Announces New Actions to Accelerate

Transformation

Second quarter 2024 highlights(1) compared to Q2

2023:

- Net revenue from continuing operations of $451.7 million, an

increase of 4.6%

- Comparable store sales growth of 2.2% and Adjusted Comparable

Store Sales Growth of 2.4%

- Net loss from continuing operations of $(1.0) million, Diluted

EPS from continuing operations of $(0.01)

- Adjusted Operating Income from continuing operations of $14.1

million

- Adjusted Diluted EPS from continuing operations of $0.15

- Discontinued Operations resulted in net revenue of $53.5

million, Net loss, net of tax, of $(2.1) million, Diluted EPS of

$(0.03) and Adjusted Diluted EPS of $0.00

- Revises fiscal 2024 outlook

(1) During the first quarter of 2024, the Company completed the

termination of its Walmart partnership and discontinued the prior

Legacy segment. During the second quarter of 2024, the Company

completed the wind down of AC Lens operations and discontinued

operations in that business.

National Vision Holdings, Inc. (NASDAQ: EYE) (“National Vision”

or the “Company”) today reported its financial results for the

second quarter ended June 29, 2024.

“Comparable store sales growth in the second quarter improved

sequentially from the first quarter largely due to increased

traffic,” said Reade Fahs, National Vision’s CEO. “We delivered an

overall 2.4% increase in adjusted comparable store sales, and a

2.9% increase at America’s Best, reflecting ongoing strength in

managed care and a notable improvement in comparable store sales

from cash pay customers. Although this progress is positive, we

needed a greater inflection in sales to deliver on the results we

originally expected and are revising our guidance accordingly.

“We have been transforming our business over the past two years

to adapt to new market realities and made valuable changes to the

way we operate, however we need to do more to accelerate both the

pace and rigor of our transformation. As such, we are taking new

actions to drive profitable growth, including recently announced

additions to our leadership team that will bring new talent and

fresh perspectives to our business as we seek to expand exam

capacity, implement new sales drivers and improve efficiencies to

strengthen our foundation. In addition, we are actively reviewing

all stores to optimize our fleet to drive growth and ensure we

continue to be disciplined stewards of capital. While our

transformation will take time, I remain excited about the

opportunity ahead for National Vision as we invest in the resources

and talent to deliver long-term success.”

During the first six months of fiscal 2024, the Company ceased

its Walmart and AC Lens operations which met the accounting

requirements for reporting each of the Legacy segment and AC Lens

operations as discontinued operations. Accordingly, the condensed

consolidated financial statements reflect the results of the Legacy

segment and the substantial majority of AC Lens operations as

discontinued operations for all periods presented.

Unless otherwise noted, amounts and disclosures below relate to

the Company’s continuing operations.

This release includes certain Non-GAAP Financial Measures that

are not recognized under generally accepted accounting principles

(“GAAP”). Please see “Non-GAAP Financial Measures” and

“Reconciliation of Non-GAAP to GAAP Financial Measures” below for

more information.

Second Quarter 2024 Summary

- Net revenue increased 4.6% to $451.7 million compared to the

second quarter of 2023 and was primarily driven by growth from new

store sales and Adjusted Comparable Store Sales Growth, partially

offset by the effect of converted and closed stores.

- Comparable store sales growth was 2.2% and Adjusted Comparable

Store Sales Growth was 2.4%, both reflecting an increase in

customer transactions and higher average ticket.

- The Company opened 17 new stores and ended the quarter with

1,216 stores. Overall, store count grew 5.6% from July 1, 2023 to

June 29, 2024.

- Costs applicable to revenue increased 7.4% to $193.6 million

compared to the second quarter of 2023. As a percentage of net

revenue, costs applicable to revenue increased 110 basis points to

42.9% compared with the second quarter of 2023 and were primarily

driven by lower eyeglass mix, and an increase in

optometrist-related costs as well as other mix and margin effects.

As a percentage of net revenue, these increased costs were

partially offset by higher exam revenue.

- Selling, general and administrative expenses (SG&A)

increased 3.8% to $231.4 million compared with the second quarter

of 2023. Adjusted SG&A increased 2.0% to $221.8 million

compared with the second quarter of 2023. As a percentage of net

revenue, SG&A decreased 40 basis points to 51.2% compared with

the second quarter of 2023 mainly due to lower performance-based

incentive compensation and lower advertising expense, partially

offset by higher legal and professional expenses, higher occupancy

expense and other operating expenses. As a percentage of net

revenue, Adjusted SG&A decreased 120 basis points to 49.1%

compared with the second quarter of 2023, driven by lower

performance-based incentive compensation and lower advertising

expense, partially offset by higher other operating expenses,

including occupancy expense.

- Depreciation and amortization expense of $22.7 million

increased 2.7% from the prior-year period, primarily driven by new

store openings and investments in remote medicine technology.

- Income (loss) from continuing operations, net of tax, decreased

to $(1.0) million, compared to $3.6 million in the second quarter

of 2023. Income (loss) from continuing operations, net of tax,

margin decreased to (0.2)% compared to 0.8% in the second quarter

of 2023.

- Diluted earnings (loss) per share (EPS) from continuing

operations decreased to $(0.01), compared to $0.05 in the second

quarter of 2023. Adjusted Diluted EPS was $0.15 compared with $0.12

in the second quarter of 2023.

- Adjusted Operating Income increased 13.8% to $14.1 million

compared with the second quarter of 2023. Adjusted Operating Margin

was 3.1% for the second quarter of 2024 compared to 2.9% for the

second quarter of 2023. The net change in margin on unearned

revenue negatively impacted net income (loss) by $0.1 million and

Adjusted Operating Income by $0.2 million.

Year-to-Date 2024 Summary

- Net revenue increased 4.2% to $934.5 million compared to the

prior-year period and was primarily driven by growth from new store

sales, Adjusted Comparable Store Sales Growth and the effect of

unearned revenue, partially offset by the effect of converted and

closed stores. Net revenue includes a 0.3% impact from the timing

of unearned revenue in the current-year period compared with the

prior-year period.

- Comparable store sales growth was 1.8% and Adjusted Comparable

Store Sales Growth was 1.3%, primarily due to higher average ticket

and an increase in customer transactions.

- The Company opened 31 new stores, and converted 20 Eyeglass

World stores to America's Best stores, and ended the period with

1,216 stores. Overall, store count grew 5.6% from July 1, 2023 to

June 29, 2024.

- Costs applicable to revenue increased 6.2% to $389.1 million

compared to the prior-year period. As a percentage of net revenue,

compared with the prior-year period, costs applicable to revenue

increased 70 basis points to 41.6%, mainly due to lower eyeglass

mix and an increase in optometrist-related costs as well as other

mix and margin effects. As a percentage of revenue, these increased

costs were partially offset by higher exam revenue.

- SG&A increased 4.4% to $471.5 million compared with the

same period in 2023. Adjusted SG&A increased 2.3% to $452.3

million compared with the same period in 2023. As a percentage of

net revenue, SG&A increased 10 basis points to 50.5% compared

with the same period of 2023, mainly due to litigation settlement

and legal and professional expenses as well as other operating

expenses, partially offset by decreases in performance-based

incentive compensation. As a percentage of net revenue, Adjusted

SG&A decreased 90 basis points driven by a decrease in

performance-based incentive compensation, partially offset by other

operating expenses.

- Depreciation and amortization expense of $45.9 million

increased 4.2% from the prior-year period, primarily due to new

store openings and investments in remote medicine technology.

- Income from continuing operations, net of tax, decreased to

$10.7 million compared to $18.7 million in the same period in 2023.

Income from continuing operations, net of tax, margin decreased to

1.1% compared to 2.1% in the same period in 2023.

- Diluted EPS from continuing operations decreased to $0.14

compared to $0.24 in the same period in 2023. Adjusted Diluted EPS

increased to $0.44 compared to $0.41 in the same period in 2023.

The net change in margin on unearned revenue benefited both Diluted

EPS and Adjusted Diluted EPS by $0.02.

- Adjusted Operating Income increased 6.7% to $48.0 million

compared with the same period of 2023. Adjusted Operating Margin

was 5.1% compared with 5.0% for the same period in 2023. The net

change in margin on unearned revenue benefited net income by $1.7

million and Adjusted Operating Income by $2.3 million.

Balance Sheet and Cash Flow Highlights as of June 29,

2024

- National Vision’s cash balance was $179.5 million as of June

29, 2024. The Company had no borrowings under its $300.0 million

first lien revolving credit facility (“Revolving Loans”), exclusive

of letters of credit of $6.4 million.

- Total debt was $456.8 million as of June 29, 2024, consisting

of outstanding first lien term loans, 2.50% convertible senior

notes due on May 15, 2025 (“2025 Notes”) and finance lease

obligations, net of unamortized discounts.

- Cash flows from operating activities for the first six months

of 2024 were $75.4 million compared to $112.2 million for the same

period in 2023.

- Capital expenditures for the first six months of 2024 totaled

$39.6 million compared to $54.1 million for the same period in

2023.

Termination of AC Lens Business

As previously announced on July 26, 2023, the Company’s

Management and Services Agreement with Walmart Inc. (“Walmart MSA”)

terminated as of February 23, 2024. This included supplying and

operating Vision Centers in 225 Walmart stores, providing contact

lens distribution and related services to Walmart and its

affiliate, Sam's Club, and arranging for the provision of

optometric services at certain Walmart locations in California.

During the second quarter of 2024, the Company wound down its

remaining AC Lens operations, including the closure of its Ohio

distribution center, which largely supported the wholesale

distribution and e-commerce contact lens services that the Company

provided to Walmart and Sam’s Club, such that AC Lens operations

are included in discontinued operations for all periods

presented.

New Actions to Accelerate Transformation

The Company announced a new phase of its transformation which

includes new additions to its executive leadership team, continued

expansion of exam capacity, new traffic-driving initiatives and

initiatives to strengthen the foundation of the business for

profitable growth. As part of this transformation, the Company has

initiated a review of all stores to optimize the fleet and is

evaluating its deployment of capital as it considers new store

opening plans in 2025.

Separately, today the Company issued a press release announcing

leadership changes, including the appointment of Alex Wilkes as

National Vision’s President, effective August 19, 2024, and that

Patrick Moore, the Company’s Chief Operating Officer, has shared

his plans to retire at the end of the year. The press release is

available on the Company’s website.

Fiscal 2024 Outlook

National Vision’s fiscal 2024 outlook reflects current expected

or estimated impacts related to macro-economic factors, including

inflation, geopolitical instability and risks of recession, as well

as constraints on exam capacity; however, the ultimate impact of

these factors on the Company’s financial outlook remains uncertain

with dynamic market conditions and the outlook shown below assumes

no material deterioration to the Company’s current business

operations as a result of such factors or as a result of the

termination of the Walmart partnership. Unless otherwise noted, the

outlook below is on a continuing operations basis.

The Company is providing the following updated outlook for the

52 weeks ending December 28, 2024:

Prior Total Company Fiscal

2024 Outlook

(as of May 8, 2024)

Prior Continuing

Operations

Fiscal 2024 Outlook*

(as of May 8, 2024)

Updated Continuing

Operations

Fiscal 2024 Outlook**

(As of August 7, 2024)

New Stores

65 - 70

65-70

Adjusted Comparable Store Sales

Growth1

2.0% - 4.0%

0.5% - 1.5%

Net Revenue (billions)

$1.965 - $2.005

$1.825 - $1.865

$1.820 - $1.840

Adjusted Operating Income (millions)

$61 - $76

$60 - $75

$57 - $62

Adjusted Diluted EPS2

$0.50 - $0.65

$0.45 - $0.50

Depreciation and Amortization3

(millions)

$95 - $100

$94 - $99

Interest4 (millions)

$7 - $9

$7 - $9

Tax Rate5

26% to 28%

26% to 28%

Capital Expenditures (millions)

$110 - $115

$110 - $115

*As detailed on slide 14 in the Q1 2024

Earnings Presentation; reflected exclusion of estimated

discontinued operations for the six months ended June 29, 2024

including $140M in revenue and $1M in Adjusted Operating Income

**Reflects current outlook and exclusion

of actual discontinued operations for the six months ended June 29,

2024 which included $132M in revenue and $0.7M in Adjusted

Operating Income

1 Refer to the Reconciliation of Adjusted

Comparable Stores Sales Growth to Total Comparable Store Sales

Growth.

2 Assumes approximately 79 million shares,

and does not include 9.7 million shares attributable to the 2025

Notes as the Company anticipates them to be anti-dilutive to

earnings per share for fiscal year 2024.

3 Includes amortization of acquisition

intangibles of approximately $1.5 million for continuing

operations, which is excluded in the definition of Adjusted

Operating Income.

4 Before the impact of gains or losses on

change in fair value of derivatives and charges related to debt

discounts and deferred financing costs.

5 Excluding the impact of vesting of

restricted stock units and stock option exercises.

The fiscal 2024 outlook information provided above includes

Adjusted Operating Income and Adjusted Diluted EPS guidance, which

are non-GAAP financial measures management uses in measuring

performance. The Company is not able to reconcile these

forward-looking non-GAAP measures to comparable GAAP measures

without unreasonable efforts because it is not possible to predict

with a reasonable degree of certainty the actual impact of certain

items and unanticipated events, including taxes and non-recurring

items, which would be included in GAAP results. The impact of such

items and unanticipated events could be potentially

significant.

The fiscal 2024 outlook is forward-looking, subject to

significant business, economic, regulatory and competitive

uncertainties and contingencies, many of which are beyond the

control of the Company and its management, and based upon

assumptions with respect to future decisions, which are subject to

change. Actual results may vary and those variations may be

material. As such, the Company’s results may not fall within the

ranges contained in its fiscal 2024 outlook. The Company uses these

forward-looking measures internally to assess and benchmark its

results and strategic plans. See “Forward-Looking Statements”

below.

Conference Call Details The Company will host a

conference call to discuss the second quarter 2024 financial

results and fiscal-year 2024 guidance today, August 7, 2024, at

8:30 a.m. Eastern Time. To pre-register for the conference call and

obtain a dial-in number and passcode please refer to the

“Investors” section of the Company’s website at

www.nationalvision.com/investors. A live audio webcast of the

conference call will be available on the “Investors” section of the

Company’s website at www.nationalvision.com/investors, where

presentation materials will be posted prior to the conference call.

A replay of the audio webcast will also be archived on the

“Investors” section of the Company’s website.

About National Vision Holdings, Inc. National Vision

Holdings, Inc. (NASDAQ: EYE) is one of the largest optical retail

companies in the United States with more than 1,200 stores in 38

states and Puerto Rico. With a mission of helping people by making

quality eye care and eyewear more affordable and accessible, the

company operates four retail brands: America’s Best Contacts &

Eyeglasses, Eyeglass World, and Vista Opticals inside select Fred

Meyer stores and on select military bases, and e-commerce websites,

offering a variety of products and services for customers’ eye care

needs. For more information, please visit

www.nationalvision.com.

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933, as

amended (the “Securities Act”) and Section 21E of the Securities

Exchange Act of 1934. These statements include, but are not limited

to, statements contained under “Fiscal 2024 Outlook,” as well as

other statements related to our current beliefs and expectations

regarding the performance of our industry, the Company’s strategic

direction, market position, prospects including remote medicine and

optometrist recruiting and retention initiatives, and future

results. You can identify these forward-looking statements by the

use of words such as “outlook,” “guidance,” “believes,” “expects,”

“potential,” “continues,” “may,” “will,” “should,” “could,”

“seeks,” “projects,” “predicts,” “intends,” “plans,” “estimates,”

“anticipates” or the negative version of these words or other

comparable words. Caution should be taken not to place undue

reliance on any forward-looking statement as such statements speak

only as of the date when made. We undertake no obligation to

publicly update or review any forward-looking statement, whether as

a result of new information, future developments or otherwise,

except as required by law.

Forward-looking statements are not guarantees and are subject to

various risks and uncertainties, which may cause actual results to

differ materially from those implied in forward-looking statements.

Such factors include, but are not limited to, the termination of

our partnership with Walmart, including the transition period and

other wind down activities, will have an impact on our business,

revenues, profitability and cash flows, which impact could be

material; market volatility, an overall decline in the health of

the economy and other factors impacting consumer spending,

including inflation, uncertainty in financial markets, recessionary

conditions, escalated interest rates, the timing and issuance of

tax refunds, governmental instability, war and natural disasters,

may affect consumer purchases, which could reduce demand for our

products and materially harm our sales, profitability and financial

condition; failure to recruit and retain vision care professionals

for in-store roles or to provide remote care offerings could

adversely affect our business, financial condition and results of

operations; the optical retail industry is highly competitive, and

if we do not compete successfully, our business may be adversely

impacted; if we fail to open and operate new stores in a timely and

cost-effective manner or fail to successfully enter new markets,

our financial performance could be materially and adversely

affected; if the performance of our Host brands declines or we are

unable to maintain or extend our operating relationships with our

Host partners, our business, profitability and cash flows may be

adversely affected and we may be required to incur impairment

charges; we are a low-cost provider and our business model relies

on the low-cost of inputs and factors such as wage rate increases,

inflation, cost increases, increases in the price of raw materials

and energy prices could have a material adverse effect on our

business, financial condition and results of operations; we require

significant capital to fund our expanding business, including

updating our Enterprise Resource Planning (“ERP”) and Customer

Relationship Management (“CRM”), and other technological, systems

and capabilities; our growth strategy could strain our existing

resources and cause the performance of our existing stores to

suffer; our success depends upon our marketing, advertising and

promotional efforts and if we are unable to implement them

successfully or efficiently, or if our competitors are more

effective than we are, we may experience a material adverse effect

on our business, financial condition and results of operations; we

are subject to risks associated with leasing substantial amounts of

space, including future increases in occupancy costs; certain

technological advances, greater availability of, or increased

consumer preferences for, vision correction alternatives to

prescription eyeglasses or contact lenses, or future drug

development for the correction of vision-related problems may

reduce the demand for our products and adversely impact our

business and profitability; if we fail to retain our existing

senior management team or attract qualified new personnel such

failure could have a material adverse effect on our business,

financial condition and results of operations; our profitability

and cash flows may be negatively affected if we are not successful

in managing our inventory balances and inventory shrinkage; our

operating results and inventory levels fluctuate on a seasonal

basis; our e-commerce and omni-channel business faces distinct

risks, and our failure to successfully manage those risks could

have a negative impact on our profitability; we depend on our

distribution centers and/or optical laboratories; we may incur

losses arising from our investments in technological innovators in

the optical retail industry, including artificial intelligence,

which would negatively affect our financial results; ESG issues,

including those related to climate change, could have a material

adverse effect on our business, financial condition and results of

operations; changing climate and weather patterns leading to severe

weather and disasters may cause significant business interruptions

and expenditures; future operational success depends on our ability

to develop, maintain and extend relationships with managed vision

care companies, vision insurance providers and other third-party

payors; we face risks associated with vendors from whom our

products are sourced and are dependent on a limited number of

suppliers; we rely heavily on our information technology systems,

as well as those of our vendors, for our business to effectively

operate and to safeguard confidential information; any significant

failure, inadequacy, interruption or security breach could

adversely affect our business, financial condition and operations;

we rely on third-party coverage and reimbursement, including

government programs, for an increasing portion of our revenues, the

future reduction of which could adversely affect our results of

operations; we are subject to extensive state, local and federal

vision care and healthcare laws and regulations and failure to

adhere to such laws and regulations would adversely affect our

business; we are subject to managed vision care laws and

regulations; we are subject to rapidly changing and increasingly

stringent laws, regulations, contractual obligations, and industry

standards relating to privacy, data security and data protection

which could subject us to liabilities that adversely affect our

business, operations and financial performance; we could be

adversely affected by product liability, product recall or personal

injury issues; failure to comply with laws, regulations and

enforcement activities or changes in statutory, regulatory,

accounting and other legal requirements could potentially impact

our operating and financial results; adverse judgments or

settlements resulting from legal proceedings relating to our

business operations could materially adversely affect our business,

financial condition and results of operations; we may not be able

to adequately protect our intellectual property, which could harm

the value of our brand and adversely affect our business; we have a

significant amount of indebtedness which could adversely affect our

business and financial position, including limiting our business

flexibility and preventing us from meeting our debt obligations; a

change in interest rates may adversely affect our business; our

credit agreement contains restrictions that limit our flexibility

in operating our business; conversion of the 2025 Notes could

dilute the ownership interest of existing stockholders or may

otherwise depress the price of our common stock; and risks related

to owning our common stock, including our ability to comply with

requirements to design and implement and maintain effective

internal controls. Additional information about these and other

factors that could cause National Vision’s results to differ

materially from those described in the forward-looking statements

can be found in filings by National Vision with the Securities and

Exchange Commission (“SEC”), including our latest Annual Report on

Form 10-K and subsequent Quarterly Reports on Form 10-Q, which are

accessible on the SEC’s website at www.sec.gov. These factors

should not be construed as exhaustive and should be read in

conjunction with the other cautionary statements that are included

in this release and in our filings with the SEC.

Non-GAAP Financial Measures

To supplement the Company’s financial information presented in

accordance with GAAP and aid understanding of the Company’s

business performance, the Company uses certain non-GAAP financial

measures, namely “EBITDA,” “Adjusted Operating Income,” “Adjusted

Operating Margin,” “Adjusted EBITDA,” “Adjusted EBITDA Margin,”

“Adjusted Diluted EPS,” “Adjusted Comparable Stores Sales Growth,”

“Adjusted SG&A,” and “Adjusted SG&A Percent of Net

Revenue.” We believe EBITDA, Adjusted Operating Income, Adjusted

Operating Margin, Adjusted EBITDA, Adjusted EBITDA Margin, Adjusted

Diluted EPS, Adjusted SG&A, and Adjusted SG&A Percent of

Net Revenue assist investors and analysts in comparing our

operating performance across reporting periods on a consistent

basis by excluding items that we do not believe are indicative of

our core operating performance. Management believes these non-GAAP

financial measures are useful to investors in highlighting trends

in our operating performance, while other measures can differ

significantly depending on long-term strategic decisions regarding

capital structure, the tax jurisdictions in which we operate and

capital investments. Management uses these non-GAAP financial

measures to supplement GAAP measures of performance in the

evaluation of the effectiveness of our business strategies, to make

budgeting decisions, to establish discretionary annual incentive

compensation and to compare our performance against that of other

peer companies using similar measures. Management supplements GAAP

results with non-GAAP financial measures to provide a more complete

understanding of the factors and trends affecting the business than

GAAP results alone.

To supplement the Company’s comparable store sales growth

presented in accordance with GAAP, the Company provides “Adjusted

Comparable Store Sales Growth,” which is a non-GAAP financial

measure we believe is useful because it provides timely and

accurate information relating to the two core metrics of retail

sales: number of transactions and value of transactions. Management

uses Adjusted Comparable Store Sales Growth as the basis for key

operating decisions, such as allocation of advertising to

particular markets and implementation of special marketing

programs. Accordingly, we believe that Adjusted Comparable Store

Sales Growth provides timely and accurate information relating to

the operational health and overall performance of each brand. We

also believe that, for the same reasons, investors find our

calculation of Adjusted Comparable Store Sales Growth to be

meaningful.

EBITDA: We define EBITDA from continuing operations as

net income, minus income (loss) from discontinued operations, net

of tax, plus interest expense (income), net, income tax provision

(benefit), and depreciation and amortization.

Adjusted Operating Income: We define Adjusted Operating

Income from continuing operations as net income, minus income

(loss) from discontinued operations, net of tax, plus interest

expense (income), net and income tax provision (benefit), further

adjusted to exclude stock-based compensation expense, loss on

extinguishment of debt, asset impairment, litigation settlement,

secondary offering expenses, management realignment expenses,

long-term incentive plan expenses, Enterprise Resource Planning

(“ERP”) and Customer Relationship Management ("CRM") implementation

expenses and certain other expenses.

Adjusted Operating Margin: We define Adjusted Operating

Margin from continuing operations as Adjusted Operating Income from

continuing operations as a percentage of total net revenue.

Adjusted EBITDA: We define Adjusted EBITDA from

continuing operations as net income, minus income (loss) from

discontinued operations, net of tax, plus interest expense

(income), net, income tax provision (benefit) and depreciation and

amortization, further adjusted to exclude stock-based compensation

expense, loss on extinguishment of debt, asset impairment,

litigation settlement, secondary offering expenses, management

realignment expenses, long-term incentive plan expenses, ERP and

CRM implementation expenses and certain other expenses.

Adjusted EBITDA Margin: We define Adjusted EBITDA Margin

from continuing operations as Adjusted EBITDA from continuing

operations as a percentage of total net revenue.

Adjusted Diluted EPS: We define Adjusted Diluted EPS from

continuing operations as diluted earnings per share, minus diluted

earnings per share from discontinued operations, adjusted for the

per share impact of stock-based compensation expense, loss on

extinguishment of debt, asset impairment, litigation settlement,

secondary offering expenses, management realignment expenses,

long-term incentive plan expenses, amortization of debt discounts

and deferred financing costs of our term loan borrowings,

amortization of the conversion feature and deferred financing costs

related to our 2025 Notes when not required under U.S. GAAP to be

added back for diluted earnings per share, derivative fair value

adjustments, ERP and CRM implementation expenses, certain other

expenses, and related tax effects.

Adjusted SG&A: We define Adjusted SG&A from

continuing operations as SG&A from continuing operations

adjusted to exclude stock-based compensation expense, litigation

settlement, secondary offering expenses, management realignment

expenses, long-term incentive plan expense, ERP and CRM

implementation expenses, and certain other expenses.

Adjusted SG&A Percent of Net Revenue: We define

Adjusted SG&A Percent of Net Revenue from continuing operations

as Adjusted SG&A from continuing operations as a percentage of

total net revenue.

Adjusted Comparable Store Sales Growth: We measure

Adjusted Comparable Store Sales Growth as the increase or decrease

in sales recorded by the comparable store base in any reporting

period, compared to sales recorded by the comparable store base in

the prior reporting period, which we calculate as follows: (i)

sales are recorded on a cash basis (i.e. when the order is placed

and paid for or submitted to a managed care payor, compared to when

the order is delivered), utilizing cash basis point of sale

information from stores; (ii) stores are added to the calculation

during the 13th full fiscal month following the store’s opening;

(iii) closed stores are removed from the calculation for time

periods that are not comparable; (iv) sales from partial months of

operation are excluded when stores do not open or close on the

first day of the month; and (v) when applicable, we adjust for the

effect of the 53rd week. Quarterly, year-to-date and annual

adjusted comparable store sales are aggregated using only sales

from all whole months of operation included in both the current

reporting period and the prior reporting period. When a partial

month is excluded from the calculation, the corresponding month in

the subsequent period is also excluded from the calculation. There

may be variations in the way in which some of our competitors and

other retailers calculate comparable store sales. As a result, our

adjusted comparable store sales may not be comparable to similar

data made available by other retailers.

EBITDA, Adjusted Operating Income, Adjusted Operating Margin,

Adjusted EBITDA, Adjusted EBITDA Margin, Adjusted Diluted EPS,

Adjusted SG&A, Adjusted SG&A Percent of Net Revenue and

Adjusted Comparable Store Sales Growth are not recognized terms

under U.S. GAAP and should not be considered as an alternative to

net income or the ratio of net income to net revenue as a measure

of financial performance, SG&A, the ratio of SG&A to net

revenue as a measure of financial performance, cash flows provided

by operating activities as a measure of liquidity, comparable store

sales growth as a measure of operating performance, or any other

performance measure derived in accordance with U.S. GAAP.

Additionally, these measures are not intended to be a measure of

free cash flow available for management’s discretionary use as they

do not consider certain cash requirements such as interest

payments, tax payments and debt service requirements. The

presentations of these measures have limitations as analytical

tools and should not be considered in isolation, or as a substitute

for analysis of our results as reported under U.S. GAAP. Because

not all companies use identical calculations, the presentations of

these measures may not be comparable to other similarly titled

measures of other companies and can differ significantly from

company to company.

Please see “Reconciliation of Non-GAAP to GAAP Financial

Measures” below for reconciliations of non-GAAP financial measures

used in this release to their most directly comparable GAAP

financial measures.

Adjustment to Method of Tax Provision Calculation

The Company’s quarterly provision (benefit) for income taxes has

historically been calculated using the annualized effective tax

rate method (“AETR method”), which applies an estimated annual

effective tax rate to pre-tax income or loss. For the three and six

months ended June 29, 2024, the Company determined that the AETR

method would not provide a reliable estimate for its tax provision

(benefit) due to the fact that small changes in the Company’s

estimated pre-tax income or loss would result in significant

changes in the estimated AETR. Accordingly, for these periods, the

Company instead elected to calculate its provision (benefit) for

income taxes using a discrete effective tax rate (“ETR”)

method.

National Vision Holdings, Inc.

and Subsidiaries

Condensed Consolidated Balance

Sheets (Unaudited)

In Thousands, Except Par Value

As of

June 29, 2024

As of

December 30, 2023

ASSETS

Current assets:

Cash and cash equivalents

$

179,515

$

149,896

Accounts receivable, net

61,068

86,854

Inventories

90,956

119,908

Prepaid expenses and other current

assets

32,863

40,012

Total current assets

364,402

396,670

Noncurrent assets:

Property and equipment, net

357,057

360,187

Goodwill

717,544

717,544

Trademarks and trade names

240,547

240,547

Other intangible assets, net

19,385

20,173

Right of use assets

414,446

406,275

Other assets

32,919

28,336

Noncurrent assets of discontinued

operations

—

2,779

Total noncurrent assets

1,781,898

1,775,841

Total assets

$

2,146,300

$

2,172,511

LIABILITIES AND STOCKHOLDERS’

EQUITY

Current liabilities:

Accounts payable

$

49,969

$

67,556

Other payables and accrued expenses

110,004

123,288

Unearned revenue

39,471

48,117

Deferred revenue

63,835

62,867

Current maturities of long-term debt and

finance lease obligations

312,888

10,480

Current operating lease obligations

86,994

85,090

Current liabilities of discontinued

operations

—

302

Total current liabilities

663,161

397,700

Noncurrent liabilities:

Long-term debt and finance lease

obligations, less current portion and debt discount

143,927

450,771

Noncurrent operating lease obligations

382,548

376,814

Deferred revenue

22,416

21,459

Other liabilities

8,381

8,465

Deferred income taxes, net

82,459

87,884

Total non-current liabilities

639,731

945,393

Commitments and contingencies

Stockholders’ equity:

Common stock, $0.01 par value; 200,000

shares authorized; 85,267 and 84,831 shares issued as of June 29,

2024 and December 30, 2023, respectively; 78,628 and 78,311 shares

outstanding as of June 29, 2024 and December 30, 2023,

respectively

853

848

Additional paid-in capital

796,812

788,967

Accumulated other comprehensive loss

(64

)

(419

)

Retained earnings

263,176

254,616

Treasury stock, at cost; 6,639 and 6,520

shares as of June 29, 2024 and December 30, 2023, respectively

(217,369

)

(214,594

)

Total stockholders’ equity

843,408

829,418

Total liabilities and stockholders’

equity

$

2,146,300

$

2,172,511

National Vision Holdings, Inc.

and Subsidiaries

Condensed Consolidated

Statements of Operations and Comprehensive Income

(Unaudited)

Three Months Ended

Six Months Ended

In Thousands, Except Earnings (Loss) Per

Share

June 29, 2024

July 1, 2023

June 29, 2024

July 1, 2023

Revenue:

Net product sales

$

361,967

$

352,180

$

750,050

$

732,333

Net sales of services and plans

89,766

79,606

184,477

164,265

Total net revenue

451,733

431,786

934,527

896,598

Costs applicable to revenue (exclusive

of depreciation and amortization):

Products

111,213

106,362

224,417

217,436

Services and plans

82,367

73,960

164,709

149,013

Total costs applicable to revenue

193,580

180,322

389,126

366,449

Operating expenses:

Selling, general and administrative

expenses

231,353

222,924

471,481

451,600

Depreciation and amortization

22,692

22,089

45,913

44,045

Asset impairment

3,519

893

3,975

1,247

Other expense (income), net

(2

)

(3

)

(1

)

(104

)

Total operating expenses

257,562

245,903

521,368

496,788

Income from operations

591

5,561

24,033

33,361

Interest expense, net

3,196

1,836

7,452

6,703

Earnings (loss) from continuing operations

before income taxes

(2,605

)

3,725

16,581

26,658

Income tax provision (benefit)

(1,564

)

88

5,869

8,007

Income (loss) from continuing operations,

net of tax

(1,041

)

3,637

10,712

18,651

Income (loss) from discontinued

operations, net of tax

(2,084

)

1,977

(2,152

)

5,233

Net income (loss)

$

(3,125

)

$

5,614

$

8,560

$

23,884

Basic earnings (loss) per

share:

Continuing operations

$

(0.01

)

$

0.05

$

0.14

$

0.24

Discontinued operations

$

(0.03

)

$

0.03

$

(0.03

)

$

0.07

Total

$

(0.04

)

$

0.07

$

0.11

$

0.30

Diluted earnings (loss) per

share:

Continuing operations

$

(0.01

)

$

0.05

$

0.14

$

0.24

Discontinued operations

$

(0.03

)

$

0.03

$

(0.03

)

$

0.07

Total

$

(0.04

)

$

0.07

$

0.11

$

0.30

Weighted average shares

outstanding:

Basic

78,575

78,101

78,480

78,411

Diluted

78,575

78,343

78,774

78,784

Comprehensive income (loss):

Net income (loss)

$

(3,125

)

$

5,614

$

8,560

$

23,884

Unrealized gain on hedge instruments

229

255

483

508

Tax provision of unrealized gain on hedge

instruments

64

65

128

130

Comprehensive income (loss)

$

(2,960

)

$

5,804

$

8,915

$

24,262

Note: Diluted EPS related to the 2025

Notes is calculated using the if-converted method. The 2025 Notes

were anti-dilutive for all periods disclosed above and excluded

from the computation of the weighted average shares for diluted

EPS. Some totals in the table above do not foot due to rounding

differences.

National Vision Holdings, Inc.

and Subsidiaries

Condensed Consolidated

Statements of Cash Flows (Unaudited)

Six Months Ended

In Thousands

June 29, 2024

July 1, 2023

Cash flows from operating

activities:

Net income

$

8,560

$

23,884

Adjustments to reconcile net income to net

cash provided by operating activities:

Depreciation and amortization

47,244

49,742

Amortization of debt discount and deferred

financing costs

1,261

1,800

Amortization of cloud computing

implementation costs

2,330

1,289

Asset impairment

3,975

1,280

Deferred income tax expense (benefit)

(5,425

)

1,220

Stock-based compensation expense

7,246

9,788

Losses (gains) on change in fair value of

derivatives

(66

)

(1,750

)

Inventory adjustments

2,951

1,996

Other

1,218

1,509

Changes in operating assets and

liabilities:

Accounts receivable

24,351

560

Inventories

26,000

290

Operating lease right of use assets and

lease liabilities

(1,722

)

525

Other assets

1,248

2,239

Accounts payable

(17,587

)

(1,168

)

Deferred and unearned revenue

(6,721

)

824

Other liabilities

(19,415

)

18,188

Net cash provided by operating

activities

75,448

112,216

Cash flows from investing

activities:

Purchase of property and equipment

(39,620

)

(54,120

)

Other

1,577

(665

)

Net cash used for investing activities

(38,043

)

(54,785

)

Cash flows from financing

activities:

Repayments on long-term debt

(3,750

)

—

Proceeds from issuance of common stock

670

945

Purchase of treasury stock

(2,775

)

(27,611

)

Payments of debt issuance costs

—

(2,869

)

Payments on finance lease obligations

(1,585

)

(2,536

)

Net cash used for financing activities

(7,440

)

(32,071

)

Net change in cash, cash equivalents and

restricted cash

29,965

25,360

Cash, cash equivalents and restricted

cash, beginning of year

151,027

230,624

Cash, cash equivalents and restricted

cash, end of period

$

180,992

$

255,984

Supplemental cash flow disclosure

information:

Cash paid for interest

$

4,196

$

5,399

Cash paid for taxes

$

5,084

$

4,347

Capital expenditures accrued at the end of

the period

$

12,124

$

10,770

National Vision Holdings, Inc.

and Subsidiaries

Reconciliation of Non-GAAP to

GAAP Financial Measures (Unaudited)

Reconciliation of Adjusted Operating

Income from Continuing Operations to Net Income (Loss)

Three Months Ended

Six Months Ended

In thousands

June 29, 2024

July 1, 2023

June 29, 2024

July 1, 2023

Net income (loss)

(3,125

)

5,614

8,560

23,884

Income (loss) from discontinued

operations, net of tax

(2,084

)

1,977

(2,152

)

5,233

Income (loss) from continuing

operations, net of tax

$

(1,041

)

$

3,637

$

10,712

$

18,651

Interest expense, net

3,196

1,836

7,452

6,703

Income tax provision (benefit)

(1,564

)

88

5,869

8,007

Stock-based compensation expense (a)

4,750

5,172

7,164

9,221

Asset impairment (b)

3,519

893

3,975

1,247

Litigation settlement (c)

—

—

4,450

—

ERP and CRM implementation expenses

(f)

2,141

—

2,657

—

Other (g)

3,072

743

5,688

1,105

Adjusted Operating Income from

continuing operations

$

14,073

$

12,369

$

47,967

$

44,934

Income (loss) from continuing

operations, net of tax margin

(0.2

)%

0.8

%

1.1

%

2.1

%

Adjusted Operating Margin from

continuing operations

3.1

%

2.9

%

5.1

%

5.0

%

Note: Percentages reflect line item as a

percentage of total net revenue, adjusted for rounding.

Reconciliation of EBITDA from

Continuing Operations and Adjusted EBITDA from Continuing

Operations to Net Income (Loss)

Three Months Ended

Six Months Ended

In thousands

June 29, 2024

July 1, 2023

June 29, 2024

July 1, 2023

Net income (loss)

(3,125

)

5,614

8,560

23,884

Income (loss) from discontinued

operations, net of tax

(2,084

)

1,977

(2,152

)

5,233

Income (loss) from continuing

operations, net of tax

$

(1,041

)

$

3,637

$

10,712

$

18,651

Interest expense, net

3,196

1,836

7,452

6,703

Income tax provision (benefit)

(1,564

)

88

5,869

8,007

Depreciation and amortization

22,692

22,089

45,913

44,045

EBITDA from continuing

operations

23,283

27,650

69,946

77,406

Stock-based compensation expense (a)

4,750

5,172

7,164

9,221

Asset impairment (b)

3,519

893

3,975

1,247

Litigation settlement (c)

—

—

4,450

—

ERP and CRM implementation expenses

(f)

2,141

—

2,657

—

Other (g)

2,690

361

4,925

342

Adjusted EBITDA from continuing

operations

$

36,383

$

34,076

$

93,117

$

88,216

Income (loss) from continuing operations, net of tax margin

(0.2

)%

0.8

%

1.1

%

2.1

%

Adjusted EBITDA Margin from continuing

operations

8.1

%

7.9

%

10.0

%

9.8

%

Note: Percentages reflect line item as a

percentage of total net revenue, adjusted for rounding.

Reconciliation of Adjusted Diluted EPS

from Continuing Operations to Diluted EPS

Three Months Ended

Six Months Ended

Shares in thousands, except per share

amounts

June 29, 2024

July 1, 2023

June 29, 2024

July 1, 2023

Diluted EPS

$

(0.04

)

$

0.07

$

0.11

$

0.30

Diluted EPS from discontinued

operations

(0.03

)

0.03

(0.03

)

0.07

Diluted EPS from continuing

operations

$

(0.01

)

$

0.05

$

0.14

$

0.24

Stock-based compensation expense (a)

0.06

0.07

0.09

0.12

Asset impairment (b)

0.04

0.01

0.05

0.02

Litigation settlement (c)

—

—

0.06

—

Amortization of debt discount and deferred

financing costs (d)

0.01

0.01

0.02

0.02

Derivatives fair value adjustments (e)

0.04

0.00

0.07

0.04

ERP and CRM implementation expenses

(f)

0.03

—

0.03

—

Other (g)

0.04

0.01

0.07

0.02

Tax effects (h)

(0.05

)

(0.03

)

(0.09

)

(0.04

)

Adjusted Diluted EPS from continuing

operations

$

0.15

$

0.12

$

0.44

$

0.41

Weighted average diluted shares

outstanding

78,575

78,343

78,774

78,784

Note: Some of the totals in the table

above do not foot due to rounding differences.

Reconciliation of Adjusted Diluted EPS

from Discontinued Operations to Diluted EPS from Discontinued

Operations

Three Months Ended

Six Months Ended

Shares in thousands, except per share

amounts

June 29, 2024

July 1, 2023

June 29, 2024

July 1, 2023

Diluted EPS from discontinued

operations

$

(0.03

)

$

0.03

$

(0.03

)

$

0.07

Stock-based compensation expense (a)

0.00

0.00

0.00

0.01

Asset impairment (b)

—

—

—

0.00

Other (i)

0.04

0.02

0.07

0.04

Tax effects (h)

(0.01

)

(0.01

)

(0.02

)

(0.01

)

Adjusted Diluted EPS from discontinued

operations

$

0.00

$

0.04

$

0.03

$

0.10

Weighted average diluted shares

outstanding

78,575

78,343

78,774

78,784

Note: Some of the totals in the table

above do not foot due to rounding differences.

Reconciliation of Adjusted SG&A

from Continuing Operations to SG&A from Continuing

Operations

Three Months Ended

Six Months Ended

In thousands

June 29, 2024

July 1, 2023

June 29, 2024

July 1, 2023

SG&A from continuing

operations

$

231,353

$

222,924

$

471,481

$

451,600

Stock-based compensation expense (a)

4,750

5,172

7,164

9,221

Litigation settlement (c)

—

—

4,450

—

ERP and CRM implementation expenses

(f)

2,141

—

2,657

—

Other (g)

2,690

365

4,925

346

Adjusted SG&A from continuing

operations

$

221,772

$

217,387

$

452,285

$

442,033

SG&A from continuing operations

Percent of Net Revenue

51.2

%

51.6

%

50.5

%

50.4

%

Adjusted SG&A from continuing

operations Percent of Net Revenue

49.1

%

50.3

%

48.4

%

49.3

%

Note: Percentages reflect line item as a

percentage of total net revenue.

(a)

Non-cash charges related to stock-based

compensation programs, which vary from period to period depending

on the timing of awards and performance vesting conditions.

(b)

Reflects write-off related to impairment

of long-lived assets, primarily impairment of property, equipment

and lease-related assets on closed or underperforming stores.

(c)

Expenses associated with settlement of

certain litigation.

(d)

Amortization of deferred financing costs

and other non-cash charges related to our long-term debt. We adjust

for amortization of deferred financing costs related to the 2025

Notes only when adjustment for these costs is not required in the

calculation of diluted earnings per share under U.S. GAAP.

(e)

The adjustments for the derivative fair

value (gains) and losses have the effect of adjusting the (gain) or

loss for changes in the fair value of derivative instruments and

amortization of AOCL for derivatives not designated as accounting

hedges. This results in reflecting derivative (gains) and losses

within Adjusted Diluted EPS during the period the derivative is

settled.

(f)

Costs related to the Company’s ERP and CRM

implementation.

(g)

Other adjustments include amounts that

management believes are not representative of our operating

performance (amounts in brackets represent reductions in Adjusted

Operating Income, Adjusted Diluted EPS and Adjusted EBITDA), which

are primarily related to costs associated with the digitization of

paper-based records of $2.3 million and $4.1 million for the three

and six months ended June 29, 2024, respectively, and other

expenses and adjustments. Other adjustments for both Adjusted

Operating Income and Adjusted Diluted EPS include amortization of

the increase in carrying values of finite-lived intangible assets

resulting from the application of purchase accounting following the

acquisition of the Company by affiliates of KKR & Co. Inc.

Adjusted Diluted EPS is also adjusted to include debt issuance

costs. Other adjustments for Adjusted SG&A exclude gains and

losses on other investments.

(h)

Represents the income tax effect of the

total adjustments at our combined statutory federal and state

income tax rates, including tax expense (benefit) from stock-based

compensation.

(i)

Represents primarily costs related to the

Walmart partnership termination and wind down of AC Lens of $2.9

million and $5.7 million for the three and six months ended June

29, 2024, respectively. and amortization of the increase in

carrying values of finite-lived intangible assets resulting from

the application of purchase accounting following the acquisition of

the Company by affiliates of KKR & Co. Inc of $1.5 million and

$3.0 million for the three and six months ended July 1, 2023,

respectively.

Reconciliation of Adjusted Comparable

Store Sales Growth from Continuing Operations to Total Comparable

Store Sales Growth from Continuing Operations

Comparable store sales growth

from continuing operations (a)

Three Months

Ended June

29, 2024

Three Months

Ended July 1,

2023

Six Months

Ended June 29,

2024

Six Months

Ended July 1,

2023

2024 Outlook (b)

Owned & Host segment

America’s Best

2.9

%

1.8

%

2.0

%

1.8

%

Eyeglass World

(0.5

)%

(2.8

)%

(2.9

)%

(2.0

)%

Military

(0.1

)%

(0.1

)%

(0.8

)%

1.6

%

Fred Meyer

(2.7

)%

(4.2

)%

(4.3

)%

(6.9

)%

Total comparable store sales growth

from continuing operations

2.2

%

(0.2

)%

1.8

%

1.6

%

1.0% - 2.0%

Adjustments for effects of: (b)

Unearned & deferred revenue

0.2

%

1.3

%

(0.5

)%

(0.4

)%

Adjusted Comparable Store Sales Growth

from continuing operations

2.4

%

1.1

%

1.3

%

1.2

%

0.5% - 1.5%

(a)

Total comparable store sales is calculated

based on consolidated net revenue from continuing operations

excluding the impact of (i) Corporate/Other segment net revenue,

(ii) sales from stores opened less than 13 months, (iii) stores

closed in the periods presented, (iv) sales from partial months of

operation when stores do not open or close on the first day of the

month and (v) if applicable, the impact of a 53rd week in a fiscal

year. Brand-level comparable store sales growth is calculated based

on cash basis revenues consistent with what the CODM reviews, and

consistent with reportable segment revenues presented in Note 12.

“Segment Reporting” in our unaudited condensed consolidated

financial statements included in Part I. Item 1. in our Quarterly

Report on Form 10-Q for the period ended June 29, 2024.

(b)

Adjusted Comparable Store Sales Growth

from continuing operations includes the effect of deferred and

unearned revenue as if such revenues were earned at the point of

sale, resulting in the changes from total comparable store sales

growth from continuing operations based on consolidated net revenue

from continuing operations; with respect to the Company’s 2024

Outlook, Adjusted Comparable Store Sales Growth includes an

estimated 0.5% decrease for the effect of deferred and unearned

revenue as if such revenues were earned at the point of sale.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240807649435/en/

Investor contact: investor.relations@nationalvision.com

National Vision Holdings, Inc. Tamara Gonzalez

ICR, Inc. Caitlin Churchill

Media contact: media@nationalvision.com

National Vision Holdings, Inc. Racheal Peters

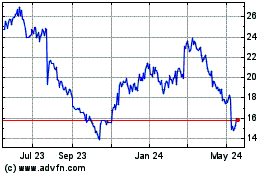

National Vision (NASDAQ:EYE)

Historical Stock Chart

From Oct 2024 to Nov 2024

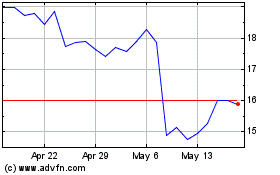

National Vision (NASDAQ:EYE)

Historical Stock Chart

From Nov 2023 to Nov 2024