Penns Woods Bancorp, Inc. (NASDAQ: PWOD)

Penns Woods Bancorp, Inc. achieved net

income of $7.0 million for the six months ended June 30, 2021,

resulting in basic and diluted earnings per share of $1.00.

Highlights

- Net income, as reported under GAAP,

for the three and six months ended June 30, 2021 was $3.6

million and $7.0 million, respectively, compared to $3.8 million

and $6.8 million for the same period of 2020. Results for the three

and six months ended June 30, 2021 compared to 2020 were

impacted by a decrease in after-tax securities gains of $45,000

(from a gain of $156,000 to a gain of $111,000) for the three month

period and an increase in after-tax securities gains of $27,000

(from a gain of $178,000 to a gain of $205,000) for the six month

period.

- The provision for loan losses

decreased $295,000 and $530,000, respectfully, for the three and

six months ended June 30, 2021, to $350,000 and $865,000 compared

to $645,000 and $1.4 million for the 2020 periods. The provision

for loan losses was elevated in 2020 due primarily to the

uncertainty caused by the COVID-19 pandemic.

- Basic and diluted earnings per

share for the three and six months ended June 30, 2021 were $0.51

and $1.00. Basic and diluted earnings per share for the three and

six months ended June 30, 2020 were $0.53 and $0.97.

- Return on average assets was 0.76%

for three months ended June 30, 2021, compared to 0.85% for the

corresponding period of 2020. Return on average assets was 0.75%

for the six months ended June 30, 2021, compared to 0.79% for the

corresponding period of 2020.

- Return on average equity was 8.70%

for the three months ended June 30, 2021, compared to 9.59% for the

corresponding period of 2020. Return on average equity was 8.69%

for the six months ended June 30, 2021, compared to 8.75% for the

corresponding period of 2020.

COVID-19 Activity

- Approximately one third of

employees working remotely.

- As of June 30, 2021, loan

modification/deferral program in place to defer payments up to 180

days for principal and/or interest with only $7.9 million in loan

principal remaining in deferral.

- All COVID-19 related loan deferrals

meet the requirements to not be considered a troubled debt

restructuring.

- Participated in the Paycheck

Protection Program ("PPP") by primarily utilizing third parties to

service and place the loans.

- Significantly reduced deposit rates

during the latter half of March 2020 continuing through June

2021.

- Total paycheck protection program

loans originated to be held on balance sheet at June 30, 2021 total

$21.6 million.

Net Income

Net income from core operations (“core

earnings”), which is a non-generally accepted accounting principles

(GAAP) measure of net income excluding net securities gains or

losses, was $3.5 million for the three months ended June 30,

2021 compared to $3.6 million for the same period of 2020. Core

earnings were $6.8 million for the six months ended June 30, 2021,

compared to $6.7 million for the same period of 2020. Core earnings

per share for the three months ended June 30, 2021 were $0.49

basic and diluted, compared to $0.51 basic and diluted core

earnings per share for the same period of 2020. Core earnings per

share for the six months ended June 30, 2021 were $0.97 basic and

diluted, compared to $0.95 basic and diluted for the same period of

2020. Core return on average assets and core return on average

equity were 0.74% and 8.43% for the three months ended June 30,

2021, compared to 0.81% and 9.19% for the corresponding period of

2020. Core return on average assets and core return on average

equity were 0.73% and 8.44% for the six months ended June 30, 2021

compared to 0.77% and 8.52% for the corresponding period of 2020. A

reconciliation of the non-GAAP financial measures of core earnings,

core return on assets, core return on equity, and core earnings per

share described in this press release to the comparable GAAP

financial measures is included at the end of this press

release.

Net Interest Margin

The net interest margin for the three and six

months ended June 30, 2021 was 2.78% and 2.83%, compared to 3.01%

and 3.09% for the corresponding period of 2020. The decrease in the

net interest margin was driven by a decrease in the yield of the

loan portfolio of 47 and 39 basis points ("bps"), while the

investment portfolio yield declined 50 and 62 bps, respectively,

during the current low interest rate environment. Further

compressing the net interest margin was the significant increase of

interest-bearing deposits. These deposits carry a current yield of

a few basis points as commercial customers have received PPP

funding and retail customers have received stimulus funding. Rates

paid on interest-bearing deposit liabilities decreased 54 and 56

bps as rates paid were decreased significantly during 2020 due to

the economic impact of COVID-19 prolonging the low interest rate

environment. These deposit rate decreases have partially offset the

decline in earning asset yield.

Assets

Total assets increased $56.5 million to $1.9

billion at June 30, 2021 compared to June 30, 2020.

Cash and cash equivalents increased significantly due to deposit

growth resulting from the various economic recovery programs

instituted at the state and federal levels that impacted both

commercial and retail customers, coupled with customers becoming

more risk averse and seeking safety in a bank deposit. Net loans

decreased $12.9 million to $1.3 billion at June 30, 2021

compared to June 30, 2020, as the COVID-19 business and travel

restrictions curtailed various lending activities such as indirect

auto, home equity, and commercial. Lending activity began to

rebound as business and travel restrictions were lessened during

the second half of 2020 and continues to rebound in 2021. The

investment portfolio increased $7.7 million from June 30, 2020

to June 30, 2021 as a portion of the excess cash liquidity was

invested into short-term municipal bonds.

Non-performing Loans

The ratio of non-performing loans to total loans

ratio decreased to 0.59% at June 30, 2021 from 0.82% at

June 30, 2020 as non-performing loans have decreased to $7.9

million at June 30, 2021 from $11.1 million at June 30,

2020 primarily due to a commercial loan relationship that was

paid-off during the fourth quarter of 2020. The majority of

non-performing loans involve loans that are either in a secured

position and have sureties with a strong underlying financial

position or have a specific allocation for any impairment recorded

within the allowance for loan losses. Net loan charge-offs of

$230,000 for the six months ended June 30, 2021 impacted the

allowance for loan losses, which was 1.08% of total loans at

June 30, 2021 compared to 0.96% at June 30, 2020.

Deposits

Deposits increased $89.4 million to $1.6 billion

at June 30, 2021 compared to June 30, 2020.

Noninterest-bearing deposits increased $59.0 million to $477.3

million at June 30, 2021 compared to June 30, 2020.

Driving deposit growth was the receipt of PPP funding by

commercial customers, stimulus funding by retail customers, and

customers becoming more risk averse and seeking safety in a bank

deposit. Emphasis remains on increasing the utilization of

electronic (internet and mobile) deposit banking among our

customers. Utilization of internet and mobile banking has increased

since the start of 2020 due to these efforts coupled with a change

in consumer behavior due to the business and travel restrictions

caused by the COVID-19 pandemic. The increased level of deposits

have allowed for a decrease in short and long-term borrowings.

Shareholders’ Equity

Shareholders’ equity increased $7.3 million to

$166.8 million at June 30, 2021 compared to June 30,

2020. Accumulated other comprehensive loss of $1.4 million at

June 30, 2021 increased from a loss of $1.0 million at June 30,

2020 primarily as a result of a change in the net excess of the

projected benefit obligations under the defined benefit plan over

the fair value of the plan’s assets, resulting in an increase in

the net loss of $364,000. The current level of shareholders’ equity

equates to a book value per share of $23.63 at June 30, 2021

compared to $22.66 at June 30, 2020, and an equity to asset

ratio of 8.80% at June 30, 2021 compared to 8.68% at

June 30, 2020. Dividends declared for the six months

ended June 30, 2021 and 2020 were $0.64 per share,

respectively.

Penns Woods Bancorp, Inc. is the parent

company of Jersey Shore State Bank, which operates eighteen branch

offices providing financial services in Lycoming, Clinton, Centre,

Montour, Union, and Blair Counties, and Luzerne Bank, which

operates eight branch offices providing financial services in

Luzerne County. Investment and insurance products are offered

through Jersey Shore State Bank’s subsidiary, The M

Group, Inc. D/B/A The Comprehensive Financial Group. Insurance

products are offered through United Insurance Solutions, LLC, a

joint venture that is a subsidiary of the holding company.

NOTE: This press release contains

financial information determined by methods other than in

accordance with U.S. Generally Accepted Accounting Principles

(“GAAP”). Management uses the non-GAAP measure of net income

from core operations in its analysis of the company’s performance.

This measure, as used by the Company, adjusts net income determined

in accordance with GAAP to exclude the effects of special items,

including significant gains or losses that are unusual in nature

such as net securities gains and losses. Because these certain

items and their impact on the Company’s performance are difficult

to predict, management believes presentation of financial measures

excluding the impact of such items provides useful supplemental

information in evaluating the operating results of the Company’s

core businesses. These disclosures should not be viewed as a

substitute for net income determined in accordance with GAAP, nor

are they necessarily comparable to non-GAAP performance measures

that may be presented by other companies.

This press release may contain certain

“forward-looking statements” including statements concerning plans,

objectives, future events or performance and assumptions and other

statements, which are statements other than statements of

historical fact. The Company cautions readers that the

following important factors, among others, may have affected and

could in the future affect actual results and could cause actual

results for subsequent periods to differ materially from those

expressed in any forward-looking statement made by or on behalf of

the Company herein: (i) the effect of changes in laws and

regulations, including federal and state banking laws and

regulations, and the associated costs of compliance with such laws

and regulations either currently or in the future as applicable;

(ii) the effect of changes in accounting policies and

practices, as may be adopted by the regulatory agencies as well as

by the Financial Accounting Standards Board, or of changes in the

Company’s organization, compensation and benefit plans;

(iii) the effect on the Company’s competitive position within

its market area of the increasing consolidation within the banking

and financial services industries, including the increased

competition from larger regional and out-of-state banking

organizations as well as non-bank providers of various financial

services; (iv) the effect of changes in interest rates; (v)

the effects of health emergencies, including the spread of

infectious diseases or pandemics; or (vi) the effect of

changes in the business cycle and downturns in the local, regional

or national economies. For a list of other factors which

could affect the Company’s results, see the Company’s filings with

the Securities and Exchange Commission, including

“Item 1A. Risk Factors,” set forth in the Company’s

Annual Report on Form 10-K for the fiscal year ended

December 31, 2020.

You should not place undue reliance on any

forward-looking statements. These statements speak only as of

the date of this press release, even if subsequently made available

by the Company on its website or otherwise. The Company

undertakes no obligation to update or revise these statements to

reflect events or circumstances occurring after the date of this

press release.

Previous press releases and additional

information can be obtained from the Company’s website at

www.pwod.com.

| Contact: |

Richard A. Grafmyre,

Chief Executive Officer |

| |

110 Reynolds

Street |

| |

Williamsport, PA

17702 |

|

|

570-322-1111 |

e-mail: pwod@pwod.com |

PENNS WOODS

BANCORP, INC.CONSOLIDATED BALANCE

SHEET(UNAUDITED)

| |

|

June 30, |

|

(In Thousands, Except Share Data) |

|

2021 |

|

2020 |

|

% Change |

|

ASSETS: |

|

|

|

|

|

|

|

Noninterest-bearing

balances |

|

$ |

27,731 |

|

|

$ |

26,932 |

|

|

2.97 |

% |

| Interest-bearing balances in

other financial

institutions |

|

199,389 |

|

|

188,242 |

|

|

5.92 |

% |

| Federal funds

sold |

|

40,000 |

|

|

— |

|

|

n/a |

|

|

Total cash and cash

equivalents |

|

267,120 |

|

|

215,174 |

|

|

24.14 |

% |

| |

|

|

|

|

|

|

| Investment debt securities,

available for sale, at fair

value |

|

171,783 |

|

|

164,369 |

|

|

4.51 |

% |

| Investment equity securities,

at fair value |

|

1,269 |

|

|

1,291 |

|

|

(1.70 |

)% |

| Investment securities,

trading |

|

43 |

|

|

37 |

|

|

16.22 |

% |

| Restricted investment in bank

stock, at fair value

|

|

15,120 |

|

|

14,849 |

|

|

1.83 |

% |

| Loans held for

sale |

|

4,927 |

|

|

5,146 |

|

|

(4.26 |

)% |

|

Loans |

|

1,337,947 |

|

|

1,349,347 |

|

|

(0.84 |

)% |

| Allowance for loan

losses |

|

(14,438 |

) |

|

(12,977 |

) |

|

11.26 |

% |

|

Loans, net |

|

1,323,509 |

|

|

1,336,370 |

|

|

(0.96 |

)% |

| Premises and equipment,

net |

|

34,629 |

|

|

32,873 |

|

|

5.34 |

% |

| Accrued interest

receivable |

|

8,363 |

|

|

8,068 |

|

|

3.66 |

% |

| Bank-owned life

insurance |

|

34,005 |

|

|

29,368 |

|

|

15.79 |

% |

| Investment in limited

partnerships |

|

4,795 |

|

|

1,596 |

|

|

200.44 |

% |

|

Goodwill |

|

17,104 |

|

|

17,104 |

|

|

— |

% |

|

Intangibles |

|

568 |

|

|

777 |

|

|

(26.90 |

)% |

| Operating lease right of use

asset |

|

2,946 |

|

|

3,231 |

|

|

(8.82 |

)% |

| Deferred tax

asset |

|

3,624 |

|

|

3,284 |

|

|

10.35 |

% |

| Other

assets |

|

5,065 |

|

|

4,827 |

|

|

4.93 |

% |

| TOTAL

ASSETS |

|

$ |

1,894,870 |

|

|

$ |

1,838,364 |

|

|

3.07 |

% |

| |

|

|

|

|

|

|

| LIABILITIES: |

|

|

|

|

|

|

| Interest-bearing

deposits |

|

$ |

1,086,352 |

|

|

$ |

1,055,981 |

|

|

2.88 |

% |

| Noninterest-bearing

deposits |

|

477,344 |

|

|

418,324 |

|

|

14.11 |

% |

|

Total deposits |

|

1,563,696 |

|

|

1,474,305 |

|

|

6.06 |

% |

| |

|

|

|

|

|

|

| Short-term

borrowings |

|

7,520 |

|

|

15,133 |

|

|

(50.31 |

)% |

| Long-term

borrowings |

|

141,051 |

|

|

171,885 |

|

|

(17.94 |

)% |

| Accrued interest

payable |

|

961 |

|

|

1,530 |

|

|

(37.19 |

)% |

| Operating lease

liability |

|

2,992 |

|

|

3,263 |

|

|

(8.31 |

)% |

| Other

liabilities |

|

11,815 |

|

|

12,640 |

|

|

(6.53 |

)% |

| TOTAL

LIABILITIES |

|

1,728,035 |

|

|

1,678,756 |

|

|

2.94 |

% |

| |

|

|

|

|

|

|

| SHAREHOLDERS’ EQUITY: |

|

|

|

|

|

|

| Preferred stock, no par value,

3,000,000 shares authorized; no shares

issued |

|

— |

|

|

— |

|

|

n/a |

|

|

Common stock, par value $5.55, 22,500,000 shares authorized;

7,541,627 and 7,522,573 shares issued; 7,061,402 and 7,042,348

shares

outstanding |

|

41,897 |

|

|

41,792 |

|

|

0.25 |

% |

| Additional paid-in

capital |

|

53,205 |

|

|

51,956 |

|

|

2.40 |

% |

| Retained

earnings |

|

85,281 |

|

|

78,910 |

|

|

8.07 |

% |

| Accumulated other

comprehensive gain (loss): |

|

|

|

|

|

|

|

Net unrealized gain on available for sale

securities |

|

4,085 |

|

|

4,194 |

|

|

(2.60 |

)% |

|

Defined benefit

plan |

|

(5,523 |

) |

|

(5,159 |

) |

|

(7.06 |

)% |

| Treasury stock at cost,

480,225 |

|

(12,115 |

) |

|

(12,115 |

) |

|

— |

% |

| TOTAL PENNS WOODS BANCORP,

INC. SHAREHOLDERS'

EQUITY |

|

166,830 |

|

|

159,578 |

|

|

4.54 |

% |

| Non-controlling

interest |

|

5 |

|

|

30 |

|

|

(83.33 |

)% |

| TOTAL SHAREHOLDERS'

EQUITY |

|

166,835 |

|

|

159,608 |

|

|

4.53 |

% |

| TOTAL LIABILITIES AND

SHAREHOLDERS’

EQUITY |

|

$ |

1,894,870 |

|

|

$ |

1,838,364 |

|

|

3.07 |

% |

PENNS WOODS BANCORP,

INC.CONSOLIDATED STATEMENT OF

INCOME(UNAUDITED)

| |

|

Three Months Ended June 30, |

|

Six Months Ended June 30, |

|

(In Thousands, Except Per Share Data) |

|

2021 |

|

2020 |

|

% Change |

|

2021 |

|

2020 |

|

% Change |

|

INTEREST AND DIVIDEND INCOME: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Loans including

fees |

|

$ |

13,099 |

|

|

$ |

14,666 |

|

|

(10.68 |

)% |

|

$ |

26,444 |

|

|

$ |

29,323 |

|

|

(9.82 |

)% |

| Investment securities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Taxable |

|

838 |

|

|

1,023 |

|

|

(18.08 |

)% |

|

1,657 |

|

|

2,033 |

|

|

(18.49 |

)% |

|

Tax-exempt |

|

164 |

|

|

169 |

|

|

(2.96 |

)% |

|

335 |

|

|

314 |

|

|

6.69 |

% |

|

Dividend and other interest

income |

|

305 |

|

|

186 |

|

|

63.98 |

% |

|

565 |

|

|

535 |

|

|

5.61 |

% |

| TOTAL INTEREST AND DIVIDEND

INCOME |

|

14,406 |

|

|

16,044 |

|

|

(10.21 |

)% |

|

29,001 |

|

|

32,205 |

|

|

(9.95 |

)% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| INTEREST EXPENSE: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Deposits |

|

1,489 |

|

|

2,802 |

|

|

(46.86 |

)% |

|

3,173 |

|

|

5,837 |

|

|

(45.64 |

)% |

| Short-term

borrowings |

|

2 |

|

|

7 |

|

|

(71.43 |

)% |

|

4 |

|

|

29 |

|

|

(86.21 |

)% |

| Long-term

borrowings |

|

820 |

|

|

985 |

|

|

(16.75 |

)% |

|

1,659 |

|

|

1,928 |

|

|

(13.95 |

)% |

| TOTAL INTEREST

EXPENSE |

|

2,311 |

|

|

3,794 |

|

|

(39.09 |

)% |

|

4,836 |

|

|

7,794 |

|

|

(37.95 |

)% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| NET INTEREST

INCOME |

|

12,095 |

|

|

12,250 |

|

|

(1.27 |

)% |

|

24,165 |

|

|

24,411 |

|

|

(1.01 |

)% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| PROVISION FOR LOAN

LOSSES |

|

350 |

|

|

645 |

|

|

(45.74 |

)% |

|

865 |

|

|

1,395 |

|

|

(37.99 |

)% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| NET INTEREST INCOME AFTER

PROVISION FOR LOAN

LOSSES |

|

11,745 |

|

|

11,605 |

|

|

1.21 |

% |

|

23,300 |

|

|

23,016 |

|

|

1.23 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| NON-INTEREST INCOME: |

|

|

|

|

|

|

|

|

|

|

|

|

| Service

charges |

|

379 |

|

|

312 |

|

|

21.47 |

% |

|

762 |

|

|

861 |

|

|

(11.50 |

)% |

| Debt securities gains,

available for

sale |

|

137 |

|

|

186 |

|

|

(26.34 |

)% |

|

275 |

|

|

207 |

|

|

32.85 |

% |

| Equity securities gains

(losses) |

|

4 |

|

|

10 |

|

|

(60.00 |

% |

|

(19 |

) |

|

30 |

|

|

(163.33 |

)% |

| Securities (losses) gains,

trading |

|

(1 |

) |

|

— |

|

|

n/a |

|

|

3 |

|

|

(14 |

) |

|

121.43 |

% |

| Bank-owned life

insurance |

|

162 |

|

|

144 |

|

|

12.50 |

% |

|

335 |

|

|

336 |

|

|

(0.30 |

)% |

| Gain on sale of

loans |

|

670 |

|

|

1,028 |

|

|

(34.82 |

)% |

|

1,578 |

|

|

1,472 |

|

|

7.20 |

% |

| Insurance

commissions |

|

150 |

|

|

92 |

|

|

63.04 |

% |

|

307 |

|

|

219 |

|

|

40.18 |

% |

| Brokerage

commissions |

|

207 |

|

|

186 |

|

|

11.29 |

% |

|

426 |

|

|

555 |

|

|

(23.24 |

)% |

| Debit card

income |

|

398 |

|

|

310 |

|

|

28.39 |

% |

|

778 |

|

|

584 |

|

|

33.22 |

% |

|

Other |

|

803 |

|

|

353 |

|

|

127.48 |

% |

|

1,078 |

|

|

808 |

|

|

33.42 |

% |

| TOTAL NON-INTEREST

INCOME |

|

2,909 |

|

|

2,621 |

|

|

10.99 |

% |

|

5,523 |

|

|

5,058 |

|

|

9.19 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| NON-INTEREST EXPENSE: |

|

|

|

|

|

|

|

|

|

|

|

|

| Salaries and employee

benefits |

|

5,672 |

|

|

5,230 |

|

|

8.45 |

% |

|

11,270 |

|

|

10,897 |

|

|

3.42 |

% |

|

Occupancy |

|

717 |

|

|

626 |

|

|

14.54 |

% |

|

1,693 |

|

|

1,328 |

|

|

27.48 |

% |

| Furniture and

equipment |

|

971 |

|

|

828 |

|

|

17.27 |

% |

|

1,780 |

|

|

1,688 |

|

|

5.45 |

% |

| Software

amortization |

|

208 |

|

|

236 |

|

|

(11.86 |

)% |

|

406 |

|

|

486 |

|

|

(16.46 |

)% |

| Pennsylvania shares

tax |

|

372 |

|

|

323 |

|

|

15.17 |

% |

|

724 |

|

|

608 |

|

|

19.08 |

% |

| Professional

fees |

|

684 |

|

|

658 |

|

|

3.95 |

% |

|

1,267 |

|

|

1,280 |

|

|

(1.02 |

)% |

| Federal Deposit Insurance

Corporation deposit

insurance |

|

264 |

|

|

185 |

|

|

42.70 |

% |

|

485 |

|

|

379 |

|

|

27.97 |

% |

|

Marketing |

|

140 |

|

|

56 |

|

|

150.00 |

% |

|

203 |

|

|

109 |

|

|

86.24 |

% |

| Intangible

amortization |

|

50 |

|

|

59 |

|

|

(15.25 |

)% |

|

103 |

|

|

121 |

|

|

(14.88 |

)% |

|

Other |

|

1,170 |

|

|

1,410 |

|

|

(17.02 |

)% |

|

2,268 |

|

|

2,825 |

|

|

(19.72 |

)% |

| TOTAL NON-INTEREST

EXPENSE |

|

10,248 |

|

|

9,611 |

|

|

6.63 |

% |

|

20,199 |

|

|

19,721 |

|

|

2.42 |

% |

| INCOME BEFORE INCOME TAX

PROVISION |

|

4,406 |

|

|

4,615 |

|

|

(4.53 |

)% |

|

8,624 |

|

|

8,353 |

|

|

3.24 |

% |

| INCOME TAX

PROVISION |

|

813 |

|

|

851 |

|

|

(4.47 |

)% |

|

1,584 |

|

|

1,512 |

|

|

4.76 |

% |

| NET

INCOME |

|

$ |

3,593 |

|

|

$ |

3,764 |

|

|

(4.54 |

)% |

|

$ |

7,040 |

|

|

$ |

6,841 |

|

|

2.91 |

% |

| Earnings attributable to

noncontrolling

interest |

|

5 |

|

|

4 |

|

|

25.00 |

% |

|

11 |

|

|

8 |

|

|

37.50 |

% |

| NET INCOME AVAILABLE TO COMMON

SHAREHOLDERS' |

|

$ |

3,588 |

|

|

$ |

3,760 |

|

|

(4.57 |

)% |

|

$ |

7,029 |

|

|

$ |

6,833 |

|

|

2.87 |

% |

| EARNINGS PER SHARE - BASIC

|

|

$ |

0.51 |

|

|

$ |

0.53 |

|

|

(3.77 |

)% |

|

$ |

1.00 |

|

|

$ |

0.97 |

|

|

3.09 |

% |

| EARNINGS PER SHARE -

DILUTED |

|

$ |

0.51 |

|

|

$ |

0.53 |

|

|

(3.77 |

)% |

|

$ |

1.00 |

|

|

$ |

0.97 |

|

|

3.09 |

% |

| WEIGHTED AVERAGE SHARES

OUTSTANDING -

BASIC |

|

7,059,667 |

|

|

7,041,629 |

|

|

0.26 |

% |

|

7,057,404 |

|

|

7,041,185 |

|

|

0.23 |

% |

| WEIGHTED AVERAGE SHARES

OUTSTANDING -

DILUTED |

|

7,059,667 |

|

|

7,041,629 |

|

|

0.26 |

% |

|

7,057,404 |

|

|

7,041,185 |

|

|

0.23 |

% |

| DIVIDENDS DECLARED PER

SHARE |

|

$ |

0.32 |

|

|

$ |

0.32 |

|

|

— |

% |

|

$ |

0.64 |

|

|

$ |

0.64 |

|

|

— |

% |

PENNS WOODS BANCORP,

INC.AVERAGE BALANCES AND INTEREST

RATES

| |

|

Three Months Ended |

| |

|

June 30, 2021 |

|

June 30, 2020 |

|

(Dollars in Thousands) |

|

Average Balance |

|

Interest |

|

Average Rate |

|

Average Balance |

|

Interest |

|

Average Rate |

|

ASSETS: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Tax-exempt

loans |

|

$ |

46,926 |

|

|

$ |

334 |

|

|

2.85 |

% |

|

$ |

44,916 |

|

|

$ |

348 |

|

|

3.12 |

% |

| All other

loans |

|

1,285,853 |

|

|

12,835 |

|

|

4.00 |

% |

|

1,294,745 |

|

|

14,391 |

|

|

4.47 |

% |

| Total

loans |

|

1,332,779 |

|

|

13,169 |

|

|

3.96 |

% |

|

1,339,661 |

|

|

14,739 |

|

|

4.43 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Federal funds

sold |

|

25,538 |

|

|

45 |

|

|

0.71 |

% |

|

— |

|

|

— |

|

|

— |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Taxable

securities |

|

148,415 |

|

|

1,051 |

|

|

2.87 |

% |

|

147,352 |

|

|

1,193 |

|

|

3.29 |

% |

| Tax-exempt

securities |

|

36,469 |

|

|

208 |

|

|

2.31 |

% |

|

28,280 |

|

|

213 |

|

|

3.06 |

% |

| Total

securities |

|

184,884 |

|

|

1,259 |

|

|

2.76 |

% |

|

175,632 |

|

|

1,406 |

|

|

3.26 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Interest-bearing

deposits |

|

218,868 |

|

|

48 |

|

|

0.09 |

% |

|

144,948 |

|

|

16 |

|

|

0.04 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Total interest-earning

assets |

|

1,762,069 |

|

|

14,521 |

|

|

3.31 |

% |

|

1,660,241 |

|

|

16,161 |

|

|

3.92 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Other

assets |

|

128,402 |

|

|

|

|

|

|

116,750 |

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| TOTAL

ASSETS |

|

$ |

1,890,471 |

|

|

|

|

|

|

$ |

1,776,991 |

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| LIABILITIES AND SHAREHOLDERS’

EQUITY: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Savings |

|

$ |

225,625 |

|

|

28 |

|

|

0.05 |

% |

|

$ |

190,243 |

|

|

67 |

|

|

0.14 |

% |

| Super Now

deposits |

|

285,672 |

|

|

208 |

|

|

0.29 |

% |

|

251,691 |

|

|

409 |

|

|

0.65 |

% |

| Money market

deposits |

|

309,749 |

|

|

256 |

|

|

0.33 |

% |

|

229,362 |

|

|

418 |

|

|

0.73 |

% |

| Time

deposits |

|

256,345 |

|

|

997 |

|

|

1.56 |

% |

|

362,545 |

|

|

1,908 |

|

|

2.12 |

% |

| Total interest-bearing

deposits |

|

1,077,391 |

|

|

1,489 |

|

|

0.55 |

% |

|

1,033,841 |

|

|

2,802 |

|

|

1.09 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Short-term

borrowings |

|

7,047 |

|

|

2 |

|

|

0.11 |

% |

|

11,174 |

|

|

7 |

|

|

0.83 |

% |

| Long-term

borrowings |

|

141,076 |

|

|

820 |

|

|

2.33 |

% |

|

171,895 |

|

|

985 |

|

|

2.21 |

% |

| Total

borrowings |

|

148,123 |

|

|

822 |

|

|

2.23 |

% |

|

183,069 |

|

|

992 |

|

|

2.12 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Total interest-bearing

liabilities |

|

1,225,514 |

|

|

2,311 |

|

|

0.76 |

% |

|

1,216,910 |

|

|

3,794 |

|

|

1.24 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Demand

deposits |

|

482,513 |

|

|

|

|

|

|

384,591 |

|

|

|

|

|

| Other

liabilities |

|

17,384 |

|

|

|

|

|

|

18,583 |

|

|

|

|

|

| Shareholders’

equity |

|

165,060 |

|

|

|

|

|

|

156,907 |

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| TOTAL LIABILITIES AND

SHAREHOLDERS’

EQUITY |

|

$ |

1,890,471 |

|

|

|

|

|

|

$ |

1,776,991 |

|

|

|

|

|

| Interest rate

spread |

|

|

|

|

|

2.55 |

% |

|

|

|

|

|

2.68 |

% |

| Net interest

income/margin |

|

|

|

$ |

12,210 |

|

|

2.78 |

% |

|

|

|

$ |

12,367 |

|

|

3.01 |

% |

| |

|

Three Months Ended June 30, |

| |

|

2021 |

|

2020 |

|

Total interest

income |

|

$ |

14,406 |

|

|

$ |

16,044 |

|

| Total interest

expense |

|

2,311 |

|

|

3,794 |

|

| Net interest

income |

|

12,095 |

|

|

12,250 |

|

| Tax equivalent

adjustment |

|

115 |

|

|

117 |

|

| Net interest income (fully

taxable

equivalent) |

|

$ |

12,210 |

|

|

$ |

12,367 |

|

| |

|

Six Months Ended |

| |

|

June 30, 2021 |

|

June 30, 2020 |

|

(Dollars in Thousands) |

|

Average Balance |

|

Interest |

|

Average Rate |

|

Average Balance |

|

Interest |

|

Average Rate |

|

ASSETS: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Tax-exempt

loans |

|

$ |

46,177 |

|

|

$ |

684 |

|

|

2.99 |

% |

|

$ |

48,346 |

|

|

$ |

752 |

|

|

3.13 |

% |

| All other

loans |

|

1,289,660 |

|

|

25,904 |

|

|

4.05 |

% |

|

1,299,893 |

|

|

28,729 |

|

|

4.44 |

% |

| Total

loans |

|

1,335,837 |

|

|

26,588 |

|

|

4.01 |

% |

|

1,348,239 |

|

|

29,481 |

|

|

4.40 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Federal funds

sold |

|

12,840 |

|

|

45 |

|

|

0.71 |

% |

|

— |

|

|

— |

|

|

— |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Taxable

securities |

|

146,740 |

|

|

2,083 |

|

|

2.88 |

% |

|

145,070 |

|

|

2,466 |

|

|

3.46 |

% |

| Tax-exempt

securities |

|

36,420 |

|

|

424 |

|

|

2.36 |

% |

|

26,027 |

|

|

397 |

|

|

3.10 |

% |

| Total

securities |

|

183,160 |

|

|

2,507 |

|

|

2.78 |

% |

|

171,097 |

|

|

2,863 |

|

|

3.40 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Interest-bearing

deposits |

|

207,495 |

|

|

94 |

|

|

0.09 |

% |

|

85,832 |

|

|

102 |

|

|

0.24 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Total interest-earning

assets |

|

1,739,332 |

|

|

29,234 |

|

|

3.39 |

% |

|

1,605,168 |

|

|

32,446 |

|

|

4.07 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Other

assets |

|

126,418 |

|

|

|

|

|

|

114,085 |

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| TOTAL

ASSETS |

|

$ |

1,865,750 |

|

|

|

|

|

|

$ |

1,719,253 |

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| LIABILITIES AND SHAREHOLDERS’

EQUITY: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Savings |

|

$ |

220,161 |

|

|

72 |

|

|

0.07 |

% |

|

$ |

184,042 |

|

|

158 |

|

|

0.17 |

% |

| Super Now

deposits |

|

287,444 |

|

|

475 |

|

|

0.33 |

% |

|

235,758 |

|

|

833 |

|

|

0.71 |

% |

| Money market

deposits |

|

307,885 |

|

|

523 |

|

|

0.34 |

% |

|

220,035 |

|

|

895 |

|

|

0.82 |

% |

| Time

deposits |

|

255,408 |

|

|

2,103 |

|

|

1.66 |

% |

|

370,902 |

|

|

3,951 |

|

|

2.14 |

% |

| Total interest-bearing

deposits |

|

1,070,898 |

|

|

3,173 |

|

|

0.60 |

% |

|

1,010,737 |

|

|

5,837 |

|

|

1.16 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Short-term

borrowings |

|

6,368 |

|

|

4 |

|

|

0.13 |

% |

|

11,011 |

|

|

29 |

|

|

0.53 |

% |

| Long-term

borrowings |

|

141,279 |

|

|

1,659 |

|

|

2.37 |

% |

|

166,024 |

|

|

1,928 |

|

|

2.34 |

% |

| Total

borrowings |

|

147,647 |

|

|

1,663 |

|

|

2.27 |

% |

|

177,035 |

|

|

1,957 |

|

|

2.22 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Total interest-bearing

liabilities |

|

1,218,545 |

|

|

4,836 |

|

|

0.80 |

% |

|

1,187,772 |

|

|

7,794 |

|

|

1.32 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Demand

deposits |

|

464,237 |

|

|

|

|

|

|

355,704 |

|

|

|

|

|

| Other

liabilities |

|

21,227 |

|

|

|

|

|

|

19,551 |

|

|

|

|

|

| Shareholders’

equity |

|

161,741 |

|

|

|

|

|

|

156,226 |

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| TOTAL LIABILITIES AND

SHAREHOLDERS’

EQUITY |

|

$ |

1,865,750 |

|

|

|

|

|

|

$ |

1,719,253 |

|

|

|

|

|

| Interest rate

spread |

|

|

|

|

|

2.59 |

% |

|

|

|

|

|

2.75 |

% |

| Net interest

income/margin |

|

|

|

$ |

24,398 |

|

|

2.83 |

% |

|

|

|

$ |

24,652 |

|

|

3.09 |

% |

| |

|

Six Months Ended June 30, |

| |

|

2021 |

|

2020 |

|

Total interest

income |

|

$ |

29,001 |

|

|

$ |

32,205 |

|

| Total interest

expense |

|

4,836 |

|

|

7,794 |

|

| Net interest

income |

|

24,165 |

|

|

24,411 |

|

| Tax equivalent

adjustment |

|

233 |

|

|

241 |

|

| Net interest income (fully

taxable

equivalent) |

|

$ |

24,398 |

|

|

$ |

24,652 |

|

|

(Dollars in Thousands, Except Per Share Data) |

|

Quarter Ended |

|

|

|

6/30/2021 |

|

3/31/2021 |

|

12/31/2020 |

|

9/30/2020 |

|

6/30/2020 |

| Operating

Data |

|

|

|

|

|

|

|

|

|

|

|

Net income |

|

$ |

3,588 |

|

|

$ |

3,441 |

|

|

$ |

3,901 |

|

|

$ |

4,472 |

|

|

$ |

3,760 |

|

|

Net interest

income |

|

12,095 |

|

|

12,070 |

|

|

11,967 |

|

|

11,845 |

|

|

12,250 |

|

|

Provision for loan

losses |

|

350 |

|

|

515 |

|

|

585 |

|

|

645 |

|

|

645 |

|

|

Net security

gains |

|

140 |

|

|

119 |

|

|

374 |

|

|

1,011 |

|

|

196 |

|

|

Non-interest income, excluding net security

gains |

|

2,769 |

|

|

2,495 |

|

|

2,701 |

|

|

3,024 |

|

|

2,423 |

|

|

Non-interest

expense |

|

10,248 |

|

|

9,951 |

|

|

9,640 |

|

|

9,707 |

|

|

9,611 |

|

| |

|

|

|

|

|

|

|

|

|

|

| Performance

Statistics |

|

|

|

|

|

|

|

|

|

|

|

Net interest

margin |

|

2.78 |

% |

|

2.88 |

% |

|

2.81 |

% |

|

2.76 |

% |

|

3.01 |

% |

|

Annualized return on average

assets |

|

0.76 |

% |

|

0.75 |

% |

|

0.85 |

% |

|

0.97 |

% |

|

0.85 |

% |

|

Annualized return on average

equity |

|

8.70 |

% |

|

8.59 |

% |

|

9.55 |

% |

|

11.05 |

% |

|

9.60 |

% |

|

Annualized net loan charge-offs to average

loans |

|

0.03 |

% |

|

0.04 |

% |

|

0.06 |

% |

|

0.06 |

% |

|

0.05 |

% |

|

Net

charge-offs |

|

114 |

|

|

116 |

|

|

211 |

|

|

193 |

|

|

168 |

|

|

Efficiency

ratio |

|

68.61 |

% |

|

67.96 |

% |

|

65.36 |

% |

|

64.89 |

% |

|

65.10 |

% |

| |

|

|

|

|

|

|

|

|

|

|

| Per Share

Data |

|

|

|

|

|

|

|

|

|

|

|

Basic earnings per

share |

|

$ |

0.51 |

|

|

$ |

0.49 |

|

|

$ |

0.55 |

|

|

$ |

0.63 |

|

|

$ |

0.53 |

|

|

Diluted earnings per

share |

|

0.51 |

|

|

0.49 |

|

|

0.55 |

|

|

0.63 |

|

|

0.53 |

|

|

Dividend declared per

share |

|

0.32 |

|

|

0.32 |

|

|

0.32 |

|

|

0.32 |

|

|

0.32 |

|

|

Book value |

|

23.63 |

|

|

23.25 |

|

|

23.27 |

|

|

23.05 |

|

|

22.66 |

|

|

Common stock price: |

|

|

|

|

|

|

|

|

|

|

|

High |

|

26.51 |

|

|

27.78 |

|

|

27.30 |

|

|

22.83 |

|

|

27.75 |

|

|

Low |

|

23.03 |

|

|

20.55 |

|

|

19.61 |

|

|

19.61 |

|

|

20.01 |

|

|

Close |

|

23.82 |

|

|

24.09 |

|

|

26.01 |

|

|

19.85 |

|

|

22.71 |

|

|

Weighted average common shares: |

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

7,060 |

|

|

7,055 |

|

|

7,050 |

|

|

7,045 |

|

|

7,042 |

|

|

Fully Diluted |

|

7,060 |

|

|

7,055 |

|

|

7,050 |

|

|

7,045 |

|

|

7,042 |

|

|

End-of-period common shares: |

|

|

|

|

|

|

|

|

|

|

|

Issued |

|

7,542 |

|

|

7,537 |

|

|

7,533 |

|

|

7,528 |

|

|

7,523 |

|

|

Treasury |

|

480 |

|

|

480 |

|

|

480 |

|

|

480 |

|

|

480 |

|

|

(Dollars in Thousands, Except Per Share Data) |

|

Quarter Ended |

|

|

|

6/30/2021 |

|

3/31/2021 |

|

12/31/2020 |

|

9/30/2020 |

|

6/30/2020 |

| Financial Condition

Data: |

|

|

|

|

|

|

|

|

|

|

| General |

|

|

|

|

|

|

|

|

|

|

|

Total assets |

|

$ |

1,894,870 |

|

|

$ |

1,896,192 |

|

|

$ |

1,834,643 |

|

|

$ |

1,840,779 |

|

|

$ |

1,838,364 |

|

|

Loans, net |

|

1,323,509 |

|

|

1,321,697 |

|

|

1,330,524 |

|

|

1,335,711 |

|

|

1,336,370 |

|

|

Goodwill |

|

17,104 |

|

|

17,104 |

|

|

17,104 |

|

|

17,104 |

|

|

17,104 |

|

|

Intangibles |

|

568 |

|

|

618 |

|

|

671 |

|

|

724 |

|

|

777 |

|

|

Total deposits |

|

1,563,696 |

|

|

1,564,364 |

|

|

1,494,443 |

|

|

1,491,810 |

|

|

1,474,305 |

|

|

Noninterest-bearing |

|

477,344 |

|

|

478,916 |

|

|

449,357 |

|

|

434,248 |

|

|

418,324 |

|

|

Savings |

|

226,573 |

|

|

224,890 |

|

|

209,924 |

|

|

202,781 |

|

|

195,964 |

|

|

NOW |

|

296,450 |

|

|

290,355 |

|

|

287,775 |

|

|

268,463 |

|

|

268,348 |

|

|

Money Market |

|

301,405 |

|

|

324,207 |

|

|

283,742 |

|

|

274,480 |

|

|

247,753 |

|

|

Time Deposits |

|

261,924 |

|

|

245,996 |

|

|

263,645 |

|

|

311,838 |

|

|

343,915 |

|

|

Total interest-bearing

deposits |

|

1,086,352 |

|

|

1,085,448 |

|

|

1,045,086 |

|

|

1,057,562 |

|

|

1,055,980 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

Core deposits* |

|

1,301,772 |

|

|

1,318,368 |

|

|

1,230,798 |

|

|

1,179,972 |

|

|

1,130,389 |

|

|

Shareholders’

equity |

|

166,830 |

|

|

164,059 |

|

|

164,142 |

|

|

162,422 |

|

|

159,578 |

|

| |

|

|

|

|

|

|

|

|

|

|

| Asset

Quality |

|

|

|

|

|

|

|

|

|

|

|

Non-performing

loans |

|

$ |

7,931 |

|

|

$ |

9,272 |

|

|

$ |

10,334 |

|

|

$ |

10,553 |

|

|

$ |

11,097 |

|

|

Non-performing loans to total

assets |

|

0.42 |

% |

|

0.49 |

% |

|

0.56 |

% |

|

0.57 |

% |

|

0.60 |

% |

|

Allowance for loan

losses |

|

14,438 |

|

|

14,202 |

|

|

13,803 |

|

|

13,429 |

|

|

12,977 |

|

|

Allowance for loan losses to total

loans |

|

1.08 |

% |

|

1.06 |

% |

|

1.03 |

% |

|

1.00 |

% |

|

0.96 |

% |

|

Allowance for loan losses to non-performing

loans |

|

182.05 |

% |

|

153.17 |

% |

|

133.57 |

% |

|

127.25 |

% |

|

116.94 |

% |

|

Non-performing loans to total

loans |

|

0.59 |

% |

|

0.69 |

% |

|

0.77 |

% |

|

0.78 |

% |

|

0.82 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

Capitalization |

|

|

|

|

|

|

|

|

|

|

|

Shareholders’ equity to total

assets |

|

8.80 |

% |

|

8.65 |

% |

|

8.95 |

% |

|

8.82 |

% |

|

8.68 |

% |

* Core deposits are defined as total deposits less time

deposits

Reconciliation of GAAP and Non-GAAP

Financial Measures

| |

|

Three Months Ended June 30, |

|

Six Months Ended June 30, |

|

(Dollars in Thousands, Except Per Share Data) |

|

2021 |

|

2020 |

|

2021 |

|

2020 |

|

GAAP net

income |

|

$ |

3,588 |

|

|

$ |

3,760 |

|

|

$ |

7,029 |

|

|

$ |

6,833 |

|

| Less: net securities gains,

net of tax |

|

|

111 |

|

|

|

156 |

|

|

|

205 |

|

|

|

178 |

|

| Non-GAAP core

earnings |

|

$ |

3,477 |

|

|

$ |

3,604 |

|

|

$ |

6,824 |

|

|

$ |

6,655 |

|

| |

|

|

|

|

|

|

|

|

| |

|

Three Months Ended June 30, |

|

Six Months Ended June 30, |

| |

|

2021 |

|

2020 |

|

2021 |

|

2020 |

| Return on average assets

(ROA) |

|

0.76 |

% |

|

0.85 |

% |

|

0.75 |

% |

|

0.79 |

% |

| Less: net securities gains,

net of tax |

|

0.02 |

% |

|

0.04 |

% |

|

0.02 |

% |

|

0.02 |

% |

| Non-GAAP core

ROA |

|

0.74 |

% |

|

0.81 |

% |

|

0.73 |

% |

|

0.77 |

% |

| |

|

|

|

|

|

|

|

|

| |

|

Three Months Ended June 30, |

|

Six Months Ended June 30, |

| |

|

2021 |

|

2020 |

|

2021 |

|

2020 |

| Return on average equity

(ROE) |

|

8.70 |

% |

|

9.59 |

% |

|

8.69 |

% |

|

8.75 |

% |

| Less: net securities gains,

net of tax |

|

0.27 |

% |

|

0.40 |

% |

|

0.25 |

% |

|

0.23 |

% |

| Non-GAAP core

ROE |

|

8.43 |

% |

|

9.19 |

% |

|

8.44 |

% |

|

8.52 |

% |

| |

|

|

|

|

|

|

|

|

| |

|

Three Months Ended June 30, |

|

Six Months Ended June 30, |

| |

|

2021 |

|

2020 |

|

2021 |

|

2020 |

| Basic earnings per share

(EPS) |

|

$ |

0.51 |

|

|

$ |

0.53 |

|

|

$ |

1.00 |

|

|

$ |

0.97 |

|

| Less: net securities gains,

net of tax |

|

0.02 |

|

|

0.02 |

|

|

0.03 |

|

|

0.02 |

|

| Non-GAAP basic core

EPS |

|

$ |

0.49 |

|

|

$ |

0.51 |

|

|

$ |

0.97 |

|

|

$ |

0.95 |

|

| |

|

|

|

|

| |

|

Three Months Ended June 30, |

|

Six Months Ended June 30, |

| |

|

2021 |

|

2020 |

|

2021 |

|

2020 |

| Diluted

EPS |

|

$ |

0.51 |

|

|

$ |

0.53 |

|

|

$ |

1.00 |

|

|

$ |

0.97 |

|

| Less: net securities gains,

net of tax |

|

0.02 |

|

|

0.02 |

|

|

0.03 |

|

|

0.02 |

|

| Non-GAAP diluted core

EPS |

|

$ |

0.49 |

|

|

$ |

0.51 |

|

|

$ |

0.97 |

|

|

$ |

0.95 |

|

COVID-19 Loan Deferrals as of June 30, 2021

|

(In Thousands) |

|

Amount |

|

Commercial, financial, and

agricultural |

|

$ |

140 |

|

| Real estate mortgage: |

|

|

|

Residential |

|

892 |

|

|

Commercial |

|

6,890 |

|

| Consumer automobile

loans |

|

— |

|

| Other consumer installment

loans |

|

9 |

|

| Total loan deferrals

|

|

$ |

7,931 |

|

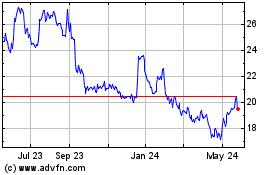

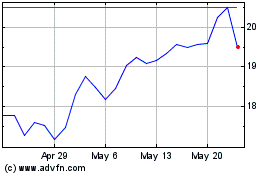

Penns Woods Bancorp (NASDAQ:PWOD)

Historical Stock Chart

From Jun 2024 to Jul 2024

Penns Woods Bancorp (NASDAQ:PWOD)

Historical Stock Chart

From Jul 2023 to Jul 2024