UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14A

(Rule

14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

The Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☐

Filed by a Party other than the Registrant ☒

Check the appropriate box:

| ☒ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Under Rule 14a-12 |

REPUBLIC FIRST BANCORP, INC.

|

(Name of Registrant as Specified in Its Charter)

|

| |

DRIVER MANAGEMENT COMPANY LLC

DRIVER OPPORTUNITY PARTNERS I LP

J. ABBOTT R. COOPER

PETER B. BARTHOLOW

|

(Name of Persons(s) Filing Proxy Statement, if Other Than the Registrant)

|

Payment of Filing Fee (Check all boxes that apply):

| ☐ | Fee paid previously with preliminary materials |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

PRELIMINARY PROXY STATEMENT

SUBJECT TO COMPLETION

DATED JUNE 9, 2022

DRIVER MANAGEMENT COMPANY LLC

•, 2022

EXPLANATORY

NOTE: THIS PRELIMINARY PROXY STATEMENT IS BEING FILED IN ANTICIPATION OF THE POTENTIAL CALLING OF A SPECIAL MEETING. AS OF THE DATE

OF THIS PRELIMINARY PROXY STATEMENT, THE CUSTODIAN HAS NOT DISSEMINATED NOTICE OF THE CALLING OF A SPECIAL MEETING, AND THIS PROXY STATEMENT

WILL ONLY BE DISSEMINATED IN DEFINITIVE FORM IF AND WHEN A SPECIAL MEETING IS CALLED.

To Our Fellow Republic First Shareholders:

Driver

Management Company LLC and the other participants in this solicitation (collectively, “Driver”, “we” or “our”)

are the beneficial owners of an aggregate of 391,854 shares of common stock, par value $0.01 per share (the “Common Stock”),

of Republic First Bancorp, Inc., a Pennsylvania corporation (“FRBK” or the “Company”). On May 26, 2022, the United

States District Court (the “District Court”) for the Eastern District of Pennsylvania ruled that the Company’s board

of directors (the “Board”) was deadlocked and “unable to manage [the Company] in shareholders’ best interests.

On May 31, 2022, the District Court issued an order (the “Special Meeting Order”), appointing a Custodian (the “Custodian”)

to call and oversee a special meeting of shareholders be held to fill an existing vacancy on the Board. We are seeking your support for

the election of our nominee at the Company’s special meeting of shareholders scheduled to be held on •, 2022 at • •m.,

local time at • (including any adjournments or postponements thereof and any meeting which may be called in lieu thereof, the “Special

Meeting”). We are deeply disappointment with the Company’s current situation and believe it is clear evidence of the need

for a change in the composition of the Board. Our nominee, Peter B. Bartholow is highly qualified and focused on restoring investor confidence

in the Board as well as preserving and enhancing shareholder value.

The Special Meeting Order

is currently the subject of an expedited appeal in the United States Court of Appeals for the Third Circuit (the “Third Circuit”)

and scheduled for disposition during the week of June 27, 2022, at which time the Third Circuit could take action that could have the

effect of cancelling the Special Meeting.

We are seeking your support

at the Special Meeting to elect our nominee to fill an existing vacancy on the Board. A shareholder group consisting of George E. Norcross

III, the Avery Connor Trust, Phillip A. Norcross, Susan D. Hudson, Geoffrey B. Hudson, Rose M. Guida and Gregory B. Braca (together the

“Norcross Group”) has announced its intention to nominate a candidate for election at the Special Meeting and other shareholders

may also nominate candidates for election at the Special Meeting.

We urge you to carefully

consider the information contained in the attached proxy statement and then support our efforts by signing, dating and returning the enclosed

WHITE proxy card today. The attached proxy statement and the enclosed WHITE proxy card are first being mailed to stockholders

on or about •, 2022.

If you have already voted

for a candidate nominated by the Norcross Group or any other shareholder, you have every right to change your vote by signing, dating

and returning a later dated WHITE proxy card or by voting in person at the Special Meeting.

If you have any questions

or require any assistance with your vote, please contact Saratoga Proxy Consulting LLC, who is assisting us, at its address and toll-free

numbers listed below.

Thank you for your support,

/s/ J. Abbott R. Cooper

J. Abbott R. Cooper

Driver Management Company LLC

|

If you have any questions, require assistance in

voting your WHITE proxy card,

or need additional copies of Driver’s proxy

materials,

please contact Saratoga at the phone numbers listed

below.

Stockholders call toll free at (888) 368-0379

Email: info@saratogaproxy.com

|

PRELIMINARY PROXY STATEMENT

SUBJECT TO COMPLETION

DATED JUNE 9, 2022

SPECIAL MEETING OF STOCKHOLDERS

OF

REPUBLIC FIRST BANCORP, INC.

_________________________

PROXY STATEMENT

OF

DRIVER MANAGEMENT COMPANY LLC

_________________________

PLEASE SIGN, DATE AND MAIL THE ENCLOSED WHITE PROXY CARD TODAY

Driver Management Company

LLC and the other participants in this solicitation (collectively, “Driver”, “we” or “our”) are the

beneficial owners of an aggregate of 391,854 shares of common stock, par value $0.01 per share (the “Common Stock”), of Republic

First Bancorp, Inc., a Pennsylvania corporation (“FRBK” or the “Company”). On May 26, 2022, he United States District

Court (the “District Court”) for the Eastern District of Pennsylvania ruled that the Company’s board of directors (the

“Board”) was deadlocked and “unable to manage [the Company] in shareholders’ best interests. On May 31, 2022,

the District Court issued an order (the “Special Meeting Order”), appointing a Custodian (the “Custodian”) to

call and oversee a special meeting of shareholders be held to fill an existing vacancy on the Board. We are seeking your support for the

election of our nominee at the special meeting of shareholders scheduled to be held on •, 2022 at • •m., local time at

• (including any adjournments or postponements thereof and any meeting which may be called in lieu thereof, the “Special Meeting”).

Our nominee, Peter B. Bartholow is highly qualified and focused on restoring investor confidence in the Board as well as preserving and

enhancing shareholder value.

The Special Meeting Order

is currently the subject of an expedited appeal in the United States Court of Appeals for the Third Circuit (the “Third Circuit”)

and scheduled for disposition during the week of June 27, 2022, at which time the Third Circuit could take action that could have the

effect of cancelling the Special Meeting.

We are seeking your support

at the Special Meeting to elect Driver’s director nominee, Peter B. Bartholow (the “Nominee”) to the Board as a Class

III director to serve until the 2022 annual meeting of shareholders (the “2022 Annual Meeting”) or until his successor is

duly elected and qualified (“Proposal 1”) and to transact such other business as may properly come before the Special Meeting.

This Proxy Statement and

the enclosed WHITE proxy card are first being mailed to stockholders on or about •, 2022.

Driver Management, Driver

Opportunity Partners I LP, a Delaware limited partnership (“Partners”), J. Abbott R. Cooper and Peter B. Bartholow are members

of a group (the “Group”) formed in connection with this proxy solicitation and are deemed participants in this proxy solicitation.

As of June 9, 2022, the

participants in this solicitation collectively own 391,854 shares of Common Stock (the “Driver Group Shares”). We intend to

vote such shares FOR the election of the Nominee.

The close of business on

•, 2022, has been set as the record date for determining shareholders entitled to notice of and to vote at the Special Meeting (the

“Record Date”). As of the Record Date, there were approximately • shares of Common Stock outstanding. The mailing address

of the principal executive offices of the Company is 50 South 16th Street, Philadelphia, Pennsylvania 19102. Shareholders of

record at the close of business on the Record Date will be entitled to vote at the Special Meeting.

A shareholder group consisting

of George E. Norcross III, the Avery Connor Trust, Phillip A. Norcross, Susan D. Hudson, Geoffrey B. Hudson, Rose M. Guida and Gregory

B. Braca (together the “Norcross Group”) has announced its intention to nominate a candidate for election at the Special Meeting

and other shareholders may also nominate candidates for election at the Special Meeting.

THIS SOLICITATION IS BEING

MADE BY DRIVER AND NOT ON BEHALF OF THE COMPANY OR ANY OTHER PARTY. WE ARE NOT AWARE OF ANY OTHER MATTERS TO BE BROUGHT BEFORE THE SPECIAL

MEETING OTHER THAN AS SET FORTH IN THIS PROXY STATEMENT. SHOULD OTHER MATTERS, WHICH DRIVER IS NOT AWARE OF A REASONABLE TIME BEFORE THIS

SOLICITATION, BE BROUGHT BEFORE THE SPECIAL MEETING, THE PERSONS NAMED AS PROXIES IN THE ENCLOSED WHITE PROXY CARD WILL VOTE ON

SUCH MATTERS IN THEIR DISCRETION.

DRIVER URGES YOU TO SIGN,

DATE AND RETURN THE WHITE PROXY CARD IN FAVOR OF THE ELECTION OF THE NOMINEE.

IF YOU HAVE ALREADY SENT

A PROXY CARD FURNISHED BY THE NORCROSS GROUP OR ANY OTHER SHAREHOLDER, YOU MAY REVOKE THAT PROXY AND VOTE ON EACH OF THE PROPOSALS DESCRIBED

IN THIS PROXY STATEMENT BY SIGNING, DATING AND RETURNING THE ENCLOSED WHITE PROXY CARD. THE LATEST DATED PROXY IS THE ONLY ONE

THAT COUNTS. ANY PROXY MAY BE REVOKED AT ANY TIME PRIOR TO THE SPECIAL MEETING BY DELIVERING A WRITTEN NOTICE OF REVOCATION OR A LATER

DATED PROXY FOR THE SPECIAL MEETING OR BY VOTING IN PERSON AT THE SPECIAL MEETING.

Important Notice Regarding the Availability

of Proxy Materials for the Special Meeting—This Proxy Statement and our WHITE proxy card are available at

www.________.com

______________________________

IMPORTANT

Your vote is important,

no matter how many shares of Common Stock you own. Driver urges you to sign, date, and return the enclosed WHITE proxy card today to vote

FOR the election of the Nominee and in accordance with Driver’s recommendations on the other proposals on the agenda for the Special

Meeting.

Registered Owners

If your shares of Common

Stock are registered in your own name, please sign and date the enclosed WHITE proxy card and return it to Driver, c/o Saratoga

Proxy Consulting LLC (“Saratoga”), in the enclosed postage-paid envelope today. Stockholders also have the following two options

for authorizing a proxy to vote their shares:

| · | Via the Internet at www.cesvote.com at any time prior to 11:59 p.m. Eastern Time on •, 2022, and

follow the instructions provided on the WHITE proxy card; or |

| · | By telephone, by calling • at any time prior to 11:59 p.m. Eastern Time on •, 2022, and follow

the instructions provided on the WHITE proxy card. |

Beneficial Owners

If your shares of Common

Stock are held in a brokerage account or bank, you are considered the beneficial owner of the shares of Common Stock, and these proxy

materials, together with a WHITE voting instruction form, are being forwarded to you by your broker or bank. As a beneficial owner,

if you wish to vote, you must instruct your broker, trustee or other representative how to vote. Your broker cannot vote your shares of

Common Stock on your behalf without your instructions.

Beneficial owners may vote

either by the Internet or toll-free telephone. Please refer to the enclosed instructions on how to vote by Internet or telephone. You

may also vote by signing, dating and returning the enclosed WHITE voting instruction form.

Since only your latest dated

proxy card will count, we urge you not to return any proxy card you receive from the Norcross Group or any other shareholder. Remember,

you can vote for our Nominee only on our WHITE proxy card. So please make certain that the latest dated proxy card you return is

the WHITE proxy card.

|

If you have any questions, require assistance in

voting your WHITE proxy card,

or need additional copies of Driver’s proxy

materials,

please contact Saratoga at the phone numbers listed

below.

Stockholders call toll free at (888) 368-0379

Email: info@saratogaproxy.com

|

QUESTIONS AND ANSWERS

Why am I receiving this proxy statement?

On May 26, 2022, a federal court ordered FRBK to have

a special meeting to elect one director to fill a vacancy on the Board. Driver has nominated Peter B. Bartholow for election to director

at the Special Meeting.

Why did the judge order FRBK to have the Special

Meeting?

On May 10, 2022, Theodore Flocco, who had been a member

of the Board, died, creating a vacancy. Following Mr. Flocco’s death, the Board replaced Vernon Hill as Chairman of the Board with

Harry Madonna. Mr. Hill (along with Brian Tierney and Barry Spevack) then filed an action (captioned Hill v. Cohen, Civ. No. 22-1924

(E.D. Pa.), which is referred to as the “Hill Litigation”) against the other members of the Board (Andrew Cohen, Lisa Jacobs,

Harry Madonna and Harris Wildstein, referred to as the “Madonna Faction”) challenging, among other things, the replacement

of Mr. Hill as Chairman of the Board.

In an order issued May 26, 2022, the judge in the

Hill Litigation determined that the Board was deadlocked and was unable “to manage [FRBK] in the shareholder’s best interests”

and, on May 31, 2022, the judge appointed a Custodian to, among other things, call and oversee the special meeting to elect a director

to fill the vacancy on the Board created by Mr. Flocco’s death.

I thought that the Board was already deadlocked

before Mr. Flocco’s death—wouldn’t his unfortunate demise mean that the deadlock had been broken? There were eight directors

before Mr. Flocco died, so if that leaves seven directors, how can the Board be deadlocked?

Good question, however, the judge in the Hill litigation

has taken the position that, based on his interpretation of FRBK’s articles of incorporation and bylaws as well as his assessment

of disputes among the various Board members, the Board remains deadlocked.

What is the Custodian supposed to do?

Pursuant to the Special Meeting Order the Custodian

is to (i) call and oversee the Special Meeting and (ii) take “any and all lawful actions necessary to manage [FRBK] in its shareholders’

best interests, including, should the Custodian so decide, the election of a ninth director.”

So who is running FRBK? The Custodian? The Board?

Vernon Hill as CEO?

Another good question. The extent of the Custodian’s

authority and duties are set forth in the Special Meeting Order, but how they will be applied leading up to the special shareholder meeting

is unclear to Driver as is the Custodian’s relationship to the Board. Further complicating matters is the fact that the Madonna

Faction, the defendants in the Hill Litigation, have appealed the appointment of the Custodian, among other things, to the United States

Court of Appeals for the Third Circuit (the “Third Circuit”) where it is being heard on an expedited appeal, which has been

scheduled for disposition during the week of June 27, 2022, at which point the Third Circuit may take action that would have the effect

of cancelling the Special Meeting.

Am I right in thinking that this is kind of a big

mess?

Yes. Driver believes that this situation is unprecedented

and is clear evidence for the need for substantial change on the Board.

Can substantial change on the Board happen as a

result of the Special Meeting?

The Special Meeting is to elect only one director,

whose term will end at the 2022 Annual Meeting. However, the judge in the Hill Litigation has indicated that the Custodian may determine

that an additional director should be elected at the Special Meeting.

Can the Custodian create a vacancy on the Board?

You ask a lot of really good questions. While the

May 31 Order effectively authorizes the Custodian to create a vacancy on the Board to provide for a ninth director, both FRBK’s

articles of incorporation and bylaws provide that only the Board can create a vacancy on the Board.

Ok—this is pretty confusing—what happened

to the 2022 Annual Meeting?

While the Board had set May 10, 2022 for the date

of the 2022 Annual Meeting, that meeting has not yet been held. As of the date of this proxy statement, it is unclear when the 2022 Annual

Meeting will be held, though Driver believes that it is important for the Company to hold the 2022 Annual Meeting as soon as possible

in order to restore investor confidence in the Board.

On May 2, 2022, Driver brought an action (captioned

Driver Opportunity Partners I LP v. Republic First Bancorp, Inc., Civ. No. 22-1694 (E.D. Pa.) (referred to as the “Driver Litigation”)

seeking to compel the Company to have the 2022 Annual Meeting on May 10, 2022, the date set by the Board. The judge in the Driver Litigation,

who is the same judge in the Hill Litigation, denied Driver’s request for injunctive relief to compel the Company to have the 2022

Annual Meeting on that date. Driver is currently appealing the judge’s ruling to the United States Court of Appeals for the Third

Circuit.

Why doesn’t the Company just have the 2022

Annual Meeting now instead of the Special Meeting?

Great question, but one that Driver cannot answer,

particularly since Driver believes that holding the 2022 Annual Meeting as soon as possible is in the best interest of FRBK and its shareholders

and will help restore investor confidence in the Board.

Didn’t I already get a proxy statement for

the 2022 Annual Meeting?

You may have. On April 12, 2022, Driver mailed a proxy

statement with respect to the 2022 Annual Meeting soliciting proxies for, among other things, the election of Peter B. Bartholow, Pamela

D. Bundy and Richard H. Sinkfield III as Class III directors.

If I already sent back the proxy card or otherwise

voted with respect to the 2022 Annual Meeting, do I need to vote now?

The Special Meeting and the 2022 Annual Meeting are

two separate meetings. Any proxy or vote with respect to the 2022 Annual Meeting is separate from a proxy or vote with respect to the

Special Meeting. To vote in the Special Election, you need to follow the instructions contained in this proxy statement.

Why has Driver nominated Peter Bartholow as a candidate

for election to director at the Special Meeting and the 2022 Annual Meeting?

The Special Meeting is to fill the vacancy on the

Board created by the death of Mr. Flocco, who was a Class III director and whose term would have expired at the 2022 Annual Meeting, so

the term of the person elected to fill that vacancy will also expire at the 2022 Annual Meeting. If Mr. Bartholow is elected at the Special

Meeting to fill the vacancy, his term will expire at the 2022 Annual Meeting. Driver was already soliciting proxies for the election of

Mr. Bartholow as a Class III director at the 2022 Annual Meeting, so if he is elected to the Board at both the Special Meeting and the

2022 Annual Meeting, he will begin serving another term as a Class III director following the 2022 Annual Meeting.

Why aren’t you seeking the election of Ms.

Bundy or Mr. Sinkfield at the Special Election?

As of the date of this proxy statement, only one director

will be elected at the Special Election and Driver has determined to nominate Mr. Bartholow, primarily due to his experience serving as

Chief Financial Officer and Chief Operating Officer, as well as a member of the board of directors of, Texas Capital Bancshares, Inc.,

in order to restore investor confidence in the Board. Driver believes that Mr. Bartholow’s experience as CFO and a director of a

publicly traded bank holding company is particularly relevant and needed given the well-publicized dysfunction that has characterized

the Board over the last several months.

Are there any other candidates for election at

the Special Election?

A shareholder group comprised of George E. Norcross,

III, Gregory B. Braca, Phillip A. Norcross, Avery Connor Capital Trust, Susan D. Hudson, Geoffrey B. Hudson and Rose M. Guida (the “Norcross

Group”) has announced its intention to nominate Mr. Braca for election to director at the Special Meeting. In addition, Driver anticipates

that Mr. Hill may nominate a candidate for election to director at the Special Meeting.

Aren’t Driver and the Norcross Group allies?

While Driver and the Norcross Group may share certain

objectives, primarily the removal of Mr. Hill from the Board, Driver and the Norcross Group are, and have been, acting independently of

each other and not in concert with each other. In addition, the Norcross Group may have interests that are not shared with Driver or any

other shareholders. In particular, the Norcross Group has publicly disclosed that, on March 14, 2022, it had submitted a proposal (the

“Norcross Proposal”) that would involve, among other things, both a direct investment in the Company as well as a partial

tender offer for outstanding shares of Common Stock that, if consummated, would result in the Norcross Group acquiring ownership of 51%

of the outstanding shares of Common Stock. The Norcross Proposal also contemplates that Mr. Braca would be appointed CEO of the Company.

Driver has not expressed a view on the merits of the Proposed Norcross Transaction, though Driver believes that the Board should consider

all possible options to increase shareholder value, which may include the Proposed Norcross Transaction and is concerned that the Norcross

Proposal might result in the Norcross Group obtaining control of the Company without paying a control premium to all shareholders.. Driver

also has not expressed a view on the qualifications of Mr. Braca to serve as CEO of the Company, though Driver believes that, if Mr. Hill

is replaced as CEO, the Board should conduct a thorough search for his replacement.

Does Driver need to obtain any regulatory approval

in order to solicit proxies for the Special Meeting?

Pennsylvania law requires prior approval

from the Bureau of Bank Supervision (the “PA Bank Regulator”) of the Pennsylvania Department of Banking and Securities before

soliciting proxies with respect to more than 10% of the outstanding shares of voting stock of any Pennsylvania bank. On June 3, 2022,

Driver filed an application (the “Section 112 Application”) pursuant to Section 112 of the Pennsylvania Banking Code of 1965

with the PA Bank Regulator. Driver will not proceed with this proxy solicitation unless and until the Section 112 Application is approved

by the PA Bank Regulator.

REASONS FOR THE SOLICITATION

Driver’s nomination of Mr. Bartholow was prompted

by deep disappointment with the Company’s current situation, a situation so problematic that it resulted in the District Court issuing

the Special Meeting Order and appointing the Custodian to manage FRBK. Put bluntly, Driver believes that the Board has ceased to function

and for quite some time has been unwilling or unable to take action to protect shareholders’ interests. Driver further believes

that the current situation is clear evidence of the need for change in the composition of the Board.

We have concerns regarding Mr. Hill’s stewardship

and his issues with banking regulators

On December 5, 2016, FRBK named Mr. Hill Chairman

of the Board. At that time, Mr. Hill announced “The Power of Red is back as Republic Bank returns to New Jersey and Pennsylvania

our unique, totally customer-oriented business model.”1

Mr. Hill developed his Power of Red business

model at Commerce Bancorp. Inc. (together with its banking subsidiary Commerce Bank, N.A., “Commerce”), where Mr. Hill had

served as chairman of the board of directors and CEO from its founding until Mr. Hill was removed from all his positions, effective July

31, 2007, in connection with a consent order (the “Commerce Consent Order”), dated, June 28, 2007, issued by the Office of

the Comptroller of the Currency (the “OCC”) and a Memorandum of Understanding (the “MOU”) dated June 28, 2007,

by and between the Federal Reserve Bank of Philadelphia and Commerce.2

George E. Norcross III was a member of the board of directors of Commerce (as well as its banking subsidiary) at that time and a signatory

to the MOU and the Commerce Consent Order. Mr. Hill later entered into a consent order with the OCC, dated, November 17, 2008, as a result

of the same investigation that led to the Commerce Consent Order.3

As a result of the Commerce Consent Order, Commerce

was labeled a “troubled institution” and, as such, was prohibited from making any severance payments to Mr. Hill following

his termination. Despite this fact, and that the investigation giving rise to the Commerce Consent Order included an investigation into

potential conflicts of interest arising out of transactions between Mr. Hill and his relatives, Mr. Hill still sued Commerce (unsuccessfully)

for payment of a “golden parachute.”4

1 https://www.sec.gov/Archives/edgar/data/834285/000095015916000819/exhibit99-1.htm.

2 https://www.sec.gov/Archives/edgar/data/0000715096/000095015907000851/commerce8k.htm.

3 https://www.occ.gov/news-issuances/news-releases/2008/nr-occ-2008-135.html.

4 https://digitalcommons.law.villanova.edu/cgi/viewcontent.cgi?article=2001&context=thirdcircuit_2014.

After being forced out of Commerce, Mr. Hill took

the Power of Red to the United Kingdom, launching Metro Bank PLC (“Metro”) in July 2010.5

Mr. Hill resigned as chairman of the board and a director of Metro effective December 31, 2019 in the wake of Metro’s announcement,

on January 23, 2019, that it had applied incorrect risk weightings to certain commercial loans and a related capital raise. On December

31, 2021, the Prudential Regulatory Authority of the Bank of England announced that it had fined Metro £5,376,000 for, among other

things, failures in Metro’s governance. From March 7, 2016, the date of Metro’s initial public offering, until December 31,

2019, when Mr. Hill ceased to be chairman of its board of directors, Metro produced a total shareholder return of negative 91.1%.6

Since the arrival of the Power of Red in 2016,

FRBK’s profitability has significantly lagged peers as indicated by the below chart comparing return on average assets (“ROAA”)

for FRBK with the Dow Jones U.S. MicroCap Banks index (the “MicroCap Bank Index”):

Source: S&P Capital IQ

On October 27, 2021, during FRBK’s earnings

call for the third quarter of 2021, Mr. Hill announced that FRBK intended to raise capital by issuing common equity during the fourth

quarter of 2021. Following this announcement, Driver immediately decided to nominate candidates for election to the Board at the 2022

Annual Meeting in an effort to prevent the Power of Red from further destroying shareholder value.

No more Power of Red

While Mr. Hill has not yet publicly disclosed an intention

to nominate a candidate for election to the Board at the Special Meeting, Driver believes that Mr. Hill and the Power of Red have

a record of destroying shareholder value and electing an entirely independent director with relevant experience is the best chance to

mitigate Mr. Hill’s destructive influence on the Board.

5 https://www.metrobankonline.co.uk/globalassets/documents/investor_documents/2016-03-07-metro-bank-prospectus.pdf.

6 Source: Bloomberg.

Driver believes that Mr. Hill, who has a well-established

history of problematic issues with banking regulators on both sides of the Atlantic ocean, a well-known penchant for related party transactions

and, in Driver’s view, an irrational commitment to a failed business model as well as a complete disregard for shareholder value,

is the primary cause of FRBK’s current predicament, and Mr. Bartholow, if elected, would work to restore investor confidence in

the Board.

Driver has concerns that the Norcross Group’s

nominee has interests not shared by other shareholders generally

On March 14, 2022, the Norcross Group disclosed that

it had submitted a proposal (the “Norcross Proposal”) to the Board that contemplated, among other things, that (i) the Norcross

Group directly invest $50,000,000 in FRBK through the purchase of newly issued shares of convertible preferred stock, (ii) that the Norcross

Group would subsequently make a public tender offer to acquire shares of Common Stock that would result in the Norcross Group acquiring

51% of the issued and outstanding shares of Common Stock, and (iii) Mr. Braca would be appointed chief executive officer of FRBK.7

While Driver believes that the Board should evaluate

all options to increase shareholder value, including the Norcross Proposal, Driver is concerned that Mr. Braca, who would be appointed

CEO pursuant to the terms of the Norcross Proposal, would not be able to objectively evaluate all the options for increasing shareholder

value that might be available to the Board. Driver is also generally concerned that the structure of the Norcross Proposal would result

in the Norcross Group controlling FRBK without paying a premium to all shareholders for acquiring control of the Company.

Mr. Bartholow’s qualifications

Mr. Bartholow has experience serving as the CFO and

COO of, and a member of the board of directors of, Texas Capital Bancshares, Inc., a publicly traded bank holding company. Mr. Bartholow

has both public company board experience as well as experience as an executive officer of banking organizations. Mr. Bartholow does not

have any relationship with Driver (other than as disclosed in this proxy statement) and is not an employee of, investor in or otherwise

associated with Driver. In addition, Mr. Bartholow has no connection to any of the current Board members or the Norcross Group. Driver

ardently believes that Mr. Bartholow will help change the toxic and dysfunctional dynamic that has rendered the Board unable to function

and that he will objectively evaluate all potential options to increase shareholder value that might be available to the Board.

7https://www.sec.gov/Archives/edgar/data/834285/000119312522073691/d270754dex997e.htm.

PROPOSAL NO. 1

ELECTION OF DIRECTOR

We are seeking your support

at the Special Meeting to elect our Nominee, Peter B. Bartholow, who is independent of the Company and Driver, to fill an existing vacancy

on the Board.

THE NOMINEE

The following information

sets forth the name, age, business address, present principal occupation, and employment and material occupations, positions, or offices

for the past five (5) years of the Nominee. The nomination of the Nominee was made in a timely manner and in compliance with the applicable

provisions of the Company’s governing instruments. The specific experience, qualifications, attributes and skills that led us to

conclude that the Nominee should serve as a director of the Company are set forth below. This information has been furnished to us by

the Nominee. The Nominee is a citizen of the United States of America.

Peter B. Bartholow,

age 73, most recently served as Chief Operating Officer and Chief Financial Officer and on the board of directors of Texas Capital Bancshares,

Inc. (NASAQ: TCBI), a bank holding company, and Chief Financial Officer of its subsidiary, Texas Capital Bank, from 2003, and Chief Operating

Officer, from 2014, until stepping down from his Chief Financial Officer roles in June 2017 and his eventual retirement from the company

in December 2017. Prior to that, Mr. Bartholow served as Managing Director of Hat Creek Partners LLC, a private equity investment company,

from 1999 to 2003. From 1995 to 1998, Mr. Bartholow served as Corporate Vice President of Finance at Electronic Data Systems, Corp. (formerly

NYSE: EDS) (“EDS”), a multinational information technology equipment and services company. Mr. Bartholow served as Chief Financial

Officer of First USA, Inc. (formerly NYSE: FUS), a financial services company originally formed as a subsidiary of MCorp, from 1994 to

1995. From 1989 to 1994, Mr. Bartholow served as Chairman of the Board of Directors, Chief Financial Officer, Chief Executive Officer

and President of MCorp, which was a bank holding company a majority of whose banks were acquired by Bank One Corporation (formerly NYSE:

ONE). Mr. Bartholow served on the board of directors of MTech, a publicly owned technology services company, of which MCorp was the majority

stockholder, from 1985 to 1988, when MTech was acquired by EDS. Mr. Bartholow also served on the board of directors of A.T. Kearney, Inc.,

a subsidiary of EDS and provider of management consulting services, from 1995 to 1998 and MCorp, from 1989 to 1994. Mr. Bartholow received

an M.B.A. from the University of Texas and a Bachelor’s Degree in Economics from Vanderbilt University.

Driver believes that Mr.

Bartholow’s extensive knowledge of capital markets, mergers & acquisitions, divestitures, and litigation management, as a result

of his significant experience in executive roles, coupled with his board experience, make him well qualified to serve on the Board.

Mr. Bartholow’s principal

business address is 4300 Beverly Drive Dallas, Texas 75205.

As of the date hereof,

Mr. Bartholow owns 6,000 shares of Common Stock. The shares of Common Stock purchased by Mr. Bartholow were purchased with personal funds

in the open market.

The Nominee may be deemed

to be a member of the Group for the purposes of Section 13(d)(3) of the Securities Exchange Act of 1934, as amended (the “Exchange

Act”). Each Nominee specifically disclaims beneficial ownership of shares of Common Stock that he or she does not directly own.

For information regarding purchases and sales of securities of the Company during the past two (2) years by the Nominee and the members

of the Group, please see Schedule I.

Driver has signed a letter

agreement (the “Indemnification Agreement”) with the Nominee pursuant to which it and its affiliates have agreed to indemnify

the Nominee against certain claims arising from the solicitation of proxies from the Company’s shareholders in connection with the

Special Meeting and any related transactions. For the avoidance of doubt, such indemnification does not apply to any claims made against

the Nominee in their capacities as directors of the Company, if so elected

Other than as stated herein,

there are no arrangements or understandings between the members of the Group or any other person or persons pursuant to which the nomination

of the Nominee described herein is to be made, other than the consent by the Nominee to be named in this Proxy Statement and to serve

as a director of the Company if elected as such at the Special Meeting. The Nominee is not a party adverse to the Company or any of its

subsidiaries nor does he have a material interest adverse to the Company or any of its subsidiaries in any material pending legal proceeding.

The Nominee presently is,

and if elected as a director of the Company, the Nominee would, in our view, qualify as, an “independent director” within

the meaning of (i) applicable NASDAQ listing standards applicable to board composition, including Rule 5605(a)(2), and (ii) Section 301

of the Sarbanes-Oxley Act of 2002. Notwithstanding the foregoing, no director of an NASDAQ listed company qualifies as “independent”

under the NASDAQ listing standards unless the board of directors affirmatively determines that such director is independent under such

standards. Accordingly, if the Nominee is elected, the determination of the Nominee’s independence under the NASDAQ listing standards

ultimately rests with the judgment and discretion of the Board.

We do not expect that the

Nominee will be unable to stand for election, but, in the event the Nominee is unable to serve or, for good cause, will not serve, the

shares of Common Stock represented by the enclosed WHITE proxy card will be voted for substitute nominee(s), to the extent this

is not prohibited under the Bylaws and applicable law. In addition, we reserve the right to nominate a substitute person(s) if the Company

makes or announces any changes to the Bylaws or takes or announces any other action that has, or if consummated would have, the effect

of disqualifying the Nominee, to the extent this is not prohibited under the Bylaws and applicable law. In any such case, we would identify

and properly nominate such substitute nominee(s) in accordance with the Bylaws and shares of Common Stock represented by the enclosed

WHITE proxy card will be voted for such substitute nominee(s). We reserve the right to nominate additional person(s), to the extent

this is not prohibited under the Bylaws and applicable law, if the Company increases the size of the Board above its existing size.

WE URGE YOU TO VOTE “FOR” THE

ELECTION OF THE NOMINEE ON THE ENCLOSED WHITE PROXY CARD.

VOTING AND PROXY PROCEDURES

Shareholders are entitled

to one vote for each share of Common Stock held of record on the Record Date with respect to each matter to be acted on at the Special

Meeting. Only shareholders of record on the Record Date will be entitled to notice of and to vote at the Special Meeting. Shareholders

who sell their shares of Common Stock before the Record Date (or acquire them without voting rights after the Record Date) may not vote

such shares. Shareholders of record on the Record Date will retain their voting rights in connection with the Special Meeting even if

they sell such shares after the Record Date. Based on publicly available information, Driver believes that the only outstanding class

of securities of the Company entitled to vote at the Special Meeting is the Common Stock.

Shares of Common Stock

represented by properly executed WHITE proxy cards will be voted at the Special Meeting as marked and, in the absence of specific

instructions, will be voted FOR the election of the Nominee and in the discretion of the persons named as proxies on all other

matters as may properly come before the Special Meeting, as described herein.

QUORUM; BROKER NON-VOTES; DISCRETIONARY VOTING

A quorum is the minimum

number of shares of Common Stock that must be represented at a duly called meeting in person or by proxy in order to legally conduct business

at the meeting. The presence, in person or by proxy, of stockholders entitled to cast a majority of all votes entitled to be cast at the

Special Meeting shall constitute a quorum. Withheld votes (in the case of the election of directors), abstentions and broker non-votes

will all be counted for purposes of determining whether a quorum is present.

Please note that if you

hold your shares in a stock brokerage account, your broker may not be able to vote your shares of Common Stock (a “broker non-vote”)

unless you provide voting instructions to your broker. You should instruct your broker to vote your shares by following the instructions

provided by the broker when it sends this Proxy Statement to you. You may not vote shares held in street name by returning a proxy card

directly to the Company or by voting in person at the Special Meeting unless you provide a “legal proxy”, which you must obtain

from your bank, broker, trustee or other nominee.

If you hold your shares

in “street name” and do not provide voting instructions to your broker, then your broker will not have the authority to vote

your shares on any proposal presented at the Special Meeting unless it has discretionary authority with respect to that proposal. In that

case, your shares will be considered to be broker non-votes and will not be voted on that proposal. Whether a broker has discretionary

authority depends on your agreement with your broker and the rules of the various regional and national exchanges of which your broker

is a member. These rules generally prohibit a broker from exercising discretionary voting authority on non-routine matters without specific

instructions from their customers. Proposals are determined to be routine or non-routine matters based on these rules. However, in the

case of meetings involving contested director elections, these rules generally prohibit a broker from exercising discretionary authority

with respect to any proposals to be voted on at such meetings, whether routine or not. As a result, brokers subject to these rules generally

will not be permitted to vote shares held by a beneficial holder at the Special Meeting without instructions from that beneficial holder

as to how to the shares are to be voted. Any shares held by such a broker who has not received instructions from the beneficial owner

as to how such shares are to be voted will have no effect on the outcome of the election of a director to fill the existing vacancy on

the Board, but the shares will be counted for establishing the presence of a quorum. It is therefore very important that you instruct

your broker on how to vote shares that you hold in street name.

VOTES REQUIRED FOR APPROVAL

Election of Director

– Driver believes that the director will be elected by a plurality vote of shares of common stock cast in person or by proxy at

the Special Meeting, provided a quorum is present. A “plurality” means that the individuals who receive the largest number

of affirmative votes cast are elected as directors up to the maximum number of directors to be chosen at the Special Meeting. Votes that

are withheld from a director nominee will be excluded entirely from the vote for such nominee and will have no effect on the result. Broker

non-votes will have no effect on the outcome of the vote. Shareholders are not entitled to cumulative voting in the election of directors.

REVOCATION OF PROXIES

Shareholders of the Company may

revoke their proxies at any time prior to exercise by attending the Special Meeting and voting in person (although, attendance at the

Special Meeting will not in and of itself constitute revocation of a proxy) or by delivering a written notice of revocation. The delivery

of a subsequently dated proxy which is properly completed will constitute a revocation of any earlier proxy. The revocation may be delivered

either to Driver in care of Saratoga at the address set forth on the back cover of this Proxy Statement or to the Company at Two Liberty

Place, 50 South 16th Street, Suite 2400, Philadelphia, Pennsylvania 19102 or any other address provided by the Company. Although

a revocation is effective if delivered to the Company, we request that either the original or photostatic copies of all revocations be

mailed to Driver in care of Saratoga at the address set forth on the back cover of this Proxy Statement so that we will be aware of all

revocations and can more accurately determine if and when proxies have been received from the holders of record on the Record Date of

a majority of the shares entitled to be voted at the Special Meeting. Additionally, Saratoga may use this information to contact stockholders

who have revoked their proxies in order to solicit later dated proxies for the election of the Nominee.

IF YOU WISH TO VOTE FOR THE ELECTION OF

THE NOMINEE TO THE BOARD, PLEASE SIGN, DATE AND RETURN PROMPTLY THE ENCLOSED WHITE PROXY CARD IN THE POSTAGE-PAID ENVELOPE PROVIDED.

SOLICITATION OF PROXIES

The solicitation of proxies

pursuant to this Proxy Statement is being made by Driver. Proxies may be solicited by mail, facsimile, telephone, Internet, in person

and by advertisements.

Members of Driver have

entered into an agreement with Saratoga for solicitation and advisory services in connection with this solicitation, for which Saratoga

will receive a fee not to exceed $•, together with reimbursement for its reasonable out-of-pocket expenses, and will be indemnified

against certain liabilities and expenses, including certain liabilities under the federal securities laws. Saratoga will solicit proxies

from individuals, brokers, banks, bank nominees and other institutional holders. Driver has requested banks, brokerage houses and other

custodians, nominees and fiduciaries to forward all solicitation materials to the beneficial owners of the shares of Common Stock they

hold of record. Driver will reimburse these record holders for their reasonable out-of-pocket expenses in so doing. It is anticipated

that Saratoga will employ approximately • persons to solicit stockholders for the Special Meeting.

The entire expense of soliciting

proxies is being borne by Driver. Costs of this solicitation of proxies are currently estimated to be approximately $• (including,

but not limited to, fees for attorneys, solicitors and other advisors, and other costs incidental to the solicitation). Driver estimates

that through the date hereof its expenses in connection with this solicitation are approximately $•. To the extent legally permissible,

if Driver is successful in its proxy solicitation, Driver intends to seek reimbursement from the Company for the expenses it incurs in

connection with this solicitation. Driver does not intend to submit the question of such reimbursement to a vote of security holders of

the Company.

In accordance with Pennsylvania

law, on June 3, 2022, Driver filed an application (the “Section 112 Application”) with the Pennsylvania Department of Banking

and Securities (the “Pennsylvania Bank Regulator”) for approval to solicit proxies with respect to more than 10% of the outstanding

shares of the Common Stock. Driver will not proceed with this proxy solicitation unless and until the Section 112 Application is approved

by the Pennsylvania Bank Regulator.

ADDITIONAL PARTICIPANT INFORMATION

Driver Management, Partners,

J. Abbott R. Cooper and the Nominee are participants in this solicitation. The principal business of Driver is serving as the general

partner of Partners and managing certain other investments on behalf of separately managed accounts and other investment vehicles. The

principal business of Partners is investing in securities. The principal occupation of Mr. Cooper is serving as the managing member of

Driver.

The address of the principal

office of each of Driver Management, Partners and Mr. Cooper is 250 Park Avenue, 7th Floor, New York, New York 10177.

As of the date hereof,

Partners directly beneficially owns 385,854 shares of Common Stock. Driver Management, as the general partner of Partners, may be deemed

to beneficially own the shares of Common Stock directly beneficially owned by Partners. Mr. Cooper, as the managing member of Driver Management,

may be deemed to beneficially own the shares of Common Stock directly beneficially owned by Partners.

Each participant in this

solicitation is a member of a “group” with the other participants for the purposes of Section 13(d)(3) of the Exchange Act.

The Group may be deemed to beneficially own the 391,854 shares of Common Stock owned in the aggregate by all of the participants in this

solicitation. Each participant in this solicitation disclaims beneficial ownership of the shares of Common Stock that he, she or it does

not directly own. For information regarding purchases and sales of securities of the Company during the past two (2) years by the participants

in this solicitation, see Schedule I.

The shares of Common Stock

purchased by Partners were purchased with working capital and without the use of any margin loans. The shares of Common Stock purchased

in the certain managed account were purchased with working capital and without the use of any margin loans.

Except as set forth in

this Proxy Statement (including the Schedules hereto), (i) during the past ten (10) years, no participant in this solicitation has been

convicted in a criminal proceeding (excluding traffic violations or similar misdemeanors); (ii) no participant in this solicitation directly

or indirectly beneficially owns any securities of the Company; (iii) no participant in this solicitation owns any securities of the Company

which are owned of record but not beneficially; (iv) no participant in this solicitation has purchased or sold any securities of the Company

during the past two (2) years; (v) no part of the purchase price or market value of the securities of the Company owned by any participant

in this solicitation is represented by funds borrowed or otherwise obtained for the purpose of acquiring or holding such securities; (vi)

no participant in this solicitation is, or within the past year was, a party to any contract, arrangements or understandings with any

person with respect to any securities of the Company, including, but not limited to, joint ventures, loan or option arrangements, puts

or calls, guarantees against loss or guarantees of profit, division of losses or profits, or the giving or withholding of proxies; (vii)

no associate of any participant in this solicitation owns beneficially, directly or indirectly, any securities of the Company; (viii)

no participant in this solicitation owns beneficially, directly or indirectly, any securities of any parent or subsidiary of the Company;

(ix) no participant in this solicitation or any of his, her or its associates was a party to any transaction, or series of similar transactions,

since the beginning of the Company’s last fiscal year, or is a party to any currently proposed transaction, or series of similar

transactions, to which the Company or any of its subsidiaries was or is to be a party, in which the amount involved exceeds $120,000;

(x) no participant in this solicitation or any of his, her or its associates has any arrangement or understanding with any person with

respect to any future employment by the Company or its affiliates, or with respect to any future transactions to which the Company or

any of its affiliates will or may be a party; and (xi) no participant in this solicitation has a substantial interest, direct or indirect,

by securities holdings or otherwise, in any matter to be acted on at the Special Meeting.

Other than as disclosed

herein, are no material proceedings to which any participant in this solicitation or any of his, her or its associates is a party adverse

to the Company or any of its subsidiaries or has a material interest adverse to the Company or any of its subsidiaries. With respect to

the Nominee, none of the events enumerated in Item 401(f)(1)-(8) of Regulation S-K of the Exchange Act occurred during the past ten (10)

years.

On May 2, 2022, in an actioned

captioned Driver Opportunity Partners I LP v. Republic First Bancorp, Inc., Civ. No. 22-1694 (E.D. Pa.), Driver Opportunity Partners I

LP filed a Complaint for Declaratory Judgement, Temporary Restraining Order and Injunctive Relief against the Company in the United States

District Court for the Eastern District of Pennsylvania seeking to compel the Company to have the 2022 Annual Meeting on May 10, 2022

or as soon thereafter as may be determined by the Board or the court.

OTHER MATTERS AND ADDITIONAL INFORMATION

Driver is unaware of any

other matters to be considered at the Special Meeting. However, should other matters, which Driver is not aware of at a reasonable time

before this solicitation, be brought before the Special Meeting, the persons named as proxies on the enclosed WHITE proxy card

will vote on such matters in their discretion.

CERTAIN ADDITIONAL INFORMATION

WE HAVE OMITTED FROM THIS

PROXY STATEMENT CERTAIN DISCLOSURE REQUIRED BY APPLICABLE LAW THAT IS INCLUDED IN THE COMPANY’S FORM 10-K AND NOTICE OF THE SPECIAL

MEETING AND THE NORCROSS GROUP’S PROXY STATEMENT RELATING TO THE SPECIAL MEETING BASED ON RELIANCE ON RULE 14A-5(C). THIS DISCLOSURE

INCLUDES, AMONG OTHER THINGS, INFORMATION CONCERNING EXECUTIVE COMPENSATION, AND INFORMATION CONCERNING THE PROCEDURES FOR SUBMITTING

STOCKHOLDER PROPOSALS FOR CONSIDERATION FOR INCLUSION IN THE PROXY MATERIALS FOR THE ANNUAL MEETING OF STOCKHOLDER. SEE SCHEDULE II FOR

INFORMATION REGARDING PERSONS WHO BENEFICIALLY OWN MORE THAN 5% OF THE SHARES AND THE OWNERSHIP OF THE SHARES BY THE DIRECTORS AND MANAGEMENT

OF THE COMPANY.

The information concerning

the Company contained in this Proxy Statement and the Schedules attached hereto has been taken from, or is based upon, publicly available

documents on file with the Securities and Exchange Commission and other publicly available information.

DRIVER OPPORTUNITY PARTNERS I LP

JUNE 9, 2022

SCHEDULE I

TRANSACTIONS IN SECURITIES OF THE

COMPANY

DURING THE PAST TWO YEARS

| Nature of Transaction |

Amount of Securities

Purchased/(Sold) |

Date of

Purchase/Sale |

DRIVER OPPORTUNITY PARTNERS I LP

| Purchase of Common Stock |

20,000 |

10/19/2021 |

| Purchase of Common Stock |

21,623 |

10/20/2021 |

| Purchase of Common Stock |

5,650 |

10/21/2021 |

| Purchase of Common Stock |

2,982 |

10/22/2021 |

| Purchase of Common Stock |

100 |

10/25/2021 |

| Purchase of Common Stock |

150,000 |

10/27/2021 |

| Purchase of Common Stock |

60,000 |

10/28/2021 |

| Purchase of Common Stock |

20,000 |

11/09/2021 |

| Purchase of Common Stock |

40,000 |

11/15/2021 |

| Purchase of Common Stock |

20,000 |

11/22/2021 |

| Purchase of Common Stock |

141 |

02/01/2022 |

| Purchase of Common Stock |

20,000 |

04/06/2022 |

| Purchase of Common Stock |

6,858 |

04/18/2022 |

| Purchase of Common Stock |

500 |

04/19/2022 |

| Purchase of Common Stock |

18,000 |

04/28/2022 |

PETER B. BARTHOLOW

| Purchase of Common Stock |

6,000 |

11/29/2021 |

[SCHEDULE II

The following table

is reprinted from the Company’s definitive proxy statement filed with the Securities and Exchange Commission on ________, 2022.]

IMPORTANT

Your vote is important,

no matter how many shares of Common Stock you own. Driver urges you to sign, date, and return the enclosed WHITE proxy card today to vote

FOR the election of the Nominee.

Registered Owners

If your shares of Common

Stock are registered in your own name, please sign and date the enclosed WHITE proxy card and return it to Driver, c/o Saratoga

Proxy Consulting LLC (“Saratoga”), in the enclosed postage-paid envelope today. Stockholders also have the following two options

for authorizing a proxy to vote their shares:

| · | Via the Internet at www.cesvote.com at any time prior to 11:59 p.m. Eastern Time on •, 2022 and

follow the instructions provided on the WHITE proxy card; or |

| · | By telephone, by calling 1 (888) 693-8683 at any time prior to 11:59 p.m. Eastern Time on •, 2022,

and follow the instructions provided on the WHITE proxy card. |

Beneficial Owners

If your shares of Common

Stock are held in a brokerage account or bank, you are considered the beneficial owner of the shares of Common Stock, and these proxy

materials, together with a WHITE voting instruction form, are being forwarded to you by your broker or bank. As a beneficial owner,

if you wish to vote, you must instruct your broker, trustee or other representative how to vote. Your broker cannot vote your shares of

Common Stock on your behalf without your instructions.

Beneficial owners may vote

either by the Internet or toll-free telephone. Please refer to the enclosed instructions on how to vote by Internet or telephone. You

may also vote by signing, dating and returning the enclosed WHITE voting instruction form.

Since

only your latest dated proxy card will count, we urge you not to return any proxy card you receive from the Company. Even if you return

the Norcross Group proxy card marked “withhold” as a protest against the election of its nominee, it will revoke any proxy

card you may have previously sent to us. Remember, you can vote for our Nominee only on our WHITE proxy

card. So please make certain that the latest dated proxy card you return is the WHITE proxy card.

If you have

any questions or require any additional information concerning this Proxy Statement, please contact Saratoga at the address set forth

below.

|

If you have any questions, require assistance in

voting your WHITE proxy card,

or need additional copies of Driver’s proxy

materials,

please contact Saratoga at the phone numbers listed

below.

Stockholders call toll free at (888) 368-0379

Email: info@saratogaproxy.com

|

PRELIMINARY PROXY STATEMENT

SUBJECT TO COMPLETION

DATED JUNE 9, 2022

REPUBLIC FIRST BANCORP, INC.

SPECIAL MEETING OF SHAREHOLDERS

THIS PROXY IS SOLICITED ON BEHALF OF DRIVER MANAGEMENT COMPANY LLC AND THE OTHER PARTICIPANTS NAMED IN THIS PROXY SOLICITATION (COLLECTIVELY,

“DRIVER”)

P R O X Y

The undersigned appoints

J. Abbott R. Cooper and John Ferguson, and each of them, attorneys and agents with full power of substitution to vote all shares of common

stock of Republic First Bancorp, Inc. (the “Company”) that the undersigned would be entitled to vote if personally present

at the Special Meeting of Shareholders of the Company, scheduled to be held on •, 2022 at • •m., local time at • (including

any adjournments or postponements thereof and any meeting called in lieu thereof, the “Special Meeting”).

The undersigned hereby

revokes any other proxy or proxies heretofore given to vote or act with respect to the shares of common stock of the Company held by the

undersigned, and hereby ratifies and confirms all action the herein named attorneys and proxies, their substitutes, or any of them may

lawfully take by virtue hereof. If properly executed, this Proxy will be voted as directed on the reverse and in the discretion of the

herein named attorneys and proxies or their substitutes with respect to any other matters as may properly come before the Special Meeting

that are unknown to Driver a reasonable time before this solicitation.

IF NO DIRECTION IS INDICATED

WITH RESPECT TO THE PROPOSALS ON THE REVERSE, THIS PROXY WILL BE VOTED “FOR” THE ELECTION OF PETER B. BARTHOLOW AS DIRECTOR.

This Proxy will be valid

until the completion of the Special Meeting. This Proxy will only be valid in connection with Driver’s solicitation of proxies for

the Special Meeting.

IMPORTANT: PLEASE SIGN, DATE AND MAIL THIS

PROXY CARD PROMPTLY!

CONTINUED AND TO BE SIGNED ON REVERSE

SIDE

[X] Please mark vote as in this example

DRIVER STRONGLY RECOMMENDS THAT STOCKHOLDERS

VOTE IN FAVOR OF THE NOMINEE LISTED BELOW IN PROPOSAL 1.

| 1. | Driver’s proposal to elect Peter B. Bartholow as a Class III director of the Company to serve until

the 2022 Annual Meeting of Stockholders. |

| |

FOR THE

NOMINEE |

WITHHOLD

AUTHORITY TO

VOTE FOR THE

NOMINEE |

|

|

Nominees: |

Peter B. Bartholow |

¨ |

¨ |

|

| |

|

|

|

|

Driver does not expect

that the nominee will be unable to stand for election, but, in the event that the Nominee is unable to serve or for good cause will not

serve, the shares of common stock represented by this proxy card will be voted for substitute nominee(s), to the extent this is not prohibited

under the Bylaws and applicable law. In addition, Driver has reserved the right to nominate substitute person(s) if the Company makes

or announces any changes to the Bylaws or takes or announces any other action that has, or if consummated would have, the effect of disqualifying

the nominee, to the extent this is not prohibited under the Bylaws and applicable law. In any such case, shares of common stock represented

by this proxy card will be voted for such substitute nominee(s).

If no direction is indicated

with respect to the election of directors, Driver intends to use this proxy to vote “FOR” Mr. Bartholow.

DATED: ____________________________

____________________________________

(Signature)

____________________________________

(Signature, if held jointly)

____________________________________

(Title)

WHEN SHARES ARE HELD JOINTLY, JOINT OWNERS

SHOULD EACH SIGN. EXECUTORS, ADMINISTRATORS, TRUSTEES, ETC., SHOULD INDICATE THE CAPACITY IN WHICH SIGNING. PLEASE SIGN EXACTLY AS NAME

APPEARS ON THIS PROXY.

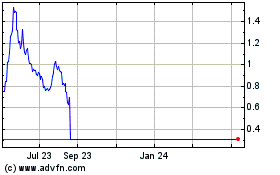

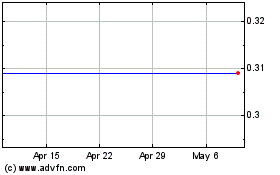

Republic First Bancorp (NASDAQ:FRBK)

Historical Stock Chart

From Jun 2024 to Jul 2024

Republic First Bancorp (NASDAQ:FRBK)

Historical Stock Chart

From Jul 2023 to Jul 2024