Current Report Filing (8-k)

January 21 2022 - 3:01PM

Edgar (US Regulatory)

0000075340

false

0000075340

2022-01-14

2022-01-14

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

January 14, 2022

P&F INDUSTRIES, INC.

(Exact Name of Registrant as Specified in Charter)

|

Delaware

|

1-5332

|

22-1657413

|

|

(State or Other Jurisdiction

|

(Commission File No.)

|

(IRS Employer

|

|

of Incorporation)

|

|

Identification Number)

|

445 Broadhollow Road, Suite 100, Melville,

New York 11747

(Address of Principal Executive Offices) (Zip Code)

Registrant's telephone number, including area code:

(631) 694-9800

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

¨

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17CFR 240.14d-2(b))

|

|

¨

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of

the Act:

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered

|

|

Class A Common Stock, $1.00 Par

Value

|

|

PFIN

|

|

NASDAQ

|

Indicate by check

mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405)

or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2). Emerging growth company ¨

If an emerging growth company, indicate

by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 1.01. Entry into a Material Definitive Agreement

Reference is made to Items 2.01 and 2.03, which

are hereby incorporated herein.

Item 2.01. Completion of Acquisition or Disposition of Assets.

On January 14, 2022 (the “Closing Date”),

Heisman Acquisition Corp. (the “Buyer”), a Delaware corporation and wholly owned subsidiary of Hy-Tech Machine, Inc. (“Hy-Tech”), an indirect wholly owned subsidiary of P&F Industries, Inc. (the “Company”), Jackson Gear Company (“Jackson Gear”),

and Robert Jackson and Scott Jackson, the stockholders of Jackson Gear (the “Stockholders”), entered into an Asset Purchase

Agreement (the “Purchase Agreement”), pursuant to which, among other things, Buyer acquired (the “Acquisition”)

substantially all of the non-real estate operating assets of Jackson Gear, more particularly described below and in the Purchase Agreement.

The Acquisition was effective as of January 15, 2022. Contemporaneously, the parties executed and delivered the Purchase Agreement and

certain other closing documents including a restrictive covenant agreement binding on Sellers and Stockholders, and consummated the transactions

contemplated thereby.

Pursuant to the Purchase Agreement, the purchase

price (the “Purchase Price”) for the assets acquired in the Acquisition was $2,300,000, in addition to the assumption of certain

payables and obligations as set forth in the Purchase Agreement. The Purchase Agreement contains customary representations, warranties

and covenants. The Purchase Price was paid on behalf of Buyer to the Seller from availability under the revolver loan pursuant to the

Loan Agreement, as amended (defined below), less certain amounts escrowed pursuant to the terms of the Purchase Agreement.

The foregoing description of the Acquisition and

the Purchase Agreement does not purport to be complete and is qualified in its entirety by reference to the full text of the Purchase

Agreement attached as an Exhibit 2.1 hereto, and incorporated herein by reference.

The Purchase Agreement and the above description

thereof have been included to provide investors and security holders with information regarding the terms of the Purchase Agreement and

are not intended to provide any other factual information about the Company or any of the parties to the Purchase Agreement or any of

their respective subsidiaries, affiliates or businesses. The representations and warranties contained in the Purchase Agreement were made

only for purposes of such agreement, and as of specific dates, were solely for the benefit of the parties to such agreement, may be subject

to a contractual standard of materiality different from what might be viewed as material to shareholders, and may be subject to limitations

agreed upon by the parties, including being qualified by confidential disclosures made by the parties to each other. Investors should

not rely on the representations and warranties contained in the Purchase Agreement as characterizations of the actual state of facts or

condition of the Company or any of the parties to the Purchase Agreement or any of their respective subsidiaries, affiliates or businesses.

Item 2.03. Creation of a Direct Financial Obligation or an Obligation

under an Off-Balance Sheet Arrangement of a Registrant

Effective as of the Closing Date, the Company,

its subsidiaries Florida Pneumatic Manufacturing Corporation (“Florida Pneumatic”) and Hy-Tech (together with the Company

and Florida Pneumatic, collectively, “Borrowers”) and the Company’s subsidiaries Jiffy Air Tool, Inc. (“Jiffy”),

ATSCO Holdings Corp. (“ATSCO”), Bonanza Properties Corp. (“Properties”), Continental Tool Group, Inc. (“Continental

Tool”), Countrywide Hardware, Inc. (“Countrywide”), Embassy Industries, Inc. (“Embassy”), Exhaust Technologies,

Inc. (“Exhaust”), Hy-Tech Illinois, Inc. (“Illinois”) and Buyer (together with Jiffy, ATSCO, Properties, Continental

Tool, Countrywide, Embassy Exhaust and Illinois, collectively, “Guarantors”) entered into Consent, Joinder and Amendment No.

9 to Second Amended and Restated Loan and Security Agreement (the “Amendment”), with Capital One, National Association, as

agent (the “Agent”) for the lenders (the “Lenders”) from time to time party to the Loan Agreement (as defined

below). The Amendment amended the Second Amended and Restated Loan and Security Agreement, dated as of April 5, 2017, as amended from

time to time (the “Loan Agreement”), among the Borrowers, the Guarantors, the Agent and the Lenders.

The Amendment, among other

things, provides a consent by the Lenders to the consummation of the Acquisition, including the joinder of the Buyer as a Guarantor under

the Loan Agreement. The Amendment also modifies the Loan Agreement by revising and adding certain defined terms and certain other provisions,

including providing for customary language with respect to the transition from LIBOR to a successor benchmark interest rate.

The foregoing description of the Amendment is qualified

in its entirety by reference to the full text of the Amendment attached as Exhibit 10.1 hereto, and incorporated herein by reference.

The Amendment and the above description thereof,

have been included to provide investors and security holders with information regarding the terms of the Amendment, and are not intended

to provide any other factual information about the Company or any of the parties to the Amendment or any of their respective subsidiaries,

affiliates or businesses. The representations and warranties contained in the Amendment were made only for purposes of such agreement,

and as of specific dates, were solely for the benefit of the parties to such agreement, may be subject to a contractual standard of materiality

different from what might be viewed as material to shareholders, and may be subject to limitations agreed upon by the parties, including

being qualified by confidential disclosures made by the parties to each other. Investors should not rely on the representations and warranties

contained in the Amendment as characterizations of the actual state of facts or condition of the Company or any of the parties to the

Loan Agreement or any of their respective subsidiaries, affiliates or businesses.

Item 8.01. Other Items

On January 18, 2022, the Company issued a press

release (the “Press Release”) announcing the Acquisition. A copy of the Press Release is furnished as Exhibit 99.1 hereto.

Item 9.01. Financial Statements and Exhibits.

|

2.1

|

Asset Purchase Agreement, dated as of January 14, 2022, by and among Buyer, Jackson Gear and the Stockholders.

|

|

10.1

|

Consent, Joinder and Amendment No. 9 to Second Amended and Restated Loan and Security Agreement, dated as of January 14, 2022, by and among the Borrowers, Guarantors, Lender and Agent.

|

|

99.1

|

Press Release, dated January 18, 2022, issued by the Company.

|

|

104

|

Cover Page Interactive Data File (embedded as Inline XBRL document).

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the Company has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

P&F INDUSTRIES, INC.

|

|

|

|

|

|

Date: January 20, 2022

|

|

|

|

|

|

|

|

|

By:

|

/s/ Joseph A. Molino. Jr.

|

|

|

|

Joseph A. Molino, Jr.

|

|

|

|

Vice President,

|

|

|

|

Chief Operating Officer and

|

|

|

|

Chief Financial Officer

|

P and F Industries (NASDAQ:PFIN)

Historical Stock Chart

From Jun 2024 to Jul 2024

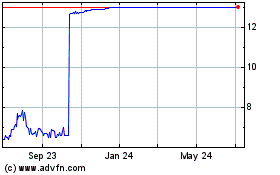

P and F Industries (NASDAQ:PFIN)

Historical Stock Chart

From Jul 2023 to Jul 2024