Monarch Casino & Resort Declares One-Time Cash Dividend of $5.00 Per Share; Initiates Recurring Annual Cash Dividend of $1.20 Per Share, to Be Paid in Quarterly Amounts

February 07 2023 - 9:00AM

Monarch Casino & Resort, Inc. (Nasdaq: MCRI) (“Monarch” or “the

Company”) today announced that its Board of Directors authorized a

one-time cash dividend of $5.00 per share of its outstanding common

stock. The one-time cash dividend is payable on March 15, 2023, to

stockholders of record on March 1, 2023. In addition, commencing in

the second quarter of 2023, the Board of Directors has approved the

payment of an annual dividend in the amount of $1.20 per

outstanding share of Common Stock, payable in quarterly amounts on

the 15th day of the third month of each applicable calendar quarter

(or, if such date is not a trading day, then the first trading day

immediately thereafter such date) to those stockholders of record

on the 1st day of the third month of each quarter (or, if such date

is not a trading day, then the first trading day immediately

thereafter such date), to be reviewed quarterly by the Board. As

such, for all of calendar year 2023, the Company expects to pay

total cash dividends of $5.90 per share.

John Farahi, Co-Chairman and Chief Executive

Officer of Monarch, commented, “The Board of Directors’

authorization of a one-time cash dividend and the initiation of a

recurring annual cash dividend highlights the free cash flow

generated by our two market-leading properties and our commitment

to enhance stockholder value. With our strong balance sheet and

ongoing free cash flow growth, we have the financial flexibility to

return capital to stockholders through both a one-time dividend and

our new recurring dividend, while continuing to invest in our

properties and evaluate M&A opportunities that can leverage our

operating and development expertise to deliver additional long-term

growth. Since opening the expanded Monarch Casino Black Hawk, we’ve

effectively eliminated all outstanding debt, and we believe this is

an ideal time to return capital to our stockholders.”

On February 1, 2023, the Company entered into a

Fifth Amended and Restated Credit Agreement with Wells Fargo Bank,

N.A. where the Company increased its revolving line of credit to

$100 million, with an option to increase the principal amount under

such credit line by an additional $100 million within the first six

months. The maturity date has also been extended to January 1,

2025. The Company may use borrowings from the Fifth Amended Credit

Facility towards a partial payment of the one-time cash dividend

and for general corporate purposes.

While the Company expects to pay regular

quarterly cash dividends to its stockholders beginning in the

second quarter of 2023 and for the foreseeable future, all future

dividends will be reviewed by the Board of Directors not less than

quarterly, based on the Company’s financial condition, available

M&A opportunities or other prudent uses of the Company’s cash

resources. As such, the Board of Directors may suspend the dividend

program at any time.

Forward Looking Statements

This press release contains forward-looking

statements within the meaning of the safe harbor provisions of the

U.S. Private Securities Litigation Reform Act of 1995.

Forward-looking statements can be identified by words such as

"plan," "believe," "expect," "seem," "look," "look forward,"

"positioning," "future," "will," "confident" and similar references

to future periods. Example of forward-looking statements include,

among others, statements we make regarding: (i) the continuing

strength of our balance sheet and our expected free cash flow; and

(ii) our expectations regarding continuing our dividend payments in

the future. Actual results and future events and conditions may

differ materially from those described in any forward-looking

statements. Therefore, you should not rely on any of these

forward-looking statements. Important factors that could cause

actual results to differ materially from estimates or projections

contained in the forward-looking statements include, without

limitation:

- continuing adverse impacts of COVID-19, including new variants,

on our business, financial condition and operating results;

- continuing actions by government officials at the federal,

state and/or local level with respect to steps to be taken,

including, without limitation, temporary or extended shutdowns,

travel restrictions, social distancing and shelter-in-place orders,

in connection with COVID-19 and its variants;

- our ability to manage guest safety concerns, whether caused by

COVID-19,its variants or other causes;

- our ability to maintain compliance with the terms and

conditions of our credit facilities and other material contracts in

the event of any unexpected or unplanned events, such as temporary

or extended shutdowns;

- access to available and reasonable financing on a timely

basis;

- our ability to maintain strong working relationships with our

regulators, employees, lenders, suppliers, insurance carriers,

customers, and other stakeholders;

- impacts of any uninsured losses;

- changes in guest visitation or spending patterns due to

economic conditions, health or other concerns;

- construction factors, including delays, disruptions,

availability of labor and materials, increased costs of labor and

materials, contractor disagreements, zoning issues, environmental

restrictions, soil and water conditions, weather and other hazards,

site access matters, building permit issues and other regulatory

approvals or issues;

- ongoing disagreements over costs of and responsibility for

delays and other construction related matters with our general

contractor at Monarch Casino Resort Spa Black Hawk, PCL

Construction Services, Inc., including, as previously reported, the

litigation against us by such contractor;

- claims for construction defects, breach of contract, breach of

warranty, fraud, fraudulent inducement, negligence or other

construction related claims that we may have in connection with

construction and completion of Monarch Casino Resort Spa Black Hawk

and any adverse impacts on operations required to correct the

same;

- our litigation against the general contractor of Monarch Casino

Resort Spa Black Hawk, PCL Construction Services, Inc., in the

above-mentioned litigation in which litigation the parties are

preparing for trial in 2023;

- our potential need to post bonds or other forms of surety to

support our legal remedies;

- risks related to development and construction activities

(including disputes with and defaults by contractors and

subcontractors; construction, equipment or staffing problems and

delays; shortages of materials or skilled labor; environmental,

health and safety issues; weather and other hazards, site access

matters, and unanticipated cost increases);

- our ability to generate sufficient operating cash flow to help

finance our expansion plans and any subsequent debt reduction;

- changes in laws mandating increases in minimum wages and

employee benefits;

- changes in laws and regulations permitting expanded and other

forms of gaming in our key markets;

- the effects of local and national economic, credit and capital

market conditions on the economy in general and on the gaming

industry and our business in particular, including predictions for

a potential recession;

- the effects of labor shortages on our market position, growth

and financial results;

- the potential of increases in state and federal taxation;

- potential of increased regulatory and other burdens;

- guest acceptance of our expanded facilities once completed and

the resulting impact on our market position, growth and financial

results;

- competition in our target market areas;

- broad-based inflation, including wage inflation; and

- the impact of the events occurring in Eastern Europe, other

parts of the world and the conflict taking place in Ukraine.

Additional information concerning potential

factors that could adversely affect all forward-looking statements,

including the Company's financial results, is included in our

Securities and Exchange Commission filings, including our most

recent annual report on Form 10-K and quarterly reports on Form

10-Q, which are available on our website at

www.monarchcasino.com.

About Monarch Casino & Resort,

Inc. Monarch Casino & Resort, Inc., through its

subsidiaries, owns and operates the Atlantis Casino Resort Spa, a

hotel/casino facility in Reno, Nevada, and the Monarch Casino

Resort Spa Black Hawk in Black Hawk, Colorado, approximately 40

miles west of Denver. For additional information on Monarch, visit

the Company's website at www.monarchcasino.com.

Atlantis features approximately 61,000 square

feet of casino space; 818 guest rooms and suites; eight food

outlets; two gourmet coffee and pastry bars; a 30,000 square foot

health spa and salon with an enclosed year-round pool; retail

outlet offering clothing and traditional gift shop merchandise; an

8,000 square-foot family entertainment center; and approximately

52,000 square feet of banquet, convention and meeting room space.

The casino features approximately 1,300 slot and video poker

machines; approximately 37 table games, including blackjack, craps,

roulette, and others; a race and sports book; a 24-hour live keno

lounge; and a poker room.

The Monarch Black Hawk features approximately

60,000 square feet of casino space; more than 1,100 slot machines;

approximately 42 table games; a live poker room; a keno; and a

sports book. The resort also includes 10 bars and lounges, as well

as four dining options: a twenty-four-hour full-service restaurant,

a buffet-style restaurant, the Monarch Chophouse (a fine-dining

steakhouse), and Bistro Mariposa (elevated Southwest cuisine). The

resort offers 516 guest rooms and suites, banquet and meeting room

space, a retail store, a concierge lounge and an upscale spa and

pool facility located on the top floor of the tower. The resort is

connected to a nine-story parking structure with approximately

1,350 parking spaces, and additional valet parking, with total

property capacity of approximately 1,500 spaces.

Contacts: John Farahi Chief

Executive Officer 775/824-4401 or JFarahi@monarchcasino.com

Joseph Jaffoni, Richard Land, James Leahy JCIR

212/835-8500 or mcri@jcir.com

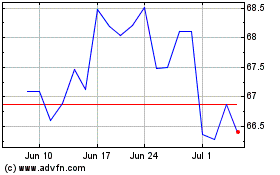

Monarch Casino and Resort (NASDAQ:MCRI)

Historical Stock Chart

From Feb 2025 to Mar 2025

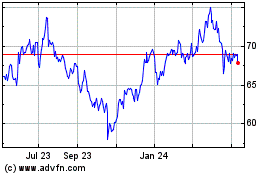

Monarch Casino and Resort (NASDAQ:MCRI)

Historical Stock Chart

From Mar 2024 to Mar 2025