Statement of Changes in Beneficial Ownership (4)

January 04 2023 - 5:09PM

Edgar (US Regulatory)

FORM 4

[ ]

Check this box if no longer subject to Section 16. Form 4 or Form 5 obligations may continue. See Instruction 1(b).

|

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

STATEMENT OF CHANGES IN BENEFICIAL OWNERSHIP OF SECURITIES

|

OMB APPROVAL

OMB Number:

3235-0287

Estimated average burden

hours per response...

0.5

|

|

Filed pursuant to Section 16(a) of the Securities Exchange Act of 1934 or Section 30(h) of the Investment Company Act of 1940

|

|

|

1. Name and Address of Reporting Person

*

Reese Nathan R |

2. Issuer Name and Ticker or Trading Symbol

NEW YORK MORTGAGE TRUST INC

[

NYMT

]

|

5. Relationship of Reporting Person(s) to Issuer

(Check all applicable)

_____ Director _____ 10% Owner

__X__ Officer (give title below) _____ Other (specify below)

Chief Operating Officer |

|

(Last)

(First)

(Middle)

C/O NEW YORK MORTGAGE TRUST, INC., 90 PARK AVENUE |

3. Date of Earliest Transaction

(MM/DD/YYYY)

1/1/2023 |

|

(Street)

NEW YORK, NY 10016

(City)

(State)

(Zip)

|

4. If Amendment, Date Original Filed

(MM/DD/YYYY)

|

6. Individual or Joint/Group Filing

(Check Applicable Line)

_X

_ Form filed by One Reporting Person

___ Form filed by More than One Reporting Person

|

Table I - Non-Derivative Securities Acquired, Disposed of, or Beneficially Owned

|

1.Title of Security

(Instr. 3)

|

2. Trans. Date

|

2A. Deemed Execution Date, if any

|

3. Trans. Code

(Instr. 8)

|

4. Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5)

|

5. Amount of Securities Beneficially Owned Following Reported Transaction(s)

(Instr. 3 and 4)

|

6. Ownership Form: Direct (D) or Indirect (I) (Instr. 4)

|

7. Nature of Indirect Beneficial Ownership (Instr. 4)

|

|

Code

|

V

|

Amount

|

(A) or (D)

|

Price

|

| Common Stock, par value $0.01 per share | 1/1/2023 | | M(1) | | 8917 | A | $0 (2) | 280162 | D | |

| Common Stock, par value $0.01 per share | 1/1/2023 | | F(3) | | 3728 | D | $2.56 | 276434 | D | |

| Common Stock, par value $0.01 per share | 1/1/2023 | | M(4) | | 15056 | A | $0 (2) | 291490 | D | |

| Common Stock, par value $0.01 per share | 1/1/2023 | | F(5) | | 6294 | D | $2.56 | 285196 | D | |

| Common Stock, par value $0.01 per share | 1/1/2023 | | M(6) | | 14935 | A | $0 (2) | 300131 | D | |

| Common Stock, par value $0.01 per share | 1/1/2023 | | F(7) | | 6223 | D | $2.56 | 293908 | D | |

Table II - Derivative Securities Beneficially Owned (e.g., puts, calls, warrants, options, convertible securities)

|

1. Title of Derivate Security

(Instr. 3) | 2. Conversion or Exercise Price of Derivative Security | 3. Trans. Date | 3A. Deemed Execution Date, if any | 4. Trans. Code

(Instr. 8) | 5. Number of Derivative Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5) | 6. Date Exercisable and Expiration Date | 7. Title and Amount of Securities Underlying Derivative Security

(Instr. 3 and 4) | 8. Price of Derivative Security

(Instr. 5) | 9. Number of derivative Securities Beneficially Owned Following Reported Transaction(s) (Instr. 4) | 10. Ownership Form of Derivative Security: Direct (D) or Indirect (I) (Instr. 4) | 11. Nature of Indirect Beneficial Ownership (Instr. 4) |

| Code | V | (A) | (D) | Date Exercisable | Expiration Date | Title | Amount or Number of Shares |

| Restricted Stock Units | (2) | 1/1/2023 | | M (8) | | | 8917 | (8) | (8) | Common Stock, par value $0.01 per share | 8917.0 | $0 | 74914 | D | |

| Restricted Stock Units | (2) | 1/1/2023 | | M (9) | | | 15056 | (9) | (9) | Common Stock, par value $0.01 per share | 15056.0 | $0 | 59858 | D | |

| Restricted Stock Units | (2) | 1/1/2023 | | M (10) | | | 14935 | (10) | (10) | Common Stock, par value $0.01 per share | 14935.0 | $0 | 44923 | D | |

| Explanation of Responses: |

| (1) | Shares acquired pursuant to the settlement of restricted stock units ("RSUs") granted to the Reporting Person in January 2020. |

| (2) | Each RSU is the economic equivalent of one share of common stock of New York Mortgage Trust ("NYMT"). Each RSU was settled in one share of common stock of NYMT. |

| (3) | Surrendered to satisfy tax liability incident to the settlement of RSUs described in Note 1 above. |

| (4) | Shares acquired pursuant to the settlement of RSUs granted to the Reporting Person in January 2021. |

| (5) | Surrendered to satisfy tax liability incident to the settlement of RSUs described in Note 4 above. |

| (6) | Shares acquired pursuant to the settlement of RSUs granted to the Reporting Person in January 2022. |

| (7) | Surrendered to satisfy tax liability incident to the settlement of RSUs described in Note 6 above. |

| (8) | On January 1, 2020, the Reporting Person was granted 26,752 RSUs, vesting in three equal annual installments beginning on the first anniversary of the grant date. |

| (9) | On January 27, 2021, the Reporting Person was granted 45,167 RSUs, vesting in three equal annual installments beginning on January 1, 2022. |

| (10) | On January 27, 2022, the Reporting Person was granted 44,803 RSUs, vesting in three equal annual installments beginning on January 1, 2023. |

Reporting Owners

|

| Reporting Owner Name / Address | Relationships |

| Director | 10% Owner | Officer | Other |

Reese Nathan R

C/O NEW YORK MORTGAGE TRUST, INC.

90 PARK AVENUE

NEW YORK, NY 10016 |

|

| Chief Operating Officer |

|

Signatures

|

| /s/ Nathan R. Reese | | 1/4/2023 |

| **Signature of Reporting Person | Date |

| Reminder: Report on a separate line for each class of securities beneficially owned directly or indirectly. |

| * | If the form is filed by more than one reporting person, see Instruction 4(b)(v). |

| ** | Intentional misstatements or omissions of facts constitute Federal Criminal Violations. See 18 U.S.C. 1001 and 15 U.S.C. 78ff(a). |

| Note: | File three copies of this Form, one of which must be manually signed. If space is insufficient, see Instruction 6 for procedure. |

| Persons who respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number. |

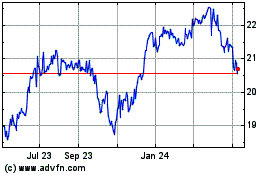

New York Mortgage (NASDAQ:NYMTN)

Historical Stock Chart

From Oct 2024 to Nov 2024

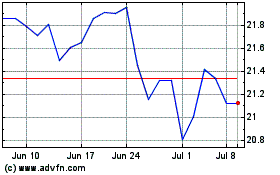

New York Mortgage (NASDAQ:NYMTN)

Historical Stock Chart

From Nov 2023 to Nov 2024