Solar Senior Capital: A Strong Buy - Analyst Blog

September 26 2012 - 1:45PM

Zacks

Positive earnings momentum on the back of strong second quarter

results – including an earnings surprise of 16.1% – helped

Solar Senior Capital Ltd. (SUNS) achieve a Zacks

#1 Rank (Strong Buy) on September 20. Moreover, this investment

management company has increased dividend for the third consecutive

month in September.

With a solid year-to-date return of 21.5% and a decent dividend

yield of 7.8%, this stock offers an attractive investment

opportunity.

The Rank Driver

Better-than-expected second quarter earnings, consecutive dividend

increases and decent interest income growth are the primary rank

drivers for this stock.

Solar Senior Capital reported its second quarter results on July 31

with net investment income per share of 36 cents, beating the Zacks

Consensus Estimate of 31 cents by 16.1% and increasing more than

four times from the year-ago income of 8 cents. Robust results for

the reported quarter were primarily aided by elevated investment

income aided by higher interest earned on investment portfolio.

Net investment income increased significantly to $3.4 million from

$0.8 million in the year-ago quarter. However, on the downside,

total expense escalated significantly on a year-over-year basis to

$3.4 million. Elevated investment advisory and management fees,

higher performance-based incentive fees and increased

administrative service fees primarily led to the overall rise in

total expenses.

Recently, Solar Senior Capital declared an increased dividend of

11.75 cents per share for the month of September 2012, indicating

an augmentation of 2.2% compared with the prior month. The dividend

will be paid on October 2, 2012 to stockholders of record on

September 20, 2012. This indicates the company’s third consecutive

increase since July 2012.

Earnings Momentum

The Zacks Consensus Estimate for 2012 increased 4.7% to $1.35 per

share over the last 60 days. The current estimate implies a

year-over-year growth of 351.1%. For 2013, over the same time

frame, the Zacks Consensus Estimate surged 5.0% to $1.48 per share,

indicating a year-over-year growth of 9.6%.

Valuation

Solar Senior Capital currently trades at a forward P/E of 13.4x, a

5.5% premium to the peer group average of 12.7x. On a price-to-book

basis, the shares are trading at 1.0x, an 11.1% premium to the peer

group average of 0.9x. Given the company's strong fundamentals, the

valuation looks reasonable.

Solar Senior Capital has a trailing 12-month ROE of 4.6% compared

with the peer group average of 6.5%.

About the Company

Headquartered in Maryland, Solar Senior Capital is an investment

management company elected to be treated as a business development

company under the Investment Company Act of 1940. It invests mainly

in leveraged, middle-market companies in the form of senior secured

loans, including first lien, unitranche and second lien debt

instruments. The company, which was incorporated in 2010, has a

market capitalization of roughly $172.1 million.

Republic First Bancorp Inc. (FRBK) is also a Zacks

#1 Rank bank stock.

REPUBLIC FST BC (FRBK): Free Stock Analysis Report

SOLAR SENIOR CP (SUNS): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

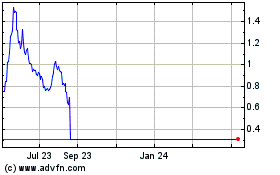

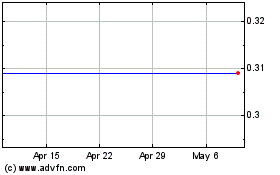

Republic First Bancorp (NASDAQ:FRBK)

Historical Stock Chart

From Jun 2024 to Jul 2024

Republic First Bancorp (NASDAQ:FRBK)

Historical Stock Chart

From Jul 2023 to Jul 2024