false

0000883975

0000883975

2023-11-21

2023-11-21

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d)

of

the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): November 21, 2023

MICROBOT

MEDICAL INC.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

000-19871 |

|

94-3078125 |

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

288 Grove Street, Suite 388

Braintree, MA 02184

(Address of Principal Executive Offices) (Zip Code)

Registrant’s

telephone number, including area code: (781) 875-3605

(Former

Name or Former Address, if Changed Since Last Report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock, $0.01 par value |

|

MBOT |

|

NASDAQ

Capital Market |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405)

or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging

Growth Company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02 Departure of Directors or Principal Officers; Election of Directors; Appointment of Principal Officers

On

November 21, 2023, Microbot Medical Inc. (the “Company”) announced the appointment of Dr. Juan Diaz-Cartelle, age 48, as

the Company’s new Chief Medical Officer (“CMO”). As CMO, Dr. Diaz-Cartelle will lead the development and execution

of the clinical strategy of the Company, including its planned clinical trials for the LIBERTY® Endovascular Robotic

Surgical System in the U.S., the medical affairs activity, and will be an integral part of the team leading its regulatory process

with the FDA and commercial efforts.

Most

recently, from May 2022 to November 2023, Dr. Diaz-Cartelle served as the Executive Medical Director at Haemonetics Corporation (NYSE:

HAE), where he advised that company on new investments in the cardiovascular space, among other responsibilities. Prior to that,

from June 2008 to May 2022, Dr. Diaz-Cartelle served as the Senior Medical Director for the Peripheral Interventional Division (Endovascular

and Interventional Oncology) at Boston Scientific Corporation (NYSE: BSX), where he played a pivotal part in the development

of global clinical strategy and study oversight, supporting commercial activities and future pipeline development.

Dr.

Diaz-Cartelle obtained his medical degree at the University of Navarra (Spain) and completed his specialty as Angiologist and Vascular

Surgeon at Hospital General Universitario Gregorio Maranon in Madrid (Spain).

The

Company entered into an employment agreement (the “Agreement”), effective as of December 1, 2023, with Dr. Diaz-Cartelle,

to serve as CMO on an indefinite basis subject to the termination provisions described in the Agreement. Pursuant to the terms of the

Agreement, Dr. Diaz-Cartelle shall receive an annual base salary (the “Base Salary”) of $350,000, which shall be reviewed

on an annual basis by the Company’s Compensation Committee (the “Compensation Committee”), which may provide for increases

as it may determine, taking into account such performance metrics and criteria of Dr. Diaz-Cartelle and the Company in its sole discretion.

Dr.

Diaz-Cartelle shall also be entitled to receive a target annual cash bonus, based on corporate performance factors established and assessed

by the Compensation Committee, of up to a maximum amount of 30% of his annual Base Salary.

Dr.

Diaz-Cartelle shall be further granted 10-year options to purchase 25,000 shares of common stock of the Company pursuant to the Company’s

2020 Omnibus Performance Award Plan, as amended, which shall have an exercise price per share based on the closing price of the Company’s

common stock on the date of grant, expected December 1, 2023, and which shall vest in total over three years. He shall also be entitled

to receive additional incentive equity awards on an annual basis at the discretion of the Compensation Committee.

Subject

to the terms and conditions of the Agreement, either the Company or Dr. Diaz-Cartelle shall have the right to earlier terminate Dr. Diaz-Cartelle’s

employment at any time for any reason or no reason upon at least one month prior written notice.

The

Company may terminate the Agreement for “Cause” (as defined in the Agreement) at any time by written notice, subject to Dr.

Diaz-Cartelle’s right to cure as provided in the Agreement. Upon Dr. Diaz-Cartelle’s termination of employment for Cause,

or if Executive shall terminate without Good Reason (as defined below), Dr. Diaz-Cartelle shall forfeit the right to receive any and

all further payments under the Agreement, other than the right to receive any compensation then due and payable to him through to the

date of termination.

Dr.

Diaz-Cartelle may terminate the Agreement with “Good Reason” (as defined in the Agreement) at any time by written notice,

subject to the Company’s right to cure as provided in the Agreement. In the event of the termination of Dr. Diaz-Cartelle’s

employment by the Company without Cause or upon Dr. Diaz-Cartelle’s voluntary termination of his employment for Good Reason, (i)

all amounts of Base Salary accrued but unpaid as of the termination date shall be paid by the Company within thirty days following the

date of termination, (ii) an amount equal to the Base Salary on the date of termination for a period of one month (in the event such

termination is on or prior to the one year anniversary of the Agreement) or two months (in the event such termination is subsequent to

the one year anniversary of the Agreement) shall be paid by the Company in twelve equal monthly installments, (iii) the dollar value

of unused and accrued vacation days shall be paid by the Company; and (iv) applicable premiums (inclusive of premiums for his dependents)

shall be paid by the Company pursuant to the Consolidated Omnibus Budget Reconciliation Act of 1986, as amended, for twelve (12) months

from the date of termination for any benefits plan sponsored by the Company.

The

Company may terminate the Agreement as a result of any mental or physical disability or illness which results in (i) Dr. Diaz-Cartelle

being unable to substantially perform his duties for a continuous period of 150 days or for periods aggregating 180 days within any period

of 365 days or (ii) Dr. Diaz-Cartelle being subject to a permanent or indefinite inability to perform essential functions based on the

reasonable opinion of a qualified medical provider chosen in good faith by the Company. Termination will be effective on the date designated

by the Company, and Dr. Diaz-Cartelle will be paid any unpaid earned Base Salary, earned target bonus (if any), reimbursement of business

expenses and accrued vacation, if any, and benefits through the date of termination.

The

Agreement contains customary non-competition and non-solicit provisions pursuant to which Dr. Diaz-Cartelle agrees not to compete and

solicit with the Company. Dr. Diaz-Cartelle also agreed to customary terms regarding non-disparagement, confidentiality and ownership

of intellectual property.

The

foregoing description of the Agreement does not purport to be complete and is qualified in its entirety by reference to the copy of the

Agreement, which is attached hereto as Exhibit 10.1 and which is incorporated herein by reference.

Item

7.01 Regulation FD Disclosure.

On

November 21, 2023, the Company issued a press release announcing the appointment of Dr. Diaz-Cartelle as CMO, effective as of December

1, 2023.

The

press release, which is furnished as Exhibit 99.1 to this Current Report on Form 8-K, is incorporated herein by reference. The information

in this Item 7.01 and Exhibit 99.1 is being furnished and shall not be deemed to be “filed” for the purposes of Section 18

of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section. This report will not be

deemed an admission as to the materiality of any information in this Item 7.01 or Exhibit 99.1.

Item 9.01 Financial Statements and Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned thereunto duly authorized.

| |

MICROBOT

MEDICAL INC. |

| |

|

|

| |

By: |

/s/

Harel Gadot |

| |

Name: |

Harel

Gadot |

| |

Title: |

Chief

Executive Officer, President and Chairman |

| |

|

|

| Date:

November 21, 2023 |

|

|

Exhibit

10.1

EMPLOYMENT

AGREEMENT

EMPLOYMENT

AGREEMENT (the “Agreement”), effective as of December 1, 2023 (the “Effective Date”), by and between Microbot

Medical Inc., a corporation organized and existing under the laws of the State of Delaware (the “Company”), and Dr. Juan

Diaz-Cartelle (the “Executive”).

WITNESSETH:

WHEREAS,

the Company is desirous of securing the Executive’s services and the Executive is willing to provide such services, upon the terms

and subject to the conditions hereinafter set forth.

NOW,

THEREFORE, for and in consideration of the mutual covenants contained herein, the parties hereto agree as follows:

1.

EMPLOYMENT OF EXECUTIVE. Subject to the terms and conditions of this Agreement, the Company hereby agrees to employ the Executive,

and the Executive hereby accepts employment in the position of Chief Medical Officer.

2.

DUTIES. The Executive shall render, as an employee, professional services as the Chief Medical Officer of the Company, responsible

among other matters for (a) working with the Company’s research and development team, regulatory team and consultants and clinical

sites to ensure clinical efforts to achieve successful regulatory submission are being properly executed, (b) working with the Company’s

commercial team, business development team, research and development team, and Medical Advisory Board to establish and execute ultimate

product definitions to ensure adoption once the Company’s products are ready for commercialization, (d) working with the commercial

team, including the professional education team, to support the commercial plans of the Company (d) working with the Company’s

business development team to explore additional opportunities, establish networks and relationships with key opinion leaders, leading

robotics research institutes, societies, entrepreneurs, and similar entities/personal to ensure the Company to strengthen its position

in the endovascular robotic space, and (d) performing such additional duties consistent with being a Chief Medical Officer as may be

assigned to the Executive by the Chief Executive Officer from time to time, and shall comply with such reasonable policies, standards

and regulations of the Company as are from time to time established by the Company (collectively, “Duties”). The Executive

agrees to devote 100% of his time and effort to the performance of his Duties, except for customary vacations and reasonable absences

due to illness or other incapacity as set forth herein, and to perform all of his Duties to the best of his professional ability.

3.

TERM. The Executive shall be employed until terminated pursuant to the termination provisions set out in Section 12 of this Agreement

(the “Term”).

4.

PLACE OF EMPLOYMENT. Services performed by the Executive pursuant to this Agreement shall be performed at such place(s) as shall

be mutually agreeable to the Company and Employee. The Employee understands and agrees that he will be required to travel often to the

Company’s offices in the United States and Israel, and to other destinations from time to time, to fulfill the Duties.

5.

COMPENSATION. For all services rendered to the Company, the Company shall provide the Executive as total compensation a sum computed

as set forth in this Section 5.

(a)

Base Salary. The Company shall pay the Executive a base salary at the rate of Three Hundred Fifty Thousand Dollars ($350,000.00)

per year (the “Base Salary”) in accordance with the customary payroll practices of the Company applicable to senior executives.

During the Term, the compensation committee of the Board of Directors (the “Board”), or, if there be no such compensation

committee, the entire Board (in either case, the “Compensation Committee”), shall review the Executive’s Base Salary

on an annual basis and may provide for such increases thereto as it may determine, taking into account such performance metrics and criteria

of the Executive and of the Company in the Compensation Committee’s sole discretion.

(b)

Discretionary Annual Bonuses. For each calendar year during the Term, Executive shall be eligible to receive a bonus (the “Target

Bonus”), in the sole discretion of the Compensation Committee, of up to a maximum amount of thirty percent (30%) of his Base Salary

for performance at the maximum level; provided, however, that Executive must be employed by the Company as of December 31st of the year

to which the Target Bonus relates in order to be paid the Target Bonus. The calculation of the Target Bonus shall be based upon corporate

performance factors established and assessed by the Compensation Committee that will take into account the performance of Executive based

on the achievement of Executive’s objectives agreed to with the Compensation Committee for a particular year. The Target Bonus

shall be paid in a lump sum cash payment as soon as reasonably practicable following December 31st of the year to which the Target Bonus

relates.

(c)

Option Grant. As soon as reasonably practicable following the Effective Date, the Company shall grant to the Executive options

to purchase Twenty Five Thousand (25,000) shares of the common stock of the Company (the “Option Grant”), subject and pursuant

to the Company’s 2020 Omnibus Performance Award Plan, as amended. The Company shall deliver an award agreement to the Executive

that sets forth the terms and conditions of the Option Grant, based on the recommendations and approval of the Compensation Committee

of the Board, including vesting and term. The executive shall be entitled to receive additional incentive equity awards on an annual

basis in the discretion of the Compensation Committee.

6.

VACATION/SICK TIME. The Executive shall be entitled to vacation time in accordance with the Company’s policies in effect

from time to time, with full pay, of four (4) weeks (twenty (20) working days), during each full year of Executive’s employment.

The scheduling of any vacation shall be coordinated with the Company so that the staffing needs of the Company are met to the extent

reasonable possible. The Executive may accumulate up to one

(1)

year of unused vacation time; any unused vacation time above such limit, as shall be calculated at the end of each calendar year, shall

be forfeited, subject to applicable law. The Executive shall be granted sick time in accordance with the Company’s policy in effect

from time to time.

7.

REIMBURSEMENT OF BUSINESS EXPENSES. The Company shall reimburse the Executive for expenses reasonably incurred during the course

of Executive’s employment. Such reimbursement shall be made in accordance with Company policies in effect from time to time upon

presentation of receipts and such other additional substantiation and justification satisfactory to the Company for expenses actually

incurred in connection with the foregoing.

8.

ADDITIONAL BENEFITS. The Executive shall be eligible to participate in the Company’s benefits plans available to its employees

from time to time in accordance with the terms and conditions of such plans. The Company reserves the right to alter, amend, replace

or discontinue the benefit plans it makes available to its employees (including the Executive), at any time, with or without notice.

9.

COMPANY PROPERTY DEFINED. The Executive acknowledges and understands that Company and Company subsidiary files, customer files,

legal files, legal research files, form files, forms, examples, samples, notes, drawings, designs, logos, inventions, improvements, developments,

discoveries, ideas, trade secrets and all briefs and memoranda, intellectual property and other work product or property, and all copies

thereof (collectively, the “Company Property”) are the sole and exclusive property of the Company or its subsidiary, as the

case may be; and the Company Property shall remain in the possession of the Company or its subsidiary, as the case may be, and shall

constitute the property of the Company (or subsidiary) irrespective of who prepared the Company Property. The Executive shall not remove,

photocopy, photograph or in any other manner duplicate or remove said Company Property other than in the performance of his Duties for

or on behalf of the Company. The provisions of this Section 9 shall survive the termination of this Agreement and the Executive’s

employment with the Company.

10.

DISPOSITION OF PROPERTY UPON TERMINATION OF EMPLOYMENT. In the event the employment of the Executive with the Company is terminated,

the Executive shall promptly return to the Company all Company Property in his possession or control, and the Executive shall have no

right, title or interest in the same. The provisions of this Section 10 shall survive the termination of this Agreement and the Executive’s

employment with the Company.

11.

OWNERSHIP OF PATENTS AND INTELLECTUAL PROPERTY.

(a)

Any work prepared for the Company or its subsidiary during the course of the Executive’s employment by the Company that is eligible

for copyright, patent and/or trademark protection under the laws of the United States or any other country (including the State of Israel)

and any proprietary know-how developed by Executive (solely or jointly with others) while rendering services for or on behalf of the

Company will vest in the Company. Executive hereby grants, transfers and assigns all right, title and interest in such work and all copyrights,

patents and trademarks in such work and all renewals and extensions thereof to the Company, all of which shall be deemed a work for hire

for the Company under the U.S. Copyright Act to the fullest extent permitted under the law, and Executive shall provide all assistance

reasonably requested by the Company in the establishment, preservation and enforcement of the Company’s copyright, patents and

trademarks in such work, such assistance to be provided at the Company’s expense but without any additional compensation to Executive.

If the Company cannot, after reasonable effort, secure Executive’s signature on any documents needed to apply for or prosecute

any patent, copyright, trademark or other right or protection relating to an invention, whether because of Executive’s physical

or mental incapacity or for any other reason whatsoever, Executive hereby irrevocably designates and appoints the Company and its duly

authorized officers and agents as Executive’s agent and attorney-in-fact, to act for and on Executive’s behalf and in Executive’s

name and stead for the purpose of executing and filing any such application or applications and taking all other lawfully permitted actions

to further the prosecution and issuance of patents, copyrights, trademarks or similar protections thereon, with the same legal force

and effect as if executed by Executive.

(b)

Executive agrees that all right, title, and interest in and to any and all copyrightable material, notes, records, drawings, designs,

logos, inventions, improvements, developments, discoveries, ideas and trade secrets conceived, discovered, authored, invented, developed

or reduced to practice by Executive, solely or in collaboration with others, during the period of time Executive is in the employ of

the Company (including during off-duty hours), or with the use of Company’s equipment, supplies, facilities, or Company Confidential

Information, and any copyrights, patents, trade secrets, mask work rights or other intellectual property rights relating to the foregoing

(collectively, “Inventions”), are the sole property of the Company. The Executive also agrees to promptly make full written

disclosure to the Company of any Inventions, and to deliver and assign and hereby irrevocably assigns fully to the Company all of Executive’s

right, title and interest in and to Inventions. The executive agrees that this assignment includes a present conveyance to the Company

of ownership of Inventions that are not yet in existence.

(c)

The provisions of this Section 11 shall survive the termination of this Agreement and the Executive’s employment with the Company.

12.

TERMINATION OF EMPLOYMENT. The employment of the Executive may be terminated as follows:

(a)

Termination on Notice. Subject to the remaining clauses of this Section 12, either party shall have the right to earlier terminate

Executive’s employment under this Agreement at any time for any reason or no reason upon at least one (1) month prior written notice.

In the event that the Company or Executive gives notice to terminate pursuant to the foregoing sentence, the Company may elect to have

Executive cease working immediately so long as the Company continues to pay Executive’s Base Salary in accordance with the provisions

of Section (5)(a) for the entire one (1) month notice period (such payment, the “Continuation Pay”). In the event the Company

elects to have Executive immediately cease working during the one (1) month notice period as provided in the foregoing sentence and Executive

finds alternative employment that is not in violation of any provision herein, including, without limitation, Section 13 hereof, Executive

may accept and engage in the alternative employment without forfeiting the Continuation Pay.

(b)

Termination by the Company for Cause. The Company may terminate this Agreement and the Executive’s employment hereunder

for Cause (as defined below), effective upon delivery of written notice (the “Termination Notice”) to the Executive given

at any time during the Term. For purposes of this Agreement, “Cause” shall mean the Executive’s: (i) conviction of

any felony or any other crime involving dishonesty or moral turpitude; (ii) commission of any act of fraud or dishonesty, or theft of

or maliciously intentional damage to the property of the Company or any of its subsidiaries or affiliates; (iii) willful or intentional

breach of his fiduciary duties to the Company or of any Company policy, plan or code then in effect; or (iv) breach of any material provision

of this Agreement. Notwithstanding the foregoing, prior to any termination by the Company of the Executive’s employment for Cause,

the Executive shall first have an opportunity to cure or remedy such act of default within ten (10) days following the Termination Notice,

or if the remedy cannot reasonably be cured or remedied within such ten (10) day period but can reasonably be cured or remedied within

forty five (45) days following the Termination Notice, the Executive may cure or remedy such act of default with forty five (45) days

provided that the Executive diligently pursues such cure or remedy promptly following the Termination Notice, and in either such case

such Termination Notice shall then become null and void.

(c)

Termination by the Executive for Good Reason. The Executive may terminate this Agreement and Executive’s employment hereunder

with Good Reason (as defined below) effective upon delivery of a Termination Notice to the Company given at any time during the Term.

For purposes of this Agreement, “Good Reason” shall mean: (i) the material reduction of the Executive’s title, authority,

Duties and responsibilities; (ii) any reduction in Base Salary of the Executive; or (iii) breach of any material provision of this Agreement

by the Company. Notwithstanding the foregoing, prior to any termination by the Executive of the Executive’s employment for Good

Reason, the Company shall first have an opportunity to cure or remedy such act of default within ten (10) days following the Termination

Notice, or if the remedy cannot reasonably be cured or remedied within such ten (10) day period but can reasonably be cured or remedied

within forty five (45) days following the Termination Notice, the Company may cure or remedy such act of default with forty five (45)

days provided that the Company diligently pursues such cure or remedy promptly following the Termination Notice, and in either such case

such Termination Notice shall then become null and void.

(d)

Termination by Death. If the Executive dies while employed under this Agreement, this Agreement shall terminate immediately and

the Company shall pay to the Executive’s estate any earned Base Salary, earned Target Bonus (if any), reimbursement of business

expenses and accrued vacation, if any, that is unpaid up to the date of his death.

(e)

Termination by Disability. The Company may terminate this Agreement as a result of any mental or physical disability or illness

which results in (i) the Executive being unable to substantially perform his duties for a continuous period of 150 days or for periods

aggregating 180 days within any period of 365 days or (ii) the Executive being subject to a permanent or indefinite inability to perform

essential functions based on the reasonable opinion of a qualified medical provider chosen in good faith by the Company. Termination

will be effective on the date designated by the Company, and the Executive will be paid any unpaid earned Base Salary, earned Target

Bonus (if any), reimbursement of business expenses and accrued vacation, if any, and benefits as set out in Section 8 through the date

of termination.

(f)

Payment upon Termination for Cause or without Good Reason. Upon Executive’s termination of employment for Cause, or if Executive

shall terminate without Good Reason, Executive shall forfeit the right to receive any and all further payments hereunder, other than

the right to receive any compensation then due and payable to the Executive pursuant to Section 5 hereof through to the date of termination.

(g)

Payment Upon Termination without Cause or for Good Reason. In the event of the termination of the Executive’s employment

by the Company without Cause or upon the Executive’s voluntary termination of her employment for Good Reason, (i) all amounts of

Base Salary accrued but unpaid as of the termination date shall be paid by the Company within thirty (30) days following the date of

termination, (ii) an amount equal to the Executive’s Base Salary on the date of termination for a period of one (1) month (in the

event such termination is on or prior to the one (1) year anniversary of the Effective Date) or two (2) months (in the event such termination

is subsequent to the one (1) year anniversary of the Effective Date) shall be paid by the Company in twelve (12) equal monthly installments,

(iii) the dollar value of unused and accrued vacation days; and (iv) applicable premiums (inclusive of premiums for Executive’s

dependents) shall be paid by the Company pursuant to the Consolidated Omnibus Budget Reconciliation Act of 1986, as amended, for twelve

(12) months from the date of termination for any benefits plan sponsored by the Company.

(h)

Deferred Compensation. This Agreement is intended to comply with or be exempt from Section 409A of the Internal Revenue Code of

1986, as amended (the “Code”) and will be interpreted, administered and operated in a manner consistent with that intent.

Notwithstanding anything herein to the contrary, if at the time of the Executive’s separation from service with the Company he

is a “specified employee” as defined in Section 409A of the Code (and the regulations thereunder) and any payments or benefits

otherwise payable hereunder as a result of such separation from service are subject to Section 409A of the Code, then the Company will

defer the commencement of the payment of any such payments or benefits hereunder (without any reduction in such payments or benefits

ultimately paid or provided to the Executive) until the date that is six months following the Executive’s separation from service

with the Company (or the earliest date as is permitted under Section 409A of the Code), and the Company will pay any such delayed amounts

in a lump sum at such time. If any other payments of money or other benefits due to the Executive hereunder could cause the application

of an accelerated or additional tax under Section 409A of the Code, such payments or other benefits shall be deferred if deferral will

make such payment or other benefits compliant under Section 409A of the Code, or otherwise such payment or other benefits shall be restructured,

to the extent possible, in a manner, determined by the Company, that does not cause such an accelerated or additional tax. To the extent

any reimbursements or in-kind benefits due to the Executive under this Agreement constitute “deferred compensation” under

Section 409A of the Code, any such reimbursements or in-kind benefits shall be paid to the Executive in a manner consistent with Treas.

Reg. Section 1.409A-3(i)(1)(iv). Each payment made under this Agreement shall be designated as a “separate payment” within

the meaning of Section 409A of the Code. References to “termination of employment” and similar terms used in this Agreement

are intended to refer to “separation from service” within the meaning of Section 409A of the Code to the extent necessary

to comply with Section 409A of the Code. Whenever a payment under this Agreement may be paid within a specified period, the actual date

of payment within the specified period shall be within the sole discretion of the Company. In no event may the Executive, directly or

indirectly, designate the calendar year of any payment to be made under this Agreement. Any provision in this Agreement providing for

any right of offset or set-off by the Company shall not permit any offset or set-off against payments of “non-qualified deferred

compensation” for purposes of Section 409A of the Code or other amounts or payments to the extent that such offset or set-off would

result in any violation of Section 409A or adverse tax consequences to the Executive under Section 409A.

(i)

Parachute Payments. In the event that the severance and other benefits provided to the Executive pursuant to this Agreement (A)

constitute “parachute payments” within the meaning of Section 280G of the Code and (B) but for this Section 12, such severance

and benefits would be subject to the excise tax imposed by Section 4999 of the Code, then the Executive’s severance benefits under

this Section shall be payable either: (y) in full, or (z) as to such lesser amount which would result in no portion of such severance

and other benefits being subject to excise tax under Section 4999 of the Code, whichever of the foregoing amounts, taking into account

the applicable federal, state and local income taxes and the excise tax imposed by Section 4999, results in the receipt by the Executive

on an after-tax basis, of the greatest amount of severance benefits under this Agreement. Unless the Company and the Executive otherwise

agree in writing, any determination required under this Section 12(i) shall be made in writing by independent public accountants reasonably

agreed to by the Company and the Executive (the “Accountants”), whose determination shall be conclusive and binding upon

the Executive and the Company for all purposes. For purposes of making the calculations required by this Section 12(i), the Accountants

may make reasonable assumptions and approximations concerning applicable taxes and may rely on reasonable, good faith interpretations

concerning the application of Section 280G and 4999 of the Code. The Company and the Executive shall furnish to the Accountants such

information and documents as the Accountants may reasonably request in order to make a determination under this Section. The Company

shall bear all costs the Accountants may reasonably incur in connection with any calculations contemplated by this Section 12(i).

13.

RESTRICTIVE COVENANTS.

(a)

Noncompetition. During the Term and for the twelve (12) month period immediately following the termination of employment, regardless

of the reason for such termination and regardless whether this Agreement has terminated or expired (the “Restricted Period”),

Executive shall not, directly or indirectly: (i) engage in, manage, operate, control, supervise, or participate in the management, operation,

control or supervision of any company or entity that competes with any business of the Company or any of its subsidiaries (a “Competitor”,

as further defined below) or serve as an employee, consultant or in any other capacity for a Competitor; (ii) have any ownership or financial

interest, directly, or indirectly, in any Competitor including, without limitation, as an individual, partner, shareholder (other than

as a shareholder of a publicly-owned corporation in which the Executive owns less than two percent (2%) of the outstanding shares of

such corporation), officer, director, employee, principal, agent or consultant; or (iii) serve as a representative of any Competitor.

For the purposes of this Agreement, “Competitor” shall further mean any company or entity, whether located in the United

States, the State of Israel or elsewhere, that engages in the research, design, or development of: (i) robotic endoluminal surgery devices;

or (ii) other developments that the Company will execute from any of its assets.

(b)

Non-Solicitation; No-Hire. Executive acknowledges and agrees that during the Restricted Period he shall not, directly or indirectly,

other than in connection with carrying out his duties hereunder, (i) solicit or induce any employee or consultant of the Company (or

any individual who was an employee or consultant of the Company at any time during the 12-month period preceding any such solicitation

or inducement) to (A) terminate his or his employment or relationship with the Company, and/or (B) work for the Executive or any Competitor,

or (ii) hire, or be involved in the process of any business, entity or division in hiring, any employee or consultant of the Company

(or any individual who was an employee or consultant of the Company at any time during the 12-month period preceding any such hiring).

(c)

Non-Solicitation of Clients. Executive acknowledges and agrees that during the Restricted Period he shall not, directly or indirectly,

solicit, take away or divert, or attempt to solicit, take away or divert, the business or patronage of any client or customer of the

Company with the intention or for the purpose of providing services that compete with the services provided by the Company at the time

of Executive’s termination.

(d)

Disparaging Comments. Executive agrees not to make critical, negative or disparaging remarks about the Company or its management,

business or employment practices; provided that nothing in this Section 13(d) shall be deemed to prevent the Executive from responding

fully and accurately to any question, inquiry or request for information when required by applicable law or legal process, or to enforce

this Agreement. The Company and its officers and directors shall not make critical, negative or disparaging remarks about the Executive;

provided that nothing in this Section 13(d) shall be deemed to prevent the Company or its officers or directors from (i) responding fully

and accurately to any question, inquiry or request for information when required by applicable law or legal process, (ii) complying with

the disclosure requirements under the federal securities laws or any applicable stock exchange or quotation system, or (iii) to enforce

this Agreement.

(e)

Confidentiality. The Executive acknowledges and agrees that the Company’s business is highly competitive and that the Executive

will be involved in and become aware of the Company’s trade secrets, materials, know-how (whether or not in writing), technology,

product information and intellectual property belonging to the Company (“Trade Secrets”) and all confidential matters (whether

available in written, electronic form or orally) relating to the Company and its business (including without limitation its strategies,

models, business and marketing plans, pricing, sales and revenue information, financial performance, etc.), and personal and other confidential

information relating to its owners, directors, officers, investors, shareholders, executives and employees (the “Confidential Information”),

all of which have been developed at great investment of time and resources by the Company so as to engender substantial good will, and

all of which are and will remain the exclusive property of the Company. Therefore, the Executive agrees that during the period of his

employment with the Company and at all times thereafter, Executive shall not disclose, shall keep secret, shall retain in strictest confidence

and shall not use for his benefit or the benefit of others, except in connection with the business and affairs of the Company, any Trade

Secret or Confidential Information.

(f)

Acknowledgement. Executive agrees and acknowledges that each restrictive covenant in this Section 13 is reasonable as to duration,

terms and geographical area and that the same protects the legitimate interests of the Company, imposes no undue hardship on Executive,

and is not injurious to the public.

(g)

Survival. All of the restrictive covenants contained in this Section 13 shall be binding on the assigns, executors, administrators

and other legal representatives of the Executive, and shall survive the termination of this Agreement and Executive’s employment.

14.

INJUNCTIVE RELIEF. The Executive acknowledges that the precise value of the covenants in Section 13 are difficult to evaluate

and that no accurate measure of liquidated damages could possibly be established and therefore, in the event of a breach or threatened

breach of such provisions, the Company shall be entitled to temporary and permanent injunctive relief (without the position of a bond

or other security) restraining Executive from such breach or threatened breach. Notwithstanding anything to the contrary herein, if any

applicable law or governmental entity shall reduce the time period or scope during which the Executive shall be prohibited from engaging

in any competitive or soliciting activity described in Section 13, the period of time or scope, as the case may be, for which the Executive

shall be prohibited shall be reduced to the maximum time or scope permitted by law.

15.

NOTICES. Any notice required or permitted to be given pursuant to the provisions of this Agreement shall be sufficient if in writing,

and if personally delivered to the party to be notified or if sent by registered or certified mail to said party at the following addresses:

| If

to the Company: |

Microbot

Medical Inc. |

| |

288

Grove Street, Suite 388 |

| |

Braintree,

Massachusetts 02184

Attn:

Board of Directors |

| |

|

| With a copy to (which shall not constitute notice): |

| |

Ruskin

Moscou Faltischek, P.C.

1425

RXR Plaza |

| |

East

Tower, 15th Floor

Uniondale,

New York 11556

Attn:

Stephen E. Fox, Esq. |

| |

|

| If

to the Executive: |

Dr.

Juan Diaz-Cartelle

91

Leonard Street

Apt.

4F |

| |

New

York, New York 10013 |

16.

SEVERABILITY. In the event any portion of this Agreement is held to be invalid or unenforceable, the invalid or unenforceable

portion or provision shall not affect any other provision hereof and this Agreement shall be construed and enforced as if the invalid

provision had not been included.

17.

BINDING EFFECT. This Agreement shall inure to the benefit of and shall be binding upon the Company and upon any person, firm or

entity with which the Company may be merged or consolidated or which may acquire all or substantially all of the Company’s assets

through sale, lease, liquidation or otherwise. The rights and benefits of the Executive are personal to him and no such rights or benefits

shall be subject to assignment or transfer by Executive.

18.

GOVERNING LAW, VENUE, INTERPRETATION OF LANGUAGE. The parties agree that this Agreement shall be governed by the laws of the Commonwealth

of Massachusetts, without regard to conflict of laws principles, and that venue for any action between the parties that arises out of

this Agreement shall be in Suffolk County, Commonwealth of Massachusetts. In the event an ambiguity or question of intent or interpretation

arises, this Agreement shall be construed as if drafted jointly by the parties and no presumption or burden of proof shall arise favoring

or disfavoring any party by virtue of the authorship of any of the provisions of this Agreement. “Dollars’ and “$”

shall mean United States dollars.

19.

AMENDMENT AND MODIFICATION. All terms, conditions and provisions of this Agreement shall remain in full force and effect unless

modified, changed, altered or amended, in writing, executed by both parties.

20.

INDEPENDENT LEGAL ADVICE. The Executive acknowledges that he has been advised to seek independent legal counsel in respect of

the Agreement and the matters contemplated herein. To the extent that he declines to receive independent legal counsel in respect of

the Agreement, he waives the right, should a dispute later develop, to rely on his lack of independent legal counsel to avoid his obligations,

to seek indulgences from the Company or to otherwise attack the integrity of the Agreement and the provisions thereof, in whole or in

part.

21.

COUNTERPARTS. This Agreement may be executed in any number of counterparts, each of which shall be deemed to be an original as

against any party whose signature appears thereon, and all of which shall together constitute one and the same instrument. This Agreement

shall become binding when one or more counterparts hereof, individually or taken together, shall bear the signatures of all of the parties

reflected hereon as the signatories. Delivery of an executed counterpart of this Agreement electronically or by facsimile shall be effective

as delivery of an original executed counterpart of this Agreement.

22.

ENTIRE AGREEMENT. This Agreement constitutes the entire agreement between the parties and supersedes and replaces any prior agreement;

and there are no other agreements between the parties with respect to the subject matter contained herein except as set forth herein.

[Signatures

follow on next page]

IN

WITNESS WHEREOF, the parties hereto have set their hands and seals effective on the day and year first above written.

| |

Microbot

Medical Inc. |

| |

|

|

| |

/s/

Harel Gadot |

| |

Name: |

Harel

Gadot |

| |

Title: |

CEO,

President and Chairman |

| |

|

|

| |

/s/

Juan Diaz-Cartelle |

| |

Dr.

Juan Diaz-Cartelle |

| |

November

15, 2023 |

Exhibit

99.1

Microbot

Medical Appoints Seasoned Medical Expert Dr. Juan Diaz-Cartelle as its New Chief Medical Officer in Anticipation of Its Clinical,

Regulatory and Commercial Activities

The

former Senior Medical Director for the Peripheral Interventions Division at Boston Scientific Corporation joins the Company as

it transitions to the clinical and regulatory phase.

BRAINTREE,

Mass., November 21, 2023 – Microbot Medical Inc. (Nasdaq: MBOT), developer of the innovative LIBERTY® Endovascular

Robotic Surgical System, today announced the appointment of Dr. Juan Diaz-Cartelle as its new Chief Medical Officer (CMO), effective

December 1, 2023. The hiring of Dr. Diaz-Cartelle, a U.S.-based physician, coincides with the transition of the Company focusing mainly

on research and development in Israel to the Company increasing its U.S.-based activities, which includes its planned clinical

trials for the LIBERTY® Endovascular Robotic Surgical System in the U.S., the regulatory process with the

FDA and establishing the commercial foundations to enter the U.S market.

Dr.

Diaz-Cartelle brings to Microbot a wealth of experience in the endovascular and interventional space, along with an impressive track

record in clinical research.

Before

joining the Company, Dr. Diaz-Cartelle served for 14 years as the Senior Medical Director for the Peripheral Interventional Division

(Endovascular and Interventional Oncology) at Boston Scientific Corporation. In this role, he played a pivotal part in

the development of global clinical strategy and study oversight, supporting commercial activities and future pipeline development. Most

recently he served as the Executive Medical Director at Haemonetics Corporation, where he advised the company on new investments

in the cardiovascular space, among other responsibilities. Before joining the corporate life, he worked at NYU as a research scientist.

“We

are fortunate to have Dr. Diaz-Cartelle join our team, especially with his extensive experience in the endovascular and interventional

space. Dr. Diaz-Cartelle’s appointment is a testament to our commitment to excellence in our transition to the clinical and regulatory

phase, especially as we are approaching our IDE submission and our upcoming clinical trial in the U.S.,” said Harel Gadot, Chairman,

President & CEO of Microbot Medical. “His deep knowledge in clinical trial management, as well as leading medical affairs activities,

will be invaluable as we work towards FDA clearance and continue to set new standards in robotic surgery.”

“I’m

thrilled to join Microbot at this stage, as through my career, and especially over the past few years, I became a true believer in the

role of robotics in the endovascular space,” said Dr. Diaz-Cartelle. “I’m looking forward to being

part of the team that supports the clinical trials and eventually the commercialization of the LIBERTY System, and to bring added value

to physicians, patients and healthcare systems globally.”

Dr.

Diaz-Cartelle succeeds Dr. Eyal Morag, the Company’s previous CMO, who was based out of Israel and played an integral part of the

development and testing of the LIBERTY Endovascular Robotic System from its inception phase. The Company is grateful for Dr. Morag’s

vast contribution to the Company over the years and wishes him success in his next ventures.

About

Microbot Medical

Microbot

Medical Inc. (NASDAQ: MBOT) is a pre-clinical medical device company that specializes in transformational micro-robotic technologies,

with the goals of improving clinical outcomes for patients and increasing accessibility through the natural and artificial lumens within

the human body.

The

LIBERTY Endovascular Robotic Surgical System aims to improve the way surgical robotics are being used in endovascular procedures today,

by eliminating the need for large, cumbersome, and expensive capital equipment, while reducing radiation exposure and physician strain.

The Company believes the LIBERTY Endovascular Robotic Surgical System’s remote operation has the potential to be the first system

to democratize endovascular interventional procedures.

Further

information about Microbot Medical is available at http://www.microbotmedical.com.

Safe

Harbor

Statements

to future financial and/or operating results, future growth in research, technology, clinical development, and potential opportunities

for Microbot Medical Inc. and its subsidiaries, along with other statements about the future expectations, beliefs, goals, plans, or

prospects expressed by management, constitute forward-looking statements within the meaning of the Private Securities Litigation Reform

Act of 1995 and the Federal securities laws. Any statements that are not historical fact (including, but not limited to statements that

contain words such as “will,” “believes,” “plans,” “anticipates,” “expects”

and “estimates”) should also be considered to be forward-looking statements. Forward-looking statements involve risks and

uncertainties, including, without limitation, market conditions, risks inherent in the development and/or commercialization of potential

products, including LIBERTY, the outcome of its studies to evaluate LIBERTY, whether the Company’s core business focus program

and cost reduction plan are sufficient to enable the Company to continue to focus on its LIBERTY technology while it stabilizes its financial

condition and seeks additional working capital, any failure or inability to recruit physicians and clinicians to serve as primary investigators

to conduct regulatory studies which could adversely affect or delay such studies, uncertainty in the results of pre-clinical and clinical

trials or regulatory pathways and regulatory approvals, disruptions resulting from new and ongoing hostilities between Israel and the

Palestinians, such as employees of Microbot and its vendors and business partners being called to active military duty, any lingering

uncertainty resulting from the COVID-19 pandemic, need and ability to obtain future capital, and maintenance of intellectual property

rights. Additional information on risks facing Microbot Medical can be found under the heading “Risk Factors” in Microbot

Medical’s periodic reports filed with the Securities and Exchange Commission (SEC), which are available on the SEC’s web

site at www.sec.gov. Microbot Medical disclaims any intent or obligation to update these forward-looking statements, except as required

by law.

Investor

Contact:

Michal

Efraty

+972-(0)52-3044404

IR@microbotmedical.com

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

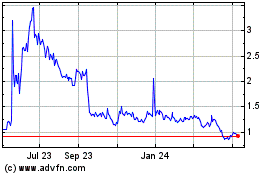

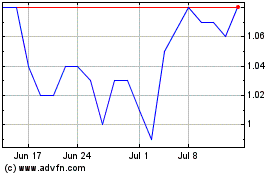

Microbot Medical (NASDAQ:MBOT)

Historical Stock Chart

From Jul 2024 to Jul 2024

Microbot Medical (NASDAQ:MBOT)

Historical Stock Chart

From Jul 2023 to Jul 2024