PetVivo Holdings, Inc. (Nasdaq: PETV

and

PETVW), an emerging biomedical device

company focused on the commercialization of innovative medical

therapeutics for animals, announces financial results for its

fiscal year ended March 31, 2022.

Key highlights for our fiscal year ended March 31, 2022,

were:

- Raised $11.25

million in uplisting to Nasdaq in August 2021

- Generation of

over $100,000 in revenue from sales of our lead product, Spryng™

with OsteoCushion™ Technology

- Rebranding of

Spryng™, launch of Sprynghealth.com and PetVivo.com websites

- Partnered with

Ethos on canine tolerance and efficacy study

- Attracted an

experienced management team to lead the Company

Management Commentary

“The most significant event on our financial

results during the fiscal year ended March 31, 2022, was our

generation of over $100,000 in revenues from the commercialization

and sale of our primary product, Spryng™, to veterinary clinics.”

Said John Lai, Chief Executive Officer of PetVivo.

“We continue to use the proceeds from our

initial public offering to expand our sales and marketing efforts

to generate clinical data to gain vet acceptance and generate

increased revenue from the sale of Spryng™”.

Fiscal Year Ended March 31, 2022

(“fiscal 2022”) Compared to The Year Ended March 31, 2021 (“fiscal

2021”)

Total Revenues. Revenues

increased to $115,586 in fiscal 2022 compared to $12,578 in fiscal

2021 and consisted of sales to veterinary clinics. The Company

began commercialization of its Spryng™ product in September

2021.

Total Cost of Sales. Cost of

sales was $201,154 in fiscal 2022 compared to $10,695 for fiscal

2021. The increase is directly related to increased sales of the

Spryng™ product. Cost of sales includes product costs related to

the sale of products and labor and overhead costs. The increase and

the negative gross margin are primarily attributed to our product

costs and related product launch expenses from the

commercialization of Spryng™ in September 2021.

Operating Expenses. Operating

expenses increased to $4,970,960 in fiscal 2022 compared to

$1,960,871 in fiscal 2021. Operating expenses consisted of general

and administrative, sales and marketing, and research and

development expenses. The increase is primarily due to increased

G&A expenses and sales and marketing expenses related to the

sale of our Spryng™ product.

General and administrative (“G&A”) expenses

were $3,148,494 and $1,767,664 in fiscal 2022 and 2021,

respectively. General and administrative expenses include

compensation and benefits, contracted services, consulting fees,

stock compensation and incremental public company costs.

Sales and marketing expenses were $1,347,585 and

$94,997 in fiscal 2022 and 2021, respectively. Sales and marketing

expenses include compensation, consulting, tradeshows, and stock

compensation costs to support the launch of our Spryng™

product.

Research and development (“R&D”) expenses

were $474,881 and $98,230 in fiscal 2022 and 2021, respectively.

The increase was related to clinical studies and efforts to support

the launch of Spryng™.

Operating Loss. As a result of

the foregoing, the Company’s operating loss was $5,056,528 and

$1,958,988 in fiscal 2022 and 2021, respectively. The increase was

related to the costs to support the launch of Spryng™ and the

incremental public company costs.

Other Income (Expense). Other

income was $41,533 in fiscal 2022 as compared to expense of

$1,563,792 in fiscal 2021. Other income in fiscal 2022 consisted of

the forgiveness of PPP Loan of $31,680 and net interest income of

$9,853. Other expense in fiscal 2021 consisted primarily of

derivative expense related to debt financing of $1,702,100 and

interest expense of $228,595 partially offset by a gain on debt

extinguishment of $366,903.

Net Loss. The Company’s net

loss in fiscal 2022 was $5,014,995 or ($0.57) as compared to a net

loss of $3,522,780 or ($0.57) per share in fiscal 2021. The

weighted average number of shares outstanding was 8,760,877

compared to 6,198,717 for fiscal 2022 and 2021, respectively.

Balance Sheet and Inventory

At March 31, 2022, the Company had $6.1 million

in cash and working capital of $5.6 million. The Company increased

its inventory to $98,000 as of March 31, 2022 in order to support

its expected revenue growth in 2023.

Business Update

In the first quarter of fiscal 2023, the Company

entered into a Distribution Services Agreement with MWI

Veterinarian Supply Co., a pre-eminent national distributor of

veterinarian products (“MWI”). Pursuant to this agreement, we

appointed MWI to distribute, advertise, promote, market, supply and

sell our lead product, Spryng™ and other products on an exclusive

basis for two (2) years within the United States.

Conference Call and Webcast

A live webcast of the conference call and

related earnings release materials can be accessed on PetVivo’s

Investor Relations website at:

https://audience.mysequire.com/webinar-view?webinar_id=4247f378-9329-46f0-adcf-44720e7f5ae6

A replay of the webcast will be available

through the same link following the conference call. Participants

can also access the call using the dial-in details below:

Date: Wednesday, June 29th, 2022Time: 4:00 p.m CT (5:00 pm

ET)Dial-in: +1-346-248-7799Meeting ID: 97245185036Passcode:

740720

About PetVivo Holdings, Inc.

PetVivo Holdings, Inc. is an emerging biomedical

device company currently focused on the manufacturing,

commercialization, and licensing of innovative medical devices and

therapeutics for animals. The Company's strategy is to leverage

human therapies for the treatment of dogs and horses in a capital

and time-efficient way. A key component of this strategy is the

accelerated timeline to revenues for veterinary medical devices,

which entered the market much earlier than more stringently

regulated pharmaceuticals and biologics.

PetVivo has a pipeline of seventeen products for

the treatment of animals and people. A portfolio of twenty-one

patents protects the Company's biomaterials, products, production

processes, and methods of use. The Company’s lead product SPRYNG™,

a veterinarian-administered intraarticular injection for the

management of lameness and joint afflictions, such as

osteoarthritis, in dogs and horses, is scheduled for expanded

commercial sale in the fourth quarter of this year.

Cautionary Note Regarding

Forward-Looking Statements

This press release contains “forward-looking

statements” within the meaning of the U.S. Private Securities

Litigation Reform Act of 1995. Forward-looking statements include

all statements that do not relate solely to historical or current

facts, including without limitation the Company’s proposed

development and commercial timelines, and can be identified by the

use of words such as “may,” “will,” “expect,” “project,”

“estimate,” “anticipate,” “plan,” “believe,” “potential,” “should,”

“continue” or the negative versions of those words or other

comparable words. Forward-looking statements are not guarantees of

future actions or performance. These forward-looking statements are

based on information currently available to the Company and its

current plans or expectations and are subject to a number of

uncertainties and risks that could significantly affect current

plans. Risks concerning the Company’s business are described in

detail in the Company’s Annual Report on Form 10-K for the year

ended March 31, 2021, and other periodic and current reports filed

with the Securities and Exchange Commission. The Company is under

no obligation to, and expressly disclaims any such obligation to,

update or alter its forward-looking statements, whether as a result

of new information, future events, or otherwise.

Disclosure Information

PetVivo uses and intends to continue to use its

Investor Relations website as a means of disclosing material

nonpublic information, and for complying with its disclosure

obligations under Regulation FD. Accordingly, investors should

monitor the company’s Investor Relations website, in addition to

following the company’s press releases, SEC filings, public

conference calls, presentations, and webcasts.

Contact:

John Lai, CEOPetVivo Holdings, Inc.Email: info1@petvivo.com(952)

405-6216

PETVIVO HOLDINGS,

INC.CONDENSED CONSOLIDATED BALANCE

SHEETS

| |

|

March 31, 2022 |

|

|

March 31, 2021 |

|

| Current Assets |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

6,106,827 |

|

|

$ |

23,578 |

|

|

Accounts receivable |

|

|

2,596 |

|

|

|

- |

|

|

Inventory, net |

|

|

98,313 |

|

|

|

- |

|

|

Prepaid expenses and other assets |

|

|

547,664 |

|

|

|

123,575 |

|

|

Total Current Assets |

|

|

6,755,400 |

|

|

|

147,153 |

|

| |

|

|

|

|

|

|

|

|

| Property and Equipment, net |

|

|

311,549 |

|

|

|

214,038 |

|

| |

|

|

|

|

|

|

|

|

| Other Assets: |

|

|

|

|

|

|

|

|

|

Deferred offering costs |

|

|

- |

|

|

|

280,163 |

|

|

Operating lease right-of-use asset |

|

|

299,101 |

|

|

|

157,760 |

|

|

Patents and trademarks, net |

|

|

48,452 |

|

|

|

27,932 |

|

|

Security deposits |

|

|

12,830 |

|

|

|

8,201 |

|

|

Total Other Assets |

|

|

360,383 |

|

|

|

474,056 |

|

|

Total Assets |

|

$ |

7,427,332 |

|

|

$ |

835,247 |

|

| |

|

|

|

|

|

|

|

|

| Liabilities and Stockholders’ Equity (Deficit) |

|

|

|

|

|

|

|

|

| Current Liabilities |

|

|

|

|

|

|

|

|

|

Accounts payable |

|

$ |

323,384 |

|

|

$ |

408,873 |

|

|

Accrued expenses |

|

|

784,375 |

|

|

|

554,012 |

|

|

Convertible notes and accrued interest |

|

|

- |

|

|

|

235,671 |

|

|

Accrued expenses – related parties |

|

|

- |

|

|

|

36,808 |

|

|

Operating lease liability – current portion |

|

|

59,178 |

|

|

|

26,582 |

|

|

PPP Loan and accrued interest |

|

|

- |

|

|

|

39,020 |

|

|

Notes payable and accrued interest - directors |

|

|

- |

|

|

|

20,000 |

|

|

Notes payable and accrued interest – related party |

|

|

- |

|

|

|

44,554 |

|

|

Note payable and accrued interest (current portion) |

|

|

6,549 |

|

|

|

39,528 |

|

|

Total Current Liabilities |

|

|

1,173,486 |

|

|

|

1,405,048 |

|

| Other Liabilities |

|

|

|

|

|

|

|

|

| Note payable and accrued interest (net of current

portion) |

|

|

27,201 |

|

|

|

- |

|

|

Operating lease liability (net of current portion) |

|

|

239,923 |

|

|

|

131,178 |

|

|

Share-settled debt obligation – related party, net of debt

discount |

|

|

- |

|

|

|

196,000 |

|

|

Total Other Liabilities |

|

|

267,124 |

|

|

|

327,178 |

|

|

Total Liabilities |

|

|

1,440,610 |

|

|

|

1,732,226 |

|

| Commitments and Contingencies (see Note 13) |

|

|

|

|

|

|

|

|

| Stockholders’ Equity (Deficit): |

|

|

|

|

|

|

|

|

| Preferred stock, par value $0.001, 20,000,000 shares

authorized, issued 0 and 0 shares outstanding at March 31, 2022 and

March 31, 2021 |

|

|

- |

|

|

|

- |

|

| Common stock, par value $0.001, 250,000,000 shares authorized,

issued 9,988,361 and 6,799,113 shares outstanding at March 31, 2022

and March 31, 2021, respectively |

|

|

9,988 |

|

|

|

6,799 |

|

|

Additional Paid-In Capital |

|

|

69,103,155 |

|

|

|

57,207,648 |

|

|

Accumulated Deficit |

|

|

(63,126,421 |

) |

|

|

(58,111,426 |

) |

|

Total Stockholders’ Equity (Deficit) |

|

|

5,986,722 |

|

|

|

(896,979 |

) |

|

Total Liabilities and Stockholders’ Equity (Deficit) |

|

$ |

7,427,332 |

|

|

$ |

835,247 |

|

The accompanying notes are an integral part of

these audited consolidated financial statements.

PETVIVO HOLDINGS,

INC.CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS(UNAUDITED)

| |

|

Year EndedMarch 31, |

|

| |

|

2022 |

|

|

2021 |

|

| Revenues |

|

$ |

115,586 |

|

|

$ |

12,578 |

|

| |

|

|

|

|

|

|

|

|

| Cost of Sales |

|

|

201,154 |

|

|

|

10,695 |

|

|

Gross Profit (Loss) |

|

|

(85,568 |

) |

|

|

1,883 |

|

| |

|

|

|

|

|

|

|

|

| Operating Expenses: |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Sales and Marketing |

|

|

1,347,585 |

|

|

|

94,977 |

|

|

Research and Development |

|

|

474,881 |

|

|

|

98,230 |

|

|

General and Administrative |

|

|

3,148,494 |

|

|

|

1,767,664 |

|

| |

|

|

|

|

|

|

|

|

|

Total Operating Expenses |

|

|

4,970,960 |

|

|

|

1,960,871 |

|

| |

|

|

|

|

|

|

|

|

|

Operating Loss |

|

|

(5,056,528 |

) |

|

|

(1,958,988 |

) |

| |

|

|

|

|

|

|

|

|

| Other Income (Expense) |

|

|

|

|

|

|

|

|

|

Gain on Debt Extinguishment |

|

|

- |

|

|

|

366,903 |

|

|

Forgiveness of PPP loan and accrued interest |

|

|

31,680 |

|

|

|

- |

|

|

Derivative Expense |

|

|

- |

|

|

|

(1,702,100 |

) |

|

Interest Income (Expense) |

|

|

9,853 |

|

|

|

(228,595 |

) |

|

Total Other Income (Expense) |

|

|

41,533 |

|

|

|

(1,563,792 |

) |

| |

|

|

|

|

|

|

|

|

|

Net Loss before taxes |

|

|

(5,014,995 |

) |

|

|

(3,522,780 |

) |

| |

|

|

|

|

|

|

|

|

|

Income Tax Provision |

|

|

- |

|

|

|

- |

|

| |

|

|

|

|

|

|

|

|

|

Net Loss |

|

$ |

(5,014,995 |

) |

|

$ |

(3,522,780 |

) |

| |

|

|

|

|

|

|

|

|

|

Net Loss Per Share: |

|

|

|

|

|

|

|

|

|

Basic and Diluted |

|

$ |

(0.57 |

) |

|

$ |

(0.57 |

) |

| |

|

|

|

|

|

|

|

|

|

Weighted Average Common Shares Outstanding: |

|

|

|

|

|

|

|

|

|

Basic and Diluted |

|

|

8,760,877 |

|

|

|

6,198,717 |

|

The accompanying notes are an integral part of

these audited consolidated financial statements.Shares

retroactively restated for 1-for-4 reverse stock split in December

of 2020.

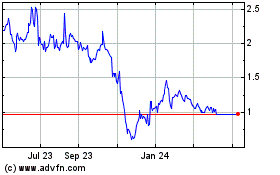

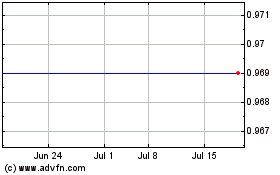

PetVivo (NASDAQ:PETV)

Historical Stock Chart

From Jul 2024 to Jul 2024

PetVivo (NASDAQ:PETV)

Historical Stock Chart

From Jul 2023 to Jul 2024