false

0000926423

0000926423

2024-06-13

2024-06-13

0000926423

mind:CommonStockCustomMember

2024-06-13

2024-06-13

0000926423

mind:SeriesAPreferredStockCustomMember

2024-06-13

2024-06-13

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

| Date of Report (Date of Earliest Event Reported): |

June 13, 2024 |

MIND Technology, Inc.

(Exact name of registrant as specified in its charter)

|

Delaware

|

|

001-13490

|

|

76-0210849

|

|

(State or other jurisdiction

|

|

(Commission

|

|

(I.R.S. Employer

|

|

of incorporation)

|

|

File Number)

|

|

Identification No.)

|

| |

|

|

|

|

|

2002 Timberloch Place, Suite 550,

|

|

|

|

|

|

The Woodlands, Texas

|

|

|

|

77380

|

|

(Address of principal executive offices)

|

|

|

|

(Zip Code)

|

|

Registrant’s telephone number, including area code:

|

(281) 353-4475

|

Former name or former address, if changed since last report

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol (s)

|

Name of each exchange on which registered

|

|

Common Stock

|

MIND

|

The NASDAQ Stock Market LLC

|

|

Series A Preferred Stock

|

MINDP

|

The NASDAQ Stock Market LLC

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.07. Submission of Matters toa Vote of Security Holders.

On June 13, 2024, MIND Technology, Inc. (the “Company”) convened and adjourned a virtual special meeting of preferred stockholders (the “Special Meeting”). At the Special Meeting, a total of 1,137,719 shares, or 67.60% of the shares of the Company’s common stock, par value $0.0001 per share, issued and outstanding as of April 26, 2024, which is the record date for the Special Meeting, were represented virtually or by proxy, constituting a quorum.

At the Special Meeting, the Company’s stockholders considered two proposals, each of which is set forth below and described in more detail in the Company’s definitive proxy statement on Schedule 14A (the “Proxy Statement”) filed with the Securities and Exchange Commission (the “SEC”) on March 22, 2024, as revised on May 8, 2024.

Proposal No. 1: To approve an amendment to the Company’s Certificate of Designations, Preferences and Rights of 9.00% Series A Cumulative Preferred Stock, to provide that, at the discretion of the Company’s Board of Directors deciding to file the Amendment with the Secretary of State of the State of Delaware at any time prior to July 31, 2024, each share of 9.00% Series A Cumulative Preferred Stock, $1.00 par value per share shall be converted into 3.9 shares of common stock, $0.01 par value per share, upon the effective time of the Amendment (the “Preferred Stock Proposal”).

Proposal No. 2: To approve one or more adjournments of the Special Meeting, if necessary, to solicit additional proxies if there are not sufficient votes at the time of the Special Meeting to approve the Preferred Stock Proposal (the “Adjournment Proposal”).

As there were not sufficient votes to approve the Preferred Stock Proposal at the time of the Special Meeting, the sole item of business presented to the preferred stockholders for consideration at the virtual special meeting was a vote on the Adjournment Proposal. The voting results for the Adjournment Proposal are set forth below.

|

For

|

|

Against

|

|

Abstentions

|

|

792,112

|

|

324,281

|

|

17,636

|

In accordance with the authority granted pursuant to the Adjournment Proposal, the Special Meeting was adjourned with respect to the Preferred Stock Proposal to solicit additional proxies in favor of the Preferred Stock Proposal. As announced at the Special Meeting, the Special Meeting will reconvene on June 27, 2024 at 9:00 a.m. Central Time.

Item 7.01 Regulation FD Disclosure.

On June 13, 2024, the Company issued a press release announcing the adjournment of the virtual special meeting of preferred stockholders. A copy of the press release is furnished as Exhibit 99.1 to this report and incorporated by reference into Item 7.01.

The information in this Item 7.01 (including the press release attached as Exhibit 99.1 and incorporated by reference into Item 7.01) is being furnished, not filed, for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), is not subject to the liabilities of that section, and will not be incorporated by reference into any filing under the Exchange Act or the Securities Act of 1933, as amended, unless specifically identified therein as being incorporated therein by reference.

Cautionary Note Regarding Forward-Looking Statements

Certain of the statements contained in this report should be considered forward-looking statements. These forward-looking statements may be identified by words such as “may,” “will,” “expect,” “intend,” “anticipate,” “believe,” “estimate,” “plan,” “project,” “could,” “should,” “would,” “continue,” “seek,” “target,” “guidance,” “outlook,” “if current trends continue,” “optimistic,” “forecast” and other similar words. Such statements include, but are not limited to, statements about the Company’s plans, objectives, expectations, intentions, estimates and strategies for the future, and other statements that are not historical facts. These forward-looking statements are based on the Company’s current objectives, beliefs and expectations, and they are subject to significant risks and uncertainties that may cause actual results and financial position and timing of certain events to differ materially from the information in the forward-looking statements. These risks and uncertainties include, but are not limited to, those set forth in the Company’s Annual Report on Form 10-K for the year ended January 31, 2024 (especially in Part II, Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations), filed with the Securities and Exchange Commission (the “SEC”) on April 30, 2024, and other risks and uncertainties listed from time to time in the Company’s other filings with the SEC. There may be other factors of which the Company is not currently aware that may affect matters discussed in the forward-looking statements and may also cause actual results to differ materially from those discussed. In addition, the lingering effect of the COVID-19 pandemic, supply chain disruptions, emerging financial institution crisis, and the potential of a recession have created significant uncertainty in the global economy and could have a material adverse effect on the Company’s business, financial position, results of operations and liquidity. The Company does not assume any obligation to publicly update or supplement any forward-looking statement to reflect actual results, changes in assumptions or changes in other factors affecting these forward-looking statements other than as required by law. Any forward-looking statements speak only as of the date hereof or as of the dates indicated in the statement.

Item 9.01 Financial Statements and Exhibits.

| |

Exhibit

Number

|

|

Description

|

| |

|

|

|

|

(d) Exhibits.

|

99.1

|

|

|

| |

104

|

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

| |

|

|

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

MIND Technology, Inc.

|

|

|

|

|

|

|

|

June 17, 2024

|

By:

|

/s/ Robert P. Capps

|

|

| |

|

|

|

|

|

|

Name: Robert P. Capps

|

|

|

|

|

Title: President and Chief Executive Officer

|

|

Exhibit 99.1

|

|

NEWS RELEASE |

| |

|

|

| |

Contacts: |

Rob Capps, President & CEO

MIND Technology, Inc.

281-353-4475

Ken Dennard / Zach Vaughan

Dennard Lascar Investor Relations

713-529-6600

MIND@dennardlascar.com

|

MIND Technology Adjourns Virtual Special Meeting of Preferred Stockholders

THE WOODLANDS, TX, June 13, 2024 –MIND Technology, Inc. (“MIND” or the “Company”) (Nasdaq: MIND; MINDP) convened its virtual special meeting of holders of its 9% Series A Cumulative Preferred Stock (the “preferred stock”) on June 13, 2024. Preferred stockholders approved a proposal to adjourn the special meeting to give the Company’s management additional time to solicit additional proxies to approve an amendment to the Certificate of Designations, Preferences and Rights of the Preferred Stock (the “Preferred Stock Proposal”). If the Preferred Stock Proposal is approved, the proposed amendment provides that each share of preferred stock may be converted into 3.9 shares of common stock, $0.01 par value per share (the “common stock”) at the sole discretion of the Company’s Board of Directors at any time prior to July 31, 2024. The virtual special meeting will be reconvened on Thursday, June 27, 2024 at 09:00 a.m.

The record date for determining preferred stockholders eligible to vote at the virtual special meeting remains April 27, 2024.

MIND strongly encourages any eligible preferred stockholder that has not yet voted their shares or provided voting instructions to their broker or other record holder, to do so promptly. No action is required by any preferred stockholder who has previously delivered a proxy and who does not wish to revoke or change that proxy.

Rob Capps, President and CEO of MIND, stated, “We are pleased with the response we have received to date to the Preferred Stock Proposal. However, given the diverse holdings of the preferred stock and the requirement to obtain the affirmative vote of two-thirds of the outstanding shares, we think it appropriate to adjourn the virtual special meeting and provide additional time to solicit proxies.”

About MIND Technology

MIND Technology, Inc. provides technology to the oceanographic, hydrographic, defense, seismic and security industries. Headquartered in The Woodlands, Texas, MIND has a global presence with key operating locations in the United States, Singapore, Malaysia, and the United Kingdom. Its Seamap unit, designs, manufactures, and sells specialized, high performance, marine exploration and survey equipment.

Forward-looking Statements

Certain statements and information in this press release may constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. All statements contained in this press release other than statements of historical fact, including statements regarding our future results of operations and financial position, our business strategy and plans, our objectives for future operations, future orders and anticipated delivery of existing orders, and future payments of dividends are forward-looking statements. The words “believe,” “expect,” “anticipate,” “plan,” “intend,” “should,” “would,” “could” or other similar expressions are intended to identify forward-looking statements, which are generally not historical in nature. These forward-looking statements are based on our current expectations and beliefs concerning future developments and their potential effect on us. While management believes that these forward-looking statements are reasonable as and when made, there can be no assurance that future developments affecting us will be those that we anticipate. All comments concerning our expectations for future revenues and operating results are based on our forecasts of our existing operations and do not include the potential impact of any future acquisitions or dispositions. Our forward-looking statements involve significant risks and uncertainties (some of which are beyond our control) and assumptions that could cause actual results to differ materially from our historical experience and our present expectations or projections. These risks and uncertainties include, without limitation, reductions in our customers’ capital budgets, our own capital budget, limitations on the availability of capital or higher costs of capital, volatility in commodity prices for oil and natural gas.

Readers are cautioned not to place undue reliance on forward-looking statements, which speak only as of the date hereof. We undertake no obligation to publicly update or revise any forward-looking statements after the date they are made, unless required by law, whether as a result of new information, future events or otherwise. All forward-looking statements included in this press release are expressly qualified in their entirety by the cautionary statements contained or referred to herein.

Important Additional Information and Where To Find It

MIND has filed with the Securities and Exchange Commission (“SEC”) a definitive revised proxy statement on Schedule 14A on May 8, 2024, with respect to its solicitation of proxies for the Virtual Special Meeting of Preferred Stockholders (including any and all adjournments, postponements, continuations, and reschedulings thereof, the “Special Meeting”). PREFERRED STOCKHOLDERS ARE URGED TO READ THE DEFINITIVE PROXY STATEMENT AND ANY OTHER AMENDMENTS OR SUPPLEMENTS FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT MIND’S SOLICITATION. Investors and security holders may obtain copies of these documents and other documents filed with the SEC by MIND free of charge through the website maintained by the SEC at www.sec.gov. The Notice of Virtual Special Meeting of Preferred Stockholders and our Proxy Statement for the Special Meeting and Annual Report on Form 10-K for the fiscal year ended January 31, 2024 are available at

www.viewproxy.com/MINDTechnology/2024

# # #

v3.24.1.1.u2

Document And Entity Information

|

Jun. 13, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

MIND Technology, Inc.

|

| Document, Type |

8-K

|

| Document, Period End Date |

Jun. 13, 2024

|

| Entity, Incorporation, State or Country Code |

DE

|

| Entity, File Number |

001-13490

|

| Entity, Tax Identification Number |

76-0210849

|

| Entity, Address, Address Line One |

2002 Timberloch Place

|

| Entity, Address, Address Line Two |

Suite 550

|

| Entity, Address, City or Town |

The Woodlands

|

| Entity, Address, State or Province |

TX

|

| Entity, Address, Postal Zip Code |

77380

|

| City Area Code |

281

|

| Local Phone Number |

353-4475

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0000926423

|

| CommonStock Custom [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

MIND

|

| Security Exchange Name |

NASDAQ

|

| SeriesAPreferredStock Custom [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Series A Preferred Stock

|

| Trading Symbol |

MINDP

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=mind_CommonStockCustomMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=mind_SeriesAPreferredStockCustomMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

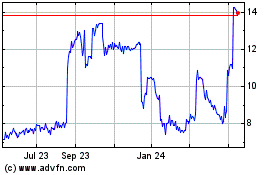

MIND Technology (NASDAQ:MINDP)

Historical Stock Chart

From Oct 2024 to Nov 2024

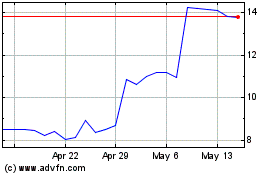

MIND Technology (NASDAQ:MINDP)

Historical Stock Chart

From Nov 2023 to Nov 2024