false0001394056NONE00013940562023-11-062023-11-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): November 06, 2023 |

One Stop Systems, Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-38371 |

33-0885351 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

2235 Enterprise Street #110 |

|

Escondido, California |

|

92029 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: 760 745-9883 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, $0.0001 par value per share |

|

OSS |

|

The Nasdaq Capital Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

The information provided below in “Item 7.01 - Regulation FD Disclosure” of this Current Report on Form 8-K is incorporated by reference into this Item 2.02.

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On November 6, 2023, the board of directors (the “Board”) of One Stop Systems, Inc. (the “Company”) adopted a resolution to temporarily increase the size of the Board from seven members to eight members, effective November 10, 2023, and to subsequently decrease the size of the Board back down to seven members, effective as of the Company’s 2024 annual meeting of stockholders (the “2024 Annual Meeting”).

Additionally, on November 6, 2023, the Board appointed Joseph Manko as a director of the Company, effective November 10, 2023, to fill the newly created directorship. Mr. Manko will serve as a director for the balance of the current term, expiring at the 2024 Annual Meeting, and until his successor is elected and qualified, subject to his earlier death, resignation or removal. The Company has not yet determined which committees of the Board, if any, Mr. Manko may be appointed to.

There is no arrangement or understanding between Mr. Manko and any other person pursuant to which Mr. Manko was selected as a director of the Company. Other than in accordance with the Company’s formal plan for compensating its non-executive directors for their services, there are no plans, contracts or arrangements or amendments to any plans, contracts or arrangements entered into with Mr. Manko in connection with his election to the Board, nor were there any equity grants or awards made to Mr. Manko in connection therewith. Mr. Manko is not a party to a related-person transaction or proposed related-person transaction required to be disclosed by Item 404(a) of Regulation S-K under the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

Item 7.01 Regulation FD Disclosure.

On November 9, 2023, One Stop Systems, Inc. (the “Company”) issued a press release announcing the temporary increase in the size of the Board and the appointment of Mr. Manko as a new director of the Company, proving an update with respect to certain business-related matters, and discussing the Company’s financial results for its third fiscal quarter ended September 30, 2023. A copy of that press release is furnished as Exhibit 99.1 hereto and incorporated herein by reference.

Exhibit 99.1 includes non-GAAP financial measures as defined in Regulation G. Exhibit 99.1 also includes a presentation of the most directly comparable financial measures calculated and presented in accordance with accounting principles generally accepted in the United States (“GAAP”), information reconciling the non-GAAP financial measures to the GAAP financial measures and a discussion of the reasons why the Company’s management believes that presentation of the non-GAAP financial measures provides useful information to investors regarding the Company’s financial condition and results of operations. The non-GAAP financial measures presented therein should be considered in addition to, not as a substitute for, or superior to, financial measures calculated and presented in accordance with GAAP.

Exhibit 99.1 also contains forward-looking statements. These forward-looking statements are not guarantees of future performance and involve risks, uncertainties and assumptions that are difficult to predict. Forward-looking statements are based upon assumptions as to future events that may not prove to be accurate. Actual outcomes and results may differ materially from what is expressed in these forward-looking statements.

The information set forth under Item 7.01 of this Current Report on Form 8-K (“Current Report”), including Exhibit 99.1 attached hereto, is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Exchange Act, or otherwise subject to the liabilities of such section. The information in Item 7.01 of this Current Report, including Exhibit 99.1, shall not be incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act, regardless of any incorporation by reference language in any such filing, except as expressly set forth by specific reference in such a filing. This Current Report will not be deemed an admission as to the materiality of any information in this Current Report that is required to be disclosed solely by Regulation FD.

Item 9.01 Financial Statements and Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

ONE STOP SYSTEMS, INC. |

|

|

|

|

Date: |

November 9, 2023 |

By: |

/s/ John Morrison |

|

|

|

John Morrison

Chief Financial Officer |

Exhibit 99.1

Press Release

One Stop Systems Reports Q3 2023 Results

Company to Hold a Conference Call Today at 5:00 p.m. Eastern Time

ESCONDIDO, Calif. – November 9, 2023 – One Stop Systems, Inc. (Nasdaq: OSS), a leader in ruggedized edge processing solutions for Artificial Intelligence (AI), Machine Learning and sensor processing, reported results for the third quarter and nine months ended September 30, 2023. All quarterly and nine month comparisons are to the same year-ago period unless otherwise noted. The company will hold a conference call at 5:00 p.m. Eastern time today to discuss the results (see dial-in information below).

“Our results for the third quarter reflect the continued focus on high performance compute for AI and sensor fusion at the rugged intelligent edge for both commercial and defense market opportunities and the transition away from our former media customer,” stated OSS president and CEO, Mike Knowles. “For these high-growth market segments, we believe we have established a clear competitive advantage with our proprietary technologies and field-proven platforms.

“Despite the expected challenges during this transitionary period, we achieved $13.7 million in revenue in Q3, while effectively executing our cost containment plan. In all, we believe we are on the right trajectory and are encouraged by our pipeline of opportunities across commercial and defense markets.”

Q3 2023 Financial Highlights

•Revenue totaled $13.7 million.

•Gross margin was $3.6 million, or 26.6%.

•Loss before income taxes was $3.4 million, inclusive of a goodwill impairment charge of $2.9 million that was partially offset by $418,000 received from the federal employee retention credit program.

•Non-GAAP net loss was $597,000 or $(0.03) per share, exclusive of one-time adjustments (see definition of this and other non-GAAP measures and a reconciliation to GAAP, below).

•Adjusted EBITDA, a non-GAAP term, was a loss of $248,000.

•Cash and short-term investments totaled $13.2 million on September 30, 2023.

Q3 2023 Operational Highlights

•Awarded first program win for a foreign navy as well as for a subsurface application, and expect delivery of the first prototypes of a sonar data processing system by the end of the year, followed by potential production orders in 2024. The win was secured through a new relationship with a global defense prime contractor.

•Won follow-on hardware order for additional storage systems to be used on Navy P-8A reconnaissance aircraft.

•Received order from a new commercial customer in the auto racing industry for a new rugged AI server platform, representing the entry of a new industry vertical for OSS.

•Granted facility security clearance, enabling OSS to access new opportunities in the government sector.

•Appointed industry veteran, Robert Kalebaugh, as VP of Sales, bringing to OSS more than 36 years of award-winning achievement in business development, sales and marketing in the commercial and defense markets.

•Appointed to the board of directors retired three-star U.S. Navy Vice Admiral, Michael J. Dumont, and OSS president and CEO, Mike Knowles.

•OSS Rigel Edge Supercomputer™ won the 4-Star Best in Show Award in the AI/Machine Learning category at the Defense and Security Equipment International (DSEI) conference.

Subsequent Events

OSS’ board of directors unanimously determined to temporarily increase the size of the board from seven to eight, effective November 10, 2023. The board intends to further temporarily increase the size of the board to no more than nine and to add one additional board member with relevant defense market expertise during the Q4 timeframe. There are candidates actively in review to fill this position. The director slate to be presented for election by the company’s shareholders at its 2024 annual shareholder meeting in May will be a seven-person slate. OSS is adding additional board members at this time to take advantage of the unique skills and expertise and fresh perspective that these individuals will bring.

OSS has appointed Mr. Joe Manko to the company’s board of directors, effective November 10, 2023, to fill the vacancy created by the temporary board expansion discussed above. Mr. Manko has been serving as a managing member and senior principal of the investment fund, Horton Capital Management, a significant shareholder of the company, since 2013. His asset management and investment banking experience has included serving in executive positions at BZ Fund Management, Deutsche Bank and Merrill Lynch. He has also served as a corporate finance attorney at Skadden, Arps, Slate, Meagher and Flom. Mr. Manko also serves on the boards of Safeguard Scientifics and Koru Medical Systems, and previously served as a director on the boards of Creative Realties and Wireless Telecom Group.

Outlook

The company anticipates revenue of approximately $13.0 million in the fourth quarter of 2023, resulting in revenue of approximately $60 million for the full year of 2023.

Q3 2023 Financial Summary

Consolidated revenue decreased 26.9% to $13.7 million due to anticipated decreased shipments to a former media customer that have now ended. The decrease was also due to delays in defense orders, bankruptcy of an autonomous truck customer and an overall delay in deployment of the technology. Approximately $4.3 million of the decline was attributed to the elimination of the media business, which was partly offset by sales of rugged edge processing product revenue.

OSS segment revenue declined 48.5% to $5.5 million due to the factors mentioned above. Bressner segment revenue increased 1.2% to $8.2 million due to additional project-based business, including approximately $377,000 of OSS core products and an increase in run rate business, as well as having more available inventory.

2

Overall gross profit decreased to $3.7 million, with gross margin percentage at 26.6% compared to 27.0% in the same year-ago quarter. The OSS segment gross margin increased 1.7 percentage points to 32.4%, attributable to the absence of lower margin sales to the former media customer and a higher mix of ruggedized AI edge processing, offset by inefficiencies in absorption of production costs due to lower revenue. Bressner’s gross margin improved 0.4 percentage points to 22.6%, as compared to 22.2% in the year-ago quarter, due to product mix, higher margin OSS products, and having sought-after products readily sold at a premium.

Loss from operations totaled $4.0 million, compared to income from operations of $163,000 in the same period in 2022. This reduction was predominantly attributable to lower revenue and a write-down attributable to impairment of goodwill totaling $2.9 million that resulted from the overall financial performance of OSS as compared to plan, the company’s increased focus on the defense industry, and revised timing for the company’s forecast of certain revenue opportunities. Excluding the impairment of goodwill, total operating expenses decreased 4.3% to $4.7 million.

Net loss was $3.6 million, or $(0.18) per share, as compared to net income of $133,000 or $0.01 per share. The net loss in the third quarter includes a one-time benefit of $418,000 received under the government’s COVID-19 employee retention credit program.

Non-GAAP net loss was $597,000, or $(0.03) per share, compared to non-GAAP net income of $691,000, or $0.03 per share. Adjusted EBITDA, a non-GAAP metric, was a loss of $248,000, decreasing from $1.0 million in the prior year. Each of these non-GAAP metrics excludes $2.9 million for the impairment of goodwill and $418,000 for the employee retention credit.

On September 30, 2023, cash and short-term investments equaled $13.2 million. This represents a decrease of $2.2 million as compared to the prior quarter. The decrease is primarily due to an increase in working capital requirements for inventory.

First Nine Months of 2023 Financial Summary

For the first nine months of 2023, consolidated revenue decreased 11.9% to $47.7 million. The decrease in revenue in the first nine months of 2023 was due to the same reasons for the decline in the third quarter. Excluding revenue from the former media customer, revenues were up 10.6% to $42.9 million.

OSS segment revenue was $22.4 million, with Bressner segment revenue of $25.3 million inclusive of $2.7 million of OSS product offerings.

Overall gross profit was $13.5 million, with gross margins of 28.3% compared to 28.5% in the same year-ago period. OSS segment gross margin was 32.7%, compared to 33.1% in the same year-ago period. The decline was due to underutilization of production resources resulting from overall lower revenue, which was partially offset by the decline in lower margin sales to the company’s former media customer.

Bressner segment gross margin was 24.4%, compared to 21.8% in the same year-ago period, due to strategic management of inventory and having sought-after products sold at a premium, as well as product mix and increased sales of OSS products.

Loss from operations totaled $7.6 million compared to income from operations of $1.2 million. The loss was primarily due to a $5.6 million write-down attributable to an impairment of goodwill and increased general and administrative expenses, which includes approximately $1.4 million of non-recurring

3

transition costs associated with the company’s organizational restructuring and outside professional services.

Net loss was $6.4 million, or $(0.32) per diluted share, inclusive of the $1.7 million employee retention credit, compared to net income of $1.0 million, or $0.05 per diluted share, in the same year-ago period.

Non-GAAP net loss totaled $592,000, or $(0.03) per diluted share, as compared to $2.5 million, or $0.12 per diluted share, in the same year-ago period. Adjusted EBITDA totaled $0.8 million, compared to $3.5 million. Both non-GAAP net income and adjusted EBITDA exclude the $5.6 million impairment of goodwill and the $1.7 million employee retention credit.

Conference Call

OSS management will hold a conference call later today to discuss its results for the third quarter ended September 30, 2023, followed by a question-and-answer period.

Date: Thursday, November 9, 2023

Time: 5:00 p.m. Eastern time (2:00 p.m. Pacific time)

Toll-free dial-in number: 1-888-999-3182

International dial-in number: 1-848-280-6330

Webcast: here (live and replay)

Approximately two hours after the Q&A session, an archived version of the webcast will be available in the Investors section of the company’s website at onestopsystems.com. OSS regularly uses its website to disclose material and non-material information to investors, customers, employees and others interested in the company.

Please call the conference telephone number five minutes prior to the start time. An operator will register your name and organization. If you require any assistance connecting with the call, please contact CMA at 1-949-432-7566.

A replay of the call will be available after 8:00 p.m. Eastern time on the same day and through November 23, 2023.

Toll-free replay number: 1-844-512-2921

International replay number: 1-412-317-6671

Replay ID: 11153924

About One Stop Systems

One Stop Systems, Inc. (Nasdaq: OSS) is a leader in AI Transportable solutions for the demanding ‘edge.’ OSS designs and manufactures the highest performance compute and storage products that enable rugged AI, sensor fusion and autonomous capabilities without compromise. These hardware and software platforms bring the latest data center performance to the harsh and challenging applications, whether they are on land, sea or in the air.

OSS products include ruggedized servers, compute accelerators, flash storage arrays, and storage acceleration software. These specialized compact products are used across multiple industries and applications, including autonomous trucking and farming, as well as aircraft, drones, ships and vehicles within the defense industry.

OSS solutions address the entire AI workflow, from high-speed data acquisition to deep learning, training

4

and large-scale inference, and have delivered many industry firsts for industrial OEM and government customers.

As the fastest growing segment of the multi-billion-dollar edge computing market, AI Transportables requires—and OSS delivers—the highest level of performance in the most challenging environments without compromise.

OSS products are available directly or through global distributors. For more information, go to www.onestopsystems.com. You can also follow OSS on Twitter, YouTube, and LinkedIn.

Non-GAAP Financial Measures

We believe that the use of adjusted earnings before interest, taxes, depreciation and amortization, or adjusted EBITDA, is helpful for an investor to assess the performance of the company. The company defines adjusted EBITDA as income (loss) before interest, taxes, depreciation, amortization, acquisition expenses, impairment of long-lived assets, financing costs, fair value adjustments from purchase accounting, stock-based compensation expense, employee retention credits and expenses related to discontinued operations.

Adjusted EBITDA is not a measurement of financial performance under generally accepted accounting principles in the United States, or GAAP. Because of varying available valuation methodologies, subjective assumptions and the variety of equity instruments that can impact a company’s non-cash operating expenses, we believe that providing a non-GAAP financial measure that excludes non-cash and non-recurring expenses allows for meaningful comparisons between our core business operating results and those of other companies, as well as providing us with an important tool for financial and operational decision making and for evaluating our own core business operating results over different periods of time.

Our adjusted EBITDA measure may not provide information that is directly comparable to that provided by other companies in our industry, as other companies in our industry may calculate non-GAAP financial results differently, particularly related to non-recurring, unusual items. Our adjusted EBITDA is not a measurement of financial performance under GAAP and should not be considered as an alternative to operating income or as an indication of operating performance or any other measure of performance derived in accordance with GAAP. We do not consider adjusted EBITDA to be a substitute for, or superior to, the information provided by GAAP financial results.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Three Months Ended

September 30, |

|

|

For the Nine Months Ended

September 30, |

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

Net (loss) income |

|

$ |

(3,638,608 |

) |

|

$ |

132,533 |

|

|

$ |

(6,438,616 |

) |

|

$ |

1,034,589 |

|

Depreciation and amortization |

|

|

271,245 |

|

|

|

260,827 |

|

|

|

813,773 |

|

|

|

785,047 |

|

Stock-based compensation expense |

|

|

518,680 |

|

|

|

542,166 |

|

|

|

1,890,897 |

|

|

|

1,457,630 |

|

Interest expense |

|

|

31,468 |

|

|

|

30,044 |

|

|

|

88,112 |

|

|

|

133,710 |

|

Interest income |

|

|

(170,420 |

) |

|

|

(46,407 |

) |

|

|

(385,471 |

) |

|

|

(152,919 |

) |

Impairment of goodwill |

|

|

2,930,788 |

|

|

|

- |

|

|

|

5,630,788 |

|

|

|

- |

|

Employee retention credit (ERC) |

|

|

(418,486 |

) |

|

|

- |

|

|

|

(1,716,727 |

) |

|

|

- |

|

Provision for income taxes |

|

|

226,967 |

|

|

|

36,156 |

|

|

|

885,332 |

|

|

|

286,954 |

|

Adjusted EBITDA |

|

$ |

(248,366 |

) |

|

$ |

955,319 |

|

|

$ |

768,088 |

|

|

$ |

3,545,011 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5

Adjusted EPS excludes the impact of certain items, and therefore, has not been calculated in accordance with GAAP. We believe that exclusion of certain selected items assists in providing a more complete understanding of our underlying results and trends and allows for comparability with our peer company index and industry. We use this measure along with the corresponding GAAP financial measures to manage our business and to evaluate our performance compared to prior periods and the marketplace. The company defines non-GAAP income (loss) as income or (loss) before amortization, stock-based compensation, employee retention credits and expenses related to discontinued operations, impairment of long-lived assets and non-recurring acquisition costs. Adjusted EPS expresses adjusted income (loss) on a per share basis using weighted average diluted shares outstanding.

Adjusted EPS is a non-GAAP financial measure and should not be considered in isolation or as a substitute for financial information provided in accordance with GAAP. These non-GAAP financial measures may not be computed in the same manner as similarly titled measures used by other companies. We expect to continue to incur expenses similar to the adjusted income from continuing operations and adjusted EPS financial adjustments described above, and investors should not infer from our presentation of these non-GAAP financial measures that these costs are unusual, infrequent or non-recurring.

The following table reconciles non-GAAP net income and basic and diluted earnings per share:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Three Months Ended

September 30, |

|

|

For the Nine Months Ended

September 30, |

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

Net (loss) income |

|

$ |

(3,638,608 |

) |

|

$ |

132,533 |

|

|

$ |

(6,438,616 |

) |

|

$ |

1,034,589 |

|

Amortization of intangibles |

|

|

10,538 |

|

|

|

15,808 |

|

|

|

42,154 |

|

|

|

47,424 |

|

Impairment of goodwill |

|

|

2,930,788 |

|

|

|

- |

|

|

|

5,630,788 |

|

|

|

- |

|

Employee retention credit (ERC) |

|

|

(418,486 |

) |

|

|

- |

|

|

|

(1,716,727 |

) |

|

|

- |

|

Stock-based compensation expense |

|

|

518,680 |

|

|

|

542,166 |

|

|

|

1,890,897 |

|

|

|

1,457,630 |

|

Non-GAAP net (loss) income |

|

$ |

(597,088 |

) |

|

$ |

690,507 |

|

|

$ |

(591,504 |

) |

|

$ |

2,539,643 |

|

Non-GAAP net (loss) income per share: |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

(0.03 |

) |

|

$ |

0.03 |

|

|

$ |

(0.03 |

) |

|

$ |

0.13 |

|

Diluted |

|

$ |

(0.03 |

) |

|

$ |

0.03 |

|

|

$ |

(0.03 |

) |

|

$ |

0.12 |

|

Weighted average common shares outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

20,569,111 |

|

|

|

20,019,625 |

|

|

|

20,407,284 |

|

|

|

19,619,971 |

|

Diluted |

|

|

20,569,111 |

|

|

|

21,138,957 |

|

|

|

20,407,284 |

|

|

|

20,582,116 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Forward-Looking Statements

One Stop Systems cautions you that statements in this press release that are not a description of historical facts are forward-looking statements. These statements are based on the company's current beliefs and expectations. The inclusion of forward-looking statements should not be regarded as a representation by One Stop Systems or its partners that any of our plans or expectations will be achieved, including but not limited to, to our management’s expectations for major program wins, the company’s penetration of the Defense and AI Transportable sectors, revenue growth generated by new and existing products, future changes to our business objectives, changes to our board, and other future financial projections. Actual results may differ from those set forth in this press release due to the risk and uncertainties inherent in our business, including risks described in our prior press releases and in our filings with the Securities and Exchange Commission (SEC), including under the heading "Risk Factors" in our latest Annual Report on Form 10-K and any subsequent filings with the SEC. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof, and the company undertakes no obligation to revise or update this press release to reflect events or circumstances after the date hereof. All

6

forward-looking statements are qualified in their entirety by this cautionary statement, which is made under the safe harbor provisions of the Private Securities Litigation Reform Act of 1995.

Media Contacts:

Katie Rivera

One Stop Systems, Inc.

Tel (760) 745-9883

Email contact

Tim Randall

CMA Media Relations

Tel (949) 432-7572

Email Contact

Investor Relations:

Ronald Both or Grant Stude

CMA Investor Relations

Tel (949) 432-7557

Email contact

7

ONE STOP SYSTEMS, INC. (OSS)

CONSOLIDATED BALANCE SHEETS

|

|

|

|

|

|

|

|

|

|

|

Unaudited |

|

|

Audited |

|

|

|

September 30, |

|

|

December 31, |

|

|

|

2023 |

|

|

2022 |

|

ASSETS |

|

|

|

|

|

|

Current assets |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

3,735,005 |

|

|

$ |

3,112,196 |

|

Short-term investments |

|

|

9,439,296 |

|

|

|

10,123,535 |

|

Accounts receivable, net |

|

|

8,978,454 |

|

|

|

11,327,244 |

|

Inventories, net |

|

|

22,225,210 |

|

|

|

20,775,366 |

|

Prepaid expenses and other current assets |

|

|

668,665 |

|

|

|

502,156 |

|

Total current assets |

|

|

45,046,630 |

|

|

|

45,840,497 |

|

Property and equipment, net |

|

|

2,261,233 |

|

|

|

2,570,124 |

|

Operating lease right-of use assets |

|

|

1,947,750 |

|

|

|

731,043 |

|

Deposits and other |

|

|

48,093 |

|

|

|

60,243 |

|

Deferred tax assets, net |

|

|

720,894 |

|

|

|

- |

|

Goodwill |

|

|

1,489,722 |

|

|

|

7,120,510 |

|

Intangible assets, net |

|

|

- |

|

|

|

42,154 |

|

Total Assets |

|

$ |

51,514,322 |

|

|

$ |

56,364,571 |

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS' EQUITY |

|

|

|

|

|

|

Current liabilities |

|

|

|

|

|

|

Accounts payable |

|

$ |

3,228,134 |

|

|

$ |

4,592,713 |

|

Accrued expenses and other liabilities |

|

|

4,778,548 |

|

|

|

3,013,869 |

|

Current portion of operating lease obligation |

|

|

365,629 |

|

|

|

536,588 |

|

Current portion of notes payable |

|

|

2,259,687 |

|

|

|

2,952,447 |

|

Total current liabilities |

|

|

10,631,998 |

|

|

|

11,095,617 |

|

Long-term debt, net of current portion |

|

|

- |

|

|

|

409,294 |

|

Deferred tax liability, net |

|

|

- |

|

|

|

138,662 |

|

Operating lease obligation, net of current portion |

|

|

1,729,433 |

|

|

|

397,249 |

|

Total liabilities |

|

|

12,361,431 |

|

|

|

12,040,822 |

|

Commitments and contingencies |

|

|

|

|

|

|

Stockholders’ equity |

|

|

|

|

|

|

Common stock, $0.0001 par value; 50,000,000 shares authorized;

20,604,050 and 20,084,528 shares issued and outstanding, respectively |

|

|

2,059 |

|

|

|

2,008 |

|

Additional paid-in capital |

|

|

46,905,058 |

|

|

|

45,513,807 |

|

Accumulated other comprehensive income |

|

|

386,941 |

|

|

|

510,485 |

|

Accumulated deficit |

|

|

(8,141,167 |

) |

|

|

(1,702,551 |

) |

Total stockholders’ equity |

|

|

39,152,891 |

|

|

|

44,323,749 |

|

Total Liabilities and Stockholders' Equity |

|

$ |

51,514,322 |

|

|

$ |

56,364,571 |

|

8

ONE STOP SYSTEMS, INC. (OSS)

UNAUDITED CONSOLIDATED STATEMENTS OF OPERATIONS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Three Months Ended September 30, |

|

|

For the Nine Months Ended September 30, |

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

Revenue |

|

$ |

13,748,163 |

|

|

$ |

18,815,844 |

|

|

$ |

47,741,589 |

|

|

$ |

54,171,864 |

|

Cost of revenue |

|

|

10,096,812 |

|

|

|

13,737,976 |

|

|

|

34,221,538 |

|

|

|

38,753,023 |

|

Gross profit |

|

|

3,651,351 |

|

|

|

5,077,868 |

|

|

|

13,520,051 |

|

|

|

15,418,841 |

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

General and administrative |

|

|

1,935,720 |

|

|

|

1,890,036 |

|

|

|

7,293,701 |

|

|

|

5,486,169 |

|

Impairment of goodwill |

|

|

2,930,788 |

|

|

|

- |

|

|

|

5,630,788 |

|

|

|

- |

|

Marketing and selling |

|

|

1,713,105 |

|

|

|

1,864,588 |

|

|

|

4,983,751 |

|

|

|

5,061,221 |

|

Research and development |

|

|

1,053,852 |

|

|

|

1,159,868 |

|

|

|

3,203,830 |

|

|

|

3,656,020 |

|

Total operating expenses |

|

|

7,633,465 |

|

|

|

4,914,492 |

|

|

|

21,112,070 |

|

|

|

14,203,410 |

|

(Loss) income from operations |

|

|

(3,982,114 |

) |

|

|

163,376 |

|

|

|

(7,592,019 |

) |

|

|

1,215,431 |

|

Other income (expense), net: |

|

|

|

|

|

|

|

|

|

|

|

|

Interest income |

|

|

170,420 |

|

|

|

46,407 |

|

|

|

385,471 |

|

|

|

152,919 |

|

Interest expense |

|

|

(31,468 |

) |

|

|

(30,044 |

) |

|

|

(88,112 |

) |

|

|

(133,710 |

) |

Employee retention credit (ERC) |

|

|

418,486 |

|

|

|

- |

|

|

|

1,716,727 |

|

|

|

- |

|

Other income (expense), net |

|

|

13,035 |

|

|

|

(11,050 |

) |

|

|

24,649 |

|

|

|

86,903 |

|

Total other income, net |

|

|

570,473 |

|

|

|

5,313 |

|

|

|

2,038,735 |

|

|

|

106,112 |

|

(Loss) income before income taxes |

|

|

(3,411,641 |

) |

|

|

168,689 |

|

|

|

(5,553,284 |

) |

|

|

1,321,543 |

|

Provision for income taxes |

|

|

226,967 |

|

|

|

36,156 |

|

|

|

885,332 |

|

|

|

286,954 |

|

Net (loss) income |

|

$ |

(3,638,608 |

) |

|

$ |

132,533 |

|

|

$ |

(6,438,616 |

) |

|

$ |

1,034,589 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net (loss) income per share: |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

(0.18 |

) |

|

$ |

0.01 |

|

|

$ |

(0.32 |

) |

|

$ |

0.05 |

|

Diluted |

|

$ |

(0.18 |

) |

|

$ |

0.01 |

|

|

$ |

(0.32 |

) |

|

$ |

0.05 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average common shares

outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

20,569,111 |

|

|

|

20,019,625 |

|

|

|

20,407,284 |

|

|

|

19,619,971 |

|

Diluted |

|

|

20,569,111 |

|

|

|

21,138,957 |

|

|

|

20,407,284 |

|

|

|

20,582,116 |

|

9

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

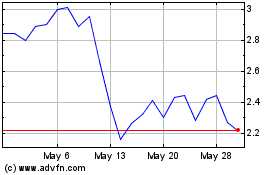

One Stop Systems (NASDAQ:OSS)

Historical Stock Chart

From Jun 2024 to Jul 2024

One Stop Systems (NASDAQ:OSS)

Historical Stock Chart

From Jul 2023 to Jul 2024