Wage Growth for U.S. Small Business Employees Remains Consistent in July, While Job Growth Continues to Moderate

July 30 2024 - 8:30AM

Business Wire

According to the Paychex Small Business Employment Watch, hourly

earnings growth for U.S. workers in businesses with fewer than 50

employees has held steady since May, reporting 3.16% growth in

July, and weekly earnings growth remains below three percent for

the sixth consecutive month. The Small Business Jobs Index has

reported moderate gains on average through the first seven months

of 2024.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20240730370165/en/

The Paychex Small Business Employment

Watch shows 3.16% hourly earnings growth in July as job growth

continues to moderate. (Graphic: Business Wire)

“Overall, small businesses are looking to hire but continue to

face a tight labor market,” says John Gibson, Paychex president and

CEO. “Inflationary pressures and an evolving regulatory environment

are making it difficult for these organizations to compete for

scarce qualified employees. While job growth has moderated compared

to last year, small businesses continue to be resilient and are

finding ways to navigate the changing economic environment.”

“Hiring dynamics by region, state, and industry are diverging,

with the strongest job growth happening in the Midwest and a

notable slowdown in Construction hiring across the country,” Gibson

adds. “Small businesses are also continuing to carefully manage

hours worked, which remains negative year-over-year for the

16th-straight month.”

Jobs Index and Wage Data Highlights:

- The national small business jobs index has averaged moderate

employment gains (100.44) through seven months of 2024. The July

reading stands at 99.87.

- The majority of states are reporting an index level above 100

in July, but others are driving the national index to trend down.

- The top four states for small business employment growth in

July are all located in the Midwest region (Indiana, Michigan,

Missouri, and Ohio).

- Employment growth in California dropped again in July to 98.74

indicating more significant year-over-year job losses.

- At 2.87%, weekly earnings growth has trended just below three

percent for the past six months. Weekly hours worked growth

(-0.20%) remains negative year-over-year for the 16th consecutive

month.

- The Construction sector has the largest one-month change among

industries, down 0.67 percentage points to an index level of 99.77

in July, yet it continues to lead growth among sectors in hourly

earnings (3.84%), weekly earnings (3.79%), and weekly hours worked

(0.16%) for the ninth consecutive month.

- Education and Health Services (102.04) remains the top industry

for small business employment growth in July yet reports the

weakest hourly earnings growth at 2.67%.

The complete Small Business Employment Watch results for July

2024, including interactive charts detailing the data at a

national, regional, state, metro, and industry sector level are

available at www.paychex.com/watch. Learn more and sign up to

receive monthly Employment Watch alerts.

About the Paychex Small Business Employment Watch

The Paychex Small Business Employment Watch is released each

month by Paychex, Inc. Focused exclusively on businesses with fewer

than 50 workers, the monthly report offers analysis of national

employment and wage trends and examines regional, state, metro, and

industry sector activity. Drawing from the payroll data of

approximately 350,000 Paychex clients, this powerful industry

benchmark delivers real-time insights into the small business

trends driving the U.S. economy. The jobs index is scaled to 100,

which represents no year-over-year change in job growth among same

store businesses. Index values above 100 represent new jobs being

added, while values below 100 represent jobs being lost.

About Paychex

Paychex, Inc. (Nasdaq: PAYX) is an industry-leading HCM company

delivering a full suite of technology and advisory services in

human resources, employee benefit solutions, insurance, and

payroll. The company serves over 745,000 customers in the U.S. and

Europe and pays one out of every 12 American private sector

employees. The more than 16,000 people at Paychex are committed to

helping businesses succeed and building thriving communities where

they work and live. Visit paychex.com to learn more.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240730370165/en/

Media Tracy Volkmann Paychex, Inc. Manager, Public

Relations (585) 387-6705 tvolkman@paychex.com @Paychex

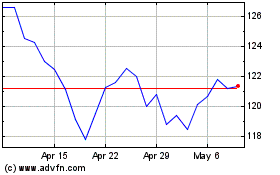

Paychex (NASDAQ:PAYX)

Historical Stock Chart

From Jun 2024 to Jul 2024

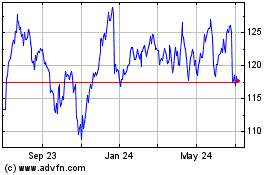

Paychex (NASDAQ:PAYX)

Historical Stock Chart

From Jul 2023 to Jul 2024