UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section

14(a) of the Securities

Exchange Act of 1934

|

Filed by the Registrant

|

x

|

|

Filed by a Party other than the Registrant

|

o

|

Check the appropriate box:

|

o

|

Preliminary Proxy Statement

|

|

|

o

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e) (2))

|

|

x

|

Definitive Proxy Statement

|

|

|

o

|

Definitive Additional Materials

|

|

|

o

|

Soliciting Material Pursuant to § 240.14a-12

|

(name of registrant as specified in its charter)

_________________________________________

(name of person(s) filing proxy statement, if other than registrant)

Payment of Filing Fee (Check the appropriate box):

|

|

o

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

(1)

|

Title of each class of securities to which transaction applies:

|

|

|

(2)

|

Aggregate number of securities to which transaction applies:

|

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11:

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

|

o

|

Fee paid previously with preliminary materials

|

|

|

o

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

(1)

|

Amount previously paid:

|

$

|

|

|

(2)

|

Form, Schedule or Registration Statement No.:

|

(4) Date Filed:

7720 N. Lehigh Avenue

Niles, Illinois 60714

May 29, 2009

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

NOTICE IS HEREBY GIVEN that the annual meeting of stockholders of MFRI, Inc. (the “Company”) will be held at The Standard Club, 320 South Plymouth Court, Chicago, Illinois on Tuesday, June 23, 2009, at 10:00 a.m., Chicago time, for the following purposes:

|

|

•

|

to elect directors; and

|

|

|

•

|

to transact such other business as may properly come before the meeting.

|

|

|

By order of the Board of Directors,

|

____________

PROXY STATEMENT

For the Annual Meeting of Stockholders of MFRI, Inc.

June 23, 2009

This Proxy Statement is furnished in connection with the solicitation of proxies on behalf of the Board of Directors of

MFRI, Inc.

for use at the annual meeting of stockholders

to be held on June 23, 2009

at 10:00 a.m., Chicago time, at The Standard Club, 320 South Plymouth Court, Chicago, Illinois,

and at any adjournment thereof. This Proxy Statement and the form of proxy are first being mailed on or about May 29, 2009 to stockholders of the Company. Only stockholders of record at the close of business on May 1, 2009 will be entitled to notice of and to vote at the meeting. On the record date there were 6,818,170 shares of common stock outstanding. There are no other voting securities. Each stockholder is entitled to one vote per share for the election of

directors, as well as on all other matters. If the accompanying proxy form is signed and returned, the shares represented thereby will be voted; such shares will be voted in accordance with the directions on the proxy form or, in the absence of direction as to any proposal, they will be voted

FOR

the election of the director nominees

, except to the extent authority to vote is withheld. The stockholder may revoke the proxy at any time prior to the voting thereof by giving written notice of such revocation to the Company in care of the Corporate Secretary at MFRI, Inc., 7720 N. Lehigh Avenue, Niles, Illinois 60714, by executing and duly and timely delivering a subsequent proxy to the same address shown immediately above, or by attending the meeting and voting in person.

In case any nominee named herein for election as a director is not available when the election occurs, proxies in the accompanying form may be voted for a substitute as well as for the other persons named herein. The Company expects all nominees to be available and knows of no matters to be brought before the meeting other than those referred to in the accompanying notice of annual meeting. If, however, any other matters come before the meeting, it is intended that proxies in the accompanying form will be voted thereon in accordance with the judgment of the persons voting such proxies.

The presence at the annual meeting, in person or by proxy, of the holders of a majority of the outstanding shares of common stock of the Company (“Common Stock”) shall constitute a quorum. Abstentions will be treated as shares that are present and entitled to vote for purposes of determining the presence of a quorum but as unvoted for purposes of determining the approval of any matter submitted to the stockholders for a vote. If a broker indicates on the proxy that it does not have discretionary authority as to certain shares to vote on a particular matter, those shares will not be considered as present and entitled to vote with respect to that matter.

A plurality of the votes of the shares present in person or represented by proxy at the meeting will be required to elect the directors.

In addition to the use of the mail, proxies may be solicited by directors, officers, or employees of the Company in person, by electronic mail, by telephone or by other means. The cost of the proxy solicitations will be paid by the Company.

On behalf of your Board of Directors, thank you for your continued support of MFRI, Inc.

The Company’s fiscal year ends January 31. Years described as 2008, 2007 and 2006 are the fiscal years ended January 31, 2009, 2008 and 2007, respectively.

Important Notice Regarding the Availability of Proxy Materials for the Shareholder Meeting to be held on June 23, 2009

.

This Proxy Statement and the Company’s 2008 Annual Report are available on the Company’s Web site at

www.mfri.com/investor/annual-report

.

PRINCIPAL STOCKHOLDERS AND SECURITY OWNERSHIP OF MANAGEMENT

The following table sets forth as of April 15, 2009, with respect to any person who is known to the Company to be the beneficial owner of more than 5% of the outstanding shares of Common Stock, the name and address of such owner, the number of shares of Common Stock beneficially owned, the nature of such ownership, and the percentage such ownership is of the outstanding shares of Common Stock:

|

Name and Address of

Beneficial Owner

|

Amount and Nature of

Beneficial Ownership

|

|

Percent of

Outstanding Shares

|

|

Babson Capital Management, LLC

470 Atlantic Avenue

Boston, MA 02210-2208

|

655,000

|

(1)

|

9.6%

|

|

|

|

|

|

|

Tontine Capital Partners, L.P.

55 Railroad Avenue, 3rd Floor,

Greenwich, CT 06830

|

512,912

|

(2)

|

7.5%

|

|

David Unger

7720 N. Lehigh Avenue

Niles, IL 60714

|

508,109

|

(3)

|

7.5%

|

|

|

|

|

|

|

Edward W. Wedbush

P.O. Box 30014

Los Angeles, CA 90030-0014

|

452,530

|

(4)

|

6.6%

|

|

|

|

|

|

|

Goodnow Investment Group, LLC

9 Old King’s Highway South Suite 300

Darien, CT 06820

|

345,047

|

(5)

|

5.1%

|

_________

|

(1)

|

According to a Schedule 13G dated December 31, 2008, Babson Capital Management LLC, in its capacity as investment adviser, may be deemed the beneficial owner of 655,000 shares of Common Stock which are owned by investment advisory client(s).

|

|

(2)

|

According to a Schedule 13G/A dated December 31, 2008, Tontine Overseas Associates, L.L.C. (“TOA”) owns 100,684 shares of Common Stock and serves as investment manager, and Tontine Capital Partners, L.P. (“TCP”) owns 412,228 shares of Common Stock. The General Partner of TCP is Tontine Capital Management, L.L.C (“TCM”), 55 Railroad Avenue, 3

rd

Floor, Greenwich, Connecticut 06830. As general

|

partner of TCP, TCM has the power to direct the affairs of TCP, including decisions respecting the disposition of the proceeds from the sale of the shares in the Company. Jeffrey L. Gendell, 55 Railroad Avenue, 3

rd

Floor, Greenwich, Connecticut 06830, is the Managing Member of TCM and TOA and in that capacity directs its operations. Thus, Mr. Gendell may be deemed the beneficial owner of the Common Stock owned by TCP.

|

(3)

|

Includes 11,847 shares held in joint tenancy with Reporting Person’s spouse, 5,923.5 of which the Reporting Person disclaims beneficial ownership. Includes 12,454 shares owned by the Reporting Person’s spouse all of which the Reporting Person disclaims beneficial ownership of. Also includes 7,250 shares that are subject to stock options granted by the Company that are exercisable on March 31, 2009, or will become, exercisable within 60 days thereafter.

|

|

(4)

|

According to a Schedule 13G/A dated December 31, 2008 (“WI Schedule 13G”), Wedbush, Inc. (“WI”), 1000 Wilshire Boulevard, Los Angeles, California 90017-2459, owns 228,132 shares of Common Stock, equaling 3.4% of the outstanding shares. Edward W. Wedbush is the chairman of WI and owns a majority of the outstanding shares of WI and, thus, may be deemed the beneficial owner (but disclaims ownership of such shares). According to WI Schedule 13G, Wedbush Morgan Securities (“WMS”), P.O. Box 30014, Los Angeles, CA 90030-0014, owns 18,285 shares of Common Stock,

equaling .3% of the outstanding shares. Edward W. Wedbush is the president of WMS and owns all shares of WMS and thus may be deemed beneficial owner of the Common Stock owned by WMS. According to the WI Schedule 13G, Mr. Wedbush, in his own name, owns 172,651 shares of Common Stock, equaling 2.5% of the outstanding shares.

|

|

(5)

|

According to a Schedule 13G dated December 31, 2008, Goodnow Investment Group, LLC, in its capacity as investment adviser, may be deemed the beneficial owner of 345,047 shares of Common Stock which are owned by investment advisory client(s).

|

The following table sets forth as of April 15, 2009, certain information concerning the ownership of Common Stock of each director, nominee, and executive officer named in the Summary Compensation Table hereof (“Named Executive Officers”) and all directors and executive officers of the Company as a group:

|

Name of Beneficial Owner

|

Amount and Nature

of Beneficial Ownership

|

Percent of Outstanding Shares

|

|

David Unger

|

508,109

(1)

|

7.5%

|

|

Henry M. Mautner

|

302,719

(2)

|

4.4%

|

|

Bradley E. Mautner

|

258,655

(3)

|

3.8%

|

|

Fati A. Elgendy

|

44,050

(4)

|

*

|

|

Arnold F. Brookstone

|

31,276

(5)

|

*

|

|

Eugene Miller

|

19,750

(6)

|

*

|

|

Robert Maffei

|

19,525

(7)

|

*

|

|

Michael D. Bennett

|

19,364

(8)

|

*

|

|

Stephen B. Schwartz

|

16,375

(9)

|

*

|

|

Dennis Kessler

|

11,750

(10)

|

*

|

|

Billy Ervin

|

3,125

(11)

|

*

|

|

Michael J. Gade

|

2,000

(12)

|

*

|

|

Mark A. Zorko

|

0

|

0

|

|

All directors and executive

officers as a group (18 persons)

|

1,256,198

|

18.4%

|

* Less than 1%.

__________________

|

(1)

|

Includes 11,847 shares held in joint tenancy with Reporting Person’s spouse, 5,923.5 of which the Reporting Person disclaims beneficial ownership. Includes 12,454 shares owned by the Reporting Person’s spouse all of which the Reporting Person disclaims beneficial ownership of. Also includes 7,250 shares that are subject to stock options granted by the Company that are exercisable by May 31, 2009.

|

|

(2)

|

Includes 7,250 shares that are subject to stock options granted by the Company that are exercisable by May 31, 2009.

|

|

(3)

|

Includes 200 shares held as custodian for the Reporting Person’s children, all of which the Reporting Person disclaims beneficial ownership of. Also includes 7,250 shares that are subject to stock options granted by the Company that are exercisable by May 31, 2009.

|

|

(4)

|

Includes 28,925 shares held in joint tenancy with Reporting Person’s spouse, 14,462.5 of which the Reporting Person disclaims beneficial ownership. Includes 15,125 shares that are subject to stock options granted by the Company that are exercisable by May 31, 2009.

|

|

(5)

|

Includes 29,526 shares held in a trust of which the Reporting Person is trustee. Also includes 1,750 shares that are subject to stock options granted by the Company that are exercisable by May 31, 2009.

|

|

(6)

|

Includes 4,000 shares held in a trust of which the Reporting Person is trustee. Also includes 15,750 shares that are subject to stock options granted by the Company that are exercisable by May 31, 2009.

|

|

(7)

|

Includes 11.400 shares held in a trust of which the Reporting Person is trustee. Also includes 8,125 shares that are subject to stock options granted by the Company that are exercisable by May 31, 2009.

|

|

(8)

|

Includes 400 shares held by Reporting Person’s spouse, of which the Reporting Person disclaims beneficial ownership. Also includes 8,000 shares that are subject to stock options granted by the Company that are exercisable by May 31, 2009.

|

|

(9)

|

Includes 14,375 shares held in a trust of which the Reporting Person is trustee. Also includes 2,000 shares that are subject to stock options granted by the Company that are exercisable by May 31, 2009.

|

|

(10)

|

Includes 1,750 shares that are subject to stock options granted by the Company that are exercisable by May 31, 2009.

|

|

(11)

|

Includes 3,125 shares that are subject to stock options granted by the Company that are exercisable by May 31, 2009.

|

|

(12)

|

Includes 2,000 shares held in joint tenancy with Reporting Person’s spouse, 1,000 of which the Reporting Person disclaims beneficial ownership.

|

PROPOSAL 1 - ELECTION OF DIRECTORS

Nine individuals have been nominated by the Nominating and Corporate Governance Committee for election at the annual meeting. All of the nominees, except Messrs. Gade and Zorko, were previously elected by the stockholders, and all are currently serving as directors of the Company.

|

Name

|

Offices and Positions, if any,

held with the Company; Age

|

First Became a Director of the Company

or a Predecessor

|

|

|

|

|

|

David Unger

|

Director, Chairman of the Board and Chief Executive Officer of the Company; Age 74

|

1989

|

|

Henry M. Mautner

|

Director of the Company; Age 82

|

1989

|

|

Bradley E. Mautner

|

Director, President and Chief Operating Officer of the Company; Age 53

|

1995

|

|

Arnold F. Brookstone

|

Director of the Company; Age 79

|

1990

|

|

Eugene Miller

|

Director of the Company; Age 83

|

1990

|

|

Stephen B. Schwartz

|

Director of the Company; Age 74

|

1995

|

|

Dennis Kessler

|

Director of the Company; Age 70

|

1998

|

|

Michael J. Gade

|

Director of the Company; Age 57

|

2009

|

|

Mark A. Zorko

|

Director of the Company; Age 57

|

2009

|

David Unger has been employed by the Company and its predecessors in various executive and administrative capacities since 1958. He became Chairman of the Board of Directors and Chief Executive Officer, (“CEO”) of the Company in 1989. He was the President of the Company from 1994 until 2004.

Henry M. Mautner has been employed by the Company and its predecessors since 1949. From 1989 until April 8, 2009, he served as Vice Chairman of the Company. Mr. Mautner is the father of Bradley E. Mautner.

Bradley E. Mautner has been employed by the Company and its predecessors in various executive and administrative capacities since 1978, has served as President and Chief Operating Officer since December 2004, was Executive Vice President from December 2002 to December 2004, was Vice President of the Company from December 1996 through December 2002 and has been a Director of the Company since 1995. Bradley E. Mautner is the son of Henry M. Mautner.

Arnold F. Brookstone served as Executive Vice President and Chief Financial and Planning Officer of Stone Container Corporation (subsequently merged into Smurfit - Stone Container Corporation) until his retirement on January 31, 1996. During the past five years he has served as an independent director of a number of public and privately-held companies.

Eugene Miller served as Vice Chairman of the Board of Directors and Chief Financial Officer of USG Corporation, a building materials holding company, from March 1987 until his retirement as of May 31, 1991. Mr. Miller is currently Executive-in-Residence and Adjunct Professor of Florida Atlantic University. During the past five years Mr. Miller served as an independent director of several privately-held companies.

Stephen B. Schwartz served as a senior vice president of IBM Corporation from 1990 until his retirement in 1992. From 1957 to 1990, Mr. Schwartz served in various capacities for IBM Corporation.

Dennis Kessler has been President of Kessler Management Consulting, LLC since February 1998. Prior to February 1998, Mr. Kessler was Co-President of Fel-Pro Incorporated, which manufactured and distributed gaskets, engine parts and industrial chemicals. Mr. Kessler had served in various capacities with Fel-Pro since 1964. He also serves as a director of a privately-held company.

Michael J. Gade is an Executive in Residence at the University of North Texas, and a Founding Partner of the Challance Group, LLP, providing corporate finance, marketing and strategic services for clients. From 2003 to 2004, Mr. Gade was the regional operations officer and corporate vice president of Home Depot, Inc., and from 2000 to 2003, he was Senior Vice President and Chief Marketing and Merchandising Officer of 7-Eleven, Inc. Rent-A-Center, Inc. (NasdaqGS: RCII) is among the boards on which he currently serves.

Mark A. Zorko has served as the Chief Financial Officer, and Secretary of Del Global Technologies Corp., an international medical electronics company since 2006. From 2000 to 2006, Mr. Zorko served in senior financial roles through Tatum CFO Partners, LLP, a professional service provider of financial and information technology executives. Mr. Zorko’s engagements included serving as chief financial officer or chief accounting officer of client companies. During the past four years he has served as a director of a number of public and privately-held companies.

CORPORATE GOVERNANCE AND THE BOARD OF DIRECTORS

Director Independence

The Company’s Board of Directors consists of nine directors, each of whom is being nominated for re-election at the annual meeting, except Messrs. Gade and Zorko, who were appointed to the Board in 2009. The Board of Directors has determined that six of the directors are “independent directors” within the meaning of the Nasdaq Stock Market rules. The other three directors, David Unger, Henry M. Mautner and Bradley E. Mautner, are employees of the Company and do not meet the definition of “independent” under the Nasdaq Stock Market rules.

Board of Directors’ Meetings and Committees

The Board of Directors held four meetings during 2008. The Board of Directors has three standing committees: the Nominating and Corporate Governance

Committee, the Compensation Committee and the Audit Committee.

Nominating and Corporate Governance Committee

The Nominating and Corporate Governance

Committee is comprised of Eugene Miller (Chairman), Arnold F. Brookstone, Stephen B. Schwartz, and Dennis Kessler. Four meetings were held in 2008. The Board of Directors has determined that all members of the Nominating and Corporate Governance

Committee are “independent” as that term is defined under the Nasdaq Stock Market rules.

The Nominating and Corporate Governance

Committee does not have a charter, but it has adopted resolutions addressing the nominations process and related matters as required under the federal securities laws and the Nasdaq Stock Market rules.

Nominating Process and Stockholder Recommendations

The Nominating and Corporate Governance

Committee identifies the attributes of the Board’s incumbent members believed to contribute to the work of the Board and its committees, including leadership, accomplishments, experience, skills, diversity, integrity and commitment to Board duties. When a position on the Board of Directors becomes vacant, or if the number of the members of the Board of Directors is being increased, the Nominating and Corporate Governance

Committee will review these attributes of the incumbent members and determine the attributes that, if possessed by the new board member, would likely result in a significant contribution to the Board of Directors. People recommended to the Nominating and Corporate Governance

Committee for consideration as

nominees for vacant or new Board positions will then be evaluated with respect to the attributes determined by the Nominating and Corporate Governance

Committee to be optimal for the vacant or new position. Following the evaluation, which may include interviews or such other procedures the Nominating and Corporate Governance

Committee deems advisable, the Nominating and Corporate Governance

Committee will make a recommendation to the Board regarding a candidate either to be nominated for election at the next annual meeting of stockholders or appointed by the Board between such meetings.

Recommendations for potential nominees may come from many sources, including members of the Board, executive officers, stockholders, self-recommendations, members of the communities the Company serves, or search firms. All persons recommended to the Board or the Nominating and Corporate Governance

Committee for a vacant or new Board position will be given equal consideration regardless of the source of the recommendation.

All of the nominees for director set forth in this proxy statement are standing for re-election, with the exception of Messrs. Gade and Zorko, who were appointed to the board in April, 2009. Mr. Gade was referred to the Nominating and Governance search committee upon recommendation by two non-management directors. Mr. Zorko was referred to the committee by the CEO and another executive officer upon referral to them by a consultant who focuses his practice on corporate governance and executive compensation. After the CEO and President interviewed Mr. Zorko, they recommended him to the committee.

Any stockholder wishing to make a recommendation for a person to be considered by the Nominating and Corporate Governance

Committee pursuant to the process described above as a potential nominee to the Board of Directors should direct the recommendation to the Nominating and Corporate Governance

Committee in care of the Secretary of the Company at the following address: Corporate Secretary, MFRI, Inc., 7720 N. Lehigh Avenue, Niles, Illinois 60714.

Compensation Committee

The Compensation Committee, consisting of Stephen B. Schwartz (Chairman), Arnold F. Brookstone, Eugene Miller, and Dennis Kessler, reviews the compensation paid to the officers of the Company, reports to the stockholders with respect to the compensation paid to the officers of the Company, approves material departures from the Company’s past compensation policies, determines the optionees and grant amounts under the Company’s 2004 Stock Incentive Plan and makes recommendations to the Board with respect to the Company’s compensation policies. The Compensation Committee does not have a charter. All of the four members of the Compensation Committee are “independent” as defined in the Nasdaq Stock Market rules. The Compensation Committee held three

meetings during 2008.

Audit Committee

The Audit Committee consists of Arnold F. Brookstone (Chairman), Dennis Kessler (Vice Chairman), Eugene Miller, Stephen B. Schwartz, and Mark A. Zorko. The Board of Directors has determined that all members of the Audit Committee are “independent” as that term is defined in the Nasdaq Stock Market rules. The Board of Directors has

also determined that at least two of the members of the Audit Committee, including Mr. Brookstone and Mr. Zorko, qualify as “audit committee financial experts” as defined in Item 407(d) of Regulation S-K. During 2008, the Audit Committee held six meetings.

The Board of Directors has adopted and approved a charter for the Audit Committee. Under the charter, the Audit Committee’s responsibilities include, among other things:

|

|

•

|

Selection and discharge of the independent auditors and approving the compensation of the independent auditors;

|

|

|

•

|

Reviewing independence with the independent auditors periodically, no less frequently than annually, including confirmation that no prohibited services were provided by the independent auditors or their affiliates, and obtaining on an annual basis written confirmation of the independence of the independent auditors;

|

|

|

•

|

Considering the results of the review of the interim financial statements by the independent auditors;

|

|

|

•

|

Reviewing the Company’s compliance with applicable accounting and financial reporting rules;

|

|

|

•

|

Considering and reviewing with management and with the independent auditors the adequacy of the Company’s internal controls, including computerized information system controls and security;

|

|

|

•

|

Considering, in consultation with the independent auditors, the audit scope and plan of the independent auditors;

|

|

|

•

|

Reviewing with management and the independent auditors the results of annual audits and related matters;

|

|

|

•

|

Reviewing with the independent auditors any impending changes in accounting and financial reporting rules and the expected impact of such changes on the Company; and

|

|

|

•

|

Conducting or authorizing investigations into any matters within the Audit Committee’s scope of responsibilities.

|

The Board of Directors of the Company adopted an Audit Committee Charter in 2000, and adopted amendments to it in 2002 and 2004. A copy of the Committee’s current charter is available at

www.mfri.com

under: corporate governance.

Indemnification

The Company has entered into indemnification agreements with each person who is currently a member of the Board of Directors of the Company and expects to enter into such agreements with persons who may in the future become directors of the Company. The Company has also entered into indemnification agreements with each of its executive officers. In general, such agreements provide for indemnification against any and all expenses incurred in connection with, as well as any and all judgments, fines, and amounts paid in settlement resulting from any threatened, pending, or completed action, suit, or proceeding, whether civil, criminal, administrative, or investigative, by reason of the fact that such director or executive officer is or was a director, officer, employee or agent of the Company, or is or was serving at the request of the Company as a director, officer, employee or agent of another corporation,

partnership, joint venture, trust, or other enterprise.

Board Attendance at Annual Meetings

The Company desires, but does not require, that all directors attend the Company’s annual meetings of stockholders. All of the Company’s directors attended the Company’s annual meeting of stockholders held in June 2008.

Code of Conduct

The Company has adopted a Code of Conduct which is applicable to all employees of the Company, including the Chief Executive Officer and Chief Financial Officer, and to the Company’s Board of Directors. The Code of Conduct is publicly available on the Company’s website at

www.mfri.com

under: corporate governance.

Stockholder Communication with the Board of Directors

Stockholders may communicate with the Board by submitting their communications in writing, addressed to the Board as a whole or, at the election of the stockholder, to one or more specific directors, in care of the Secretary of the Company, to: Corporate Secretary, MFRI, Inc., 7720 N. Lehigh Avenue, Niles, Illinois 60714. Stockholders also have the opportunity to communicate with Board members at the annual meeting.

The Audit Committee of the Board of Directors has established procedures for the receipt, retention and treatment of complaints regarding accounting, internal accounting controls, or auditing matters. Stockholders who wish to submit a complaint under these procedures should submit the complaint in writing to: Ethics Compliance Officer, MFRI, Inc., 7720 N. Lehigh Avenue, Niles, Illinois 60714.

REPORT OF THE AUDIT COMMITTEE

Included in the Company’s Annual Report on Form 10-K for the year ended January 31, 2009 are the consolidated balance sheets of the Company and its subsidiaries as of January 31, 2009 and 2008 and the related consolidated statements of earnings, stockholders’ equity and cash flows for each of the three years ended January 31, 2009, 2008 and 2007. The balance sheets and statements are the subject of a report by Grant Thornton LLP who was engaged in December 2004 as the Company’s independent auditors. The Audit Committee will appoint independent auditors for the year ending January 31, 2010 at a meeting to be held after the 2009 annual meeting of stockholders.

The Audit Committee reviewed and discussed the Audited Financial Statements with the Company’s management and with the independent registered public accounting firms prior to publication and filing. The Audit Committee has discussed with the independent registered public accounting firms, among other matters, the matters required to be discussed by Statement of Auditing Standards No. 61. The Audit Committee has received from the independent registered public accounting firms the written disclosures and letter required by Independence Standards Board Standard No. 1, and it has discussed with the independent registered public accounting firms their independence with respect to the Company.

Based upon the review and discussions referred to above, the Audit Committee recommended to the Company’s Board of Directors that the Audited Financial Statements be included in the Company’s Annual Report on Form 10-K for the year ended January 31, 2009, for filing with the Securities and Exchange Commission.

This Report of the Audit Committee shall not be deemed incorporated by reference by any general statement incorporating by reference this proxy statement into any filing under the Securities Act of 1933, as amended (the “Securities Act”), or the Securities Exchange Act of 1934, as amended (the “Exchange Act”), except to the extent that the Company specifically incorporates this information by reference, and shall not otherwise be deemed to be soliciting material or deemed filed under any such acts.

Arnold F. Brookstone, Chairman

Dennis Kessler, Vice Chairman

Eugene Miller

Stephen B. Schwartz

Members of the Audit Committee

(

Mr. Zorko was added to the Board of Directors and Audit Committee membership on April 7, 2009, subsequent to the report of the committee.)

COMPENSATION DISCUSSION AND ANALYSIS

The following discusses the material principles underlying the Company’s compensation policies for its Named Executive Officers (each, a “NEO”), its Management Committee (consisting of the Chief Executive Officer, President, Chief Financial Officer, Vice President Human Resources, and Segment Presidents), and its other Executive Officers, including both the separate elements of executive compensation and executive compensation as a whole. The specific amounts paid or payable to the NEOs are disclosed in the tables and narrative in the section of this proxy statement titled “Executive Compensation”. The following discussion cross-references those specific tables and narrative disclosures where appropriate.

Compensation Philosophy and Objectives:

The Compensation Committee reviews the compensation paid to the Company’s Executive Officers, reports to the stockholders with respect to the compensation paid to the Executive Officers, approves material departures from the Company’s past compensation policies of which there have been none, approves grants under the Company’s non-qualified deferred compensation plan, determines the optionees and grant amounts under the Company’s 2004 Stock Incentive Plan, and makes recommendations to the Board with respect to the Company’s compensation policies, which are approved by the Board after any changes that the Board deems appropriate.

The Company’s compensation program is designed to attract, motivate and retain talented individuals that MFRI needs to achieve business success, and to reward performance. The program reflects the following philosophy and objectives:

The interests of MFRI employees and stockholders should be aligned.

We believe that MFRI employees should act in the interests of MFRI stockholders; Executive Officer compensation includes equity compensation in the form of stock options to encourage such action.

Compensation should be related to performance.

Executive Officer compensation should vary based on objectively measurable performance of the Company or of the business unit of which the Executive Officer is a part.

Incentive compensation should be a greater part of total compensation for employees with more senior positions.

The proportion of an employee’s total compensation that varies based on performance should increase as the employee’s business responsibilities increase.

Compensation should balance long-term and short-term goals.

The Company’s incentive compensation plans reward short-term performance through cash compensation based on one year’s financial performance. Employee stock options are designed to increase in value with the Company’s long-term financial performance.

Benchmarking:

The Company has not formally compared its executive compensation to peer group or other benchmarks. Instead, the Company continually uses compensation information that becomes available when recruiting employees at all levels of the organization, and on other occasions, to attempt to ensure that total compensation is competitive and fair.

Elements of compensation:

The Company’s compensation program for NEOs and other Executive Officers is comprised of salary, annual cash incentive compensation, stock options, non-qualified deferred compensation, and other benefits and perquisites.

Salary:

Base salary is paid to all the Company’s salaried employees, including Executive Officers, to provide a degree of financial certainty. Competitive base salaries are intended to attract talented employees by providing a fixed portion of compensation on which employees can rely. Salary level for each employee other than members of the Management Committee is ordinarily reviewed annually by his or her manager with the approval of and under the oversight of that manager’s manager. However, the Company’s practice has been to review Management Committee salaries every two years, taking a somewhat longer view of those salaries than of salaries of other employees. The Chief Executive Officer, following consultation with the President, the Chief Financial Officer and the Vice President of Human Resources, recommends to the Compensation Committee base salary changes for the Management Committee.

Incentive Compensation:

Annual cash incentive compensation for Executive Officers is intended to reflect the Company’s belief that a significant portion of each Executive Officer’s potential compensation should be contingent on the performance of the Company or of the business unit of which the Executive Officer is a part. Incentive compensation formulas remain in place over many years. To align Executive Officer interests with the Company’s interests, incentive compensation formulas are not limited to minimum or maximum amounts earned. Executive Officers of the parent company earn incentive compensation based upon defined percentages ranging from 0.5% to 2% from the first dollar of the Company’s consolidated income before income taxes and before corporate profit-based incentive compensation. Executive Officers in more senior positions have a higher defined percentage than those in less senior positions. In

the year 2000, the Board of Directors amended the incentive compensation formulas for parent company Executive Officers to provide for doubling of the defined percentage for earnings in excess of those earned during the year ended January 31, 1998, $4,584,000, to provide additional compensation for growth in the Company’s earnings. Executive Officers of Company’s business units generally earn incentive compensation based upon defined percentages ranging from 2.5% to 6% of the business unit’s income from operations before allocated corporate expenses; to the extent such income exceeds six percent of business unit sales. The incentive compensation amounts for the NEOs are disclosed in Table 1 column g.

Stock Options:

Historically, the Company’s exclusive form of long-term compensation has been stock options with option price equal to market value (average of the highest price and lowest price) on the option grant date. Stock option grants provide a direct link to shareholder value as they only have value when stock price exceeds the option price. The Company’s practice of granting such stock options with a ten-year life and graduated vesting on each of the first four grant anniversary dates encourages retention of the stock option recipients. The Chief Executive Officer, following consultation with the members of the Management Committee, recommends stock option grants to the Compensation Committee, generally at the Compensation Committee’s meeting preceding the recommended grant date, but never later than its meeting on the recommended grant date. The Compensation Committee makes the final determination

of grants. On occasion, the Company has granted stock options to a new hire effective on the individual’s date of hire.

The total number of shares to grant on each grant date is determined subjectively, and is intended to provide significant performance and retention incentive to stock option recipients, while maintaining capacity to grant additional stock options in future years and avoiding excessive potential stockholder dilution upon stock option exercise. Allocation of the total shares granted among more senior executives, less senior executives, and other key employees of the Company is also a subjective process, which is an important part of the Chief Executives Officers’ consultation with the Management Committee members.

The Company has never backdated stock option grants, has not attempted to time stock option grants in coordination with announcement of material nonpublic information, has not timed its release of material non public information to affect the value of executive compensation, and has no plan to practice such timing. The general practice of annual stock option grants that has been in effect since May 1995 was approved by the Compensation Committee, upon recommendation by the Chief Executive Officer.

Non-Qualified Deferred Compensation:

In 1997, the Company instituted a non-qualified deferred compensation plan for its Executive Officers and certain key employees whose participation in the Company’s 401(k) retirement plan is restricted by federal limits, to provide those executives with financial security after their employment has terminated by retirement or after long service. Company deferred compensation contributions are fully vested at all times for terminations that result from death, disability or retirement, and vest 20% per year from years six through ten of the participant’s service for terminations for any other reason. Participant elective deferrals are fully vested at all times.

Other Benefits and Perquisites:

The executive officers participate in the benefit plans that are available generally to all salaried employees of the Company in the United States, including group medical insurance, life insurance, paid vacation, accidental death and dismemberment insurance and long-term disability insurance plans. These benefits provide financial security and peace of mind for employees and executives and are seen as a standard part of basic employee benefits. The cost of country club membership is reimbursed for Mr. Unger. All the NEOs except for Mr. Bennett and Mr. Ervin are furnished with a company automobile, for which NEOs reimburse the Company a fixed amount toward personal use; personal use beyond the amount reimbursed to the Company is shown as compensation in the accompanying compensation tables.

Tax Deductibility of Pay

Section 162(m) of the Internal Revenue Code places a limit of $1,000,000 on the amount of compensation that the Company may deduct in any one year with respect to each of the Named Executive Officers employed by the Company on the last day of the fiscal year. There is an exception to the $1,000,000 limitation for performance-based compensation meeting certain requirements. While the Committee considers the tax impact of Section 162(m), the Committee has determined that it is appropriate to maintain flexibility in compensating NEOs in a manner intended to promote varying corporate goals, recognizing that certain amounts paid to Named Executive Officers in excess of $1,000,000 may not be deductible under Section 162(m). For 2008, all compensation paid to NEOs was deductible for federal income tax purposes.

COMPENSATION COMMITTEE REPORT

The information contained in this report shall not be deemed to be “soliciting material” or “filed” with the SEC or subject to the liabilities of Section 18 of the Exchange Act, except to the extent that the Company specifically incorporates in by reference into a document filed under the Securities Act or Exchange Act.

The Compensation Committee, comprised of independent directors, reviewed and discussed the above Compensation Discussion and Analysis (CD&A) with the Company’s management. Based on such review and discussions, the Compensation Committee recommended to the Company’s Board of Directors that the CD&A be included in the Company’s Proxy Statement for its 2009 Annual Meeting of Stockholders.

|

|

Stephen B. Schwartz, Chairman

|

Arnold F. Brookstone

Eugene Miller

Dennis Kessler

Members of the Compensation Committee

EXECUTIVE COMPENSATION

The following table shows the total compensation earned by the Company’s Chief Executive Officer, Chief Financial Officer, and the three most highly paid executive officers other than the Chief Executive Officer and Chief Financial Officer for the fiscal years ended January 31, 2009, 2008 and 2007 (each, a “Named Executive Officer” or “NEO,”) for services rendered in all capacities to the Company and its subsidiaries.

The Named Executive Officers were not entitled to receive payments that would be characterized as “Bonus” or “Stock Award” payments as defined by the SEC, for the years ended January 31, 2009, 2008 and 2007. Annual incentive compensation earned is shown under column (g), “Non-Equity Incentive Plan Compensation.”

Summary Compensation Table

|

TABLE 1

Name and Principal Position

(a)

|

Year

(b)

|

Salary

($)

(c)

|

Option

Awards

($)

(f) (1)

|

Non-Equity

Incentive Plan

Compensation

($)

(g) (2)

|

Change in Nonqualified Deferred Compensation Earnings ($) (h) (3)

|

|

All Other

Compensation

($)

(i) (4)

|

Total

($)

(j)

|

|

David Unger

Chairman and Chief Executive Officer

|

2008

2007

2006

|

$282,500

275,000

262,500

|

$31,843

6,991

2,168

|

$267,020

12,109

205,593

|

$0

0

0

|

|

$100,725

40,299

73,616

|

$682,088

334,399

543,877

|

|

Michael D. Bennett

Vice President and Chief Financial Officer

|

2008

2007

2006

|

197,500

192,500

174,375

|

31,843

6,563

1,301

|

133,510

6,055

102,797

|

(44,038

13,231

31,196

|

)

|

8,446

7,494

6,298

|

327,261

225,843

315,967

|

|

Fati Elgendy

Vice President,

President Perma-Pipe, Inc.

|

2008

2007

2006

|

202,500

192,500

183,750

|

31,843

6,991

2,168

|

934,524

303,248

324,720

|

(78,525

90,885

35,709

|

)

|

17,466

17,869

15,096

|

1,107,808

611,493

561,443

|

|

Robert A. Maffei

Vice President Perma-Pipe, Inc.

|

2008

2007

2006

|

135,000

120,000

120,000

|

15,922

8,971

2,784

|

549,720

182,479

215,929

|

(152,754

(2,714

44,588

|

)

)

|

7,833

12,659

11,579

|

555,721

321,395

394,880

|

|

Billy E. Ervin

Vice President Perma-Pipe, Inc.

|

2008

2007

2006

|

125,000

105,300

105,300

|

15,922

8,971

2,784

|

458,100

152,066

179,941

|

(134,221

4,723

30,458

|

)

|

4,347

5,702

3,382

|

469,148

276,762

321,865

|

|

(1)

|

The amounts in column (f) represent SFAS 123(R) expense recognized for financial statement purposes.

|

|

(2)

|

See Table 3 for additional disclosure.

|

|

(3)

|

The amounts in column (h) are presented in more detail in Table 7 columns (b) and (c).

|

|

(4)

|

Details of the amounts presented in Table 1 column (i) All Other Compensation are as follows:

|

|

TABLE 2

Name

(a)

|

Year

|

Medical Payments and Premiums for Individually Selected Insurance Policies including Income Tax Gross-Up

(b)

|

Club Dues and Fees

(c)

|

Personal Use of Company Provided Automobile

(d)

|

401(k)

Contribution

(e)

|

Life Insurance Premiums

(f)

|

Total All Other Compensation

(g)

|

|

David Unger

|

2008

2007

2006

|

$81,957

19,996

54,199

|

$6,780

8,300

8,156

|

$3,807

3,781

5,625

|

$6,945

6,986

4,400

|

$1,236

1,236

1,236

|

$100,725

40,299

73,616

|

|

Michael D. Bennett

|

2008

2007

2006

|

0

0

0

|

0

0

0

|

0

0

0

|

5,925

4,973

3,777

|

2,521

2,521

2,521

|

8,446

7,494

6,298

|

|

Fati A. Elgendy

|

2008

2007

2006

|

0

0

0

|

0

0

0

|

7,742

8,185

8,851

|

6,950

6,910

3,471

|

2,774

2,774

2,774

|

17,466

17,869

15,096

|

|

Robert A. Maffei

|

2008

2007

2006

|

0

0

0

|

0

0

0

|

0

6,740

6,636

|

6,938

5,145

4,169

|

895

774

774

|

7,833

12,659

11,579

|

|

Billy E. Ervin

|

2008

2007

2006

|

0

0

0

|

0

0

0

|

0

0

0

|

3,159

4,514

2,194

|

1,188

1,188

1,188

|

4,347

5,702

3,382

|

Grants of Plan-Based Awards

Amounts in Table 1 column (g) represent the following:

|

TABLE 3

Name

(a)

|

Grant Date

(b)

|

Estimated Future Payouts under Non-Equity Incentive

Plan Awards

|

|

Threshold ($) (c

)

|

Target ($) (d)

|

Maximum ($) (e)

|

|

David Unger

|

2/1/08

|

|

$267,020

|

|

|

Michael D. Bennett

|

2/1/08

|

|

133,510

|

|

|

Fati A. Elgendy

|

2/1/08

|

|

934,524

|

|

|

Robert A. Maffei

|

2/1/08

|

|

549,720

|

|

|

Billy E. Ervin

|

2/1/08

|

|

458,100

|

|

A substantial portion of the total compensation reported in the Summary Compensation Table above is paid to the NEOs pursuant to the terms of their compensation plans described below maintained by the Company.

All the Company’s NEOs are employed at will, except for Fati A. Elgendy, whose employment agreement is described below, and are eligible for employee benefits available to the Company’s other salaried employees in the United States of America, including group medical insurance, group life insurance, Company-funded short-term disability benefits, group long-term-disability insurance, and a 401(k) retirement plan. The only amounts payable to a NEO, except for Mr. Elgendy

,

upon employment termination are amounts vested under the Company’s Nonqualified Deferred Compensation Plan, pro-rated amounts earned for a partial year under the NEO’s Non-Equity Incentive formula, and amounts required by law.

Compensation Plans for NEOs as of January 31, 2009

David Unger.

In addition to Mr. Unger’s annual base salary, he earns incentive compensation calculated as a defined percentage of the Company’s consolidated income before income taxes and before corporate profit-based incentive compensation. The Company makes available to Mr. Unger an annual amount to pay premiums for certain insurance policies for Mr. Unger and his wife currently or in later years, reimburses his and his wife’s medical expenses, and pays him an annual allowance for income tax gross-up on such insurance premiums and medical insurance payments. Mr. Unger is reimbursed for a club membership, and is provided a company automobile. Mr. Unger is granted stock options as approved by the Compensation Committee from time to time.

Michael D. Bennett.

In addition to Mr. Bennett’s annual base salary, he earns incentive compensation calculated as a defined percentage of the Company’s consolidated income before income taxes and before corporate profit-based incentive compensation. Mr. Bennett is credited with nonqualified deferred compensation and is granted stock options as approved by the Compensation Committee from time to time.

Fati A. Elgendy.

On November 12, 2007, the Company and Mr. Elgendy entered into an employment agreement to confirm Mr. Elgendy’s employment arrangement with the Company (“Employment Agreement”). For details, refer to Exhibit 10(j) filed with the 10 K on April 15, 2009. In addition to Mr. Elgendy’s annual base salary under the Employment Agreement, he earns incentive compensation calculated as a defined percentage of the Perma-Pipe Incentive Earnings, which is the business unit’s income from operations before allocated corporate expenses; to the extent such income exceeds six percent of business unit sales. In 2008, $934,524 of management incentive was earned. Pursuant to the Employment Agreement,

Mr. Elgendy is provided a company automobile, credited with nonqualified deferred compensation, and granted stock

options as approved by the Compensation Committee from time to time.

Robert A. Maffei.

In addition to Mr. Maffei’s annual base salary, he earns incentive compensation calculated as a defined percentage of the Perma-Pipe Incentive Earnings, which is the business unit’s income from operations before allocated corporate expenses, to the extent such income exceeds six percent of business unit sales. Mr. Maffei is credited with nonqualified deferred compensation and is granted stock options as approved by the Compensation Committee from time to time.

Billy E. Ervin.

In addition to Mr. Ervin’s annual base salary, he earns incentive compensation calculated as a defined percentage of the Perma-Pipe Incentive Earnings, which is the business unit’s income from operations before allocated corporate expenses, to the extent such income exceeds six percent of business unit sales. Mr. Ervin is credited with nonqualified deferred compensation and is granted stock options as approved by the Compensation Committee from time to time.

Outstanding Equity Awards at January 31, 2009

The following unexercised stock options are outstanding as of January 31, 2009:

|

TABLE 4

Name

(a)

|

Number of Securities Underlying Unexercised Options

(#) Exercisable

(b)

|

Number of Securities Underlying Unexercised Options

(#) Unexercisable

(c)

|

Option Exercise Price

($)

(e)

|

Option Vesting

Date

|

Option Expiration Date

(f)

|

|

David Unger

|

4,000

2,000

1,250

|

1,000

1,000

1,250

1,250

1,250

1,250

1,250

1,250

1,250

|

$7.61

10.075

10.075

10.075

28.99

28.99

28.99

28.99

17.64

17.64

17.64

17.64

|

6/22/09

6/22/10

6/19/09

6/19/10

6/19/11

6/19/09

6/19/10

6/19/11

6/19/12

|

5/31/15

5/31/16

5/31/16

5/31/16

5/31/17

5/31/17

5/31/17

5/31/17

5/31/18

5/31/18

5/31/18

5/31/18

|

|

Michael D. Bennett

|

1,250

1,500

2,000

2,000

1,250

|

1,000

1,000

1,250

1,250

1,250

1,250

1,250

1,250

1,250

|

$2.15

2.16

7.61

10.075

10.075

10.075

28.99

28.99

28.99

28.99

17.64

17.64

17.64

17.64

|

6/22/09

6/22/10

6/19/09

6/19/10

6/19/11

6/19/09

6/19/10

6/19/11

6/19/12

|

5/31/12

5/31/13

5/31/15

5/31/16

5/31/16

5/31/16

5/31/17

5/31/17

5/31/17

5/31/17

5/31/18

5/31/18

5/31/18

5/31/18

|

|

Fati A. Elgendy

|

7,000

875

4,000

2,000

1,250

|

1,000

1,000

1,250

1,250

1,250

1,250

1,250

1,250

1,250

|

$3.12

2.16

7.61

10.075

10.075

10.075

28.99

28.99

28.99

28.99

17.64

17.64

17.64

17.64

|

6/22/09

6/22/10

6/19/09

6/19/10

6/19/11

6/19/09

6/19/10

6/19/11

6/19/12

|

11/30/11

5/31/13

5/31/15

5/31/16

5/31/16

5/31/16

5/31/17

5/31/17

5/31/17

5/31/17

5/31/18

5/31/18

5/31/18

5/31/18

|

|

Robert A. Maffei

|

2,500

2,000

2,000

1,000

625

|

500

500

625

625

625

625

625

625

625

|

$2.15

2.16

7.61

10.075

10.075

10.075

28.99

28.99

28.99

28.99

17.64

17.64

17.64

17.64

|

6/22/09

6/22/10

6/19/09

6/19/10

6/19/11

6/19/09

6/19/10

6/19/11

6/19/12

|

5/31/12

5/31/13

5/31/15

5/31/16

5/31/16

5/31/16

5/31/17

5/31/17

5/31/17

5/31/17

5/31/18

5/31/18

5/31/18

5/31/18

|

|

Billy E. Ervin

|

500

1,000

1,000

625

|

500

500

625

625

625

625

625

625

625

|

$2.16

7.61

10.075

10.075

10.075

28.99

28.99

28.99

28.99

17.64

17.64

17.64

17.64

|

6/22/09

6/22/10

6/19/09

6/19/10

6/19/11

6/19/09

6/19/10

6/19/11

6/19/12

|

5/31/13

5/31/15

5/31/16

5/31/16

5/31/16

5/31/17

5/31/17

5/31/17

5/31/17

5/31/18

5/31/18

5/31/18

5/31/18

|

Option Exercises and Stock Vested 2008

The following stock options were exercised during 2008:

|

TABLE 5

Name

(a)

|

Option Awards

|

|

Number of Shares Acquired on Exercise (#)

(b)

|

Value Realized on Exercise

($)

(c)

|

|

David Unger

|

0

|

$0

|

|

Michael D. Bennett

|

0

|

0

|

|

Fati A. Elgendy

|

5,000

|

37,375

|

|

Robert A. Maffei

|

0

|

0

|

|

Billy E. Ervin

|

0

|

0

|

Nonqualified Deferred Compensation 2008 and at January 31, 2009

The following table contains additional required disclosures regarding nonqualified deferred compensation.

|

TABLE 6

Name

(a)

|

Executive Contributions in Last FY

($)

(b)

|

Registrant Contributions in Last FY

(c) (1)

|

Aggregate Earnings in Last FY

($)

(d) (1)

|

|

Aggregate Balance at Last FYE

($)

(f)

|

|

|

David Unger

|

$0

|

$0

|

$0

|

|

$0

|

|

Michael D. Bennett

|

0

|

20,000

|

(64,038

|

)

|

123,586

|

|

|

Fati A. Elgendy

|

150,000

|

20,000

|

(98,525

|

)

|

964,086

|

|

|

Robert A. Maffei

|

84,190

|

15,000

|

(167,754

|

)

|

404,716

|

|

|

Billy E. Ervin

|

75,000

|

15,000

|

(149,221

|

)

|

244,405

|

|

|

(1)

|

Following are the amounts in Columns (c) and (d) above also reported in the Summary Compensation Table for the last Fiscal Year, and amounts reported as compensation to the Named Executive officer in the Company’s Summary Compensation Tables of previous years:

|

|

TABLE 7

Name

(a)

|

Amounts in Columns (c) and (d) Above Also Reported in the Summary Compensation Table for the Last Fiscal Year

|

|

Amounts Reported as Compensation to the Named Executive Officer in The Company’s Summary Compensation Tables of Previous Years

(d)

|

|

|

Col (c) Registrant Contributions in Last FY

(b)

|

Col (d) Aggregate Earnings in Last FY

(c) (1)

|

|

|

|

David Unger

|

$0

|

$0

|

|

$0

|

|

|

Michael D. Bennett

|

20,000

|

(64,038

|

)

|

(44,038

|

)

|

|

Fati A. Elgendy

|

20,000

|

(98,525

|

)

|

(78,525

|

)

|

|

Robert A. Maffei

|

15,000

|

(167,754

|

)

|

(152,754

|

)

|

|

Billy E. Ervin

|

15,000

|

(149,221

|

)

|

(134,221

|

)

|

(1) Aggregate earnings in last fiscal year included in the Summary Compensation Table represent earnings on the Company’s contributions.

Non-management Directors’ Compensation 2008

|

Name

(a)

|

Fees Earned or Paid in Cash

($) (b)

|

Option Awards

($)

(d) (1)

|

Total

($)

(h)

|

|

Arnold F. Brookstone

|

$30,450

|

$7,015

|

$37,465

|

|

Eugene Miller

|

25,250

|

7,015

|

32,265

|

|

Stephen B. Schwartz

|

21,850

|

7,015

|

28,865

|

|

Dennis Kessler

|

27,050

|

7,015

|

34,065

|

|

(1)

|

The amounts in column (d) represent the 2008 expense as recognized under SFAS 123(R) for financial statement purposes for each Director.

|

Directors who are also employees of the Company or a subsidiary of the Company are not compensated for service as a Director.

Effective the beginning of the fourth quarter 2008, Independent Directors are paid a quarterly fee of $3,750, a fee of $2,000 for each day of attendance at Board meetings, $1,000 for attendance at each Audit Committee meeting, and a $200 fee per hour for engagement in any other activity on behalf of the Company, and are reimbursed for their expenses. The Audit Committee Chairman, Mr. Brookstone, receives an additional $1,250 quarterly fee as compensation for that service.

Stock options under the Company’s 2001 Independent Directors Stock Option Plan are granted as follows: (i) an option to purchase 10,000 shares upon an Independent Director’s first election to the Board; (ii) an option to purchase

1,000 shares automatically upon each date the Independent Director is re-elected to the board, and (iii) the Board of Directors has the discretion to make additional option grants to Independent Directors from time to time as the Board of Directors deems necessary or desirable. No discretionary grants have been made to-date.

The following stock options were exercised during 2008:

|

Name

(a)

|

Option Awards

|

|

Number of Shares Acquired on Exercise (#)

(b)

|

Value Realized on Exercise

($)

(c)

|

|

Arnold F. Brookstone

|

5,000

|

$9,815

|

|

Eugene Miller

|

0

|

0

|

|

Stephen B. Schwartz

|

6,000

|

54,193

|

|

Dennis Kessler

|

10,000

|

14,038

|

The following unexercised stock options are outstanding as of January 31, 2009:

|

Name

(a)

|

Number of Securities Underlying Unexercised Options

(#) Exercisable

(b)

|

Number of Securities Underlying Unexercised Options

(#) Unexercisable

(c)

|

Option Exercise Price

($)

(e)

|

Option Vesting

Date

|

Option Expiration Date

(f)

|

|

Arnold F. Brookstone

|

1,000

500

250

|

250

250

250

250

250

250

250

250

250

|

$7.61

10.075

10.075

10.075

28.99

28.99

28.99

28.99

17.64

17.64

17.64

17.64

|

6/22/09

6/22/10

6/19/09

6/19/10

6/19/11

6/19/09

6/19/10

6/19/11

6/19/12

|

5/31/15

5/31/16

5/31/16

5/31/16

5/31/17

5/31/17

5/31/17

5/31/17

5/31/18

5/31/18

5/31/18

5/31/18

|

|

Eugene Miller

|

11,000

1,000

1,000

1,000

1,000

500

250

|

250

250

250

250

250

250

250

250

250

|

$3.12

2.15

2.16

3.31

7.61

10.075

10.075

10.075

28.99

28.99

28.99

28.99

17.64

17.64

17.64

17.64

|

6/22/09

6/22/10

6/19/09

6/19/10

6/19/11

6/19/09

6/19/10

6/19/11

6/19/12

|

11/30/11

5/31/12

5/31/13

5/31/14

5/31/15

5/31/16

5/31/16

5/31/16

5/31/17

5/31/17

5/31/17

5/31/17

5/31/18

5/31/18

5/31/18

5/31/18

|

|

Stephen B. Schwartz

|

250

1,000

500

250

|

250

250

250

250

250

250

250

250

250

|

$3.31

7.61

10.075

10.075

10.075

28.99

28.99

28.99

28.99

17.64

17.64

17.64

17.64

|

6/22/09

6/22/10

6/19/09

6/19/10

6/19/11

6/19/09

6/19/10

6/19/11

6/19/12

|

5/31/14

5/31/15

5/31/16

5/31/16

5/31/16

5/31/17

5/31/17

5/31/17

5/31/17

5/31/18

5/31/18

5/31/18

5/31/18

|

|

Dennis Kessler

|

1,000

500

250

|

250

250

250

250

250

250

250

250

250

|

$7.61

10.075

10.075

10.075

28.99

28.99

28.99

28.99

17.64

17.64

17.64

17.64

|

6/22/09

6/22/10

6/19/09

6/19/10

6/19/11

6/19/09

6/19/10

6/19/11

6/19/12

|

5/31/15

5/31/16

5/31/16

5/31/16

5/31/17

5/31/17

5/31/17

5/31/17

5/31/18

5/31/18

5/31/18

5/31/18

|

401(k) Plan

The domestic employees of the Company, including the Named Executive Officers, are eligible to participate in the MFRI, Inc. Employee Savings and Protection Plan (the “401(k) Plan”), which is applicable to all employees except certain employees covered by collective bargaining agreement benefits. The 401(k) Plan allows employee pretax payroll contributions of up to 16% of total compensation. The Company matches 50% of each participant's contribution, up to a maximum of 3% of each participant’s salary.

Compensation Committee Interlocks and Insider Participation

There are no matters related to Compensation Committee interlocks

or insider participation that the Company is required to report.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934 requires that the Company’s directors and executive officers and persons who own more than 10% of the Company’s outstanding Common Stock report their beneficial ownership and changes in their beneficial ownership of the Company’s Common Stock by filing reports with the Securities and Exchange Commission. Based solely on the Company’s review of reports provided to the Company, no director, officer or owner of more than 10% of the Common Stock has failed to file on a timely basis a Statement of Beneficial Ownership of Securities on Form 3, 4 or 5 during 2008.

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Fees

The chart below sets forth the aggregate fees for professional services billed by Grant Thornton LLP in 2008 and 2007, and breaks down these amounts by category of service:

|

|

|

2008

|

|

|

2007

|

|

Audit Fees

|

$

|

784,214

|

|

$

|

623,300

|

|

Audit-Related Fees

|

|

0

|

|

|

0

|

|

Tax Fees

|

|

0

|

|

|

0

|

|

All Other Fees

|

|

3,750

|

|

|

3,750

|

|

Total

|

$

|

787,964

|

|

$

|

627,050

|

Audit Fees -

Audit fees represent services rendered for the audit of the Company’s consolidated annual financial statements and reviews of the quarterly financial statements, and the audit of internal controls over financial reporting. Additionally, audit fees include consents and other services related to SEC matters.

Audit-Related Fees -

There were no fees billed for audit related fees.

Tax Fees -

There were no fees billed for tax services in 2008.

All Other Fees

– Fees represent subscription fees for an accounting and auditing research tool.

Engagement -

Grant Thornton was engaged by the Audit Committee, and the Audit Committee approved in advance all audit and non-audit services rendered to the Company for 2008.

Representatives of Grant Thornton are expected to be present at the meeting and will be available to respond to appropriate questions and may make a statement if they so desire. The Audit Committee has considered whether the provision of non-audit services is compatible with maintaining the independence of Grant Thornton.

MULTIPLE STOCKHOLDERS SHARING AN ADDRESS

The rules of the Securities and Exchange Commission permit companies to provide a single copy of an annual report and proxy statement to households in which more than one stockholder resides (“Householding”). Stockholders who share an address and who have been previously notified that their broker, bank or other intermediary will be Householding their proxy materials will receive only one copy of the Company’s Proxy Statement and 2008 Annual Report to Stockholders unless they have affirmatively objected to the Householding notice.

Stockholders sharing an address who received only one set of these materials may request a separate copy, which will be promptly sent at no cost, by contacting the Corporate Secretary of the Company orally or in writing. For future annual meetings, a stockholder may request separate annual reports or proxy statements, or may request the Householding of such materials, by contacting the Company’s Transfer Agent at the following address:

Continental Stock Transfer & Trust Company

1 Battery Place

New York, New York 10004

(212) 509-4000

ANNUAL REPORT ON FORM 10-K

A copy of the Company’s Annual Report on Form 10-K for the year ended January 31, 2009 filed with the Securities and Exchange Commission accompanies this Proxy Statement.

Additional copies of the Annual Report on Form 10-K may be obtained, without charge, from the Company’s website at

www.mfri.com

, 847-966-1000,

or by writing to the Company’s Corporate Secretary at MFRI, Inc., 7720 N. Lehigh Avenue, Niles, Illinois 60714.

STOCKHOLDER PROPOSALS FOR 2010

Any proposal which a stockholder intends to present at the annual meeting of stockholders in 2010 must be in writing, must be received by the Company at its principal executive offices in Niles, Illinois by January 28, 2010 and must satisfy the applicable rules and regulations of the Securities and Exchange Commission, in order to be eligible for inclusion in the proxy statement and proxy form relating to such meeting.

IMPORTANT

All stockholders are cordially invited to attend the meeting in person.

If you cannot be present at the meeting, please sign and date the enclosed Proxy and mail it PROMPTLY in the enclosed self-addressed envelope. No postage need be affixed if mailed in the United States.

MFRI, INC.

THIS PROXY WILL BE VOTED IN ACCORDANCE WITH SPECIFICATIONS MADE. IF NO CHOICES ARE INDICATED, THIS PROXY WILL BE VOTED

FOR

EACH OF THE NOMINEES LISTED UNDER ITEM 1.

|

1. Election of Directors

Nominees: David Unger, Henry M. Mautner, Bradley E. Mautner,

Arnold F. Brookstone,

Eugene Miller, Stephen B. Schwartz, Dennis Kessler, Michael J. Gade and Mark A. Zorko.

(INSTRUCTION: To withhold authority to vote for any individual

nominee, write that nominee's name in the space provided at the right

and mark the oval "For All Nominees Except")

|

For

/ /

|

Withheld

/ /

|

For All Nominees

Except

/ /

|

|

|

|

|

|

|

|

Nominee

|

Exceptions

|

|

|

|

|

|

|

|

|

|

|

|

|

2.

In accordance with their discretion upon all other matters that may properly come before said meeting and any adjournment thereof.

|

|

|

|

The undersigned hereby revokes any proxy or proxies heretofore given to vote such shares at said meeting or at any adjournment thereof.

|

|

Signature

Signature

|

|

|

Date:

, 2009

NOTE: Please sign exactly as name appears hereon. For joint accounts, both owners should sign. When signing as executor, administrator, attorney, trustee or guardian,

etc.

, please sign your full title.

|

|

|

FOR SHARES OF COMMON STOCK SOLICITED ON

|

|

|

BEHALF OF THE BOARD OF DIRECTORS FOR THE ANNUAL MEETING

|

OF STOCKHOLDERS TO BE HELD ON JUNE 23, 2009

The undersigned hereby appoints DAVID UNGER, BRADLEY E. MAUTNER and MICHAEL D. BENNETT, and each of them, proxies with power of substitution and revocation, acting by majority of those present and voting, or if only one is present and voting then that one, to vote, as designated on the reverse side hereof, all of the shares of stock of MFRI, INC. which the undersigned is entitled to vote, at the annual meeting of stockholders to be held at The Standard Club, 320 South Plymouth Court, Chicago, Illinois on June 23, 2009 at 10:00 a.m. Chicago time, and at any adjournment thereof, with all the powers the undersigned would possess if present.

PLEASE VOTE, SIGN AND DATE ON REVERSE SIDE AND RETURN PROMPTLY IN THE ENCLOSED ENVELOPE. NO POSTAGE NEED BE AFFIXED IF MAILED IN THE UNITED STATES.

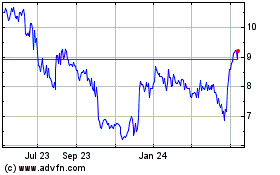

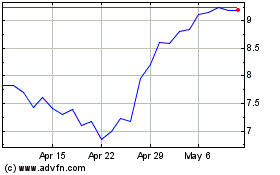

Perma Pipe (NASDAQ:PPIH)

Historical Stock Chart

From Jun 2024 to Jul 2024

Perma Pipe (NASDAQ:PPIH)

Historical Stock Chart

From Jul 2023 to Jul 2024