Radware® (NASDAQ: RDWR), a leading provider of cyber security and

application delivery solutions, today announced its consolidated

financial results for the second quarter ended June 30, 2023.

“During the second quarter of 2023, we continued to execute on

our cloud security strategy, accelerating our cloud ARR growth 23%

year-over-year,” said Roy Zisapel, Radware’s president and CEO. “At

the same time, we encountered headwinds in on-premise appliance

sales. As the macroeconomic environment evolves, we will continue

to align our investments with our key priorities, which include

driving cloud security growth, enhancing our go-to-market

partnerships, and expanding into the mid-sized enterprise

market.”

Financial Highlights for the Second Quarter

2023Revenue for the second quarter of 2023 totaled $65.6

million:

- Revenue in the Americas region was $26.8 million for the second

quarter of 2023, a decrease of 10% from $29.7 million in the second

quarter of 2022.

- Revenue in the Europe, Middle East, and Africa (“EMEA”) region

was $22.6 million for the second quarter of 2023, a decrease of 24%

from $29.7 million in the second quarter of 2022.

- Revenue in the Asia-Pacific (“APAC”) region was $16.2 million

for the second quarter of 2023, an increase of 3% from $15.7

million in the second quarter of 2022.

GAAP net loss for the second quarter of 2023 was $5.8 million,

or $(0.13) per diluted share, compared to GAAP net income of $3.2

million, or $0.07 per diluted share, for the second quarter of

2022.

Non-GAAP net income for the second quarter of

2023 was $4.5 million, or $0.10 per diluted share, compared to

non-GAAP net income of $8.1 million, or $0.18 per diluted share,

for the second quarter of 2022.

As of June 30, 2023, the Company had cash, cash

equivalents, short-term bank deposits, and marketable securities of

$402.0 million. Net cash provided by operating activities was $4.9

million in the second quarter of 2023.

Non-GAAP results are calculated excluding, as

applicable, the impact of stock-based compensation expenses,

amortization of intangible assets, litigation costs, acquisition

costs, exchange rate differences, net on balance sheet items

included in financial income, net, and tax-related adjustments. A

reconciliation of each of the Company’s non-GAAP measures to the

most directly comparable GAAP measure is included at the end of

this press release.

Conference CallRadware

management will host a call today, August 2, 2023, at 8:30 a.m. EDT

to discuss its second quarter 2023 results and the Company’s third

quarter 2023 outlook. To participate on the call, please use the

following numbers:U.S. participants call toll free:

888-510-2008 International participants call: 1

646-960-0306Conference ID: 1864701

A replay will be available for two days, starting two hours

after the end of the call, on telephone number +1-647-362-9199 or

(US toll-free) 800-770-2030. Passcode 1864701.

The call will be webcast live on the Company’s website at:

http://www.radware.com/IR/. The webcast will remain available for

replay during the next 12 months.

Use of Non-GAAP Financial Information

and Key Performance IndicatorsIn addition to reporting

financial results in accordance with generally accepted accounting

principles (GAAP), Radware uses non-GAAP measures of gross profit,

research and development expense, selling and marketing expense,

general and administrative expense, total operating expenses,

operating income, financial income, net, income before taxes on

income, taxes on income, net income and diluted earnings per share,

which are adjustments from results based on GAAP to exclude, as

applicable, stock-based compensation expenses, amortization of

intangible assets, litigation costs, acquisition costs, exchange

rate differences, net on balance sheet items included in financial

income, net, and tax-related adjustments. Management believes that

exclusion of these charges allows for meaningful comparisons of

operating results across past, present, and future periods.

Radware’s management believes the non-GAAP financial measures

provided in this release are useful to investors for the purpose of

understanding and assessing Radware’s ongoing operations. The

presentation of these non-GAAP financial measures is not intended

to be considered in isolation or as a substitute for results

prepared in accordance with GAAP. A reconciliation of each non-GAAP

financial measure to the most directly comparable GAAP financial

measure is included with the financial information contained in

this press release. Management uses both GAAP and non-GAAP

financial measures in evaluating and operating the business and, as

such, has determined that it is important to provide this

information to investors.

Annual recurring revenue ("ARR") is a key

performance indicator defined as the annualized value of booked

orders for term-based cloud services, subscription licenses, and

maintenance contracts that are in effect at the end of a reporting

period. ARR should be viewed independently of revenue and deferred

revenue and is not intended to be combined with or to replace

either of those items. ARR is not a forecast of future revenue,

which can be impacted by contract start and end dates and renewal

rates and does not include revenue reported as perpetual license or

professional services revenue in our consolidated statement of

operations. We consider ARR a key performance indicator of the

value of the recurring components of our business.

Safe Harbor Statement

This press release includes “forward-looking statements” within

the meaning of the Private Securities Litigation Reform Act of

1995. Any statements made herein that are not statements of

historical fact, including statements about Radware’s plans,

outlook, beliefs, or opinions, are forward-looking statements.

Generally, forward-looking statements may be identified by words

such as “believes,” “expects,” “anticipates,” “intends,”

“estimates,” “plans,” and similar expressions or future or

conditional verbs such as “will,” “should,” “would,” “may,” and

“could.” Because such statements deal with future events, they are

subject to various risks and uncertainties, and actual results,

expressed or implied by such forward-looking statements, could

differ materially from Radware’s current forecasts and estimates.

Factors that could cause or contribute to such differences include,

but are not limited to: the impact of global economic conditions

and volatility of the market for our products; natural disasters

and public health crises, such as the coronavirus disease 2019

(COVID-19) pandemic; a shortage of components or manufacturing

capacity could cause a delay in our ability to fulfill orders or

increase our manufacturing costs; our business may be affected by

sanctions, export controls and similar measures targeting Russia

and other countries and territories as well as other responses to

Russia’s military conflict in Ukraine, including indefinite

suspension of operations in Russia and dealings with Russian

entities by many multi-national businesses across a variety of

industries; our ability to successfully implement our strategic

initiative to accelerate our cloud business; our ability to expand

our operations effectively; timely availability and customer

acceptance of our new and existing solutions; risks and

uncertainties relating to acquisitions or other investments; the

impact of economic and political uncertainties and weaknesses in

various regions of the world, including the commencement or

escalation of hostilities or acts of terrorism; intense competition

in the market for cyber security and application delivery solutions

and in our industry in general, and changes in the competitive

landscape; changes in government regulation; outages,

interruptions, or delays in hosting services or our internal

network system; compliance with open source and third-party

licenses; the risk that our intangible assets or goodwill may

become impaired; our dependence on independent distributors to sell

our products; long sales cycles for our solutions; changes in

foreign currency exchange rates; undetected defects or errors in

our products or a failure of our products to protect against

malicious attacks; the ability of vendors to provide our hardware

platforms and components for our main accessories; our ability to

protect our proprietary technology; intellectual property

infringement claims made by third parties; changes in tax laws; our

ability to realize our investment objectives for our cash and

liquid investments; our ability to attract, train, and retain

highly qualified personnel; and other factors and risks over which

we may have little or no control. This list is intended to identify

only certain of the principal factors that could cause actual

results to differ. For a more detailed description of the risks and

uncertainties affecting Radware, refer to Radware’s Annual Report

on Form 20-F, filed with the Securities and Exchange Commission

(SEC), and the other risk factors discussed from time to time by

Radware in reports filed with, or furnished to, the SEC.

Forward-looking statements speak only as of the date on which they

are made and, except as required by applicable law, Radware

undertakes no commitment to revise or update any forward-looking

statement in order to reflect events or circumstances after the

date any such statement is made. Radware’s public filings are

available from the SEC’s website at www.sec.gov or may be obtained

on Radware’s website at www.radware.com.

About RadwareRadware® (NASDAQ: RDWR) is a

global leader of cyber security and application delivery solutions

for physical, cloud, and software defined data centers. Its

award-winning solutions portfolio secures the digital experience by

providing infrastructure, application, and corporate IT protection,

and availability services to enterprises globally. Radware’s

solutions empower enterprise and carrier customers worldwide to

adapt to market challenges quickly, maintain business continuity,

and achieve maximum productivity while keeping costs down. For more

information, please visit the Radware website.

Radware encourages you to join our community and follow us on:

Facebook, LinkedIn, Radware Blog, Twitter, YouTube, and

Radware Mobile for iOS and Android.

©2023 Radware Ltd. All rights reserved. Any Radware products and

solutions mentioned in this press release are protected by

trademarks, patents, and pending patent applications of Radware in

the U.S. and other countries. For more details, please

see: https://www.radware.com/LegalNotice/. All other

trademarks and names are property of their respective owners.

Radware believes the information in this document is accurate in

all material respects as of its publication date. However, the

information is provided without any express, statutory, or implied

warranties and is subject to change without notice.

The contents of any website or hyperlinks mentioned in this

press release are for informational purposes and the contents

thereof are not part of this press release.

CONTACTSInvestor

Relations:Yisca Erez, +972-72-3917211, ir@radware.com

Media Contact:Gerri Dyrek,

gerri.dyrek@radware.com

|

Radware Ltd. |

|

Condensed Consolidated Balance Sheets |

|

(U.S. Dollars in thousands) |

| |

|

|

|

| |

June 30, |

|

December 31, |

|

|

2023 |

|

2022 |

| |

(Unaudited) |

|

(Unaudited) |

| Assets |

|

|

|

| |

|

|

|

| Current

assets |

|

|

|

|

Cash and cash equivalents |

42,644 |

|

|

46,185 |

|

| Available-for-sale marketable

securities |

77,222 |

|

|

44,180 |

|

| Short-term bank deposits |

222,769 |

|

|

207,679 |

|

| Trade receivables, net |

16,820 |

|

|

17,752 |

|

| Other receivables and prepaid

expenses |

9,815 |

|

|

7,196 |

|

| Inventories |

12,323 |

|

|

11,428 |

|

| |

381,593 |

|

|

334,420 |

|

| |

|

|

|

| Long-term

investments |

|

|

|

| Available-for-sale marketable

securities |

59,375 |

|

|

90,148 |

|

| Long-term bank deposits |

0 |

|

|

43,765 |

|

| Severance pay funds |

2,092 |

|

|

2,146 |

|

| |

61,467 |

|

|

136,059 |

|

| |

|

|

|

| |

|

|

|

| Property and equipment,

net |

20,224 |

|

|

21,068 |

|

| Intangible assets, net |

17,702 |

|

|

19,686 |

|

| Other long-term assets |

41,168 |

|

|

41,269 |

|

| Operating lease right-of-use

assets |

20,776 |

|

|

23,078 |

|

| Goodwill |

68,008 |

|

|

68,008 |

|

| Total assets |

610,938 |

|

|

643,588 |

|

| |

|

|

|

| |

|

|

|

| Liabilities and

shareholders' equity |

|

|

|

| |

|

|

|

| Current

Liabilities |

|

|

|

| Trade payables |

7,847 |

|

|

6,464 |

|

| Deferred revenues |

111,309 |

|

|

108,243 |

|

| Operating lease

liabilities |

4,633 |

|

|

4,685 |

|

| Other payables and accrued

expenses |

36,391 |

|

|

44,643 |

|

| |

160,180 |

|

|

164,035 |

|

| |

|

|

|

| Long-term

liabilities |

|

|

|

| Deferred revenues |

70,369 |

|

|

72,219 |

|

| Operating lease

liabilities |

17,210 |

|

|

19,461 |

|

| Other long-term

liabilities |

18,809 |

|

|

19,430 |

|

| |

106,388 |

|

|

111,110 |

|

| |

|

|

|

| Shareholders'

equity |

|

|

|

| Share capital |

733 |

|

|

732 |

|

| Additional paid-in

capital |

514,743 |

|

|

498,168 |

|

| Accumulated other

comprehensive loss, net of tax |

(4,680) |

|

|

(4,844) |

|

| Treasury stock, at cost |

(336,953) |

|

|

(303,299) |

|

| Retained earnings |

132,513 |

|

|

141,402 |

|

| Total Radware Ltd.

shareholder's equity |

306,356 |

|

|

332,159 |

|

| |

|

|

|

|

Non–controlling interest |

38,014 |

|

|

36,284 |

|

|

|

|

|

|

|

Total shareholders' equity |

344,370 |

|

|

368,443 |

|

| |

|

|

|

| Total liabilities and

shareholders' equity |

610,938 |

|

|

643,588 |

|

| |

|

|

|

|

Radware Ltd. |

|

|

|

|

|

|

|

|

|

Condensed Consolidated Statements of Income

(loss) |

|

|

|

|

|

|

|

|

|

(U.S Dollars in thousands, except share and per share

data) |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| |

|

For the three months ended |

|

For the six months ended |

| |

|

June 30, |

|

June 30, |

|

|

|

2023 |

|

|

2022 |

|

2023 |

|

|

2022 |

| |

|

(Unaudited) |

|

(Unaudited) |

|

(Unaudited) |

|

(Unaudited) |

| |

|

|

|

|

|

|

|

|

| Revenues |

|

65,607 |

|

|

75,114 |

|

134,648 |

|

|

148,822 |

| Cost of revenues |

|

12,742 |

|

|

13,888 |

|

26,048 |

|

|

26,829 |

| Gross profit |

|

52,865 |

|

|

61,226 |

|

108,600 |

|

|

121,993 |

| |

|

|

|

|

|

|

|

|

| Operating expenses, net: |

|

|

|

|

|

|

|

|

| Research and development,

net |

|

21,141 |

|

|

21,623 |

|

42,291 |

|

|

41,993 |

| Selling and marketing |

|

31,917 |

|

|

32,290 |

|

63,836 |

|

|

62,573 |

| General and

administrative |

|

8,307 |

|

|

5,737 |

|

16,554 |

|

|

12,264 |

| Total operating expenses,

net |

|

61,365 |

|

|

59,650 |

|

122,681 |

|

|

116,830 |

| |

|

|

|

|

|

|

|

|

| Operating income (loss) |

|

(8,500) |

|

|

1,576 |

|

(14,081) |

|

|

5,163 |

| Financial income, net |

|

3,419 |

|

|

2,986 |

|

6,910 |

|

|

4,684 |

| Income (loss) before taxes on

income |

|

(5,081) |

|

|

4,562 |

|

(7,171) |

|

|

9,847 |

| Taxes on income |

|

727 |

|

|

1,410 |

|

1,718 |

|

|

2,925 |

| Net income (loss) |

|

(5,808) |

|

|

3,152 |

|

(8,889) |

|

|

6,922 |

| |

|

|

|

|

|

|

|

|

| Basic net earnings (loss) per

share |

|

(0.13) |

|

|

0.07 |

|

(0.20) |

|

|

0.15 |

| |

|

|

|

|

|

|

|

|

|

Weighted average number of shares used to compute basic net

earnings (loss) per share |

|

43,400,635 |

|

|

44,914,427 |

|

43,725,443 |

|

|

45,288,463 |

| |

|

|

|

|

|

|

|

|

| Diluted net earnings (loss)

per share |

|

(0.13) |

|

|

0.07 |

|

(0.20) |

|

|

0.15 |

| |

|

|

|

|

|

|

|

|

|

Weighted average number of shares used to compute diluted net

earnings (loss) per share |

|

43,400,635 |

|

|

45,835,440 |

|

43,725,443 |

|

|

46,476,687 |

| |

Radware Ltd. |

|

|

|

|

|

|

|

| |

Reconciliation of GAAP to Non-GAAP Financial

Information |

|

|

|

|

|

|

|

| |

(U.S Dollars in thousands, except share and per share

data) |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| |

|

For the three months ended |

|

For the six months ended |

| |

|

June 30, |

|

June 30, |

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

| |

|

(Unaudited) |

|

(Unaudited) |

|

(Unaudited) |

|

(Unaudited) |

| GAAP gross

profit |

52,865 |

|

|

61,226 |

|

|

108,600 |

|

|

121,993 |

|

|

|

Share-based compensation |

113 |

|

|

94 |

|

|

226 |

|

|

184 |

|

|

|

Amortization of intangible assets |

992 |

|

|

1,256 |

|

|

1,984 |

|

|

1,720 |

|

| Non-GAAP gross

profit |

53,970 |

|

|

62,576 |

|

|

110,810 |

|

|

123,897 |

|

|

|

|

|

|

|

|

|

|

|

| GAAP research

and development, net |

21,141 |

|

|

21,623 |

|

|

42,291 |

|

|

41,993 |

|

|

|

Share-based compensation |

2,177 |

|

|

1,635 |

|

|

4,136 |

|

|

3,444 |

|

| Non-GAAP

Research and development, net |

18,964 |

|

|

19,988 |

|

|

38,155 |

|

|

38,549 |

|

|

|

|

|

|

|

|

|

|

|

| GAAP selling

and marketing |

31,917 |

|

|

32,290 |

|

|

63,836 |

|

|

62,573 |

|

|

|

Share-based compensation |

3,537 |

|

|

3,043 |

|

|

6,931 |

|

|

4,892 |

|

| Non-GAAP

selling and marketing |

28,380 |

|

|

29,247 |

|

|

56,905 |

|

|

57,681 |

|

|

|

|

|

|

|

|

|

|

|

| GAAP general

and administrative |

8,307 |

|

|

5,737 |

|

|

16,554 |

|

|

12,264 |

|

|

|

Share-based compensation |

3,068 |

|

|

876 |

|

|

6,599 |

|

|

1,544 |

|

|

|

Litigation costs |

- |

|

|

- |

|

|

- |

|

|

- |

|

|

|

Acquisition costs |

545 |

|

|

- |

|

|

558 |

|

|

1,142 |

|

| Non-GAAP

general and administrative |

4,694 |

|

|

4,861 |

|

|

9,397 |

|

|

9,578 |

|

|

|

|

|

|

|

|

|

|

|

| GAAP total

operating expenses, net |

61,365 |

|

|

59,650 |

|

|

122,681 |

|

|

116,830 |

|

|

|

Share-based compensation |

8,782 |

|

|

5,554 |

|

|

17,666 |

|

|

9,880 |

|

|

|

Litigation costs |

- |

|

|

- |

|

|

- |

|

|

- |

|

|

|

Acquisition costs |

545 |

|

|

- |

|

|

558 |

|

|

1,142 |

|

| Non-GAAP total

operating expenses, net |

52,038 |

|

|

54,096 |

|

|

104,457 |

|

|

105,808 |

|

|

|

|

|

|

|

|

|

|

|

| GAAP operating

income (loss) |

(8,500) |

|

|

1,576 |

|

|

(14,081) |

|

|

5,163 |

|

|

|

Share-based compensation |

8,895 |

|

|

5,648 |

|

|

17,892 |

|

|

10,064 |

|

|

|

Amortization of intangible assets |

992 |

|

|

1,256 |

|

|

1,984 |

|

|

1,720 |

|

|

|

Litigation costs |

- |

|

|

- |

|

|

- |

|

|

- |

|

|

|

Acquisition costs |

545 |

|

|

- |

|

|

558 |

|

|

1,142 |

|

| Non-GAAP

operating income |

1,932 |

|

|

8,480 |

|

|

6,353 |

|

|

18,089 |

|

|

|

|

|

|

|

|

|

|

|

| GAAP financial

income, net |

3,419 |

|

|

2,986 |

|

|

6,910 |

|

|

4,684 |

|

|

|

Exchange rate differences, net on balance sheet items included in

financial income, net |

(32) |

|

|

(1,920) |

|

|

(807) |

|

|

(2,814) |

|

| Non-GAAP

financial income, net |

3,387 |

|

|

1,066 |

|

|

6,103 |

|

|

1,870 |

|

|

|

|

|

|

|

|

|

|

|

| GAAP income

before taxes on income (loss) |

(5,081) |

|

|

4,562 |

|

|

(7,171) |

|

|

9,847 |

|

|

|

Share-based compensation |

8,895 |

|

|

5,648 |

|

|

17,892 |

|

|

10,064 |

|

|

|

Amortization of intangible assets |

992 |

|

|

1,256 |

|

|

1,984 |

|

|

1,720 |

|

|

|

Litigation costs |

- |

|

|

- |

|

|

- |

|

|

- |

|

|

|

Acquisition costs |

545 |

|

|

- |

|

|

558 |

|

|

1,142 |

|

|

|

Exchange rate differences, net on balance sheet items included in

financial income, net |

(32) |

|

|

(1,920) |

|

|

(807) |

|

|

(2,814) |

|

| Non-GAAP income

before taxes on income |

5,319 |

|

|

9,546 |

|

|

12,456 |

|

|

19,959 |

|

|

|

|

|

|

|

|

|

|

|

| GAAP taxes on

income |

727 |

|

|

1,410 |

|

|

1,718 |

|

|

2,925 |

|

|

|

Tax

related adjustments |

61 |

|

|

61 |

|

|

123 |

|

|

123 |

|

| Non-GAAP taxes

on income |

788 |

|

|

1,471 |

|

|

1,841 |

|

|

3,048 |

|

|

|

|

|

|

|

|

|

|

|

| GAAP net income

(loss) |

(5,808) |

|

|

3,152 |

|

|

(8,889) |

|

|

6,922 |

|

|

|

Share-based compensation |

8,895 |

|

|

5,648 |

|

|

17,892 |

|

|

10,064 |

|

|

|

Amortization of intangible assets |

992 |

|

|

1,256 |

|

|

1,984 |

|

|

1,720 |

|

|

|

Litigation costs |

- |

|

|

- |

|

|

- |

|

|

- |

|

|

|

Acquisition costs |

545 |

|

|

- |

|

|

558 |

|

|

1,142 |

|

|

|

Exchange rate differences, net on balance sheet items included in

financial income, net |

(32) |

|

|

(1,920) |

|

|

(807) |

|

|

(2,814) |

|

|

|

Tax

related adjustments |

(61) |

|

|

(61) |

|

|

(123) |

|

|

(123) |

|

| Non-GAAP net

income |

4,531 |

|

|

8,075 |

|

|

10,615 |

|

|

16,911 |

|

|

|

|

|

|

|

|

|

|

|

| GAAP diluted

net earnings (loss) per share |

(0.13) |

|

|

0.07 |

|

|

(0.20) |

|

|

0.15 |

|

|

|

Share-based compensation |

0.20 |

|

|

0.12 |

|

|

0.40 |

|

|

0.22 |

|

|

|

Amortization of intangible assets |

0.02 |

|

|

0.03 |

|

|

0.05 |

|

|

0.04 |

|

|

|

Litigation costs |

0.00 |

|

|

0.00 |

|

|

0.00 |

|

|

0.00 |

|

|

|

Acquisition costs |

0.01 |

|

|

0.00 |

|

|

0.01 |

|

|

0.02 |

|

|

|

Exchange rate differences, net on balance sheet items included in

financial income, net |

(0.00) |

|

|

(0.04) |

|

|

(0.02) |

|

|

(0.06) |

|

|

|

Tax

related adjustments |

(0.00) |

|

|

(0.00) |

|

|

(0.00) |

|

|

(0.00) |

|

| Non-GAAP

diluted net earnings per share |

0.10 |

|

|

0.18 |

|

|

0.24 |

|

|

0.36 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted

average number of shares used to compute non-GAAP diluted net

earnings per share |

44,268,786 |

|

|

45,835,440 |

|

|

44,513,899 |

|

|

46,476,687 |

|

|

Radware Ltd. |

|

|

|

|

|

|

|

|

|

Condensed Consolidated Statements of Cash

Flow |

|

|

|

|

|

|

|

|

|

(U.S. Dollars in thousands) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the three months ended |

|

For the six months ended |

|

|

|

June 30, |

|

June 30, |

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

|

|

(Unaudited) |

|

(Unaudited) |

|

(Unaudited) |

|

(Unaudited) |

| Cash

flow from operating activities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net

income (loss) |

|

(5,808) |

|

|

3,152 |

|

|

(8,889) |

|

|

6,922 |

|

| Adjustments to

reconcile net income to net cash provided by operating

activities: |

|

|

|

|

|

Depreciation and amortization |

|

3,113 |

|

|

3,229 |

|

|

6,191 |

|

|

5,717 |

|

|

Share-based compensation |

|

8,895 |

|

|

5,648 |

|

|

17,892 |

|

|

10,064 |

|

|

Amortization of premium, accretion of discounts and accrued

interest on marketable securities, net |

|

718 |

|

|

798 |

|

|

955 |

|

|

1,386 |

|

| Loss

(gain) related to securities, net |

|

(1) |

|

|

(1) |

|

|

244 |

|

|

(60) |

|

|

Increase (decrease) in accrued interest on bank deposits |

|

229 |

|

|

39 |

|

|

(1,525) |

|

|

72 |

|

|

Increase (decrease) in accrued severance pay, net |

|

(36) |

|

|

(53) |

|

|

(105) |

|

|

94 |

|

|

Increase in trade receivables, net |

|

1,937 |

|

|

7,203 |

|

|

932 |

|

|

1,349 |

|

|

Increase (decrease) in other receivables and prepaid expenses and

other long-term assets |

|

532 |

|

|

(509) |

|

|

(2,326) |

|

|

(4,325) |

|

|

Decrease (increase) in inventories |

|

(1,044) |

|

|

(148) |

|

|

(895) |

|

|

177 |

|

|

Increase (decrease) in trade payables |

|

3,020 |

|

|

(713) |

|

|

1,383 |

|

|

3,130 |

|

|

Increase in deferred revenues |

|

470 |

|

|

18,064 |

|

|

1,216 |

|

|

20,500 |

|

|

Decrease in other payables and accrued expenses |

|

(6,944) |

|

|

(3,850) |

|

|

(11,442) |

|

|

(22,182) |

|

|

Decrease in operating lease liabilities, net |

|

(215) |

|

|

(1,335) |

|

|

(1) |

|

|

(1,772) |

|

| Net

cash provided by operating activities |

|

4,866 |

|

|

31,524 |

|

|

3,630 |

|

|

21,072 |

|

|

|

|

|

|

|

|

|

|

|

| Cash

flows from investing activities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Purchase of property and equipment |

|

(1,595) |

|

|

(2,333) |

|

|

(3,363) |

|

|

(4,497) |

|

|

Proceeds from other long-term assets, net |

|

1 |

|

|

92 |

|

|

48 |

|

|

37 |

|

|

Proceeds from (investment in) bank deposits, net |

|

21,000 |

|

|

(42,550) |

|

|

30,200 |

|

|

(20,201) |

|

|

Proceeds from sale, redemption of and purchase of marketable

securities, net |

|

(3,857) |

|

|

(9,196) |

|

|

(1,881) |

|

|

(4,640) |

|

|

Payment for the business acquisition of SecurityDAM Ltd. |

|

0 |

|

|

0 |

|

|

0 |

|

|

(30,000) |

|

| Net

cash provided (used in) investing activities |

|

15,549 |

|

|

(53,987) |

|

|

25,004 |

|

|

(59,301) |

|

|

|

|

|

|

|

|

|

|

|

| Cash

flows from financing activities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Proceeds from exercise of stock options |

|

88 |

|

|

239 |

|

|

308 |

|

|

801 |

|

|

Repurchase of shares |

|

(19,741) |

|

|

(18,060) |

|

|

(32,483) |

|

|

(40,886) |

|

|

Proceeds from issuance of Preferred A shares in subsidiary |

|

|

|

35,000 |

|

|

|

|

35,000 |

|

| Net

cash provided by (used in) financing activities |

|

(19,653) |

|

|

17,179 |

|

|

(32,175) |

|

|

(5,085) |

|

|

|

|

|

|

|

|

|

|

|

|

Increase (decrease) in cash and cash equivalents |

|

762 |

|

|

(5,284) |

|

|

(3,541) |

|

|

(43,314) |

|

| Cash

and cash equivalents at the beginning of the period |

|

41,882 |

|

|

54,483 |

|

|

46,185 |

|

|

92,513 |

|

| Cash

and cash equivalents at the end of the period |

|

42,644 |

|

|

49,199 |

|

|

42,644 |

|

|

49,199 |

|

|

|

|

|

|

|

|

|

|

|

| |

Radware Ltd. |

|

|

|

| |

RECONCILIATION OF GAAP NET INCOME (LOSS) TO EBITDA AND

ADJUSTED EBITDA (NON-GAAP) |

|

|

|

| |

(U.S Dollars in thousands) |

|

|

|

| |

|

|

|

|

|

|

|

|

| |

|

For the three months ended |

|

For the six months ended |

| |

|

June 30, |

|

June 30, |

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

| |

|

(Unaudited) |

|

(Unaudited) |

|

(Unaudited) |

|

(Unaudited) |

| GAAP

net income (loss) |

(5,808) |

|

|

3,152 |

|

|

(8,889) |

|

|

6,922 |

|

|

|

Exclude: Financial income, net |

(3,419) |

|

|

(2,986) |

|

|

(6,910) |

|

|

(4,684) |

|

|

|

Exclude: Depreciation and amortization expense |

3,113 |

|

|

3,229 |

|

|

6,191 |

|

|

5,717 |

|

|

|

Exclude: Taxes on income |

727 |

|

|

1,410 |

|

|

1,718 |

|

|

2,925 |

|

|

EBITDA |

(5,387) |

|

|

4,805 |

|

|

(7,890) |

|

|

10,880 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Share-based compensation |

8,895 |

|

|

5,648 |

|

|

17,892 |

|

|

10,064 |

|

|

|

Litigation costs |

- |

|

|

- |

|

|

- |

|

|

288 |

|

|

|

Acquisition costs |

545 |

|

|

- |

|

|

558 |

|

|

1,142 |

|

|

Adjusted EBITDA |

4,053 |

|

|

10,453 |

|

|

10,560 |

|

|

22,374 |

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| |

|

For the three months ended |

|

For the six months ended |

| |

|

June 30, |

|

June 30, |

| |

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

| |

|

|

|

|

|

|

|

|

| |

Amortization of intangible

assets |

992 |

|

|

1,256 |

|

|

1,984 |

|

|

1,720 |

|

| |

|

|

|

|

|

|

|

|

| |

Depreciation |

2,121 |

|

|

1,973 |

|

|

4,207 |

|

|

3,997 |

|

| |

|

|

|

|

|

|

|

|

| |

|

3,113 |

|

|

3,229 |

|

|

6,191 |

|

|

5,717 |

|

| |

|

|

|

|

|

|

|

|

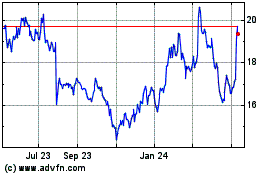

RADWARE (NASDAQ:RDWR)

Historical Stock Chart

From Jul 2024 to Aug 2024

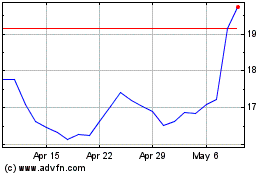

RADWARE (NASDAQ:RDWR)

Historical Stock Chart

From Aug 2023 to Aug 2024