false

0001056943

0001056943

2024-10-25

2024-10-25

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report: October 25, 2024

(Date of earliest event reported)

PEOPLES FINANCIAL SERVICES CORP.

(Exact name of registrant as specified in its Charter)

| PA |

|

001-36388 |

|

23-2391852 |

| (State or other jurisdiction |

|

(Commission file number) |

|

(IRS Employer |

| of incorporation) |

|

|

|

Identification No.) |

150 North Washington Avenue, Scranton, Pennsylvania 18503-1848

(Address of Principal Executive Offices) (Zip Code)

(570) 346-7741

(Registrant’s telephone number, including

area code)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (See General

Instruction A.2. below):

| ¨ | Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, $2.00 par value |

|

PFIS |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the

registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or

Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company ¨

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 5.02 | Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers;

Compensatory Arrangements of Certain Officers |

On October 25, 2024, Peoples Financial Services

Corp., a Pennsylvania corporation (“Peoples”), and its banking subsidiary, Peoples Security Bank and Trust Company (“Peoples

Bank”), entered into a Separation Agreement with Craig W. Best, Chief Executive Officer of Peoples and Peoples Bank (the “Separation

Agreement”). The Separation contemplates that Mr. Best will resign from his positions as Chief Executive Officer and director

of Peoples and Peoples Bank effective as of December 31, 2024. Upon his resignation, Mr. Best will cease to serve as principal

executive officer of Peoples.

The

Separation Agreement provides that Mr. Best will receive, in addition to his accrued compensation and other benefits through

his termination date, severance in an aggregate amount of $1,190,073, payable in substantially equal monthly installments over a 24-month

period, the applicable premium otherwise payable for COBRA continuation coverage for the executive, his spouse and any dependents for

a period of up to 24 months following termination, and up to $30,000 in outplacement assistance. The Separation Agreement provides that

payment of severance is contingent upon Mr. Best’s execution and delivery of a release agreement to Peoples and Peoples Bank.

The

Separation Agreement also includes a provision whereby Mr. Best acknowledges and affirms his existing restrictive covenants

concerning confidentiality and nondisclosure, non-competition and non-interference with employees, customers and other business relationships

of Peoples and Peoples Bank, subject to an amendment pursuant to which Peoples Bank’s Lebanon, Pennsylvania branch will be disregarded

for purposes of determining the restricted territory.

The foregoing summary and description of the Separation

Agreement does not purport to be complete and is qualified in its entirety by reference to the full text of the Separation Agreement,

which is filed with this Current Report on Form 8-K as Exhibit 10.1, and incorporated herein by reference.

Gerard A. Champi, President of Peoples and Peoples

Bank, will succeed Mr. Best as Chief Executive Officer of Peoples and Peoples Bank, and principal executive officer of Peoples. At

that time, Mr. Champi will cease to serve as President of Peoples and Peoples Bank, and Thomas P. Tulaney, Chief Operating Officer

of the Company and the Bank, will succeed Mr. Champi as President of Peoples and Peoples Bank.

Mr.

Champi is party to that certain Employment Agreement dated July 26, 2024 between Mr. Champi and Peoples and Peoples Bank, a summary

of which can be found in Peoples’ Current

Report on Form 8-K filed with the SEC on July 29, 2024, and which is incorporated herein by reference. Since July 1,

2024, Mr. Champi has served as President of Peoples and Peoples Bank. Additional information about Mr. Champi’s background,

experience, and qualifications can be found in Part

III, Item 10 of the Annual Report on Form 10-K filed by FNCB Bancorp, Inc. on March 8, 2024, and is incorporated

herein by reference.

Mr.

Tulaney is party that certain Employment Agreement dated May 30, 2012 between Mr. Tulaney and Peoples and Peoples Bank, a summary of which

can be found under the heading “Thomas P. Tulaney Employment Agreement” in the Definitive

Proxy Statement on Schedule 14A filed by Peoples on April 5, 2024, (the “Peoples Proxy”), and is incorporated herein

by reference. Since July 1, 2024, Mr. Tulaney has served as Chief Operating Officer of Peoples and Peoples Bank. Additional information

about Mr. Tulaney’s background, experience, and qualifications can also be found in Peoples

Proxy, and is incorporated herein by reference.

There are no family relationships between either

Mr. Champi and Mr. Tulaney and other person serving as a director or executive officer of Peoples. Neither Messrs. Champi

nor Tulaney are party to any transactions that require disclosure under Item 404(a) of Regulation S-K.

On October 25, 2024, the board of directors

of Peoples unanimously resolved to decrease the number of directors constituting the entire Peoples board from sixteen (16) to fifteen

(15), and the board of directors of Peoples Bank unanimously resolved to decrease the number of directors constituting the entire Peoples

Bank board from eighteen (18) to seventeen (17), in each case effective upon Mr. Best’s resignation from the boards.

On October 25, 2024, Peoples issued a press

release announcing updates to the company’s succession plans. A copy of the press release is attached hereto as Exhibit 99.1

and is incorporated herein by reference.

| Item 9.01 | Financial Statements and Exhibits |

(d) Exhibits

The following exhibits are filed with this form

8-K:

| Exhibit

No. |

|

Description |

| 10.1 |

|

Separation Agreement, dated as of October 25, 2024 by and between Craig W. Best, Peoples Security Bank and Trust Company, and Peoples Financial Services Corp. |

| 10.2 |

|

Employment Agreement, dated as of July 26, 2024 by and among Peoples Security Bank and Trust Company, Peoples Financial Services Corp. and Gerard A. Champi (incorporated by reference to Exhibit 10.1 of Peoples’ Current Report on Form 8-K filed with the SEC on July 29, 2024). |

| 10.3 |

|

Employment Agreement, dated May 30, 2012, among Penseco Financial Services Corporation, Penn Security Bank and Trust Company, and Thomas P. Tulaney (incorporated by reference to Exhibit 10.1 Exhibit 10.1 of Peoples’ quarterly report on Form 10-Q filed with the SEC on August 9, 2012). |

| 99.1 |

|

Press release dated October 25, 2024 announcing update to succession plan. |

| 104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

| | PEOPLES FINANCIAL SERVICES CORP. |

| | |

| | By: |

/s/ John R. Anderson, III |

| | |

John R. Anderson, III |

| | |

Executive Vice President and Chief

Financial Officer |

| | |

(Principal Financial Officer and Principal

Accounting Officer) |

| | |

| Dated:

October 25, 2024 | |

Exhibit 10.1

separation

Agreement

THIS

SEPARATION AGREEMENT (this “Agreement”) is made October 25, 2024, by and between Craig W. Best (the “Executive”),

Peoples Security Bank and Trust Company, successor-by-merger to Penn Security Bank and Trust Company (the “Bank”),

and Peoples Financial Services Corp., successor-by-merger to Penseco Financial Services Corporation (the “Parent”

and, together with the Bank, the “Company”).

WHEREAS, the Company and

the Executive entered into that certain Employment Agreement, dated as of January 3, 2011, as amended, which governs the Executive’s

employment with the Company (the “Employment Agreement”);

WHEREAS, the Executive’s

employment shall cease effective as of December 31, 2024 (the “Termination Date”); and

WHEREAS, the Company has

agreed to pay the Executive certain amounts in connection with the Executive’s termination of employment, subject to the Executive’s

execution of this Agreement and the Release (as defined below).

NOW THEREFORE, in consideration

of these premises and the mutual promises contained herein, and intending to be legally bound hereby, the parties agree as follows:

1. Termination.

1.1. The

parties acknowledge and agree that the Executive shall resign his employment and any positions with the Bank, Parent and any and all

of their direct and indirect parent entities, subsidiaries, and affiliates (collectively, the “Company Group”)

as of the Termination Date and cease to hold any officer or director positions with any Company Group member.

1.2. The

Executive acknowledges that except as otherwise provided specifically in Section 2 of this Agreement and such benefits provided

under qualified and non-qualified benefit programs under which the Executive is a participant, no Company Group member has, nor will

any such Company Group member have any other liability or obligation to the Executive in connection with, or otherwise arising from,

the Executive’s employment with the Company Group. The Executive further acknowledges that, in the absence of his execution of

this Agreement and the Release, the payments specified in Section 2 below, would not otherwise be payable. The severance

and other benefits described in Section 2 are conditioned on the Executive executing the release agreement in the form attached

hereto as Exhibit A (the “Release”) during the 22-day period that follows the Termination Date

and will become payable in accordance with the terms of this Agreement only upon the Release becoming irrevocable.

2. Severance

Benefit. In connection with the cessation of the Executive’s employment, and in consideration of the Executive’s execution

of this Agreement and the Release, and the Release becoming irrevocable, and in satisfaction of all obligations under the Employment

Agreement or otherwise, and this Agreement becoming irrevocable, the Company will: (i) pay an aggregate amount of $1,190,073 in

twenty-four (24) substantially equal installment over a period of twenty-four (24) months from the Termination Date, payable in accordance

with the Company’s payroll practices; (ii) pay the applicable premiums otherwise payable for COBRA continuation coverage for

the Executive (and, to the extent covered immediately prior to the date of Executive’s termination, his spouse and dependents)

for a period of twenty-four (24) months (or if COBRA continuation coverage expires or is otherwise unavailable, then, in lieu thereof,

the Executive will receive monthly payments equal to the monthly “applicable premium,” as that term is defined under COBRA,

for a period equal to twenty-four (24) months); provided, however, that such COBRA premiums or payment in lieu thereof shall automatically

cease upon the Executive becoming eligible for group health plan insurance, including under a spouse’s group health plan; and (iii) if

applicable, pay to an outplacement firm of the Executive’s choice of a lump sum cash payment of up to $30,000 for outplacement

assistance. All payments shall be made in accordance with the Company’s payroll policies as may be in effect from time to time

and subject to required tax withholdings.

Notwithstanding anything

to the contrary herein, Section 3.7(f) of the Employment Agreement is hereby incorporated by reference in its entirety, and

accordingly, any payment to be made under this Section 2 or any other arrangement between the Executive and any member of

the Company Group determined to be subject to Section 409A of the Internal Revenue Code of 1986, as amended (“Section 409A”),

to the extent required by Section 409A to avoid accelerated taxation and/or tax penalties thereunder, shall be delayed and shall

be paid on the first day of the seventh month following the Termination Date, or if earlier, upon the Executive’s death.

3. Restrictive

Covenants. The Executive acknowledges and affirms his continuing obligations and restrictions under Article IV of the Employment

Agreement, and that the terms and conditions of such obligations and restrictions contained therein are reasonable and necessary to protect

the legitimate interests of the Company Group and that the Executive received adequate consideration in exchange for agreeing to those

restrictions. In exchange for the good and valuable consideration contained in this Agreement, the Company agrees that the Company’s

Lebanon, Pennsylvania branch shall be disregarded for purposes of determining whether any business activities are within 50 miles of

any Company branch or office under Section 4.3(a) of the Employment Agreement, provided that the Executive otherwise complies

with all other covenants in the Employment Agreement (including, without limitation, confidentiality and non-solicitation covenants).

4. Cooperation.

The Executive shall provide his reasonable cooperation in connection with any investigation, action or proceeding (or any appeal from

any action or proceeding) which relates to events that occurred during the Executive’s employment by the Company Group; provided,

however, that the Company shall reimburse the Executive for the Executive’s reasonable and documented costs and expenses.

5. Challenge;

Breach. If the Executive materially violates or challenges the enforceability of any provision of this Agreement or the Release,

or materially fails to comply with any terms or conditions of this Agreement, the Release or the restrictive covenants described in Section 3,

no further payments under Section 2 hereof will be due to Executive.

6. Miscellaneous.

6.1. Return

of Company Property. The Executive hereby acknowledges and agrees that all Company Property (as defined in the Employment

Agreement) and equipment furnished to, or prepared by, the Executive in the course of, or incident to, the Executive’s employment,

belongs to the Company and no later than five (5) days after the Termination Date, shall be returned to the Company. Such Company

Property includes, without limitation, all books, manuals, records, reports, notes, contracts, lists, blueprints, and other documents,

or materials, or copies thereof (including computer files), keys, building card keys, company credit cards, business cards, computer

hardware and software, laptop computers, docking stations, cellular and portable telephone equipment, personal digital assistant (PDA)

devices and all other proprietary information relating to the business of the Company Group.

6.2. Reporting.

Nothing in this Agreement, the Release or Article IV of the Employment Agreement will (i) prohibit the Executive from making

reports (including voluntary reports) of possible violations of federal law or regulation to any governmental agency or entity in accordance

with the provisions of and rules promulgated under Section 21F of the Securities Exchange Act of 1934, as amended, or Section 806

of the Sarbanes-Oxley Act of 2002, or making other disclosures protected under the whistleblower provisions of federal law or regulation,

(ii) require prior approval by the Company or notification to the Company of any such report or (iii) prevent the Executive

from collecting a monetary award in connection with such report.

6.3. Tax

Withholding. All payments provided to the Executive will be subject to tax withholding in accordance with applicable law.

6.4. No

Admission of Liability. Neither this Agreement nor the Release is to be construed as an admission of any violation of any federal,

state or local statute, ordinance or regulation or of any duty owed by any Company Group member. There have been no such violations,

and the Company specifically denies any such violations.

6.5. No

Reinstatement. The Executive agrees that he will not apply for reinstatement with the Company Group or seek in any way to be reinstated,

re-employed or hired by the Company Group in the future unless specifically approached by the Company Group regarding re-employment or

re-hiring at a future date.

6.6. Successors

and Assigns. This Agreement shall inure to the benefit of and be binding upon the Company and the Executive and their respective

successors, assigns, subsidiaries, affiliates, executors, administrators and heirs. The Company reserves its right to assign this Agreement.

Executive has no right to assign this Agreement. Executive understands and acknowledges that each other Company Group member is a third-party

beneficiary of this Agreement and shall have the right to enforce the terms and obligations hereunder as it were a direct party to this

Agreement.

6.7. Severability.

Whenever possible, each provision of this Agreement will be interpreted in such manner as to be effective and valid under applicable

law. However, if any provision of this Agreement is held to be invalid, illegal or unenforceable in any respect, such invalidity, illegality

or unenforceability will not affect any other provision, and this Agreement will be reformed, construed and enforced as though the invalid,

illegal or unenforceable provision had never been herein contained.

6.8. Entire

Agreement; Amendments. The parties agree that this Agreement and the Release, together with the surviving provisions of the Executive’s

restrictive covenants, contain their entire agreement and understanding relating to the subject matter hereof and merges and supersedes

all prior and contemporaneous discussions, agreements and understandings of every nature relating to the subject matter hereof. This

Agreement and the Release may not be changed or modified, except by an agreement in writing signed by each of the parties hereto.

6.9. Governing

Law. This Agreement shall be governed by, and enforced in accordance with, the laws of the Commonwealth of Pennsylvania without regard

to the application of the principles of conflicts of laws.

6.10. Execution

Date; Counterparts and Facsimiles. This Agreement may be executed by the parties on separate counterparts, each of which shall be

an original and each of which together shall constitute one and the same agreement. Counterparts may be delivered via facsimile, electronic

mail (including pdf or any electronic signature complying with the U.S. federal ESIGN Act of 2000, e.g., www.docusign.com) or other transmission

method and any counterpart so delivered shall be deemed to have been duly and validly delivered and be valid and effective for all purposes.

[Space intentionally left blank; signature

page follows.]

IN WITNESS WHEREOF, the Company

has caused this Agreement to be executed by its respective duly authorized officer, and the Executive has executed this Agreement, on

the date(s) below written.

| | COMPANy: |

| | |

| | PEOPLES

FINANCIAL SERVICES CORP. |

| | |

| | By: |

/s/

Mary Griffin Cummings, Esquire |

| | Name: |

Mary Griffin Cummings, Esquire |

| | Title: |

Executive Vice President, General Counsel |

| | |

| | Date: |

October 25,

2024 |

| | |

| | |

| | PEOPLES

SECURITY BANK AND TRUST COMPANY |

| | |

| | By: |

/s/

Mary Griffin Cummings, Esquire |

| | Name: |

Mary Griffin Cummings, Esquire |

| | Title: |

Executive Vice President, General Counsel |

| | |

| | Date: |

October 25,

2024 |

| | |

| | |

| | EXECUTIVE: |

| | |

| | /s/

Craig W. Best |

| | Craig

W. Best |

| | |

| | Date: |

October 25,

2024 |

Exhibit A

Release

AGREEMENT

THIS

RELEASE AGREEMENT is for and in consideration of the payments and benefits to be provided to Craig W. Best (“Executive”)

in connection with the Separation Agreement by and between the Executive, Peoples Security Bank and Trust Company (the “Bank”)

and Peoples Financial Services Corp. (the “Parent”, and together the Bank, the “Company”),

dated as of October 25, 2024 (the “Separation Agreement”), which rights are conditioned on the Executive

signing this Release. This Release may not be executed by the Executive or the Company prior to the Termination Date (as defined in the

Separation Agreement).

1. Executive’s

Release and Covenant Not to Sue.

1.1. In

exchange for the good and valuable consideration contained in the Separation Agreement, which the Executive acknowledges is sufficient,

the Executive on behalf of himself and his heirs, executors, administrators, successors and assigns, hereby fully and forever releases

and discharges each Company Group (as defined in the Separation Agreement) member and their respective affiliates, and each of their

predecessors and successors, assigns, direct and indirect equityholders, officers, directors, trustees, employees, agents and attorneys,

past and present (each, a “Released Person,” and collectively, the “Released Persons”)

from any and all claims, demands, liens, agreements, contracts, covenants, suits, actions, causes of action, obligations, controversies,

debts, costs, expenses, damages, judgments, orders and liabilities, of whatever kind or nature, direct or indirect, in law, equity or

otherwise, whether known or unknown, or whether asserted or unasserted, which the Executive now has, or hereafter can, shall or may have,

upon or by reason of any act, transaction, practice, conduct, matter, cause or thing of any kind or nature whatsoever arising or occurring

through the date of this Release Agreement (each, a “Claim”, and collectively, “Claims”),

including, but not limited to, any Claim for severance, any Claim arising out of the Executive’s employment by the Company Group

or the termination thereof, any Claim under the Age Discrimination in Employment Act, 29 U.S.C. § 621, et seq., the Executive Retirement

Income Security Act, 29 U.S.C. § 1001, et seq., any Claim based upon alleged wrongful or retaliatory discharge or breach of

contract, any Claim for attorneys’ fees, any Claim for the breach of the covenant of good faith and fair dealing, promissory estoppel,

detrimental reliance, invasion of privacy, personal injury or sickness or any other harm, defamation, slander or libel, intentional infliction

of emotional distress, discrimination and harassment Claims, any Claim related to age, sex, race, religion, national origin, marital

status, sexual orientation, ancestry, parental status, handicap, disability, veteran status, and any Claim under any other federal, state,

local or foreign statute, ordinance, regulation, or under any contract, tort or common law theory. The Executive understands and acknowledges

the significance of this release and that this release is a complete and general release. The Executive further understands and acknowledges

the release of unknown Claims and waiver of statutory protection against the release of unknown Claims. The Executive acknowledges and

agrees that the agreements contained in this Section 1.1 are an integral part and condition of the benefits contemplated

by Section 2 of the Separation Agreement.

1.2. Notwithstanding

Section 1.1 above, the Executive is not releasing any Claims hereunder with respect to (i) his rights to enforce the

Separation Agreement and (ii) his right to be indemnified pursuant to the Company’s applicable governing documents.

1.3. The

Executive expressly represents that he has not filed a lawsuit or initiated any other administrative proceeding against a Released Person

and that he has not assigned any Claim against a Released Person. The Executive further promises not to initiate a lawsuit, to bring

or to assign to any person or entity any Claim against a Released Person arising out of or in any way related to the Executive’s

employment by the Company or the termination of that employment (other than those expressly set forth in Section 1.2 above).

Notwithstanding anything herein to the contrary, this Release Agreement will not prevent the Executive from filing a charge with the

Equal Employment Opportunity Commission (the “EEOC”) (or similar state agency) or participating in any investigation

conducted by the EEOC (or similar state agency).

2. Company’s

Release and Covenant Not to Sue. In exchange for the good and valuable consideration contained in this Release Agreement and the

Separation Agreement, the Bank and Parent, and on behalf each of their direct and indirect parent entities, subsidiaries, and affiliates,

hereby fully and forever releases and discharges the Executive from any and all claims, demands, liens, agreements, contracts, covenants,

suits, actions, causes of action, obligations, controversies, debts, costs, expenses, damages, judgments, orders and liabilities, of

whatever kind or nature, direct or indirect, in law, equity or otherwise, whether known or unknown, or whether asserted or unasserted,

which any member of the Company Group now has, or hereafter can, shall or may have, upon or by reason of any act, transaction, practice,

conduct, matter, cause or thing of any kind or nature whatsoever arising or occurring through the date of this Release Agreement. It

is explicitly agreed, understood and intended that this general release of claims against the Executive shall not include or constitute

a waiver of (i) the Executive’s restrictive covenant obligations to the Company Group that survive the Executive’s termination

of employment, including those specified in the Employment Agreement (as modified by Section 3 of the Separation Agreement), (ii) any

claim of any member of the Company Group for fraud or based on willful and intentional acts or omissions of the Executive, other than

those taken in good faith and in a manner that the Executive believed to be in or not opposed to the interests of the Company Group,

(iii) any claims arising in connection with the Executive’s engagement by the Company Group as a director or consultant after

the Termination Date (to the extent applicable), (iv) any claims to enforce this Release Agreement, and (v) any claims

not waivable by the Company Group under applicable law.

3. Rescission

Right. The Executive expressly acknowledges and recites that (i) he has read and understands the terms of this Release Agreement

in its entirety, (ii) he has entered into this Release Agreement knowingly and voluntarily, without any duress or coercion; (iii) he

has been advised orally and is hereby advised in writing to consult with an attorney with respect to this Release Agreement before signing

it; (iv) he was provided twenty-two (22) calendar days after receipt of this Release Agreement to consider its terms before signing

it; and (v) he has seven (7) calendar days from the date of signing to terminate and revoke this Release Agreement, in which

case this Release Agreement shall be unenforceable, null and void. The Executive may revoke this Release Agreement during those seven

(7) days by providing written notice of revocation to the Company at 150 North Washington Avenue, Scranton, PA 18503 Attention:

General Counsel. If Executive revokes this Release Agreement, Executive will be deemed not to have accepted the terms of the Separation

Agreement, no action or forbearance of action will be required of the Company or the Executive under any section of the Separation Agreement,

and Executive shall not be entitled to receive any portion of the severance compensation described in Section 2 of the Separation

Agreement which is conditioned on the delivery and non-revocation of this Release Agreement.

4. Miscellaneous.

4.1. Successors

and Assigns. This Release Agreement shall inure to the benefit of and be binding upon the Company and the Executive and their respective

successors, assigns, subsidiaries, affiliates, executors, administrators and heirs. The Company reserves its right to assign this Release

Agreement. Executive has no right to assign this Release Agreement. Executive understands and acknowledges that each other Company Group

member is a third-party beneficiary of this Release Agreement and shall have the right to enforce the terms and obligations hereunder

as it were a direct party to this Release Agreement.

4.2. Severability.

Whenever possible, each provision of this Release Agreement will be interpreted in such manner as to be effective and valid under applicable

law. However, if any provision of this Release Agreement is held to be invalid, illegal or unenforceable in any respect, such invalidity,

illegality or unenforceability will not affect any other provision, and this Release Agreement will be reformed, construed and enforced

as though the invalid, illegal or unenforceable provision had never been herein contained.

4.3. Entire

Agreement; Amendments. The parties agree that this Release Agreement and the Separation Agreement, together with the surviving provisions

of the Executive’s restrictive covenants, contain their entire agreement and understanding relating to the subject matter hereof

and merges and supersedes all prior and contemporaneous discussions, agreements and understandings of every nature relating to the subject

matter hereof. This Release Agreement and the Separation Agreement may not be changed or modified, except by an agreement in writing

signed by each of the parties hereto.

4.4. Governing

Law. This Release Agreement shall be governed by, and enforced in accordance with, the laws of the Commonwealth of Pennsylvania without

regard to the application of the principles of conflicts of laws.

4.5. Execution

Date; Counterparts and Facsimiles. This Release Agreement may be executed by the parties on separate counterparts, each of which

shall be an original and each of which together shall constitute one and the same agreement. Counterparts may be delivered via facsimile,

electronic mail (including pdf or any electronic signature complying with the U.S. federal ESIGN Act of 2000, e.g., www.docusign.com)

or other transmission method and any counterpart so delivered shall be deemed to have been duly and validly delivered and be valid and

effective for all purposes.

[Space intentionally left blank; signature

page follows.]

IN WITNESS WHEREOF, the Company

has caused this Release Agreement to be executed by its respective duly authorized officer, and the Executive has executed this Release

Agreement, on the date(s) below written.

| | COMPANy: |

| | |

| | PEOPLES FINANCIAL

SERVICES CORP. |

| | |

| | By: |

|

| | Name: |

|

| | Title: |

|

| | |

| | Date: |

|

| | |

| | PEOPLES SECURITY

BANK AND TRUST COMPANY |

| | |

| | By: |

|

| | Name: |

|

| | Title: |

| | |

| | Date: |

|

| | |

| | EXECUTIVE: |

| | |

| | |

| | Craig W. Best |

| | |

| | Date: |

|

Exhibit 99.1

NEWS RELEASE

TO BUSINESS EDITOR

PEOPLES FINANCIAL SERVICES CORP. Announces Update

to Succession Plans

Scranton, PA, October 25,

2024/PRNEWSWIRE/ – On October 25, 2024, the board of directors of Peoples Financial Services Corp. (the “Company”)

and Craig W. Best mutually agreed that Mr. Best would cease serving as Chief Executive Officer and director of the Company and its

banking subsidiary, Peoples Security Bank and Trust Company (the “Bank”), effective December 31, 2024.

The Company consummated a

merger with FNCB Bancorp, Inc. on July 1, 2024, and it had been contemplated that Mr. Best would remain as an officer of

the Company and the Bank through the first anniversary of the merger. Given the progress made in the integration of the two companies

and the successful completion of the Bank’s system conversion on October 15, 2024, the parties determined that Mr. Best

was able to leave at the end of this year.

Gerard A. Champi, President

of the Company and the Bank, will succeed Mr. Best as Chief Executive Officer of the Company and the Bank, and Thomas P. Tulaney,

Chief Operating Officer of the Company and the Bank, will succeed Mr. Champi as President of the Company and the Bank.

Peoples

Financial Services Corp. is the bank holding company of Peoples Security Bank and Trust Company, an independent community bank serving

its retail and commercial customers through 39 full-service community banking offices located within the Allegheny, Bucks, Lackawanna,

Lebanon, Lehigh, Luzerne, Monroe, Montgomery, Northampton, Susquehanna, Wayne, and Wyoming Counties in Pennsylvania, Middlesex County

in New Jersey and Broome County in New York. Each office, interdependent with the community, offers a comprehensive array of financial

products and services to individuals, businesses, not-for-profit organizations and government entities. People’s business philosophy

includes offering direct access to senior management and other officers and providing friendly, informed and courteous service, local

and timely. For more information, visit psbt.com.

Contact: MEDIA/INVESTORS, Marie L. Luciani, Investor Relations

Officer, 570.346.7741 or marie.luciani@psbt.com

Forward-looking Statements

This communication includes “forward-looking

statements” within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of

1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, with respect to the beliefs, goals, intentions,

and expectations of Peoples Financial Services Corp. and its subsidiaries (“Peoples”) and other statements that are not historical

facts. Forward–looking statements are typically identified by such words as “believe,” “expect,” “anticipate,”

“intend,” “outlook,” “estimate,” “forecast,” “project,” “will,”

“should,” and other similar words and expressions, and are subject to numerous assumptions, risks, and uncertainties, which

change over time.

Additionally, forward–looking statements

speak only as of the date they are made; Peoples does not assume any duty, and does not undertake, to update such forward–looking

statements, whether written or oral, that may be made from time to time, whether as a result of new information, future events, or otherwise.

Furthermore, because forward–looking statements are subject to assumptions and uncertainties, actual results or future events could

differ, possibly materially, from those indicated in or implied by such forward-looking statements as a result of a variety of factors,

many of which are beyond the control of Peoples. Such statements are based upon the current beliefs and expectations of the management

of Peoples and are subject to significant risks and uncertainties outside of the control of Peoples. Caution should be exercised against

placing undue reliance on forward-looking statements. The factors that could cause actual results to differ materially include the following:

the possibility that the anticipated benefits of Peoples’ merger with FNCB Bancorp, Inc. (“FNCB”), which was consummated

on July 1, 2024, will not be realized when expected or at all, including as a result of the impact of, or problems arising from,

the integration of FNCB; the strength of the economy and competitive factors in the areas where Peoples conducts business; the possibility

that the FNCB merger may be more expensive to complete than anticipated, including as a result of unexpected factors or events; diversion

of management’s attention from ongoing business operations and opportunities; the possibility that Peoples may be unable to

achieve expected synergies and operating efficiencies in the FNCB merger within the expected timeframes or at all and to successfully

integrate the operations of Peoples; such integration may be more difficult, time-consuming or costly than expected; revenues following

the FNCB merger may be lower than expected; Peoples’ success in executing its business plans and strategies and managing the risks

involved in the foregoing; the dilution caused by Peoples’ issuance of additional shares of its capital stock in connection with

the FNCB merger; the outcome of any legal proceedings that may be instituted against Peoples; the ability of Peoples to meet expectations

regarding the accounting and tax treatments of the FNCB merger; effects of the completion of the FNCB merger on the ability of Peoples

to retain customers and retain and hire key personnel and maintain relationships with its suppliers, and on its operating results and

businesses generally; and risks related to the potential impact of general economic, political and market factors on Peoples; and the

other factors discussed in the “Risk Factors” section of Peoples’ Annual Report on Form 10–K for the year

ended December 31, 2023, and in the “Risk Factors” and “Management’s Discussion and Analysis of Financial

Condition and Results of Operations” sections of other reports Peoples may file with the SEC from time to time.

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

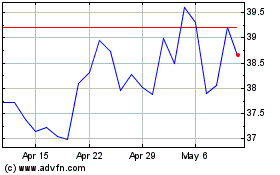

Peoples Financial Services (NASDAQ:PFIS)

Historical Stock Chart

From Jan 2025 to Feb 2025

Peoples Financial Services (NASDAQ:PFIS)

Historical Stock Chart

From Feb 2024 to Feb 2025