience 3 Data on file. Revance poster presented at:

DERM2023 NP/PA CME Conference; August 3-6, 2023, Las Vegas, NV.

Opportunities to Enhance our Launch Success Intended for investor

audience

MAIN TAKEAWAY BASED ON CUSTOMER FEEDBACK Alignment between price and

product expectations is critical to unlocking meaningful adoption 37 Intended for investor audience

With alignment SUCCESS FACTORS between price • Proper expectation

setting and expectations, ® • Alignment between price and desired outcome DAXXIFY has become top share • Favorable economics of wallet in some practices Intended for investor audience

HIGH PREMIUM CAN LEAD TO When there’s • Elevated consumer

expectations misalignment, • More involved switch discussion hurdles to deeper • Consumer price sensitivity adoption exist • No movement expectations Intended for investor audience

“We think we could switch over 50% of our Real-world experience

confirms patients if DAXXIFY® was the unique performance profile of priced competitively DAXXIFY® and reinforces our potential ® with Botox .” to achieve broad-based adoption Plastic Surgeon, Private Practice Intended for

investor audience

Positioning ourselves for meaningful share gain Intended for investor

audience

® New DAXXIFY pricing st effective September 1 OB JEC T I VES : 1.

Positions 2. Makes switching 3. Gives providers 4. Allows the ® ® DAXXIFY to be to DAXXIFY flexibility to full value competitively easier for both enhance their proposition of ® ® priced to Botox injectors and economics DAXXIFY

to be Cosmetic for the consumers unencumbered provider by price IInt ntend ended ed f for or i inv nves est tor or a aud udiienc ence e

Execution, Early Insights and Expectations for Q3 2023 Based on recent

roll out of EARLY INSIGHTS EX EC U TI ON st Based on 1 week of September pricing program coupled Rolled out new pricing program Strong positive feedback st on September 1 with traditional seasonality, 50% increase in number of accounts Currently

re-engaging existing ordering DAXXIFY® vs. first week in June Q3 ‘23 product revenue DAXXIFY® practices 60% increase in the number of accounts • Focused on current vs new who have already ordered two or more has the potential

to be times vs. first week in June • Partnering with practices on strategy for greater consumer Early confidence in broader adoption around conversion through price change Q2 ‘23 levels Intended for investor audience

Launch strategy, • Measured launch strategy provided valuable

learnings real-world learnings • DAXXIFY’s differentiated performance profile continues and pricing to be clinically validated adjustments ® position DAXXIFY • Launch optimizations underway for future growth • Strong

foundation for long-term success Intended for investor audience

® RHA COLLECTION OVERVIEW & PROGRESS UPDATE Intended for

investor audience

® RHA Collection – First and only FDA-approved hyaluronic

acid dermal 1 fillers for the correction of dynamic facial wrinkles and folds ™ ® ® ® RHA Redensity RHA 2 & RHA 3 RHA 4 Weightless filler that smooths Elegant softening and refined Natural volume for moderate to delicate

lipstick lines smoothing for moderate to severe severe folds and deeper deficits (perioral rhytids) facial lines 1. RHA® Redensity is indicated for injection into the dermis and superficial dermis of the face, for the correction of moderate to

severe dynamic perioral rhytids in adults 22 or older. RHA® 2, RHA® 3 and RHA® 4 are for the correction of moderate to severe dynamic facial wrinkles and folds, such as nasolabial folds, in adults 22 or older. Intended for investor

audience Directions for Use. Revance Therapeutics, Inc, 2020.

® RHA is designed to more A 1-3 closely resemble natural HA

• Designed for facial dynamic movement B • Created to be adaptable to facial animation for long-lasting, natural-looking results C A Intrinsic non-covalent bonds B Long hyaluronic acid chains C Low degree of BDDE modification 1.

Kaufman-Janette et al. J Cosmet Dermatol. 2019;18(5):1244-1253. 2. Monheit et al. Dermatol Surg. 2020;46(12):1521-1529. 3. Mashburn et al. Evaluation of the impact of hyaluronic acid (HA) filler manufacturing technologies on HA chain degradation.

Poster presented at: American Society for Dermatologic Surgery Virtual Annual Meeting; October 9-11, 2020. 4. Data on file. RDRE 2016—US Products, 2016. Newark, CA: Revance Therapeutics, Inc, Intended for investor audience 2016. 5. Faivre et

al. Dermatol Surg. 2021;47(5):159-167.

HA LENGTH HA Gel Technology Starting Material (MW) Finished Product

(MW) All HA gels have the same ® Preserved Network starting material, RHA ≥1500 kDa ~500-660 kDa ™ Technology (PNT ) technology preserves ™ 1 NASHA ≥1500 kDa ~200 kDa greater HA chain length ™ XpresHAn (OBT )

≥1500 kDa ~100-275 kDa ® HA chains of RHA Collection gels are up to 5x longer than HA chains ™ Hylacross ≥1500 kDa ~300 kDa 1 of other products ® Vycross 90% ≤1000 kDa ~100-165 kDa NASHA=Non-Animal Stabilized HA;

OBT=Optimal Balance Technology. 1. Mashburn J, Faivre J, Bourdon F. Evaluation of the impact of hyaluronic acid (HA) filler manufacturing technologies on HA chain degradation. Poster presented at: American Society for Dermatologic Surgery Virtual

Annual Meeting; October 9-11, 2020. Intended for investor audience

® RHA® Collection offers injectors RHA RHA ™

versatility in treating a wide range Redensity 2 of patient needs INJECTION DEPTHS BY SKU Fine-tuned finish Elegant softening for moderate to for moderate to severe perioral severe facial lines Epidermis rhytids Superficial Dermis Mid Dermis ®

® Deep Dermis RHA RHA 4 3 Subcutaneous Fat Muscle Refined Natural volume Deep Fat smoothing for moderate to for moderate to severe folds and severe wrinkles deeper deficits Periosteum and folds Bone Intended for investor audience

® RHA growth continues, wins 9% of market share within just 3

years of launch ® REVENUE ($M) RHA Collection RA N KE D $150 9% Market Share Q2’ 23 >$250M #1 Cumulative Profitability to $100 Revenue (Q2’ 23) My Practice $123 $107 $50 RA N KE D RA N KE D $71 #1 #1 $13 $- YOY Brand Growth

Relationship with 2020 2021 2022 TTM Q2'23 in (Q2’ 23) Sales Rep Rankings based on Guidepoint data from July 2023. * YOY sales growth in Guidepoint POS data based on Q2 2023 Intended for investor audience

ACCOUNT GROWTH Strong commercial execution >6,000 >5,000

>3,000 ~1,000 YE 2020 YE 2021 YE 2022 Q2 2023 Intended for investor audience

LOYALTY & PRACTICE PARTNERSHIP DUSTIN S. SJUTS P R ESI D EN T

Intended for investor audience

Enhance the customer experience at every touchpoint Our loyalty and

practice Deliver a loyalty program to customers and consumers in addition to portfolio pricing partnership Continue to leverage data and digital capabilities priorities to enhance engagement Intended for investor audience

Practice Locator Virtual & Digital in-person Marketing training Our

customer engagement Data initiatives include Loyalty & Capabilities Injector Practice and insights an expanded range Events Partnership of offerings, which currently include Practice payment processing Services Payment Processing Direct-to-

Consumer Intended for investor audience

M EM B ER S H I P S MARKET DATA Why payments? We acquired HintMD in

2020 ® and introduced the OPUL TECH & TALENT R EV EN U E platform in 2021 to accelerate G R O SS Processing Volume ($M) our digital capabilities $664 $511 $102 2020 2021 2022 Intended for investor audience

® Despite our progress with OPUL , the significant costs and

resources required for a payments business no longer align with our capital allocation priorities Intended for investor audience

® • Exiting OPUL payments business by end of Q1 2024;

ceasing related R&D spend while exploring strategic alternatives - 2023 projected loss from services segment ~$25M − Preliminary and estimated non-cash impairment Next steps charges from goodwill and other assets between $80M - $100M,

which will increase 2023 GAAP ® opex guidance for OPUL − Reduction in 2023 Non-GAAP operating expense guidance by $5M • Continue to leverage technical architecture and digital capabilities to execute on our loyalty and practice

partnership priorities Intended for investor audience

• Learnings to date validate the innovation of Well- ®

DAXXIFY and our launch strategy positioned • Clear launch optimizations underway to maximize for continued share-take over time growth across • Competitive toxin and filler portfolio supported by aesthetics ® continued success of

RHA Collection and future innovations to come portfolio • Growing loyalty and partnership capabilities support long-term success of aesthetics franchise Intended for investor audience

® DAXXIFY KOL PANEL T ARYN M. CONWAY GENERAL MANAGER, AESTHETICS

Intended for investor audience

INVESTOR DAY 2023 REVANCE THERAPEUTICS DUSTIN S. SJUTS – P R ES

ID ENT Intended for investor audience

A GEND A Market Landscape Addressing the Unmet Need Commercial Launch

Strategy Intended for investor audience

MARKET LANDSCAPE Intended for investor audience

1 $2.5B U.S. Market by Indication GLOBAL MARKET OPPORTUNITY IN D IC A T

IO N M AR KE T S HAR E M A R K ET SIZ E Cervical Dystonia 14% $345M 8 4% US Spasticity 27% $654M Migraine 40% $977M $2.9B +8% CAGR Overactive Bladder 6% $159M Other 13% $331M 16% E X US 1. Market size as of 2022. CAGRs represent projected estimates.

Decision Resources Group Therapeutic Botulinum Toxin Market Analysis Global 2023. Intended for investor audience

® DAXXIFY for cervical dystonia provides entry into significant

therapeutics opportunity 1st 12 Years True innovation in Since a new botulinum toxin has over 30 years been introduced to U.S. market Intended for investor audience

Cervical dystonia is a painful and disabling chronic condition that

causes the neck 1 muscles to involuntarily contract PATIENTS DIAGNOSED IN THE U.S. AGE OF ONSET TYPICALLY ~60,000 40-60s AFFECTS WOMEN 2x 85% AS OFTEN AS MEN TREATED BY BoNTs* 65 65 * Kx Movement Disorder Survey Q2,. 2019 C CO ONFI NFIDE DEN NTI TIA

AL L:: D Do n o not ot prin print t,, c copy opy,, or dis or dist tribu ribut te. e. 1 Comella C. Patient perspectives on the therapeutic profile of botulinum neurotoxin type A in cervical dystonia. J of Neurology, 2020. Intended for investor

audience

2022 Share 1 ® US Botox has never been CD seriously challenged

1989 Botox® by new entrants 83% (Abbvie) Type A OTHER COMPETITORS 2000 Myobloc® ® 2% Myobloc (Supernus) Type B • 2nd line 2009 • Primarily reserved for type A Dysport® 5% non-responders (Ipsen) Type A ® ®

Dysport /Xeomin 2010 Xeomin® 10% (Merz) • Lack clinical differentiation Type A • Primarily focus on low- 2 cost positioning with payers $345 TOTAL ($M) 1. Internal estimate based on 2022 claims data. 2. Decision Resources Group

Therapeutic Botulinum Toxin Market Intended for investor audience Analysis Global 2023

CD physician community is concentrated and conservative, dealing with

complex conditions and treatments PRACTICE MINDSET PRACTICE FACTS O F PA TI E N TS TR E A TE D E V E R Y 9 0 D A YS 90% ~70% NO CURE CONSERVATISM * OF CD PATIENTS The best outcome is Physicians cautiously improvements in optimize toxin dosing

patient’s daily O F P R A CT ICE S US E ” B UY in CD over 2-4 cycles & B I L L ” R EI M B U R S EM EN T 85% functioning and to minimize side Are treated by top 20% of quality of life effects physicians (~1,000 injectors)

*Internal estimate based on 2022 claims data. Intended for investor audience

Physical Limitations Loneliness Shame Loneliness For majority of CD

patients, conventional BoNTs do not provide 1-3 Embarrassment durable symptom relief. Patients are left to struggle with the full Stress Shame severity of the disorder 1-3 for weeks at a time. Disability 1. Benecke R, Jost WH, Kanovsky P, Ruzicka E,

Comes G, Grafe S. A new botulinum toxin type A free of complexing proteins for treatment of cervical dystonia. Neurology. Embarrassment 2005;64(11):1949-1951. 2. Data on file. Revance® Market Research 2019: Understanding the Value of

DaxibotulinumtoxinA for Injections’ Therapeutic Franchise. 3. Evidente VGH, Fernandez HH, LeDoux MS, et al. A randomized, double-blind study of repeated incobotulinumtoxinA (Xeomin(®)) in cervical dystonia. J Neural Transm Intended for

investor audience (Vienna). 2013;120(12):1699-1707. Shame

ADDRESSING THE UNMET NEED DAVID A. HOLLANDER, MD CHIEF MEDICAL OFFICER

Intended for investor audience

Cervical dystonia patients typically experience a return of symptoms

prior to their next BoNT treatment Due to product labeling restrictions and reimbursement policies, BoNT treatments are spread out 12 weeks or more, during which most CD patients experience a re-emergence of symptoms. 1 2 FIGURE 1: Patient

Experience Following a BoNT-A Treatment FIGURE 2: Preferred Retreatment Intervals in CD 35 Peak therapeutic effect: 32.1 (~4.5 weeks) 30 25 22.4 Symptom re-emergence: 20 Onset of effect: (~ 10.5 weeks) 15.7 (~ 1.7 weeks) 14.2 15 8.2 10 5.2 0 4 8 12

5 1.5 Time (weeks) 0.8 0 0 Injection Next Injection <7 7–8 9–10 11–12 13–14 15–16 17–18 19–20 >20 Preferred Retreatment Intervals (weeks) All BoNT labels have retreatment restrictions prior to week 12

1. Comella C, et al. Patient perspectives on the therapeutic profile of botulinum neurotoxin type A in cervical dystonia. J Neurol, 20211, 268(3):903-912; 2. Sethi K, et al. Satisfaction with botulinum toxin treatment: a cross-sectional survey of

patients with cervical dystonia. J Med Econ, 2012, 15(3):419-423. Intended for investor audience Surveyed Response Percentage of Patients

® Two Phase 3 trials were conducted in cervical dystonia patients,

DAXXIFY Cervical including a randomized study evaluating two doses (Aspen-1) Dystonia Phase 3 Trial 1-2 and an open-label trial involving repeat dosing (Aspen-OLS). (ASPEN-1) DAXXIFY 250U (n=130) Adults with Moderate to Severe DAXXIFY 125U (n=125)

Cervical Dystonia N = 301 (3:3:1) Placebo (n=46) • Moderate to severe CD (TWSTRS-Total ≥ 20) 2 4 & 6 36 Weeks 0 12 • Toxin-naïve or experienced Single Primary Visit every administration endpoint 4 weeks CD, Cervical

Dystonia; TWSTRS, Toronto Western Spasmodic Torticollis Rating Scale; U, units. 1 Data on File. ASPEN 1 CSR. Newark, CA: Revance Therapeutics, Inc., 2022. 2 Data on File. ASPEN OLS CSR. Newark, CA: Revance Therapeutics, Inc., 2022. Intended for

investor audience

E X AM P LE Toronto Western Spasmodic Torticollis Rating Scale (TWSTRS)

How is efficacy assessed in CD registration studies? TORONTO WESTERN SPASMODIC TORTICOLLIS RATING SCALE (TWSTRS) Severity Scale (Clinician-rated): 0 – 35 Disability Scale (Patient-rated): 0 - 30 Pain Scale (Patient-rated): 0 – 20 Total

Score: 0-85 Consky ES and Lang AE. Clinical assessments of patients with cervical dystonia. In: Jankovic J, Hallet M (eds). Therapy with botulinum toxin. New York: Dekker, 1994: Intended for investor audience 211-237.

® Both 125U and 250U of DAXXIFY proved effective in providing

symptom ® 1-2 Efficacy of DAXXIFY in CD relief in patients with cervical dystonia. 1 FIGURE 1: Change in TWSTRS at Weeks 4 & 6 (Primary Endpoint) 2 • p<0.0001 (125 U vs. Placebo) 2 50 45.3 • p=0.0006 (250 U vs. Placebo) 42.6

2 43.1 • p=0.1902 (250 U vs. 125 U) 40.0 40 31.3 29.8 30 Δ=29% Δ=26% 20 12.7 Δ=9% 10.9 10 4.3 0 Baseline Wks 4 & 6 Wks 4 & 6 Reduction* Baseline Reduction* Baseline Wks 4 & 6 Reduction* Placebo DAXXIFY® 125 U

DAXXIFY® 250 U (n=46) (n=125) (n=130) *Least Square Means. ∆ Percent Change from Baseline . P-values based on ANCOVA model with prior BoNT treatment, Baseline TWSTRS, and region as a covariate. Multiple imputation for subjects missing

both Week 4 and Week 6 (n=3). 1 DAXXIFY® Prescribing Information, 2023.Data on File. 2 ASPEN 1 CSR. Newark, CA: Revance Therapeutics, Inc., 2022. Intended for investor audience 3 Comella C, Jankovic J, Hauser R, et al. Efficacy and Safety of

DaxibotulinumtoxinA for Injection (DAXI) in Cervical Dystonia: ASPEN-1 Phase 3 Randomized Controlled Trial. In review

® DAXXIFY demonstrated long-lasting duration, with a median

duration 1-4 of 20-24 weeks until significant loss of effect (~80%) 0 Placebo (n=46) ® DAXXIFY 125U (n=125) -5 ® DAXXIFY 250U (n=130) -10 -15 -20 0 4 8 12 16 20 24 28 32 36 Weeks TWSTRS, Toronto Western Spasmodic Torticollis Rating Scale.

1 Comella CL, Jankivic J. Comparison of botulinum toxin serotypes A and B for the treatment of cervical dystonia. Neurology, 2005;65:1423–1429 2 Data on File. ASPEN 1 CSR. Newark, CA: Revance Therapeutics, Inc., 2022. Intended for investor

audience 3 Data on File. ASPEN OLS CSR. Newark, CA: Revance Therapeutics, Inc., 2022. 4 DAXXIFY® Prescribing Information, 2023. Mean Change from Baseline in TWSTRS Total Score

ASPEN-OLS allowed individualized dose adjustments with Cycle 1 Cycles

2-4 (125U, 200U, 250U, or 300U) up to 4 treatment cycles at doses ® DAXXIFY 125U higher than initial 1 Phase 3 study Up to 3 additional treatments based on clinical Follow-up response ® DAXXIFY 250U 0 4 6 12 40 52 Weeks IM Injection 2.5 mL

Visit every 4 weeks IM, intramuscular 1. Comella C, Barbano R, Vasquez A. Efficacy of DaxibotulinumtoxinA for Injection Over Successive Treatments in Adults With Isolated Cervical Dystonia in the Phase 3 ASPEN-1 and ASPEN-OLS Trials. Intended for

investor audience Poster presented at: Association of Academic Physiatrists Annual Meeting; Anaheim, CA; February 21- 24, 2023.

ASPEN- OLS ASPEN- OLS ASPEN- OLS ASPEN- OLS The ASPEN-OLS * ASPEN-1

CYCLE 1 CYCLE 2 CYCLE 3 CYCLE 4 study demonstrated 0 continued -2 improvement with -4 repeat dosing and -6 individualized 1-2 treatment. -8 -10 -12 -12.5 -14 -15.4 -16 -17.7 -18 -17.9 -20 -19.9 -22 -24 Treatment Cycle TWSTRS, Toronto Western

Spasmodic Torticollis Rating Scale *In patients who continued on to ASPEN OLS 1 Comella C, Barbano R, Vasquez A. Efficacy of DaxibotulinumtoxinA for Injection Over Successive Treatments in Adults With Isolated Cervical Dystonia in the Phase 3

ASPEN-1 and ASPEN-OLS Trials. Poster presented at: Association of Academic Physiatrists Annual Meeting; Intended for investor audience Anaheim, CA; February 21-24, 2023. 2 Data on file. Revance Therapeutics, Inc. Mean Change From Baseline in TWSTRS

Total Score (95% CI)

Dosing increased in some patients up to 300U over successive 1

individualized treatments 100% 90% 300U 80% 300U 70% 300U 250U 60% 250U 50% 40% 250U 30% 250U 200U 20% 125U 200U 10% 200U 125U 125U 0% Cycle 1 (n=357) Cycle 2 (n=329) Cycle 3 (n=234) Cycle 4 (n=65) 1. McAllister, P, Jinnah, HA, Evidente, V, Patel,

AT, et al. Long-term Safety of Repeat Treatments of DaxibotulinumtoxinA for Injection in Adults With Isolated Cervical Dystonia in Phase 3, Open-label, Multicenter ASPEN-OLS Trial. Poster presented at: American Academy of Neurology, Boston, MA,

Intended for investor audience April 22-26, 2023. Percentage of Patients

Treatment-related adverse events ASPEN-1 ASPEN-OLS remained low with

repeat treatments, Treatment-Related ASPEN-1 Cycle 1 Cycle 2 Cycle 3 Cycle 4 even with Adverse Events by Cycle (n=255) (n=357) (n=329) (n=234) (n=65) increasing doses ®1-2 of DAXXIFY Any treatment-related 26.7 21.0 17.0 19.7 13.8 adverse event

Headache 4.7 1.1 1.5 0.4 0 Injection site pain 6.3 4.2 2.1 0.9 3.1 Injection site erythema 3.5 2.2 1.8 3.0 1.5 Muscular weakness 3.5 4.2 4.6 6.4 3.1 Dysphagia 2.7 3.9 4.3 4.7 3.1 1. Data on File. ASPEN 1 CSR. Newark, CA: Revance Therapeutics, Inc.,

2022. 2. Data on File. ASPEN OLS CSR. Newark, CA: Revance Therapeutics, Inc., 2022. Intended for investor audience

® DAXXIFY has a strong safety profile with a low adverse event

rate, notably across important areas such as dysphagia and muscle 1-2 weakness 3 3 2.5 2.5 2.7 ng 2.7 ng 5 5 500U 500U 2 2 2.12 ng 2.12 ng 6 236U 6,8 236U 1.5 1.5 1 1 1.1ng 1.1ng 0.96 ng 0.96 ng 7 7 250U 250U 4 4 240U 240U 0.5 0.5 0.56ng 0.48 ng 7

0.56ng 125U 0.48 ng 4 120U 7 125U 4 120U 0 0 0 2 4 6 8 10 12 14 16 18 20 22 24 26 28 30 0 2 4 6 8 10 12 14 16 % DYSPHAGIA % MUSCLE WEAKNESS 1. Data on File. ASPEN 1 CSRs. Newark, CA: Revance Therapeutics, Inc., 2022. 2. Data on File. ASPEN OLS CSR.

Newark, CA: Revance Therapeutics, Inc., 2022. 3. Field. et al. AbobotulinumtoxinA (Dysport®), OnabotulinumtoxinA (Botox®), and IncobotulinumtoxinA (Xeomin®) Neurotoxin Content and Potential Implications for Duration and Response in

Patients, Toxins 2018, 10(12), 535. 4. Xeomin® Prescribing Information, 2020 5. Dysport® Prescribing Information, 2020. 6. Botox® Prescribing Information, 2020. Intended for investor audience 7. DAXXIFY® Prescribing Information,

2023 8. FDA clinical review, BOTOX® CD sBLA 3 Amount of core neurotoxin (ng) 3 Amount of core neurotoxin (ng)

® Dose titration with DAXXIFY can be utilized to increase efficacy

and duration to optimize outcomes for patients F igu r e 1 : Dose Titration to Increase Efficacy F i g u re 2: Dose Titration to Increase Duration TWSTRS, Toronto Western Spasmodic Torticollis Rating Scale TWSTRS, Toronto Western Spasmodic

Torticollis Rating Scale Data on file. Revance Therapeutics Inc. 2022 Intended for investor audience

TIME OF RETREATMENT CYCLE - 1 Approved label provides 35% physicians

flexibility in 30% 32% optimizing individualized treatment plans 25% 1 23% • Recommended dose of 125 to 250 units. 20% • Label contains data from repeat dose open 15% label trial, 28 (7.8%) subjects received one 13% treatment, 95 (26.6%)

subjects received two 10% treatments, 169 (47.3%) received three 9% 5% treatments, and 65 (18.2%) received four 5% 4% ® treatments with DAXXIFY over the course 3% 2% 2% 0% 1 of 52 weeks. Week 12 Week 16 Week 20 Week 24 Week 28 Week 32 Week 36

Week 40 Week 44 Study Visit 1 DAXXIFY® Prescribing Information, 2023. 2 Data on File. ASPEN OLS CSR. Newark, CA: Revance Therapeutics, Inc., 2022. . Intended for investor audience Percentage of Patients

® The long duration of DAXXIFY may allow fewer treatments per year

as well as more days of symptom relief 1-2 • Patients want to be treated as their symptoms re-emerge and before they return to baseline. 3 • For example, patients requested retreatment in ASPEN with ~40-50% peak efficacy remaining.

Figure 1: Options to Treat as Symptoms Re-emerge Figure 2: Retreatment Prior to Returning to Baseline ® DAXXIFY BoNT-A Onset of effect Retreatment as symptoms re-emerge 0 4 8 16 12 20 Time (weeks) Injection ® With long-acting DAXXIFY ,

retreatments can be performed as symptoms re-emerge 3-5 at 12 weeks or beyond depending on an individualized treatment plan. 1. Evidente VGH, Fernandez HH, LeDoux MS, et al. A randomized, double-blind study of repeated incobotulinumtoxinA

(Xeomin(®)) in cervical dystonia. J Neural Transm (Vienna). 2013;120(12):1699-1707. 2. Sethi KD, Rodriguez R, Olayinka B. Satisfaction with botulinum toxin treatment: a cross-sectional survey of patients with cervical dystonia. J Med Econ.

2012;15(3):419-423 3. Data on File. ASPEN 1 CSR. Newark, CA: Revance Therapeutics, Inc., 2022. Intended for investor audience 4. Adapted from Comella C. Patient perspectives on the therapeutic profile of botulinum neurotoxin type A in cervical

dystonia. J of Neurology, 2020. 5. Data on File. ASPEN OLS CSR. Newark, CA: Revance Therapeutics, Inc., 2022. Symptom Response >

COMMERCIAL LAUNCH STRATEGY ROB E. BANCROFT GENERAL MANAGER,

THERAPEUTICS Intended for investor audience

P H Y SIC IAN Confidence to optimize treatment outcomes for patients

® DAXXIFY P AY ER Opportunity for category cost delivers for all management 3 stakeholders P ATIENT Potential for more good days Intended for investor audience

Physicians Measured launch strategy designed to optimize patient

outcomes and ensure smooth practice integration MID-YEAR 2024 SEPT 1, 2023 2-3 injection cycles Optimized dose, duration Operational best practices PREVU EARLY C O MME R C IAL SEPT 15, 2023 EXPERIENCE PROGRAM LAU N C H • 11 physicians

injecting ® • 32 patients treated with DAXXIFY Leverage learnings from PrevU to 30+ KOLs • Starting dose range 100U – 400U build physician confidence in broad product rollout Intended for investor audience

Payers Striving to manage medical benefit drug spend 1 BoNTs are #12

most costly medical benefit drug category 65% 60% 30% of commercial of CD treatment utilization mgmt (UM) payers cover by is covered by within the commercial category; commercial channel 35% cover by payers brand Trending Up 5% 15% 20% MEDICAID

MEDICARE FEDERAL 1. 2022 / Magellan Rx Medical Pharmacy Trend Report Intended for investor audience

® DAXXIFY Economics Annual drug costs favorable vs. the market

leader DIRECT VIAL COST ANNUALIZED COMPARISON ® ® vs BOTOX D A X XI F Y Graph represents first two quarters of WAC-based reimbursement. ASP-based reimbursement expected to begin Q2 2024 List price for 100U vials $7,608 $7,608 $8,000 ®

BOTOX CALCULATED AT: $420 $634 3 vials/injection 4 injections/yr $6,000 $5,040 PER I N J EC T I O N S ES S I O N $3,780 $3,360 $4,000 $1,902 $2,520 $1,260 ® BOTOX 3 Vials $2,000 $840 ® DAXXIFY 2 Vials ® DAXXIFY 3 Vials $0 ®

® DAXXIFY 3X/yr DAXXIFY 4X/yr Botox® 3 Vials DAXXIFY® 2 Vials DAXXIFY® 3 Vials Intended for investor audience

® DAXXIFY Resonating with Payers Unique clinical profile,

attractive economics ”No denying we need to revisit our ® UM strategy in light of DAXXIFY .” TOP REGIONAL PLAN WITH >1.5M LIVES BoNT step edit in place for years, covers by brand Potential cost UP TO savings per year ”The

clinical efficacy and pricing are better 50% 1. Lower drug costs per year than what’s out there today.” LESS LARGE NORTHEAST PLAN WITH >3.5M lives 2. Fewer treatments per year No UM, covers by category 3. Lower procedural costs per

year ”That’s responsible pricing. Let’s discuss a larger strategy.” TOP 10 COMMERCIAL PLAN WITH >10M lives Currently covers a single BoNT Intended for investor audience

The most important stakeholder Patients INNOVATIVE PRODUCT Opportunity

for more good days BETTER ECONOMICS Reduced co-insurance LONG DURATION Potentially fewer injections IInt ntend ended ed f for or i inv nves est tor or a aud udiienc ence e

Aspiration: BoNT of Choice for CD Unique product, strong economic

value, efficient strategy MUST WIN BATTLES Infrastructure Leverage PrevU to • Sales accelerate broader • Field Reimbursement adoption at launch • Medical Affairs • Ntl Acct Directors TARGETED GO-TO-MARKET Optimized, scalable

switching journey for ~30 field headcount ~1,000 high volume CD HCPs HCPs and patients CLEAR COMMERCIAL OBJECTIVE HCP confidence that Key Milestones ® ® DAXXIFY solves patient Switch CD patients to DAXXIFY • Permanent J Code unmet

needs − January 2024 • Commercial Coverage − ~50% by mid-year 2024 Unencumbered • Commercial Launch − Mid-year 2024 market access Intended for investor audience

INVESTOR DAY 2023 FUTURE GROWTH OPPORTUNITIES DUSTIN S. SJUTS – P

R ES ID ENT Intended for investor audience

Multiple paths to growth beyond ® DAXXIFY Strategic Therapeutics

International Partnerships Pipeline U.S. aesthetics Expansion Expansion Intended for investor audience

® DAXXIFY supply chain investments support future

growth—creating opportunity for higher capacity and lower cost over time 2010 2017 2021 2023 2025 WHOLLY-OWNED CMO SIGNED CMO SIGNED CMO APPROVAL ANTICIPATED U.S.-BASED AJINOMOTO PCI PHARMA AJINOMOTO CMO APPROVAL MANUFACTURING BIOSCIENCES

BIOSCIENCES PCI PHARMA FACILITY ® U.S International DAXXIFY commercialization expansion (2025+) clinical trials International regulatory filings (2023-2025) Intended for investor audience

EU C H INA CA N A DA Significant OUS neuromodulator market totaling

$2.6B Key countries and regions represent majority of opportunity A U STR A LI A B R A ZIL Market size as of 2022. Decision Resources Group Aesthetics Injectables Botulinum Toxin Reports- 2023. Intended for investor audience

Partnership with Fosun Pharma P R OVID ES REGULATORY MILESTONES

potential entry into CHINA NMPA BLA ACCEPTANCES: 2024 1st ® DAXXIFY for glabellar lines – April 2023 AN TI C I P AT E D 2 A PPR OVA L S ® DAXXIFY for cervical dystonia - July 2023 international market for DAXXIFY®, China, a 1

$740M market with established distribution partner 1. Market size as of 2022. Decision Resources Group Aesthetics Injectables Botulinum Toxin Reports, Asia Pacific Supplemental- 2023. 2. Assumes 14-16 month review cycle by China's National Medical

Products Administration. Intended for investor audience

Partnership with Viatris - ® Biosimilar to BOTOX P R OG R ESS P R