0001533040

false

0001533040

2023-06-08

2023-06-08

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

Table of Contents

As filed with the Securities and Exchange Commission

on June 8, 2023

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

PHIO PHARMACEUTICALS CORP.

(Exact name of Registrant as specified in its

charter)

| |

|

|

|

|

|

Delaware

(State or other jurisdiction of

incorporation or organization) |

|

2834

(Primary Standard Industrial

Classification Code Number) |

|

45-3215903

(I.R.S. Employer

Identification Number) |

257 Simarano Drive, Suite 101

Marlborough, Massachusetts 01752

(508) 767-3861

(Address, including zip code, and telephone

number, including area code, of Registrant’s principal executive offices)

Robert J. Bitterman

President & CEO

Phio Pharmaceuticals Corp.

257 Simarano Drive, Suite 101

Marlborough, Massachusetts 01752

(508)

767-3861

(Name, address, including zip code, and telephone

number, including area code, of agent for service)

Copies to:

Steven J. Abrams, Esq.

Hogan Lovells US LLP

1735 Market Street, Suite 2300

Philadelphia, Pennsylvania 19103

(267) 675-4600

Approximate date of commencement

of proposed sale to the public:

From time to time after the

effective date of this Registration Statement.

If any of the securities being registered on this

Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box.

☒

If this Form is filed to register additional securities

for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration

statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed

pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of

the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed

pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of

the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant

is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company.

See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,”

and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer |

|

☐ |

|

Accelerated filer |

|

☐ |

| |

|

|

|

| Non-accelerated filer |

|

☒ |

|

Smaller reporting company |

|

☒ |

| |

|

|

|

| |

|

|

|

Emerging growth company |

|

☐ |

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 7(a)(2)(B) of the Securities Act. ☐

The registrant hereby amends this registration statement on such

date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states

that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended,

or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to

said Section 8(a), may determine.

The information in this preliminary prospectus is not

complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange

Commission is effective. This preliminary prospectus is not an offer to sell these securities, and it is not soliciting an offer to buy

these securities in any jurisdiction where the offer or sale is not permitted.

Subject to completion, dated June

8, 2023

Preliminary Prospectus

Up to 2,640,191 Shares of Common Stock

Pursuant to this prospectus, the selling stockholders

identified herein (the “Selling Stockholders”) are offering on a resale basis an aggregate of up to 2,640,191 shares

of common stock of Phio Pharmaceuticals Corp. (the “Company,” “we,” “us” or “our”),

par value $0.0001 per share (the “Common Stock) consisting of (a) 72,000 shares of Common Stock, (b) up to 628,935 shares

of Common Stock that are issuable upon exercise of pre-funded warrants (“Pre-funded Warrants”), (c) up to an aggregate

of 934,581 shares of Common Stock that are issuable upon exercise of warrants with a five and one-half year term (“Series A Warrants”)

and up to an aggregate of 934,581 shares of Common Stock that are issuable upon exercise of warrants with an eighteen month term (the

“Series B Warrants”), in each case purchased pursuant to securities purchase agreements by and among us and the Selling

Stockholders, each dated May 31, 2023 (the “Purchase Agreements”), and (d) up to 70,094 shares of Common Stock that

are issuable upon the exercise of certain warrants (together with the Pre-funded Warrants, the Series A Warrants and the Series B Warrants,

the “Warrants”) issued to our placement agent pursuant to an engagement letter in connection with the Purchase Agreements

and the offerings contemplated thereunder.

We will not receive any of the proceeds from the

sale by the Selling Stockholders of the Common Stock. Upon any exercise of the Warrants by payment of cash, however, we will receive the

exercise price of the Warrants, which, if exercised in cash with respect to 2,568,191 shares of Common Stock offered hereby, would result

in gross proceeds to us of approximately $8 million. However, we cannot predict when and in what amounts or if the Warrants will be exercised

by payments of cash and it is possible that the Warrants may expire and never be exercised, in which case we would not receive any cash

proceeds.

The Selling Stockholders may sell or otherwise

dispose of the Common Stock covered by this prospectus in a number of different ways and at varying prices. We provide more information

about how the Selling Stockholders may sell or otherwise dispose of the Common Stock covered by this prospectus in the section entitled

“Plan of Distribution” on page 9. Discounts, concessions, commissions and similar selling expenses attributable to the sale

of Common Stock covered by this prospectus will be borne by the Selling Stockholders. We will pay all expenses (other than discounts,

concessions, commissions and similar selling expenses) relating to the registration of the Common Stock with the Securities and Exchange

Commission (the “SEC”).

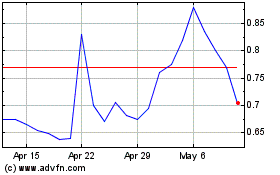

Our Common Stock is listed on The Nasdaq Capital

Market under the symbol “PHIO.” On June 7, 2023, the last reported sale price of our Common Stock on The Nasdaq Capital Market

was $3.16 per share.

Investing in our securities involves a high

degree of risk. Before making any investment in these securities, you should consider carefully the risks and uncertainties described

in the section entitled “Risk Factors” beginning on page 6 of this prospectus.

Neither the Securities and Exchange Commission

nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete.

Any representation to the contrary is a criminal offense.

The date of this prospectus is ,

2023

TABLE OF CONTENTS

ABOUT

THIS PROSPECTUS

This prospectus relates to the resale by the Selling

Stockholders identified in this prospectus under the caption “Selling Stockholders,” from time to time, of up to an aggregate

of 2,640,191 shares of Common Stock. We are not selling any shares of Common Stock under this prospectus, and we will not receive any

proceeds from the sale of shares of Common Stock offered hereby by the Selling Stockholders, although we may receive cash from the exercise

of the Warrants.

You should rely only on the information provided

in this prospectus, including any information incorporated by reference. We have not authorized anyone to provide you with any other information

and we take no responsibility for, and can provide no assurances as to the reliability of, any other information that others may give

you. The information contained in this prospectus speaks only as of the date set forth on the cover page and may not reflect subsequent

changes in our business, financial condition, results of operations and prospects.

We are not, and the Selling Stockholders are not,

making offers to sell these securities in any jurisdiction in which an offer or solicitation is not authorized or permitted or in which

the person making such offer or solicitation is not qualified to do so or to any person to whom it is unlawful to make such an offer or

solicitation. You should read this prospectus, including any information incorporated by reference, in its entirety before making an investment

decision. You should also read and consider the information in the documents to which we have referred you in the sections entitled “Where You Can Find More Information” and “Incorporation of Certain Information by Reference.”

In this prospectus, unless otherwise noted, (1)

the term “Phio” refers to Phio Pharmaceuticals Corp. and our subsidiary, MirImmune, LLC and (2) the terms “Company,”

“we,” “us” and “our” refer to the ongoing business operations of Phio and MirImmune, LLC, whether

conducted through Phio or MirImmune, LLC.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains forward-looking statements

within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements can be identified by words such

as “intends,” “believes,” “anticipates,” “indicates,” “plans,” “expects,”

“suggests,” “may,” “would,” “should,” “potential,” “designed to,”

“will,” “ongoing,” “estimate,” “forecast,” “target,” “predict,”

“could,” and similar references, although not all forward-looking statements contain these words. Forward-looking statements

are neither historical facts nor assurances of future performance. These statements are based only on our current beliefs, expectations

and assumptions regarding the future of our business, future plans and strategies, projections, anticipated events and trends, the economy

and other future conditions. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks

and changes in circumstances that are difficult to predict and many of which are outside of our control. Risks that could cause actual

results to vary from expected results expressed in our forward-looking statements include, but are not limited to:

| |

· |

we are dependent on the success of our INTASYL™ technology platform, and our product candidates based on this platform, which is unproven and may never lead to approved and marketable products; |

| |

· |

our product candidates are in an early stage of development and we may fail, experience significant delays, never advance in clinical development or not be successful in our efforts to identify or discover additional product candidates, which may materially and adversely impact our business; |

| |

· |

we are dependent on collaboration partners for the successful development of our adoptive cell therapy product candidates; |

| |

· |

if we experience delays or difficulties in identifying and enrolling subjects in clinical trials, it may lead to delays in generating clinical data and the receipt of necessary regulatory approvals; |

| |

· |

topline data may not accurately reflect or may materially differ from the complete results of a clinical trial; |

| |

· |

we rely upon third parties for the manufacture of the clinical supply for our product candidates; |

| |

· |

we are dependent on the patents we own and the technologies we license, and if we fail to maintain our patents or lose the right to license such technologies, our ability to develop new products would be harmed; |

| |

· |

we will require substantial additional funds to complete our research and development activities; |

| |

· |

future financing may be obtained through, and future development efforts may be paid for by, the issuance of debt or equity, which may have an adverse effect on our stockholders or may otherwise adversely affect our business; and |

| |

· |

the price of our Common Stock has been and may continue to be volatile. |

The risks set forth above are not exhaustive and

additional factors, including those identified in this prospectus under the heading “Risk Factors,” for reasons described

elsewhere in this prospectus and in other filings Phio Pharmaceuticals Corp. periodically makes with the Securities and Exchange Commission,

including the other risks identified in Item 1A. Risk Factors in our Annual Report on Form 10-K for the year ended December 31, 2022,

could adversely affect our business and financial performance. Therefore, you should not rely unduly on any of these forward-looking statements.

Forward-looking statements contained in this prospectus speak as of the date hereof and Phio Pharmaceuticals Corp. does not undertake

to update any of these forward-looking statements to reflect a change in its views or events or circumstances that occur after the date

of this report, except as required by law.

Prospectus

Summary

The following summary

highlights certain information contained elsewhere in this prospectus and the documents incorporated by reference herein. This

summary provides an overview of selected information and does not contain all of the information you should consider in making your

investment decision. Therefore, you should read the entire prospectus and the documents incorporated by reference herein carefully

before investing in our securities. Investors should carefully consider the information set forth under “Risk

Factors” beginning on page 6 of this prospectus and the financial statements and other information incorporated by

reference in this prospectus. In this prospectus, unless otherwise noted, (1) the term “Phio” refers to Phio

Pharmaceuticals Corp. and our subsidiary, MirImmune, LLC and (2) the terms “Company,” “we,”

“us,” and “our” refer to the ongoing business operations of Phio and MirImmune, LLC, whether conducted

through Phio or MirImmune, LLC.

Overview

Phio is a clinical stage biotechnology

company whose proprietary INTASYL™ self-delivering RNAi technology platform is designed to make immune cells more effective in killing

tumor cells. We are developing therapeutics that are designed to leverage INTASYL to precisely target specific proteins that reduce the

body’s ability to fight cancer, without the need for specialized formulations or drug delivery systems. We are committed to discovering

and developing innovative cancer treatments for patients by creating new pathways toward a cancer-free future.

INTASYL Platform

Overall, RNA is involved in

the synthesis, regulation and expression of proteins. RNA takes the instructions from DNA and turns those instructions into proteins within

the body’s cells. RNA interference, or RNAi, is a biological process that inhibits the expression of genes or the production of

proteins. Diseases are often related to the incorrect protein being made, excessive amounts of a specific protein being made, or the correct

protein being made, but at the wrong location or time. RNAi offers a novel approach to drug development because RNAi compounds can be

designed to silence any one of the thousands of human genes, many of which are considered “undruggable” by traditional therapeutics.

Our development efforts are

based on our proprietary INTASYL self-delivering RNAi technology platform. INTASYL compounds are designed to precisely target specific

proteins that reduce the body’s ability to fight cancer, without the need for specialized formulations or drug delivery systems,

and are designed to make immune cells more effective in killing tumor cells. Our efforts are focused on developing immuno-oncology therapeutics

using our INTASYL platform. We have demonstrated preclinical efficacy in both direct-to-tumor injection and adoptive cell therapy (“ACT”)

applications with our INTASYL compounds.

Since the initial discovery

of RNAi, drug delivery has been the primary challenge in developing RNAi-based therapeutics. Other siRNA technologies require cell targeting

chemical conjugates which limit delivery to specific cell types. INTASYL is based on proprietary chemistry that is designed to maximize

the activity and adaptability of the compound and is unique in that it can be delivered to any cell type or tissue without the need to

modify the chemistry. This is designed to eliminate the need for formulations or delivery systems (for example, nanoparticles or electroporation).

This provides efficient, spontaneous, cellular uptake with potent, long-lasting intracellular activity.

We believe that our INTASYL

platform provides the following benefits including, but not limited to:

| |

· |

Ability to target a broad range of cell types and tissues; |

| |

· |

Ability to target both intracellular and extracellular protein targets; |

| |

· |

Efficient uptake by target cells, avoiding the need for assisted delivery; |

| |

· |

Sustained, or long-term, effect in vivo; |

| |

· |

Ability to target multiple genes in one drug product; |

| |

· |

Favorable clinical safety profile with local administration; and |

| |

· |

Readily manufactured under current good manufacturing practices. |

PH-762

PH-762 is an INTASYL compound

designed to reduce the expression of cell death protein 1 (“PD-1”). PD-1 is a protein that inhibits T cells’

ability to kill cancer cells and is a clinically validated target in immunotherapy. Decreasing the expression of PD-1 can thereby increase

the capacity of T cells, which protect the body from cancer cells and infections, to kill cancer cells.

Preclinical studies conducted

by us have demonstrated that direct-to-tumor application of PH-762 resulted in potent anti-tumoral effects and have shown that direct-to-tumor

treatment with PH-762 inhibits tumor growth in a dose dependent fashion in PD-1 responsive and refractory models. Importantly, direct-to-tumor

administration of PH-762 resulted in activity against distant untreated tumors, indicative of a systemic anti-tumor response. We believe

these data further support the potential for PH-762 to provide a strong local immune response without the dose immune-related adverse

effects seen with systemic antibody therapy.

In May 2023, we announced

that the U.S. Food and Drug Administration (the “FDA”) cleared our Investigational New Drug (“IND”)

application to proceed with a U.S. clinical trial of PH-762. The initial multi-center, dose-escalating, Phase 1b clinical trial under

our cleared IND is designed to evaluate the safety and tolerability of neoadjuvant use of intratumorally injected PH-762, assess the tumor

response, and determine the dose or dose range for continued study of PH-762. We plan to initiate our Phase 1b clinical trial of intratumoral

PH-762 in patients with cutaneous squamous cell carcinoma, melanoma and Merkel cell in the second half of 2023.

We intend to focus our efforts

on the U.S. clinical trial and intend to wind down our first-in-human clinical trial for PH-762 in France, which was limited to the treatment

of patients with metastatic melanoma. Safety data from the initial cohort of three subjects in the French clinical trial were evaluated

by a Data Monitoring Committee in the first quarter of 2023. The safety data review disclosed no dose-limiting toxicity, and no drug-related

severe or serious adverse events.

Due to INTASYL’s ease

of administration, we have shown that our compounds can easily be incorporated into current ACT manufacturing processes. In ACT, T cells

are usually taken from a patient's own blood or tumor tissue, grown in large numbers in a laboratory, and then given back to the patient

to help the immune system fight cancer. By treating T cells with our INTASYL compounds while they are being grown in the laboratory, we

believe our INTASYL compounds can improve these immune cells to make them more effective in killing cancer. Preclinical data generated

in collaboration with AgonOx, Inc. (“AgonOx”), a private company developing a pipeline of novel immunotherapy drugs

targeting key regulators of the immune response to cancer, demonstrated that treating AgonOx’s “double positive” tumor

infiltrating lymphocytes (“DP TIL”) with PH-762 increased by two-fold their tumor killing activity.

In

March 2021, we entered into a clinical co-development collaboration agreement (the “Clinical Co-Development Agreement”)

with AgonOx to develop a T cell-based therapy using PH-762 and AgonOx’s DP TIL. Under the Clinical Co-Development Agreement, we

committed to provide financial support for development costs of up to $4 million to AgonOx for expenses incurred to conduct a Phase 1

clinical trial of PH-762 treated DP TIL in subjects with advanced melanoma and other advanced solid tumors. Phio is also eligible to receive

certain future development milestones and low single-digit sales-based royalty payments from AgonOx’s licensing of its DP TIL technology.

As of March 31, 2023, we have recognized approximately $0.3 million of expense under the Clinical Co-Development Agreement.

PH-762 treated DP TIL will

be evaluated in a Phase 1 clinical trial at the Providence Cancer Institute in Portland, Oregon, with up to 18 subjects with advanced

melanoma and other advanced solid tumors. The primary study objectives are to evaluate the safety and to study the potential for enhanced

therapeutic benefit from the administration of PH-762 treated DP TIL. Enrollment of subjects is expected to commence in the second quarter

of 2023.

PH-894

PH-894 is an INTASYL compound

that is designed to silence BRD4, a protein that controls gene expression in both T cells and tumor cells, thereby effecting the immune

system as well as the tumor. Intracellular and/or commonly considered “undruggable” targets, such as BRD4, represent a challenge

for small molecule and antibody therapies. Therefore, what sets this compound apart is its dual mechanism: PH-894 suppression of BRD4

in T cells results in T cell activation, and suppression of BRD4 in tumor cells results in tumors becoming more sensitive to being killed

by T cells.

Preclinical studies have demonstrated

that PH-894 resulted in a strong, concentration dependent and durable silencing of BRD4 in T cells and in various cancer cells. Similar

to PH-762, preclinical studies have also shown that direct-to-tumor application of PH-894 resulted in potent and statistically significant

anti-tumoral effects and demonstrated a systemic anti-tumor response. These preclinical data indicate that PH-894 can reprogram T cells

and other cells in the tumor microenvironment to provide enhanced immunotherapeutic activity. We have completed the IND-enabling studies

and are in the process of finalizing the study reports required for an IND submission with PH-894. As a result of the reprioritization

to advance our clinical trial with PH-762 in the U.S., we have elected to defer the IND submission for PH-894.

June 2023 Offerings

On May 31, 2023, we entered

into a securities purchase agreement (the “Registered Direct Purchase Agreement”) with the selling stockholders identified

herein (the “Selling Stockholders”) in connection with a registered direct offering (the “Registered Direct

Offering”). On May 31, 2023, we also entered into a securities purchase agreement (the “PIPE Purchase Agreement”

and, together with the Registered Direct Purchase Agreement, the “Purchase Agreements”) and a registration rights agreement

(the “Registration Rights Agreement”) with the Selling Stockholders in connection with a concurrent private placement

(the “PIPE Private Placement”).

Pursuant to the Registered

Direct Purchase Agreement, we agreed to offer and sell in the Registered Direct Offering 233,646 shares of common stock, par value $0.0001

per share (the “Common Stock”), at a purchase price of $4.28. Pursuant to the Registered Direct Purchase Agreement,

in a concurrent private placement (the “RD Private Placement” and, together with the PIPE Private Placement, the “Private

Placements”), we also issued to the Selling Stockholders unregistered warrants with a five and one-half year term to purchase

up to 233,646 shares of Common Stock (the “RD Series A Warrants”) and unregistered warrants with an eighteen month

term to purchase up to 233,646 shares of Common Stock (the “RD Series B Warrants” and, together with the RD Series

A Warrants, the “RD Warrants”), collectively exercisable for up to an aggregate of 467,292 shares of Common Stock (the

“RD Warrant Shares”). In the RD Private Placement and under the terms of the Registered Direct Purchase Agreement,

for each share of Common Stock issued in the Registered Direct Offering, an accompanying RD Series A Warrant and RD Series B Warrant were

issued to the purchaser thereof, respectively. Each RD Series A Warrant is immediately exercisable for one RD Warrant Share at an exercise

price of $4.03 per share and will expire five and one-half years from the date of issuance. Each RD Series B Warrant is immediately exercisable

for one RD Warrant Share at an exercise price of $4.03 per share and will expire eighteen months from the date of issuance. The purchase

price in the Registered Direct Offering included $0.125 per underlying RD Warrant Share.

Pursuant to the PIPE Purchase

Agreement, we agreed to offer and sell in the PIPE Private Placement 72,000 unregistered shares of Common Stock (the “PIPE Shares”),

at a purchase price of $4.28 and unregistered pre-funded warrants (the “Pre-funded Warrants”) to purchase up to 628,935

shares of Common Stock (the “Pre-funded Warrant Shares”), at a purchase price equal to $4.279. Each Pre-funded Warrant

is immediately exercisable for one share of Common Stock at an exercise price of $0.001 per share and will expire once exercised in full.

Pursuant to the PIPE Purchase Agreement, we also issued to the Selling Stockholders unregistered warrants with a five and one-half year

term to purchase up to 700,935 shares of Common Stock (the “PIPE Series A Warrants”) and unregistered warrants with

an eighteen month term to purchase up to 700,935 shares of Common Stock (the “PIPE Series B Warrants”, together with

the Pre-funded Warrants and the PIPE Series A Warrants, the “PIPE Warrants”), together exercisable for an aggregate

of up to 1,401,870 shares of Common Stock (together with the Pre-funded Warrant Shares, the “PIPE Warrant Shares”).

Under the terms of the PIPE Purchase Agreement, for each PIPE Share and each Pre-funded Warrant issued in the PIPE Private Placement,

an accompanying PIPE Series A Warrant and PIPE Series B Warrant were issued to the purchaser thereof, respectively. The terms of the PIPE

Series A Warrants and PIPE Series B Warrants are identical to the terms of the RD Series A Warrants and the RD Series B Warrants described

above. The purchase price in the PIPE Private Placement included $0.125 per underlying PIPE Warrant Share. When used herein, the term

“Series A Warrants” refers to the RD Series A Warrants and the PIPE Series A Warrants, collectively, and the term “Series

B Warrants” refers to the RD Series B Warrants and the PIPE Series B Warrants, collectively.

The net proceeds to us from

the Registered Direct Offering and the Private Placements was approximately $3.5 million, after deducting placement agent’s fees

and offering expenses.

Pursuant

to an engagement letter, dated as of January 20, 2023 (the “Engagement Letter”), between us and H.C. Wainwright &

Co., LLC (the “Placement Agent”), we agreed to pay the Placement Agent a total cash fee equal to 7.5% of the gross

proceeds received in the Registered Direct Offering and the PIPE Private Placement. We also agreed to pay the Placement Agent in connection

with the Registered Direct Offering and the PIPE Private Placement a management fee equal to 1.0% of the gross proceeds raised in the

Registered Direct Offering and Private Placement, $60,000 for non-accountable expenses, and $15,950 for clearing fees. In addition, issued

to the placement agent, or its designees, warrants (the “Placement Agent Warrants” and, together with the RD Warrants

and the PIPE Warrants, the “Warrants”) to purchase up to 70,094 shares of Common Stock (the “Placement Agent

Warrant Shares” and, together with the RD Warrant Shares and the PIPE Warrant Shares, the “Warrant Shares”),

which represents 7.5% of the aggregate number of shares of Common Stock, PIPE Shares and Pre-funded Warrants sold in the Registered Direct

Offering and the PIPE Private Placement, as applicable. The Placement Agent Warrants have substantially the same terms as the Series A

Warrants, except that the Placement Agent Warrants have an exercise price equal to $5.35, or 125% of the offering price per

share, and will have a term of five years from the commencement of sales pursuant to the Registered Direct Offering and PIPE Private Placement.

Pursuant to the terms of the

Registration Rights Agreement and the Engagement Letter, we agreed to register for resale the PIPE Shares and the Warrant Shares issuable

upon exercise of the Warrants sold in the Private Placements and issued to the Placement Agent on or prior to the date that is 10 calendar

days following the date of the Registration Rights Agreement. We shall use our best efforts to cause this registration statement to be

declared effective as promptly as possible after the filing thereof, but in any event no later the 40th calendar day following the

date of the Registration Rights Agreement (or in the event of a full review by the SEC, the 70th calendar day following the date

of the Registration Rights Agreement).

The Registered Direct Offering

and PIPE Private Placement closed on June 2, 2023.

Corporate Information

The Company was incorporated

in the state of Delaware in 2011 as RXi Pharmaceuticals Corporation. On November 19, 2018, we changed our name to Phio Pharmaceuticals

Corp., to reflect our transition from a platform company to one that is fully committed to developing groundbreaking immuno-oncology therapeutics.

Our executive offices are located at 257 Simarano Drive, Suite 101, Marlborough, MA 01752, and our telephone number is (508) 767-3861.

Our website address is http://www.phiopharma.com. Our website and the information contained on that site, or connected to that

site, is not part of or incorporated by reference into this prospectus.

THE OFFERING

| The Selling Stockholders identified in this prospectus are offering on a resale basis a total of 2,640,191 shares of Common Stock, consisting of (a) 72,000 shares of Common Stock and (b) up to 2,568,191 Warrant Shares issuable upon exercise of the Warrants, as more fully described above. |

| Common Stock to be offered by the Selling Stockholders |

|

Up to 2,640,191 shares of Common Stock |

| |

|

|

| Common Stock outstanding prior to this offering |

|

1,150,582 shares of Common Stock as of March 31, 2023 |

| |

|

|

| Common Stock to be outstanding after this offering |

|

4,378,4021 shares of Common Stock |

| |

|

|

| Use of proceeds: |

|

We will not receive any proceeds from the sale of the shares of Common Stock by the Selling Stockholders, except for the Warrant exercise price paid for the Common Stock offered hereby and issuable upon the exercise of the Warrants. See “Use of Proceeds” on page 7 of this prospectus. |

| |

|

|

| Risk factors: |

|

You should read the “Risk Factors” section beginning on page 6 of this prospectus for a discussion of factors to consider carefully before deciding to invest in shares of our securities. |

| |

|

|

| Nasdaq Capital Market symbol: |

|

Our Common Stock is listed on The Nasdaq Capital Market under the symbol “PHIO.” We do not intend to apply for listing of the Warrants on any securities exchange or nationally recognized trading system. |

1 The number of shares

of Common Stock to be outstanding after this offering is based on 1,150,582 shares of Common Stock outstanding as of March 31, 2023, plus

(i) 233,646 shares of our Common Stock issued in the Registered Direct Offering and (ii) 353,983 shares of Common Stock issued in a registered

direct public offering that closed on April 20, 2023 (the “April 2023 Offering”), and excludes as of such date:

| |

· |

707,966 shares of Common Stock issuable upon the exercise of warrants issued in a private placement conducted concurrently with the April 2023 Offering, having an exercise price of $5.40 per share; |

| |

|

|

| |

· |

26,549 shares of Common Stock issuable upon the exercise of placement agent warrants issued to the placement agent as compensation in connection with the April 2023 Offering, having an exercise price of $7.06 per share; |

| |

|

|

| |

· |

177 shares of Common Stock issuable upon the exercise of stock options outstanding as of March 31, 2023, having a weighted average exercise price of $35,231.40 per share; |

| |

|

|

| |

· |

72,755 shares of Common Stock issuable upon the vesting of restricted stock units outstanding as of March 31, 2023; |

| |

|

|

| |

· |

545,401 shares of Common Stock issuable upon the exercise of warrants outstanding as of March 31, 2023, having a weighted average exercise price of $54.53 per share; |

| |

|

|

| |

· |

243 shares of Common Stock reserved for future issuance under our 2020 Long-Term Incentive Plan as of March 31, 2023; and |

| |

|

|

| |

· |

660 shares of Common Stock reserved for future issuance under our Employee Stock Purchase Plan as of March 31, 2023. |

RISK FACTORS

Investing in our securities

involves a high degree of risk. Before investing in our securities, you should carefully consider the risks, uncertainties and assumptions

contained in this prospectus and discussed under the heading “Risk Factors” included in our Annual Report on Form 10-K for

the year ended December 31, 2022, as revised or supplemented by subsequent filings, which are on file with the SEC and are incorporated

herein by reference, and which may be amended, supplemented or superseded from time to time by other reports we file with the SEC in the

future. The risks described in these documents are not the only ones we face, but those that we consider to be material. There may be

other unknown or unpredictable economic, business, competitive, regulatory or other factors that could have material adverse effects on

our future results. Our business, financial condition, results of operations and future growth prospects could be materially and adversely

affected by any of these risks. In these circumstances, the market price of our Common Stock could decline, and you may lose all or part

of your investment.

Use

of Proceeds

We will not receive any of

the proceeds from the sale of the Common Stock by the Selling Stockholders. Certain of the shares offered hereby are issuable upon the

exercise of the Warrants. Upon exercise of such Warrants for cash, we will receive the applicable cash exercise price paid by the holders

of the Warrants of approximately $8 million (assuming the full exercise of the Warrants).

We intend to use any proceeds

received by us from the cash exercise of the Warrants to fund the development of our product candidates, other research and development

activities and for general working capital needs. We may also use a portion of any proceeds received by us from the cash exercise of the

Warrants to acquire or invest in complementary businesses, products and technologies or to fund the development of any such complementary

businesses, products or technologies. We currently have no plans for any such acquisitions.

DIVIDEND POLICY

We have never paid any cash

dividends and do not anticipate paying any cash dividends on our Common Stock in the foreseeable future. We expect to retain future earnings,

if any, for use in our development activities and the operation of our business. The payment of any future dividends will be subject to

the discretion of our Board of Directors and will depend, among other things, upon our results of operations, financial condition, cash

requirements, prospects and other factors that our Board of Directors may deem relevant.

DETERMINATION

OF OFFERING PRICE

The prices at which the shares

of Common Stock covered by this prospectus may actually be sold will be determined by the prevailing public market price for shares of

our Common Stock or by negotiations between the Selling Stockholders and buyers of our Common Stock in private transactions or as otherwise

described in “Plan of Distribution.”

SELLING

STOCKHOLDERS

The Common Stock being offered

by the Selling Stockholders consists of shares of Common Stock previously issued to the Selling Stockholders, and those issuable to the

Selling Stockholders upon exercise of the Warrants. For additional information regarding the issuances of those shares of Common Stock

and Warrants, see “June 2023 Offerings” in the Prospectus Summary section above. We are registering the shares of Common Stock

in order to permit the Selling Stockholders to offer the shares for resale from time to time. Except for (a) the ownership of the shares

of Common Stock and the Warrants and (b) with respect to the Warrants issued as compensation to the Placement Agent, who has acted as

our Placement Agent in a number of past offerings, or its designees, the Selling Stockholders have not had any material relationship with

us within the past three years.

The table below lists the

Selling Stockholders and other information regarding the beneficial ownership of the shares of Common Stock by each of the Selling Stockholders.

The second column lists the number of shares of Common Stock beneficially owned by each Selling Stockholder, based on its ownership of

the shares of Common Stock and Warrants, as of June 2, 2023, assuming exercise of the Warrants held by the Selling Stockholders on that

date, without regard to any limitations on exercises.

The third column lists the

shares of Common Stock being offered under this prospectus by the Selling Stockholder.

In accordance with the terms

of the Registration Rights Agreement with the Selling Stockholders, this prospectus generally covers the resale of the sum of (i) the

number of PIPE Shares issued to the Selling Stockholders in the PIPE Private Placement described above and (ii) the maximum number of

shares of Common Stock issuable upon exercise of the related Warrants issued in and in connection with, as applicable, the RD Private

Placement and the PIPE Private Placement, determined as if the outstanding Warrants were exercised in full as of the trading day immediately

preceding the date this registration statement was initially filed with the SEC, each as of the trading day immediately preceding the

applicable date of determination and all subject to adjustment as provided in the registration right agreement, without regard to any

limitations on the exercise of the Warrants. The fourth column assumes the sale of all of the shares offered by the Selling Stockholders

pursuant to this prospectus.

Under the terms of the Warrants,

a Selling Stockholder may not exercise the Warrants to the extent such exercise would cause such Selling Stockholder, together with its

affiliates and attribution parties, to beneficially own a number of shares of Common Stock which would exceed 4.99% or 9.99%, as applicable,

of our then outstanding Common Stock following such exercise, excluding for purposes of such determination shares of Common Stock issuable

upon exercise of such Warrants which have not been exercised. The number of shares in the second and fourth columns do not reflect this

limitation. The Selling Stockholder may sell all, some or none of their shares in this offering. See “Plan of Distribution”

below for further information.

| | |

| | |

| | |

Shares Beneficially Owned

After this Offering

| |

| Selling Stockholder | |

Number of Shares Beneficially

Owned Before this

Offering(1) | | |

Number of Shares to be Sold in

this Offering | | |

Number of Shares | | |

Percentage of Total Outstanding Common Stock(1) | |

| Anson Investments Master Fund LP(2) | |

| 938,856 | | |

| 856,699 | | |

| 82,157 | | |

| 1.87% | |

| Intracoastal Capital, LLC(3) | |

| 1,178,873 | | |

| 856,699 | | |

| 322,174 | | |

| 6.91% | |

| Sabby Volatility Warrant Master Fund, Ltd. (4) | |

| 1,242,950 | | |

| 856,699 | | |

| 386,251 | | |

| 8.23% | |

| Noam Rubinstein(5) | |

| 52,672 | | |

| 22,080 | | |

| 30,592 | | |

| * | |

| Craig Schwabe(5) | |

| 5,164 | | |

| 2,366 | | |

| 2,798 | | |

| * | |

| Michael Vasinkevich(5) | |

| 100,367 | | |

| 44,948 | | |

| 55,419 | | |

| 1.25% | |

| Charles Worthman(5) | |

| 1,675 | | |

| 700 | | |

| 975 | | |

| * | |

*Represents beneficial ownership of less than one percent.

(1) The ability to exercise the Warrants held

by the Selling Stockholders is subject to a beneficial ownership limitation that, at the time of initial issuance of the Warrants, was

capped at either 4.99% or 9.99% beneficial ownership of the Company’s issued and outstanding Common Stock (post-exercise). These

beneficial ownership limitations may be adjusted up or down, subject to providing advanced notice to the Company. Beneficial ownership

as reflected in the selling stockholder table reflects the total number of shares potentially issuable underlying the Warrants and does

not give effect to these beneficial ownership limitations. Accordingly, actual beneficial ownership, as calculated in accordance with

Section 13(d) and Rule 13d-3 thereunder may be lower than as reflected in the table.

(2) Anson Advisors Inc. and Anson Funds Management

LP, the Co-Investment Advisers of Anson Investments Master Fund LP (“Anson”), hold voting and dispositive power over

the Common Stock held by Anson. Bruce Winson is the managing member of Anson Management GP LLC, which is the general partner of Anson

Funds Management LP. Moez Kassam and Amin Nathoo are directors of Anson Advisors Inc. Mr. Winson, Mr. Kassam and Mr. Nathoo each disclaim

beneficial ownership of these shares of Common Stock except to the extent of their pecuniary interest therein. The principal business

address of Anson is Maples Corporate Services Limited, PO Box 309, Ugland House, Grand Cayman, KY1-1104, Cayman Islands.

(3) Mitchell P. Kopin (“Mr. Kopin”)

and Daniel B. Asher (“Mr. Asher”), each of whom are managers of Intracoastal Capital LLC (“Intracoastal”),

have shared voting control and investment discretion over the securities reported herein that are held by Intracoastal. As a result, each

of Mr. Kopin and Mr. Asher may be deemed to have beneficial ownership (as determined under Section 13(d) of the Securities and Exchange

Act of 1934, as amended (the “Exchange Act”)) of the securities reported herein that are held by Intracoastal.

(4) Sabby Management, LLC, the investment manager

to Sabby Volatility Warrant Master Fund, Ltd. (“Sabby”), has discretionary authority to vote and dispose of the shares

held by Sabby and may be deemed to be the beneficial owner of these shares. Hal Mintz (“Mr. Mintz”), in his capacity

as manager of Sabby Management, LLC, may also be deemed to have investment discretion and voting power over the shares held by Sabby.

Sabby Management, LLC and Mr. Mintz each disclaim any beneficial ownership of these shares.

(5) The Selling Stockholder was issued its Warrants

as a representative of H.C. Wainwright & Co., LLC, our placement agent, in connection with the Purchase Agreements and each representative

has sole voting and dispositive power over the securities held.

PLAN

OF DISTRIBUTION

Each Selling Stockholder of

the securities and any of their pledgees, assignees and successors-in-interest may, from time to time, sell any or all of their securities

covered hereby on the principal trading market or any other stock exchange, market or trading facility on which the securities are traded

or in private transactions. These sales may be at fixed or negotiated prices. A Selling Stockholder may use any one or more of the following

methods when selling securities:

| · | ordinary brokerage transactions and transactions

in which the broker dealer solicits purchasers; |

| · | block trades in which the broker-dealer will

attempt to sell the securities as agent but may position and resell a portion of the block as principal to facilitate the transaction; |

| · | purchases by a broker-dealer as principal and

resale by the broker dealer for its account; |

| · | an exchange distribution in accordance with the

rules of the applicable exchange; |

| · | privately negotiated transactions; |

| · | settlement of short sales; |

| · | in transactions through broker-dealers that agree

with the Selling Stockholders to sell a specified number of such securities at a stipulated price per security; |

| · | through the writing or settlement of options

or other hedging transactions, whether through an options exchange or otherwise; |

| · | a combination of any such methods of sale; or |

| · | any other method permitted pursuant to applicable

law. |

The Selling Stockholders may

also sell securities under Rule 144 or any other exemption from registration under the Securities Act of 1933, as amended (the “Securities

Act”), if available, rather than under this prospectus.

Broker-dealers engaged by

the Selling Stockholders may arrange for other brokers-dealers to participate in sales. Broker-dealers may receive commissions or discounts

from the Selling Stockholders (or, if any broker-dealer acts as agent for the purchaser of securities, from the purchaser) in amounts

to be negotiated, but, except as set forth in a supplement to this prospectus, in the case of an agency transaction not in excess of a

customary brokerage commission in compliance with FINRA Rule 2121; and in the case of a principal transaction a markup or markdown in

compliance with FINRA Rule 2121.

In connection with the sale

of the securities or interests therein, the Selling Stockholders may enter into hedging transactions with broker-dealers or other financial

institutions, which may in turn engage in short sales of the securities in the course of hedging the positions they assume. The Selling

Stockholders may also sell securities short and deliver these securities to close out their short positions, or loan or pledge the securities

to broker-dealers that in turn may sell these securities. The Selling Stockholders may also enter into option or other transactions with

broker-dealers or other financial institutions or create one or more derivative securities which require the delivery to such broker-dealer

or other financial institution of securities offered by this prospectus, which securities such broker-dealer or other financial institution

may resell pursuant to this prospectus (as supplemented or amended to reflect such transaction).

The Selling Stockholders and

any broker-dealers or agents that are involved in selling the securities may be deemed to be “underwriters” within the meaning

of the Securities Act in connection with such sales. In such event, any commissions received by such broker-dealers or agents and any

profit on the resale of the securities purchased by them may be deemed to be underwriting commissions or discounts under the Securities

Act. Each Selling Stockholder has informed us that it does not have any written or oral agreement or understanding, directly or indirectly,

with any person to distribute the securities.

We are required to pay certain

fees and expenses incurred incident to the registration of the securities. We have agreed to indemnify the Selling Stockholders against

certain losses, claims, damages and liabilities, including liabilities under the Securities Act.

We have agreed to keep this

prospectus effective until the earlier of (i) the date on which the securities may be resold by the Selling Stockholders without registration

and without regard to any volume or manner-of-sale limitations by reason of Rule 144, without the requirement for us to be in compliance

with the current public information under Rule 144 under the Securities Act or any other rule of similar effect or (ii) all of the securities

have been sold pursuant to this prospectus or Rule 144 under the Securities Act or any other rule of similar effect. The resale securities

will be sold only through registered or licensed brokers or dealers if required under applicable state securities laws. In addition, in

certain states, the resale securities covered hereby may not be sold unless they have been registered or qualified for sale in the applicable

state or an exemption from the registration or qualification requirement is available and is complied with.

Under applicable rules and

regulations under the Exchange Act, any person engaged in the distribution of the resale securities may not simultaneously engage in market

making activities with respect to the Common Stock for the applicable restricted period, as defined in Regulation M, prior to the commencement

of the distribution. In addition, the Selling Stockholders will be subject to applicable provisions of the Exchange Act and the rules

and regulations thereunder, including Regulation M, which may limit the timing of purchases and sales of the Common Stock by the Selling

Stockholders or any other person. We will make copies of this prospectus available to the Selling Stockholders and have informed them

of the need to deliver a copy of this prospectus to each purchaser at or prior to the time of the sale (including by compliance with Rule

172 under the Securities Act).

DESCRIPTION OF SECURITIES TO BE REGISTERED

The following summary description of our capital

stock is based on the provisions of our amended and restated certificate of incorporation and amended and restated bylaws and the applicable

provisions of the Delaware General Corporation Law (“DGCL”). This information is qualified entirely by reference to

the applicable provisions of our amended and restated certificate of incorporation, amended and restated bylaws and the DGCL. For information

on how to obtain copies of our amended and restated certificate of incorporation and amended and restated bylaws, which are exhibits to

the registration statement of which this prospectus forms a part, see the sections titled "Where You Can Find More Information"

and "Incorporation of Certain Information by Reference" in this prospectus.

General

Our authorized capital stock

consists of 100,000,000 shares of Common Stock, par value $0.0001 per share and 10,000,000 shares of preferred stock, par value $0.0001

per share.

Common Stock

Holders of our Common Stock

are entitled to one vote per share for the election of members of our Board of Directors and on all other matters that require stockholder

approval. Holders of our Common Stock may not cumulate votes for the election of directors. Subject to any preferential rights of any

outstanding preferred stock, in the event of our liquidation, dissolution or winding up, holders of our Common Stock are entitled to share

ratably in the assets remaining after payment of liabilities and the liquidation preferences of any outstanding preferred stock. Holders

of Common Stock have the right to receive dividends when, as and if, declared by the Board of Directors. Our Common Stock does not carry

any preemptive rights enabling a holder to subscribe for, or receive shares of, any class of our Common Stock or any other securities

convertible into shares of any class of our Common Stock. There are no redemption or sinking-fund provisions applicable to our Common

Stock.

Preferred Stock

The shares of preferred stock

have such rights and preferences as our Board of Directors shall determine, from time to time, the Board of Directors may divide the preferred

stock into any number of series and shall fix the designation and number of shares of each such series. Our Board of Directors may determine

and alter the rights, powers, preferences and privileges, and qualifications, restrictions and limitations thereof, including, but not

limited to, voting rights (if any), granted to and imposed upon any wholly unissued series of preferred stock. Our Board of Directors

(within the limits and restrictions of any resolutions adopted originally fixing the number of shares of any series) may increase or decrease

the number of shares of that series; provided, that no such decrease shall reduce the number of shares of such series to a number less

than the number of shares of such series then outstanding, plus the number of shares reserved for issuance upon the exercise of outstanding

options, rights or warrants or upon the conversion of any outstanding securities issued by us convertible into shares of such series.

Our Common Stock is subject

to the express terms of our preferred stock and any series thereof. Our Board of Directors may issue preferred stock with voting, dividend,

liquidation and other rights that could adversely affect the relative rights of the holders of our Common Stock.

Anti-Takeover Effects of Provisions of our

Certificate of Incorporation and Bylaws

Certificate of Incorporation

and Bylaw Provisions. Certain provisions of our amended and restated certificate of incorporation and amended and restated bylaws,

which provisions are summarized in the following paragraphs, may have an anti-takeover effect and may delay, defer or prevent a takeover

attempt that a stockholder might consider in its best interest, including those attempts that might result in a premium over the market

price for the shares held by stockholders.

Filling Vacancies. Any

vacancy on our Board of Directors, however occurring, including a vacancy resulting from an increase in the size of the Board of Directors,

may only be filled by the affirmative vote of a majority of our directors then in office even if less than a quorum.

No Written Consent of Stockholders. Our

amended and restated certificate of incorporation provides that all stockholder actions are required to be taken by a vote of the stockholders

at an annual or special meeting, and that stockholders may not take any action by written consent in lieu of a meeting.

Advance Notice Requirements. Our

amended and restated bylaws include advance notice procedures with regard to stockholder proposals relating to the nomination of candidates

for election as directors or new business to be brought before meetings of our stockholders. These procedures provide that notice of stockholder

proposals must be timely given in writing to our corporate secretary prior to the meeting at which the action is to be taken. Generally,

to be timely, notice must be received at our principal executive offices not less than 90 days nor more than 120 days prior to the first

anniversary date of the annual meeting for the preceding year. The notice must contain certain information specified in the amended and

restated bylaws.

Amendment to Bylaws and

Certificate of Incorporation. As required by the DGCL any amendment to our amended and restated certificate of incorporation

must first be approved by a majority of our Board of Directors and, if required by law or our amended and restated certificate of incorporation,

thereafter be approved by a majority of the outstanding shares entitled to vote on the amendment, and a majority of the outstanding shares

of each class entitled to vote thereon as a class. Our amended and restated bylaws may be amended by the affirmative vote of a majority

vote of the directors then in office, subject to any limitations set forth in the amended and restated bylaws.

Blank Check Preferred Stock. Our

amended and restated certificate of incorporation provides for 10,000,000 authorized shares of preferred stock. The existence of authorized

but unissued shares of preferred stock may enable our Board of Directors to render more difficult or to discourage an attempt to obtain

control of us by means of a merger, tender offer, proxy contest, or otherwise. In this regard, the amended and restated certificate of

incorporation grants the Board of Directors broad power to establish the rights and preferences of authorized and unissued shares of preferred

stock. The issuance of shares of preferred stock could decrease the amount of earnings and assets available for distribution to holders

of shares of Common Stock. The issuance may also adversely affect the relative rights and powers, including voting rights, of these holders

and may have the effect of delaying, deterring, or preventing a change of control of the Company.

Exclusive Forum Provision

in Certificate of Incorporation. Our amended and restated certificate of incorporation provides that the Court of Chancery of

the State of Delaware is the exclusive forum for the following types of actions or proceedings: any derivative action or proceeding brought

on behalf of the Company, any action asserting a claim of breach of a fiduciary duty owed by any director, officer or other employee of

the Company to the Company or the Company’s stockholders, any action asserting a claim against the Company arising pursuant to any

provision of the DGCL or our amended and restated certificate of incorporation or our amended and restated bylaws, or any action asserting

a claim against us governed by the internal affairs doctrine. Despite the fact that our amended and restated certificate of incorporation

provides for this exclusive forum provision to be applicable to the fullest extent permitted by applicable law, Section 27 of the Exchange

Act, creates exclusive federal jurisdiction over all suits brought to enforce any duty or liability created by the Exchange Act or the

rules and regulations thereunder and Section 22 of the Securities Act, creates concurrent jurisdiction for federal and state courts over

all suits brought to enforce any duty or liability created by the Securities Act or the rules and regulations thereunder. As a result,

this provision of our amended and restated certificate of incorporation would not apply to claims brought to enforce a duty or liability

created by the Securities Act, Exchange Act, or any other claim for which the federal courts have exclusive jurisdiction.

LEGAL MATTERS

Certain legal matters relating to the issuance of the securities offered

hereby will be passed upon for us by Hogan Lovells US LLP.

EXPERTS

The consolidated financial statements as of December 31,

2022 and 2021 and for each of the two years in the period ended December 31, 2022 incorporated by reference in this prospectus and in

the registration statement have been so incorporated in reliance on the report of BDO USA, LLP, an independent registered public accounting

firm, incorporated herein by reference, given on the authority of said firm as experts in auditing and accounting. The report on the consolidated

financial statements contains an explanatory paragraph regarding the Company’s ability to continue as a going concern.

Where

You Can Find More Information

We are required to file annual, quarterly and

current reports, proxy statements and other information with the SEC. Our filings with the SEC are available to the public at the SEC’s

Internet web site at http://www.sec.gov. Copies of certain information filed by us with the SEC are also available on our website

at www.phiopharma.com. Our website is not a part of this prospectus and is not incorporated by reference in this prospectus, and

you should not consider the contents of our website in making an investment decision with respect to our Common Stock.

We have filed a registration statement, of which

this prospectus is a part, covering the securities offered hereby. As allowed by SEC rules, this prospectus does not include all of the

information contained in the registration statement and the included exhibits, financial statements and schedules. You are referred to

the registration statement, the included exhibits, financial statements and schedules for further information. You should review the information

and exhibits in the registration statement for further information about us and our subsidiaries and the securities we are offering. Statements

in this prospectus concerning any document we filed as an exhibit to the registration statement or that we otherwise filed with the SEC

are not intended to be comprehensive and are qualified by reference to these filings. You should review the complete document to evaluate

these statements.

INCORPORATION OF CERTAIN INFORMATION BY REFERENCE

The SEC allows us to “incorporate by reference”

the information we have filed with them, which means that we can disclose important information to you by referring you to those documents.

The information we incorporate by reference is an important part of this prospectus, and information that we file later with the SEC will

automatically update and supersede this information. The documents we are incorporating by reference are:

| |

· |

Our Annual Report on Form 10-K for the year ended December 31, 2022, filed with the SEC on March 22, 2023; |

| |

|

|

| |

· |

Our

Quarterly Report on Form 10-Q for the quarter ended March 31, 2023, filed with the SEC on May 11, 2023; |

| |

|

|

| |

· |

Our

Current Reports on Form 8-K, filed with the SEC on January 6, 2023, January 25, 2023, February 13, 2023, February 22, 2023, March 10,

2023, April 17, 2023, April 18, 2023, April 20, 2023, April 20, 2023, May 16, 2023, May 24, 2023, and June 2, 2023; and |

| |

|

|

| |

· |

The

description of our Common Stock contained in our registration statement on Form 8-A12B filed with the SEC on February 7, 2014, as updated

by the description of our Common Stock filed as Exhibit 4.13 to our Annual Report on Form 10-K for the year ended December 31, 2019,

including any amendment or report filed for the purpose of updating such description. |

All documents we file with the SEC pursuant to

Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act, except as to any portion of any report or document that is not deemed filed under

such provisions, (1) on or after the date of filing of the registration statement containing this prospectus and prior to the effectiveness

of the registration statement and (2) on or after the date of this prospectus until the earlier of the date on which all of the securities

registered hereunder have been sold or the registration statement of which this prospectus forms a part has been withdrawn, shall be deemed

incorporated by reference in this prospectus and to be a part of this prospectus from the date of filing of those documents and will be

automatically updated and, to the extent described above, supersede information contained or incorporated by reference in this prospectus

and previously filed documents that are incorporated by reference in this prospectus.

Nothing in this prospectus shall be deemed to

incorporate information furnished but not filed with the SEC pursuant to Item 2.02, 7.01 or 9.01 of Form 8-K.

Upon written or oral request, we will provide

without charge to each person, including any beneficial owner, to whom a copy of the prospectus is delivered a copy of any or all of the

reports or documents incorporated by reference herein (other than exhibits to such documents, unless such exhibits are specifically incorporated

by reference herein). You may request a copy of these filings, at no cost, by writing or telephoning us at the following address: Phio

Pharmaceuticals Corp., 257 Simarano Drive, Suite 101, Marlborough, Massachusetts 01752 Attention: Investor Relations, telephone: (508) 767-3861. We

maintain a website at www.phiopharma.com. You may access our definitive proxy statements on Schedule 14A, annual reports on

Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and periodic amendments to those

reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act with the SEC free of charge at our website as soon

as reasonably practicable after such material is electronically filed with, or furnished to, the SEC. The information contained in, or

that can be accessed through, our website is not incorporated by reference in, and is not part of, this prospectus. We have not authorized

anyone to provide you with any information that differs from that contained in this prospectus. Accordingly, you should not rely on any

information that is not contained in this prospectus. You should not assume that the information in this prospectus is accurate as of

any date other than the date of the front cover of this prospectus.

Phio

Pharmaceuticals Corp.

Up

to 2,640,191 Shares of Common Stock

PROSPECTUS

,

2023

PART

II

Information Not Required

in Prospectus

Item 13. Other Expenses

of Issuance and Distribution

The following table sets forth

the fees and expenses payable in connection with the registration of the Common Stock hereunder. All amounts other than the SEC registration

fees are estimates.

| Item | |

Amount

to be paid |

| SEC registration fees | |

$ | 899.03 | |

| Legal fees and expenses | |

| 50,000.00 | |

| Accounting fees and expenses | |

| 25,000.00 | |

| Printing and miscellaneous expenses | |

| 3,000.00 | |

| Total | |

$ | 78,899.03 | |

Item 14. Indemnification

of Directors and Officers

Section 145 of the Delaware

General Corporation Law (“DGCL”) authorizes a corporation to indemnify its directors and officers against liabilities

arising out of actions, suits and proceedings to which they are made or threatened to be made a party by reason of the fact that they

have served or are currently serving as a director or officer to a corporation. The indemnity may cover expenses (including attorneys’

fees) judgments, fines and amounts paid in settlement actually and reasonably incurred by the director or officer in connection with any

such action, suit or proceeding. Section 145 permits corporations to pay expenses (including attorneys’ fees) incurred by directors

and officers in advance of the final disposition of such action, suit or proceeding. In addition, Section 145 provides that a corporation

has the power to purchase and maintain insurance on behalf of its directors and officers against any liability asserted against them and

incurred by them in their capacity as a director or officer, or arising out of their status as such, whether or not the corporation would

have the power to indemnify the director or officer against such liability under Section 145.

Our amended and restated certificate

of incorporation provides that we will indemnify to the fullest extent authorized or permitted by the DGCL or any other applicable law

as now or hereafter in effect any person made, or threatened to be made, a defendant or witness to any action, suit or proceeding (whether

civil, criminal or otherwise) by reason of the fact that he or she is or was a director of our corporation or by reason of the fact that

such director, at our request, is or was serving any other corporation, partnership, joint venture, trust, employee benefit plan or other

enterprise in any capacity. Our amended and restated certificate of incorporation also provides that no amendment or repeal of the amended

and restated certificate of incorporation will apply to or have any effect on any right to indemnification provided in the amended and

restated certificate of incorporation with respect to any acts or omissions occurring prior to such amendment or repeal.

As permitted by the DGCL,

our bylaws, as amended, provide that we will indemnify to the fullest extent authorized or permitted by applicable law as now or hereafter

in effect any person who was or is made, or is threatened to be made, a party or is otherwise involved in any action, suit or proceeding

(whether civil, criminal, administrative or investigative), by reason of the fact that he or she (or a person for whom he or she is the

legal representative) is or was a director or officer of our corporation, is or was serving at our request as a director, officer, employee,

member, trustee or agent of another corporation or of a partnership, joint venture, trust, nonprofit entity or other enterprise.

Consequently, no director

of our corporation will be personally liable to our corporation or its stockholders for monetary damages for any breach of fiduciary duty

by such a director as a director. However, notwithstanding the preceding sentence, a director will be liable to the extent provided by

the DGCL (1) for any breach of the director’s duty of loyalty to our corporation or its stockholders, (2) for acts or

omissions not in good faith or which involve intentional misconduct or a knowing violation of law, (3) for payments of unlawful dividends

or for unlawful stock repurchases or redemption, or (4) for any transaction from which the director derived an improper personal

benefit.

We have entered into indemnification

agreements with each of our executive officers and directors. These agreements provide that, subject to limited exceptions and among other

things, we will indemnify each of our executive officers and directors to the fullest extent permitted by law and advance expenses to

each indemnitee in connection with any proceeding in which a right to indemnification is available.

We also maintain insurance

on behalf of any person who is or was our director, officer, trustee, employee or agent or serving at our request as a director, officer,

trustee, employee or agent of another corporation, partnership, joint venture, trust, non-profit entity or other enterprise against any

liability asserted against the person and incurred by the person in any such capacity, or arising out of his or her status as such.

Insofar as indemnification

for liabilities arising under the Securities Act may be permitted for directors, officers, or persons who control us, we have been informed

that, in the opinion of the SEC, such indemnification is against public policy as expressed in the Securities Act and is therefore unenforceable.

Item 15. Recent Sales

of Unregistered Securities

In the three years preceding

the filing of this registration statement, we have issued the following securities that were not registered under the Securities Act.

Pursuant to a securities purchase

agreement dated January 21, 2021, we issued 368,405 shares of our Common Stock at a price of $36.84, pre-funded warrants to purchase an

aggregate of 11,672 shares of our Common Stock at a purchase price per pre-funded warrant of $36.828 and warrants to purchase an aggregate

of 285,061 shares of our Common Stock with an exercise price of $36.00 per warrant to certain accredited and institutional investors.

In connection with such offering, we issued warrants to purchase up to 28,509 shares of our Common Stock at an exercise price of $46.05

per share of our Common Stock to our placement agent.

On February 17, 2021, we issued

warrants exercisable for up to 14,044 shares of our Common Stock at an exercise price of $51.30 per share of our Common Stock to our placement

agent in connection with a registered direct offering.

On November 16, 2022, we

entered into a subscription and investment representation agreement with Robert J. Bitterman, our President and Chief Executive Officer,

who is an accredited investor, pursuant to which we agreed to issue and sell one share of our Series D Preferred Stock, par value

$0.0001 per share (the “Series D Preferred Stock”), to the Mr. Bitterman for $1,750 in cash. The sale closed on November

16, 2022. The share of our Series D Preferred Stock was entitled to 17,500,000 votes per share exclusively with respect to

any proposal to amend our amended and restated certificate of incorporation to effect a reverse stock split of our Common Stock (“Reverse

Stock Split”). The terms of our Series D Preferred Stock provided that it would be voted, without action by the holder, on

any such proposal in the same proportion as shares of our Common Stock were voted. The share of our Series D Preferred Stock otherwise

had no voting rights except as otherwise required by the DGCL. Under its terms, the outstanding share of our Series D Preferred

Stock was to be redeemed in whole, but not in part, at any time: (i) if such redemption was approved by our Board of Directors in its

sole discretion or (ii) automatically and effective upon the approval by our stockholders of a Reverse Stock Split. Upon such redemption,

the holder of the share of our Series D Preferred Stock was entitled to receive consideration of $1,750 in cash. The share of our

Series D Preferred Stock was redeemed in whole on January 4, 2023, upon the approval by our stockholders of a Reverse Stock Split.

On April 18, 2023, we entered

into a securities purchase agreement relating to the registered direct offering and sale of 353,983 shares of our Common Stock at a purchase

price of $5.65 per share to certain accredited and institutional investors. In a concurrent private placement, we also issued warrants

with a five and one-half year term to purchase up to 353,983 shares of Common Stock at an exercise price of $5.40 per share and warrants

with an eighteen month term to purchase up to 353,983 shares of Common Stock at an exercise price of $5.40 per share to the same accredited

and institutional investors. In connection with this offering, we also issued warrants to purchase up to 26,549 shares of our Common Stock

at an exercise price of $7.0625 to our placement agent.

On May 31, 2023, we entered

into a securities purchase agreements relating to (a) the registered direct offering and sale of 233,646 shares of our Common Stock at

a purchase price of $4.28 to certain accredited and institutional investors and (b) a concurrent private placement to the same accredited

and institutional investors, in which we issued 72,000 shares of unregistered Common Stock at a purchase price of $4.28 per share, unregistered

pre-funded warrants to purchase up to 628,935 shares of Common Stock at a purchase price of $4.279, unregistered warrants with a five