Zillow's Shares Hit 52-Week High - Analyst Blog

March 19 2013 - 10:31AM

Zacks

On Mar 18, 2013, shares of Zillow Inc. (Z) hit

a 52-week high of $55.09. The company reported fourth-quarter

results with a positive earnings surprise of 133.33%. Zillow

delivered positive earnings surprise in all 4 quarters of 2012 with

an average beat of 411.11%.

On Feb 13, 2013, Zillow reported its fourth-quarter net earnings of

2 cents, which exceeded the Zacks Consensus Estimate of a loss of 6

cents. Results were down 33.3% year over year from 3 cents earned

in the year-ago quarter.

During the fourth quarter Zillow’s top line grew 73% to $34.3

million on a year-over-year basis. It surpassed the Zacks

Consensus Estimate by 10.6%. Results were driven by improvement in

marketplace revenue and display revenue.

Zillow has been continuously working toward improving its revenue

structure through increasing its clientele. In order to achieve

this goal, the company is pursuing strategic acquisitions and is

offering new and better products to its customers.

In Oct 2012, Zillow introduced a new website, Zillow Rentals, to

enhance the rental business on mobile and Web. Again, in Feb 2013,

it launched Zillow Digs– an online service in home remodeling,

which marked an expansion in its existing lines of businesses.

In 2012, Zillow acquired four companies– RentJuice, HotPads,

Mortech Inc. and Buyfolio– to boost its organic growth story.

Further, in Feb 2013, the company declared that Zillow Real Estate

Network will be partnering HGTV to provide all real estate listings

for HGTV’s Front Door, the cable channel’s home-related media

content website. Zillow Premier Agent website which is expected to

come into force in the second quarter of 2013 will also be

benefited from the partnership.

During its fourth-quarter earnings release, Zillow guided its 2013

revenue to be in the range of $165–$170 million. The liaisons,

launch of advanced services and acquisitions are expected to help

Zillow achieve its expectation and improve its top line going

forward.

However, valuation looks stretched for Zillow. The shares are

trading at a considerable premium to the peer group average on a

forward price-to-earnings basis and at a 36.6% premium to the peer

group average on a price-to-book basis.

The return on equity is 3.3% above the peer group average.

Nevertheless, the 1-year return from the stock is 63.63%, much

above NASDAQ’s return of 5.96%.

Going forward, Zillow’s focus on maintaining aggressive expansion

of its mobile and desktop user base, enhancing its Premier Agent

business as well as improving mortgages, rentals and home

improvement to cement its position in emerging markets are expected

to be beneficial.

We believe that the strong emphasis on revenue improvement will

bolster future earnings. The overall long-term expected earnings

growth rate for this stock is 30.0%.

Zillow currently carries a Zacks Rank #3 (Hold). Among others from

the industry, Changyou.com (CYOU), China

Distance Education (DL) and Perion

Network (PERI) carry a favorable Zacks Rank #2 (Buy) and

are worth noting.

CHANGYOU.COM (CYOU): Free Stock Analysis Report

CHINA DISTANCE (DL): Free Stock Analysis Report

PERION NETWORK (PERI): Get Free Report

ZILLOW INC (Z): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

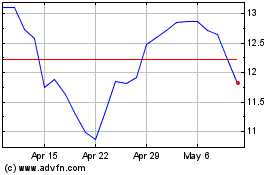

Perion Network (NASDAQ:PERI)

Historical Stock Chart

From Jun 2024 to Jul 2024

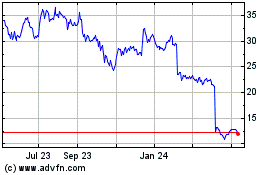

Perion Network (NASDAQ:PERI)

Historical Stock Chart

From Jul 2023 to Jul 2024