Pathfinder Bancorp, Inc. ("Company") (NASDAQ: PBHC), the holding

company for Pathfinder Bank ("Bank"), announced second quarter 2024

net income available to common shareholders of $2.0 million, or

$0.32 per basic and diluted share, consistent with the $2.0

million, or $0.32 per basic and diluted share, earned in the second

quarter of 2023. The Company's total revenue, which is comprised of

net interest income, before provision for credit losses, and total

noninterest income, for the second quarter of 2024, was $10.7

million, decreasing by $128,000, or 1.2%, compared to the same

quarter in 2023.

Second Quarter 2024 Key

Results:

- Net Interest Income of $9.5 million in the quarter decreased by

$252,000, or 2.6% from June 30, 2023.

- Non-Interest Income of $1.2 million in the quarter increased by

$124,000, or 11.4% from June 30, 2023 driven by various fees

associated with our loan and deposit accounts.

- Non-Interest Expense of $7.9 million in the quarter increased

by $734,000, or 10.2% from June 30, 2023 due primarily to increases

in salaries and benefits and professional and other services.

- Total Deposits were $1.10 billion at the end of the second

quarter, relatively flat to June 30, 2023.

- Total Loans were $888.3 million at the end of the second

quarter, reflecting a $2.8 million decrease from June 30,

2023.

“Our outlook remains positive, bolstered by the

recent acquisition of the East Syracuse branch completed last week,

strategically strengthening Pathfinder’s presence in Central New

York. This region is positioned for outstanding economic growth

through significant public and private investments in the

semiconductor industry and its supporting infrastructure. With $186

million in deposits and $30 million in loans, the branch

acquisition is designed to improve our liquidity profile and

earnings, while enhancing our ability to serve the community in

this dynamic market,” said President and Chief Executive Officer

James A. Dowd. “We are also pleased with the improvement in net

interest margin, which has modestly expanded for two consecutive

quarters in what continues to be an unprecedented interest rate

environment.”

The average cost of deposits acquired in the

East Syracuse branch acquisition was approximately 1.99% (excluding

Core Deposit Intangible), and the Company intends to utilize the

additional liquidity to pay down approximately $150 million of

borrowings that have an average cost of approximately 5.33% in

three months ending June 30, which is expected to benefit total

funding costs in the third quarter of 2024.

“In addition, we are making measured strategic

investments in customer-facing technologies to better serve our

customers and improve operational efficiencies, while continuing to

benefit from our interactions with Castle Creek Capital’s ecosystem

of financial institutions and fintech companies to help us control

noninterest expenses and serve customers in new ways."

“From an asset quality perspective, we continue

to manage the risk of our nonperforming loans by maintaining what

we believe is a prudent allowance for credit losses, which

increased during the second quarter to 1.90% of loans at period

end. While net loan charge offs represented just 0.02% of average

loans in the second quarter and provision expense declined to

$290,000 for the three months ended June 30, we intend to further

enhance the Bank’s approach to managing credit risk as part of our

commitment to continuous improvement and long-term shareholder

value creation.”

Dowd also took the opportunity to welcome Justin

K. Bigham, CPA, who as previously announced was named Senior Vice

President and Chief Financial Officer, effective at the end of last

month. "Justin brings deep financial expertise and a broad

understanding of the banking sector, including comprehensive

knowledge and experience across finance, accounting, retail and

small business banking, wealth management, insurance and marketing.

Justin’s experience, leadership skills, and shared values will help

drive our strategy and growth ambitions and deliver value. I am

excited to work with Justin and welcome him to the Pathfinder

family," Dowd said.

East Syracuse, New York Branch Purchase

The Company filed Form 8-K on July 22, 2024, and

announced that it completed the purchase and assumption of the East

Syracuse branch of Berkshire Bank, the banking subsidiary of

Berkshire Hills Bancorp, Inc. In connection with the purchase, the

Company assumed approximately $186 million in deposits and acquired

approximately $30 million in loans.

Components of Net Interest Income and Net Interest

Margin

In the second quarter of 2024, the Bank's net

interest income, before provision for credit losses, was reported

at $9.5 million, a 2.6% decrease, or a reduction of $252,000, from

the corresponding quarter in 2023. An increase in interest and

dividend income of $2.4 million was more than offset by an increase

in interest expense of almost $2.7 million.

This increase in interest and dividend income of

$2.4 million was primarily attributed to loan yield increases of 44

basis points, investment securities and federal funds sold average

balance increases of $68.3 million, and investment securities and

federal funds sold average yield increases of 75 basis points. The

corresponding increase in loan interest income and investment

securities and federal funds sold interest income was $698,000 and

$1.7 million, respectively.

The increase in interest expense of $2.7

million, compared to the prior quarter, was predominantly the

result of a change in the Bank's deposit mix and a rise in average

rates paid on interest-bearing liabilities, reflecting the

competitive conditions in the current interest rate

environment.

As a result, the net interest margin for the

second quarter of 2024 was 2.78%, compared to 2.75% in the first

quarter of 2024, and 2.96% in the second quarter of 2023. The

increase of three basis points compared to the first quarter was

driven by asset yield improvements partially offset by deposit cost

increases. The decline in net interest margin compared to the

second quarter of 2023 was primarily attributed to higher funding

costs related to the current high interest rate environment and

repricing within the deposit portfolio, partially offset by an

increase in the average yield on interest-earning assets.

Provision for Credit Losses

The provision for credit losses was $290,000 in

the second quarter, reflecting a decrease of $850,000 compared to

the same period in 2023. The June 30, 2023, provision for

credit losses of $1.14 million was attributed to two large

commercial real estate and commercial loan relationships

experiencing credit deterioration. The June 30, 2024

provision for credit losses included an increase in specific

reserves of approximately $665,000, partially offset by improvement

in certain qualitative and other factors that resulted in a net

increase in the provision for loans of $304,000. The

remaining components in provision for credit losses was a net

reduction of $14,000.

The Bank continues to diligently monitor credit

portfolios, particularly those considered sensitive to prevailing

economic stressors, and apply conservative loan classification and

reserve building methodologies.

Noninterest Income

Pathfinder's noninterest income for the second

quarter of 2024 amounted to $1.2 million, reflecting an increase of

$124,000 compared to the same quarter of 2023. This increase can

primarily be attributed to the factors influencing recurring

noninterest income, which excludes volatile items such as

unrealized gains or losses on equity securities, as well as

nonrecurring gains on sales of loans, investment securities,

foreclosed real estate, premises, and equipment.

Recurring noninterest income during the quarter

ended June 30, 2024 increased $155,000, or 13.6%, as compared to

the same quarter in 2023. This is primarily due to an increase of

$79,000 in debit card interchange fees, as a result of increased

gross interchange revenues related to higher levels of consumer

activity. Other components of noninterest income that also

increased during the quarter ended June 30, 2024 include a $45,000

increase in loan servicing fees, a $27,000 increase in service

charges on deposit accounts, and a $24,000 increase in earnings and

gain on bank owned life insurance. These modest increases were

partially offset by an aggregate decrease of $20,000 in other

noninterest income categories.

The $31,000 year-over-year decrease in all other

(nonrecurring) categories of noninterest income was primarily the

result of a $77,000 decrease in sales of loans and foreclosed real

estate during the three months ended June 30, 2024 as compared to

the same period in 2023. Partially offsetting this decrease

were lower losses on marketable equity securities in the amount of

$30,000, and a $16,000 increase in gains on sales and redemptions

of investment securities.

Second quarter results reflect the Bank’s

strategy to proactively seek out and capitalize on new

opportunities to diversify and enhance recurring noninterest

income’s contribution to total revenue. As the Bank moves forward

with its growth strategy, noninterest income is anticipated to play

an increasingly vital role in maintaining a well-balanced and

resilient financial profile.

The following table details the components of

noninterest income for the three and six months ended June 30,

2024, and 2023:

|

Unaudited |

|

For the three months ended |

|

For the six months ended |

| (In

thousands) |

|

June 30, 2024 |

|

June 30, 2023 |

|

Change |

|

June 30, 2024 |

|

June 30, 2023 |

|

Change |

|

Service charges on deposit accounts |

|

$ |

330 |

|

$ |

303 |

|

$ |

27 |

|

8.9 |

% |

|

$ |

639 |

|

$ |

570 |

|

$ |

69 |

|

12.1 |

% |

| Earnings and gain on bank

owned life insurance |

|

|

167 |

|

|

143 |

|

|

24 |

|

16.8 |

% |

|

|

324 |

|

|

301 |

|

|

23 |

|

7.6 |

% |

| Loan servicing fees |

|

|

112 |

|

|

67 |

|

|

45 |

|

67.2 |

% |

|

|

200 |

|

|

139 |

|

|

61 |

|

43.9 |

% |

| Debit card interchange

fees |

|

|

191 |

|

|

112 |

|

|

79 |

|

70.5 |

% |

|

|

310 |

|

|

433 |

|

|

(123 |

) |

-28.4 |

% |

| Insurance agency revenue |

|

|

260 |

|

|

271 |

|

|

(11 |

) |

-4.1 |

% |

|

|

657 |

|

|

691 |

|

|

(34 |

) |

-4.9 |

% |

| Other

charges, commissions and fees |

|

|

234 |

|

|

243 |

|

|

(9 |

) |

-3.7 |

% |

|

|

678 |

|

|

499 |

|

|

179 |

|

35.9 |

% |

| Noninterest income before

gains |

|

|

1,294 |

|

|

1,139 |

|

|

155 |

|

13.6 |

% |

|

|

2,808 |

|

|

2,633 |

|

|

175 |

|

6.6 |

% |

| Gains (losses) on sales and

redemptions of investment securities |

|

|

16 |

|

|

- |

|

|

16 |

|

0.0 |

% |

|

|

(132 |

) |

|

73 |

|

|

(205 |

) |

-280.8 |

% |

| Gain on sales of loans and

foreclosed real estate |

|

|

40 |

|

|

117 |

|

|

(77 |

) |

-65.8 |

% |

|

|

58 |

|

|

142 |

|

|

(84 |

) |

-59.2 |

% |

| Non-recurring gain on lease

renegotiations |

|

|

- |

|

|

- |

|

|

- |

|

0.0 |

% |

|

|

245 |

|

|

- |

|

|

245 |

|

100.0 |

% |

| Losses

on marketable equity securities |

|

|

(139 |

) |

|

(169 |

) |

|

30 |

|

-17.8 |

% |

|

|

(31 |

) |

|

(169 |

) |

|

138 |

|

-81.7 |

% |

| Total

noninterest income |

|

$ |

1,211 |

|

$ |

1,087 |

|

$ |

124 |

|

11.4 |

% |

|

$ |

2,948 |

|

$ |

2,679 |

|

$ |

269 |

|

10.0 |

% |

Noninterest Expense

For the second quarter of 2024, Pathfinder Bank

reported noninterest expenses of $7.9 million. This represents an

increase of approximately $734,000, or 10.2%, compared to the same

period in 2023.

Salaries and benefits increased $493,000, or

12.6% during the quarter ended June 30, 2024, as compared to June

30, 2023. Headcount increases drove approximately $285,000 and

salary adjustments related to merit and wage inflation accounted

for approximately $208,000. These adjustments for merit and wage

inflation are crucial in maintaining competitive remuneration

packages to attract and retain talent in the dynamic banking

sector.

Professional and other services increased

$193,000 during the second quarter of 2024, as compared to the same

quarter in 2023. This increase is primarily due to $116,000 of

nonrecurring expenses associated with a review of technology

enhancements meant to drive improvements in operational

efficiencies. The remaining increase in professional and other

services of $77,000 is spread across several smaller consulting

engagements. All other remaining noninterest expense

categories had an aggregate increase of $48,000, or 1.7%.

The following table details the components of

noninterest expense for the three and six months ended June 30,

2024, and 2023:

|

Unaudited |

|

For the three months ended |

|

|

For the six months ended |

|

| (In

thousands) |

|

June 30, 2024 |

|

June 30, 2023 |

|

Change |

|

|

June 30, 2024 |

|

June 30,2023 |

|

Change |

|

|

Salaries and employee benefits |

|

$ |

4,399 |

|

$ |

3,906 |

|

$ |

493 |

|

12.6 |

% |

|

$ |

8,728 |

|

$ |

8,089 |

|

$ |

639 |

|

7.9 |

% |

| Building and occupancy |

|

|

914 |

|

|

979 |

|

|

(65 |

) |

-6.6 |

% |

|

|

1,730 |

|

|

1,831 |

|

|

(101 |

) |

-5.5 |

% |

| Data processing |

|

|

550 |

|

|

483 |

|

|

67 |

|

13.9 |

% |

|

|

1,078 |

|

|

1,036 |

|

|

42 |

|

4.1 |

% |

| Professional and other

services |

|

|

696 |

|

|

503 |

|

|

193 |

|

38.4 |

% |

|

|

1,258 |

|

|

1,039 |

|

|

219 |

|

21.1 |

% |

| Advertising |

|

|

116 |

|

|

166 |

|

|

(50 |

) |

-30.1 |

% |

|

|

221 |

|

|

372 |

|

|

(151 |

) |

-40.6 |

% |

| FDIC assessments |

|

|

228 |

|

|

222 |

|

|

6 |

|

2.7 |

% |

|

|

457 |

|

|

441 |

|

|

16 |

|

3.6 |

% |

| Audits and exams |

|

|

123 |

|

|

158 |

|

|

(35 |

) |

-22.2 |

% |

|

|

293 |

|

|

317 |

|

|

(24 |

) |

-7.6 |

% |

| Insurance agency expense |

|

|

232 |

|

|

283 |

|

|

(51 |

) |

-18.0 |

% |

|

|

517 |

|

|

544 |

|

|

(27 |

) |

-5.0 |

% |

| Community service

activities |

|

|

39 |

|

|

66 |

|

|

(27 |

) |

-40.9 |

% |

|

|

91 |

|

|

96 |

|

|

(5 |

) |

-5.2 |

% |

| Foreclosed real estate

expenses |

|

|

30 |

|

|

18 |

|

|

12 |

|

66.7 |

% |

|

|

55 |

|

|

32 |

|

|

23 |

|

71.9 |

% |

| Other

expenses |

|

|

581 |

|

|

390 |

|

|

191 |

|

49.0 |

% |

|

|

1,186 |

|

|

901 |

|

|

285 |

|

31.6 |

% |

| Total

noninterest expenses |

|

$ |

7,908 |

|

$ |

7,174 |

|

$ |

734 |

|

10.2 |

% |

|

$ |

15,614 |

|

$ |

14,698 |

|

$ |

916 |

|

6.2 |

% |

Statement of Financial Condition at June 30,

2024

As of June 30, 2024, Pathfinder Bancorp, Inc.'s

statement of financial condition reflects total assets of $1.45

billion. This represents a slight decrease from the $1.47 billion

recorded at December 31, 2023, a contraction of $19.6 million, or

1.3%. The observed reduction in assets since December 31, 2023 is

primarily due to a decrease in total loan balances, which declined

from $897.2 million to $888.3 million, representing a decrease of

$8.9 million or approximately 1.0%. This contraction in the loan

portfolio reflects both normal fluctuations in loan repayments and

a strategic recalibration to focus on higher-yielding products with

high quality, in-market borrowers.

Additionally, interest-earning deposits

experienced a significant reduction since December 31, 2023 from

$36.4 million to $19.8 million, contributing to the decrease in

total cash and cash equivalents, which fell from $48.7 million to

$31.8 million. A deliberate shift in investments reduced held-to

maturity securities from $179.3 million at December 31, 2023 to

$166.3 million at June 30, 2024, a decrease of $13.0, or

7.3%. Conversely, the Bank saw growth in its

available-for-sale securities from $258.7 million to $275.0

million, at December 31, 2023 and June 30, 2024, respectively, and

an increase in other assets, which grew by $3.1 million in the

current quarter.

With respect to liabilities, total deposits

demonstrated stability, with a slight decrease of $18.8 million or

1.7%, from $1.12 billion at December 31, 2023 to $1.10 billion at

June 30, 2024. The decrease in deposits was primarily due to

seasonal fluctuations of municipal depositors. The stability

reflects the Company's ability to maintain strong customer

relationships and a solid funding base amidst competitive

pressures.

Shareholders' equity saw a rise of $3.9 million

or about 3.2%, increasing from $119.5 million at the end of 2023 to

$123.3 million by the end of June 2024. This uptrend was primarily

fueled by the Bank's profitable operations, with net income

contributing to the increment in retained earnings, which increased

from $76.1 million to $78.9 million, net of dividends distributed

to shareholders.

Asset Quality

The Bank reported an increase in the

nonperforming loans ratio from 1.92% at the end of December 2023 to

2.76% at the end of June 2024. This was recognized within the

Company’s $917,000 increase to the allowance for credit losses

("ACL") of $16.9 million, or 1.90% of loans, as of June 30, 2024,

compared to $16.0 million, or 1.78% of loans, at the end of

2023. This reserve underscores the Bank’s prudent approach to

potential credit risks and its capacity to absorb potential loan

losses.

The Company remains vigilant in its oversight of

asset quality and maintenance of what it believes are prudent

reserves for credit losses. Management continues to

proactively monitor and address asset quality, including the close

surveillance of nonaccrual loans. The reported ACL as of June 30,

2024, incorporates management’s estimates of future collectability,

adjusting for current conditions and forward-looking economic

forecasts. The Bank’s strategies, including the ongoing refinement

of its credit risk practices, aim to bolster the loan portfolio

against future uncertainties.

The following table summarizes nonaccrual loans

by category and status at June 30, 2024:

| (In thousands) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loan Type |

Collateral Type |

Number of Loans |

|

|

Loan Balance |

|

|

Average Loan Balance |

|

|

Weighted LTV at Origination/ Modification |

|

|

Status |

| Secured

residential mortgage: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Real Estate |

|

23 |

|

|

$ |

1,737 |

|

|

$ |

76 |

|

|

|

71 |

% |

|

Individual loans are under active resolution management by the

Bank. |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Secured

commercial real estate: |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Private Museum |

|

1 |

|

|

|

1,339 |

|

|

|

1,339 |

|

|

|

77 |

% |

|

The borrower is making

interest only and escrow payments. Strategic initiatives are

being implemented by the borrower that will provide cash flow for

future debt requirements under a modified debt restructure;

inclusive of the sale of the building to a qualified buyer. |

| |

Office Space |

|

1 |

|

|

|

1,665 |

|

|

|

1,665 |

|

|

|

77 |

% |

|

The loan is secured by a first

mortgage with strong tenancy and a long-term lease. The

borrower is in the process of securing grants and tax credit

funding. The Bank is in regular communication with the

borrower. |

| |

Recreation/Golf Course/Marina |

|

1 |

|

|

|

1,368 |

|

|

|

1,368 |

|

|

|

55 |

% |

|

The borrower is in the process

of restructuring debt and loan payments for its seasonal

business. |

| |

All other |

|

10 |

|

|

|

2,049 |

|

|

|

205 |

|

|

|

132 |

% |

|

Individual loans are under

active resolution management by the Bank. |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Commercial

lines of credit: |

|

11 |

|

|

|

2,312 |

|

|

|

210 |

|

|

|

(1 |

) |

|

Individual lines are under

active resolution management by the Bank. |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Commercial

and industrial loans: |

|

21 |

|

|

|

9,783 |

|

|

|

466 |

|

|

|

(1 |

) |

|

Individual loans are under

active resolution management by the Bank. |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Consumer loans: |

|

136 |

|

|

|

4,237 |

|

|

|

31 |

|

|

|

(1 |

) |

|

Individual loans are under active resolution management by the

Bank. |

|

|

|

|

204 |

|

|

$ |

24,490 |

|

|

|

|

|

|

|

|

|

(1) These loans were originated as unsecured or with minimal

collateral.

Liquidity

The Company has diligently ensured a strong

liquidity profile as of June 30, 2024, to meet its ongoing

financial obligations. The Bank's liquidity management, as

evaluated by its cash reserves and operational cash flows from loan

repayments and investment securities, remains robust and is

effectively managed by the institution's leadership.

The Bank's analysis indicates that expected cash

inflows from loans and investment securities are more than

sufficient to meet all projected financial obligations. In

the second quarter of 2024, the Bank's non-brokered deposit

balances decreased modestly to $865.7 million at June 30, 2024 from

$877.4 million at June 30, 2023. In line with this strong

liquidity stance, the Bank's total deposits remain stable and were

$1.10 billion at June 30, 2024 as compared to $1.10 billion and

$1.12 billion at June 20, 2023 and December 31, 2023,

respectively. This further underscores the success of the

Bank’s strategic initiatives in deposit gathering, including

targeted marketing campaigns and customer engagement programs aimed

at deepening banking relationships and enhancing deposit

stability.

The Bank continues to fortify its liquidity

position through established alliances, including its longstanding

partnership with the Federal Home Loan Bank of New York

("FHLB-NY"). By the end of the current quarter, Pathfinder Bancorp

had an available additional funding capacity of $42.1 million with

the FHLB-NY, which complements its liquidity reserves. Moreover,

the Bank maintains additional unused credit lines totaling $29.4

million, which provide a buffer for additional funding needs. These

facilities, including access to the Federal Reserve’s Discount

Window, are part of a comprehensive liquidity strategy that ensures

flexibility and readiness to respond to any funding

requirements.

Pathfinder Bancorp's oversight extends to

continuous liquidity monitoring, ensuring that it is positioned to

withstand financial market fluctuations. The Bank's deposit base

remained stable at $1.10 billion as of June 30, 2024. Out of this

amount, the portion above the FDIC insurance limits is

well-managed, with $56.7 million safeguarded by a reciprocal

deposit program and $100.0 million in municipal deposits fully

collateralized by high-quality securities at June 30, 2024. This

leaves the remaining fraction of $82.4 million, or 7.5%, of total

deposits, as uninsured. Pathfinder Bancorp’s liquidity management

strategies and comprehensive risk mitigation measures demonstrate

the Bank’s capacity to maintain liquidity and financial resilience,

ensuring operational continuity and the continuing growth of

stakeholder confidence.

Cash Dividend Declared

On July 1, 2024, Pathfinder Bancorp declared its

quarterly cash dividend, a testament to the Company’s enduring

commitment to shareholder returns within a framework of risk

management and financial stability. Consistent with the Company’s

tradition of sharing success, the Board of Directors declared a

cash dividend of $0.10 per share for holders of both voting common

and non-voting common stock reflective of the Company’s solid

performance and optimistic outlook.

In addition, this dividend also extends to the

notional shares of the Company's warrants. Shareholders registered

by July 19, 2024 will be eligible for the dividend, which is

scheduled for disbursement on August 9, 2024. This distribution

aligns with Pathfinder Bancorp’s philosophy of consistent and

reliable delivery of shareholder value.

Evaluating the Company's market performance, the

closing stock price as of June 28, 2024, stood at $13.19 per share.

This positions the dividend yield at an attractive 3.03%. The

annualized dividend payout ratio, based on the current dividend, is

calculated to be 30.2%, underscoring the Board’s strategic approach

to capital allocation, shareholder returns and the preservation of

a fortified balance sheet.

Pathfinder Bancorp continues to navigate through

economic cycles with a prudent and disciplined approach, ensuring

that its capital distribution strategy is well calibrated to

support sustained growth and long-term shareholder wealth

creation.

About Pathfinder Bancorp,

Inc.

Pathfinder Bank is a New York State chartered

commercial Bank headquartered in Oswego, whose deposits are insured

by the Federal Deposit Insurance Corporation. The Bank is a wholly

owned subsidiary of Pathfinder Bancorp, Inc., (NASDAQ SmallCap

Market; symbol: PBHC). The Bank has twelve full-service offices,

including the East Syracuse branch acquired in July 2024, located

in its market areas consisting of Oswego and Onondaga Counties and

one limited purpose office in Oneida County. Through its

subsidiary, Pathfinder Risk Management Company, Inc., the Bank owns

a 51% interest in the FitzGibbons Agency, LLC. At June 30, 2024,

there were 4,719,788 shares of voting common stock issued and

outstanding, as well as 1,380,283 shares of non-voting common stock

issued and outstanding. The Company's common stock trades on the

NASDAQ market under the symbol "PBHC." At June 30, 2024, the

Company and subsidiaries had total consolidated assets of $1.45

billion, total deposits of $1.10 billion and shareholders' equity

of $124.2 million.

Forward-Looking Statement

Certain statements contained herein are “forward

looking statements” within the meaning of Section 27A of the

Securities Act of 1933 and Section 21E of the Securities Exchange

Act of 1934. These forward-looking statements are generally

identified by use of the words "believe," "expect," "intend,"

"anticipate," "estimate," "project" or similar expressions, or

future or conditional verbs, such as “will,” “would,” “should,”

“could,” or “may.” These forward-looking statements are based on

current beliefs and expectations of the Company’s and the Bank’s

management and are inherently subject to significant business,

economic and competitive uncertainties and contingencies, many of

which are beyond the Company’s and the Bank’s control. In addition,

these forward-looking statements are subject to assumptions with

respect to future business strategies and decisions that are

subject to change. Actual results may differ materially from those

set forth in the forward-looking statements as a result of numerous

factors. Factors that could cause such differences to exist

include, but are not limited to: risks related to the real estate

and economic environment, particularly in the market areas in which

the Company and the Bank operate; fiscal and monetary policies of

the U.S. Government; inflation; changes in government regulations

affecting financial institutions, including regulatory compliance

costs and capital requirements; fluctuations in the adequacy of the

allowance for credit losses; decreases in deposit levels

necessitating increased borrowing to fund loans and investments;

operational risks including, but not limited to, cybersecurity,

fraud and natural disasters; the risk that the Company may not be

successful in the implementation of its business strategy; changes

in prevailing interest rates; credit risk management;

asset-liability management; and other risks described in the

Company’s filings with the Securities and Exchange Commission,

which are available at the SEC’s website, www.sec.gov.

This release contains non-GAAP financial

measures. For purposes of Regulation G, a non-GAAP financial

measure is a numerical measure of a registrant’s historical or

future financial performance, financial position, or cash flows

that excludes amounts, or is subject to adjustments that have the

effect of excluding amounts, that are included in the most directly

comparable measure calculated and presented in accordance with GAAP

in the statement of income, balance sheet, or statement of cash

flows (or equivalent statements) of the registrant; or includes

amounts, or is subject to adjustments that have the effect of

including amounts, that are excluded from the most directly

comparable measure so calculated and presented. In this regard,

GAAP refers to generally accepted accounting principles in the

United States. Pursuant to the requirements of Regulation G, the

Company has provided reconciliations within the release of the

non-GAAP financial measures to the most directly comparable GAAP

financial measures.

|

PATHFINDER BANCORP, INC.FINANCIAL

HIGHLIGHTS(Dollars and shares in thousands except

per share amounts) |

|

| |

For the three months |

|

|

For the six months |

|

| |

ended June 30, |

|

|

ended June 30, |

|

| |

(Unaudited) |

|

|

(Unaudited) |

|

| |

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

| Condensed Income

Statement |

|

|

|

|

|

|

|

|

|

|

|

|

Interest and dividend income |

$ |

19,022 |

|

|

$ |

16,621 |

|

|

$ |

37,632 |

|

|

$ |

31,664 |

|

|

Interest expense |

|

9,542 |

|

|

|

6,889 |

|

|

|

18,752 |

|

|

|

11,964 |

|

|

Net interest income |

|

9,480 |

|

|

|

9,732 |

|

|

|

18,880 |

|

|

|

19,700 |

|

|

Provision for credit losses |

|

290 |

|

|

|

1,140 |

|

|

|

1,016 |

|

|

|

1,832 |

|

|

Net interest income after provision for credit losses |

|

9,190 |

|

|

|

8,592 |

|

|

|

17,864 |

|

|

|

17,868 |

|

|

Noninterest income excluding net gains on sales ofsecurities, loans

and foreclosed real estate |

|

1,294 |

|

|

|

1,139 |

|

|

|

3,053 |

|

|

|

2,633 |

|

|

Net gains (losses) on sales of securities, fixed assets, loans and

foreclosed real estate |

|

56 |

|

|

|

117 |

|

|

|

(74 |

) |

|

|

215 |

|

|

Net realized losses on sales of marketable equity securities |

|

(139 |

) |

|

|

(169 |

) |

|

|

(31 |

) |

|

|

(169 |

) |

|

Noninterest expense |

|

(7,908 |

) |

|

|

(7,174 |

) |

|

|

(15,614 |

) |

|

|

(14,698 |

) |

|

Income before provision for income taxes |

|

2,493 |

|

|

|

2,505 |

|

|

|

5,198 |

|

|

|

5,849 |

|

|

Provision for income taxes |

|

481 |

|

|

|

530 |

|

|

|

1,013 |

|

|

|

1,199 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income attributable to noncontrolling interest

andPathfinder Bancorp, Inc. |

$ |

2,012 |

|

|

$ |

1,975 |

|

|

$ |

4,185 |

|

|

$ |

4,650 |

|

|

Net income (loss) attributable to noncontrolling interest |

|

12 |

|

|

|

(7 |

) |

|

|

65 |

|

|

|

69 |

|

|

Net income attributable to Pathfinder Bancorp

Inc. |

$ |

2,000 |

|

|

$ |

1,982 |

|

|

$ |

4,120 |

|

|

$ |

4,581 |

|

|

|

As of and for the three months ended |

|

| |

June 30, |

|

|

December 31, |

|

|

June 30, |

|

| |

(Unaudited) |

|

|

(Unaudited) |

|

|

(Unaudited) |

|

| |

2024 |

|

|

2023 |

|

|

2023 |

|

| Selected Balance Sheet

Data |

|

|

|

|

|

|

|

|

|

Assets |

$ |

1,446,211 |

|

|

$ |

1,465,798 |

|

|

$ |

1,392,346 |

|

|

Earning assets |

|

1,361,803 |

|

|

|

1,383,557 |

|

|

|

1,295,623 |

|

|

Total loans |

|

888,263 |

|

|

|

897,207 |

|

|

|

891,111 |

|

|

Total deposits |

|

1,101,277 |

|

|

|

1,120,067 |

|

|

|

1,101,100 |

|

|

Borrowed funds |

|

173,446 |

|

|

|

175,599 |

|

|

|

129,451 |

|

|

Allowance for credit losses |

|

16,892 |

|

|

|

15,975 |

|

|

|

18,796 |

|

|

Subordinated debt |

|

30,008 |

|

|

|

29,914 |

|

|

|

29,821 |

|

|

Pathfinder Bancorp, Inc. Shareholders' equity |

|

123,348 |

|

|

|

119,495 |

|

|

|

113,775 |

|

| |

|

|

|

|

|

|

|

|

| Asset Quality

Ratios |

|

|

|

|

|

|

|

|

|

Net loan charge-offs to average loans |

|

0.02 |

% |

|

|

0.47 |

% |

|

|

0.06 |

% |

|

Allowance for credit losses to period end loans |

|

1.90 |

% |

|

|

1.78 |

% |

|

|

2.11 |

% |

|

Allowance for credit losses to nonperforming loans |

|

68.98 |

% |

|

|

92.73 |

% |

|

|

92.37 |

% |

|

Nonperforming loans to period end loans |

|

2.76 |

% |

|

|

1.92 |

% |

|

|

2.28 |

% |

|

Nonperforming assets to total assets |

|

1.70 |

% |

|

|

1.19 |

% |

|

|

1.48 |

% |

The above information is preliminary and based

on the Company's data available at the time of presentation.

|

PATHFINDER BANCORP, INC.FINANCIAL

HIGHLIGHTS(Dollars and shares in thousands except

per share amounts) |

|

| |

For the three months |

|

|

For the six months |

|

| |

ended June 30, |

|

|

ended June 30, |

|

| |

(Unaudited) |

|

|

(Unaudited) |

|

| |

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

| Key Earnings

Ratios |

|

|

|

|

|

|

|

|

|

|

|

|

Return on average assets |

|

0.56 |

% |

|

|

0.57 |

% |

|

|

0.58 |

% |

|

|

0.66 |

% |

|

Return on average common equity |

|

6.49 |

% |

|

|

6.96 |

% |

|

|

6.74 |

% |

|

|

8.08 |

% |

|

Return on average equity |

|

6.49 |

% |

|

|

6.96 |

% |

|

|

6.74 |

% |

|

|

8.08 |

% |

|

Net interest margin |

|

2.78 |

% |

|

|

2.96 |

% |

|

|

2.77 |

% |

|

|

2.99 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

| Share, Per Share and

Ratio Data |

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted weighted average shares outstanding -Voting |

|

4,708 |

|

|

|

4,639 |

|

|

|

4,704 |

|

|

|

4,624 |

|

|

Basic and diluted earnings per share - Voting |

$ |

0.32 |

|

|

$ |

0.32 |

|

|

$ |

0.66 |

|

|

$ |

0.75 |

|

|

Basic and diluted weighted average shares outstanding - Series A

Non-Voting |

|

1,380 |

|

|

|

1,380 |

|

|

|

1,380 |

|

|

|

1,380 |

|

|

Basic and diluted earnings per share - Series A Non-Voting |

$ |

0.32 |

|

|

$ |

0.32 |

|

|

$ |

0.66 |

|

|

$ |

0.75 |

|

|

Cash dividends per share |

$ |

0.10 |

|

|

$ |

0.09 |

|

|

$ |

0.20 |

|

|

$ |

0.18 |

|

|

Book value per common share at June 30, 2024 and 2023 |

|

|

|

|

|

|

$ |

20.22 |

|

|

$ |

18.74 |

|

|

Tangible book value per common share at June 30, 2024 and 2023 |

|

|

|

|

|

|

$ |

19.46 |

|

|

$ |

17.98 |

|

|

Tangible common equity to tangible assets at June 30, 2024 and

2023 |

|

|

|

|

|

|

|

8.24 |

% |

|

|

7.87 |

% |

Throughout the accompanying document, certain

financial metrics and ratios are presented that are not defined

under generally accepted accounting principles (GAAP).

Reconciliations of the non-GAAP financial metrics and ratios,

presented elsewhere within this document, are presented below:

| |

|

|

|

|

|

|

|

As of and for the six months |

|

|

|

ended June 30, |

|

|

|

(Unaudited) |

|

| Non-GAAP

Reconciliation |

2024 |

|

|

2023 |

|

|

Tangible book value per common share |

|

|

|

|

|

|

Total equity |

$ |

123,348 |

|

|

$ |

113,775 |

|

|

Intangible assets |

|

(4,612 |

) |

|

|

(4,628 |

) |

|

Tangible common equity |

|

118,736 |

|

|

|

109,147 |

|

|

Common shares outstanding |

|

6,100 |

|

|

|

6,070 |

|

|

Tangible book value per common share |

$ |

19.46 |

|

|

$ |

17.98 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tangible common equity to tangible assets |

|

|

|

|

|

|

Tangible common equity |

$ |

118,736 |

|

|

$ |

109,147 |

|

|

Tangible assets |

|

1,441,599 |

|

|

|

1,387,718 |

|

|

Tangible common equity to tangible assets ratio |

|

8.24 |

% |

|

|

7.87 |

% |

|

|

|

|

|

|

|

* Basic and diluted earnings per share are

calculated based upon the two-class method for the three and six

months ended .June 30, 2024 and 2023. Weighted average shares

outstanding do not include unallocated ESOP shares.The above

information is preliminary and based on the Company's data

available at the time of presentation.

PATHFINDER BANCORP,

INC.FINANCIAL HIGHLIGHTS(Dollars

and shares in thousands except per share amounts)

The following table sets forth information

concerning average interest-earning assets and interest-bearing

liabilities and the yields and rates thereon. Interest income and

resultant yield information in the table has not been adjusted for

tax equivalency. Averages are computed on the daily average balance

for each month in the period divided by the number of days in the

period. Yields and amounts earned include loan fees. Nonaccrual

loans have been included in interest-earning assets for purposes of

these calculations.

| |

For the three months ended June 30, |

|

| |

(Unaudited) |

|

| |

2024 |

|

|

2023 |

|

|

(Dollars in thousands) |

Average Balance |

|

|

Interest |

|

|

Average Yield/Cost |

|

|

Average Balance |

|

|

Interest |

|

|

Average Yield/Cost |

|

| Interest-earning

assets: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loans |

$ |

885,384 |

|

|

$ |

12,489 |

|

|

5.64 |

% |

|

$ |

907,556 |

|

|

$ |

11,791 |

|

|

|

5.20 |

% |

|

Taxable investment securities |

|

434,572 |

|

|

|

5,914 |

|

|

5.44 |

% |

|

|

369,870 |

|

|

|

4,296 |

|

|

|

4.65 |

% |

|

Tax-exempt investment securities |

|

28,944 |

|

|

|

498 |

|

|

6.88 |

% |

|

|

29,013 |

|

|

|

479 |

|

|

|

6.60 |

% |

|

Fed funds sold and interest-earning deposits |

|

13,387 |

|

|

|

121 |

|

|

3.62 |

% |

|

|

9,723 |

|

|

|

55 |

|

|

|

2.26 |

% |

|

Total interest-earning assets |

|

1,362,287 |

|

|

|

19,022 |

|

|

5.59 |

% |

|

|

1,316,162 |

|

|

|

16,621 |

|

|

|

5.05 |

% |

| Noninterest-earning

assets: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other assets |

|

98,746 |

|

|

|

|

|

|

|

|

|

94,350 |

|

|

|

|

|

|

|

|

Allowance for credit losses |

|

(16,905 |

) |

|

|

|

|

|

|

|

|

(18,030 |

) |

|

|

|

|

|

|

|

Net unrealized losseson available-for-sale securities |

|

(10,248 |

) |

|

|

|

|

|

|

|

|

(12,944 |

) |

|

|

|

|

|

|

|

Total assets |

$ |

1,433,880 |

|

|

|

|

|

|

|

|

$ |

1,379,538 |

|

|

|

|

|

|

|

| Interest-bearing

liabilities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NOW accounts |

$ |

92,918 |

|

|

$ |

264 |

|

|

1.14 |

% |

|

$ |

93,560 |

|

|

$ |

100 |

|

|

|

0.43 |

% |

|

Money management accounts |

|

12,076 |

|

|

|

3 |

|

|

0.10 |

% |

|

|

14,159 |

|

|

|

4 |

|

|

|

0.11 |

% |

|

MMDA accounts |

|

214,364 |

|

|

|

2,002 |

|

|

3.74 |

% |

|

|

244,927 |

|

|

|

1,622 |

|

|

|

2.65 |

% |

|

Savings and club accounts |

|

107,558 |

|

|

|

71 |

|

|

0.26 |

% |

|

|

127,356 |

|

|

|

67 |

|

|

|

0.21 |

% |

|

Time deposits |

|

524,276 |

|

|

|

5,286 |

|

|

4.03 |

% |

|

|

468,534 |

|

|

|

3,832 |

|

|

|

3.27 |

% |

|

Subordinated loans |

|

29,977 |

|

|

|

489 |

|

|

6.53 |

% |

|

|

29,792 |

|

|

|

483 |

|

|

|

6.48 |

% |

|

Borrowings |

|

141,067 |

|

|

|

1,427 |

|

|

4.05 |

% |

|

|

99,284 |

|

|

|

781 |

|

|

|

3.15 |

% |

|

Total interest-bearing liabilities |

|

1,122,236 |

|

|

|

9,542 |

|

|

3.40 |

% |

|

|

1,077,612 |

|

|

|

6,889 |

|

|

|

2.56 |

% |

| Noninterest-bearing

liabilities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Demand deposits |

|

171,135 |

|

|

|

|

|

|

|

|

|

171,882 |

|

|

|

|

|

|

|

|

Other liabilities |

|

17,298 |

|

|

|

|

|

|

|

|

|

16,129 |

|

|

|

|

|

|

|

|

Total liabilities |

|

1,310,669 |

|

|

|

|

|

|

|

|

|

1,265,623 |

|

|

|

|

|

|

|

|

Shareholders' equity |

|

123,211 |

|

|

|

|

|

|

|

|

|

113,915 |

|

|

|

|

|

|

|

|

Total liabilities & shareholders' equity |

$ |

1,433,880 |

|

|

|

|

|

|

|

|

$ |

1,379,538 |

|

|

|

|

|

|

|

| Net interest income |

|

|

|

$ |

9,480 |

|

|

|

|

|

|

|

|

$ |

9,732 |

|

|

|

|

| Net interest rate spread |

|

|

|

|

|

|

2.19 |

% |

|

|

|

|

|

|

|

|

2.49 |

% |

| Net

interest margin |

|

|

|

|

|

|

2.78 |

% |

|

|

|

|

|

|

|

|

2.96 |

% |

| Ratio

of average interest-earning assetsto average interest-bearing

liabilities |

|

|

|

|

|

|

121.39 |

% |

|

|

|

|

|

|

|

|

122.14 |

% |

| |

For the six months ended June 30, |

| |

(Unaudited) |

| |

|

2024 |

|

|

|

2023 |

|

|

(Dollars in thousands) |

Average Balance |

|

Interest |

|

Average Yield/Cost |

|

Average Balance |

|

Interest |

|

Average Yield/Cost |

| Interest-earning

assets: |

|

|

|

|

|

|

|

|

|

|

|

|

Loans |

$ |

889,988 |

|

|

$ |

24,757 |

|

5.56 |

% |

|

$ |

903,255 |

|

|

$ |

22,449 |

|

4.97 |

% |

|

Taxable investment securities |

|

433,156 |

|

|

|

11,650 |

|

5.38 |

% |

|

|

369,155 |

|

|

|

8,121 |

|

4.40 |

% |

|

Tax-exempt investment securities |

|

29,053 |

|

|

|

1,006 |

|

6.93 |

% |

|

|

32,726 |

|

|

|

934 |

|

5.71 |

% |

|

Fed funds sold and interest-earning deposits |

|

8,669 |

|

|

|

219 |

|

5.05 |

% |

|

|

11,930 |

|

|

|

160 |

|

2.68 |

% |

|

Total interest-earning assets |

|

1,360,866 |

|

|

|

37,632 |

|

5.53 |

% |

|

|

1,317,066 |

|

|

|

31,664 |

|

4.81 |

% |

| Noninterest-earning

assets: |

|

|

|

|

|

|

|

|

|

|

|

|

Other assets |

|

96,772 |

|

|

|

|

|

|

|

97,754 |

|

|

|

|

|

|

Allowance for credit losses |

|

(16,498 |

) |

|

|

|

|

|

|

(17,542 |

) |

|

|

|

|

|

Net unrealized losseson available-for-sale securities |

|

(10,701 |

) |

|

|

|

|

|

|

(12,738 |

) |

|

|

|

|

|

Total assets |

$ |

1,430,439 |

|

|

|

|

|

|

$ |

1,384,540 |

|

|

|

|

|

| Interest-bearing

liabilities: |

|

|

|

|

|

|

|

|

|

|

|

|

NOW accounts |

$ |

97,213 |

|

|

$ |

526 |

|

1.08 |

% |

|

$ |

95,492 |

|

|

$ |

191 |

|

0.40 |

% |

|

Money management accounts |

|

11,759 |

|

|

|

6 |

|

0.11 |

% |

|

|

14,727 |

|

|

|

8 |

|

0.11 |

% |

|

MMDA accounts |

|

212,693 |

|

|

|

3,935 |

|

3.70 |

% |

|

|

253,214 |

|

|

|

2,897 |

|

2.29 |

% |

|

Savings and club accounts |

|

110,119 |

|

|

|

144 |

|

0.26 |

% |

|

|

130,427 |

|

|

|

131 |

|

0.20 |

% |

|

Time deposits |

|

525,767 |

|

|

|

10,426 |

|

3.97 |

% |

|

|

461,793 |

|

|

|

6,435 |

|

2.79 |

% |

|

Subordinated loans |

|

29,954 |

|

|

|

980 |

|

6.54 |

% |

|

|

29,770 |

|

|

|

955 |

|

6.42 |

% |

|

Borrowings |

|

133,894 |

|

|

|

2,735 |

|

4.09 |

% |

|

|

93,057 |

|

|

|

1,347 |

|

2.89 |

% |

|

Total interest-bearing liabilities |

|

1,121,399 |

|

|

|

18,752 |

|

3.34 |

% |

|

|

1,078,480 |

|

|

|

11,964 |

|

2.22 |

% |

| Noninterest-bearing

liabilities: |

|

|

|

|

|

|

|

|

|

|

|

|

Demand deposits |

|

170,313 |

|

|

|

|

|

|

|

176,339 |

|

|

|

|

|

|

Other liabilities |

|

16,542 |

|

|

|

|

|

|

|

16,269 |

|

|

|

|

|

|

Total liabilities |

|

1,308,254 |

|

|

|

|

|

|

|

1,271,088 |

|

|

|

|

|

|

Shareholders' equity |

|

122,185 |

|

|

|

|

|

|

|

113,452 |

|

|

|

|

|

|

Total liabilities & shareholders' equity |

|

1,430,439 |

|

|

|

|

|

|

|

1,384,540 |

|

|

|

|

|

| Net interest income |

|

|

$ |

18,880 |

|

|

|

|

|

$ |

19,700 |

|

|

| Net interest rate spread |

|

|

|

|

2.19 |

% |

|

|

|

|

|

2.59 |

% |

| Net

interest margin |

|

|

|

|

2.77 |

% |

|

|

|

|

|

2.99 |

% |

| Ratio

of average interest-earning assetsto average interest-bearing

liabilities |

|

|

|

|

121.35 |

% |

|

|

|

|

|

122.12 |

% |

The above information is preliminary and based

on the Company's data available at the time of presentation.

PATHFINDER BANCORP,

INC.FINANCIAL HIGHLIGHTS(Dollars

and shares in thousands except per share amounts)

Net interest income can also be analyzed in terms of the impact

of changing interest rates on interest-earning assets and interest

bearing liabilities, and changes in the volume or amount of these

assets and liabilities. The following table represents the extent

to which changes in interest rates and changes in the volume of

interest-earning assets and interest-bearing liabilities have

affected the Company’s interest income and interest expense during

the years indicated. Information is provided in each category with

respect to: (i) changes attributable to changes in volume (change

in volume multiplied by prior rate); (ii) changes attributable to

changes in rate (changes in rate multiplied by prior volume); and

(iii) total increase or decrease. Changes attributable to both rate

and volume have been allocated ratably. Tax-exempt securities have

not been adjusted for tax equivalency.

| |

For the three months ended June 30, |

|

|

For the six months ended June 30, |

|

| |

(Unaudited) |

|

|

(Unaudited) |

|

| |

2024 vs. 2023 |

|

|

2024 vs. 2023 |

|

| |

Increase/(Decrease) due to |

|

|

Increase/(Decrease) due to |

|

| |

|

|

|

|

|

|

Total |

|

|

|

|

|

|

|

|

Total |

|

| (In

thousands) |

Volume |

|

|

Rate |

|

|

Increase (Decrease) |

|

|

Volume |

|

|

Rate |

|

|

Increase (Decrease) |

|

| Interest

Income: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loans |

$ |

(1,639 |

) |

|

$ |

2,337 |

|

|

$ |

698 |

|

|

$ |

(921 |

) |

|

$ |

3,229 |

|

|

$ |

2,308 |

|

|

Taxable investment securities |

|

817 |

|

|

|

801 |

|

|

|

1,618 |

|

|

|

1,545 |

|

|

|

1,984 |

|

|

|

3,529 |

|

|

Tax-exempt investment securities |

|

(8 |

) |

|

|

27 |

|

|

|

19 |

|

|

|

(250 |

) |

|

|

322 |

|

|

|

72 |

|

|

Interest-earning deposits |

|

26 |

|

|

|

40 |

|

|

|

66 |

|

|

|

(120 |

) |

|

|

179 |

|

|

|

59 |

|

|

Total interest income |

|

(804 |

) |

|

|

3,205 |

|

|

|

2,401 |

|

|

|

254 |

|

|

|

5,714 |

|

|

|

5,968 |

|

| Interest

Expense: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NOW accounts |

|

(5 |

) |

|

|

169 |

|

|

|

164 |

|

|

|

4 |

|

|

|

331 |

|

|

|

335 |

|

|

Money management accounts |

|

(1 |

) |

|

|

- |

|

|

|

(1 |

) |

|

|

(2 |

) |

|

|

- |

|

|

|

(2 |

) |

|

MMDA accounts |

|

(1,153 |

) |

|

|

1,533 |

|

|

|

380 |

|

|

|

(1,259 |

) |

|

|

2,297 |

|

|

|

1,038 |

|

|

Savings and club accounts |

|

(50 |

) |

|

|

54 |

|

|

|

4 |

|

|

|

(49 |

) |

|

|

62 |

|

|

|

13 |

|

|

Time deposits |

|

492 |

|

|

|

962 |

|

|

|

1,454 |

|

|

|

984 |

|

|

|

3,007 |

|

|

|

3,991 |

|

|

Subordinated loans |

|

3 |

|

|

|

3 |

|

|

|

6 |

|

|

|

6 |

|

|

|

19 |

|

|

|

25 |

|

|

Borrowings |

|

385 |

|

|

|

261 |

|

|

|

646 |

|

|

|

717 |

|

|

|

671 |

|

|

|

1,388 |

|

|

Total interest expense |

|

(329 |

) |

|

|

2,982 |

|

|

|

2,653 |

|

|

|

401 |

|

|

|

6,387 |

|

|

|

6,788 |

|

| Net

change in net interest income |

$ |

(475 |

) |

|

$ |

223 |

|

|

$ |

(252 |

) |

|

$ |

(147 |

) |

|

$ |

(673 |

) |

|

$ |

(820 |

) |

The above information is preliminary and based

on the Company's data available at the time of presentation.

Investor/Media Contacts James

A. Dowd, President, CEOJustin K. Bigham, Senior Vice President,

CFOTelephone: (315) 343-0057

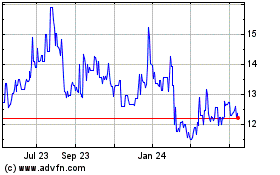

Pathfinder Bancorp (NASDAQ:PBHC)

Historical Stock Chart

From Dec 2024 to Jan 2025

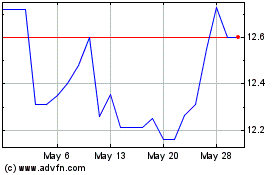

Pathfinder Bancorp (NASDAQ:PBHC)

Historical Stock Chart

From Jan 2024 to Jan 2025