false

0001325670

0001325670

2024-07-25

2024-07-25

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form

8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

July 25, 2024

Primis Financial Corp.

(Exact Name of Registrant

as Specified in its Charter)

| Virginia |

001-33037 |

20-1417448 |

(State or Other Jurisdiction of

Incorporation) |

(Commission File Number) |

(I.R.S. Employer Identification Number) |

1676

International Drive, Suite 900, McLean, Virginia 22102

(Address of Principal Executive Offices) (Zip Code)

(703) 893-7400

(Registrant's telephone number, including area

code)

Not Applicable

(Former name or former address,

if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| COMMON STOCK |

|

FRST |

|

NASDAQ |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ¨

Item 2.02. Results of Operations and Financial Condition.

On July 25, 2024, Primis Financial Corp. (“Primis” or the

“Company”) issued a press release announcing its preliminary financial results for the three months ended June 30, 2024.

A copy of the press release is attached as Exhibit 99.1 to this Current Report on Form 8-K and incorporated herein by reference.

The Company’s independent auditor has not reviewed or audited

these preliminary estimated financial results. The Company’s actual results may differ materially from these preliminary financial

results.

In accordance with General Instruction

B.2 of Form 8-K, the information in Item 2.02 of this Current Report on Form 8-K, including Exhibit 99.1, shall not be deemed “filed”

for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to

the liability of that section, and shall not be incorporated by reference into any registration statement or other document filed under

the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item 8.01. Other Events.

On July 25, 2024, Primis issued a press release

announcing the declaration of a dividend payable on August 23, 2024 to shareholders of record as of August 9, 2024. A copy of the press

release is attached as Exhibit 99.1 to this Current Report on Form 8-K and incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

Primis Financial Corp. |

| |

|

|

| |

|

|

| Date: July 25, 2024 |

By: |

/s/ Matthew A. Switzer |

| |

|

Matthew A. Switzer |

| |

|

Chief Financial Officer |

Exhibit 99.1

Primis Financial Corp. Reports Preliminary Earnings

Per Share for the Second Quarter of 2024

Declares Quarterly Cash Dividend of $0.10 Per

Share

For immediate release

Thursday, July 25, 2024

McLean, Virginia, July 25, 2024 – Primis

Financial Corp. (NASDAQ: FRST) (“Primis” or the “Company”), and its wholly-owned subsidiary, Primis Bank (the

“Bank”), today reported preliminary results for the second quarter of 2024. As previously discussed in its Form 12b-25/A

filed on April 1, 2024, Primis is currently pursuing a consultation process with the Office of the Chief Accountant of the Securities

and Exchange Commission (“SEC”) regarding the accounting for a consumer loan portfolio originated through a third-party. This

process with the SEC is ongoing and must be completed in order for the Company to complete its Annual Report on Form 10-K for the

year ended December 31, 2023, its Quarterly Reports on Form 10-Q for the three and six months ended March 31, 2024 and

June 30, 2024, respectively, and to restate its financial statements for each of the first three quarters of 2023.

While Primis works diligently to complete the

pre-clearance process with the SEC, the Company is providing the preliminary results for the second quarter of 2024 below. These results

reflect the same accounting methodology as in prior periods for the consumer portfolio identified above for comparison purposes and to

demonstrate underlying trends in the Company’s performance. The Company’s independent auditor has not reviewed or audited

these preliminary estimated financial results. The Company’s actual results may differ materially from these preliminary financial

results. This preliminary financial data has been prepared by and is the responsibility of the Company. Until the process with the SEC

is complete, the results should be considered preliminary and are subject to adjustment based on the results of that process, the restatement,

and other developments that may arise between now and the time its audited consolidated financial statements for the year ended December 31,

2023 are issued.

Preliminary Financial Results (Unaudited)

– Q2 2024 versus Q2 2023

| (Dollars in thousands except per share) |

|

Q2 2024 |

|

|

Q2 2023 |

|

| Total Assets |

|

$ |

3,997,539 |

|

|

$ |

3,868,675 |

|

| Loans HFI |

|

|

3,300,562 |

|

|

|

3,194,352 |

|

| Allowance for Credit Losses |

|

|

(41,519 |

) |

|

|

(38,544 |

) |

| Total Deposits |

|

|

3,335,463 |

|

|

|

3,316,996 |

|

| Common Stockholders' Equity |

|

|

405,856 |

|

|

|

392,831 |

|

| |

|

|

|

|

|

|

|

|

| Book Value per Common Share |

|

$ |

16.43 |

|

|

$ |

15.91 |

|

| Effect of Intangible Assets |

|

|

(3.84 |

) |

|

|

(4.34 |

) |

| Tangible Book Value per Common Share |

|

$ |

12.59 |

|

|

$ |

11.57 |

|

| |

|

|

|

|

|

|

|

|

| Net Interest Income |

|

$ |

27,625 |

|

|

$ |

26,235 |

|

| Provision For Credit Losses |

|

|

3,929 |

|

|

|

4,355 |

|

| Noninterest Income |

|

|

14,491 |

|

|

|

8,305 |

|

| Noninterest Expense |

|

|

30,166 |

|

|

|

30,554 |

|

| Pre-Tax Income / (Loss) |

|

|

8,021 |

|

|

|

(369 |

) |

| Tax Expense / (Benefit) |

|

|

2,100 |

|

|

|

(58 |

) |

| Net Income / (Loss) |

|

|

5,921 |

|

|

|

(311 |

) |

| Loss Attributable to Noncontrolling Interest |

|

|

1,900 |

|

|

|

- |

|

| Net Income / (Loss) Avail. To Common |

|

$ |

7,821 |

|

|

$ |

(311 |

) |

| |

|

|

|

|

|

|

|

|

| Basic Earnings per Common Share |

|

$ |

0.32 |

|

|

$ |

(0.01 |

) |

| Diluted Earnings per Common Share |

|

$ |

0.32 |

|

|

$ |

(0.01 |

) |

| |

|

|

|

|

|

|

|

|

| Return on Average Assets |

|

|

0.80 |

% |

|

|

(0.03 |

)% |

| Return on Average Common Equity |

|

|

7.86 |

% |

|

|

(0.31 |

)% |

| Net Interest Margin |

|

|

3.03 |

% |

|

|

2.64 |

% |

| |

|

|

|

|

|

|

|

|

| Nonperforming Assets (excluding SBA Guarantees) |

|

$ |

9,918 |

|

|

$ |

24,673 |

|

| NPAs (excl. SBA Guarantees) / Total Assets |

|

|

0.25 |

% |

|

|

0.64 |

% |

| Net Charge-offs |

|

$ |

5,002 |

|

|

$ |

1,614 |

|

| Net Charge-offs (excluding third-party covered) |

|

|

590 |

|

|

|

195 |

|

| Net C/O's / Avg. Loans (annualized) |

|

|

0.60 |

% |

|

|

0.20 |

% |

| Net C/O's (excl. third-party covered) / Avg. Loans (ann.) |

|

|

0.07 |

% |

|

|

0.02 |

% |

Beginning in the fourth quarter of 2023, results

include consolidated results for Panacea Financial Holdings, Inc. (“PFH”) which is partially owned by the Company. Noncontrolling

interests in the table above represent the portion of PFH losses not owned by Primis. Pre-tax income for the second quarter of 2024 included

$2.34 million of pre-tax losses attributable to PFH. Pre-tax income in the second quarter of 2024 was also impacted by approximately $1.3

million of expenses related to accounting advisory and other projects in the quarter. Adjusting for these items, pre-tax income would

have been $11.66 million in the second quarter of 2024, an increase of $10.54 million as compared to adjusted pre-tax earnings of $1.12

million in the year-ago period.

Declaration of Cash Dividend

The Board of Directors declared a dividend of

$0.10 per share payable on August 23, 2024 to shareholders of record on August 9, 2024. This is Primis’ fifty-first consecutive

quarterly dividend.

About Primis Financial Corp.

As of June 30, 2024, Primis had $4.0 billion

in total assets, $3.3 billion in total loans and $3.3 billion in total deposits. Primis Bank provides a range of financial services to

individuals and small- and medium-sized businesses through twenty-four full-service branches in Virginia and Maryland and provides services

to customers through certain online and mobile applications.

| Contacts: |

Address: |

| Dennis J. Zember, Jr., President and CEO |

Primis Financial Corp. |

| Matthew A. Switzer, EVP and CFO |

1676 International Drive, Suite 900 |

| Phone: (703) 893-7400 |

McLean, VA 22102 |

Primis Financial Corp., NASDAQ Symbol FRST

Website: www.primisbank.com

Conference Call

The Company’s management will host a conference

call to discuss its preliminary second quarter results on Friday, July 26, 2024 at 10:00 a.m. (ET). A live Webcast of the conference

call is available at the following website: https://events.q4inc.com/attendee/808999214. Participants may also call 1-888-330-3573 and

ask for the Primis Financial Corp. call. A replay of the teleconference will be available for 7 days by calling 1-800-770-2030 and providing

Replay Access Code 4440924.

Forward-Looking Statements

This press release and certain of our other filings

with the Securities and Exchange Commission contain statements that constitute “forward-looking statements” within the meaning

of, and subject to the protections of, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities

Exchange Act of 1934, as amended. All statements other than statements of historical fact are forward-looking statements. Such statements

can generally be identified by such words as "may," "plan," "contemplate," "anticipate," "believe,"

"intend," "continue," "expect," "project," "predict," "estimate," "could,"

"should," "would," "will," and other similar words or expressions of the future or otherwise regarding the

outlook for the Company’s future business and financial performance and/or the performance of the banking industry and economy in

general. These forward-looking statements include, but are not limited to, our expectations regarding our future operating and financial

performance, including the preliminary estimated financial and operating information presented herein, which is subject to adjustment;

our outlook and long-term goals for future growth and new offerings and services; our expectations regarding net interest margin; expectations

on our growth strategy, expense management, capital management and future profitability; expectations on credit quality and performance;

and the assumptions underlying our expectations.

Prospective

investors are cautioned that any such forward-looking statements are not guarantees of future performance and involve known and unknown

risks and uncertainties which may cause the actual results, performance or achievements of the Company to be materially different from

the future results, performance or achievements expressed or implied by such forward-looking statements. Forward-looking statements are

based on the information known to, and current beliefs and expectations of, the Company’s management and are subject to significant

risks and uncertainties. Actual results may differ materially from those contemplated by such forward-looking statements. Factors that

might cause such differences include, but are not limited to: the result of the “pre-clearance” process with the Office of

the Chief Accountant of the SEC and the impact on the Company’s financial statements; the Company’s ability to implement

its various strategic and growth initiatives, including its recently established Panacea Financial and Life Premium Finance Divisions,

digital banking platform, V1BE fulfillment service and Primis Mortgage Company; competitive pressures

among financial institutions increasing significantly; changes in applicable laws, rules, or regulations, including changes to statutes,

regulations or regulatory policies or practices; changes in management’s plans for the future; credit risk associated with our lending

activities; the impact of current and future economic and market conditions generally (including seasonality) and in the financial services

industry, nationally and within our primary market areas; changes in interest rates, inflation, loan demand, real estate values, or competition,

as well as labor shortages and supply chain disruptions; changes in accounting principles, policies, or guidelines; adverse results from

current or future litigation, regulatory examinations or other legal and/or regulatory actions; potential impacts of adverse developments

in the banking industry highlighted by high-profile bank failures, including impacts on customer confidence, deposit outflows, liquidity

and the regulatory response thereto; potential increases in the provision for credit losses; our ability to identify and address increased

cybersecurity risks, including those impacting vendors and other third parties; fraud or misconduct by internal or external actors, which

we may not be able to prevent, detect or mitigate; acts of God or of war or other conflicts, including the current Ukraine/Russia conflict

and Israel/Hamas conflict, acts of terrorism, pandemics or other catastrophic events that may affect general economic conditions; and

other general competitive, economic, political, and market factors, including those affecting our business, operations, pricing, products,

or services.

Forward-looking statements speak only as of

the date on which such statements are made. These forward-looking statements are based upon information presently known to the

Company’s management and are inherently subjective, uncertain and subject to change due to any number of risks and

uncertainties, including, without limitation, the risks and other factors set forth in the Company’s filings with the

Securities and Exchange Commission, the Company’s Annual Report on Form 10-K for the year ended December 31, 2022,

under the captions “Cautionary Note Regarding Forward-Looking Statements” and “Risk Factors,” and in the

Company’s Quarterly Reports on Form 10-Q and Current Reports on Form 8-K. The Company undertakes no obligation to

update any forward-looking statement to reflect events or circumstances after the date on which such statement is made, or to

reflect the occurrence of unanticipated events. Readers are cautioned not to place undue reliance on these forward-looking

statements.

v3.24.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

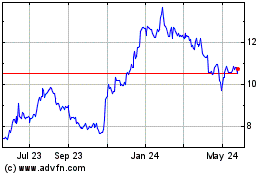

Primis Financial (NASDAQ:FRST)

Historical Stock Chart

From Jun 2024 to Jul 2024

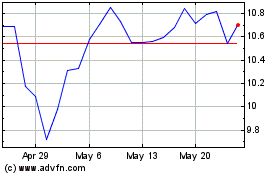

Primis Financial (NASDAQ:FRST)

Historical Stock Chart

From Jul 2023 to Jul 2024