0001512922

false

0001512922

2023-08-11

2023-08-11

0001512922

us-gaap:CommonStockMember

2023-08-11

2023-08-11

0001512922

PETV:WarrantsMember

2023-08-11

2023-08-11

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

August

11, 2023

Date

of Report (Date of earliest event reported)

PETVIVO

HOLDINGS, INC.

(Exact

name of registrant as specified in its charter)

| Nevada |

|

001-40715 |

|

99-0363559 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

5251

Edina Industrial Blvd.

Edina,

Minnesota |

|

55349 |

| (Address of principal executive

offices) |

|

(Zip Code) |

(952)

405-6216

Registrant’s

telephone number, including area code

Check

the appropriate box below if the Form 8-K is intended to simultaneously satisfy the filing obligation of the registrant under any of

the following provisions:

| ☐ |

Written communications

pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting material pursuant

to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common Stock |

|

PETV |

|

The Nasdaq Stock Market LLC |

| Warrants |

|

PETVW |

|

The Nasdaq Stock Market LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

| Item

1.01 | Entry

into a Material Definitive Agreement |

On

August 11, 2023, PetVivo Holdings, Inc. (the “Company”) entered into Convertible Debenture Conversion Agreements (“Conversion

Agreements”) with three debenture holders (“Debenture Holders”) who advanced an aggregate of $550,000 to the Company

pursuant to convertible debentures (“Convertible Debentures”) dated July 26, 2023. The Company previously disclosed the issuance,

sale, and terms of these Convertible Debentures in its Form 8-K dated July 27, 2023 filed with the Securities and Exchange Commission

on July 31, 2023.

Pursuant

to the Conversion Agreements, each Debenture Holder agreed to voluntarily and immediately convert the outstanding balance on his Convertible

Debenture into shares of the Company’s common stock prior to January 26, 2024, the maturity date of the Convertible Debentures,

provided that the Company (i) adjust the original conversion rate to one share of the Company’s common stock for each $1.50 of

principal (reduced from $1.60 in the Convertible Debenture) and pay an amount equal to six months of interest (the “New Conversion

Rate”) and (ii) grant warrants to the Debenture Holders providing each Debenture Holder with the right to purchase the number of

shares of the Company’s common stock issued to the Debenture Holder in the conversion.

Pursuant

to the Conversion Agreement effective as of August 11, 2023, the Debenture Holders converted $550,000 in Convertible Debenture and accrued

interest of $27,500 on the Convertible Debentures, into (i) 385,000 shares of the Company’s common stock restricted under Rule

144 of the Securities Act of 1933, as amended and (ii) warrants (“Warrants”) to purchase an aggregate of 385,000 shares of

the Company’s common stock. The Warrants are exercisable any time on or after February 7, 2024 and prior to August 10, 2026 at

an exercise price of Two Dollars ($2.00) per share.

The

foregoing description of the Conversion Agreement and the Warrants is not complete and is qualified in its entirety by reference to the

full text of such agreement, a copy of which is filed herewith as Exhibits 10.1 and 4.1 to this Current Report on Form 8-K and is incorporated

herein by reference.

| Item 9.01 |

Financial Statements and Exhibits. |

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Company has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

| |

PETVIVO HOLDINGS, INC. |

| |

|

|

| Date: August 11, 2023 |

By: |

/s/ John

Lai |

| |

Name: |

John Lai |

| |

Title: |

Chief Executive Officer |

Exhibit

4.1

WARRANT

To

Purchase

___

Shares

of Common Stock

of

PETVIVO

HOLDINGS, INC.

August

11, 2023

THIS

WARRANT AND THE SECURITIES ISSUABLE UPON EXERCISE OR CONVERSION OF THIS WARRANT HAVE NOT BEEN REGISTERED UNDER THE UNITED STATES SECURITIES

ACT OF 1933, AS AMENDED (THE “ACT”), OR UNDER THE SECURITIES LAWS OF ANY STATES OF THE UNITED STATES. THESE SECURITIES ARE

SUBJECT TO RESTRICTIONS ON TRANSFERABILITY AND RESALE AND MAY NOT BE TRANSFERRED OR RESOLD EXCEPT PURSUANT TO REGISTRATION UNDER THE

ACT OR PURSUANT TO AN EXEMPTION THEREFROM, AND EXCEPT AS PERMITTED UNDER APPLICABLE STATE SECURITIES LAWS. INVESTORS SHOULD BE AWARE

THAT THEY MAY BE REQUIRED TO BEAR THE FINANCIAL RISKS OF THIS INVESTMENT FOR AN INDEFINITE PERIOD OF TIME. THE ISSUER OF THESE SECURITIES

MAY REQUIRE AN OPINION OF COUNSEL IN FORM AND SUBSTANCE SATISFACTORY TO THE ISSUER TO THE EFFECT THAT ANY PROPOSED TRANSFER OR RESALE

IS IN COMPLIANCE WITH THE ACT AND ANY APPLICABLE STATE SECURITIES LAWS.

PetVivo

Holdings, Inc., a Nevada corporation (the “Company”), for value received, hereby certifies that (the “Holder”),

or assigns, is entitled, subject to the terms set forth below, to purchase from the Company _____ shares of the Company’s Common

Stock, $0.001 par value (the “Common Stock”), subject to adjustment as provided by the terms of this Warrant, at an

exercise price per share of $2.00 per share (the “Exercise Price”). The shares issuable upon exercise or conversion

of this Warrant, as adjusted from time to time pursuant to the provisions of this Warrant, are hereinafter referred to as the “Warrant

Shares.”

This

Warrant is further subject to the following provisions, terms, and conditions:

| |

1. |

Term.

This Warrant may be exercised by the Holder, in whole or in part, at any time beginning on or after February 7, 2024, on or after

5:00 P.M. Central Standard Time if exercised pursuant to the terms of Section 2 or 3 hereof. These exercise rights shall continue

until expiration on August 10, 2026, at which time this Warrant shall be null and void. |

| |

2. |

Manner

of Exercise. This Warrant may be exercised by the Holder, in whole or in part (but not as to any fractional shares of Common

Stock), by surrendering this Warrant, with the Exercise Form attached hereto as Exhibit A filled in and duly executed by such Holder

or by such Holder’s duly authorized attorney, to the Company at its principal office accompanied by payment of the Exercise

Price in the amount of the Exercise Price multiplied by the number of shares as to which the Warrant is being exercised. The Exercise

Price may be paid in the form of a cashier’s check, certified check, or wire transfer of funds. |

| |

3. |

Effective

Date of Exercise or Conversion. Each exercise or conversion of this Warrant shall be deemed effective as of the close of business

on the day on which this Warrant is surrendered to the Company as provided in Section 2 above. At such time, the person or persons

in whose name or names any certificates for Warrant Shares shall be issuable upon such exercise or conversion shall be deemed to

have become the holder or holders of record of the Warrant Shares represented by such certificates. Within ten (10) days after the

exercise or conversion of this Warrant in full or in part, the Company will, at its expense, cause to be issued in the name of and

delivered to the Holder or such other person as the Holder may (upon payment by such Holder of any applicable transfer taxes) direct:

(i) a certificate or certificates for the number of full Warrant Shares to which such Holder is entitled upon such exercise or conversion,

and (ii) unless this Warrant has expired, a new Warrant or Warrants (dated the date hereof and in a form identical hereto) representing

the right to purchase the remaining number of shares of Common Stock, if any, with respect to which this Warrant has not then been

exercised or converted. |

| |

4. |

Adjustments

to Exercise Price. The above provisions are, however, subject to the following: |

| |

(i) |

If

the Company shall at any time after the date of this Warrant subdivide or combine the outstanding shares of its capital stock or

declare a dividend payable in capital stock, then the number of shares of Common Stock for which this Warrant may be exercised immediately

prior to the subdivision, combination or record date for such dividend payable in capital stock shall forthwith be proportionately

decreased, in the case of combination, or increased, in the case of subdivision or dividend payable in capital stock. |

| |

(ii) |

If

the Company shall at any time after the date of this Warrant subdivide or combine the outstanding shares of capital stock or declare

a dividend payable in capital stock or other securities, the Exercise Price in effect immediately prior to the subdivision, combination,

or record date for such dividend payable in capital stock or other securities shall forthwith be proportionately increased, in the

case of combination, or decreased, in the case of subdivision or dividend payable in capital stock or other securities. |

| |

(iii) |

If

any capital reorganization or reclassification of the capital stock of the Company, or share exchange, combination, consolidation

or merger of the Company with another corporation, or the sale of all or substantially all of its assets to another corporation shall

be effected in such a way that holders of capital stock shall be entitled to receive stock, securities or assets with respect to

or in exchange for capital stock, then, as a condition of such reorganization, reclassification, share exchange, combination, consolidation,

merger or sale, lawful and adequate provision shall be made whereby the Holder shall thereafter have the right to receive upon exercise

of this Warrant, upon the basis and upon the terms and conditions specified in this Warrant and in lieu of the shares of the Common

Stock of the Company into which this Warrant could be exercisable or convertible, such shares of stock, securities or assets as may

be issued or payable with respect to or in exchange for a number of outstanding shares of such Common Stock equal to the maximum

number of shares of such stock issuable upon exercise of this Warrant, and in any such case appropriate provisions shall be made

with respect to the rights and interests of Holder to the end that the provisions hereof (including without limitation provisions

for adjustments of the Exercise Price and of the number of shares purchasable upon exercise or conversion of this Warrant) shall

thereafter be applicable, as nearly as may be, in relation to any shares of stock, securities or assets thereafter deliverable upon

the exercise or conversion hereof. The Company shall not affect any such share exchange, combination, consolidation, merger, or sale,

unless prior to the consummation thereof the successor corporation (if other than the Company) resulting from such share exchange,

combination, consolidation, or merger or the corporation purchasing such assets shall assume by written instrument executed and mailed

to the Holder, at the last address of such Holder appearing on the books of the Company, the obligation to deliver to such Holder

such shares of stock, securities or assets that, in accordance with the foregoing provisions, such Holder may thereafter be entitled

to receive upon exercise or conversion of this Warrant. Alternatively, the Company may cash out the Warrants based upon the per-share

price for Common Stock that is obtained from such successor in connection with such transaction. |

| |

5. |

No

Voting Rights. This Warrant shall not entitle the Holder to any voting rights or other rights as a shareholder of the Company

unless and until exercised or converted pursuant to the provisions hereof. |

| |

6. |

Exercise

or Transfer of Warrant or Resale of Common Stock. The Holder agrees to give written notice to the Company thirty (30) days prior

to any proposed transfer of this Warrant, in whole or in part, or any proposed transfer of any shares of Common Stock issued upon

the exercise or conversion hereof, which notice shall describe the manner of any proposed transfer. Such notice shall include an

opinion of counsel reasonably satisfactory to the Company that (i) the proposed exercise or transfer may be affected without registration

or qualification under the Securities Act of 1933, as amended (the “Act”), and any applicable state securities

or blue sky laws, or (ii) the proposed exercise or transfer has been registered under such laws. The Company may require that an

appropriate legend may be endorsed on the certificates for such shares respecting restrictions upon transfer thereof necessary or

advisable in the opinion of counsel to the Company to prevent further transfer that would be in violation of Section 5 of the Act

and applicable state securities or blue sky laws. If in the opinion of counsel to the Company or other counsel acceptable to the

Company the proposed transfer or disposition of this Warrant or the Warrant Shares described in the written notice given pursuant

to this Section 6 may not be effected without registration of this Warrant or the Warrant Shares, the Company shall give written

notice thereof to the Holder within 30 days after the Company receives such notice, and such holder will limit its activities in

respect to such as, in the opinion of such counsel, is permitted by law. |

| |

|

|

| |

7. |

Covenants

of the Company. The Company covenants and agrees that all shares that may be issued upon conversion of this Warrant will, upon

issuance, be duly authorized and issued, fully paid, nonassessable, and free from all taxes, liens, and charges with respect to the

issuance thereof. The Company further covenants and agrees that the Company will at all times have authorized and reserved for the

purpose of issuance upon exercise hereof, a sufficient number of shares of its Common Stock and the common stock into which such

Common Stock is convertible, to provide for the exercise of this Warrant. |

| |

8. |

Certain

Notices. The Holder shall be entitled to receive from the Company immediately upon declaration thereof and at least 20 days prior

to the record date for determination of shareholders entitled thereto or to vote thereon (or, if no record date is set, prior to

the event), written notice of any event that could require an adjustment pursuant to Section 5 hereof or of the dissolution or liquidation

of the Company. All notices hereunder shall be in writing and shall be delivered personally or by telecopy (receipt confirmed) to

such party (or, in the case of an entity, to an executive officer of such party) or shall be sent by a reputable express delivery

service or by certified mail, postage prepaid with return receipt requested, addressed as follows: |

If

to the Holder, to:

__________________

__________________

__________________

If

to the Company, to:

PetVivo

Holdings, Inc.

5251

Edina Industrial Blvd.

Edina,

MN 55439

Attention:

John Lai, CEO

PHONE:

(952) 258-922

Any

party may change the above-specified recipient and/or mailing address by notice to all other parties given in the manner herein prescribed.

All notices shall be deemed given on the day when actually delivered as provided above (if delivered personally or by telecopy) or on

the day shown on the return receipt (if delivered by mail or delivery service).

No

amendment, modification, or waiver of any provision of this Warrant shall be effective unless the same shall be in writing and signed

by the holder hereof.

This

Warrant shall be governed by and construed in accordance with the laws of the State of Nevada.

ACCORDINGLY,

the Company has caused this Warrant to be signed by its authorized officer and dated as of the date stated above.

| |

PetVivo

Holdings, Inc. |

| |

|

|

| |

By: |

|

| |

|

John

Lai, Chief Executive Officer |

Exhibit

10.1

CONVERTIBLE

DEBENTURE CONVERSION AGREEMENT

THIS

CONVERTIBLE DEBENTURE CONVERSION AGREEMENT (this “Agreement”) is made and entered into as of the 11th day

of August, 2023 (“Effective Date”) by and between PetVivo Holdings, Inc., a Nevada corporation (the “Company”),

and the individual listed on the signature page hereto (the “Debenture Holder”).

WHEREAS,

the Debenture Holder holds a Convertible Debenture issued by the Company on July 26, 2023 in the principal amount set forth

on the signature page hereto (the “Debenture”), convertible into shares of the Company’s common stock,

$0.001 par value per share (the “Common Stock”), at a conversion rate of one share of Common Stock for the greater

of i) the per Share price at which the Company sells Shares of the Company Common Stock in the Qualified Financing; or ii) One Dollar

and Sixty Cents ($1.60) (the “Original Conversion Rate”);

WHEREAS,

in consideration of the Debenture Holder’s agreement to voluntarily and immediately convert the entire outstanding balance of the

Debenture prior to the closing date of the Debenture, respectively, the Company agrees to i) adjust the Original Conversion Rate to one

share of Common Stock for each $1.50 of principal and an amount equal to six months of interest (the “New Conversion Rate”),

and ii) grant a warrant to the Debenture Holder providing the right to purchase ___________ (_____ shares of common stock at any time

after six months from the date of issuance and prior to the third year anniversary of the Effective Date at a price of Two Dollars ($2.00)

per share (“Warrant”).

NOW,

THEREFORE, for and in consideration of the mutual agreements set forth herein, the parties hereto agree as follows:

1. Conversion

of Debenture; Change in Exercise Price. Subject to the terms and conditions set forth herein, upon receipt by the Company of

this Agreement signed by Debenture Holder (the “Closing Date”) all of the outstanding principal amount and an

amount equal to six months of interest will automatically convert into the number of shares of the Company’s Common Stock

as determined based on the New Conversion Rate. Furthermore, the Debenture Holder will receive the Warrant providing the right to

purchase up to Two Hundred Ten Thousand (210,000) shares of common stock at any time after six months from the date of issuance and

prior to the third year anniversary of the Effective Date at a price of Two Dollars ($2.00) per share.

2.

Manner of Conversion/Termination of Debenture. On the Closing Date, the Company shall issue and deliver to the

Debenture Holder, or to such other party as directed by the Debenture Holder, i) a certificate or certificates or other document evidencing

the shares of Common Stock issued upon conversion as set forth in Section 1 of this Agreement, and ii) the Warrant providing the Debenture

Holder the right to purchase up to _______________ (______) shares of common stock at any time after six months from the date

of issuance and prior to the third year anniversary of the Effective Date at a price of Two Dollars ($2.00) per share. Upon receipt of

such certificate or certificates or other document evidencing the shares of Common Stock by the Debenture Holder as well as receipt of

such Warrant, the Debenture will be deemed paid in full and the accrued interest will be deemed satisfied, with no further obligations

thereunder or for the borrowing evidenced by the Debenture, and all rights of the Debenture Holder under the Debenture shall cease and

the Debenture Holder shall be deemed to be a holder of record of the shares of Common Stock of the Company into which the Debenture

was converted as well as the holder of record of the Warrant. On the Closing Date, the Debenture Holder shall deliver to the Company

the Debenture.

3. Representations

of Debenture Holder. The Debenture Holder represents and warrants to the Company that: (i) Debenture Holder has,

and at the time immediately prior to the Closing Date, it will have, good and valid title to the Debenture, free and clear of all

liens, security interests, encumbrances, equities and claims, with no defects of title whatsoever and (ii) Debenture Holder is not a

party to or bound by any agreement, or any judgment, decree or ruling of any governmental authority, affecting or relating to

Debenture Holder’s right to convert the Debenture.

4. Unregistered

Securities. The Debenture Holder understands that the shares of Common Stock to be issued hereunder have not been

registered under the Securities Act of 1933, as amended (the “Securities Act”), and agrees that none of the

shares of Common Stock to be issued hereunder may be sold, offered for sale, transferred, pledged, hypothecated or otherwise

disposed of except in compliance with the Securities Act. The Debenture Holder will not, directly or indirectly, voluntarily offer,

sell, transfer, pledge, hypothecate or otherwise dispose of (or solicit any offers to purchase or otherwise acquire or take a pledge

of) any shares of Common Stock to be issued hereunder unless (i) registered pursuant to the provisions of the Securities Act, or

(ii) an exemption from registration is available under the Securities Act. The Debenture Holder has been advised that neither the

Company nor the Company has an obligation, and does not intend, to cause any shares of Common Stock to be issued hereunder to be

registered under the Securities Act, or to take any action necessary for the Debenture Holder to comply with any exemption under the

Securities Act that would permit such shares of Common Stock to be issued hereunder to be sold by the Debenture Holder. The

Debenture Holder understands that the legal consequences of the foregoing mean that the Debenture Holder must bear the economic risk

of his investment in the Company for an indefinite period of time. The Debenture Holder further understands that, if the Debenture

Holder desires to sell or transfer all or any part of the shares of Common Stock to be issued hereunder, the Company may require the

Debenture Holder’s counsel to provide a legal opinion that the transfer may be made without registration under the Securities

Act. The Debenture Holder understands that the shares of Common Stock to be issued hereunder will bear substantially the following

restrictive legend:

THE

SHARES OF STOCK EVIDENCED HEREBY HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED (“THE ACT”) NOR QUALIFIED

UNDER THE SECURITIES LAWS OF ANY STATES, AND HAVE BEEN ISSUED IN RELIANCE UPON EXEMPTIONS FROM SUCH REGISTRATION AND QUALIFICATION FOR

NONPUBLIC OFFERINGS. ACCORDINGLY, THE SALE, TRANSFER, PLEDGE, HYPOTHECATION, OR OTHER DISPOSITION OF ANY SUCH SECURITIES OR ANY INTEREST

THEREIN MAY NOT BE ACCOMPLISHED EXCEPT PURSUANT TO AN EFFECTIVE REGISTRATION STATEMENT UNDER THE ACT AND QUALIFICATION UNDER APPLICABLE

STATE SECURITIES LAWS, OR PURSUANT TO AN OPINION OF COUNSEL SATISFACTORY IN FORM AND SUBSTANCE TO THE COMPANY TO THE EFFECT THAT SUCH

REGISTRATION AND QUALIFICATION ARE NOT REQUIRED.

5. Covenants.

The Debenture Holder hereby covenants and agrees that for a period of at least six (6) months following the Closing Date, Debenture

Holder shall not, without the prior consent of the Company, sell or otherwise dispose of, whether directly or indirectly, the Common

Stock issued upon conversion pursuant to Section 1.

6. Waiver

of Notice. The Company and the Debenture Holder hereby waive any and all notice required pursuant to the

Debenture.

7. Survival

of Representations and Warranties. All representations and warranties made hereunder shall survive the consummation of the

transactions contemplated hereunder.

8. Binding

Effect. This Agreement shall be binding upon and inure to the benefit of the respective parties hereto, their legal

representatives, successors, and assigns.

8. Non-waiver.

No delay or failure by any party to exercise any right under this Agreement, and no partial or single exercise of that right, shall

constitute a waiver of that or any other right, unless otherwise expressly provided herein.

9. Headings.

Headings in this Agreement are for convenience only and shall not be used to interpret or construe its provisions.

10. Governing

Law. This Agreement shall be construed in accordance with and governed by the laws of the State of Nevada.

11. Counterparts.

This Agreement may be executed in two or more counterparts, each of which shall be deemed an original but all of which together

shall be one and the same instrument.

IN

WITNESS WHEREOF the parties have signed this instrument as of the date first set forth above.

| PETVIVO HOLDINGS, INC. |

|

| |

|

| By: |

|

|

| |

|

| Name: |

John Lai |

|

| |

|

| Title: |

Chief Executive Officer |

|

| DEBENTURE HOLDER: |

|

| |

|

| Name: |

|

| |

|

| Signature: |

|

|

| |

|

| Principal Amount of Debenture: $ |

|

| Interest Amount: $ |

|

| Total Shares Issued: |

|

| Total Warrant Shares Issued: |

|

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=PETV_WarrantsMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

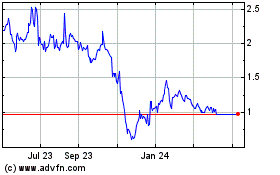

PetVivo (NASDAQ:PETV)

Historical Stock Chart

From Feb 2025 to Mar 2025

PetVivo (NASDAQ:PETV)

Historical Stock Chart

From Mar 2024 to Mar 2025