0000716605False00007166052023-07-252023-07-25

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

The Securities Exchange Act of 1934

October 25, 2023

Date of Report (Date of earliest event reported)

PENNS WOODS BANCORP, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Pennsylvania | | 000-17077 | | 23-2226454 |

(State or other jurisdiction

of incorporation) | | (Commission

File Number) | | (IRS Employer

Ident. No.) |

| | | | | | | | |

| 300 Market Street | P.O. Box 967 | 17703-0967 |

| Williamsport | Pennsylvania | (Zip Code) |

| (Address of principal executive offices) |

| | | | | | | | | | | |

| (570) | 322-1111 | |

| Registrant's telephone number, including area code | |

| | |

| N/A |

| (Former name or former address, if changed since last report.) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4 (c))

Securities registered pursuant to Section 12(b) of the Exchange Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common stock, $5.55 par value | | PWOD | | The Nasdaq Global Select Market |

Indicated by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR 230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR 240.12b-2) ☐

If an emerging growth company, indicate by check mark if registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act ☐

Item 2.02 Results of Operation and Financial Condition.

On October 25, 2023, Penns Woods Bancorp, Inc. (the “Company”) distributed a press release announcing its earnings for the period ended September 30, 2023. The press release is attached as Exhibit 99.1 hereto and incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits:

99.1 Press release, dated October 25, 2023, of Penns Woods Bancorp, Inc. announcing earnings for the period ended September 30, 2023.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | | PENNS WOODS BANCORP, INC. |

| | | | |

| Dated: | October 25, 2023 | | |

| | | | |

| | | By: | /s/ Brian L. Knepp |

| | | | Brian L. Knepp |

| | | | President and Chief Financial Officer |

EXHIBIT INDEX

| | | | | | | | |

| Exhibit Number | | Description |

| | Press release, dated October 25, 2023, of Penns Woods Bancorp, Inc. announcing earnings for the period ended September 30, 2023. |

| 104 | | Cover page Interactive Data File (the cover page XBRL tags are embedded within the Inline XBRL document). |

Exhibit 99.1

Press Release — For Immediate Release

October 25, 2023

Penns Woods Bancorp, Inc. Reports Third Quarter 2023 Earnings

Williamsport, PA — October 25, 2023 - Penns Woods Bancorp, Inc. (NASDAQ: PWOD)

Penns Woods Bancorp, Inc. achieved net income of $11.1 million for the nine months ended September 30, 2023, resulting in basic and diluted earnings per share of $1.56 and $1.53.

Highlights

•Net income, as reported under GAAP, for the three and nine months ended September 30, 2023 was $2.2 million and $11.1 million, compared to $5.3 million and $12.9 million for the same periods of 2022. Results for the three and nine months ended September 30, 2023 compared to 2022 were impacted by a decrease in net interest income of $2.2 million and $1.2 million as interest expense increased significantly due to the velocity and magnitude of the rate increases enacted by the Federal Open Market Committee ("FOMC"). In addition, results were impacted by a decrease in after-tax securities losses of $77,000 (from a loss of $167,000 to a loss of $90,000) for the three month period and a decrease in after-tax securities losses of $106,000 (from a loss of $258,000 to a loss of $152,000) for the nine month period. Bank-owned life insurance income increased due to a gain on death benefit of $380,000 during the nine months ended September 30, 2023, while an after-tax loss of $201,000 related to a branch closure negatively impacted the nine months ended September 30, 2022.

•The provision for credit losses increased $537,000 for the three months ended September 30, 2023 and decreased $1.1 million for the nine months ended September 30, 2023 due to a provision of $1.4 million and $263,000, respectively, for the 2023 periods compared to a provision of $835,000 and $1.3 million for the 2022 periods. The decrease for the nine month periods was due primarily to a recovery on a commercial loan during the second quarter of 2023. The increase in the provision for credit losses for the 2023 three month period was due primarily to loan portfolio growth as loan portfolio credit metrics continue to improve and loan net charge-offs remain at a low level.

•Basic earnings per share for the three and nine months ended September 30, 2023 were $0.31 and $1.56, while the diluted earnings per share were $0.31 and $1.53 for the periods. Basic and diluted earnings per share for the three and nine months ended September 30, 2022 were $0.74 and $1.83.

•Annualized return on average assets was 0.41% for three months ended September 30, 2023, compared to 1.09% for the corresponding period of 2022. Annualized return on average assets was 0.70% for the nine months ended September 30, 2023, compared to 0.89% for the corresponding period of 2022.

•Annualized return on average equity was 5.06% for the three months ended September 30, 2023, compared to 12.61% for the corresponding period of 2022. Annualized return on average equity was 8.58% for the nine months ended September 30, 2023, compared to 10.48% for the corresponding period of 2022.

Net Income

Net income from core operations (“core earnings”), which is a non-generally accepted accounting principles (GAAP) measure of net income excluding net securities gains or losses, was $2.3 million and $11.2 million for the three and nine months ended September 30, 2023 compared to $5.4 million and $13.2 million for the same periods of 2022. Basic core earnings per share for the three and nine months ended September 30, 2023 was $0.33 and $1.59, while the diluted core earnings per share was $0.32 and $1.55, compared to $0.77 and $1.87 basic and diluted core earnings per share for the same periods of 2022. Annualized core return on average assets and core return on average equity were 0.43% and 5.26% for the three months ended September 30, 2023, compared to 1.12% and 13.02% for the corresponding periods of 2022. Core return on average assets and core return on average

equity were 0.71% and 8.69% for the nine months ended September 30, 2023 compared to 0.91% and 10.69% for the corresponding periods of 2022. A reconciliation of the non-GAAP financial measures of core earnings, core return on assets, core return on equity, and core earnings per share described in this press release to the comparable GAAP financial measures is included at the end of this press release.

Net Interest Margin

The net interest margin for the three and nine months ended September 30, 2023 was 2.65% and 2.82%, compared to 3.47% and 3.17% for the corresponding periods of 2022. The decrease in the net interest margin for the three and nine month periods was driven by an increase in the rate paid on interest-bearing liabilities of 239 and 189 basis points ("bps"), respectively. The FOMC rate increases during 2022 and 2023 contributed to the increases in rate paid on interest-bearing liabilities as the rate paid on short-term borrowings increased 429 bps and 467 bps for the three and nine month periods ended September 30, 2023 compared to the same periods of 2022. Short-term borrowings increased in volume and rate paid as this funding source was utilized to provide funding for the growth in the loan portfolio, resulting in an increase of $2.4 million and $6.1 million in expense for the three and nine month periods ended September 30, 2023 compared to the same periods of 2022. The rate paid on interest-bearing deposits increased 207 and 154 bps for the three and nine month periods ended September 30, 2023 compared to the corresponding periods of 2022 due to the FOMC rate actions and an increase in competition for deposits. The rates paid on time deposits significantly contributed to the increase in funding costs as rates paid for the three and nine month periods ended September 30, 2023 compared to the same periods of 2022 increased 328 bps and 259 bps, respectively, as deposit gathering campaigns initiated in the latter part of 2022 continued throughout 2023. In addition, brokered deposits have been utilized to assist with the funding of the loan portfolio growth and contributed to the increase in time deposit funding costs. Partially offsetting the increase in funding cost was an increase in the yield on interest-earning assets and growth in the average balance of the earning asset portfolio compared to the same periods in 2022. The average loan portfolio balance increased $276.8 million and $278.2 million for the three and nine month periods, respectively, as the average yield on the portfolio increased 87 and 76 bps for the same periods. The three and nine month periods ended September 30, 2023 were impacted by an increase of 113 and 101 bps in the yield earned on the securities portfolio as legacy securities matured with the funds reinvested at higher rates.

Assets

Total assets increased to $2.2 billion at September 30, 2023, an increase of $271.4 million compared to September 30, 2022. Net loans increased $260.1 million to $1.8 billion at September 30, 2023 compared to September 30, 2022, as an emphasis was placed on commercial loan growth coupled with growth in indirect auto lending. The investment portfolio increased $7.2 million from September 30, 2022 to September 30, 2023 as restricted investment in bank stock increased $10.8 million resulting from the requirement to hold additional stock in the Federal Home Loan Bank of Pittsburgh ("FHLB") due to an increase in the level of borrowings from the FHLB. The increase in total borrowings of $277.7 million to $411.4 million at September 30, 2023 was utilized to provide funding for the growth in the loan portfolio.

Non-performing Loans

The ratio of non-performing loans to total loans ratio decreased to 0.20% at September 30, 2023 from 0.37% at September 30, 2022, as non-performing loans decreased to $3.7 million at September 30, 2023 from $5.7 million at September 30, 2022. The majority of non-performing loans involve loans that are either in a secured position and have sureties with a strong underlying financial position or have been classified as individually evaluated loans that have a specific allocation recorded within the allowance for credit losses. Net loan recoveries of $316,000 for the nine months ended September 30, 2023 impacted the allowance for credit losses, which was 0.71% of total loans at September 30, 2023 compared to 0.97% at September 30, 2022 (prior to the adoption of CECL).

Deposits

Deposits decreased $23.1 million to $1.6 billion at September 30, 2023 compared to September 30, 2022. Noninterest-bearing deposits decreased $65.9 million to $471.5 million at September 30, 2023 compared to September 30, 2022. Core deposits declined as deposits migrated from core deposit accounts into time deposits as market rates increased due to the FOMC rate increases and increased competition for deposits. Core deposit gathering efforts remained focused on increasing the utilization of electronic (internet and mobile) deposit banking by our customers. Interest-bearing deposits increased $42.7 million from September 30, 2022 to September 30, 2023 primarily due to increased utilization of brokered deposits of $101.2 million as this funding source was utilized to supplement funding loan portfolio growth, while reducing the need to draw upon available borrowing lines. A campaign to attract time deposits with a maturity of five to twenty-four months commenced during the latter part of 2022 and has continued during the first nine months of 2023 with current efforts centered on five to twelve months.

Shareholders’ Equity

Shareholders’ equity increased $10.1 million to $174.5 million at September 30, 2023 compared to September 30, 2022. During the three months ended September 30, 2023 the Company sold 34,411 shares of common stock, for net proceeds of $752,000, in a registered at-the-market offering. An additional 8,349 shares for net proceeds of $200,000 were issued as part of the Dividend Reinvestment Plan during the three months ended September 30, 2023. Accumulated other comprehensive loss of $14.9 million at September 30, 2023 increased from a loss of $14.6 million at September 30, 2022 as a result of a $10.9 million net unrealized loss on available for sale securities at September 30, 2023 compared to an unrealized loss of $11.1 million at September 30, 2022 coupled with an increase in loss of $607,000 in the defined benefit plan obligation. The current level of shareholders’ equity equates to a book value per share of $24.55 at September 30, 2023 compared to $23.32 at September 30, 2022, and an equity to asset ratio of 8.02% at September 30, 2023 and 8.63% at September 30, 2022. Dividends declared for the nine months ended September 30, 2023 and 2022 were $0.96 per share.

Penns Woods Bancorp, Inc. is the parent company of Jersey Shore State Bank, which operates sixteen branch offices providing financial services in Lycoming, Clinton, Centre, Montour, Union, and Blair Counties, and Luzerne Bank, which operates eight branch offices providing financial services in Luzerne County, and United Insurance Solutions, LLC, which offers insurance products. Investment and insurance products are offered through Jersey Shore State Bank’s subsidiary, The M Group, Inc. D/B/A The Comprehensive Financial Group.

NOTE: This press release contains financial information determined by methods other than in accordance with U.S. Generally Accepted Accounting Principles (“GAAP”). Management uses the non-GAAP measure of net income from core operations in its analysis of the company’s performance. This measure, as used by the Company, adjusts net income determined in accordance with GAAP to exclude the effects of special items, including significant gains or losses that are unusual in nature such as net securities gains and losses. Because these certain items and their impact on the Company’s performance are difficult to predict, management believes presentation of financial measures excluding the impact of such items provides useful supplemental information in evaluating the operating results of the Company’s core businesses. These disclosures should not be viewed as a substitute for net income determined in accordance with GAAP, nor are they necessarily comparable to non-GAAP performance measures that may be presented by other companies.

This press release may contain certain “forward-looking statements” including statements concerning plans, objectives, future events or performance and assumptions and other statements, which are statements other than statements of historical fact. The Company cautions readers that the following important factors, among others, may have affected and could in the future affect actual results and could cause actual results for subsequent periods to differ materially from those expressed in any forward-looking statement made by or on behalf of the Company herein: (i) the effect of changes in laws and regulations, including federal and state banking laws and regulations, and the associated costs of compliance with such laws and regulations either currently or in the future as applicable; (ii) the effect of changes in accounting policies and practices, as may be adopted by the regulatory agencies as well as by the Financial Accounting Standards Board, or of changes in the Company’s organization, compensation and benefit plans; (iii) the effect on the Company’s competitive position within its market area of the increasing consolidation within the banking and financial services industries, including the increased competition from larger regional and out-of-state banking organizations as well as non-bank providers of various financial services; (iv) the effect of changes in interest rates; (v) the effects of health emergencies, including the spread of infectious diseases or pandemics; or (vi) the effect of changes in the business cycle and downturns in the local, regional or national economies. For a list of other factors which could affect the Company’s results, see the Company’s filings with the Securities and Exchange Commission, including “Item 1A. Risk Factors,” set forth in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2022.

You should not place undue reliance on any forward-looking statements. These statements speak only as of the date of this press release, even if subsequently made available by the Company on its website or otherwise. The Company undertakes no obligation to update or revise these statements to reflect events or circumstances occurring after the date of this press release.

Previous press releases and additional information can be obtained from the Company’s website at www.pwod.com.

| | | | | | | | |

| Contact: | Richard A. Grafmyre, Chief Executive Officer |

| | 110 Reynolds Street |

| | Williamsport, PA 17702 |

| | 570-322-1111 | e-mail: pwod@pwod.com |

PENNS WOODS BANCORP, INC.

CONSOLIDATED BALANCE SHEET

(UNAUDITED)

| | | | | | | | | | | | | | | | | | | | |

| | | September 30, |

| (In Thousands, Except Share and Per Share Data) | | 2023 | | 2022 | | % Change |

| ASSETS: | | | | | | |

| Noninterest-bearing balances | | $ | 26,651 | | | $ | 24,418 | | | 9.14 | % |

| Interest-bearing balances in other financial institutions | | 8,939 | | | 12,444 | | | (28.17) | % |

| | | | | | |

| Total cash and cash equivalents | | 35,590 | | | 36,862 | | | (3.45) | % |

| | | | | | |

| Investment debt securities, available for sale, at fair value | | 184,667 | | | 188,196 | | | (1.88) | % |

| Investment equity securities, at fair value | | 1,072 | | | 1,130 | | | (5.13) | % |

| | | | | | |

| Restricted investment in bank stock, at fair value | | 25,289 | | | 14,539 | | | 73.94 | % |

| Loans held for sale | | 4,083 | | | 2,485 | | | 64.31 | % |

| Loans | | 1,818,461 | | | 1,560,700 | | | 16.52 | % |

| Allowance for credit losses | | (12,890) | | | (15,211) | | | (15.26) | % |

| Loans, net | | 1,805,571 | | | 1,545,489 | | | 16.83 | % |

| Premises and equipment, net | | 30,746 | | | 32,227 | | | (4.60) | % |

| Accrued interest receivable | | 10,500 | | | 8,647 | | | 21.43 | % |

| Bank-owned life insurance | | 33,695 | | | 34,288 | | | (1.73) | % |

| Investment in limited partnerships | | 8,275 | | | 4,771 | | | 73.44 | % |

| Goodwill | | 16,450 | | | 17,104 | | | (3.82) | % |

| Intangibles | | 235 | | | 361 | | | (34.90) | % |

| Operating lease right of use asset | | 2,562 | | | 2,699 | | | (5.08) | % |

| Deferred tax asset | | 6,961 | | | 7,187 | | | (3.14) | % |

| Other assets | | 10,772 | | | 9,131 | | | 17.97 | % |

| TOTAL ASSETS | | $ | 2,176,468 | | | $ | 1,905,116 | | | 14.24 | % |

| | | | | | |

| LIABILITIES: | | | | | | |

| Interest-bearing deposits | | $ | 1,095,760 | | | $ | 1,053,012 | | | 4.06 | % |

| Noninterest-bearing deposits | | 471,507 | | | 537,403 | | | (12.26) | % |

| Total deposits | | 1,567,267 | | | 1,590,415 | | | (1.46) | % |

| | | | | | |

| Short-term borrowings | | 193,746 | | | 30,901 | | | 526.99 | % |

| Long-term borrowings | | 217,645 | | | 102,829 | | | 111.66 | % |

| Accrued interest payable | | 2,716 | | | 427 | | | 536.07 | % |

| Operating lease liability | | 2,619 | | | 2,753 | | | (4.87) | % |

| Other liabilities | | 17,935 | | | 13,302 | | | 34.83 | % |

| TOTAL LIABILITIES | | 2,001,928 | | | 1,740,627 | | | 15.01 | % |

| | | | | | |

| SHAREHOLDERS’ EQUITY: | | | | | | |

| Preferred stock, no par value, 3,000,000 shares authorized; no shares issued | | — | | | — | | | n/a |

| Common stock, par value $5.55, 22,500,000 shares authorized; 7,620,250 and 7,563,200 shares issued; 7,110,025 and 7,052,975 shares outstanding | | 42,335 | | | 42,019 | | | 0.75 | % |

| Additional paid-in capital | | 55,890 | | | 53,958 | | | 3.58 | % |

| Retained earnings | | 104,067 | | | 95,896 | | | 8.52 | % |

| Accumulated other comprehensive loss: | | | | | | |

| Net unrealized loss on available for sale securities | | (10,886) | | | (11,125) | | | 2.15 | % |

| Defined benefit plan | | (4,051) | | | (3,444) | | | (17.62) | % |

| Treasury stock at cost, 510,225 | | (12,815) | | | (12,815) | | | — | % |

| | | | | | |

| | | | | | |

| TOTAL SHAREHOLDERS' EQUITY | | 174,540 | | | 164,489 | | | 6.11 | % |

| TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY | | $ | 2,176,468 | | | $ | 1,905,116 | | | 14.24 | % |

PENNS WOODS BANCORP, INC.

CONSOLIDATED STATEMENT OF INCOME

(UNAUDITED)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | Nine Months Ended September 30, |

| (In Thousands, Except Share and Per Share Data) | | 2023 | | 2022 | | % Change | | 2023 | | 2022 | | % Change |

| INTEREST AND DIVIDEND INCOME: | | | | | | | | | | | | |

| Loans including fees | | $ | 21,720 | | | $ | 15,051 | | | 44.31 | % | | $ | 59,571 | | | $ | 41,709 | | | 42.83 | % |

| Investment securities: | | | | | | | | | | | | |

| Taxable | | 1,365 | | | 949 | | | 43.84 | % | | 3,870 | | | 2,550 | | | 51.76 | % |

| Tax-exempt | | 114 | | | 236 | | | (51.69) | % | | 410 | | | 594 | | | (30.98) | % |

| Dividend and other interest income | | 722 | | | 628 | | | 14.97 | % | | 1,827 | | | 1,470 | | | 24.29 | % |

| TOTAL INTEREST AND DIVIDEND INCOME | | 23,921 | | | 16,864 | | | 41.85 | % | | 65,678 | | | 46,323 | | | 41.78 | % |

| | | | | | | | | | | | |

| INTEREST EXPENSE: | | | | | | | | | | | | |

| Deposits | | 6,463 | | | 693 | | | 832.61 | % | | 14,686 | | | 2,191 | | | 570.29 | % |

| Short-term borrowings | | 2,412 | | | 26 | | | n/m | | 6,084 | | | 29 | | | n/m |

| Long-term borrowings | | 1,714 | | | 613 | | | 179.61 | % | | 3,892 | | | 1,871 | | | 108.02 | % |

| TOTAL INTEREST EXPENSE | | 10,589 | | | 1,332 | | | 694.97 | % | | 24,662 | | | 4,091 | | | 502.84 | % |

| | | | | | | | | | | | |

| NET INTEREST INCOME | | 13,332 | | | 15,532 | | | (14.16) | % | | 41,016 | | | 42,232 | | | (2.88) | % |

| | | | | | | | | | | | |

| Provision for loan credit losses | | 1,331 | | | 855 | | | 55.67 | % | | 726 | | | 1,335 | | | (45.62) | % |

| Provision (recovery) for off balance sheet credit exposures | | 41 | | | — | | | n/a | | (463) | | | — | | | n/a |

| TOTAL PROVISION FOR CREDIT LOSSES | | 1,372 | | | 855 | | | 60.47 | % | | 263 | | | 1,335 | | | (80.30) | % |

| | | | | | | | | | | | |

| NET INTEREST INCOME AFTER PROVISION FOR CREDIT LOSSES | | 11,960 | | | 14,677 | | | (18.51) | % | | 40,753 | | | 40,897 | | | (0.35) | % |

| | | | | | | | | | | | |

| NON-INTEREST INCOME: | | | | | | | | | | | | |

| Service charges | | 545 | | | 559 | | | (2.50) | % | | 1,557 | | | 1,563 | | | (0.38) | % |

| Debt securities losses, available for sale | | (78) | | | (156) | | | 50.00 | % | | (158) | | | (168) | | | 5.95 | % |

| Net equity securities losses | | (36) | | | (55) | | | 34.55 | % | | (35) | | | (158) | | | 77.85 | % |

| | | | | | | | | | | | |

| Bank-owned life insurance | | 170 | | | 170 | | | — | % | | 892 | | | 501 | | | 78.04 | % |

| Gain on sale of loans | | 290 | | | 294 | | | (1.36) | % | . | 765 | | | 905 | | | (15.47) | % |

| Insurance commissions | | 136 | | | 109 | | | 24.77 | % | | 416 | | | 386 | | | 7.77 | % |

| Brokerage commissions | | 142 | | | 142 | | | — | % | | 448 | | | 500 | | | (10.40) | % |

| Loan broker income | | 241 | | | 438 | | | (44.98) | % | | 728 | | | 1,350 | | | (46.07) | % |

| Debit card income | | 320 | | | 344 | | | (6.98) | % | | 995 | | | 1,080 | | | (7.87) | % |

| Other | | 145 | | | 238 | | | (39.08) | % | | 546 | | | 673 | | | (18.87) | % |

| TOTAL NON-INTEREST INCOME | | 1,875 | | | 2,083 | | | (9.99) | % | | 6,154 | | | 6,632 | | | (7.21) | % |

| | | | | | | | | | | | |

| NON-INTEREST EXPENSE: | | | | | | | | | | | | |

| Salaries and employee benefits | | 6,290 | | | 6,016 | | | 4.55 | % | | 18,778 | | | 18,421 | | | 1.94 | % |

| Occupancy | | 784 | | | 730 | | | 7.40 | % | | 2,422 | | | 2,380 | | | 1.76 | % |

| Furniture and equipment | | 867 | | | 816 | | | 6.25 | % | | 2,503 | | | 2,454 | | | 2.00 | % |

| Software amortization | | 237 | | | 188 | | | 26.06 | % | | 593 | | | 660 | | | (10.15) | % |

| Pennsylvania shares tax | | 280 | | | 334 | | | (16.17) | % | | 807 | | | 1,119 | | | (27.88) | % |

| Professional fees | | 719 | | | 626 | | | 14.86 | % | | 2,313 | | | 1,746 | | | 32.47 | % |

| Federal Deposit Insurance Corporation deposit insurance | | 425 | | | 260 | | | 63.46 | % | | 1,122 | | | 690 | | | 62.61 | % |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Marketing | | 167 | | | 151 | | | 10.60 | % | | 594 | | | 435 | | | 36.55 | % |

| Intangible amortization | | 25 | | | 34 | | | (26.47) | % | | 92 | | | 119 | | | (22.69) | % |

| | | | | | | | | | | | |

| Other | | 1,378 | | | 1,165 | | | 18.28 | % | | 4,275 | | | 3,723 | | | 14.83 | % |

| TOTAL NON-INTEREST EXPENSE | | 11,172 | | | 10,320 | | | 8.26 | % | | 33,499 | | | 31,747 | | | 5.52 | % |

| INCOME BEFORE INCOME TAX PROVISION | | 2,663 | | | 6,440 | | | (58.65) | % | | 13,408 | | | 15,782 | | | (15.04) | % |

| INCOME TAX PROVISION | | 439 | | | 1,190 | | | (63.11) | % | | 2,355 | | | 2,869 | | | (17.92) | % |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| NET INCOME AVAILABLE TO COMMON SHAREHOLDERS' | | $ | 2,224 | | | $ | 5,250 | | | (57.64) | % | | $ | 11,053 | | | $ | 12,913 | | | (14.40) | % |

| EARNINGS PER SHARE - BASIC | | $ | 0.31 | | | $ | 0.74 | | | (58.11) | % | | $ | 1.56 | | | $ | 1.83 | | | (14.75) | % |

| EARNINGS PER SHARE - DILUTED | | $ | 0.31 | | | $ | 0.74 | | | (58.11) | % | | $ | 1.53 | | | $ | 1.83 | | | (16.39) | % |

| WEIGHTED AVERAGE SHARES OUTSTANDING - BASIC | | 7,072,440 | | | 7,051,228 | | | 0.30 | % | | 7,064,336 | | | 7,060,871 | | | 0.05 | % |

| WEIGHTED AVERAGE SHARES OUTSTANDING - DILUTED | | 7,228,940 | | | 7,051,228 | | | 2.52 | % | | 7,220,836 | | | 7,060,871 | | | 2.27 | % |

| | | | | | | | | | | | |

PENNS WOODS BANCORP, INC.

AVERAGE BALANCES AND INTEREST RATES

(UNAUDITED)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended |

| | | September 30, 2023 | | September 30, 2022 |

| (Dollars in Thousands) | | Average Balance (1) | | Interest | | Average

Rate | | Average Balance (1) | | Interest | | Average

Rate |

| ASSETS: | | | | | | | | | | | | |

Tax-exempt loans (3) | | $ | 68,243 | | | $ | 462 | | | 2.69 | % | | $ | 58,735 | | | $ | 394 | | | 2.66 | % |

| All other loans | | 1,730,669 | | | 21,355 | | | 4.90 | % | | 1,463,330 | | | 14,740 | | | 4.00 | % |

Total loans (2) | | 1,798,912 | | | 21,817 | | | 4.81 | % | | 1,522,065 | | | 15,134 | | | 3.94 | % |

| | | | | | | | | | | | |

| Federal funds sold | | — | | | — | | | — | % | | 33,641 | | | 218 | | | 2.57 | % |

| | | | | | | | | | | | |

| Taxable securities | | 193,019 | | | 1,945 | | | 4.09 | % | | 159,721 | | | 1,158 | | | 2.94 | % |

Tax-exempt securities (3) | | 20,777 | | | 144 | | | 2.81 | % | | 49,177 | | | 299 | | | 2.47 | % |

| Total securities | | 213,796 | | | 2,089 | | | 3.96 | % | | 208,898 | | | 1,457 | | | 2.83 | % |

| | | | | | | | | | | | |

| Interest-bearing balances in other financial institutions | | 11,868 | | | 142 | | | 4.75 | % | | 34,202 | | | 201 | | | 2.33 | % |

| | | | | | | | | | | | |

| Total interest-earning assets | | 2,024,576 | | | 24,048 | | | 4.72 | % | | 1,798,806 | | | 17,010 | | | 3.76 | % |

| | | | | | | | | | | | |

| Other assets | | 131,451 | | | | | | | 130,576 | | | | | |

| | | | | | | | | | | | |

| TOTAL ASSETS | | $ | 2,156,027 | | | | | | | $ | 1,929,382 | | | | | |

| | | | | | | | | | | | |

| LIABILITIES AND SHAREHOLDERS’ EQUITY: | | | | | | | | | | | | |

| Savings | | $ | 225,357 | | | 181 | | | 0.32 | % | | $ | 249,083 | | | 26 | | | 0.04 | % |

| Super Now deposits | | 244,387 | | | 1,174 | | | 1.91 | % | | 405,173 | | | 287 | | | 0.28 | % |

| Money market deposits | | 294,006 | | | 1,862 | | | 2.51 | % | | 287,660 | | | 200 | | | 0.28 | % |

| Time deposits | | 342,450 | | | 3,246 | | | 3.76 | % | | 148,968 | | | 180 | | | 0.48 | % |

| Total interest-bearing deposits | | 1,106,200 | | | 6,463 | | | 2.32 | % | | 1,090,884 | | | 693 | | | 0.25 | % |

| | | | | | | | | | | | |

| Short-term borrowings | | 173,364 | | | 2,412 | | | 5.52 | % | | 8,062 | | | 26 | | | 1.23 | % |

| Long-term borrowings | | 204,901 | | | 1,714 | | | 3.32 | % | | 109,269 | | | 613 | | | 2.23 | % |

| Total borrowings | | 378,265 | | | 4,126 | | | 4.33 | % | | 117,331 | | | 639 | | | 2.16 | % |

| | | | | | | | | | | | |

| Total interest-bearing liabilities | | 1,484,465 | | | 10,589 | | | 2.83 | % | | 1,208,215 | | | 1,332 | | | 0.44 | % |

| | | | | | | | | | | | |

| Demand deposits | | 471,494 | | | | | | | 533,681 | | | | | |

| Other liabilities | | 24,193 | | | | | | | 21,008 | | | | | |

| Shareholders’ equity | | 175,875 | | | | | | | 166,478 | | | | | |

| | | | | | | | | | | | |

| TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY | | $ | 2,156,027 | | | | | | | $ | 1,929,382 | | | | | |

Interest rate spread (3) | | | | | | 1.89 | % | | | | | | 3.32 | % |

Net interest income/margin (3) | | | | $ | 13,459 | | | 2.65 | % | | | | $ | 15,678 | | | 3.47 | % |

1. Information on this table has been calculated using average daily balance sheets to obtain average balances.

2. Non-accrual loans have been included with loans for the purpose of analyzing net interest earnings.

3. Income and rates on fully taxable equivalent basis include an adjustment for the difference between annual income

from tax-exempt obligations and the taxable equivalent of such income at the standard tax rate of 21%

| | | | | | | | | | | | | | |

| | Three Months Ended September 30, |

| | | 2023 | | 2022 |

| Total interest income | | $ | 23,921 | | | $ | 16,864 | |

| Total interest expense | | 10,589 | | | 1,332 | |

| Net interest income (GAAP) | | 13,332 | | | 15,532 | |

| Tax equivalent adjustment | | 127 | | | 146 | |

| Net interest income (fully taxable equivalent) (non-GAAP) | | $ | 13,459 | | | $ | 15,678 | |

PENNS WOODS BANCORP, INC.

AVERAGE BALANCES AND INTEREST RATES

(UNAUDITED)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Nine Months Ended |

| | | September 30, 2023 | | September 30, 2022 |

| (Dollars in Thousands) | | Average Balance (1) | | Interest | | Average

Rate | | Average Balance (1) | | Interest | | Average

Rate |

| ASSETS: | | | | | | | | | | | | |

Tax-exempt loans (3) | | $ | 66,372 | | | $ | 1,371 | | | 2.76 | % | | $ | 53,269 | | | $ | 1,033 | | | 2.59 | % |

| All other loans | | 1,668,596 | | | 58,488 | | | 4.69 | % | | 1,403,504 | | | 40,893 | | | 3.90 | % |

Total loans (2) | | 1,734,968 | | | 59,859 | | | 4.61 | % | | 1,456,773 | | | 41,926 | | | 3.85 | % |

| | | | | | | | | | | | |

| Federal funds sold | | — | | | — | | | — | % | | 43,938 | | | 465 | | | 1.41 | % |

| | | | | | | | | | | | |

| Taxable securities | | 188,477 | | | 5,331 | | | 3.78 | % | | 152,937 | | | 3,126 | | | 2.76 | % |

Tax-exempt securities (3) | | 25,837 | | | 519 | | | 2.69 | % | | 45,357 | | | 752 | | | 2.24 | % |

| Total securities | | 214,314 | | | 5,850 | | | 3.65 | % | | 198,294 | | | 3,878 | | | 2.64 | % |

| | | | | | | | | | | | |

| Interest-bearing balances in other financial institutions | | 10,619 | | | 366 | | | 4.61 | % | | 97,520 | | | 429 | | | 0.59 | % |

| | | | | | | | | | | | |

| Total interest-earning assets | | 1,959,901 | | | 66,075 | | | 4.41 | % | | 1,796,525 | | | 46,698 | | | 3.48 | % |

| | | | | | | | | | | | |

| Other assets | | 132,133 | | | | | | | 129,048 | | | | | |

| | | | | | | | | | | | |

| TOTAL ASSETS | | $ | 2,092,034 | | | | | | | $ | 1,925,573 | | | | | |

| | | | | | | | | | | | |

| LIABILITIES AND SHAREHOLDERS’ EQUITY: | | | | | | | | | | | | |

| Savings | | $ | 233,784 | | | 456 | | | 0.26 | % | | $ | 246,063 | | | 72 | | | 0.04 | % |

| Super Now deposits | | 293,636 | | | 3,026 | | | 1.38 | % | | 388,149 | | | 721 | | | 0.25 | % |

| Money market deposits | | 292,490 | | | 4,807 | | | 2.20 | % | | 296,998 | | | 596 | | | 0.27 | % |

| Time deposits | | 264,855 | | | 6,397 | | | 3.23 | % | | 167,876 | | | 802 | | | 0.64 | % |

| Total interest-bearing deposits | | 1,084,765 | | | 14,686 | | | 1.81 | % | | 1,099,086 | | | 2,191 | | | 0.27 | % |

| | | | | | | | | | | | |

| Short-term borrowings | | 155,136 | | | 6,084 | | | 5.26 | % | | 6,308 | | | 29 | | | 0.59 | % |

| Long-term borrowings | | 169,276 | | | 3,892 | | | 3.07 | % | | 112,457 | | | 1,871 | | | 2.22 | % |

| Total borrowings | | 324,412 | | | 9,976 | | | 4.12 | % | | 118,765 | | | 1,900 | | | 2.14 | % |

| | | | | | | | | | | | |

| Total interest-bearing liabilities | | 1,409,177 | | | 24,662 | | | 2.34 | % | | 1,217,851 | | | 4,091 | | | 0.45 | % |

| | | | | | | | | | | | |

| Demand deposits | | 484,662 | | | | | | | 519,599 | | | | | |

| Other liabilities | | 26,334 | | | | | | | 23,814 | | | | | |

| Shareholders’ equity | | 171,861 | | | | | | | 164,309 | | | | | |

| | | | | | | | | | | | |

| TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY | | $ | 2,092,034 | | | | | | | $ | 1,925,573 | | | | | |

Interest rate spread (3) | | | | | | 2.07 | % | | | | | | 3.03 | % |

Net interest income/margin (3) | | | | $ | 41,413 | | | 2.82 | % | | | | $ | 42,607 | | | 3.17 | % |

1. Information on this table has been calculated using average daily balance sheets to obtain average balances.

2. Non-accrual loans have been included with loans for the purpose of analyzing net interest earnings.

3. Income and rates on fully taxable equivalent basis include an adjustment for the difference between annual income

from tax-exempt obligations and the taxable equivalent of such income at the standard tax rate of 21%

| | | | | | | | | | | | | | |

| | Nine Months Ended September 30, |

| | | 2023 | | 2022 |

| Total interest income | | $ | 65,678 | | | $ | 46,323 | |

| Total interest expense | | 24,662 | | | 4,091 | |

| Net interest income | | 41,016 | | | 42,232 | |

| Tax equivalent adjustment | | 397 | | | 375 | |

| Net interest income (fully taxable equivalent) (non-GAAP) | | $ | 41,413 | | | $ | 42,607 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (Dollars in Thousands, Except Per Share Data, Unaudited) | | Quarter Ended |

| | 9/30/2023 | | 6/30/2023 | | 3/31/2023 | | 12/31/2022 | | 9/30/2022 |

| Operating Data | | | | | | | | | | |

| Net income | | $ | 2,224 | | $ | 4,171 | | $ | 4,658 | | $ | 4,509 | | $ | 5,250 |

| Net interest income | | 13,332 | | 13,386 | | 14,298 | | 15,548 | | 15,532 |

| Provision (recovery) for credit losses | | 1,372 | | (1,180) | | 71 | | 575 | | 855 |

| Net security losses | | (114) | | (39) | | (40) | | (39) | | (211) |

| Non-interest income, excluding net security losses | | 1,989 | | 2,061 | | 2,297 | | 2,120 | | 2,294 |

| Non-interest expense | | 11,172 | | 11,429 | | 10,898 | | 11,251 | | 10,320 |

| | | | | | | | | | |

| Performance Statistics | | | | | | | | | | |

| Net interest margin | | 2.65 | % | | 2.77 | % | | 3.10 | % | | 3.42 | % | | 3.47 | % |

| Annualized return on average assets | | 0.41 | % | | 0.80 | % | | 0.92 | % | | 0.92 | % | | 1.09 | % |

| Annualized return on average equity | | 5.06 | % | | 9.53 | % | | 11.12 | % | | 10.92 | % | | 12.61 | % |

| Annualized net loan charge-offs (recoveries) to average loans | | 0.01 | % | | (0.11) | % | | 0.03 | % | | 0.04 | % | | 0.01 | % |

| Net charge-offs (recoveries) | | 33 | | (472) | | 123 | | 149 | | 37 |

| Efficiency ratio | | 72.76 | % | | 73.78 | % | | 65.46 | % | | 59.79 | % | | 57.70 | % |

| | | | | | | | | | |

| Per Share Data | | | | | | | | | | |

| Basic earnings per share | | $ | 0.31 | | $ | 0.59 | | $ | 0.66 | | $ | 0.64 | | $ | 0.74 |

| Diluted earnings per share | | 0.31 | | 0.59 | | 0.64 | | 0.64 | | 0.74 |

| Dividend declared per share | | 0.32 | | 0.32 | | 0.32 | | 0.32 | | 0.32 |

| Book value | | 24.55 | | 24.70 | | 24.64 | | 23.76 | | 23.32 |

| Common stock price: | | | | | | | | | | |

| High | | 27.17 | | 27.34 | | 27.77 | | 26.89 | | 24.29 |

| Low | | 20.70 | | 21.95 | | 21.90 | | 23.15 | | 22.02 |

| Close | | 21.08 | | 25.03 | | 23.10 | | 26.62 | | 22.91 |

| Weighted average common shares: | | | | | | | | | | |

| Basic | | 7,072 | | 7,062 | | 7,058 | | 7,055 | | 7,051 |

| Fully Diluted | | 7,229 | | 7,062 | | 7,334 | | 7,055 | | 7,051 |

| End-of-period common shares: | | | | | | | | | | |

| Issued | | 7,620 | | 7,574 | | 7,570 | | 7,567 | | 7,563 |

| Treasury | | (510) | | (510) | | (510) | | (510) | | (510) |

| | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (Dollars in Thousands) | | Quarter Ended |

| | 9/30/2023 | | 6/30/2023 | | 3/31/2023 | | 12/31/2022 | | 9/30/2022 | | |

| Financial Condition Data: | | | | | | | | | | | | |

| General | | | | | | | | | | | | |

| Total assets | | $ | 2,176,468 | | $ | 2,135,319 | | $ | 2,065,143 | | $ | 2,000,080 | | $ | 1,905,116 | | |

| Loans, net | | 1,805,571 | | 1,757,811 | | 1,688,289 | | 1,624,094 | | 1,545,489 | | |

| Goodwill | | 16,450 | | 16,450 | | 16,450 | | 16,450 | | 17,104 | | |

| Intangibles | | 235 | | 260 | | 292 | | 327 | | 361 | | |

| Total deposits | | 1,567,267 | | 1,553,757 | | 1,638,835 | | 1,556,460 | | 1,590,415 | | |

| Noninterest-bearing | | 471,507 | | 475,937 | | 502,352 | | 519,063 | | 537,403 | | |

| | | | | | | | | | | | |

| Savings | | 226,897 | | 229,108 | | 239,526 | | 247,952 | | 249,532 | | |

| NOW | | 220,730 | | 238,353 | | 363,548 | | 372,574 | | 392,140 | | |

| Money Market | | 291,889 | | 296,957 | | 300,273 | | 270,589 | | 268,532 | | |

| Time Deposits | | 249,550 | | 226,224 | | 191,203 | | 137,949 | | 137,348 | | |

| Brokered Deposits | | 106,694 | | 87,178 | | 41,933 | | 8,333 | | 5,460 | | |

| Total interest-bearing deposits | | 1,095,760 | | 1,077,820 | | 1,136,483 | | 1,037,397 | | 1,053,012 | | |

| | | | | | | | | | | | |

| Core deposits* | | 1,211,023 | | 1,240,355 | | 1,405,699 | | 1,410,178 | | 1,447,607 | | |

| Shareholders’ equity | | 174,540 | | 174,402 | | 173,970 | | 167,665 | | 164,489 | | |

| | | | | | | | | | | | |

| Asset Quality | | | | | | | | | | | | |

| Non-performing loans | | $ | 3,683 | | $ | 4,276 | | $ | 4,766 | | $ | 4,890 | | $ | 5,743 | | |

| Non-performing loans to total assets | | 0.17 | % | | 0.20 | % | | 0.23 | % | | 0.24 | % | | 0.30 | % | | |

| Allowance for loan losses | | 12,890 | | 11,592 | | 11,734 | | 15,637 | | 15,211 | | |

| Allowance for loan losses to total loans | | 0.71 | % | | 0.66 | % | | 0.69 | % | | 0.95 | % | | 0.97 | % | | |

Allowance for loan losses to non-performing loans | | 349.99 | % | | 271.09 | % | | 246.20 | % | | 319.78 | % | | 264.86 | % | | |

| Non-performing loans to total loans | | 0.20 | % | | 0.24 | % | | 0.28 | % | | 0.30 | % | | 0.37 | % | | |

| | | | | | | | | | | | |

| Capitalization | | | | | | | | | | | | |

| Shareholders’ equity to total assets | | 8.02 | % | | 8.17 | % | | 8.42 | % | | 8.40 | % | | 8.63 | % | | |

* Core deposits are defined as total deposits less time deposits and brokered deposits.

Reconciliation of GAAP and Non-GAAP Financial Measures

(UNAUDITED)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | Nine Months Ended September 30, |

| (Dollars in Thousands, Except Per Share Data) | | 2023 | | 2022 | | 2023 | | 2022 |

| GAAP net income | | $ | 2,224 | | $ | 5,250 | | $ | 11,053 | | $ | 12,913 |

| Net securities losses, net of tax | | 90 | | 167 | | 152 | | 258 |

| | | | | | | | |

| Non-GAAP core earnings | | $ | 2,314 | | $ | 5,417 | | $ | 11,205 | | $ | 13,171 |

| | | | | | | | |

| | | Three Months Ended September 30, | | Nine Months Ended September 30, |

| | | 2023 | | 2022 | | 2023 | | 2022 |

| Return on average assets (ROA) | | 0.41 | % | | 1.09 | % | | 0.70 | % | | 0.89 | % |

| Net securities losses, net of tax | | 0.02 | % | | 0.03 | % | | 0.01 | % | | 0.02 | % |

| | | | | | | | |

| Non-GAAP core ROA | | 0.43 | % | | 1.12 | % | | 0.71 | % | | 0.91 | % |

| | | | | | | | |

| | | Three Months Ended September 30, | | Nine Months Ended September 30, |

| | | 2023 | | 2022 | | 2023 | | 2022 |

| Return on average equity (ROE) | | 5.06 | % | | 12.61 | % | | 8.58 | % | | 10.48 | % |

| Net securities losses, net of tax | | 0.20 | % | | 0.41 | % | | 0.11 | % | | 0.21 | % |

| | | | | | | | |

| Non-GAAP core ROE | | 5.26 | % | | 13.02 | % | | 8.69 | % | | 10.69 | % |

| | | | | | | | |

| | | Three Months Ended September 30, | | Nine Months Ended September 30, |

| | | 2023 | | 2022 | | 2023 | | 2022 |

| Basic earnings per share (EPS) | | $ | 0.31 | | $ | 0.74 | | $ | 1.56 | | $ | 1.83 |

| Net securities losses, net of tax | | 0.02 | | 0.03 | | 0.03 | | 0.04 |

| | | | | | | | |

| Non-GAAP basic core EPS | | $ | 0.33 | | $ | 0.77 | | $ | 1.59 | | $ | 1.87 |

| | | | |

| | | Three Months Ended September 30, | | Nine Months Ended September 30, |

| | | 2023 | | 2022 | | 2023 | | 2022 |

| Diluted EPS | | $ | 0.31 | | $ | 0.74 | | $ | 1.53 | | $ | 1.83 |

| Net securities losses, net of tax | | 0.01 | | 0.03 | | 0.02 | | 0.04 |

| | | | | | | | |

| Non-GAAP diluted core EPS | | $ | 0.32 | | $ | 0.77 | | $ | 1.55 | | $ | 1.87 |

v3.23.3

Cover Document

|

Jul. 25, 2023 |

| Cover [Abstract] |

|

| Title of 12(b) Security |

Common stock, $5.55 par value

|

| City Area Code |

(570)

|

| Entity Address, Address Line One |

300 Market Street

|

| Entity Incorporation, State or Country Code |

PA

|

| Entity Registrant Name |

PENNS WOODS BANCORP, INC.

|

| Document Type |

8-K

|

| Document Period End Date |

Oct. 25, 2023

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Entity File Number |

000-17077

|

| Entity Tax Identification Number |

23-2226454

|

| Entity Address, Address Line Two |

P.O. Box 967

|

| Entity Address, Postal Zip Code |

17703-0967

|

| Entity Address, City or Town |

Williamsport

|

| Entity Address, State or Province |

PA

|

| Local Phone Number |

322-1111

|

| Trading Symbol |

PWOD

|

| Security Exchange Name |

NASDAQ

|

| Entity Central Index Key |

0000716605

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

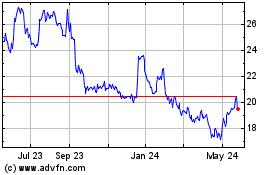

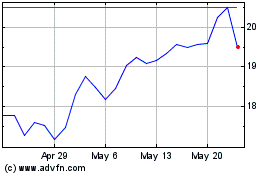

Penns Woods Bancorp (NASDAQ:PWOD)

Historical Stock Chart

From Jun 2024 to Jul 2024

Penns Woods Bancorp (NASDAQ:PWOD)

Historical Stock Chart

From Jul 2023 to Jul 2024