0001512922

false

0001512922

2023-09-08

2023-09-08

0001512922

us-gaap:CommonStockMember

2023-09-08

2023-09-08

0001512922

PETV:WarrantsMember

2023-09-08

2023-09-08

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

September

8, 2023

Date

of Report (Date of earliest event reported)

PETVIVO

HOLDINGS, INC.

(Exact

name of registrant as specified in its charter)

| Nevada |

|

001-40715 |

|

99-0363559 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

5251

Edina Industrial Blvd.

Edina,

Minnesota |

|

55349 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

(952)

405-6216

Registrant’s

telephone number, including area code

Check

the appropriate box below if the Form 8-K is intended to simultaneously satisfy the filing obligation of the registrant under any of

the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock |

|

PETV |

|

The

Nasdaq Stock Market LLC |

| Warrants |

|

PETVW |

|

The

Nasdaq Stock Market LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item

1.01 Entry into a Material Definitive Agreement.

On

September 8, 2023, PetVivo Holdings, Inc., a Nevada Corporation (“Company”) executed a Confidential Settlement and

Mutual Release Agreement having an effective date of March 14, 2022 (“Settlement Agreement”), with the Company’s

former Chief Technology Officer and former director, Dr. David B. Masters (“Masters”).

Under

the Settlement Agreement, Masters agreed to release any and all claims that he had, has, or may have against the Company arising out

of any event occurring on or before the effective date of the Settlement Agreement, including claims that the Company owed him money

for work that he had performed for the Company. Masters further agreed that he would continue to comply with his surviving obligations

under the Consulting Agreement entered between the Company and Masters and having an effective date of September 1, 2020 (“Consulting

Agreement”), including those obligations under Paragraph 6 thereof, which pertain to maintaining confidentiality of certain

proprietary information and trade secrets of the Company.

Masters

also agreed that for a period of three years beginning on the Effective Date of the Settlement Agreement and ending on March 14, 2025,

Masters would notify the Company in writing of the name of any future employer, person, or business (collectively, the “New

Business Partner”) to whom Masters provides services if such information is not permanently listed on Masters’ LinkedIn

public profile. In the event that confidentiality provisions unilaterally imposed by such New Business Partner prohibit Masters from

providing the required disclosure to the Company, Masters agrees to inform the New Business Partner in writing that he was a party to

the Consulting Agreement and the Settlement Agreement, both of which are a matter of public record. Masters agrees to maintain a copy

of the written notice signed by the New Business Partner which documents that the New Business Partner received the notice and is signed

by an executive at the New Business Partner. Master agrees to provide a copy of this notice to the Company upon its request. The requirements

described in this paragraph shall not apply to Masters’ provision of services outside of the veterinary, biomedical, or medical

technology fields if such services do not directly or indirectly relate to or involve protein biomaterials, protein technology or the

Company’s trade secrets or other proprietary information.

In

exchange for Masters’ promises and other consideration under the Settlement Agreement, the Company agreed to pay Masters $180,000

within thirty days of execution of the Settlement Agreement. The Company also agreed to release Masters from any and all claims that

it had, has, or may have against Masters arising out of any event occurring on or before the effective date of the Settlement Agreement

(except it does not release Masters from any claims of the Company for breach by Masters of his confidentiality or trade

secret obligations that the Company could have not discovered through reasonable due diligence, even if such claims related to any act,

omission or event that occurred prior to the effective date of Settlement Agreement).

The

descriptions of the Settlement Agreement and the Consulting Agreement contained herein do not purport to be complete and are qualified

in their entirety by reference to the full texts of the Settlement Agreement and the Consulting Agreement, which are filed hereto as

Exhibits 10.1 and 10.2, respectively, and are incorporated herein by reference.

Item

9.01 Financial Statements and Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Company has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

| |

PETVIVO

HOLDINGS, INC. |

| |

|

|

| Date:

September 13, 2023 |

By: |

/s/

John Lai |

| |

|

John

Lai, Chief Executive Officer |

Exhibit 10.1

CONFIDENTIAL

SETTLEMENT AGREEMENT AND MUTUAL RELEASE

This

Confidential Settlement Agreement and Mutual Release (“Agreement”) is entered into the last date signed below and

is effective as of March 14, 2022 (the “Effective Date”) by and between PetVivo Holdings, Inc., a Nevada corporation,

and its wholly-owned subsidiaries (collectively referred to herein as the “Company” or “PetVivo”)

and Dr. David B. Masters (“Masters”). The Company and Masters shall be referred to herein as a “Party”

or the “Parties’’.

WHEREAS

PetVivo is a veterinary biotech and biomedical device company primarily engaged in the business of translating or adapting human

biotech and medical technology into products for commercial sale in the veterinary market to help companion animals such as dogs and

horses suffering from arthritis and other afflictions;

WHEREAS

Masters is an expert in protein biomaterials and technology across many platforms and was the founder of Gel-Del Technologies, Inc.

(“Gel-Del”) and silent co-founder to PetVivo;

WHEREAS

Masters led the development of Gel-Del’s innovative proprietary biomaterials which simulate a body’s cellular tissue

and thus can be readily and effectively utilized to manufacture implantable therapeutic medical devices;

WHEREAS

the Company acquired Gel-Del, including all of Gel-Del’s technology and related patents and other intellectual property (IP)

and production techniques;

WHEREAS

Masters was the Company’s President & Chief Technical Officer from 2015 until December 1, 2017, at which time the Company

owed Masters more than $450,000 in unpaid salary, and Masters agreed to end his employment contract with the Company and convert a large

portion of the money the Company owed to him to stock in the Company;

WHEREAS

Masters served on the Company’s Board of Directors from 2015 until March 4, 2022;

WHEREAS

Masters provided consulting services to the Company pursuant to a Consulting Agreement dated September 1, 2020, with an original

term commencing on September 1, 2020 and ending on December 31, 2020, which term was extended by the Parties on January 20, 2021 to end

on February 28, 2021 (the “Consulting Agreement”);

WHEREAS

Masters contends that the Company (1) failed to pay Masters the full amount owed for his work performed under the Consulting Agreement

during its term and for Consulting Agreement work performed at the Company’s request after the Consulting Agreement’s purported

end date of February 28, 2021; (2) failed to pay Masters $300/hour as promised, for additional work outside the Consulting Agreement,

which was provided at the Company’s request from March 1, 2021 through approximately September of 2021; and (3) failed to provide

Masters with an employment agreement upon completion of the Company’s S-1 public financing and NASDAQ uplift in August of 2021;

WHEREAS

PetVivo contends that Masters’ conduct in connection with the merger between the Company and Gel-Del and his services as a

director breached his contractual obligations and fiduciary duties to the Company;

WHEREAS

each Party disputes the contentions made by the other Party;

WHEREAS

the Parties wish to avoid litigation and the accompanying expense, delay, and uncertainty, without admitting to any of the claims

threatened by the other Party; and

WHEREAS

the Parties enter into this Agreement to resolve their disputes and to allow both Parties to move forward in their future commercial

endeavors.

NOW,

THEREFORE, IT IS AGREED AS FOLLOWS:

In

consideration of the mutual promises, covenants, representations, and other good and valuable consideration exchanged herein, the sufficiency

of which is hereby acknowledged, the Parties agree that the Company

will pay Masters the sum of $180,000.00 (the “Settlement Payment”) within thirty days of the execution of this Agreement.

| 2. |

Restrictions on Warrants and Stock and Cashless Exercise

of Certain Warrants |

A.

The Company has set forth in Exhibit A the stock that Masters owns (the “Stock”) based on the

Certificate List provided by Equity Stock Transfer, LLC. The Company has set forth in Exhibit B the warrants issued to

Masters (the “Warrants”). The Company believes based on its legal analysis that the Stock and the Warrants are or

were restricted by the Securities Act of 1933, as amended (the “Securities Act”), as set forth in Exhibit

A and Exhibit B.

B.

The Stock and the Warrants can be resold pursuant to the requirements of Rule 144 of the Securities Act and other applicable

exemptions. PetVivo states that Masters was no longer a PetVivo director as of March 5, 2022, and is not currently an

“affiliate” as that term is defined under the Securities Act of 1933, as amended because he has not directly or

indirectly been in a relationship of control with the Company since March 5, 2022. Masters will remain a non-affiliate in the future

based on the assumption that he remains not an officer, director, or 10% beneficial owner. Based on this expectation, and on the

further assumptions that Masters’ resales comply with the applicable securities law exemption requirements and other laws,

including, without limitation, the insider trading laws and any Section 16 filing requirements for post-sale transactions, the dates

that Masters’ Stock and Warrants were eligible to have the Rule 144 legends removed are set forth by PetVivo in Exhibit

A and Exhibit B.

C.

The Company provided Masters with Exhibit C, which is a form opinion letter that the Company believes substantially

conforms with Rule 144 of the Securities Act. Based on this information, and the information in Exhibit A and Exhibit

B, Masters’ counsel has provided the opinion letter set forth in Exhibit D with respect to the Stock and

the Warrants that are currently eligible to have the Rule 144 legends removed.

D.

By virtue of its execution of this Agreement, the Company hereby approves the opinion letter set forth in Exhibit D

and agrees it can be submitted to the transfer agent immediately upon the Company’s execution of this Agreement. The Company

further agrees to provide all reasonably necessary cooperation to Masters and the Company’s transfer agent following the

execution of this Agreement to ensure that the transfer agent timely lifts all restrictions on Masters’ Stock and Warrants and

until such time that Masters is issued new registered and unrestricted shares and certificates for all Stock and Warrants identified

in Exhibit A and Exhibit B. With respect to such cooperation, the Company agrees to use reasonable best

efforts to act within seventy-two (72) hours following a written demand from Masters or his counsel to act upon the request to

remove the restriction. The Company’s agreements in this paragraph are conditioned on no unforeseen events arising in the

future that would make the Company’s agreements in this paragraph inconsistent with Rule 144 of the Securities Act. However,

the Company’s obligation to provide necessary and timely cooperation to Masters and its transfer agent will remain and survive

execution of this Agreement.

| 3. |

Conversion of Warrants |

A. With

respect to the subset of Warrants that have a cashless exercise provision, PET- 93, PET- I 02, PET-116, and PET-148, the Company shall

accept Masters’ exercise of these Warrants, on a cashless basis, within seventy-two (72) hours of Masters providing PetVivo an

executed Notice of Exercise in the form attached as Exhibit E. Delivery of this notice will be made pursuant to Paragraph

19 of this Agreement and effective at the time of delivery. The Company agrees to issue Masters common stock shares for these Warrants

in accordance with the terms of each Warrant. The Company further agrees to facilitate the issuance of registered, unrestricted shares

for these Warrants without a Rule 144 restrictive legend as soon as practicable. These Warrants may be exercised on multiple occasions

as directed by Masters until they expire, and Masters shall pay all costs to exercise.

B. With

respect to the subset of Warrants that do not have a cashless exercise provision, PET-149, the Company will provide reasonable cooperation

to Masters and the transfer agent in whatever means necessary with

respect to the issuance of shares without a Rule 144 restrictive legend after Masters provides notice of exercise and pays the Company

cash to exercise the warrants and fulfills the other requirements of Rule 144 as delineated herein. These non-cashless Warrants may be

exercised on multiple occasions as directed by Masters until they expire, and Masters shall pay all costs to exercise. To facilitate

the above, with respect to PET-149, the Company hereby approves the opinion letter set forth in Exhibit F, provided there

is compliance with all regulatory requirements imposed on the Company and Masters, and agrees it can be submitted to the transfer agent

following a six (6) month holding period after exercise (when Masters pays cash to exercise), provided that the Company is a reporting

company under Rule 144, is current in its SEC filing requirements, and Masters is a non-affiliate of the Company (and has been so for

at least three months prior to the sales date) at the time of the request to remove the legend.

C. The

Company agrees to request that the Transfer Agent deliver registered and unrestricted stock certificates to Masters or his designated

brokerage at the expense of Masters for: (1) all Masters’ Stock identified in Exhibit A within three business days

of the opinion letter (Exhibit D) being sent to the Transfer Agent; (2) Warrants being converted to stock under Section

3(A) above within three business days of exercise; and (3) Warrants being converted to stock under Section 3(B) above within three business

days of Exhibit F being sent to the Transfer Agent.

D. For

the avoidance of doubt, the Parties understand and agree that one purpose of this Agreement is for Masters to obtain shares of PetVivo

common stock and have the Rule 144 restrictive legend removed from the certificates, when legally permissible, for all Stock identified

in Exhibit A, and all Warrants (when exercised) identified in Exhibit B, as soon as practicable. As such,

the Company will provide reasonable cooperation to Masters and the transfer agent for as long as necessary to accomplish: (1) Masters’

exercise of the Warrants identified in Paragraphs 3(A) and (B); and (2) the issuance to Masters of shares and certificates for all Stock

identified in Exhibit A and all Warrants identified in Exhibit B after exercise.

| 4. |

Status of Consulting Agreement |

The

Parties agree that the term of the Consulting Agreement was September 1, 2020 to February 28, 2021. The Parties further agree that any

obligations of Masters under the Consulting Agreement that survive its expiration, including his obligations under Consulting Agreement

Paragraph 6, remain in place per the original terms of the Consulting Agreement. The Parties reserve all rights as to the meaning, validity,

and enforceability of any terms of the Consulting Agreement that survive its expiration, including Consulting Agreement Paragraph 6 and

its definition of “Confidential Information.”

The

Parties agree that there is not a noncompetition covenant contained in the Consulting Agreement. The Parties further agree that any noncompetition

covenants contained in any other agreements between the Parties have now expired.

| 6. |

Notification Regarding Future Services |

For

a period of 3 years beginning on the Effective Date and ending on March 14, 2025, Masters agrees to notify the Company in writing, pursuant

to Paragraph 19, of the name of any future employer, person, or business (collectively, the “New Business Partner”)

to whom Masters provides services if such information is not permanently listed on Masters’ LinkedIn public profile. In the event

that confidentiality provisions unilaterally imposed by such New Business Partner prohibit Masters from providing the required disclosure

to the Company, Masters agrees to inform the New Business Partner in writing that he was a party to the Consulting Agreement and this

Agreement, both of which are a matter of public record. Masters agrees to maintain a copy of the written notice signed by the New Business

Partner which documents that the New Business Partner received the notice and is signed by an executive at the New Business Partner Masters

agrees to provide a copy of this notice to the Company upon its request. This Paragraph 6 shall not apply to Masters’ provision

of services outside of the veterinary, biomedical, biotech, or medical technology fields if such services do not directly or indirectly

relate to or involve protein biomaterials, protein technology, or the Company’s trade secrets or other proprietary information.

| 7. |

Masters’ Release of the Company |

Masters,

on his own behalf, and on behalf of Masters’ affiliates and their respective successors and permitted assigns, does hereby irrevocably,

unconditionally, voluntarily, fully, and completely forever release and discharge each of the Company, the Company’s affiliates

and each of their respective past, present and future directors, officers, employees, agents, successors, assigns and shareholders (collectively,

the “Company Released Parties”), from and against any and all claims, demands, damages, judgments, causes of action

and liabilities of any nature whatsoever, whether in law, equity or otherwise, direct or indirect, fixed or contingent, foreseeable or

unforeseeable, liquidated or unliquidated, known or unknown, matured or unmatured, absolute or contingent, determined or determinable,

that Masters ever had, now has, or may hereafter have or acquire against the Company Released Parties (collectively, “Claims”)

arising out of or relating in any way to any act, omission, matter, cause or event occurring on or prior to the Effective Date, March

14, 2022, including, but not limited to, any of the foregoing arising out of or related in any way to (a) the ownership, operation, business,

or financial condition of Company or its business (b) any contract, agreement, or other arrangement, whether verbal or written, entered

into or established between Masters (or an affiliate of Masters) and the Company on or prior to March 14, 2022, or (c) any services Masters

provided to the Company.

| 8. |

The Company’s Release of Masters |

A. Except

as set forth in Paragraph 8(B) below, the Company, the Company’s affiliates, and each of their respective past, present, and future

directors, officers, employees, agents, successors, assigns, and shareholders does hereby irrevocably, unconditionally, voluntarily,

fully, and completely forever release and discharge each of Masters, Masters’ affiliates, and their respective successors and permitted

assigns (collectively, the “Masters Released Parties”), from and against any and all claims, 7 demands, damages, judgments,

causes of action and liabilities of any nature whatsoever, whether in law, equity or otherwise, direct or indirect, fixed or contingent,

foreseeable or unforeseeable, liquidated or unliquidated, known or unknown, matured or unmatured, absolute or contingent, determined

or determinable, that the Company ever had, now has, or may hereafter have or acquire against the Masters Released Parties (collectively,

“Claims”) arising out of or relating in any way to any act, omission, matter, cause or event occurring on or prior

to the Effective Date, March 14, 2022, including, but not limited to, any of the foregoing arising out of or related in any way to (a)

the ownership, operation, business, or financial condition of Company or its business (b) any contract, agreement, or other arrangement,

whether verbal or written, entered into or established between Masters (or an affiliate of Masters) and the Company on or prior to March

14, 2022, or (c) any services Masters provided to the Company.

B. The

release set forth in Paragraph 8(A) above is not intended to release, and does not release, any claims of the Company for breach by Masters

of his confidentiality or trade secret obligations, if any, that the Company could not have discovered through reasonable due diligence,

even if such claims arise out of or relate in any way to any act, omission, matter, cause or event that occurred on or prior to the Effective

Date, March 14, 2022. As of the date the Company executes this Agreement and makes the Settlement Payment, the Company represents that

it is unaware of any such claims or potential claims.

The

Parties agree that they each shall bear their own costs, expenses, and attorneys’ fees with respect to the mediation and this Agreement.

A. The

Parties agree that neither they nor their attorneys nor representatives shall reveal to anyone any of the terms of this Agreement, except:

(a) to the extent that such disclosure may be required by the operation of law, regulation, subpoena, or court order; (b) to the officers,

directors, 8 accountants, auditors, lenders, insurance brokers, insurers, and reinsurers of a Party; (c) to the legal counsel of any

Party; (d) to members of Masters’ immediate family; (e) Masters’ significant other, Wendy M. Johnson; (f) silent co-founders

of Gel-Del, Linda K. Hansen and Harlan Jacobs; (g) by any Party in a proceeding to enforce the terms of this Agreement (in which case

the party seeking such enforcement will have such proceeding filed and proceed under seal unless and until otherwise ordered by the relevant

tribunal or court); or (h) to Masters’ potential or future employer or New Business Partner. Masters acknowledges and understands

that the Company will disclose a summary of the Agreement’s terms on Form 8-K and a copy of this Agreement will be attached to

the Form 8-K as an exhibit.

The

Company agrees that its Form 8-K summary of this Agreement’s terms will contain the following statement:

After

PetVivo made the decision that Dr. Masters’ services were no longer necessary, Dr. Masters agreed to part ways with PetVivo on

amicable terms. PetVivo thanks Dr. Masters for his contributions to our company and wishes Dr. Masters the best in his personal endeavors

and in his profession.

| 11. |

No Admission of Liability |

Each

Party represents and agrees that this Agreement is a compromise of disputed claims and that the entering into this Agreement, the terms

of this Agreement, and the performance of any obligation hereunder, shall not be regarded or deemed an admission of any liability or

wrongdoing, which liability and wrongdoing is expressly denied.

This

Agreement contains the complete agreement between the Parties and supersedes all prior agreements, orders, and understandings between

the Parties, except as specifically set forth herein. This Agreement shall be binding upon, inure to the benefit of, and be enforceable

by the Parties and their respective heirs, successors, agents, employees, insurers, assigns, and legal representatives.

This

Agreement may only be amended or modified in writing signed by the party against whom enforcement of such amendment is sought.

The

provisions of this Agreement are severable. If any portion, provision, or part of this Agreement is held, determined, or adjudicated

to be invalid, unenforceable, or void for any reason whatsoever, each such portion, provision, or part shall be severed from the remaining

portions, provisions, or parts of this Agreement and shall not affect the validity or enforceability of any remaining portions, provisions,

or parts.

The

Parties agree that this Agreement shall be construed and interpreted under the laws of the State of Minnesota, excluding any choice of

law rules that may direct the application of the laws of another jurisdiction. The Parties agree that the exclusive jurisdiction for

any dispute arising out of or relating to this Agreement is the state and federal courts of the State of Minnesota. The Parties consent

to personal jurisdiction in the State of Minnesota for any dispute arising out of or relating to this Agreement.

This

Agreement shall not be construed more strictly against one Party than the other merely by virtue of the fact that it has been prepared

initially by counsel for one of the Parties, it being recognized that both Parties and their respective counsel have had a full and fair

opportunity to negotiate and review the terms and provisions of this Agreement and to contribute to its substance and form.

| 17. |

Warrant of Authority, Duty of Cooperation |

Any

individual signing this Agreement on behalf of any entity warrants and guarantees actual authority to bind such entity. Each Party agrees

to do all things reasonably necessary to in good faith fulfill the terms of this Agreement.

This

Agreement may be executed in counterparts, each of which when so executed and delivered shall be deemed an original, but all of which

together shall constitute one and the same document. An executed signature page sent via email shall be sufficient to evidence a Party’s

intention to be bound by the terms of this Agreement.

Any

notice required or permitted in this Agreement shall be in writing and shall be given by United States registered or certified mail,

postage prepaid; or transmitted by email; or deposited cost paid with a nationally recognized, reputable, overnight courier, properly

addressed and delivered to the party as listed below:

If

to Masters:

Dr.

David B. Masters

Copy

to:

Ballard

Spahr LLP

2000

IDS Center, 80 South 8th Street

Minneapolis,

MN 55402-2119

Direct

612.371.3259

Fax

612.371.3207

Mobile

612.616.3246

byej@ballardspahr.com

If

to PetVivo:

Robert

J. Folkes, Chief Financial Officer

5151

Edina Industrial Blvd., Suite 575

Minneapolis,

MN 55439

bfolkes@petvivo.com

Copy

to:

Fox

Rothschild LLP

Attn:

Laura Holm

Phillips

Point, West Tower, 777 S Flagler Dr# 1700

West

Palm Beach, FL 33401

Notices,

demands, and requests by the parties in the manner stated above shall be deemed sufficiently served or given for all purposes hereunder

two (2) days after the date such notice, demand, or request is postmarked if mailed, on the date of delivery if sent by confirmed email

transmission or overnight courier. Either party may change the place to which notice is to be sent by serving written notice thereof

upon the other in accordance with this Paragraph 19.

[The

remainder of this page intentionally left blank]

Executed

by:

| PETVIVO HOLDINGS, INC. |

|

| |

|

|

| By: |

/s/ Robert J. Folkes |

|

| |

Robert

J. Folkes |

|

| Its: |

Chief

Financial Officer |

|

| Date:

|

September 8, 2023 |

|

| |

|

|

| By:

| /s/ David B. Masters |

|

| |

David

B. Masters |

|

| Date: |

August

25, 2023 |

|

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=PETV_WarrantsMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

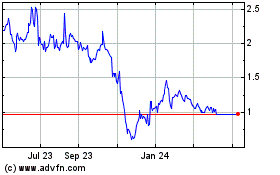

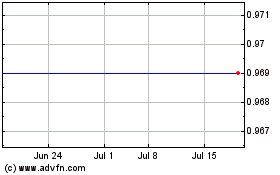

PetVivo (NASDAQ:PETV)

Historical Stock Chart

From Nov 2024 to Dec 2024

PetVivo (NASDAQ:PETV)

Historical Stock Chart

From Dec 2023 to Dec 2024