Republic First Bancorp, Inc. Reports First Quarter 2023 Financial Results

May 01 2023 - 6:30AM

Republic First Bancorp, Inc. (NASDAQ: FRBK) (the “Company” or

“Republic”), the holding company for Republic First Bank d/b/a

Republic Bank (the “Bank”), today reported financial results for

the first quarter ended March 31, 2023.

“Our strong community banking brand, ingrained commitment to

customers and focus on relationship banking have allowed us to

largely maintain steady deposit levels amid a period of uncertainty

and volatility in the banking sector,” said President and Chief

Executive Officer Thomas X. Geisel. “We are highly focused on

executing our strategy to restore profitability, improve capital

levels and enhance shareholder value – and are seeing signs of

progress as we move through the Company’s legacy headwinds. The

results aren’t where we want them to be yet, but I am proud of our

colleagues’ commitment to Republic’s customers and their ongoing

efforts to weather the current environment and lay the foundation

for a successful future.”

Key First Quarter 2023 Results

- Reported loss attributable to common stockholders of $9.7

million, or $0.15 per diluted share, in the first quarter of 2023

included the pre-tax effect of a $3.1 million write-down of an

investment in Signature Bank preferred securities, and $5.5 million

in legal, professional, and audit fees due to strategic and

shareholder matters and as legacy legal and reporting matters are

addressed with enhanced processes, procedures and capabilities

being established since new members of the leadership team joined

the Company on December 22, 2022. Reported loss attributable to

common stockholders for the fourth quarter of 2022 was $398,000, or

$0.01 per diluted share, and net income available to common

stockholders for the first quarter of 2022 was $5.4 million, or

$0.08 per diluted share.

- More than 76% of total deposits on March 31, 2023 were

FDIC-insured or fully collateralized.

- Even as deposit balances declined 2.7% during the first

quarter, the number of deposit relationships with the bank

increased by 5.2% in the period. Republic also grew deposit

balances between March 31, 2023, and April 30, 2023.

- The loan/deposit ratio of 64.4% remained relatively unchanged

during the first quarter of 2023.

- Cash and equivalents grew by 211.7% during the first three

months of 2023 to $153.2 million at period end and total available

liquidity, inclusive of cash and equivalents, unencumbered

securities and borrowing capacity totaled $1.4 billion on March

31,2023.

- The fair value of our available for sale and held to maturity

investment portfolio improved $43.9 million, or 9.7%, from December

31, 2022.

“Today’s announcement is a critical milestone in our ongoing

efforts to bring Republic current on its quarterly and annual

filings with the Securities and Exchange Commission,” said Chief

Financial Officer Michael W. Harrington. “We are pleased to provide

shareholders with the Company’s results for the first three months

of 2023, as well as comparisons to the fourth and first quarters of

2022, on a consolidated, unaudited basis. We’ve assembled a group

of experienced financial institution professionals who are working

diligently to complete our efforts to bring our financial reporting

current as we work to improve profitability and enhance Republic’s

liquidity and capital position.”

Additional Business Updates

- Today’s announcement marks the first time Republic has

published a quarterly financial results news release since January

2022, over one year ago.

- On March 10, 2023, the Company announced a planned $125 million

capital raise with the participation of affiliates of seasoned bank

investor Castle Creek Capital and affiliates of existing

shareholder Cohen Private Ventures, LLC.

- On April 25, 2023, as a measure of prudent oversight and to

preserve capital and liquidity, the Company’s Board of Directors

determined to suspend the payment of dividends on its Perpetual

Non-Cumulative, Convertible Preferred Stock and elected to defer

payments of interest on its two issuances of outstanding Floating

Rate Junior Subordinated Debt Securities Due 2037. The Board

intends to re-evaluate the payment of such dividends and interest

on a quarterly basis.

- Republic enters May 2023 with newly added reciprocal deposit

programs to expand its offering for current and potential customers

while providing the Bank with an additional channel for core

deposit gathering.

- The Company plans to implement several next steps of the

strategic plan in the second quarter of 2023, including meaningful

business realignment and efficiency initiatives designed to improve

profitability and refocus the Company on its core businesses.

- Feedback from employees led to The Philadelphia Inquirer naming

Republic a 2023 Top Workplace in the first quarter.

- Republic recently received a 2023 Community Impact Award, from

South Jersey Biz Magazine, which recognized the Bank for

initiatives like Money Zone, its free financial literacy program

for schools, as well as its participation in the Future Bankers

& Financial Professionals camp and support for local nonprofit

partners.

Results of Operations, Sequential

Comparison

- Net loss attributable to common stockholders was $9.7 million,

or $0.15 per diluted share, in the first quarter of 2023, compared

to $398,000, or $0.01 per diluted share in the fourth quarter of

2022. Compared to the linked quarter, net interest income decreased

$8.9 million, non-interest income decreased $3.6 million, and

non-interest expense increased $782,000, respectively. These items

more than offset declines in the provision for credit losses and

provision for income taxes of $321,000 and $3.7 million,

respectively.

- Net interest income was $24.0 million in the first quarter,

decreasing $8.9 million from $32.9 million in the linked quarter,

as higher yields and average balances of interest-earning assets

were more than offset by higher funding costs and increased average

balances of interest-bearing liabilities. Net interest margin was

1.62% in the first quarter, down 63 basis points from the linked

quarter, reflecting pressure from higher interest rates, the

inverted yield curve and intense industry-wide competition for

deposits in the first three months of 2023.Total interest income

was $52.2 million in the first quarter, increasing $2.2 million

from the linked quarter. Average total interest-earning assets were

$5.99 billion in the first quarter, increasing $75.6 million from

the linked quarter. The average yield on total interest-earning

assets was 3.55% for the first quarter, increasing 15 basis points

from the linked quarter.Interest and fees earned on loans totaled

$36.2 million in the first quarter, increasing $1.5 million from

the linked quarter. Average loans receivable were $3.14 billion in

the first quarter, increasing $52.3 million from the linked

quarter. The average yield on loans receivable was 4.69% for the

first quarter, increasing 17 basis points from the linked

quarter.Interest and dividends earned on investment securities

totaled $15.4 million in the first quarter, increasing $292,000

from the linked quarter. Average securities and restricted stock

was $2.76 billion in the first quarter, decreasing $15.4 million

from the linked quarter. The average yield on investment securities

and restricted stock was 2.27% for the first quarter, increasing

eight basis points from the linked quarter.Total interest expense

was $28.2 million in the first quarter, increasing $11.2 million

from the linked quarter. Average total interest-bearing liabilities

for the first quarter were $4.54 billion, increasing $206.6 million

from the linked quarter. The average rate paid on interest-bearing

liabilities was 2.52% for the first quarter, increasing 95 basis

points from the linked quarter.Interest expense on deposits totaled

$18.6 million in the first quarter, increasing $6.4 million from

the linked quarter, the result of higher market rates driving

demand from customers for better rates paid on deposits. Average

interest-bearing deposits for the first quarter were $3.77 billion,

decreasing $85.7 million from the linked quarter. The average rate

paid on interest-bearing deposits was 2.00% for the first quarter,

increasing 73 basis points from the linked quarter.Interest expense

on borrowings totaled $9.6 million in the first quarter, increasing

$4.8 million from the linked quarter. Average borrowings for the

first quarter were $771.1 million, increasing $292.4 million from

the linked quarter. The average rate paid on borrowings was 5.05%

for the first quarter, increasing 101 basis points from the linked

quarter.

- Non-interest income was $1.3 million in the first quarter, down

$3.6 million from the linked quarter. The decline was primarily due

to a $3.1 million write-down of the Company’s investment in

preferred securities issued by Signature Bank. The change in

non-interest income from the linked quarter also reflected

decreases of $595,000, $275,000 and $164,000 in loan and servicing

fees, mortgage banking income and gain on sales of SBA loans,

respectively.

- Non-interest expense was $37.2 million in the first quarter,

increasing $782,000 from the linked quarter. Non-interest expense

included $5.5 million of legal, audit, and other professional fees

that were incurred as the Company continued to address strategic

and shareholder matters and legacy legal and reporting matters in

the first three months of 2023.

- Provision for credit losses was $433,000 in the first quarter,

increasing the allowance for credit losses $448,000 from the linked

quarter, primarily due to continuing deteriorating forecasted

economic conditions impacting management's expectations of future

credit losses, and partly due to loan growth.

- The Company recorded an income tax benefit of $3.3 million in

the first quarter, a $3.7 million reduction from the linked

quarter.

Results of Operations, Year-over-Year

Comparison

- Net loss attributable to common stockholders was $9.7 million,

or $0.15 per diluted share, in the first quarter of 2023, compared

to net income available to common stockholders of $5.4 million, or

$0.08 per diluted share in the first quarter of 2022. Compared to

the year-ago period, net interest income decreased $12.1 million,

non-interest income decreased $3.1 million, and non-interest

expense increased $5.0 million. These items more than offset a

decline in the provision for income taxes of $5.5 million.

- Net interest income was $24.0 million in the first quarter,

decreasing $12.1 million from $36.1 million in the year-ago period,

as higher yields and average balances of interest earning assets

were more than offset by higher funding costs and higher average

balance of interest-bearing liabilities. Net interest margin was

1.62% in the first quarter, down 107 basis points from the year-ago

period, reflecting pressure from higher interest rates, the

inverted yield curve and intense industry-wide competition for

deposits in the first three months of 2023.Total interest income

was $52.2 million in the first quarter, increasing $12.7 million

from the year-ago period. Average total interest-earning assets

were $5.99 billion in the first quarter, increasing $515.6 million

from the year-ago period. The average yield on total

interest-earning assets was 3.55% for the first quarter, increasing

62 basis points from the year-ago period.Interest and fees earned

on loans and leases totaled $36.2 million in the first quarter,

increasing $10.1 million from the year-ago period. Average loans

receivable were $3.14 billion in the first quarter, increasing

$621.9 million from the year-ago period. The average yield on loans

receivable was 4.69% for the first quarter, increasing 47 basis

points from the year-ago period.Interest and dividends earned on

investment securities totaled $15.4 million in the first quarter,

increasing $2.1 million from the year-ago period. Average

securities and restricted stock were $2.76 billion in the first

quarter, decreasing $53.1 million from the year-ago period. The

average yield on investment securities and restricted stock was

2.27% for the first quarter, increasing 34 basis points from the

year-ago period.Total interest expense was $28.2 million in the

first quarter, increasing $24.9 million from the year-ago period.

Average total deposits and other borrowings for the first quarter

were $4.54 billion, increasing $639.1 million from the year-ago

period. The average rate paid on interest-bearing liabilities was

2.52% for the first quarter, increasing 218 basis points from the

year-ago period.Interest expense on borrowings totaled $9.6 million

in the first quarter, increasing $9.5 million from the year-ago

period. Average borrowings for the first quarter were $771.1

million, increasing $759.1 million from the year-ago period. The

average rate paid on borrowings was 5.05% for the first quarter,

increasing 311 basis points from the year-ago period.Interest

expense on deposits totaled $18.6 million in the first quarter,

increasing $15.3 million from the year-ago period. Average

interest-bearing deposits for the first quarter were $3.77 billion,

decreasing $120.1 million from the year-ago period. The average

rate paid on interest-bearing deposits was 2.00% for the first

quarter, increasing 164 basis points from the year-ago period.

- Non-interest income was $1.3 million in the first quarter, down

$3.1 million from the year ago period. The decline was primarily

due to a $3.1 million write-down of the Company’s investment in

preferred securities issued by Signature Bank. The change in

non-interest income from the year-ago period also reflected

decreases of $904,000, $337,000 and $319,000 in mortgage banking

income gain on sales of SBA loans and loan and servicing fees,

respectively.

- Non-interest expense was $37.2 million in the first quarter, an

increase of $5.0 million from the year-ago period. Non-interest

expense included $5.5 million in legal, audit, and other

professional fees as the Company continued to address strategic and

shareholder matters and legacy legal and reporting matters in the

first three months of 2023.

- Provision for credit losses was $443,000 in the first quarter,

up $515,000 from a credit to provision in the year-ago period, due

to continuing deteriorating forecasted economic conditions

impacting management's expectations of future credit losses.

- The Company recorded an income tax benefit of $3.3 million in

the first quarter, a $5.5 million reduction from the year-ago

period.

Financial Condition, March 31, 2023

- Total assets were $6.16 billion on March 31, 2023, increasing

$108.5 million from December 31, 2022, primarily driven by a $104.1

million increase in cash and equivalents due to excess cash from

other borrowings.

- Available for sale investment securities were $899.2 million on

March 31, 2023. Unrealized losses on available for sale investment

securities were $154.3 million as of March 31, 2023, an improvement

of $17.8 million from December 31, 2022.

- Held to maturity investment securities were $1.63 billion on

March 31, 2023. Unrealized losses on held to maturity investment

securities were $253.8 million as of March 31, 2023, an improvement

of $26.1 million from December 31, 2022.

- Total loans were $3.14 billion on March 31, 2023 increasing

$6.2 million from December 31, 2022, as growth in construction and

land development loans and owner-occupied real estate was offset by

declines in balances in commercial and industrial loans and other

lending categories.

- The allowance for credit losses was $26.5 million on March 31,

2023 increasing $448,000 from December 31, 2022. The change in

allowance for credit losses was primarily attributed to the

degradation in forecasted economic conditions impacting

management’s expectation of future credit losses. The Company also

had net recoveries of $8,000 for the quarter ended March 31,

2023.

- Total deposits were $4.88 billion on March 31, 2023, decreasing

$134.7 million from December 31, 2022. The decrease reflected $79.2

million, $125.5 million and $83.2 million reductions in

non-interest bearing demand deposits, interest-bearing demand

deposits and money market and savings accounts, respectively, more

than offsetting a $153.2 million increase in time deposits. More

than 76% of total deposits on March 31, 2023 were FDIC insured or

fully collateralized. Deposits, net of fully collateralized public

funds, were $3.19 billion on March 31, 2023, of which 60% were FDIC

insured.

- Borrowings of $981.3 million on March 31, 2023, which included

$645 million from the Federal Home Loan Bank, $325 million from the

Federal Reserve and $11.3 million of subordinated debt, increased

$242.8 million from December 31, 2022.

- The capital ratios for the Bank and the Company, as of March

31, 2023, as shown in the attached tables, indicate regulatory

capital levels in excess of the regulatory minimums and the levels

necessary for the Bank to be considered “well capitalized.”

About Republic First Bancorp, Inc.

Republic First Bancorp, Inc. is the holding company for Republic

First Bank, which does business under the name Republic Bank.

Republic Bank is a full-service, state-chartered commercial bank,

whose deposits are insured up to the applicable limits by the

Federal Deposit Insurance Corporation. The Bank offers a variety of

banking services to individuals and businesses throughout the

Greater Philadelphia, Southern New Jersey, and New York City

markets through its offices and branch locations in Philadelphia,

Montgomery, Delaware and Bucks in Pennsylvania, Camden, Burlington,

Atlantic and Gloucester, New Jersey and New York County. The Bank

also offers a wide range of residential mortgage products through

its mortgage division, which does business under the name of Oak

Mortgage Company. For more information about Republic Bank, visit

www.myrepublicbank.com.

Forward Looking Statements

This press release may contain “forward-looking statements,”

which are subject to certain risks and uncertainties that could

cause actual results to differ materially from those projected in

the forward-looking statements. For example, risks and

uncertainties can arise with changes in: general economic

conditions, including turmoil in the financial markets and related

efforts of government agencies to stabilize the financial system;

the impact of the COVID-19 pandemic on our business and results of

operation; geopolitical conflict and inflationary pressures

including Federal Reserve interest rate hikes; the effect of

potential recessionary conditions; the adequacy of our allowance

for credit losses and our methodology for determining such

allowance; adverse changes in our loan portfolio and credit

risk-related losses and expenses; concentrations within our loan

portfolio, including our exposure to commercial real estate loans;

inflation; changes to our primary service area; changes in interest

rates; our ability to identify, negotiate, secure and develop new

branch locations and renew, modify, or terminate leases or dispose

of properties for existing branch locations effectively; business

conditions in the financial services industry, including

competitive pressure among financial services companies, new

service and product offerings by competitors, price pressures and

similar items; deposit flows; loan demand; the regulatory

environment, including evolving banking industry standards, changes

in legislation or regulation; our securities portfolio and the

valuation of our securities; change in accounting principles,

policies and guidelines as well as estimates and assumptions used

in the preparation of our financial statements; rapidly changing

technology; our ability to regain compliance with Nasdaq Listing

Rules 5250(c)(1) and 5620(a); the failure to maintain current

technologies; failure to attract or retain key employees; our

ability to access cost-effective funding; fluctuations in real

estate values; litigation liabilities, including costs, expenses,

settlements and judgments; and other economic, competitive,

governmental, regulatory and technological factors affecting our

operations, pricing, products and services. You should carefully

review the risk factors described in the Annual Report on Form 10-K

for the year ended December 31, 2021, and other documents we file

from time to time with the Securities and Exchange Commission. The

words "would be," "could be," "should be," "probability," "risk,"

"target," "objective," "may," "will," "estimate," "project,"

"believe," "intend," "anticipate," "plan," "seek," "expect" and

similar expressions or variations on such expressions are intended

to identify forward-looking statements. All such statements are

made in good faith by us pursuant to the "safe harbor" provisions

of the U.S. Private Securities Litigation Reform Act of 1995. We do

not undertake to update any forward-looking statement, whether

written or oral, that may be made from time to time by or on behalf

of us, except as may be required by applicable law or

regulations.

Contact:Longacre Square PartnersJoe Germani / David

Reingoldfrbk@longacresquare.com

|

Republic First Bancorp,

Inc. |

|

Summary Financial Information

(UNAUDITED) |

|

(dollars in thousands, except per share

data) |

| |

As of or for the Three Months Ended |

|

Consolidated Balance Sheet (selected items) |

March 31, 2023 |

|

December 31, 2022 |

|

September 30, 2022 |

|

June 30, 2022 |

|

March 31, 2022 |

|

Cash and cash equivalents |

$ |

153,234 |

|

|

$ |

49,167 |

|

|

$ |

52,452 |

|

|

$ |

86,156 |

|

|

$ |

101,457 |

|

|

Investment securities |

|

2,529,469 |

|

|

|

2,527,335 |

|

|

|

2,561,897 |

|

|

|

2,711,757 |

|

|

|

2,765,965 |

|

|

Equity securities |

|

13 |

|

|

|

6,019 |

|

|

|

6,627 |

|

|

|

6,793 |

|

|

|

7,888 |

|

|

Restricted stock |

|

34,327 |

|

|

|

34,245 |

|

|

|

21,907 |

|

|

|

15,528 |

|

|

|

3,135 |

|

|

Loans receivable |

|

3,139,418 |

|

|

|

3,132,967 |

|

|

|

3,060,852 |

|

|

|

2,750,683 |

|

|

|

2,557,167 |

|

|

Allowance for credit losses |

|

(26,520 |

) |

|

|

(26,072 |

) |

|

|

(25,255 |

) |

|

|

(20,997 |

) |

|

|

(23,156 |

) |

|

Premises and equipment, net |

|

134,553 |

|

|

|

134,747 |

|

|

|

130,902 |

|

|

|

130,498 |

|

|

|

129,607 |

|

|

Other assets |

|

192,306 |

|

|

|

189,911 |

|

|

|

189,872 |

|

|

|

175,187 |

|

|

|

158,402 |

|

|

Total assets |

$ |

6,156,800 |

|

|

$ |

6,048,319 |

|

|

$ |

5,999,254 |

|

|

$ |

5,855,605 |

|

|

$ |

5,700,465 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Deposits - interest-bearing |

$ |

3,667,977 |

|

|

$ |

3,723,543 |

|

|

$ |

3,833,524 |

|

|

$ |

3,787,367 |

|

|

$ |

3,905,782 |

|

|

Deposits - non-interest-bearing |

|

1,210,262 |

|

|

|

1,289,420 |

|

|

|

1,418,060 |

|

|

|

1,425,659 |

|

|

|

1,404,454 |

|

|

Other borrowings |

|

970,000 |

|

|

|

727,200 |

|

|

|

442,500 |

|

|

|

292,500 |

|

|

|

- |

|

|

Subordinated debt |

|

11,286 |

|

|

|

11,284 |

|

|

|

11,282 |

|

|

|

11,281 |

|

|

|

11,279 |

|

|

Other liabilities |

|

100,480 |

|

|

|

104,123 |

|

|

|

104,430 |

|

|

|

105,657 |

|

|

|

103,214 |

|

|

Total liabilities |

|

5,960,005 |

|

|

|

5,855,570 |

|

|

|

5,809,796 |

|

|

|

5,622,464 |

|

|

|

5,424,729 |

|

|

Total shareholders' equity |

|

196,795 |

|

|

|

192,749 |

|

|

|

189,458 |

|

|

|

233,141 |

|

|

|

275,736 |

|

|

Total liabilities and shareholders' equity |

$ |

6,156,800 |

|

|

$ |

6,048,319 |

|

|

$ |

5,999,254 |

|

|

$ |

5,855,605 |

|

|

$ |

5,700,465 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Average Balance Sheet (selected items) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Federal funds sold and other interest earning assets |

$ |

84,228 |

|

|

$ |

45,580 |

|

|

$ |

46,073 |

|

|

$ |

96,632 |

|

|

$ |

137,533 |

|

|

Investment securities and restricted stock |

|

2,763,904 |

|

|

|

2,779,268 |

|

|

|

2,837,891 |

|

|

|

2,899,551 |

|

|

|

2,816,956 |

|

|

Loans receivable |

|

3,138,633 |

|

|

|

3,086,339 |

|

|

|

2,894,473 |

|

|

|

2,625,902 |

|

|

|

2,516,719 |

|

|

Total interest-earning assets |

|

5,986,765 |

|

|

|

5,911,187 |

|

|

|

5,778,437 |

|

|

|

5,622,085 |

|

|

|

5,471,208 |

|

|

Other assets |

|

102,259 |

|

|

|

92,565 |

|

|

|

142,619 |

|

|

|

162,382 |

|

|

|

221,835 |

|

|

Total assets |

$ |

6,089,024 |

|

|

$ |

6,003,752 |

|

|

$ |

5,921,056 |

|

|

$ |

5,784,467 |

|

|

$ |

5,693,043 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total interest-bearing deposits |

$ |

3,768,095 |

|

|

$ |

3,853,821 |

|

|

$ |

3,830,688 |

|

|

$ |

2,419,113 |

|

|

$ |

3,888,181 |

|

|

Other borrowings |

|

771,076 |

|

|

|

478,730 |

|

|

|

345,758 |

|

|

|

69,224 |

|

|

|

11,938 |

|

|

Total interest-bearing liabilities |

|

4,539,171 |

|

|

|

4,332,551 |

|

|

|

4,176,446 |

|

|

|

4,026,262 |

|

|

|

3,900,119 |

|

|

Total non-interest bearing deposits |

|

1,248,426 |

|

|

|

1,380,744 |

|

|

|

1,398,086 |

|

|

|

1,400,644 |

|

|

|

1,378,400 |

|

|

Non-interest bearing other liabilities |

|

106,506 |

|

|

|

106,010 |

|

|

|

119,131 |

|

|

|

105,816 |

|

|

|

110,416 |

|

|

Shareholders' equity |

|

194,921 |

|

|

|

184,447 |

|

|

|

227,393 |

|

|

|

251,745 |

|

|

|

304,108 |

|

|

Total liabilities and shareholders' equity |

$ |

6,089,024 |

|

|

$ |

6,003,752 |

|

|

$ |

5,921,056 |

|

|

$ |

5,784,467 |

|

|

$ |

5,693,043 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Consolidated Income Statement (selected

items) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net interest income |

$ |

23,993 |

|

|

$ |

32,935 |

|

|

$ |

37,999 |

|

|

$ |

38,400 |

|

|

$ |

36,140 |

|

|

Provision for credit losses |

|

443 |

|

|

|

764 |

|

|

|

3,998 |

|

|

|

830 |

|

|

|

(72 |

) |

|

Noninterest income |

|

1,269 |

|

|

|

4,892 |

|

|

|

5,742 |

|

|

|

4,873 |

|

|

|

4,347 |

|

|

Noninterest expense |

|

37,215 |

|

|

|

36,433 |

|

|

|

37,714 |

|

|

|

37,250 |

|

|

|

32,195 |

|

|

Net income before tax |

|

(12,396 |

) |

|

|

630 |

|

|

|

2,029 |

|

|

|

5,193 |

|

|

|

8,364 |

|

|

Provision for income taxes |

|

(3,320 |

) |

|

|

384 |

|

|

|

476 |

|

|

|

1,200 |

|

|

|

2,129 |

|

|

Net (loss) income |

$ |

(9,076 |

) |

|

$ |

246 |

|

|

$ |

1,553 |

|

|

$ |

3,993 |

|

|

$ |

6,235 |

|

|

Preferred stock dividends |

|

644 |

|

|

|

644 |

|

|

|

644 |

|

|

|

644 |

|

|

|

866 |

|

|

Net (loss) income attributable to common shareholders |

$ |

(9,720 |

) |

|

$ |

(398 |

) |

|

$ |

909 |

|

|

$ |

3,349 |

|

|

$ |

5,369 |

|

|

Basic earnings per common share |

$ |

(0.15 |

) |

|

$ |

(0.01 |

) |

|

$ |

0.01 |

|

|

$ |

0.05 |

|

|

$ |

0.09 |

|

|

Diluted earnings per common share |

$ |

(0.15 |

) |

|

$ |

(0.01 |

) |

|

$ |

0.01 |

|

|

$ |

0.05 |

|

|

$ |

0.08 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Profitability Indicators |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Return on average assets (annualized) |

|

-0.64 |

% |

|

|

-0.03 |

% |

|

|

0.06 |

% |

|

|

0.23 |

% |

|

|

0.38 |

% |

|

Return on average equity (annualized) |

|

-19.95 |

% |

|

|

-0.86 |

% |

|

|

1.60 |

% |

|

|

5.32 |

% |

|

|

7.06 |

% |

|

Tax-equivalent net interest margin |

|

1.62 |

% |

|

|

2.25 |

% |

|

|

2.63 |

% |

|

|

2.76 |

% |

|

|

2.69 |

% |

|

Efficiency ratio |

|

147.32 |

% |

|

|

96.31 |

% |

|

|

86.22 |

% |

|

|

86.08 |

% |

|

|

79.52 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Share Data |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

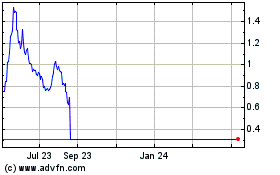

Closing share price |

$ |

1.36 |

|

|

$ |

2.15 |

|

|

$ |

2.83 |

|

|

$ |

3.81 |

|

|

$ |

5.16 |

|

|

Book value per common share |

$ |

2.53 |

|

|

$ |

2.47 |

|

|

$ |

2.42 |

|

|

$ |

3.11 |

|

|

$ |

3.78 |

|

|

Price / book value |

|

54.0 |

% |

|

|

87.0 |

% |

|

|

117.0 |

% |

|

|

123.0 |

% |

|

|

137.0 |

% |

|

Weighted average diluted shares outstanding |

|

76,126,478 |

|

|

|

76,106,537 |

|

|

|

76,109,691 |

|

|

|

76,545,952 |

|

|

|

75,180,067 |

|

|

Shares outstanding, end of period |

|

63,867,092 |

|

|

|

63,814,001 |

|

|

|

63,787,064 |

|

|

|

63,755,960 |

|

|

|

63,739,566 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Capital Ratios |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Republic First Bancorp, Inc ("Company") |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total risk based capital |

|

10.42 |

% |

|

|

10.62 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

Tier one risk based capital |

|

9.67 |

% |

|

|

9.89 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

CET 1 risk based capital |

|

8.36 |

% |

|

|

8.59 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

Tier one leveraged capital |

|

5.45 |

% |

|

|

5.64 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Republic First Bank ("Republic") |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total risk based capital |

|

10.19 |

% |

|

|

10.34 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

Tier one risk based capital |

|

9.43 |

% |

|

|

9.61 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

CET 1 risk based capital |

|

9.43 |

% |

|

|

9.61 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

Tier one leveraged capital |

|

5.30 |

% |

|

|

5.47 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Asset Quality Indicators |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loan charge-offs (recoveries) ("NCO"s) |

$ |

(8 |

) |

|

$ |

(37 |

) |

|

$ |

(359 |

) |

|

$ |

3,007 |

|

|

$ |

50 |

|

|

Loans risk-rated special mention |

|

877 |

|

|

|

881 |

|

|

|

887 |

|

|

|

232 |

|

|

|

234 |

|

|

Total risk-rated substandard |

|

21,269 |

|

|

|

22,059 |

|

|

|

19,347 |

|

|

|

20,274 |

|

|

|

18,292 |

|

|

Total criticized loans |

$ |

22,146 |

|

|

$ |

22,940 |

|

|

$ |

20,234 |

|

|

$ |

20,506 |

|

|

$ |

18,526 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nonperforming loans ("NPL"s) |

$ |

18,592 |

|

|

$ |

17,191 |

|

|

$ |

15,450 |

|

|

$ |

14,540 |

|

|

$ |

12,426 |

|

|

Other real estate owned ("OREO") |

|

554 |

|

|

|

875 |

|

|

|

876 |

|

|

|

230 |

|

|

|

360 |

|

|

Total nonperforming assets ("NPA"s) |

$ |

19,146 |

|

|

$ |

18,066 |

|

|

$ |

16,326 |

|

|

$ |

14,770 |

|

|

$ |

12,786 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loans 30 to 59 days past due |

$ |

6,160 |

|

|

$ |

6,354 |

|

|

$ |

11,795 |

|

|

$ |

13,602 |

|

|

$ |

7,588 |

|

|

Loans 60 to 89 days past due |

|

123 |

|

|

|

1,178 |

|

|

|

3,307 |

|

|

|

2 |

|

|

|

2,825 |

|

|

Loans 90 or more days past due |

|

18,592 |

|

|

|

17,191 |

|

|

|

15,450 |

|

|

|

14,540 |

|

|

|

12,424 |

|

|

Total delinquent loans |

$ |

24,875 |

|

|

$ |

24,723 |

|

|

$ |

30,552 |

|

|

$ |

28,144 |

|

|

$ |

22,837 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Delinquent loans to total loans |

|

0.79 |

% |

|

|

0.79 |

% |

|

|

1.00 |

% |

|

|

1.02 |

% |

|

|

0.89 |

% |

|

NCOs to average loans (annualized) |

|

0.00 |

% |

|

|

0.00 |

% |

|

|

-0.05 |

% |

|

|

0.46 |

% |

|

|

0.01 |

% |

|

NPLs to total loans |

|

0.59 |

% |

|

|

0.55 |

% |

|

|

0.50 |

% |

|

|

0.53 |

% |

|

|

0.49 |

% |

|

NPAs to total loans |

|

0.61 |

% |

|

|

0.58 |

% |

|

|

0.53 |

% |

|

|

0.54 |

% |

|

|

0.50 |

% |

|

NPAs to total assets |

|

0.31 |

% |

|

|

0.30 |

% |

|

|

0.27 |

% |

|

|

0.25 |

% |

|

|

0.22 |

% |

|

ACL to NPLs |

|

143 |

% |

|

|

152 |

% |

|

|

163 |

% |

|

|

144 |

% |

|

|

186 |

% |

|

ACL to classified loans |

|

125 |

% |

|

|

118 |

% |

|

|

131 |

% |

|

|

104 |

% |

|

|

127 |

% |

|

ACL to total loans |

|

0.84 |

% |

|

|

0.83 |

% |

|

|

0.83 |

% |

|

|

0.76 |

% |

|

|

0.91 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Republic First Bancorp,

Inc. |

|

Consolidating Balance Sheet

(UNAUDITED) |

|

(dollars in thousands, except per share

data) |

| |

|

|

|

|

|

|

|

|

|

| |

March 31, |

|

December 31, |

|

September 30, |

June 30, |

|

March 31, |

|

|

|

2023 |

|

|

|

2022 |

|

|

|

2022 |

|

|

|

2022 |

|

|

|

2022 |

|

|

ASSETS: |

|

|

|

|

|

|

|

|

|

|

Cash and Due From Banks |

$ |

11,778 |

|

|

$ |

13,736 |

|

|

$ |

15,670 |

|

|

$ |

16,423 |

|

|

$ |

15,231 |

|

|

Interest bearing deposits with banks |

|

141,456 |

|

|

|

35,431 |

|

|

|

36,782 |

|

|

|

69,733 |

|

|

|

86,226 |

|

|

Cash and cash equivalents |

|

153,234 |

|

|

|

49,167 |

|

|

|

52,452 |

|

|

|

86,156 |

|

|

|

101,457 |

|

|

Investment securities AFS, at fair value |

|

899,225 |

|

|

|

897,980 |

|

|

|

999,521 |

|

|

|

1,111,672 |

|

|

|

1,116,109 |

|

|

Investment securities HTM, at amortized cost |

|

1,630,244 |

|

|

|

1,629,355 |

|

|

|

1,562,376 |

|

|

|

1,600,085 |

|

|

|

1,649,856 |

|

|

Equity securities |

|

13 |

|

|

|

6,019 |

|

|

|

6,627 |

|

|

|

6,793 |

|

|

|

7,888 |

|

|

Restricted Stock, at cost |

|

34,327 |

|

|

|

34,245 |

|

|

|

21,907 |

|

|

|

15,528 |

|

|

|

3,135 |

|

|

Mortgage loans held for sale, at fair value |

|

2,294 |

|

|

|

3,590 |

|

|

|

6,038 |

|

|

|

5,670 |

|

|

|

4,653 |

|

|

Other loans held for sale |

|

9,412 |

|

|

|

4,249 |

|

|

|

4,785 |

|

|

|

4,759 |

|

|

|

4,488 |

|

|

Loans receivable (net of ACL) |

|

3,112,898 |

|

|

|

3,106,895 |

|

|

|

3,035,597 |

|

|

|

2,729,686 |

|

|

|

2,534,011 |

|

|

Premises and equipment, net |

|

134,553 |

|

|

|

134,747 |

|

|

|

130,902 |

|

|

|

130,498 |

|

|

|

129,607 |

|

|

Other real estate owned, net |

|

554 |

|

|

|

875 |

|

|

|

876 |

|

|

|

230 |

|

|

|

360 |

|

|

Accrued interest receivable |

|

21,275 |

|

|

|

19,748 |

|

|

|

18,783 |

|

|

|

16,381 |

|

|

|

16,014 |

|

|

Operating lease right-of-use asset |

|

70,099 |

|

|

|

71,453 |

|

|

|

73,135 |

|

|

|

75,271 |

|

|

|

76,454 |

|

|

Other assets |

|

88,672 |

|

|

|

89,996 |

|

|

|

86,255 |

|

|

|

72,876 |

|

|

|

56,433 |

|

|

TOTAL ASSETS |

$ |

6,156,800 |

|

|

$ |

6,048,319 |

|

|

$ |

5,999,254 |

|

|

$ |

5,855,605 |

|

|

$ |

5,700,465 |

|

|

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES & SHAREHOLDERS' EQUITY: |

|

|

|

|

|

|

|

|

|

|

Liabilities: |

|

|

|

|

|

|

|

|

|

|

Deposits |

|

|

|

|

|

|

|

|

|

|

Demand (Non-interest Bearing) |

$ |

1,210,262 |

|

|

$ |

1,289,420 |

|

|

$ |

1,418,060 |

|

|

$ |

1,425,659 |

|

|

$ |

1,404,454 |

|

|

Demand (Interest Bearing) |

|

2,344,256 |

|

|

|

2,469,761 |

|

|

|

2,497,761 |

|

|

|

2,294,931 |

|

|

|

2,352,205 |

|

|

Money market and savings |

|

1,066,786 |

|

|

|

1,149,995 |

|

|

|

1,217,580 |

|

|

|

1,342,883 |

|

|

|

1,363,484 |

|

|

Time deposits |

|

256,935 |

|

|

|

103,787 |

|

|

|

118,183 |

|

|

|

149,553 |

|

|

|

190,093 |

|

|

Total deposits |

|

4,878,239 |

|

|

|

5,012,963 |

|

|

|

5,251,584 |

|

|

|

5,213,026 |

|

|

|

5,310,236 |

|

|

Other borrowings |

|

970,000 |

|

|

|

727,200 |

|

|

|

442,500 |

|

|

|

292,500 |

|

|

|

- |

|

|

Subordinated debt |

|

11,286 |

|

|

|

11,284 |

|

|

|

11,282 |

|

|

|

11,281 |

|

|

|

11,279 |

|

|

Accrued interest payable |

|

1,405 |

|

|

|

650 |

|

|

|

401 |

|

|

|

498 |

|

|

|

563 |

|

|

Operating lease liability |

|

76,071 |

|

|

|

77,031 |

|

|

|

79,620 |

|

|

|

81,700 |

|

|

|

82,824 |

|

|

Other liabilities |

|

23,004 |

|

|

|

26,442 |

|

|

|

24,409 |

|

|

|

23,459 |

|

|

|

19,827 |

|

|

TOTAL LIABILITIES: |

|

5,960,005 |

|

|

|

5,855,570 |

|

|

|

5,809,796 |

|

|

|

5,622,464 |

|

|

|

5,424,729 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Preferred Stock |

|

15 |

|

|

|

15 |

|

|

|

15 |

|

|

|

15 |

|

|

|

15 |

|

|

Common Stock |

|

645 |

|

|

|

643 |

|

|

|

643 |

|

|

|

643 |

|

|

|

643 |

|

|

Additional paid in capital |

|

326,955 |

|

|

|

326,931 |

|

|

|

326,549 |

|

|

|

326,031 |

|

|

|

325,479 |

|

|

Retained earnings |

|

9,484 |

|

|

|

19,203 |

|

|

|

19,601 |

|

|

|

18,692 |

|

|

|

15,343 |

|

|

Treasury Stock at cost |

|

(3,725 |

) |

|

|

(3,725 |

) |

|

|

(3,725 |

) |

|

|

(3,725 |

) |

|

|

(3,725 |

) |

|

Stock held by deferred compensation plan |

|

- |

|

|

|

- |

|

|

|

(183 |

) |

|

|

(183 |

) |

|

|

(183 |

) |

|

Accumulated other comprehensive loss |

|

(136,579 |

) |

|

|

(150,318 |

) |

|

|

(153,442 |

) |

|

|

(108,332 |

) |

|

|

(61,836 |

) |

|

Total Shareholders' Equity |

|

196,795 |

|

|

|

192,749 |

|

|

|

189,458 |

|

|

|

233,141 |

|

|

|

275,736 |

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL LIABILITIES & SHAREHOLDERS'

EQUITY: |

$ |

6,156,800 |

|

|

$ |

6,048,319 |

|

|

$ |

5,999,254 |

|

|

$ |

5,855,605 |

|

|

$ |

5,700,465 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Republic First Bancorp,

Inc. |

|

Supplemental Balance Sheet Information

(UNAUDITED) |

|

(dollars in thousands, except for share

data) |

| |

As of or For the Three Months Ended |

|

Total loans: |

March 31, 2023 |

|

December 31, 2022 |

|

September 30, 2022 |

|

June 30, 2022 |

|

March 31, 2022 |

|

Commercial real estate |

$ |

895,403 |

|

|

$ |

918,545 |

|

|

$ |

915,494 |

|

|

$ |

827,720 |

|

|

$ |

771,549 |

|

|

Construction and land development |

|

303,549 |

|

|

|

256,528 |

|

|

|

226,627 |

|

|

|

212,436 |

|

|

|

234,217 |

|

|

Commercial and industrial |

|

288,920 |

|

|

|

301,410 |

|

|

|

303,518 |

|

|

|

310,783 |

|

|

|

289,547 |

|

|

Owner occupied real estate |

|

569,706 |

|

|

|

565,327 |

|

|

|

557,496 |

|

|

|

552,723 |

|

|

|

534,710 |

|

|

Consumer and other |

|

86,972 |

|

|

|

91,186 |

|

|

|

95,618 |

|

|

|

81,140 |

|

|

|

78,374 |

|

|

Residential mortgage |

|

992,113 |

|

|

|

996,707 |

|

|

|

954,679 |

|

|

|

739,768 |

|

|

|

590,337 |

|

|

Paycheck protection program |

|

5,628 |

|

|

|

6,412 |

|

|

|

10,787 |

|

|

|

29,824 |

|

|

|

63,334 |

|

|

Total loans receivable |

|

3,142,291 |

|

|

|

3,136,115 |

|

|

|

3,064,219 |

|

|

|

2,754,394 |

|

|

|

2,562,068 |

|

|

Deferred costs (fees) |

|

(2,873 |

) |

|

|

(3,148 |

) |

|

|

(3,367 |

) |

|

|

(3,711 |

) |

|

|

(4,901 |

) |

|

Allowance for credit losses |

|

(26,520 |

) |

|

|

(26,072 |

) |

|

|

(25,255 |

) |

|

|

(20,997 |

) |

|

|

(23,156 |

) |

|

Net loans receivable |

$ |

3,112,898 |

|

|

$ |

3,106,895 |

|

|

$ |

3,035,597 |

|

|

$ |

2,729,686 |

|

|

$ |

2,534,011 |

|

| |

|

|

|

|

|

|

|

|

|

|

Non-Performing Loans: |

|

|

|

|

|

|

|

|

|

|

Commercial real estate |

$ |

1,304 |

|

|

$ |

1,334 |

|

|

$ |

600 |

|

|

$ |

825 |

|

|

$ |

4,493 |

|

|

Construction and land development |

|

8,961 |

|

|

|

8,997 |

|

|

|

9,052 |

|

|

|

9,128 |

|

|

|

- |

|

|

Commercial and industrial |

|

2,129 |

|

|

|

1,293 |

|

|

|

304 |

|

|

|

305 |

|

|

|

2,468 |

|

|

Owner occupied real estate |

|

3,114 |

|

|

|

2,746 |

|

|

|

2,759 |

|

|

|

3,225 |

|

|

|

3,710 |

|

|

Consumer and other |

|

1,373 |

|

|

|

1,383 |

|

|

|

815 |

|

|

|

1,044 |

|

|

|

1,052 |

|

|

Residential mortgage |

|

287 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

701 |

|

|

Paycheck protection program |

|

1,424 |

|

|

|

1,438 |

|

|

|

1,920 |

|

|

|

13 |

|

|

|

- |

|

|

Total non-performing loans |

$ |

18,592 |

|

|

$ |

17,191 |

|

|

$ |

15,450 |

|

|

$ |

14,540 |

|

|

$ |

12,424 |

|

| |

|

|

|

|

|

|

|

|

|

|

Net Loan Charge-Offs (Recoveries): |

|

|

|

|

|

|

|

|

|

|

Commercial real estate |

$ |

- |

|

|

$ |

- |

|

|

$ |

(215 |

) |

|

$ |

621 |

|

|

$ |

- |

|

|

Construction and land development |

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

Commercial and industrial |

|

- |

|

|

|

(29 |

) |

|

|

(149 |

) |

|

|

2,154 |

|

|

|

(10 |

) |

|

Owner occupied real estate |

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

197 |

|

|

|

(7 |

) |

|

Consumer and other |

|

(8 |

) |

|

|

(8 |

) |

|

|

5 |

|

|

|

35 |

|

|

|

67 |

|

|

Residential mortgage |

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

Paycheck protection program |

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

Total net loan charge-offs (recoveries) |

$ |

(8 |

) |

|

$ |

(37 |

) |

|

$ |

(359 |

) |

|

$ |

3,007 |

|

|

$ |

50 |

|

| |

|

|

|

|

|

|

|

|

|

|

Investment securities available for sale at fair

value |

|

|

|

|

|

|

|

|

|

|

U.S. Government agencies |

$ |

16,213 |

|

|

$ |

17,021 |

|

|

$ |

18,395 |

|

|

$ |

20,051 |

|

|

$ |

21,536 |

|

|

Collateralized mortgage obligations |

|

316,538 |

|

|

|

312,988 |

|

|

|

321,015 |

|

|

|

350,776 |

|

|

|

354,341 |

|

|

Agency mortgage-backed securities |

|

414,332 |

|

|

|

413,706 |

|

|

|

416,022 |

|

|

|

484,760 |

|

|

|

495,122 |

|

|

Municipal securities |

|

48,973 |

|

|

|

47,523 |

|

|

|

45,773 |

|

|

|

48,618 |

|

|

|

21,837 |

|

|

Corporate bonds |

|

103,169 |

|

|

|

106,742 |

|

|

|

198,316 |

|

|

|

207,467 |

|

|

|

223,273 |

|

|

Total investment securities available for sale, at fair

value |

$ |

899,225 |

|

|

$ |

897,980 |

|

|

$ |

999,521 |

|

|

$ |

1,111,672 |

|

|

$ |

1,116,109 |

|

| |

|

|

|

|

|

|

|

|

|

|

Unrealized gain (loss) on investment securities available

for sale |

|

|

|

|

|

|

|

|

|

U.S. Government agencies |

$ |

(1,045 |

) |

|

$ |

(1,467 |

) |

|

$ |

(1,411 |

) |

|

$ |

(939 |

) |

|

$ |

(1,483 |

) |

|

Collateralized mortgage obligations |

|

(59,918 |

) |

|

|

(68,291 |

) |

|

|

(67,004 |

) |

|

|

(45,387 |

) |

|

|

(26,475 |

) |

|

Agency mortgage-backed securities |

|

(82,924 |

) |

|

|

(89,973 |

) |

|

|

(94,247 |

) |

|

|

(67,559 |

) |

|

|

(36,899 |

) |

|

Municipal securities |

|

(2,934 |

) |

|

|

(4,498 |

) |

|

|

(6,355 |

) |

|

|

(3,673 |

) |

|

|

(1,417 |

) |

|

Corporate bonds |

|

(7,481 |

) |

|

|

(7,911 |

) |

|

|

(34,526 |

) |

|

|

(25,366 |

) |

|

|

(14,138 |

) |

|

Total unrealized gain (loss) on investment securities

available for sale |

$ |

(154,302 |

) |

|

$ |

(172,140 |

) |

|

$ |

(203,543 |

) |

|

$ |

(142,924 |

) |

|

$ |

(80,412 |

) |

| |

|

|

|

|

|

|

|

|

|

|

Investment securities held to maturity, at amortized

cost |

|

|

|

|

|

|

|

|

|

|

U.S. Government agencies |

$ |

47,975 |

|

|

$ |

50,408 |

|

|

$ |

52,788 |

|

|

$ |

56,226 |

|

|

$ |

61,072 |

|

|

Collateralized mortgage obligations |

|

363,389 |

|

|

|

363,733 |

|

|

|

374,421 |

|

|

|

385,744 |

|

|

|

402,478 |

|

|

Agency mortgage-backed securities |

|

1,122,559 |

|

|

|

1,126,111 |

|

|

|

1,135,167 |

|

|

|

1,158,115 |

|

|

|

1,186,306 |

|

|

Municipal securities |

|

6,551 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

Corporate bonds |

|

89,770 |

|

|

|

89,103 |

|

|

|

|

|

|

|

|

Total investment securities held to maturity, at amortized

cost |

$ |

1,630,244 |

|

|

$ |

1,629,355 |

|

|

$ |

1,562,376 |

|

|

$ |

1,600,085 |

|

|

$ |

1,649,856 |

|

| |

|

|

|

|

|

|

|

|

|

|

Unrealized gain (loss) on investment securities held to

maturity |

|

|

|

|

|

|

|

|

|

U.S. Government agencies |

$ |

(3,608 |

) |

|

$ |

(4,417 |

) |

|

$ |

(4,764 |

) |

|

$ |

(3,012 |

) |

|

$ |

(1,631 |

) |

|

Collateralized mortgage obligations |

|

(58,181 |

) |

|

|

(66,232 |

) |

|

|

(67,557 |

) |

|

|

(36,989 |

) |

|

|

(23,898 |

) |

|

Agency mortgage-backed securities |

|

(196,310 |

) |

|

|

(209,762 |

) |

|

|

(222,509 |

) |

|

|

(160,039 |

) |

|

|

(92,916 |

) |

|

Municipal securities |

|

(16 |

) |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

Corporate bonds |

|

4,357 |

|

|

|

551 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

Total unrealized gain (loss) on investment securities held

to maturity |

$ |

(253,758 |

) |

|

$ |

(279,860 |

) |

|

$ |

(294,830 |

) |

|

$ |

(200,040 |

) |

|

$ |

(118,445 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

Deposits |

|

|

|

|

|

|

|

|

|

|

Demand – non-interest bearing |

$ |

1,210,262 |

|

|

$ |

1,289,420 |

|

|

$ |

1,418,060 |

|

|

$ |

1,425,659 |

|

|

$ |

1,404,454 |

|

|

Demand – interest bearing |

|

2,344,256 |

|

|

|

2,469,761 |

|

|

|

2,497,761 |

|

|

|

2,294,931 |

|

|

|

2,352,205 |

|

|

Money market and savings |

|

1,066,786 |

|

|

|

1,149,995 |

|

|

|

1,217,580 |

|

|

|

1,342,883 |

|

|

|

1,363,484 |

|

|

Time Deposits |

|

256,935 |

|

|

|

103,787 |

|

|

|

118,183 |

|

|

|

149,553 |

|

|

|

190,093 |

|

|

Total deposits |

$ |

4,878,239 |

|

|

$ |

5,012,963 |

|

|

$ |

5,251,584 |

|

|

$ |

5,213,026 |

|

|

$ |

5,310,236 |

|

| |

|

|

|

|

|

|

|

|

|

| Republic First

Bancorp,

Inc. |

| Consolidating

Income Statement

(UNAUDITED) |

| (dollars in

thousands, except for share

data) |

| |

For the three months ended |

| |

March 31, |

|

December 31, |

|

September 30, |

June 30, |

|

March 31, |

|

|

|

2023 |

|

|

|

2022 |

|

|

|

2022 |

|

|

|

2022 |

|

|

|

2022 |

|

|

Interest income: |

|

|

|

|

|

|

|

|

|

|

Interest and fees on taxable loans |

$ |

35,557 |

|

|

$ |

34,060 |

|

|

$ |

30,653 |

|

|

$ |

26,994 |

|

|

$ |

25,657 |

|

|

Interest and fees on tax-exempt loans |

|

612 |

|

|

|

615 |

|

|

|

605 |

|

|

|

557 |

|

|

|

411 |

|

|

Interest and dividends on taxable investment

securities |

|

14,990 |

|

|

|

14,730 |

|

|

|

14,304 |

|

|

|

14,248 |

|

|

|

13,197 |

|

|

Interest and dividends on tax-exempt investment

securities |

|

424 |

|

|

|

392 |

|

|

|

392 |

|

|

|

340 |

|

|

|

143 |

|

|

Interest on federal funds sold and other

interest-earning assets |

|

581 |

|

|

|

143 |

|

|

|

54 |

|

|

|

85 |

|

|

|

40 |

|

|

Total interest income |

|

52,164 |

|

|

|

49,940 |

|

|

|

46,008 |

|

|

|

42,224 |

|

|

|

39,448 |

|

|

Interest expense |

|

|

|

|

|

|

|

|

|

|

Demand- interest bearing |

|

13,912 |

|

|

|

9,831 |

|

|

|

4,798 |

|

|

|

2,528 |

|

|

|

2,210 |

|

|

Money market and savings |

|

3,643 |

|

|

|

2,234 |

|

|

|

845 |

|

|

|

779 |

|

|

|

795 |

|

|

Time deposits |

|

1,023 |

|

|

|

119 |

|

|

|

139 |

|

|

|

222 |

|

|

|

246 |

|

|

Other borrowings |

|

9,593 |

|

|

|

4,821 |

|

|

|

2,227 |

|

|

|

295 |

|

|

|

57 |

|

|

Total interest expense |

|

28,171 |

|

|

|

17,005 |

|

|

|

8,009 |

|

|

|

3,824 |

|

|

|

3,308 |

|

| Net

interest income |

|

23,993 |

|

|

|

32,935 |

|

|

|

37,999 |

|

|

|

38,400 |

|

|

|

36,140 |

|

|

Provision for credit losses |

|

443 |

|

|

|

764 |

|

|

|

3,998 |

|

|

|

830 |

|

|

|

(72 |

) |

|

Net interest income after provision for credit

losses |

|

23,550 |

|

|

|

32,171 |

|

|

|

34,001 |

|

|

|

37,570 |

|

|

|

36,212 |

|

|

Non-interest income |

|

|

|

|

|

|

|

|

|

|

Loan and servicing fees |

|

176 |

|

|

|

771 |

|

|

|

311 |

|

|

|

694 |

|

|

|

495 |

|

|

Mortgage banking income |

|

211 |

|

|

|

486 |

|

|

|

844 |

|

|

|

888 |

|

|

|

1,115 |

|

|

Gain on sales of SBA loans |

|

190 |

|

|

|

354 |

|

|

|

502 |

|

|

|

684 |

|

|

|

527 |

|

|

Service fees on deposit accounts |

|

3,268 |

|

|

|

3,473 |

|

|

|

3,668 |

|

|

|

3,108 |

|

|

|

3,467 |

|

|

Net (loss) gain on sale or call of investment

securities |

|

- |

|

|

|

- |

|

|

|

(46 |

) |

|

|

- |

|

|

|

- |

|

|

Other non-interest (loss) income |

|

(2,576 |

) |

|

|

(192 |

) |

|

|

463 |

|

|

|

(501 |

) |

|

|

(1,257 |