false

0001512922

0001512922

2024-02-12

2024-02-12

0001512922

us-gaap:CommonStockMember

2024-02-12

2024-02-12

0001512922

PETV:WarrantsMember

2024-02-12

2024-02-12

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

February

12, 2024

Date

of Report (Date of earliest event reported)

PETVIVO

HOLDINGS, INC.

(Exact

name of registrant as specified in its charter)

| Nevada |

|

001-40715 |

|

99-0363559 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

5251

Edina Industrial Blvd.

Edina,

Minnesota |

|

55349 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

(952)

405-6216

Registrant’s

telephone number, including area code

Check

the appropriate box below if the Form 8-K is intended to simultaneously satisfy the filing obligation of the registrant under any of

the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock |

|

PETV |

|

The

Nasdaq Stock Market LLC |

| Warrants |

|

PETVW |

|

The

Nasdaq Stock Market LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item 2.02 Results of Operations and Financial Condition.

On

February 12, 2024, PetVivo Holdings, Inc. (the “Company”) issued a press release announcing financial results for the third

quarter ended December 31, 2023. A copy of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K and incorporated

in this Item 2.02 by reference.

The

information contained under this Item 2.02 in this Current Report on Form 8-K, including Exhibit 99.1, is being furnished and shall not

be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject

to the liabilities of that Section. Furthermore, the information contained under this Item 2.02 in this Current Report on Form 8-K, including

Exhibit 99.1, shall not be deemed to be incorporated by reference into any registration statement or other document filed pursuant to

the Securities Act of 1933, as amended, unless specifically identified therein as being incorporated therein by reference.

Item 9.01 Financial Statements and Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Company has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

| |

PETVIVO

HOLDINGS, INC. |

| |

|

|

| Date:

February 12, 2024 |

By: |

/s/

John Lai |

| |

Name: |

John

Lai |

| |

Title: |

Chief

Executive Officer |

Exhibit

99.1

PetVivo

Reports Third Quarter of Fiscal 2024 Financial Results

Conference

call begins at 4:00 p.m. Central time today

EDINA,

MN (February 12, 2024) – PetVivo Holdings, Inc. (Nasdaq: PETV), an emerging biomedical device company focused on the commercialization

of innovative medical therapeutics for animals, announces financial results for the three months ended December 31, 2023 (“third

quarter of 2024”).

Key

highlights from the third quarter of 2024 and through February 12, 2024, include the following:

| ● | Developed

a multi-distribution sales strategy, including entering into non-exclusive distribution agreements

with Covetrus North America LLC and MW Veterinary Supply Co.; |

| ● | Added

a new Board member, Diane Levitan, who is a licensed veterinarian. |

Subsequent

to December 31, 2023, the Company raised an aggregate of $1.2 million in gross proceeds in a private offering.

Management

Commentary

“We

are excited about the progress the Company has made this past quarter, including the addition of Covetrus North America, LLC. (Covetrus),

to distribute our products beginning in January 2024,” said John Lai, Chief Executive Officer of PetVivo Holdings, Inc. The addition

of the vast distribution resources offered by Covetrus to the distribution resources offered by our other distribution partner, MWI Animal

Health, arms PetVivo with the two largest animal health industry distributors in the United States selling Spryng™ with OsteoCushion™

Technology

Third

Quarter Financial Results

For

The Three Months Ended December 31, 2023 Compared to The Three Months Ended December 31, 2022

Total

Revenues. Revenues were $595,891 and $510,109 for three months ended December 31, 2023 and 2022, respectively. Revenues in the

three months ended December 31, 2023 consist of sales of our Spryng™ product to MWI Veterinary Supply Co. (MWI) of $439,922, Covetrus

of $106,074 and to veterinary clinics in the amount of $49,265. In the three months ended December 31, 2022, our revenues of $510,109

consisted of sales of our Spryng™ product to MWI of $456,502 and to veterinary clinics in the amount of $53,607 of sales to veterinary

clinics.

Cost

of Sales. Cost of sales were $183,087 and $223,687 for the three months ended December 31, 2023 and 2022, respectively. Cost

of sales includes product costs related to the sale of our Spryng™ products and labor and overhead costs.

Operating

Expenses. Operating expenses were $2,546,428 and $2,605,240 for the three months ended December 31, 2023 and 2022, respectively.

Operating expenses consisted of general and administrative, sales and marketing and research and development expenses.

Operating

Loss. As a result of the foregoing, our operating loss was $2,133,624 and $2,318,818 for the three months ended December 31,

2023 and 2022, respectively. The decrease was related to the increase in revenues and lower costs of sales as compared to the prior year.

Other

Income. Other income was $383,776 for the three months ended December 31, 2023 as compared to other income of $7,200 for the

three months ended December 31, 2022. Other income in 2023 consisted primarily of the extinguishment of payables. Other income in 2022

consisted of net interest income.

Net

Loss. Our net loss for the three months ended December 31, 2023 was $1,749,848 or ($0.12) per share as compared to a net loss

of $2,311,618 or ($0.23) per share for the three months ended December 31, 2022. The decrease was related to the extinguishment of payables.

The weighted average number of shares outstanding was 14,271,530 compared to 10,098,658 for the three months ended December 31, 2023

and 2022, respectively.

For

The Nine Months Ended December 31, 2023 Compared to The Nine Months Ended December 31, 2022

Revenues.

Revenues were $920,440 for the nine months ended December 31, 2023 compared to revenues of $791,563 in the nine months ended December

31, 2022. Revenues in the nine months ended December 31, 2023 consisted of sales of our Spryng™ product MWI of $595,891, Covetrus

of $106,074 and to veterinary clinics in the amount of $196,419. In the nine months ended December 31, 2022, our revenues of $791,563

consisted of sales of our Spryng™ product to MWI of $574,766 and to veterinary clinics in the amount of $191,797 of sales to veterinary

clinics.

Cost

of Sales. Cost of sales was $406,270 and $424,866 for the nine months ended December 31, 2023 and 2022, respectively. Cost of

sales includes product costs related to the sale of products and labor and overhead costs.

Operating

Expenses. Operating expenses were $8,485,714 and $6,771,176 for the nine months ended December 31, 2023 and 2022, respectively.

Operating expenses consisted of general and administrative, sales and marketing, and research and development expenses.

Operating

Loss. As a result of the foregoing, our operating loss was $7,971,544 and $6,404,479 for the nine months ended December 31, 2023

and 2022, respectively. The increase in our operating loss, was related to the costs to support the launch of Spryng™, stock issued

for services and stock compensation.

Other

(Expense) Income. Other expense was $333,034 for the nine months ended December 31, 2023 as compared to other income of $15,844

for the nine months ended December 31, 2022, respectively. Other expense in 2023 consisted of a loss on extinguishment of debt of $534,366,

the settlement payment and interest expense partially offset by the extinguishment of payables of $385,874. Other income in 2022 consisted

of interest income.

Net

Loss. Our net loss for the nine months ended December 31, 2023 was $8,304,578 or ($0.64) per share as compared to a net loss

of $6,388,635 or ($0.64) per share for the nine months ended December 31, 2022. The weighted average number of shares outstanding was

12,976,851 compared to 10,047,040 for the nine months ended December 31, 2023 and 2022, respectively.

Balance

Sheet and Inventory

As

of December 31, 2023, our current assets were $1,492,884, including $80,085 in cash and cash equivalents, $518,696 in accounts receivable

and $467,467 in inventory. Our working capital deficit as of December 31, 2023 was $169,236.

Conference

Call and Webcast

A

live webcast of the conference call and related earnings release materials can be accessed on the Company’s Investor Relations

website at:

https://audience.mysequire.com/webinar-view?webinar_id=aabb88e0-5162-4f89-8aaf-69e333b45beb

A

replay of the webcast will be available through the same link following the conference call. Participants can also access the call using

the dial-in details below:

Date:

February 12, 2024

Time:

4:00 p.m. CT (5:00 pm ET)

Dial-in

number: +1 253 205 0468

Conference

ID: 84597743640

Passcode:

192442

About

PetVivo Holdings, Inc.

PetVivo

Holdings, Inc. (the “Company”) is in the business of licensing and commercializing its proprietary medical devices and biomaterials

for the treatment and/or management of afflictions and diseases in animals, initially for dogs and horses. The Company began commercialization

of its lead product Spryng™ with OsteoCushion™ Technology, a veterinarian-administered, intraarticular injection for the

management of lameness and other joint afflictions such as osteoarthritis in dogs and horses in September 2021. The Company has a pipeline

of additional products for the treatment of animals in various stages of development. A portfolio of twenty patents protects the Company’s

biomaterials, products, production processes and methods of use.

Cautionary

Note Regarding Forward-Looking Statements

This

press release contains “forward-looking statements” within the meaning of the U.S. Private Securities Litigation Reform Act

of 1995. Forward-looking statements include all statements that do not relate solely to historical or current facts, including without

limitation the Company’s proposed development and commercial timelines, and can be identified by the use of words such as “may,”

“will,” “expect,” “project,” “estimate,” “anticipate,” “plan,”

“believe,” “potential,” “should,” “continue” or the negative versions of those words

or other comparable words. Forward-looking statements are not guarantees of future actions or performance. These forward-looking statements

are based on information currently available to the Company and its current plans or expectations and are subject to a number of uncertainties

and risks that could significantly affect current plans. Risks concerning the Company’s business are described in detail in the

Company’s Annual Report on Form 10-K for the year ended March 31, 2023, and other periodic and current reports filed with the Securities

and Exchange Commission. The Company is under no obligation to, and expressly disclaims any such obligation to, update or alter its forward-looking

statements, whether as a result of new information, future events, or otherwise.

Disclosure

Information

The

Company uses and intends to continue to use its Investor Relations website as a means of disclosing material nonpublic information, and

for complying with its disclosure obligations under Regulation FD. Accordingly, investors should monitor the Company’s Investor

Relations website, in addition to following the Company’s press releases, SEC filings, public conference calls, presentations,

and webcasts.

Contact:

John

Lai, CEO

PetVivo

Holdings, Inc.

Email:

info1@petvivo.com

(952)

405-6216

(Tables

to follow)

PETVIVO

HOLDINGS, INC.

CONDENSED

CONSOLIDATED BALANCE SHEETS

(UNAUDITED)

| | |

December 31, 2023 (Unaudited) | | |

March 31, 2023 | |

| Assets: | |

| | | |

| | |

| Current Assets | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 80,085 | | |

$ | 475,314 | |

| Accounts receivable | |

| 518,686 | | |

| 86,689 | |

| Inventory | |

| 467,467 | | |

| 370,283 | |

| Prepaid expenses and other assets | |

| 426,646 | | |

| 491,694 | |

| Total Current Assets | |

| 1,492,884 | | |

| 1,423,980 | |

| | |

| | | |

| | |

| Property and Equipment, net | |

| 823,280 | | |

| 630,852 | |

| | |

| | | |

| | |

| Other Assets: | |

| | | |

| | |

| Operating lease right-of-use asset | |

| 1,253,815 | | |

| 317,981 | |

| Patents and trademarks, net | |

| 32,333 | | |

| 38,649 | |

| Security deposit | |

| 27,490 | | |

| 27,490 | |

| Total Other Assets | |

| 1,313,638 | | |

| 384,120 | |

| Total Assets | |

$ | 3,629,802 | | |

$ | 2,438,952 | |

| | |

| | | |

| | |

| Liabilities and Stockholders’ Equity: | |

| | | |

| | |

| Current Liabilities | |

| | | |

| | |

| Accounts payable | |

$ | 1,094,152 | | |

$ | 588,713 | |

| Accrued expenses | |

| 241,959 | | |

| 779,882 | |

| Operating lease liability – short term | |

| 196,263 | | |

| 78,149 | |

| Notes payables and accrued interest | |

| 129,746 | | |

| 6,936 | |

| Total Current Liabilities | |

| 1,662,120 | | |

| 1,453,680 | |

| Non-Current Liabilities | |

| | | |

| | |

| Note payable and accrued interest (net of current portion) | |

| 15,030 | | |

| 20,415 | |

| Operating lease liability (net of current portion) | |

| 1,057,552 | | |

| 239,832 | |

| Total Non-Current Liabilities | |

| 1,072,582 | | |

| 260,247 | |

| Total Liabilities | |

| 2,734,702 | | |

| 1,713,927 | |

| Commitments and Contingencies (see Note 9) | |

| - | | |

| - | |

| Stockholders’ Equity: | |

| | | |

| | |

| Preferred Stock, par value $0.001, 20,000,000 shares authorized, no shares issued and outstanding at December 31, 2023 and March 31, 2023 | |

| - | | |

| - | |

| Common Stock, par value $0.001, 250,000,000 shares authorized, 14,921,209 and 10,950,220 issued and outstanding at December 31, 2023 and March 31, 2023, respectively | |

| 14,921 | | |

| 10,950 | |

| Common Stock to be Issued | |

| - | | |

| 137,500 | |

| Common Stock Receivable | |

| (27,000 | ) | |

| - | |

| Additional Paid-In Capital | |

| 81,055,786 | | |

| 72,420,604 | |

| Accumulated Deficit | |

| (80,148,607 | ) | |

| (71,844,029 | ) |

| Total Stockholders’ Equity | |

| 895,100 | | |

| 725,025 | |

| Total Liabilities and Stockholders’ Equity | |

$ | 3,629,802 | | |

$ | 2,438,952 | |

PETVIVO

HOLDINGS, INC.

CONDENSED

CONSOLIDATED STATEMENTS OF OPERATIONS

(UNAUDITED)

| | |

Three Months Ended December 31, | | |

Nine Months Ended

December 31, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| Revenues | |

$ | 595,891 | | |

$ | 510,109 | | |

$ | 920,440 | | |

$ | 791,563 | |

| | |

| | | |

| | | |

| | | |

| | |

| Cost of Sales | |

| 183,087 | | |

| 223,687 | | |

| 406,270 | | |

| 424,866 | |

| Gross Profit | |

| 412,804 | | |

| 286,422 | | |

| 514,170 | | |

| 366,697 | |

| | |

| | | |

| | | |

| | | |

| | |

| Operating Expenses: | |

| | | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | |

| Sales and Marketing | |

| 1,032,575 | | |

| 1,047,549 | | |

| 3,053,184 | | |

| 2,572,103 | |

| Research and Development | |

| 231,066 | | |

| 248,157 | | |

| 695,156 | | |

| 460,197 | |

| General and Administrative | |

| 1,282,787 | | |

| 1,309,534 | | |

| 4,737,374 | | |

| 3,738,876 | |

| | |

| | | |

| | | |

| | | |

| | |

| Total Operating Expenses | |

| 2,546,428 | | |

| 2,605,240 | | |

| 8,485,714 | | |

| 6,771,176 | |

| | |

| | | |

| | | |

| | | |

| | |

| Operating Loss | |

| (2,133,624 | ) | |

| (2,318,818 | ) | |

| (7,971,544 | ) | |

| (6,404,479 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Other (Expense) Income | |

| | | |

| | | |

| | | |

| | |

| Loss on Extinguishment of Debt | |

| - | | |

| - | | |

| (534,366 | ) | |

| - | |

| Settlement Expense | |

| - | | |

| - | | |

| (180,000 | ) | |

| - | |

| Extinguishment of payables | |

| 385,874 | | |

| - | | |

| 385,874 | | |

| - | |

| Interest (Expense) Income | |

| (2,098 | ) | |

| 7,200 | | |

| (4,542 | ) | |

| 15,844 | |

| | |

| | | |

| | | |

| | | |

| | |

| Total Other Income (Expense) | |

| 383,776 | | |

| 7,200 | | |

| (333,034 | ) | |

| 8,644 | |

| | |

| | | |

| - | | |

| | | |

| - | |

| Loss before taxes | |

| (1,749,848 | ) | |

| (2,311,618 | ) | |

| (8,304,578 | ) | |

| (6,388,635 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Income Tax Provision | |

| - | | |

| - | | |

| - | | |

| - | |

| | |

| | | |

| | | |

| | | |

| | |

| Net Loss | |

$ | (1,749,848 | ) | |

$ | (2,311,618 | ) | |

$ | (8,304,578 | ) | |

$ | (6,388,635 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net Loss Per Share: | |

| | | |

| | | |

| | | |

| | |

| Basic and Diluted | |

$ | (0.12 | ) | |

$ | (0.23 | ) | |

$ | (0.64 | ) | |

$ | (0.64 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted Average Common Shares Outstanding: | |

| | | |

| | | |

| | | |

| | |

| Basic and Diluted | |

| 14,271,530 | | |

| 10,098,658 | | |

| 12,976,851 | | |

| 10,047,040 | |

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=PETV_WarrantsMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

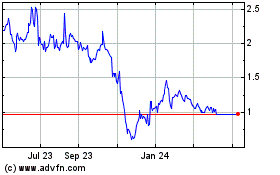

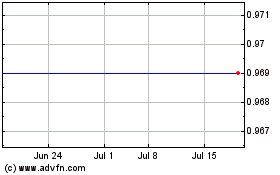

PetVivo (NASDAQ:PETV)

Historical Stock Chart

From Nov 2024 to Dec 2024

PetVivo (NASDAQ:PETV)

Historical Stock Chart

From Dec 2023 to Dec 2024