0001512922

false

0001512922

2023-08-04

2023-08-04

0001512922

us-gaap:CommonStockMember

2023-08-04

2023-08-04

0001512922

PETV:WarrantsMember

2023-08-04

2023-08-04

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

August

4, 2023

Date

of Report (Date of earliest event reported)

PETVIVO

HOLDINGS, INC.

(Exact

name of registrant as specified in its charter)

| Nevada |

|

001-40715 |

|

99-0363559 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

5251

Edina Industrial Blvd.

Edina,

Minnesota |

|

55349 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

(952)

405-6216

Registrant’s

telephone number, including area code

Check

the appropriate box below if the Form 8-K is intended to simultaneously satisfy the filing obligation of the registrant under any of

the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock |

|

PETV |

|

The

Nasdaq Stock Market LLC |

| Warrants |

|

PETVW |

|

The

Nasdaq Stock Market LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item 1.01 Entry into a Material Definitive Agreement.

On

August 4, 2023, PetVivo Holdings, Inc. (the “Company”) entered into a Securities Purchase Agreement (the “Purchase

Agreement”) with a two accredited investors (the “Investor”), pursuant to which the Company agreed to issue and sell

to the Investors in a registered direct offering (the “Registered Offering”) 1,200,002 shares (“Registered Shares”)

of the Company’s common stock (the “Common Stock”) at a price of $1.50 per share. Under the Purchase Agreements, the

Company also agreed to issue and sell to the Investors in a concurrent private placement (the “Private Placement,” and together

with the Registered Offering, the “Offering”) warrants to purchase an aggregate of 1,200,002 shares of Common Stock (the

“Private Warrants”). The Company closed this Offering on August 9, 2023.

The

Company estimates that the net proceeds from the Registered Offering will be approximately $1,775,000, after deducting offering expenses

of $25,000. The Company intends to use the net proceeds from the Registered Offering primarily for commercialization of its lead product

Spryng™ with OsteoCushion™ Technology, to finance clinical trials and to fund working capital and general corporate purposes.

The

Private Warrants have an exercise price of $2.00 per share, will be exercisable for cash six (6) months after the issuance date and will

expire three years following the initial exercise date. The exercise price and the number of shares of Common Stock issuable upon exercise

of the Private Warrants is subject to appropriate adjustments in the event of certain stock dividends and distributions, stock splits,

stock combinations, reclassifications or similar events affecting the Common Stock.

The

Registered Shares were offered pursuant to prospectus supplement dated August 3, 2023, and a base prospectus dated May 13, 2022, which

is part of a registration statement (“Registration Statement”) on Form S-3 (Registration No. 333-264700) that was declared

effective by the Securities and Exchange Commission (the “SEC”) on May 13, 2022. Copies of the prospectus supplements and

the accompanying prospectus relating to the Registered Shares may be obtained for free by visiting the SEC’s website at www.sec.gov.

The

representations, warranties and covenants contained in the Purchase Agreement were made solely for the benefit of the parties to the

Purchase Agreement and may be subject to limitations agreed upon by the contracting parties. Accordingly, the Purchase Agreement is incorporated

herein by reference only to provide investors with information regarding the terms of the Purchase Agreement, and not to provide investors

with any other factual information regarding the Company or its business, and should be read in conjunction with the disclosures in the

Company’s periodic reports and other filings with the Securities and Exchange Commission.

The

foregoing descriptions of the Purchase Agreement and the Private Warrants do not purport to be complete and are qualified in their entirety

by reference to the full text of the form of Purchase Agreement and the Private Warrants, which are filed as Exhibits 10.1 and 4.1, respectively,

to this Current Report on Form 8-K and incorporated herein by reference. The legal opinion, including the related consent, of Fox Rothschild

LLP relating to the issuance and sale of the Registered Shares is filed as Exhibit 5.1 hereto.

Item 9.01 Financial Statements and Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Company has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

| |

PETVIVO

HOLDINGS, INC. |

| |

|

|

| Date:

August 9, 2023 |

By: |

/s/

John Lai |

| |

|

John

Lai, Chief Executive Officer |

Exhibit

4.1

WARRANT

To

Purchase

Shares

of Common Stock

of

PETVIVO

HOLDINGS, INC.

August

__, 2023

THIS

WARRANT AND THE SECURITIES ISSUABLE UPON EXERCISE OR CONVERSION OF THIS WARRANT HAVE NOT BEEN REGISTERED UNDER THE UNITED STATES SECURITIES

ACT OF 1933, AS AMENDED (THE “ACT”), OR UNDER THE SECURITIES LAWS OF ANY STATES OF THE UNITED STATES. THESE SECURITIES ARE

SUBJECT TO RESTRICTIONS ON TRANSFERABILITY AND RESALE AND MAY NOT BE TRANSFERRED OR RESOLD EXCEPT PURSUANT TO REGISTRATION UNDER THE

ACT OR PURSUANT TO AN EXEMPTION THEREFROM, AND EXCEPT AS PERMITTED UNDER APPLICABLE STATE SECURITIES LAWS. INVESTORS SHOULD BE AWARE

THAT THEY MAY BE REQUIRED TO BEAR THE FINANCIAL RISKS OF THIS INVESTMENT FOR AN INDEFINITE PERIOD OF TIME. THE ISSUER OF THESE SECURITIES

MAY REQUIRE AN OPINION OF COUNSEL IN FORM AND SUBSTANCE SATISFACTORY TO THE ISSUER TO THE EFFECT THAT ANY PROPOSED TRANSFER OR RESALE

IS IN COMPLIANCE WITH THE ACT AND ANY APPLICABLE STATE SECURITIES LAWS.

PetVivo

Holdings, Inc., a Nevada corporation (the “Company”), for value received, hereby certifies that ________________ (the “Holder”),

or assigns, is entitled, subject to the terms set forth below, to purchase from the Company shares of the Company’s

Common Stock, $0.001 par value (the “Common Stock”), subject to adjustment as provided by the terms of this Warrant, at an

exercise price per share of $2.00 per share (the “Exercise Price”). The shares issuable upon exercise or conversion of this

Warrant, as adjusted from time to time pursuant to the provisions of this Warrant, are hereinafter referred to as the “Warrant

Shares.”

This

Warrant is further subject to the following provisions, terms and conditions:

| 1. | Term.

This Warrant may be exercised by the Holder, in whole or in part, at any time beginning on

or after __________ on or after 5:00 P.M. Central Standard Time if exercised pursuant to

the terms of Section 2 or 3 hereof. These exercise rights shall continue until expiration

on August , 2026, at which time this Warrant shall be null and void. |

| 2. | Manner

of Exercise. This Warrant may be exercised by the Holder, in whole or in part (but not

as to any fractional shares of Common Stock), by surrendering this Warrant, with the Exercise

Form attached hereto as Exhibit A filled in and duly executed by such Holder or by such Holder’s

duly authorized attorney, to the Company at its principal office accompanied by payment of

the Exercise Price in the amount of the Exercise Price multiplied by the number of shares

as to which the Warrant is being exercised. The Exercise Price may be paid in the form of

a cashier’s check, certified check or wire transfer of funds. |

| 3. | Effective

Date of Exercise or Conversion. Each exercise or conversion of this Warrant shall be

deemed effective as of the close of business on the day on which this Warrant is surrendered

to the Company as provided in Section 2 above. At such time, the person or persons in whose

name or names any certificates for Warrant Shares shall be issuable upon such exercise or

conversion shall be deemed to have become the holder or holders of record of the Warrant

Shares represented by such certificates. Within ten (10) days after the exercise or conversion

of this Warrant in full or in part, the Company will, at its expense, cause to be issued

in the name of and delivered to the Holder or such other person as the Holder may (upon payment

by such Holder of any applicable transfer taxes) direct: (i) a certificate or certificates

for the number of full Warrant Shares to which such Holder is entitled upon such exercise

or conversion, and (ii) unless this Warrant has expired, a new Warrant or Warrants (dated

the date hereof and in form identical hereto) representing the right to purchase the remaining

number of shares of Common Stock, if any, with respect to which this Warrant has not then

been exercised or converted. |

| 4. | Adjustments

to Exercise Price. The above provisions are, however, subject to the following: |

| (i) | If

the Company shall at any time after the date of this Warrant subdivide or combine the outstanding

shares of its capital stock or declare a dividend payable in capital stock, then the number

of shares of Common Stock for which this Warrant may be exercised immediately prior to the

subdivision, combination or record date for such dividend payable in capital stock shall

forthwith be proportionately decreased, in the case of combination, or increased, in the

case of subdivision or dividend payable in capital stock. |

| (ii) | If

the Company shall at any time after the date of this Warrant subdivide or combine the outstanding

shares of capital stock or declare a dividend payable in capital stock or other securities,

the Exercise Price in effect immediately prior to the subdivision, combination or record

date for such dividend payable in capital stock or other securities shall forthwith be proportionately

increased, in the case of combination, or decreased, in the case of subdivision or dividend

payable in capital stock or other securities. |

| (iii) | If

any capital reorganization or reclassification of the capital stock of the Company, or share

exchange, combination, consolidation or merger of the Company with another corporation, or

the sale of all or substantially all of its assets to another corporation shall be effected

in such a way that holders of capital stock shall be entitled to receive stock, securities

or assets with respect to or in exchange for capital stock, then, as a condition of such

reorganization, reclassification, share exchange, combination, consolidation, merger or sale,

lawful and adequate provision shall be made whereby the Holder shall thereafter have the

right to receive upon exercise of this Warrant, upon the basis and upon the terms and conditions

specified in this Warrant and in lieu of the shares of the Common Stock of the Company into

which this Warrant could be exercisable or convertible, such shares of stock, securities

or assets as may be issued or payable with respect to or in exchange for a number of outstanding

shares of such Common Stock equal to the maximum number of shares of such stock issuable

upon exercise of this Warrant, and in any such case appropriate provisions shall be made

with respect to the rights and interests of Holder to the end that the provisions hereof

(including without limitation provisions for adjustments of the Exercise Price and of the

number of shares purchasable upon exercise or conversion of this Warrant) shall thereafter

be applicable, as nearly as may be, in relation to any shares of stock, securities or assets

thereafter deliverable upon the exercise or conversion hereof. The Company shall not effect

any such share exchange, combination, consolidation, merger or sale, unless prior to the

consummation thereof the successor corporation (if other than the Company) resulting from

such share exchange, combination, consolidation or merger or the corporation purchasing such

assets shall assume by written instrument executed and mailed to the Holder, at the last

address of such Holder appearing on the books of the Company, the obligation to deliver to

such Holder such shares of stock, securities or assets that, in accordance with the foregoing

provisions, such Holder may thereafter be entitled to receive upon exercise or conversion

of this Warrant. Alternatively, the Company may cash out the Warrants based upon the per-share

price for Common Stock that is obtained from such successor in connection with such transaction. |

| 5. | No

Voting Rights. This Warrant shall not entitle the Holder to any voting rights or other

rights as a shareholder of the Company unless and until exercised or converted pursuant to

the provisions hereof. |

| 6. | Exercise

or Transfer of Warrant or Resale of Common Stock. The Holder, agrees to give written

notice to the Company thirty (30) days prior to any proposed transfer of this Warrant, in

whole or in part, or any proposed transfer of any shares of Common Stock issued upon the

exercise or conversion hereof, which notice shall, describe the manner of any proposed transfer.

Such notice shall include an opinion of counsel reasonably satisfactory to the Company that

(i) the proposed exercise or transfer may be effected without registration or qualification

under the Securities Act of 1933, as amended (the “Act”), and any applicable

state securities or blue sky laws, or (ii) the proposed exercise or transfer has been registered

under such laws. The Company may require that an appropriate legend may be endorsed on the

certificates for such shares respecting restrictions upon transfer thereof necessary or advisable

in the opinion of counsel to the Company to prevent further transfer that would be in violation

of Section 5 of the Act and applicable state securities or blue sky laws. If in the opinion

of counsel to the Company or other counsel acceptable to the Company the proposed transfer

or disposition of this Warrant or the Warrant Shares described in the written notice given

pursuant to this Section 6 may not be effected without registration of this Warrant or the

Warrant Shares, the Company shall give written notice thereof to the Holder within 30 days

after the Company receives such notice, and such holder will limit its activities in respect

to such as, in the opinion of such counsel, is permitted by law. |

| | 7. | Covenants

of the Company. The Company covenants and agrees that all shares that may be issued upon

conversion of this Warrant will, upon issuance, be duly authorized and issued, fully paid,

nonassessable and free from all taxes, liens and charges with respect to the issuance thereof.

The Company further covenants and agrees that the Company will at all times have authorized,

and reserved for the purpose of issuance upon exercise hereof, a sufficient number of shares

of its Common Stock and the common stock into which such Common Stock is convertible, to

provide for the exercise of this Warrant. |

| | 8. | Certain

Notices. The Holder shall be entitled to receive from the Company immediately upon declaration

thereof and at least 20 days prior to the record date for determination of shareholders entitled

thereto or to vote thereon (or, if no record date is set, prior to the event), written notice

of any event that could require an adjustment pursuant to Section 5 hereof or of the dissolution

or liquidation of the Company. All notices hereunder shall be in writing and shall be delivered

personally or by telecopy (receipt confirmed) to such party (or, in the case of an entity,

to an executive officer of such party) or shall be sent by a reputable express delivery service

or by certified mail, postage prepaid with return receipt requested, addressed as follows: |

If

to the Holder, to:

__________________

__________________

__________________

If

to the Company, to:

PetVivo

Holdings, Inc.

5251

Edina Industrial Blvd.

Edina,

MN 55439

Attention:

John Lai, CEO

PHONE:

(952) 258-922

Any

party may change the above-specified recipient and/or mailing address by notice to all other parties given in the manner herein prescribed.

All notices shall be deemed given on the day when actually delivered as provided above (if delivered personally or by telecopy) or on

the day shown on the return receipt (if delivered by mail or delivery service).

No

amendment, modification or waiver of any provision of this Warrant shall be effective unless the same shall be in writing and signed

by the holder hereof.

This

Warrant shall be governed by and construed in accordance with the laws of the State of Nevada.

ACCORDINGLY,

the Company has caused this Warrant to be signed by its authorized officer and dated as of the date stated above.

| |

PetVivo

Holdings, Inc. |

| |

|

|

| |

By: |

|

| |

|

John

Lai, Chief Executive Officer |

Exhibit

A

| NOTICE

OF EXERCISE OF WARRANT — |

To

Be Executed by the Registered Holder in Order to Exercise the Warrant |

The

undersigned hereby irrevocably elects to exercise the attached Warrant to purchase, for cash pursuant to Section 2 thereof, ________________

shares of Common Stock issuable upon the exercise of such Warrant. The undersigned requests that certificates for such shares be issued

in the name of the undersigned. If this Warrant is not fully exercised, the undersigned requests that a new Warrant to purchase the balance

of shares remaining purchasable hereunder be issued in the name of the same.

| Date: ___________,

20__ |

Holder

|

| |

|

| |

_______________________________________________ |

| |

[signature] |

| |

|

| |

INSERT

ADDRESS |

| |

_____________

_______ |

| |

PHONE:

(___) ___- ____ |

| |

|

| |

_______________________________________________ |

| |

[tax

identification number] |

Exhibit 5.1

33 South 6th Street, Suite 3600

Minneapolis, MN 55402

Tel (612) 607-7000, Fax (612) 607-7100

www.foxrothschild.com

August 9, 2023

PetVivo Holdings, Inc.

5251 Edina Industrial Blvd.

Edina, MN 55439

| Re: |

Prospectus Supplement to Registration Statement on Form S-3 (Registration No. 333-264700) |

Ladies and Gentlemen:

We have acted as counsel to PetVivo

Holdings, Inc., a Nevada corporation (the “Company”), in connection with (i) the preparation and filing with the Securities

and Exchange Commission (the “Commission”) of a Registration Statement on Form S-3 (Registration No. 333-264700) which was

declared effective by the Commission on May 13, 2022 (the “Registration Statement”), relating to the offering from time to

time, pursuant to Rule 415 of the General Rules and Regulations of the Commission promulgated under the Securities Act of 1933, as amended

(the “Securities Act”), of securities of the Company with an aggregate offering price of up to $100,000,000; and (ii) the

Prospectus Supplement of the Company, dated August 3, 2023 (the “Prospectus Supplement”), relating to the issuance and sale

by the Company of 1,200,002 shares of common stock (the “Shares”), pursuant to those securities purchase agreements

dated August 4, 2023 between the Company and the investors named therein (individually, a “Purchase Agreement” and collectively,

the “Purchase Agreements”).

In connection with this opinion,

we have examined instruments, documents, certificates, and records which we have deemed relevant and necessary for the basis of our opinion

hereinafter expressed including (1) the Registration Statement, including the exhibits thereto and the Prospectus Supplement, (2) the

Company’s Articles of Incorporation, as amended to date, (3) the Company’s Bylaws, as amended to date, (4) certain resolutions

of the Board of Directors of the Company, and (5) such other documents, corporate records, and instruments as we have deemed necessary

for purposes of rendering the opinions set forth herein. In rendering these opinions, we have assumed: the genuineness and authenticity

of all signatures on original documents, including electronic signatures made and/or transmitted using electronic signature technology

(e.g., via DocuSign or similar electronic signature technology); that any such signed electronic record shall be valid and as effective

to bind the party so signing as a paper copy bearing such party’s handwritten signature.

As to certain factual matters,

we have relied upon the certificates of the officers of the Company and have not sought to independently verify such matters. In such

examination, we have assumed (a) the authenticity of original documents and the genuineness of all signatures; (b) the conformity to the

originals of all documents submitted to us as copies; (c) the truth, accuracy, and completeness of the information, representations, and

warranties contained in the records, documents, instruments, and certificates we have reviewed; and (d) the Shares will be issued and

sold in compliance with applicable Federal and state securities laws and in the manner stated in the Registration Statement.

Based upon and subject to the

foregoing, we are of the opinion that the Shares have been duly authorized for issuance and, when issued, delivered, and paid for in accordance

with the terms of each Purchase Agreement, will be validly issued, fully paid and nonassessable.

We express no opinion as to the

laws of any jurisdiction, other than Chapter 78 of the Nevada Revised Statutes and the Federal laws of the United States.

We hereby consent to the filing

of this opinion with the Commission as Exhibit 5.1 to the Company’s Current Report Form 8-K filed on August 9, 2023, and

to the incorporation by reference of this opinion in the Registration Statement, and to the reference to our firm under the caption “Legal

Matters” in the Prospectus Supplement and any amendment or supplement thereto. In giving this consent, we do not thereby admit

that we are included in the category of persons whose consent is required under Section 7 of the Securities Act or the rules and regulations

of the Commission.

This opinion is expressed as of

the date hereof, and we disclaim any undertaking to advise you of any subsequent changes in the facts stated or assumed herein or of any

subsequent changes in applicable law.

| |

Very truly yours, |

| |

|

| |

/s/ Fox Rothschild LLP |

Exhibit

10.1

SECURITIES

PURCHASE AGREEMENT

This

Securities Purchase Agreement (this “Agreement”) is made as of August __, 2023, by and between PetVivo Holdings,

Inc., a Nevada corporation (the “Company”), and the purchasers identified on the signature pages hereto (each,

including its successors and assigns, a “Purchaser” and, collectively, the “Purchasers”).

RECITALS

WHEREAS,

subject to the terms and conditions set forth in this Agreement and pursuant to (i) an effective registration statement under the

Securities Act (as defined herein), as to the Shares and (ii) to an exemption from the registration requirements of Section 5 of the

Securities Act contained in Section 4(a)(2) thereof and/or Regulation D thereunder as to the Private Warrants and the Warrant Shares,

the Company desires to issue and sell to each Purchaser, and each Purchaser, severally and not jointly, desires to purchase from the

Company, securities of the Company as more fully described in this Agreement.

NOW,

THEREFORE, IN CONSIDERATION of the mutual covenants contained in this Agreement, and for other good and valuable consideration the

receipt and adequacy of which are hereby acknowledged, the Company and each Purchaser agree as follows:

ARTICLE

I.

DEFINITIONS

1.1

Definitions. In addition to the terms defined elsewhere in this Agreement, the following terms have the meanings set forth in this

Section 1.1:

“Base

Prospectus” means the prospectus, dated May 13, 2022, contained in the Registration Statement.

“Board”

means the board of directors of the Company.

“Closing”

means the closing of the purchase and sale of the Shares pursuant to Section 2.2.

“Closing

Date” means the Trading Day on which all conditions precedent to (i) each Purchaser’s obligations to pay the Subscription

Amount and (ii) the Company’s obligations to deliver the Shares, in each case, have been satisfied or waived.

“Commission”

means the United States Securities and Exchange Commission.

“Common

Stock” means the common stock of the Company, par value $0.001 per share, and any other class of securities into which such

securities may hereafter be reclassified or changed.

“Disclosure

Package” means, collectively, the Prospectus, together with the documents incorporated by reference therein.

“Exchange

Act” means the Securities Exchange Act of 1934, as amended.

“Private

Warrants” means the Warrants issued in a concurrent private offering to the Purchasers.

“Prospectus” means

the Prospectus Supplement, together with the Base Prospectus.

“Prospectus

Supplement” means the supplement to the Base Prospectus complying with Rule 424(b) of the Securities Act that is filed with

the Commission and delivered by the Company to each Purchaser at the Closing.

“Registration

Statement” means the effective registration statement with Commission File No. 333-264700 that registered the sale of the Shares

to the Purchasers, as such Registration Statement may be amended and supplemented from time to time (including pursuant to Rule 462(b)

of the Securities Act).

“Securities

Act” means the Securities Act of 1933, as amended, and the rules and regulations promulgated thereunder.

“Shares”

means, with respect to a particular Purchaser, the number of shares of Common Stock set forth opposite such Purchaser’s name under

the column titled “Shares” set forth on Schedule A hereto issued or issuable to such Purchaser pursuant to this Agreement.

“Short

Sales” means, all “short sales” as defined in Rule 200 promulgated under Regulation SHO under the Exchange Act,

whether or not against the box, and forward sale contracts, options, puts, calls, short sales, “put equivalent positions”

(as defined in Rule 16a-1(h) under the Exchange Act) and similar arrangements, and sales and other transactions through non-U.S. broker-dealers

or foreign regulated brokers.

“Subscription

Amount” means, with respect to a particular Purchaser, the amount to be paid for the Shares purchased hereunder by such Purchaser

as specified below such Purchaser’s name on the signature page of this Agreement and next to the heading “Subscription Amount”

in United States dollars and in immediately available funds.

“Trading

Day” means a day on which the Nasdaq Stock Market is open for trading.

“Transfer

Agent” means Equity Stock Transfer, 237 West 37th Street, Suite 602, New York, NY 10018, and any successor transfer

agent of the Company.

“Warrant

Shares” means the shares of the Company’s common stock issuable upon exercise of the Private Warrants.

ARTICLE

II.

PURCHASE

AND SALE

2.1

Closing. The Company has authorized the sale and issuance to each Purchaser, and each Purchaser agrees, severally and not jointly,

to purchase from the Company, the Shares for a purchase price of $ 1.50 per Share.

(a)

The offering and sale of the Shares (the “Offering” or the “Registered Offering”) is being made

pursuant to (i) the Registration Statement filed by the Company with the Commission, including the Base Prospectus; (ii) if applicable,

certain “free writing prospectuses” (as that term is defined in Rule 405 under the Securities Act) that have been or will

be filed, if required, with the Commission and delivered to each Purchaser on or before the date hereof, containing certain supplemental

information regarding the terms of the Offering and the Company; and (iii) the Prospectus Supplement containing certain supplemental

information regarding the Shares and the terms of the Offering and information that may be material to the Company and its securities

that wasdelivered to each Purchaser and will be filed with the Commission. In a concurrent private placement, the Company will offer

and sell the Private Warrants in an amount equal to the number of Shares sold to the Purchaser in the Registered Offering.

(b)

At the Closing, the Company and each Purchaser agree, severally and not jointly, that such Purchaser wi l purchase from the Company

and the Company will issue and sell to such Purchaser, upon the terms and conditions set forth herein, the Shares and the Private Warrants.

There is no placement agent or underwriter for this Offering. The Shares and Private Warrants are being issued directly by the Company

to the Purchasers.

2.2

Closing and Delivery of the Shares, Warrants and Funds.

(a)

The Closing shall take place at the offices of Fox Rothschild LLP, City Center, 33 South Sixth Street, Suite 3600, Minneapolis, MN 55402,

or such other location as the parties shall mutually agree on the Closing Date. At the Closing, (i) each Purchaser shall deliver to the

Company, via check or wire transfer in accordance with the instructions provided by the Company, immediately available funds equal to

the Subscription Amount set forth opposite such Purchaser’s name on the signature page of this Agreement hereto, and (ii) the Company

shall deliver, or caused to be delivered, to each Purchaser, the Shares by electronic delivery to such Purchaser’s designated book-

entry account with the Transfer Agent or such other method approved by the Purchaser. The Private Warrants sha l be delivered

to the Purchaser electronically in pdf format at the email address specified on the signature page of this Agreement.

(b)

The Company’s obligation to issue and sell the Shares and the Private Warrants to each Purchaser and each Purchaser’s obligation

to purchase the Sharesfrom the Company shall be subject to: (i) no stop order suspending the effectiveness of the Registration Statement

or any part thereof, or preventing or suspending the use of the Base Prospectus or the Prospectus or any part thereof, shall have been

issued and no proceedings for that purpose or pursuant to Section 8A under the Securities Act shall have been initiated or threatened

by the Commission, and (ii) no objection shall have been raised by the Nasdaq Stock Market LLC and unresolved with respect to the consummation

of the transactions contemplated by this Agreement.

ARTICLE

III.

REPRESENTATIONS

AND WARRANTIES

3.1

Representations, Warranties, and Covenants of the Company . The Company acknowledges, represents, and warrants to, and agrees with,

each Purchaser that:

(a)

The Company has the requisite right, power, and authority to enter into this Agreement, to authorize, issue, and sell the Shares as contemplated

by this Agreement and to perform and to consummate the transactions contemplated hereby; and this Agreement has been duly authorized,

executed and delivered by the Company, and constitutes the valid and binding obligation of the Company enforceable a gainst the Company

in accordance with its terms, except (i) as may be limited by bankruptcy, insolvency, reorganization or other simila r laws relating

to the enforcement of creditors’ rights generally and by general principles of equity and (ii) to the extent any indemnification

or contribution provisions contained herein may further be limited by applicable laws and principles of public policy.

(b)

The Shares to be issued and sold by the Company to the Purchasers under this Agreement have been duly authorized and the Shares, when

issued and delivered against payment therefor as provided in this Agreement, will be validly issued, fully paid, and non-assessable and

free of any preemptive or similar rights. The Registration Statement is effective under the Securities Act and no stop order preventing

or suspending the effectiveness of the Registration Statement or suspending or preventing the use of the Prospectus has been issued by

the Commission and no proceedings for that purpose have been instituted or, to the knowledge of the Company, are threatened by the Commission.

The Company, if required by the rulesand regulations of the Commission, proposes to file the Prospectus with the Commission pursuant

to Rule 424(b) in relation to the sale of the Shares.

(c)

The execution and delivery of this Agreement and the consummation of the transactions contemplated hereby will not (i) result in a breach

or violation of any of the terms and provisions of, or constitute a default under, any law, rule or regulation to which the Company or

any subsidiary is subject, or by which any property or asset of the Company or any subsidiary is bound or affected, (ii) conflict with,

result in any violation or breach of, or constitute a default (or an event that with notice or lapse of time or both would become a default)

under, or give to others any right of termination, amendment, acceleration or cancellation (with or without notice, lapse of time or

both) of, any agreement, lease, credit facility, debt, note, bond, mortgage, indenture or other instrument or obligation or other understanding

to which the Company or any subsidiary is a party of by which any property or asset of the Company or any subsidiary is bound or affected,

or (iii) result in a breach or violation of any of the terms and provisions of, or constitute a default under, the Company’s certificate

of incorporation, except, in the case of clauses (i) and (ii), for such breaches, violations, defaults, or conflicts which are not, individually

or in the aggregate, reasonably likely to result in a material adverse effect upon the business, prospects, properties, operations, condition

(financial or otherwise) or results of operations of the Company and its subsidiaries, taken as a whole, or in its ability to perform

its obligations under this Agreement.

(d)

The Company shall, by 5:30 p.m. Eastern time on the second Trading Day immediately following the Closing Date of this Agreement, issue

a Current Report on Form 8-K including the form of this Agreement and an opinion of legal counsel as to the validity of the Shares as

exhibits thereto.

(e)

No brokerage or finder’s fees or commissions are or will be payable by the Company or any of its subsidiaries to any broker, financial

advisor or consultant, finder, placement agent, investment banker, bank, or other person with respect to the transactions contemplated

by this Agreement. The Purchasers shall have no obligation with respect to any fees or with respect to any claimsmade by or on behalf

of other persons for fees of a type contemplated in this section that may be due in connection with the transactions contemplated by

this Agreement.

(f)

Neither the Company nor any Person acting on behalf of the Company has offered or sold any of the Private Warrant or Private Warrant

Shares by any form of general solicitation or general advertising. The Company has offered the Private Warrants and Warrant Shares for

sale only to the Purchasers and certain other “accredited investors” within the meaning of Rule 501 under the Securities

Act.

3.2

Representations, Warranties, and Covenants of Each Purchaser. Each Purchaser, severally and not jointly, acknowledges, represents,

and warrants to, and agrees with, the Company that:

(a)

At the time such Purchaser was offered the Shares, it was, and as of the date hereof it is, either (i) an “accredited investor”

as defined in Rule 501(a) under the Securities Act or (ii) a “qualified institutional buyer” as defined in Rule 144A(a) under

the Securities Act.

(b)

It has had the opportunity to review this Agreement and the Company’s filings with the Commission and has been afforded (i) the

opportunity to ask such questions as it has deemed necessary of, and to receive answers from, representatives of the Company concerning

the terms and conditions of the offering of the Shares and the merits and risks of investing in the Shares, (ii) access to information

about the Company and its financial condition, results of operations, business, properties, management and prospects sufficient to enable

it to evaluate its investment and (iii) the opportunity to obtain such additional information that the Company possesses or can acquire

without unreasonable effort or expense that is necessary to make an informed investment decision with respect to the investment.

(c)

No agent of the Company has been authorized to make and no such agent has made any representation, disclosure, or use of any information

in connection with the issue, placement, purchase, and sale of the Shares, except as set forth in or incorporated by reference in the

Base Prospectus or the Prospectus Supplement or as otherwise contemplated by this Agreement.

(d)

(i) Such Purchaser has full right, power, authority and capacity to enter into this Agreement and to consummate the transactions contemplated

hereby; and this Agreement has been duly authorized, executed, and delivered by such Purchaser and (ii) this Agreement constitutes the

valid and binding obligation of such Purchaser enforceable against such Purchaser in accordance with its terms, except (A) as may be

limited by bankruptcy, insolvency, reorganization or other similar laws relating to the enforcement of creditors’ rights generally

and by general principles of equity and (B) to the extent any indemnification or contribution provisions contained herein may further

be limited by applicable laws and principles of public policy.

(e)

The Private Warrants and Warrants Sharesto be purchased by such Purchaser hereunder will be acquired for such Purchaser’s own account,

not as nominee or agent, and not with a view to the resale or distribution of any part thereof in violation of the Securities Act, and

such Purchaser has no present intention of selling, granting any participation in, or otherwise distributing the same in violation of

the Securities Act without prejudice, however, to such Purchaser’s right at all times to sell or otherwise dispose of all or any

part of the Private Warrants or the Warrant Shares in compliance with applicable federal and state securities laws. The Purchaser agrees

that the Private Warrants and the Warrant Shares will be imprinted with a restrictive legend regarding resale limitations under the SEcuriteis

Act.

(f)

Such Purchaser, either alone or together with its representatives, has such knowledge, sophistication, and experience in business and

financial matters so as to be capable of evaluating the merits and risks of the prospective investment in the Shares, and has so evaluated

the merits and risks of such investment. Such Purchaser is able to bear the economic risk of an investment in the Shares and, at the

present time, is able to afford a complete loss of such investment.

(g)

Nothing in this Agreement, the Prospectus, the Disclosure Package, or any other materials presented to such Purchaser in connection with

the purchase and sale of the Shares constitutes legal, tax, or investment advice. Such Purchaser has consulted such legal, tax, and investment

advisors as it, in its sole discretion, has deemed necessary or appropriate in connection with its purchase of the Shares.

(h)

Since the time of the initial conversation between the Company and the Purchaser regarding the Offering, the Purchaser has not directly

or indirectly, nor has any person acting on behalf of or pursuant to any understanding with the Purchaser, disclosed any information

regarding the Offering to any third parties (other than its lega l, accounting and other advisors) or engaged in any transactions in

the securities of the Company (including, without limitations, any Short Sales of the Company’s securities). The Purchaser covenants

that neither it nor any person acting on its behalf or pursuant to any understanding with it has or will engage in any transactions in

the securities of the Company (including short sales) prior to the time that the transactions contemplated by this Subscription Agreement

are publicly disclosed.

ARTICLE

IV.

MISCELLANEOUS

4.1

Entire Agreement; Modifications. Except as otherwise provided herein, this Agreement constitutes the entire understanding and agreement

between the parties with respect to its subject matter and there are no agreements or understandings with respect to the subject matter

hereof which are not contained in this Agreement. This Agreement may be modified only in writing signed by the Company and, with respect

to such Purchaser’s Shares, the applicable Purchaser.

4.2

Survival. All representations, warranties, and agreements of the Company and each Purchaser herein shall survive delivery of, and

payment for, the Shares purchased hereunder.

4.3

Counterparts. This Agreement may be executed in any number of counterparts, all of which taken together shall constitute one and

the same instrument and shall become effective when counterparts have been signed by each party and delivered to the other party hereto,

it being understood that all parties need not sign the same counterpart. Execution may be made by delivery of a facsimile or PDF.

4.4

Severability. The provisions of this Agreement are severable and, in the event that any court or officials of any regulatory agency

of competent jurisdiction shall determine that any one or more of the provisions or part of the provisions contained in this Agreement

shall, for any reason, be held to be invalid, illegal or unenforceable in any respect, such invalidity, illegality or unenforceability

shall not affect any other provision or part of a provision of this Agreement and this Agreement shall be reformed and construed as if

such invalid or illegal or unenforceable provision, or part of such provision, had never been contained herein, so that such provisions

would be valid, legal and enforceable to the maximum extent possible, so long as such construction does not materially adversely affect

the economic rights of either party hereto.

4.5

Notices. All notices or other communications required or permitted to be provided hereunder shall be in writing and shall be deemed

effectively given (i) upon personal delivery to the party to be notified, (ii) when sent by confirmed e-mail or facsimile if sent during

normal business hours of the recipient, if not, then on the next business day, (iii) five days after having been sent by registered or

certified mail, return receipt requested, postage prepaid, or (iv) one day after deposit with a nationally recognized overnight courier,

specifying next day delivery, with written verification of receipt. All communications shall be sent to the Company or the Purchasers,

as applicable, at the address for such recipient listed on the signature pages hereto or at such other address as such recipient hasdesignated

by two days advance written notice to the other parties hereto.

4.6

Governing Law. This Agreement shall be governed by, and construed in accordance with, the internal laws of the State of Nevada without

regard to the choice of law principles thereof.

4.7

WAIVER OF JURY TRIAL. IN ANY ACTION, SUIT, OR PROCEEDING IN ANY JURISDICTION BROUGHT BY ANY PARTY AGAINST ANY OTHER PARTY, THE PARTIES

EACH KNOWINGLY AND INTENTIONALLY, TO THE GREATEST EXTENT PERMITTED BY APPLICABLE LAW, HEREBY ABSOLUTELY, UNCONDITIONALLY, IRREVOCABLY,

AND EXPRESSLY WAIVES FOREVER TRIAL BY JURY.

4.8

Headings. The headings of the various sections of this Agreement have been inserted for convenience of reference only and will not

be deemed to be part of this Agreement.

4.9

Fees and Expenses. Each party shall pay the feesand expenses of its advisors, counsel, accountants, and other experts, if any, and

all other expenses incurred by such party incident to the negotiation, preparation, execution, delivery, and performance of this Agreement.

The Company shall pay all transfer agent fees incurred in connection with the delivery of any Shares to the Purchasers.

4.10

Termination. This Agreement may be terminated by the Company or any Purchaser, with respect to such Purchaser’s Shares only,

by written notice to the other party, if the Closing has not been consummated on or before the Closing Date; provided, however, that

no such termination will affect the right of any party to sue for any breach by any other party.

[Signature

Pages Follow]

IN

WITNESS WHEREOF, the parties hereto have caused this Securities Purchase Agreement to be duly executed by their respective authorized

signatories as of the date first indicated above.

| PETVIVO

HOLDINGS, INC. |

|

Address

for Notice: |

| |

|

|

|

| By |

|

|

5251

Edina Industrial Blvd. |

| Name: |

John Lai |

|

Edina,

MN 55439 |

| Title:

|

Chief Executive Officer |

|

Email:

jlai@petvivo.com |

[REMAINDER

OF PAGE INTENTIONALLY LEFT BLANK

SIGNATURE

PAGE FOR PURCHASER(S) FOLLOWS]

[PURCHASER

SIGNATURE PAGES TO THE SECURITIES PURCHASE AGREEMENT]

IN

WITNESS WHEREOF, the undersigned have caused this Securities Purchase Agreement to be duly executed by their respective authorized

signatories as of the date first indicated above.

Name

of Purchaser: _________________________________________________

Signature

of Authorized Signatory of Purchaser: _______________________________

Name

of Authorized Signatory: ____________________________________________

Title

of Authorized Signatory: ___________________________________________

Email

Address of Authorized Signatory: ____________________________________

Address

for Notice to Purchaser: _________________________________________

_________________________________________

Subscription

Amount: __________________

Shares:

_____________________________

Private

Warrants: ______________________

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=PETV_WarrantsMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

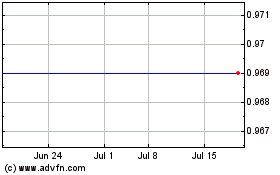

PetVivo (NASDAQ:PETV)

Historical Stock Chart

From Jun 2024 to Jul 2024

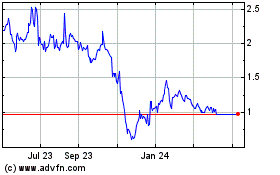

PetVivo (NASDAQ:PETV)

Historical Stock Chart

From Jul 2023 to Jul 2024