Penns Woods Bancorp, Inc. (NASDAQ:PWOD)

Highlights

- Net income from core operations

(“operating earnings”), which is a non-GAAP measure of net income

excluding net securities gains and losses and bank owned life

insurance gains on death benefit, increased to $3,286,000 and

$6,477,000 for the three and six months ended June 30, 2012

compared to $2,958,000 and $5,729,000 for the same period of

2011.

- Operating earnings per share for the

three and six months ended June 30, 2012 were $0.86 and $1.69 basic

and dilutive compared to $0.77 and $1.49 basic and dilutive for the

same period of 2011, an increase of 11.7% and 13.4%.

- Return on average assets was 1.67% and

1.78% for the three and six months ended June 30, 2012 compared to

1.64% for the three and six month periods of 2011.

- Return on average equity was 15.48% and

16.42% for the three and six months ended June 30, 2012 compared to

16.29% and 16.45% for the corresponding period of 2011.

“The effort of all employees to focus on relationships has

resulted in continued growth of loans and deposits. These efforts

have resulted in significant growth in home equity loans, while

core deposits have increased substantially and have been utilized

to fund the loan growth. The growth in loans and deposits is the

cornerstone of the strong financial metrics of net income, earnings

per share, return on equity, and return on assets that are being

reported,” said Richard A. Grafmyre, CFP®, President and CEO.

A reconciliation of the non-GAAP financial measures of operating

earnings, operating return on assets, operating return on equity,

and operating earnings per share, described in the highlights, to

the comparable GAAP financial measures is included at the end of

this press release.

Net Income

Net income, as reported under GAAP, for the three and six months

ended June 30, 2012 was $3,398,000 and $7,087,000 compared to

$2,964,000 and $5,817,000 for the same period of 2011. Results for

the three and six months ended June 30, 2012 compared to 2011 were

impacted by an increase in after-tax securities gains of $106,000

(from a gain of $6,000 to a gain of $112,000) for the three month

periods and an increase in after-tax securities gains of $413,000

(from a gain of $88,000 to a gain of $501,000) for the six month

periods. In addition, a gain of $109,000 on death benefit related

to bank owned life insurance was recorded during the six months

ended June 30, 2012. Basic and dilutive earnings per share for the

three and six months ended June 30, 2012 were $0.89 and $1.85

compared to $0.78 and $1.52 for the corresponding periods of 2011.

Return on average assets and return on average equity were 1.67%

and 15.48% for the three months ended June 30, 2012 compared to

1.64% and 16.29% for the corresponding period of 2011. Earnings for

the six months ended June 30, 2012 correlate to a return on average

assets and a return on average equity of 1.78% and 16.42% compared

to 1.64% and 16.45% for the six month 2011 period.

Net Interest Margin

The net interest margin for the three and six months ended June

30, 2012 was 4.47% and 4.59% compared to 4.58% and 4.73% for the

corresponding period of 2011. While the net interest margin has

decreased year over year, net interest income on a fully taxable

equivalent basis has increased $1,578,000 to $17,010,000 for the

six months ended June 30, 2012 compared to the corresponding period

of 2011. Driving this increase is the continued emphasis on core

deposit growth. These deposits represent a lower cost funding

source than time deposits and comprise 72.9% of total deposits at

June 30, 2012 compared to 68.8% at June 30, 2011. The average rate

paid on total interest-bearing deposits decreased 32 and 33 basis

points (bp) for the three and six months ended June 30, 2012

compared to the same period of 2011. The decrease was led by the

rate paid on time deposits decreasing 35 and 36 bp for the three

and six months ended June 30, 2012 compared to the same period of

2011. The duration of the time deposit portfolio, which was

shortened over the past several years, is now being slowly

lengthened due to the apparent bottoming or near bottoming of

deposit rates. FHLB long-term borrowings have been reduced by

$10,500,000 since June 30, 2011 as borrowings in that amount

carrying an average rate of 4.60% matured during the three months

ended December 31, 2011.

“Maintaining the net interest margin in the current interest

rate environment will be challenging. We have been able to reduce

the rates paid on interest-bearing liabilities; however, earning

asset yields have also been decreasing. Earning asset yields are

expected to decrease over the near term as loan yields have been

decreasing due to the interest rate environment, while at the same

time the duration of the bond portfolio has been shortened by

utilizing shorter term corporate and agency bonds to offset the

relatively longer duration of municipal bonds in the portfolio. The

shortening of the earning asset portfolio may limit current

earnings due to the low rates on the short end of the interest rate

curve, but it also limits interest rate risk and will provide cash

flow over the next few years as we anticipate a period of

increasing rates. The negative effect of the declining yield on

earning assets is being limited due to the increase in core

deposits. We expect the overall cost of interest-bearing

liabilities to decline through the second half of the year as time

deposits reprice and FHLB borrowings mature during the fourth

quarter of 2012,” commented President Grafmyre.

Assets

Total assets increased $73,447,000 to $818,433,000 at June 30,

2012 compared to June 30, 2011. Net loans increased 10.8% to

$457,904,000 at June 30, 2012 compared to June 30, 2011 as the

economic environment has in general provided fewer loan

opportunities over the past year. Housing, transportation, and all

other facets related to the Marcellus Shale natural gas exploration

are creating loan opportunities and we are aggressively attempting

to attract those loans that meet or exceed our credit standards.

During 2012 a successful loan campaign was undertaken to build home

equity loans and lines of credit. The campaign resulted in loan

growth of approximately $15,000,000. The investment portfolio

increased $49,204,000 from June 30, 2011 to June 30, 2012 due to a

combination of market value increases and the purchase of short

maturity bonds that have been utilized to reduce the portfolio

duration and to provide current cash flow.

Non-performing Loans

Our non-performing loans to total loans ratio has decreased to

1.87% at June 30, 2012 from 2.60% at June 30, 2011. The decrease in

non-performing loans is primarily the result of a decrease in

commercial loan delinquencies due to several partial charge-offs

and the receipt of collateral in lieu of payment with the

collateral now carried as other real estate owned. The majority of

non-performing loans are centered on several loans that are either

in a secured position and have sureties with a strong underlying

financial position or have a specific allocation for any impairment

recorded within the allowance for loan losses. Net loan charge-offs

of $907,000 for the three months ended June 30, 2012 represented

0.79% of average loans for the three months ended June 30, 2012.

The allowance for loan losses was increased to 1.60% of total loans

at June 30, 2012 from 1.38% at June 30, 2011 due to the general

economic uncertainty that persists.

Deposits

Deposits have grown 12.5%, or $71,334,000, to $641,167,000 at

June 30, 2012 compared to June 30, 2011, with core deposits (total

deposits excluding time deposits) increasing $75,011,000, while

higher cost time deposits decreased $3,677,000. Noninterest-bearing

deposits have increased 17.6% to $117,762,000 at June 30, 2012

compared to June 30, 2011. Also playing a significant role in

increasing core deposits were money market and NOW accounts with

growth rates of 17.9% and 27.0%, respectively. Driving this growth

is our commitment to easy-to-use products, community involvement,

and emphasis on customer service. We have also successfully

implemented a targeted marketing campaign aimed at further

strengthening our customer relationships, while also expanding our

market penetration. In addition our newest branch, Danville, opened

in January 2012 and has gathered approximately $20 million in

deposits during the first six months of its operation.

Shareholders’ Equity

Shareholders’ equity increased $14,205,000 to $88,111,000 at

June 30, 2012 compared to June 30, 2011. The accumulated other

comprehensive gain of $2,925,000 at June 30, 2012 is a result of an

increase in unrealized gains on available for sale securities from

an unrealized loss of $2,312,000 at June 30, 2011 to an unrealized

gain of $7,058,000 at June 30, 2012. However, the amount of

accumulated other comprehensive gain at June 30, 2012 was also

impacted by the change in net excess of the projected benefit

obligation over the market value of the plan assets of the defined

benefit pension plan resulting in an increase in the net loss of

$1,720,000. The current level of shareholders’ equity equates to a

book value per share of $22.96 at June 30, 2012 compared to $19.27

at June 30, 2011 and an equity to asset ratio of 10.77% at June 30,

2012 compared to 9.92% at June 30, 2011. Excluding accumulated

other comprehensive gain/loss, book value per share was $22.20 at

June 30, 2012 compared to $20.50 at June 30, 2011. Dividends per

share paid to shareholders were $0.47 and $0.94 for the three and

six months ended June 30, 2012 compared to $0.46 and $0.92 for the

three and six months ended June 30, 2011.

Penns Woods Bancorp, Inc. is the parent company of Jersey Shore

State Bank, which operates thirteen branch offices providing

financial services in Lycoming, Clinton, Centre, and Montour

Counties. Investment and insurance products are offered through the

bank’s subsidiary, The M Group, Inc. D/B/A The Comprehensive

Financial Group.

NOTE: This press release contains financial information

determined by methods other than in accordance with U.S. Generally

Accepted Accounting Principles ("GAAP"). Management uses the

non-GAAP measure of net income from core operations in its analysis

of the company's performance. This measure, as used by the Company,

adjusts net income determined in accordance with GAAP to exclude

the effects of special items, including significant gains or losses

that are unusual in nature such as net securities gains and losses.

Because certain of these items and their impact on the Company’s

performance are difficult to predict, management believes

presentation of financial measures excluding the impact of such

items provides useful supplemental information in evaluating the

operating results of the Company’s core businesses. These

disclosures should not be viewed as a substitute for net income

determined in accordance with GAAP, nor are they necessarily

comparable to non-GAAP performance measures that may be presented

by other companies.

This press release may contain certain “forward-looking

statements” including statements concerning plans, objectives,

future events or performance and assumptions and other statements,

which are statements other than statements of historical fact. The

Company cautions readers that the following important factors,

among others, may have affected and could in the future affect

actual results and could cause actual results for subsequent

periods to differ materially from those expressed in any

forward-looking statement made by or on behalf of the Company

herein: (i) the effect of changes in laws and regulations,

including federal and state banking laws and regulations, and the

associated costs of compliance with such laws and regulations

either currently or in the future as applicable; (ii) the effect of

changes in accounting policies and practices, as may be adopted by

the regulatory agencies as well as by the Financial Accounting

Standards Board, or of changes in the Company’s organization,

compensation and benefit plans; (iii) the effect on the Company’s

competitive position within its market area of the increasing

consolidation within the banking and financial services industries,

including the increased competition from larger regional and

out-of-state banking organizations as well as non-bank providers of

various financial services; (iv) the effect of changes in interest

rates; and (v) the effect of changes in the business cycle and

downturns in the local, regional or national economies. For a list

of other factors which could affect the Company’s results, see the

Company’s filings with the Securities and Exchange Commission,

including “Item 1A. Risk Factors,” set forth in the Company’s

Annual Report on Form 10-K for the fiscal year ended

December 31, 2011.

You should not place undue reliance on any forward-looking

statements. These statements speak only as of the date of this

press release, even if subsequently made available by the Company

on its website or otherwise. The Company undertakes no obligation

to update or revise these statements to reflect events or

circumstances occurring after the date of this press release.

Previous press releases and additional information can be

obtained from the Company’s website at www.jssb.com.

THIS INFORMATION IS SUBJECT TO YEAR-END AUDIT ADJUSTMENT

PENNS WOODS BANCORP, INC.

CONSOLIDATED BALANCE SHEET (UNAUDITED) (In

Thousands, Except Share Data) June 30, 2012 2011 % Change

ASSETS Noninterest-bearing balances $ 16,052 $ 9,765 64.4 %

Interest-bearing deposits in other financial institutions 21

20,904 -99.9 % Total cash and cash equivalents

16,073 30,669 -47.6 % Investment securities, available for

sale, at fair value 295,121 245,863 20.0 % Investment securities

held to maturity (fair value of $0 and $54) - 54 -100.0 % Loans

held for sale 3,496 6,393 -45.3 % Loans 465,342 419,161 11.0 %

Less: Allowance for loan losses 7,438 5,764

29.0 % Loans, net 457,904 413,397 10.8 % Premises and

equipment, net 8,229 7,520 9.4 % Accrued interest receivable 4,071

3,803 7.0 % Bank-owned life insurance 16,101 15,776 2.1 %

Investment in limited partnerships 3,213 3,875 -17.1 % Goodwill

3,032 3,032 0.0 % Deferred tax asset 5,960 9,638 -38.2 % Other

assets 5,233 4,966 5.4 % TOTAL ASSETS $

818,433 $ 744,986 9.9 % LIABILITIES

Interest-bearing deposits $ 523,405 $ 469,729 11.4 %

Noninterest-bearing deposits 117,762 100,104

17.6 % Total deposits 641,167 569,833 12.5 %

Short-term borrowings 17,855 17,007 5.0 % Long-term borrowings,

Federal Home Loan Bank (FHLB) 61,278 71,778 -14.6 % Accrued

interest payable 490 676 -27.5 % Other liabilities 9,532

11,786 -19.1 % TOTAL LIABILITIES

730,322 671,080 8.8 % SHAREHOLDERS'

EQUITY Preferred stock, no par value, 3,000,000 shares authorized;

no shares issued - - 0.0 %

Common stock, par value $8.33, 15,000,000

shares authorized; 4,018,386 and 4,016,686 shares issued

33,486 33,472 0.0 % Additional paid-in capital 18,136 18,090 0.3 %

Retained earnings 39,874 33,379 19.5 % Accumulated other

comprehensive gain (loss): Net unrealized gain (loss) on available

for sale securities 7,058 (2,312 ) 405.3 % Defined benefit plan

(4,133 ) (2,413 ) -71.3 % Less: Treasury stock at cost, 180,596

shares (6,310 ) (6,310 ) 0.0 % TOTAL SHAREHOLDERS'

EQUITY 88,111 73,906 19.2 % TOTAL

LIABILITIES AND SHAREHOLDERS' EQUITY $ 818,433 $ 744,986

9.9 %

PENNS WOODS BANCORP, INC. CONSOLIDATED STATEMENT OF

INCOME (UNAUDITED) (In Thousands, Except

Per Share Data) Three Months Ended Six Months Ended June 30, June

30, 2012 2011 % Change 2012 2011 % Change INTEREST AND

DIVIDEND INCOME: Loans including fees $ 6,294 $ 6,144 2.4 % $

12,608 $ 12,432 1.4 % Investment securities: Taxable 1,517 1,411

7.5 % 2,991 2,786 7.4 % Tax-exempt 1,383 1,272 8.7 % 2,788 2,539

9.8 % Dividend and other interest income 86 57 50.9 %

178 109 63.3 % TOTAL INTEREST AND DIVIDEND INCOME

9,280 8,884 4.5 % 18,565 17,866 3.9 %

INTEREST EXPENSE: Deposits 934 1,182 -21.0 % 1,895 2,376

-20.2 % Short-term borrowings 28 42 -33.3 % 62 99 -37.4 % Long-term

borrowings, FHLB 620 742 -16.4 % 1,240

1,476 -16.0 % TOTAL INTEREST EXPENSE 1,582 1,966

-19.5 % 3,197 3,951 -19.1 % NET INTEREST

INCOME 7,698 6,918 11.3 % 15,368 13,915 10.4 % PROVISION FOR

LOAN LOSSES 600 600 0.0 % 1,200 1,200

0.0 % NET INTEREST INCOME AFTER PROVISION FOR LOAN LOSSES

7,098 6,318 12.3 % 14,168 12,715 11.4 %

NON-INTEREST INCOME: Service charges 458 527 -13.1 % 905

1,030 -12.1 % Securities gains, net 170 9 1788.9 % 759 134 466.4 %

Bank-owned life insurance 133 139 -4.3 % 401 313 28.1 % Gain on

sale of loans 343 242 41.7 % 526 491 7.1 % Insurance commissions

316 180 75.6 % 758 389 94.9 % Brokerage commissions 247 281 -12.1 %

459 555 -17.3 % Other 614 495 24.0 % 1,236

906 36.4 % TOTAL NON-INTEREST INCOME 2,281

1,873 21.8 % 5,044 3,818 32.1 % NON-INTEREST

EXPENSE: Salaries and employee benefits 2,850 2,475 15.2 % 5,867

5,107 14.9 % Occupancy, net 318 301 5.6 % 646 649 -0.5 % Furniture

and equipment 357 349 2.3 % 703 657 7.0 % Pennsylvania shares tax

167 172 -2.9 % 336 344 -2.3 % Amortization of investments in

limited partnerships 166 165 0.6 % 331 331 0.0 % FDIC deposit

insurance 115 186 -38.2 % 238 373 -36.2 % Other 1,370

1,208 13.4 % 2,686 2,383 12.7 % TOTAL NON-INTEREST

EXPENSE 5,343 4,856 10.0 % 10,807 9,844

9.8 % INCOME BEFORE INCOME TAX PROVISION 4,036 3,335 21.0 %

8,405 6,689 25.7 % INCOME TAX PROVISION 638 371 72.0

% 1,318 872 51.1 % NET INCOME $ 3,398 $ 2,964 14.6 %

$ 7,087 $ 5,817 21.8 % EARNINGS PER SHARE - BASIC $ 0.89 $

0.78 14.1 % $ 1.85 $ 1.52 21.7 % EARNINGS PER SHARE -

DILUTED $ 0.89 $ 0.78 14.1 % $ 1.85 $ 1.52 21.7 % WEIGHTED

AVERAGE SHARES OUTSTANDING - BASIC 3,837,579

3,835,785 0.0 % 3,837,391 3,835,542 0.0 %

WEIGHTED AVERAGE SHARES OUTSTANDING - DILUTED 3,837,579

3,835,785 0.0 % 3,837,391 3,835,542 0.0 %

DIVIDENDS PER SHARE $ 0.47 $ 0.46 2.2 % $ 0.94 $ 0.92 2.2 %

PENNS WOODS

BANCORP, INC. AVERAGE BALANCES AND INTEREST RATES

For the Three Months Ended (Dollars in Thousands) June 30, 2012

June 30, 2011 Average Balance Interest Average Rate Average Balance

Interest Average Rate ASSETS: Tax-exempt loans $ 21,621 $ 298 5.54

% $ 20,369 $ 306 6.03 % All other loans 435,918 6,097

5.63 % 400,072 5,942 5.96 % Total loans

457,539 6,395 5.62 % 420,441 6,248 5.96

% Taxable securities 163,294 1,601 3.92 % 126,139 1,467 4.65

% Tax-exempt securities 130,313 2,095 6.43 %

107,469 1,927 7.17 % Total securities 293,607

3,696 5.04 % 233,608 3,394 5.81 %

Interest-bearing deposits 13,285 2 0.06

% 17,860 1 0.02 % Total interest-earning

assets 764,431 10,093 5.30 % 671,909 9,643

5.75 % Other assets 50,251 53,037 TOTAL

ASSETS $ 814,682 $ 724,946 LIABILITIES AND SHAREHOLDERS'

EQUITY: Savings $ 79,465 16 0.08 % $ 70,698 34 0.19 % Super Now

deposits 120,066 153 0.51 % 82,483 107 0.52 % Money market deposits

152,858 202 0.53 % 123,116 291 0.95 % Time deposits 172,431

563 1.31 % 181,250 750 1.66 % Total

interest-bearing deposits 524,820 934 0.72 %

457,547 1,182 1.04 % Short-term borrowings

17,222 28 0.65 % 14,623 42 1.15 % Long-term borrowings, FHLB

61,278 620 4.00 % 71,778 742 4.09 %

Total borrowings 78,500 648 3.27 %

86,401 784 3.59 % Total interest-bearing liabilities

603,320 1,582 1.05 % 543,948 1,966 1.44 %

Demand deposits 112,683 98,371 Other liabilities 10,889

9,832 Shareholders' equity 87,790 72,795 TOTAL

LIABILITIES AND SHAREHOLDERS' EQUITY $ 814,682 $ 724,946 Interest

rate spread 4.25 % 4.31 % Net interest income/margin $ 8,511

4.47 % $ 7,677 4.58 % For the Three Months

Ended June 30, 2012 2011 Total interest income $ 9,280 $ 8,884

Total interest expense 1,582 1,966 Net

interest income 7,698 6,918 Tax equivalent adjustment 813

759 Net interest income (fully taxable

equivalent) $ 8,511 $ 7,677

PENNS WOODS BANCORP, INC. AVERAGE

BALANCES AND INTEREST RATES For the Six Months Ended

(Dollars in Thousands) June 30, 2012 June 30, 2011 Average Balance

Interest Average Rate Average Balance Interest Average Rate

ASSETS: Tax-exempt loans $ 21,574 $ 607 5.66 % $ 20,370 $ 614 6.08

% All other loans 429,040 12,207 5.72 %

399,839 12,027 6.07 % Total loans 450,614

12,814 5.72 % 420,209 12,641 6.07 %

Taxable securities 155,247 3,167 4.08 % 120,471 2,893 4.80 %

Tax-exempt securities 130,452 4,224 6.48 %

105,301 3,847 7.31 % Total securities 285,699

7,391 5.17 % 225,772 6,740 5.97 %

Interest-bearing deposits 7,660 2 0.05

% 9,975 2 0.04 % Total interest-earning assets

743,973 20,207 5.45 % 655,956 19,383 5.94 %

Other assets 50,517 53,464 TOTAL ASSETS

$ 794,490 $ 709,420 LIABILITIES AND SHAREHOLDERS' EQUITY:

Savings $ 76,546 27 0.07 % $ 68,616 70 0.21 % Super Now deposits

114,218 295 0.52 % 75,867 190 0.51 % Money market deposits 140,122

407 0.58 % 116,194 555 0.96 % Time deposits 174,754

1,166 1.34 % 184,885 1,561 1.70 % Total

interest-bearing deposits 505,640 1,895 0.75 %

445,562 2,376 1.08 % Short-term borrowings

19,640 62 0.63 % 16,902 99 1.18 % Long-term borrowings, FHLB

61,278 1,240 4.00 % 71,778 1,476 4.09 %

Total borrowings 80,918 1,302 3.18 %

88,680 1,575 3.54 % Total interest-bearing

liabilities 586,558 3,197 1.09 % 534,242 3,951

1.48 % Demand deposits 110,382 94,941 Other liabilities

11,216 9,502 Shareholders' equity 86,334 70,735

TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY $ 794,490 $

709,420 Interest rate spread 4.36 % 4.46 % Net interest

income/margin $ 17,010 4.59 % $ 15,432 4.73 %

For the Six Months Ended June 30, 2012 2011

Total interest income $ 18,565 $ 17,866 Total interest expense

3,197 3,951 Net interest income 15,368

13,915 Tax equivalent adjustment 1,642 1,517

Net interest income (fully taxable equivalent) $ 17,010 $

15,432

Quarter

Ended (Dollars in Thousands, Except Per Share Data)

6/30/2012

3/31/2012

12/31/2011

9/30/2011

6/30/2011

Operating Data

Net

income $ 3,398 $ 3,689 $ 3,395 $ 3,150

$ 2,964 Net interest income 7,698 7,670

7,595 7,210 6,918 Provision for

loan losses 600 600 900

600 600 Net security gains 170

589 479 8 9

Non-interest income, ex. net security gains 2,111

2,174 1,932 1,982

1,864 Non-interest expense 5,343 5,464

5,152 4,968 4,856

Performance Statistics

Net

interest margin 4.47% 4.72%

4.78% 4.55% 4.58% Annualized return on

average assets 1.67% 1.91% 1.80%

1.67% 1.64% Annualized return on

average equity 15.48% 17.39%

17.00% 16.49% 16.29% Annualized net

loan charge-offs to avg loans 0.79% 0.01%

0.09% 0.01% 1.41% Net

charge-offs 907 9 101

8 1,477 Efficiency ratio 54.5%

55.5% 54.1% 54.1%

55.3%

Per Share Data

Basic earnings per share $ 0.89 $ 0.96 $ 0.88

$ 0.82 $ 0.78 Diluted earnings per share 0.89

0.96 0.88 0.82

0.78 Dividend declared per share 0.47

0.47 0.46 0.46 0.46 Book

value 22.96 22.22 20.97

20.48 19.27 Common stock price:

High 39.90 41.67

39.30 36.56 39.30 Low

36.72 36.20 32.01 31.07

33.33 Close 39.81 40.88

38.78 32.75 34.36 Weighted

average common shares:

Basic

3,838 3,837 3,837

3,836 3,836 Fully Diluted 3,838

3,837 3,837 3,836 3,836

End-of-period common shares:

Issued 4,018 4,018 4,018

4,017 4,017 Treasury 181

181 181 181 181

Quarter Ended (Dollars in

Thousands, Except Per Share Data)

6/30/2012

3/31/2012

12/31/2011

9/30/2011

6/30/2011

Financial Condition Data:

General

Total assets $ 818,433 $ 793,114

$ 763,953 $ 752,650 $ 744,986 Loans, net

457,904 435,832 428,805

422,989 413,397 Intangibles 3,032

3,032 3,032 3,032

3,032 Total deposits 641,167 621,542

581,664 575,300 569,833

Noninterest-bearing 117,762 116,271

111,354 104,783 100,104

Savings 81,479

77,253 71,646 73,376

71,923 NOW 115,972 108,904

101,808 103,264 91,285 Money Market

152,114 141,830 124,335

122,896 129,004 Time Deposits 173,840

177,284 172,521 170,981

177,517 Total interest-bearing deposits

523,405 505,271 470,310

470,517 469,729

Core

deposits* 467,327 444,258

409,143 404,319 392,316 Shareholders'

equity 88,111 85,279 80,460

78,572 73,906

Asset Quality

Non-performing assets $

8,725 $ 11,308 $ 12,009 $ 14,344 $

10,911 Non-performing assets to total assets 1.07%

1.43% 1.57% 1.91%

1.46% Allowance for loan losses 7,438 7,745

7,154 6,355 5,764

Allowance for loan losses to total loans 1.60%

1.75% 1.64% 1.48% 1.38%

Allowance for loan losses to

non-performing loans

85.25% 68.49% 59.57%

44.30% 52.83% Non-performing loans to total

loans 1.87% 2.55% 2.75%

3.34% 2.60%

Capitalization

Shareholders' equity to total assets

10.77% 10.75% 10.53%

10.44% 9.92% * Core deposits are

defined as total deposits less time deposits

Reconciliation of GAAP and Non-GAAP Financial

Measures (Dollars in Thousands, Except Per Share Data)

Three Months Ended Six Months Ended June 30, June 30, 2012 2011

2012 2011 GAAP net income $ 3,398 $ 2,964 $ 7,087 $ 5,817 Less: net

securities and bank-owned life insurance gains, net of tax

112 6 610 88

Non-GAAP operating earnings $ 3,286 $ 2,958 $ 6,477

$ 5,729 Three Months Ended Six Months Ended

June 30, June 30, 2012 2011 2012 2011 Return on average assets

(ROA) 1.67 % 1.64 % 1.78 % 1.64 % Less: net securities and

bank-owned life insurance gains, net of tax 0.06 %

0.01 % 0.15 % 0.02 % Non-GAAP operating ROA

1.61 % 1.63 % 1.63 % 1.62 % Three

Months Ended Six Months Ended June 30, June 30, 2012 2011 2012 2011

Return on average equity (ROE) 15.48 % 16.29 % 16.42 % 16.45 %

Less: net securities and bank-owned life insurance gains, net of

tax 0.51 % 0.04 % 1.42 % 0.25 %

Non-GAAP operating ROE 14.97 % 16.25 % 15.00 %

16.20 % Three Months Ended Six Months Ended June 30,

June 30, 2012 2011 2012 2011 Basic earnings per share (EPS) $ 0.89

$ 0.78 $ 1.85 $ 1.52 Less: net securities and bank-owned life

insurance gains, net of tax 0.03 0.01

0.16 0.03 Non-GAAP basic operating EPS

$ 0.86 $ 0.77 $ 1.69 $ 1.49

Three Months Ended Six Months Ended June 30, June 30, 2012 2011

2012 2011 Dilutive EPS $ 0.89 $ 0.78 $ 1.85 $ 1.52 Less: net

securities and bank-owned life insurance gains, net of tax

0.03 0.01 0.16 0.03

Non-GAAP dilutive operating EPS $ 0.86 $ 0.77

$ 1.69 $ 1.49

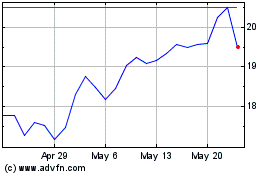

Penns Woods Bancorp (NASDAQ:PWOD)

Historical Stock Chart

From Jun 2024 to Jul 2024

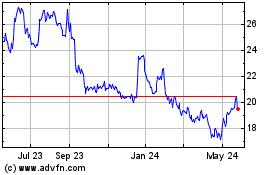

Penns Woods Bancorp (NASDAQ:PWOD)

Historical Stock Chart

From Jul 2023 to Jul 2024