PetVivo Holdings, Inc. (OTCQB: PETV, PETVW), a leading biomedical

company delivering innovative therapeutic medical devices for

equines and companion animals, reported results for the fiscal

first quarter ended June 30, 2024. All comparisons are to the same

year-ago period unless otherwise noted.

The company will hold a conference call at 5:00

p.m. Eastern time August 14, 2024 to discuss the results (see

dial-in information below).

Fiscal Q1 2025 Financial Highlights

- Revenues increased 6% to $124,000,

driven by the increasing roll out and adoption of the company’s

flagship veterinary medical device, Spryng™ with OsteoCushion™

technology.

- Sales growth primarily driven by

the company’s expanded nationwide distributor network, with sales

to distributors up by 102% to $68,000.

- Gross profit increased 6% to

$111,000.

- Gross margin maintained at

89.5%.

- Net loss improved to $2.0 million

or $(0.11) per basic and diluted share, as compared to a net loss

of $2.9 million or $(0.25) per basic and diluted share in the same

year-ago quarter. This large expense reduction was due to a

strategic corporate restructuring and company-wide cost-reduction

program implemented during the fiscal quarter.

Fiscal Q1 2025 Operational Highlights

- Achieved distribution milestone of

Spryng used by more than 800 veterinary clinics across 50 States,

and have achieved distribution of more than 10,000 syringes of

Spryng.

- Appointed April Boyce to the new

position of vice president of marketing, bringing to PetVivo more

than 25 years of experience in marketing, sales, strategic

partnerships, and global product licensing, including executive

positions at Procter & Gamble (P&G) and Clorox.

- Appointed as vice president of

sales, Bryan Monninger, with more than 20 years of experience in

sales and marketing, including senior executive positions at Hill’s

Pet Nutrition, Novus International and Lintbells, as well as the

Fortune 500 companies, Colgate-Palmolive, ConAgra and Hormel

Foods.

- Exhibited Spryng at the American

College of Veterinary Sports Medicine and Rehabilitation (ACVSMR)

Symposium, demonstrating the research-backed benefits of Spryng to

leading sports medicine and rehabilitation experts in the

veterinary industry.

- Presented Spryng to leading

veterinary pain management experts at the International Veterinary

Academy of Pain Management (IVAPM) Pain Management Forum. Marie

Bartling, DVM, cVMA, CCRT, Veterinary Medical Advisor (Small Animal

Orthopedics and Pain Management) for PetVivo spoke on the topic,

“How Do We Elevate Our Strategy for Managing Osteoarthritis in

Pets.”

Management Commentary

“In the fiscal first quarter of 2025, we

achieved strong financial and operational progress as we continued

to advance the rollout of our flagship product, Spryng with

OsteoCushion™ Technology,” commented PetVivo CEO, John Lai.

“Moreover, our success with expanding the adoption of Spryng by

veterinarians is also improving the health and wellbeing of equine

and companion animals nationwide.

Our revenue growth was driven largely by our

expanding distributor network, with sales of Spryng by distributors

more than doubling over the past year, and this continues to climb

as we maintained our highly favorable gross margins at 89.5%.

Now after accumulating a strong body of

independent research that reveals the benefits of Spryng for

companion animals, we are focused on accelerating the market

adoption of Spryng with a number of key hires. This has included

restructuring and realigning our sales and marketing teams and

strengthening their efforts with two key senior sales and marketing

appointments of individuals with extraordinary records of

achievement in executive roles at Fortune 500 companies.

These individuals include appointing former

Hills Pet Nutrition, Novus International and Colgate-Palmolive

senior sales and marketing executive, Bryan Monninger, to the

position of VP of sales, and appointing former P&G sales and

Clorox marketing executive, April Boyce, as VP of marketing. We

believe our ability to attract such exceptionally capable and

experienced sales and marketing professionals in such a competitive

jobs market is a testament to the strength of our product offering

and potential for strong growth ahead.

Furthermore, as demand continues to grow, we

plan to add additional sales and marketing personnel to support our

growing distribution relationships with market leaders, MWI and

Covetrus, as well as directly to leading veterinary clinics

nationwide.

There are also a few studies currently in

progress. One is being conducted at Colorado State University,

where researchers are evaluating the effectiveness of

intra-articular Spryng injections for managing pain associated with

naturally occurring elbow osteoarthritis in dogs. The accumulation

of data was recently completed, and scientists and statisticians

are currently analyzing the data and preparing the results for

publication. We anticipate seeing a presentation of this study

sometime in the first half of next year.

All studies performed on behalf of the Company

will add to the body of clinical research that now totals more than

five published studies to date. These studies are critical to our

distribution strategy, as large national and international

distributors typically require university or independently

conducted studies before considering a new product for inclusion in

their catalogs.

Such studies also support our go-to-market

strategy by attracting endorsements from Key Opinion Leaders and

increasing our chances of receiving additional invitations to

present at animal health conferences and tradeshows.

Between our strengthening distributor network,

benefit-confirming clinical studies, exceptional new key hires and

more efficient operational structure, we believe we have set the

stage for accelerated growth in revenues and shareholder value for

the remainder of the year and beyond.

By far, we have never been in a better position

to address the enormous opportunities we enjoy in the $5.7 billion

U.S. animal health market, which is expected to double to $11.3

billion by 2030.“

Fiscal 2025 Revenue Outlook

For the fiscal full year of 2025, the company

reiterated its outlook for net revenue of approximately $1.5

million to $2.0 million, which would represent growth of

approximately 50% to 100% over the prior year.

Fiscal Q1 2025 Financial

Summary

Revenues in the fiscal first quarter of 2025

increased 6% to $124,000, largely due to distribution channel

expansion and broader adoption of the company’s lead veterinary

medical device, Spryng with OsteoCushion technology.

Gross profit totaled $111,000 or 89.5% of

revenues as compared to $105,000 or 89.5% of revenues in fiscal

first quarter of 2024.

Operating expenses decreased 28% to $2.2 million

compared to the fiscal first quarter of 2024. The expense reduction

was due to a strategic company-wide cost reduction and

restructuring program that decreased general and administrative

expenses by $530,000 and sales and marketing expenses by $407,000

versus the same year-ago quarter. The decreases were partially

offset by an increase in research and development of $94,000 due to

additional clinical trials.

Net loss improved to $2.0 million or $(0.11) per

basic and diluted share from a net loss of $2.9 million or $(0.25)

per basic and diluted share in the same year-ago quarter.

Cash and cash equivalents totaled $12,000 at

June 30, 2024. Subsequent to the first quarter-end, the company

raised net proceeds of $1.21 million in July 2024, which keeps us

in a good position to execute our growth plan over the next several

months.

Net cash used in operating activities decreased

29% or $633,000 compared to fiscal first quarter of 2024.

For a more detailed overview of the company’s

financials, see PetVivo Holdings’ consolidated statements of

operations and consolidated balance sheet, below.

Conference CallPetVivo

management will host a conference call today to discuss these

results, which will include a question-and-answer period.

Date: Wednesday, August 14, 2024Time: 5:00 p.m. Eastern time

(2:00 p.m. Pacific time)Toll-free dial-in number:

1-253-215-8782Conference ID: 85913290613Passcode: 187583Webcast

(live and replay): here

A replay of the webcast will be available

through the same link following the conference call.

The conference call webcast is also available

via a link in the Investors section of the company’s website at

petvivo.com/investors.

If you require any assistance connecting to the

call, please contact CMA at 1-949-432-7566.

About PetVivo Holdings

PetVivo Holdings, Inc. (OTCQB: PETV, PETVW) is a

biomedical device company focused on the manufacturing,

commercialization and licensing of innovative medical devices and

therapeutics for companion animals. The company is pursuing a

strategy of developing and commercializing human therapies for the

treatment of companion animals in capital and time efficient ways.

A key component of this strategy is an accelerated timeline to

revenues for veterinary medical devices that can enter the market

much earlier than more stringently regulated human pharmaceuticals

and biologics.

PetVivo has developed a robust pipeline of

products for the medical treatment of animals and people, with a

portfolio of 21 patents that protect the company's biomaterials,

products, production processes and methods of use. The company’s

commercially launched flagship product, Spryng™ with OsteoCushion™

Technology, is a veterinarian-administered, intra-articular

injectable designed for the management of lameness and other joint

related afflictions, including osteoarthritis, in cats, dogs and

horses.

For more information about PetVivo and its

revolutionary Spryng with OsteoCushion Technology, email

info1@petvivo.com or visit petvivo.com or sprynghealth.com.

Disclosure Information

PetVivo uses and intends to continue to use its

Investor Relations website as a means of disclosing material

nonpublic information and for complying with its disclosure

obligations under Regulation FD. Accordingly, investors should

monitor the company’s Investor Relations website, in addition to

following the company’s press releases, SEC filings, public

conference calls, presentations and webcasts.

Forward-Looking commercial Statements

The foregoing information regarding PetVivo

Holdings, Inc. (the “Company”) may contain “forward-looking

statements” within the meaning of Section 27A of the Securities Act

of 1933 and Section 21E of the Securities Exchange Act of 1934,

each as amended. Forward-looking statements include all statements

that do not relate solely to historical or current facts, including

without limitation the Company’s proposed development and

commercial timelines, and can be identified by the use of words

such as “may,” “will,” “expect,” “project,” “estimate,”

“anticipate,” “plan,” “believe,” “potential,” “should,” “continue”

or the negative versions of those words or other comparable words.

Forward-looking statements are not guarantees of future actions or

performance. These forward-looking statements are based on

information currently available to the Company and its current

plans or expectations and are subject to a number of uncertainties

and risks that could significantly affect current plans. Risks

concerning the Company’s business are described in detail in the

Company’s Annual Report on Form 10-K for the year ended March 31,

2024 and other periodic and current reports filed with the

Securities and Exchange Commission. The Company is under no

obligation to, and expressly disclaims any such obligation to,

update or alter its forward-looking statements, whether as a result

of new information, future events or otherwise.

Company ContactJohn Lai,

CEOPetVivo Holdings, Inc.Email ContactTel (952) 405-6216

Investor Relations ContactRonald Both or Grant

StudeCMA Investor RelationsTel (949) 432-7566Email contact

PETVIVO HOLDINGS,

INC.CONDENSED CONSOLIDATED BALANCE

SHEETS(UNAUDITED)

| |

|

June 30, 2024(Unaudited) |

|

|

March 31, 2024 |

|

| |

|

|

|

|

|

|

| Assets: |

|

|

|

|

|

|

|

|

| Current Assets |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

12,414 |

|

|

$ |

87,403 |

|

|

Accounts receivable |

|

|

72,026 |

|

|

|

18,669 |

|

|

Inventory, net |

|

|

383,577 |

|

|

|

390,076 |

|

|

Prepaid expenses and other assets |

|

|

412,048 |

|

|

|

545,512 |

|

|

Total Current Assets |

|

|

880,065 |

|

|

|

1,041,660 |

|

| |

|

|

|

|

|

|

|

|

| Property and Equipment,

net |

|

|

805,570 |

|

|

|

821,656 |

|

| |

|

|

|

|

|

|

|

|

| Other Assets: |

|

|

|

|

|

|

|

|

|

Operating lease right-of-use |

|

|

1,147,939 |

|

|

|

1,194,348 |

|

|

Trademark and patents, net |

|

|

27,866 |

|

|

|

30,099 |

|

|

Security deposit |

|

|

29,490 |

|

|

|

27,490 |

|

|

Total Other Assets |

|

|

1,203,295 |

|

|

|

1,251,937 |

|

|

Total Assets |

|

$ |

2,888,930 |

|

|

$ |

3,115,253 |

|

| |

|

|

|

|

|

|

|

|

| Liabilities and Stockholders’

Equity: |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Current Liabilities |

|

|

|

|

|

|

|

|

|

Accounts payable |

|

$ |

646,360 |

|

|

$ |

821,230 |

|

|

Accrued expenses |

|

|

246,378 |

|

|

|

243,030 |

|

|

Operating lease liability – short term |

|

|

190,980 |

|

|

|

190,589 |

|

|

Note payable and accrued interest |

|

|

7,463 |

|

|

|

157,521 |

|

|

Total Current Liabilities |

|

|

1,091,181 |

|

|

|

1,412,370 |

|

| Other Liabilities |

|

|

|

|

|

|

|

|

|

Operating lease liability (net of current portion) |

|

|

956,959 |

|

|

|

1,003,759 |

|

|

Note payable and accrued interest (net of current portion) |

|

|

11,287 |

|

|

|

13,171 |

|

|

Total Other Liabilities |

|

|

968,246 |

|

|

|

1,016,930 |

|

|

Total Liabilities |

|

|

2,059,427 |

|

|

|

2,429,300 |

|

| Commitments and

Contingencies |

|

|

|

|

|

|

|

|

| Stockholders’ Equity: |

|

|

|

|

|

|

|

|

| Preferred Stock, par value

$0.001, 20,000,000 shares authorized, no shares issued and

outstanding at June 30, 2024 and March 31, 2024 |

|

|

- |

|

|

|

- |

|

| Common Stock, par value

$0.001, 250,000,000 shares authorized, 19,904,852 and 17,058,620

issued and outstanding at June 30, 2024 and March 31, 2024,

respectively |

|

|

19,905 |

|

|

|

17,059 |

|

|

Additional Paid-In Capital |

|

|

85,655,985 |

|

|

|

83,468,218 |

|

|

Accumulated Deficit |

|

|

(84,846,387 |

) |

|

|

(82,799,324 |

) |

|

Total Stockholders’ Equity |

|

|

829,503 |

|

|

|

685,953 |

|

|

Total Liabilities and Stockholders’ Equity |

|

$ |

2,888,930 |

|

|

$ |

3,115,253 |

|

PETVIVO HOLDINGS,

INC.CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS(UNAUDITED)

|

|

|

For the Three Months Ended |

|

|

|

|

June 30, 2024 |

|

|

June 30, 2023 |

|

|

|

|

|

|

|

|

|

| Revenues |

|

$ |

123,751 |

|

|

|

$ |

117,183 |

|

| |

|

|

|

|

|

|

|

|

| Cost of

Sales |

|

|

12,994 |

|

|

|

|

12,304 |

|

| |

|

|

|

|

|

|

|

|

|

Gross Profit |

|

|

110,757 |

|

|

|

|

104,879 |

|

| |

|

|

|

|

|

|

|

|

| Operating

Expenses: |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Sales and Marketing |

|

|

534,413 |

|

|

|

|

941,886 |

|

|

General and administrative |

|

|

1,233,261 |

|

|

|

|

1,762,798 |

|

|

Research and development |

|

|

387,515 |

|

|

|

|

293,772 |

|

|

Total Operating Expenses |

|

|

2,155,189 |

|

|

|

|

2,998,456 |

|

| |

|

|

|

|

|

|

|

|

|

Operating Loss |

|

|

(2,044,432 |

) |

|

|

|

(2,893,577 |

) |

| |

|

|

|

|

|

|

|

|

| Other Income

(Expense) |

|

|

|

|

|

|

|

|

|

Interest expense |

|

|

(2,631 |

) |

|

|

|

- |

|

|

Total Other Income (Expense) |

|

|

(2,631 |

) |

|

|

|

- |

|

| |

|

|

|

|

|

|

|

|

|

Loss before taxes |

|

|

(2,047,063 |

) |

|

|

|

(2,893,577 |

) |

| |

|

|

|

|

|

|

|

|

|

Income Tax Provision |

|

|

- |

|

|

|

|

- |

|

| |

|

|

|

|

|

|

|

|

|

Net Loss |

|

$ |

(2,047,063 |

) |

|

|

$ |

(2,893,577 |

) |

| |

|

|

|

|

|

|

|

|

|

Net Loss Per Share: |

|

|

|

|

|

|

|

|

|

Basic and Diluted |

|

$ |

(.11) |

|

|

$ |

(0.25 |

) |

| |

|

|

|

|

|

|

|

|

|

Weighted Average Common Shares Outstanding: |

|

|

|

|

|

|

|

|

|

Basic and Diluted |

|

|

18,683,975 |

|

|

|

|

11,657,035 |

|

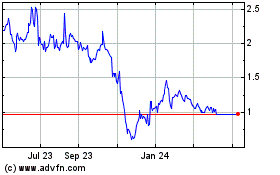

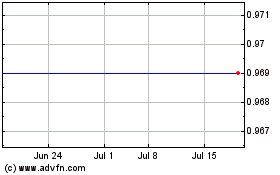

PetVivo (NASDAQ:PETV)

Historical Stock Chart

From Nov 2024 to Dec 2024

PetVivo (NASDAQ:PETV)

Historical Stock Chart

From Dec 2023 to Dec 2024