Perion Network Ltd. (NASDAQ: PERI) today announced financial

results for the fourth quarter and full year ended December 31,

2012.

Q4 2012 non-GAAP Financial Highlights Include:

- Quarterly revenues increased 90%

year-over-year to a record $21.4 million;

- Product and advertising revenues

increased 27% year-over-year, reaching $6.1 million;

- Search revenue increased year-over-year

136% to a record $15.3 million;

- Adjusted EBITDA increased 262%

year-over-year, reaching $4.9 million, or 23% of revenues;

- Net income doubled year-over-year,

reaching $3.6 million, or 17% of revenues; and

- Earnings Per Share was $0.32, double

that of the fourth quarter of 2011.

Year of 2012 non-GAAP Financial Highlights Include:

- Year-to date revenues increased 65%

year-over-year to a record $61.2 million;

- Product and advertising revenues

increased 101% year-over-year, reaching $23.1 million;

- Search revenue increased year-over-year

49% to $38.1 million;

- Adjusted EBITDA increased

year-over-year 44% to $14.0 million, or 23% of revenues;

- Net income was $10.3 million,

representing 17% of revenues;

- Earnings Per Share was $0.99, a 20%

increase from 2011; and

- GAAP Cash Flow from Operations was

$16.3 million, a 133% increase from 2011.

Josef Mandelbaum, Perion’s CEO, commented: “2012 was a great

year for Perion. We had record organic revenue growth, increased

profitability, strong cash generation, made significant progress in

our mobile product efforts and we completed another successful and

accretive acquisition. As we enter 2013, I am as optimistic about

our business as I've ever been since joining Perion. Based on the

tremendous advances so far and the opportunities I see ahead, I

believe we are well on our way to achieving our long term objective

of building a growing and profitable company that provides real

value to its users through quality products and services.”

“The momentum has continued in the first quarter and we remain

very confident and excited about 2013,” continued Mr. Mandelbaum.

“In addition to reaffirming our guidance, we fully expect to

continue our existing search partnerships well into the future. At

the same time, we are exploring additional search partnership

opportunities to leverage our new scale. 2013 will also be a year

of exciting new product launches, like our recent Incredimail for

iPad launch, further diversification of our business model and

accelerated and sustained growth."

Non-GAAP Financial Comparison for the Fourth Quarter and the

Year of 2012:

Revenue: Q4’12 revenues were a record $21.4 million,

increasing 90%, compared to the fourth quarter of 2011. The

accelerating growth was a result of positive trends in all Perion’s

revenue streams, particularly with search generated revenues

increasing 136% year-over-year. The extensive growth in search

generated revenues was primarily a result of organic growth, in

addition to which we benefited from one month of revenues from

SweetPacks.

In 2012, revenues increased 65%, reaching $61.2 million,

compared to $37.0 million in 2011. As product and advertising sales

more than doubled in 2012, they represented 38% of total revenues,

as compared to 31% in 2011.

Gross Profits: Gross profit in the fourth quarter of 2012

was $20.3 million, almost double the $10.2 million in the fourth

quarter of 2011. The gross profit margin increased to 95% this last

quarter, compared to 91% in the fourth quarter of 2011. For the

entire year, gross profit in 2012 increased 67%, reaching $57.5

million, compared to $34.5 million, with the gross profit margin

increasing to 94%, from 93% in 2011.

Customer Acquisition Costs (“CAC”): In the fourth quarter

of 2012, Perion increased its investment in CAC to a record $9.7

million, more than triple the $3.1 million invested in the fourth

quarter of 2011. For the entire year, CAC totaled $22.1 million in

2012, compared to only $8.0 million in 2011. The increase in CAC

was a combination of an organic increase resulting from ability to

better track the return on this investment since the second quarter

of this year, as well as that incurred by the acquisition of

SweetPacks in November of this year.

Adjusted EBITDA: In the fourth quarter of 2012, Adjusted

EBITDA was $4.9 million, or 23% of sales, a 262% increase compared

to the $1.4 million in the same quarter last year, despite the $6.6

million increase in CAC. Adjusted EBITDA in 2012 was $14.0 million,

increasing $4.3 million, or 44% from $9.7 million in 2011, even

though CAC increased $14.0 million in 2012, compared to 2011.

Net Income: In the fourth quarter of 2012, net income was

$3.6 million, or $0.32 per share, more than double the $1.6 million

or $0.16 per share in the fourth quarter of 2011. Net income in

2012 was $10.3 million, or $0.99 per share, compared to $8.3

million and $0.83 per share in 2011, increasing 20% despite the

$14.0 million increase in CAC.

Cash Flow from Operations: Based on U.S. GAAP, in 2012

cash flow from operations was $16.3 million. Included in that

number is $3.1 million cash, from accounts receivable acquired as

part of the SweetPacks acquisition, which will be returned to

SweetPacks shareholders in the first half of 2013. In 2011, cash

flow from operations was $7.0 million.

2013 Financial Outlook:

Management today reaffirmed its 2013 Financial Outlook from the

Company’s press release on January 8th that it expects:

- Revenues to exceed $110 million,

representing overall growth of 80%+ year-over-year, representing at

least 25% organic growth year-over-year;

- Adjusted EBITDA of at least $26

million, representing an EBITDA margin of 24% and representing

approximately 105% growth vs. 2012;

- Non-GAAP Net Income of at least $20

million, an 18% net profit margin and representing approximately

100% growth vs. 2012; with cash flow from operations closely

tracking Non-GAAP Net Income; and

- Non-GAAP EPS of $1.61, based on an

average of 12.4 million shares outstanding.

"Our guidance takes macro changes to the search industry into

account, but reflects minimal contribution from new products we

expect to introduce during the first half of 2013 and does not

include the incremental benefit of potential accretive

acquisitions,” concluded Mr. Mandelbaum.

Conference Call

Perion will host a conference call to discuss the results today,

March 13th at 10 a.m. EDT (4 p.m. Israel Time). To listen to the

call please visit the Investor Relations section of Perion’s

website at www.perion.com/events-presentations. Click on the link

provided for the webcast, or dial 1-866-744-5399. Callers from

Israel may access the call by dialing (03) 918-0685. The webcast

will be archived on the company’s website for seven days.

About Perion Network Ltd.

Perion Network Ltd. (NASDAQ: PERI) is a global consumer internet

company that develops applications to make the online experience of

its users simple, safe and enjoyable. Perion’s three main consumer

brands are: Incredimail, Smilebox and SweetIM. Incredimail

is a unified messaging application enabling consumers to manage

multiple email accounts and Facebook messages in one place with an

easy-to-use interface and extensive personalization features, and

is available in over 100 countries in 8 languages; Smilebox

is a leading photo sharing and social expression product and

service that quickly turns life's moments into digital keepsakes

for sharing and connecting with friends and family, in a fun and

personal way. SweetIM is an instant messaging application

that enables consumers to personalize their everyday communications

with free, fun and easy to use content. Perion products have had

over 300 million downloads to date with more than 50 million

monthly unique visitors across all of its brands. Most of Perion’s

applications are monetized through a freemium model. Free versions

of our applications are monetized primarily through our toolbar

which generates search revenue and display advertising revenue,

generated through impressions. A more advanced feature rich version

of many of our products is available with a premium upgrade. Perion

also offers and develops a range of products for mobile phones and

tablets to answer its users' increasing mobile demands. For more

information on Perion please visit www.perion.com.

Non-GAAP measures

Non-GAAP financial measures consist of GAAP financial measures

adjusted to exclude: Valuation adjustment on acquired deferred

product revenues, amortization of acquired intangible assets,

share-based compensation expenses, acquisition related expenses,

deferred finance expenses and non-recurring tax benefits. The

purpose of such adjustments is to give an indication of our

performance exclusive of non-cash charges and other items that are

considered by management to be outside of our core operating

results. Our non-GAAP financial measures are not meant to be

considered in isolation or as a substitute for comparable GAAP

measures, and should be read only in conjunction with our

consolidated financial statements prepared in accordance with GAAP.

Our management regularly uses our supplemental non-GAAP financial

measures internally to understand, manage and evaluate our business

and make operating decisions. These non-GAAP measures are among the

primary factors management uses in planning for and forecasting

future periods. Business combination accounting rules requires us

to recognize a legal performance obligation related to a revenue

arrangement of an acquired entity. The amount assigned to that

liability should be based on its fair value at the date of

acquisition. The non-GAAP adjustment is intended to reflect the

full amount of such revenue. We believe this adjustment is useful

to investors as a measure of the ongoing performance of our

business. We believe these non-GAAP financial measures provide

consistent and comparable measures to help investors understand our

current and future operating cash flow performance. These non-GAAP

financial measures may differ materially from the non-GAAP

financial measures used by other companies. Reconciliation between

results on a GAAP and non-GAAP basis is provided in a table

immediately following the Consolidated Statements of Income.

Forward Looking Statements

This press release contains historical information and

forward-looking statements within the meaning of The Private

Securities Litigation Reform Act of 1995 with respect to the

business, financial condition and results of operations of the

Company. The words “will,” “believe,” “expect,” “intend,” “plan,”

“should” and similar expressions are intended to identify

forward-looking statements. Such statements reflect the current

views, assumptions and expectations of the Company with respect to

future events and are subject to risks and uncertainties. Many

factors could cause the actual results, performance or achievements

of the Company to be materially different from any future results,

performance or achievements that may be expressed or implied by

such forward-looking statements, or financial information,

including, among others, potential litigation associated with the

transaction, risks that the Company's acquisition activities may

disrupt current plans and operations and pose difficulties in

employee retention, risks entailed in integrating acquired

businesses, changes in the markets in which the Company operates

and in general economic and business conditions, loss of key

customers and unpredictable sales cycles, competitive pressures,

market acceptance of new products, inability to meet efficiency and

cost reduction objectives, changes in business strategy and various

other factors, whether referenced or not referenced in this press

release. Various other risks and uncertainties may affect the

Company and its results of operations, as described in reports

filed by the Company with the Securities and Exchange Commission

from time to time, including its annual report on Form 20-F for the

year ended December 31, 2011. The Company does not assume any

obligation to update these forward-looking statements.

Source: Perion Network Ltd.

PERION NETWORK LTD. NON-GAAP SUMMARY FINANCIAL METRICS U.S. dollars

in thousands (except per share data), unaudited

Quarter ended December 31, Year ended December 31,

2012 2011 2012

2011 Revenues: Search $ 15,250 $ 6,458 $ 38,061 $ 25,466

Product 4,382 4,209 18,557 8,724 Other 1,739 609

4,588 2,816 Total revenues $ 21,371 $ 11,276 $ 61,206

$ 37,006 Gross Profit $ 20,262 $ 10,215 $ 57,481 $ 34,499 EBITDA $

4,926 $ 1,361 $ 13,994 $ 9,670 Net Income $ 3,634 $ 1,598 $ 10,301

$ 8,269 Diluted EPS $ 0.32 $ 0.16 $ 0.99 $ 0.83

PERION NETWORK LTD.

GAAP FINANCIAL STATEMENTS

CONSOLIDATED STATEMENTS OF INCOME

U.S. dollars and number of shares in

thousands (except per share data)

Quarter endedDecember

31,

Year endedDecember 31,

2012 2011 2012

2011 (unaudited) (unaudited) (unaudited) Revenues: Search $

15,250 $ 6,458 $ 38,061 $ 25,466 Product 4,377 3,236 17,574 7,191

Other 1,739 609 4,588

2,816 Total revenues 21,366 10,303 60,223 35,473 Cost of revenues

1,850 1,311 5,230 2,840

Gross profit 19,516 8,992 54,993

32,633 Operating expenses: Research and development, net

2,877 2,386 10,735 7,453 Selling and marketing 2,196 2,494 7,456

4,971 Customer acquisition costs 9,698 3,071 22,061 8,013 General

and administrative 3,307 1,665 8,560

7,649 Total operating expenses 18,078

9,616 48,812 28,086 Operating income

(loss) 1,438 (624 ) 6,181 4,547 Financial income (expense), net

80 1,059 (174 ) 1,293

Income before taxes on income 1,518 435 6,007 5,840 Taxes on income

925 243 2,473 172 Net

income $ 593 $ 192 $ 3,534 $ 5,668 Basic

earnings per share $ 0.06 $ 0.02 $ 0.35 $ 0.58

Diluted earnings per share $ 0.05 $ 0.02 $ 0.34 $

0.57 Basic weighted number of shares 10,727

9,914 10,159 9,796 Diluted weighted

number of shares 11,275 9,958 10,367

10,002 PERION NETWORK LTD.

RECONCILIATION OF GAAP TO NON-GAAP RESULTS U.S. dollars and number

of shares in thousands (except per share data), unaudited

Quarter endedDecember

31,

Year endedDecember 31,

2012 2011 2012

2011 GAAP revenues $ 21,366 $ 10,303 $ 60,223 $

35,473 Valuation adjustment on acquired deferred product revenues

5 973 983 1,533

Non-GAAP revenues $ 21,371 $ 11,276 $ 61,206

$ 37,006 GAAP gross profit $ 19,516 $ 8,992 $

54,993 $ 32,633 Valuation adjustment on acquired deferred product

revenues 5 973 983 1,533 Share based compensation 2 - 16 -

Amortization of acquired intangible assets 739

250 1,489 333 Non-GAAP gross

profit $ 20,262 $ 10,215 $ 57,481 $ 34,499

GAAP operating expenses $ 18,078 $ 9,616 $ 48,812 $

28,086 Acquisition related expenses 1,703 39 2,204 1,069 Share

based compensation 265 268 1,040 1,183 Amortization of acquired

intangible assets 314 255 946 323 Other - -

- (50 ) Non-GAAP operating expenses $

15,796 $ 9,054 $ 44,622 $ 25,561

GAAP operating income (loss) $ 1,438 $ (624 ) $ 6,181

$ 4,547 Valuation adjustment on acquired deferred product

revenues 5 973 983 1,533 Acquisition related expenses 1,703 39

2,204 1,069 Share based compensation 267 268 1,056 1,183

Amortization of acquired intangible assets 1,053 505 2,435 656

Other - - - (50 )

Operating income adjustments 3,028 1,785

6,678 4,391 Non-GAAP operating

income $ 4,466 $ 1,161 $ 12,859 $ 8,938

GAAP Net income $ 593 $ 192 $ 3,534 $ 5,668 Operating income

adjustments 3,028 1,785 6,678 4,391 Deferred finance expenses 101 -

177 - Non-recurring tax benefit - (379 ) - (1,790 ) Taxes related

to amortization of acquired intangible assets (88 ) -

(88 ) - Non-GAAP net income $ 3,634

$ 1,598 $ 10,301 $ 8,269 GAAP

diluted earnings per share $ 0.05 $ 0.02 $ 0.34

$ 0.57 Non-GAAP diluted earnings per share $

0.32 $ 0.16 $ 0.99 $ 0.83 Shares

used in computing US GAAP and Non-GAAP diluted earnings per share

11,275 9,958 10,367

10,002 Non-GAAP net income $ 3,634 $ 1,598 $

10,301 $ 8,269 Income tax expense 925 243 2,473 172 Non-recurring

tax benefit 88 379 88 1,790 Interest expense (income), net (80 )

(1,059 ) 174 (1,293 ) Deferred finance expenses (101 ) - (177 ) -

Depreciation and amortization 460 200

1,135 732 Non-GAAP EBITDA $ 4,926

$ 1,361 $ 13,994 $ 9,670

PERION NETWORK LTD. CONDENSED CONSOLIDATED BALANCE SHEETS U.S.

dollars in thousands (except share data)

December 31, 2012

2011 Unaudited Unaudited ASSETS CURRENT

ASSETS: Cash and cash equivalents $ 21,762 $ 11,260 Trade

receivables 10,246 3,265 Restricted cash 10,260 - Other receivables

and prepaid expenses 5,424 6,459 Total current assets

47,692 20,984 LONG-TERM ASSETS: Property and

equipment, net 1,522 1,300 Goodwill and other intangible assets,

net 72,250 31,359 Other assets 1,216 1,261 Total

long-term assets 74,988 33,920 Total assets $ 122,680

$ 54,904 LIABILITIES AND SHAREHOLDERS' EQUITY CURRENT

LIABILITIES: Current maturities of long-term debt $ 2,300 $ - Trade

payables 9,560 3,207 Deferred revenues 5,132 4,280 Payment

obligation related to acquisition 20,317 6,574 Accrued expenses and

other liabilities 14,676 11,230 Total current

liabilities 51,985 21,011 LONG-TERM

LIABILITIES: Long-term debt 6,550 - Contingent purchase

consideration 6,078 - Other long-term liabilities 3,357

2,078 Total long-term liabilities 15,985 2,078

SHAREHOLDERS' EQUITY 54,710 31,815 Total liabilities

and shareholders' equity $ 122,680 $ 54,904 PERION

NETWORK LTD. CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS U.S.

dollars in thousands, (unaudited)

Year ended December 31, 2012

2011

Cash flows from

operating activities:

Net income $ 3,534 $ 5,668 Adjustments required to reconcile net

income to net cash provided by operating activities: Depreciation

and amortization 3,572 1,388 Stock based compensation expense 1,056

1,183 Accretion of payment obligation related to acquisition 490

100 Finance expense related to marketable securities - 84 Deferred

taxes, net (172 ) (1,140 ) Net changes in operating assets and

liabilities: Trade receivables 492 (383 ) Other receivables and

prepaid expenses 1,658 (1,100 ) Other long-term assets 82 60 Trade

payables 4,035 108 Deferred revenues (268 ) 998 Accrued expenses

and other liabilities 1,788 112 Accrued severance pay, net

(3 ) (40 ) Net cash provided by operating activities

16,264 7,038

Cash flows from

investing activities:

Purchase of property and equipment (662 ) (316 ) Restricted cash

(343 ) 90 Capitalization of software development and content costs

(821 ) (829 ) Cash paid in connection with acquisitions, net of

cash acquired (13,590 ) (21,712 ) Cash paid by employees on

previously exercised options of acquired company 727 - Proceeds

from sales of marketable securities - 26,704 Investment in

marketable securities - (11,915 ) Net cash

used in investing activities (14,689 ) (7,978 )

Cash flows from

financing activities:

Exercise of share options 77 30 Proceeds from long-term loans

10,000 - Repayment of long-term loans (1,150 ) - Dividend paid

- (3,885 ) Net cash provided by (used in)

financing activities 8,927 (3,855 ) Increase

(Decrease) in cash and cash equivalents 10,502 (4,795 ) Cash and

cash equivalents at beginning of year 11,260

16,055 Cash and cash equivalents at end of period $ 21,762

$ 11,260

Supplemental

disclosure of non-cash investing activities:

Issuance of shares in connection with acquisitions 18,200

750 Stock-based compensation that was

capitalized as part of capitalization of software development costs

27 -

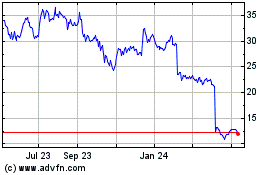

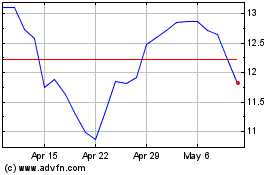

Perion Network (NASDAQ:PERI)

Historical Stock Chart

From Jun 2024 to Jul 2024

Perion Network (NASDAQ:PERI)

Historical Stock Chart

From Jul 2023 to Jul 2024