Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

August 02 2024 - 8:45AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN

PRIVATE ISSUER PURSUANT TO RULE

13a-16 OR 15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of August 2024

Commission File Number: 001-39911

Patria Investments Limited

(Exact name of registrant as specified in its

charter)

60 Nexus Way, 4th floor,

Camana Bay, PO Box 757, KY1-9006

Grand Cayman, Cayman Islands

+1 345 640 4900

(Address of principal executive office)

Indicate by check mark whether the registrant files

or will file annual reports under cover of Form 20-F or Form 40-F:

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

Patria Investments Limited |

| |

|

|

|

| |

|

|

|

| |

By: |

/s/ Ana Cristina Russo |

| |

|

Name: |

Ana Cristina Russo |

| |

|

Title: |

Chief Financial Officer |

Date: August 2, 2024

TABLE OF CONTENTS

Exhibit 99.1

Patria Investments Limited Announces Share Repurchase Program.

Grand Cayman, Cayman Islands, August 2, 2024 – Patria Investments

Limited (“Patria”) (Nasdaq: PAX) announced today that its board of directors has authorized a share repurchase program. Under

the repurchase program, Patria may repurchase up to 1.8 million of its outstanding Class A common shares in the open market, based on

prevailing market prices, or in privately negotiated transactions, over a period beginning on August 2, 2024 continuing until the earlier

of the completion of the repurchase or August 2, 2025, depending upon market conditions. Patria’s board of directors will review

the repurchase program periodically and may authorize adjustments to its terms and size or suspend or discontinue the repurchase program.

Such purchases may benefit from the

safe harbors provided by Rule 10b-18 and/or Rule 10b5-1, promulgated by the Securities and Exchange Commission under the Securities Exchange

Act of 1934, as amended.

The actual timing, number and value of shares repurchased under the

repurchase program will depend on several factors, including constraints specified in the Rule 10b-18 and/or Rule 10b5-1, price, general

business and market conditions, and alternative investment opportunities. The repurchase program does not obligate Patria to acquire any

specific number of shares in any period, and may be expanded, extended, modified or discontinued at any time.

About Patria

Patria is a global alternative asset manager and industry leader in

Latin America, with over 35 years of history, combined assets under management of $40.3 billion, and a global presence with offices in

13 cities across 4 continents. Patria aims to provide consistent returns in attractive long-term investment opportunities as the gateway

for alternative investments in Latin America. Through a diversified platform spanning Private Equity, Infrastructure, Credit, Real Estate,

Public Equities and Global Private Markets Solutions strategies, Patria provides a comprehensive range of products to serve its global

client base. Further information is available at www.patria.com.

Forward-Looking Statements

This press release may contain forward-looking statements within the

meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended.

You can identify these forward-looking statements by the use of words such as “outlook,” “indicator,” “believes,”

“expects,” “potential,” “continues,” “may,” “will,” “could,” “should,”

“seeks,” “approximately,” “predicts,” “intends,” “plans,” “estimates,”

“anticipates” or the negative version of these words or other comparable words, among others. Forward-looking statements appear

in a number of places in this press release and include, but are not limited to, statements regarding our intent, belief or current expectations.

Forward-looking statements are based on our management’s beliefs and assumptions and on information currently available to our management.

Forward-looking statements speak only as of the date they are made, and we do not undertake any obligation to update them in light of

new information or future developments or to release publicly any revisions to these statements in order to reflect later events or circumstances

or to reflect the occurrence of unanticipated events. Such forward-looking statements are subject to various risks and uncertainties.

Accordingly, there are or will be important factors that could cause actual outcomes or results to differ materially from those indicated

in these statements. Further information on these and other factors that could affect our financial results is included in filings we

have made and will make with the U.S. Securities and Exchange Commission from time to time, including but not limited to those described

under the section entitled “Risk Factors” in our most recent annual report on Form 20-F, as such factors may be updated from

time to time in our periodic filings with the United States Securities and Exchange Commission (“SEC”), which are accessible

on the SEC’s website at www.sec.gov. These factors should not be construed as exhaustive and should be read in conjunction with

the other cautionary statements that are included in our periodic filings.

Contact

Rob Lee

t +1 917 769 1611

rob.lee.consult@patria.com

Andre Medina

t +1 917 769 1611

andre.medina@patria.com

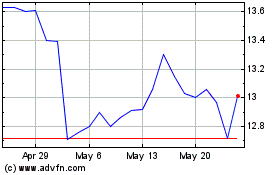

Patria Investments (NASDAQ:PAX)

Historical Stock Chart

From Nov 2024 to Dec 2024

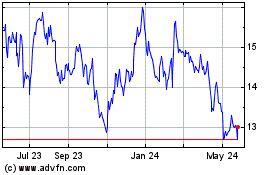

Patria Investments (NASDAQ:PAX)

Historical Stock Chart

From Dec 2023 to Dec 2024