Current Report Filing (8-k)

May 16 2023 - 6:06AM

Edgar (US Regulatory)

0001649989

false

0001649989

2023-05-15

2023-05-15

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section

13 OR 15(d) of

The Securities Exchange Act of 1934

Date of Report (Date of

earliest event reported): May 15, 2023

Outlook Therapeutics,

Inc.

(Exact name of registrant as specified in its charter)

| Delaware |

001-37759 |

38-3982704 |

(State or other jurisdiction

of incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

|

485 Route 1 South

Building F, Suite 320

Iselin, New Jersey |

08830 |

| (Address of principal executive offices) |

(Zip Code) |

Registrant's telephone number, including area code:

(609) 619-3990

(Former

name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| |

¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities pursuant to Section 12(b) of the Act:

| Title of Each Class |

|

Trading Symbol(s) |

|

Name of Each Exchange on Which

Registered |

| Common Stock |

|

OTLK |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ¨

Item 1.01 Entry into a Material Definitive Agreement.

On May 16, 2023, Outlook Therapeutics, Inc. (the “Company”)

entered into an at-the-market-sales agreement (the “Sales Agreement”) with BTIG, LLC (“BTIG”), pursuant to which the

Company may issue and sell shares of its common stock, $0.01 par value per share (“Common Stock”), from time to time through

BTIG as sales agent and/or principal having an aggregate offering price of up to $100,000,000 (the “Shares”).

The offering has been registered under the Securities Act of 1933,

as amended (the “Securities Act”), pursuant to the Company’s shelf registration statement on Form S-3 (File No. 333-254778),

which was declared effective by the Securities and Exchange Commission (the “Commission”) on April 1, 2021. The Company will

file a prospectus supplement, dated May 16, 2023, with the Commission relating to the Shares.

BTIG may sell the Shares by any method that is deemed to be an “at

the market offering” as defined in Rule 415 of the Securities Act, including, without limitation, sales made directly on The Nasdaq

Capital Market or any other existing trading market for the Common Stock. BTIG may also sell Shares under the Sales Agreement in privately

negotiated transactions with the Company’s consent, and in block transactions. BTIG will use commercially reasonable efforts to

sell the Common Stock under the Sales Agreement from time to time, based upon instructions from the Company (including any price, time

or size limits or other customary parameters or conditions the Company may impose). The Company is not obligated to make any sales of

Common Stock under the Sales Agreement.

The Sales Agreement contains customary representations,

warranties, and agreements by the Company, and customary indemnification rights and obligations of the parties. The Company will pay

BTIG a commission equal to 3% of the aggregate gross proceeds of any sale of Shares under the Sales Agreement. In addition, the

Company has agreed to reimburse certain legal expenses and fees incurred by BTIG in connection with the transactions contemplated by

the Sales Agreement, in an amount not to exceed (A) $65,000 in connection with the execution of the Sales Agreement and (B) up to

$6,500 in connection with each Representation Date (as defined in the Sales Agreement).

The offering of Shares pursuant to the Sales Agreement will terminate

upon the earlier of (i) the sale of all Common Stock subject to the Sales Agreement or (ii) termination of the Sales Agreement in accordance

with its terms.

The foregoing description of the Sales Agreement is not complete and

is qualified in its entirety by reference to the full text of the Sales Agreement, a copy of which is filed as Exhibit 10.1 to this Current

Report on Form 8-K and is incorporated herein by reference. The legal opinion of Cooley LLP relating to the Common Stock being offered

pursuant to the Sales Agreement is filed as Exhibit 5.1 to this Current Report on Form 8-K.

This Current Report on Form 8-K shall not constitute an offer to sell

or the solicitation of an offer to buy the Common Stock nor shall there be any offer, solicitation or sale of the Common Stock in any

state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities

laws of any such state or other jurisdiction.

Item 1.02 Termination of a Material Definitive Agreement.

In connection with entering into the Sales Agreement, the Company terminated, effective May 15, 2023, its at-the-market offering agreement, dated as of March 26, 2021 (the “Prior Sales Agreement”) with H.C.

Wainwright & Co. with respect to an at-the-market offering program under which the Company could offer and sell, from time to time

at its sole discretion, shares of its Common Stock having an aggregate offering price of up to $40,000,000 (the “Prior ATM Program”).

As a result of the termination of the Prior Sales Agreement, the Company will not offer or sell any additional shares under the Prior

ATM Program.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

Outlook Therapeutics, Inc. |

| |

|

| Date: May 16, 2023 |

By: |

/s/ Lawrence A. Kenyon |

| |

|

Lawrence A. Kenyon |

| |

|

Chief Financial Officer |

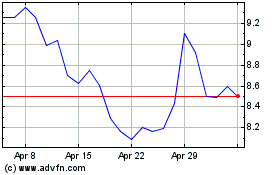

Outlook Therapeutics (NASDAQ:OTLK)

Historical Stock Chart

From Jun 2024 to Jul 2024

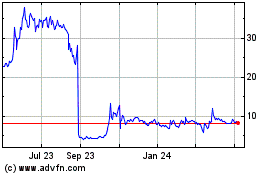

Outlook Therapeutics (NASDAQ:OTLK)

Historical Stock Chart

From Jul 2023 to Jul 2024