UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14A

(Rule

14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

The Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☐

Filed by a Party other than the Registrant ☒

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☒ | Definitive Additional Materials |

| ☐ | Soliciting Material Under Rule 14a-12 |

REPUBLIC FIRST BANCORP, INC.

|

(Name of Registrant as Specified in Its Charter)

|

| |

DRIVER MANAGEMENT COMPANY LLC

DRIVER OPPORTUNITY PARTNERS I LP

J. ABBOTT R. COOPER

PETER B. BARTHOLOW

PAMELA D. BUNDY

RICHARD H. SINKFIELD III

|

(Name of Persons(s) Filing Proxy Statement, if Other Than the Registrant)

|

Payment of Filing Fee (Check the appropriate box):

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on

which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| ☐ | Fee paid previously with preliminary materials: |

☐ Check

box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting

fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of

its filing.

| (1) | Amount previously paid: |

| (2) | Form, Schedule or Registration Statement No.: |

Driver Management Company

LLC, together with the other participants named herein (collectively, “Driver”), has filed a definitive proxy statement and

accompanying WHITE proxy card with the Securities and Exchange Commission to be used to solicit votes for the election of its slate of

highly-qualified director nominees at the 2022 annual meeting of shareholders of Republic

First Bancorp, Inc., a Pennsylvania corporation (“FRBK” or the “Company”).

Item 1: On May 18, 2022,

J. Abbott R. Cooper, Managing Member of Driver Management Company LLC, was quoted in the following article in American Banker:

Vernon Hill sues Republic First after ouster as chairman

American Banker

By John Reosti

May 18, 2022

Vernon Hill is not going down without a fight.

The death last week of an ally among Republic First Bancorp’s directors

deprived Hill, the $5.6 billion-asset company’s embattled CEO and until recently its chairman, of parity on the board, but he appears

prepared to use his remaining influence and litigation in a bid to retain control.

Indeed, Hill filed suit Tuesday in U.S. District Court for the Eastern

District of Pennsylvania seeking a temporary restraining order to block Republic First’s board, now chaired by Harry Madonna, from

conducting business without a quorum, communicating with employees of the bank, or “taking any other actions that will disturb the

status quo on the board of directors, at the company or its subsidiaries.”

The Republic First board faction led by Harry Madonna “has been waging

a campaign to force out [Vernon Hill] and seize control of the company, so they can sell it at any price,” the lawsuit filed by

Hill says.Bloomberg News

Madonna founded Philadelphia-based Republic First in 1987. He served as

chairman from 1998 until 2016, when he ceded the position to Hill, and as CEO until February 2021, again making way for Hill.

The case is being heard by U.S. District Judge Paul Diamond, who on Friday

ruled against an activist investor who was seeking an order to compel Republic First to hold its annual meeting, which was originally

scheduled for May 10. Diamond scheduled a hearing on Hill’s motion for late Tuesday but has yet to issue a ruling.

New York activist investor Abbott Cooper, who filed the suit involving

Republic First's annual meeting date, said Friday’s result was “wrong on the facts and the law” and added he expects

to file a notice of appeal as early as Wednesday.

Cooper called the situation at Republic First “an absolute mess,”

and said shareholders “have to be allowed to weigh in.”

Confronted by a pair of activist investor campaigns — one led by

Cooper, the other by prominent New Jersey insurance executive George Norcross and former TD Bank President and CEO Greg Braca —

Hill has been the subject of a number of legal actions the past six months. Meanwhile, Madonna has led a board faction hostile to Hill.

Tuesday’s action was the first suit initiated by Hill, who did not

mince words characterizing the motives of his antagonists.

Hill asserted the Madonna-led board faction “has been waging a campaign

to force out [Hill] and seize control of the company, so they can sell it at any price.” Hill’s filing further alleges that

Madonna “was simply failing in his role” as chairman and CEO in 2008, when Hill began his connection with Republic First,

agreeing initially to act as a financial and strategic consultant.

Hill still must clear several steep hurdles if he is to retain his job

as CEO and possibly return as chairman. Driver Management, where Cooper is founder and managing member, has nominated three director candidates

and the Norcross-Braca group has pledged to support them. Together the two groups control nearly 11% of Republic First’s outstanding

shares.

The Norcross-Braca group, moreover, was quick to demonstrate its backing

for the board’s action late Friday ousting Hill as chairman and reinstalling Madonna. On Monday, the group announced it had withdrawn

two lawsuits it filed in March, one seeking to compel the company to produce its books and other financial records for inspection, and

the other to prevent Hill and his allies on the board from amending employment contracts of the company’s senior management team

to provide substantial severance payments in the event Hill was forced off the board or removed as CEO.

Hill’s suit also claims Cooper and Driver have coordinated their

actions, including legal actions, with the Norcross-Braca group, a claim Cooper said was “categorically not the case.”

“The fact we want the same thing, to get Vernon Hill off the board,

doesn’t imply co-action,” Cooper said Wednesday in an interview.

Hill had not responded to a request for comment at deadline. A spokesman

for the Norcross-Braca group declined to comment.

Hill’s lawsuit claims Friday’s action amounted to a “putsch”

since the Madonna faction, which includes directors Andrew Cohen, Lisa Jacobs and Harris Wildstein, lacks the five board members needed

for a quorum on an eight-member board. Even after the death of director Theodore Flocco death, Hill — who retains his board seat

— can still count on the loyalty of directors Brian Tierney and Barry Spivak.

According to Hill’s suit, Madonna and his allies are a “rump

board.”

“They have purported to seize control of the board, but they have

no quorum, and lack authority to act,” the filing stated.

Item 2: On May 19, 2022,

J. Abbott R. Cooper, Managing Member of Driver Management Company LLC, was quoted in the following article in Philadelphia Business Journal:

Judge orders warring Republic First board factions to take a timeout

Philadelphia Business Journal

By Jeff Blumenthal

May 19, 2022

A federal judge in Philadelphia has given the warring board factions at

Republic First Bancorp a weeklong timeout to sort out their differences.

In response to a request for a temporary restraining order from a faction

led by CEO Vernon Hill against another faction led by Chairman Harry Madonna, U.S. District Judge Paul Diamond said in a Thursday morning

order that both sides are required to maintain the status quo in overseeing Philadelphia-based Republic First (NASDAQ: FRBK) for a period

of seven days.

Diamond said the Hill and Madonna board factions must manage the affairs

of the company and its subsidiary, Republic Bank, “in the ordinary course” and “may not cause FRBK or the bank (directly

or indirectly) to engage in any actions outside the ordinary course of day-to-day management of FRBK’s or the bank’s affairs

unless unanimously consented to in writing by all members of FRBK’s board of directors then in office.”

Diamond added that to avoid any doubt, the bank cannot authorize new or

supplemental branch expansion or amend any material employee contracts that are subject to approval by the board or any of its committees.

He also said the board is not allowed to engage in “the transaction of business” as cited by the company’s bylaws at

any board meeting without at least five of the seven board members present in person or via phone and no committee is allowed to take

any action during the status quo period.

Sources familiar with the situation said the two sides agreed to the status

quo period and are being asked to use that time to work out their sizable differences.

Diamond’s ruling came after a Tuesday evening hearing in response

to a request for a temporary restraining order in a 52-page filing by Hill’s faction, which argued that Madonna’s group was

engaging in a “coup attempt” by trying to seize control of Republic First and work with activist investor groups to sell the

Philadelphia bank “at any price.”

The suit sought to stop Republic First's board from meeting late Tuesday

on removing Hill as CEO, a vote that would have occurred just days after he was ousted as chairman. The Hill group’s filing also

asked Diamond to appoint a custodian or custodians to manage the bank's affairs until the lawsuit is decided.

The complaint said that Madonna for months has been waging a campaign to

force out Hill as chairman and CEO. The Hill faction’s lawsuit comes after Hill was removed as chairman by Madonna’s group,

which gained a 4-3 majority on the board upon last week’s death of Theodore Flocco — who was a Hill ally on the eight-member

board. Republic First is engaged in a proxy battle with two activist investors and has delayed its annual meeting to conduct an investigation

into allegations made against Hill by Madonna’s faction.

The suit claims Madonna and his allies are set on a sale of the bank that

would enrich them but leave shareholders fleeced by teaming up with two activist investor groups — Abbott Cooper of New York’s

Driver Management Co. and another led by South Jersey power broker George Norcross and former TD Bank CEO Greg Braca.

Joining Hill as plaintiffs are board members Barry Spevak and Brian Tierney.

Named as defendants are Madonna and allied board members Lisa Jacobs, Harris Wildstein and Andrew Cohen. Republic First itself is listed

as both a plaintiff and defendant.

Hill, Spevak and Flocco faced re-election at this year's annual shareholder

meeting and are opposed by the activist investors. Hill’s faction delayed the annual meeting after saying that its auditor, Crowe,

requested that a law firm conduct an independent investigation into alleged self-dealing by Hill’s family and allies that was made

by Madonna’s faction in March and then mentioned in a lawsuit by the Norcross group. That lawsuit has since been dropped.

Madonna founded the bank in 1988 and served as chairman and CEO until being

replaced by Hill as chairman in 2016 and CEO in 2021. Madonna originally brought Hill aboard in 2008 as a strategic and financial advisor.

Since that time, Republic Bank has grown from $700 million in assets to $5.6 billion and increased its number of retail branches from

eight to 36. In the process, Republic adopted many of the retail-friendly strategies Hill employed during his time leading Commerce Bank,

such as free checking, coin-counting machines, pet treats, and longer hours. But some investors have complained that the bank’s

fast-growth strategy cut into its stock and financial performance.

The proxy battle started in late October when Republic First talked about

raising capital to fuel more growth, which was opposed by Cooper, who complained about the bank’s relatively low earnings per share

and stock price compared to its peers. Cooper nominated his board slate in December and Republic First delayed the capital raise indefinitely

in January. The Norcross-Braca group joined the fray on Jan. 31 and said it would back Driver’s slate. They ultimately proposed

a plan to acquire a majority stake and install Braca to replace Hill as CEO.

Also this week, Cooper and Driver Management appealed Diamond's May 13

ruling from the 3rd Circuit Court of Appeals. Cooper filed a lawsuit on May 2 seeking an injunction forcing the bank to hold its public

meeting as scheduled on May 10, “or by no later than June 29. Diamond denied the temporary restraining order and Cooper's motion

for an expedited hearing as moot.

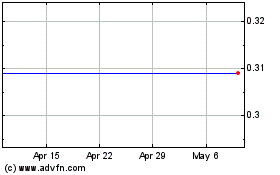

Republic First Bancorp (NASDAQ:FRBK)

Historical Stock Chart

From Jun 2024 to Jul 2024

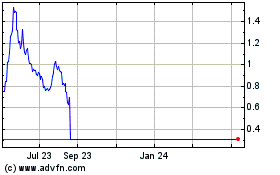

Republic First Bancorp (NASDAQ:FRBK)

Historical Stock Chart

From Jul 2023 to Jul 2024