Report of Foreign Issuer Pursuant to Rule 13a-16 or 15d-16 (6-k)

September 13 2022 - 5:02PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF

1934

For the month of September 2022

Commission File Number: 001-38851

POWERBRIDGE TECHNOLOGIES CO., LTD.

(Translation of Registrant’s name into English)

Advanced Business Park, 9th Fl, Bldg C2,

29 Lanwan Lane, Hightech District,

Zhuhai, Guangdong 519080, China

(Address of Principal Executive Office)

Indicate by check mark whether the registrant

files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒

Form 40-F ☐

Indicate by check mark if the registrant is submitting

the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Note : Regulation

S-T Rule 101(b)(1) only permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual

report to security holders.

Indicate by check mark if the registrant is submitting

the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

Note: Regulation S-T Rule 101(b)(7) only

permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private issuer

must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized

(the registrant’s “home country”), or under the rules of the home country exchange on which

the registrant’s securities are traded, as long as the report or other document is not a press release, is not required to be and

has not been distributed to the registrant’s security holders, and, if discussing a material event, has already been the subject

of a Form 6-K submission or other Commission filing on EDGAR.

CONTENTS

Execution of a Material Definitive Agreement

On September 9, 2022, Powerbridge

Technologies Co. LTD. (“Powerbridge” or the “Company”) entered into a Standby Equity Purchase Agreement (the “Purchase

Agreement”) with YA II PN, Ltd. (the “Investor”). Pursuant to the Purchase Agreement, the Company will be able to issue

and sell up to $30,000,000 of its ordinary shares, par value of US$ 0.00166667 per share (the “Common Shares”), at the Company’s

sole option, any time during the three-year period following the execution date of the Purchase Agreement subject to certain limitations

(the “Offering”). Pursuant to the terms of the Purchase Agreement, any Common Shares sold to the Investor will be priced at

96% of the market price, which is defined as the lowest daily volume weighted average price of the Common Shares during the three consecutive

trading days commencing on the trading day immediately following the Company’s delivery of an advance notice to the Investor. Any

sale of Common Shares pursuant to the Purchase Agreement is subject to certain limitations, including that the Investor is not permitted

to purchase any Common Shares that would result in it owning more than 4.99% of the Company’s Shares.

The Company is not obligated to utilize any of

the $30,000,000 available under the Purchase agreement, and there are no minimum commitments or minimum use penalties. The total

amount of funds that ultimately can be raised under the Purchase Agreement over the three-year term will depend on the market price for

the Common Shares and the number of Common Shares actually sold. The Purchase Agreement does not impose any restrictions on the Company’s

operating activities. During the term of the Purchase Agreement, the Investor, and its affiliates, are prohibited from engaging in any

short selling or hedging transactions related to the Common Shares.

The Company has also agreed to issue the Investor

an aggregate of 223,880 Common Shares as a commitment fee upon the execution date of the Purchase Agreement.

The Company intends to use the net proceeds from

the sale of the Common Shares sold pursuant to the Purchase Agreement, for general corporate purpose and working capital purposes.

The Common Shares offered in the Offering was

issued pursuant to the Company’s shelf registration statement on Form F-3 (File No. 333-253395) filed with the Securities and Exchange

Commission (the “SEC”) on February 23, 2021 and declared effective on March 4, 2021 (the “Registration Statement”),

as supplemented by the preliminary prospectus supplement dated September 13, 2022 related to this offering and filed with SEC September

13, 2022.

The foregoing is a summary description of certain

terms of the Purchase Agreement. For a full description of all terms, please refer to the copy of the Purchase Agreement that is filed

herewith as Exhibit 99.1 to this form 6-K and is incorporated herein by reference.

This current report on form 6-K is incorporated

by reference into the Company’s registration statements on Form F-3 (File No. 333-253395).

Exhibits

SIGNATURE

Pursuant to the requirements of the Securities

and Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: September 13, 2022

| |

POWERBRIDGE TECHNOLOGIES CO., LTD. |

| |

|

|

| |

By: |

/s/ Yuxia Xu |

| |

|

Yuxia Xu |

| |

|

Chief Financial Officer |

2

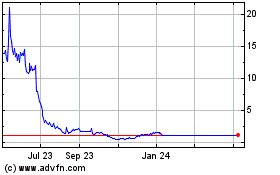

Powerbridge Technologies (NASDAQ:PBTS)

Historical Stock Chart

From Aug 2024 to Sep 2024

Powerbridge Technologies (NASDAQ:PBTS)

Historical Stock Chart

From Sep 2023 to Sep 2024