Report of Foreign Issuer (6-k)

September 22 2014 - 11:50AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

under the Securities Exchange Act of 1934

For the month of September 2014 (Report No. 3)

Commission File Number: 000-51694

Perion Network Ltd.

(Translation of registrant's name into English)

1 Azrieli Center, Building A, 4th Floor

26 HaRokmim Street, Holon, Israel 5885849

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F x Form 40-F o

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): _N/A_

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): __N/A__

Contents

This Report on Form 6-K of the registrant consists of the following document, which is attached hereto and incorporated by reference herein.

|

Exhibit 1:

|

Press Release: Perion Network Announces Results of Institutional Tender for Convertible Bonds in Israeli Public Offering, dated September 22, 2014.

|

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

Perion Network Ltd.

|

|

| |

|

|

|

| |

By:

|

/s/ Limor Gershoni Levy |

|

| |

Name: |

Limor Gershoni Levy

|

|

| |

Title: |

Corporate Secretary &

|

|

| |

|

General Counsel |

|

Date: September 22, 2014

Exhibit Index

|

Exhibit 1:

|

Press Release: Perion Network Announces Results of Institutional Tender for Convertible Bonds in Israeli Public Offering, dated September 22, 2014.

|

Exhibit 1

PERION NETWORK ANNOUNCES RESULTS OF INSTITUTIONAL TENDER

FOR CONVERTIBLE BONDS IN ISRAELI PUBLIC OFFERING

Tel Aviv and San Francisco – September 22, 2014 – Perion Network Ltd. (NASDAQ and TASE: PERI) today announced the results of its tender to institutional investors (the “Tender”), offering Series L Convertible Bonds in an aggregate amount of up to NIS 200 million par value (the "Bonds"). The Tender is the first stage of a public offering process being conducted in Israel only, and the Bonds are expected to trade on the Tel Aviv Stock Exchange.

At the Tender, the Company received early commitments for the purchase of Bonds in the aggregate amount of NIS 144 million par value (approximately $38 million) at an initial issuance price of NIS 965 per unit of NIS 1,000 par value of Bonds. The institutional investors will receive an early commitment discount of 0.5%.

If the offering is consummated, the Bonds will bear interest at the rate of 5% per year and will be convertible, at the election of the holder, into the Company’s ordinary shares at a conversion price of NIS 33.605 per share (currently equal to approximately $9.22), subject to adjustment for share splits, combinations, dividends and rights offerings. The principal of the Bonds will be repayable in five equal installments, with a final maturity date of March 31, 2020. The Bonds will be unsecured and denominated in nominal Israeli shekels. The Company has the right to redeem the Bonds under certain circumstances.

As previously reported, Standard & Poor’s Maalot assigned a local 'A-' stable rating for a proposed issuance of the Bonds up to NIS 200 million par value.

The public tender for the Bonds, which is the second and final stage of the process, is expected to be held on Tuesday, September 23, 2014.

The offering described in this press release will be made only in Israel and only to residents of Israel by way of the shelf offering report dated September 22, 2014 issued pursuant to the Company's shelf prospectus dated May 19, 2014, as amended on September 18, 2014. The Bonds will not be registered under the U.S. Securities Act of 1933 and will not be offered or sold in the United Statesor to U.S. persons. This press release shall not constitute an offer to sell or the solicitation of an offer to buy any Bonds.

About Perion Network Ltd.

Perion powers innovation. Perion is a global performance-based media and Internet company, providing online publishers and app developers advanced technology and a variety of intelligent, data-driven solutions to monetize their application or content and expand their reach to larger audiences, based on our own experience as an app developer. Our leading software monetization platform, Perion Codefuel, empowers digital businesses to optimize installs, analyze data and maximize revenue. Our app promotion platform, Perion Lightspeed, enables developers to make wise decisions on where to spend advertising budgets to produce the highest yield and the most visibility. The Perion team brings decades of experience, operating and investing in digitally-enabled businesses, and we continue to innovate and create value for the app ecosystem. More information about Perion may be found at www.perion.com. Follow Perion on Twitter @perionnetwork.

Forward Looking Statements

This press release contains historical information and forward-looking statements within the meaning of The Private Securities Litigation Reform Act of 1995 with respect to Perion. Such statements reflect the current views, assumptions and expectations of Perion with respect to future events and are subject to risks and uncertainties. Many factors could cause the actual results, performance or achievements of Perion to be materially different from any future results, performance or achievements that may be expressed or implied by such forward-looking statements, including, among others, our failure to receive requisite regulatory approvals for a particular offering, a downgrade of our credit rating, a lack of robust interest in our securities on the part of investors, the availability of more attractive investments at the time of an offering by us, adverse developments in our business or industry, general economic, market and political conditions, and various other factors, whether referenced or not referenced in this press release. Various other risks and uncertainties may affect Perion and its business, as described in reports filed by the Company with the Securities and Exchange Commission from time to time, including its annual report on Form 20-F/A for the year ended December 31, 2013. Perion does not assume any obligation to update these forward-looking statements.

Contact Information

Deborah Margalit

Perion Investor Relations

+972-73-398-1000

investors@perion.com

Source: Perion Network Ltd.

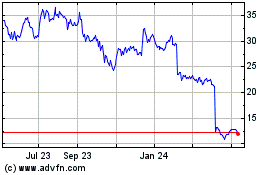

Perion Network (NASDAQ:PERI)

Historical Stock Chart

From Jun 2024 to Jul 2024

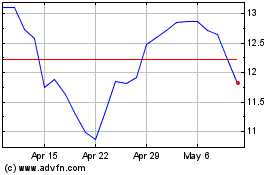

Perion Network (NASDAQ:PERI)

Historical Stock Chart

From Jul 2023 to Jul 2024