UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO

RULE 13a-16 OR 15d-16 UNDER THE

SECURITIES EXCHANGE ACT OF 1934

For the Month of January 2024

Commission

file number 001- 41291

Meihua

International Medical Technologies Co., Ltd.

(Translation of registrant’s name into English)

88 Tongda Road, Touqiao Town

Guangling District, Yangzhou, 225000

People’s Republic of China

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F:

Form 20-F ☒

Form 40-F ☐

Other Events

As previously disclosed on our Current Report on Form 6-K, dated December

28, 2023 (the “December 28 Current Report”), on December 27, 2023, Meihua International Medical Technologies Co., Ltd., a

Cayman Islands exempted company with limited liability (the “Company”), entered into a securities purchase agreement (the

“SPA”) with certain institutional investors (the “Investors”), pursuant to which the Company agreed to issue and

sell, from time to time, up to $50,500,0000 in the Company’s securities (the “Offering”), consisting of senior convertible

notes, issuable at a 7.0% original issue discount (the “Notes”), and accompanying ordinary share purchase warrants (the “Warrants”)

with five-year terms and exercisable for a number of the Company’s ordinary shares, par value $0.0005 per share (the “Ordinary

Shares”), equal to 50% of the number obtained from dividing each Note’s principal value by the applicable VWAP (as defined

in the SPA) subject to adjustment pursuant and a 4.99% beneficial ownership limitation. The Company also agreed to sell to the Investors

at the initial closing of the Offering (the “First Closing”) $6,000,000 in Notes (the “Registered Notes”), convertible

at the lower of (i) $2.738 per share (or 110% of the VWAP of the Ordinary Shares on December 27, 2023) or (ii) a price per share equal

to 95% of the lowest VWAP of the Ordinary Shares during the seven trading day period immediately preceding the applicable conversion date,

subject to certain adjustments and a 4.99% beneficial ownership limitation, and Warrants exercisable for up to an aggregate of 1,205,255

Ordinary Shares, at an exercise price of $2.9869 per share (or 120% of the VWAP of the Ordinary Shares on December 27, 2023) (the “First

Warrants”). The terms of the SPA, Registered Notes and First Warrants are further described in our December 28 Current Report.

On January 2, 2024, the Company and the Investors

closed on the First Closing, at which time the Registered Notes were issued pursuant to a prospectus supplement to our effective shelf

registration statement on Form F-3, as amended (File No. 333-274194), which was declared effective on September 29, 2023, and the First

Warrants were issued in a concurrent private placement pursuant to an exemption from registration under Section 4(a)(2) and Regulation

D of the Securities Act of 1933, as amended.

As also previously disclosed in the December 28

Current Report, the Notes do not bear interest except upon the occurrence of an event of default thereunder, have 364-day maturity dates,

must be redeemed by the Company at a premium in the event of (i) a Subsequent Financing (as defined in the SPA), (ii) a Change of Control

(as defined in the SPA) and (iii) certain equity conditions listed therein. The Company also has the option to redeem the Notes in the

event that the Company deems it in its best interest to do so, such as if it believes an event of default under the Notes is imminent.

The Notes contain certain other covenants and events of default customary for similar transactions.

At the First Closing, the Company received gross proceeds of $5,580,000,

before expenses. Maxim Group LLC (“Maxim”) acted as the Company’s sole placement agent for the Offering and received

compensation equal to 7.0% of the gross proceeds of the First Closing. The Company also reimbursed all travel and other out-of-pocket

expenses of Maxim for $50,000, including the reasonable and accounted fees and expenses of legal counsel to Maxim.

Issuance of Press Release

On January 2, 2024, the Company issued a press release, a copy of which

is attached as Exhibit 99.1 to this Current Report on Form 6-K, announcing the closing of the sale of $6.0 million of Registered Notes

and the First Warrants .

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

Meihua International Medical Technologies Co., Ltd. |

| |

|

| Dated: January 2, 2024 |

By: |

/s/ Xin Wang |

| |

Name: |

Xin Wang |

| |

Title: |

Chief Executive Officer |

| |

|

(Principal Executive Officer) |

3

Exhibit 5.1

2 January 2024

|

Meihua International Medical Technologies Co.,

Ltd.

美华国际医疗科技有限公司 |

|

D +852 3656 6054/ +852 3656 6061 |

| |

E:nathan.powell@ogier.com/

florence.chan@ogier.com |

| |

|

| |

Reference: FYC/ACG/181505.00004 |

2 January 2024

Dear Sirs

Meihua International Medical Technologies Co.,

Ltd. 美华国际医疗科技有限公司

(the Company)

We have acted as Cayman

Islands counsel to the Company in connection with the Company’s Form 6-K to be filed by the Company with the United States

Securities and Exchange Commission (the Commission) under the United States Securities Act of 1933, as amended (the Securities

Act), on or about the date hereof. The Form relates to, among other things, the offering and sale, as set forth in the Company’s

prospectus supplement (the Prospectus Supplement) to its effective shelf registration statement on Form F-3, as amended (File

No. 333-274194), which was declared effective on 29 September 2023, of an aggregate of $6,000,000 in convertible notes of the

Company (the Convertible Notes), convertible into ordinary shares of a par value $0.0005 each (the Ordinary Shares) of

the Company. All of the Convertible Notes and the Ordinary Shares underlying the Convertible Notes (the CN Shares) are

collectively referred to as the Securities.

No opinion is expressed herein

as to any matter pertaining to the contents of the Prospectus Supplement, other than as expressly stated herein with respect to the issuance

of the Securities.

Unless a contrary intention appears, all capitalised

terms used in this opinion have the respective meanings set forth in the Documents. A reference to a Schedule is a reference to a schedule

to this opinion and the headings herein are for convenience only and do not affect the construction of this opinion.

For the purposes of giving this opinion,

we have examined originals, copies, or drafts of the following documents (the Documents):

| (a) | the certificate of incorporation of the Company dated 10 November

2020 issued by the Registrar of Companies of the Cayman Islands (the Registrar); |

| (b) | the amended and restated memorandum and articles of association

of the Company adopted by special resolutions of the Company dated 21 December 2020 (the Memorandum and Articles); |

Ogier

Providing advice on British Virgin

Islands,

Cayman Islands and Guernsey laws

Floor 11 Central Tower

28 Queen’s Road Central

Central

Hong Kong

T +852 3656 6000

F +852 3656 6001

ogier.com |

|

Partners

Nicholas Plowman

Nathan Powell

Anthony Oakes

Oliver Payne

Kate Hodson

David Nelson

Michael Snape

Justin Davis |

|

Florence Chan*

Lin Han**

Cecilia Li**

Rachel Huang**

Richard Bennett**‡

James Bergstrom‡

Marcus Leese‡

|

|

* admitted in New Zealand

** admitted in England and Wales

‡

not ordinarily resident in Hong Kong |

Page 2 of 9

| (c) | a certificate of good standing dated 28 December 2023 (the

Good Standing Certificate) issued by the Registrar in respect of the Company; |

| (d) | a copy of the register of directors and officers of the Company

as provided to us on 16 August 2023 (the ROD); |

| (e) | a copy of the certified

shareholder list of the Company as of 2 January 2024 provided to us by the Company on 2 January 2024 (the ROM, and together with

the ROD, the Registers); |

| (f) | copies of the written resolutions of all of the directors

of the Company dated 18 August 2023, 27 December 2023 and 2 January 2024, respectively (the Board Resolutions); |

| (g) | a copy of the certificate from a director of the Company dated

2 January 2024, a copy of which is attached hereto (the Director’s Certificate); and |

| (h) | the Prospectus Supplement. |

In giving this opinion we have relied

upon the assumptions set forth in this paragraph 2 without having carried out any independent investigation or verification in respect

of those assumptions:

| (a) | all original documents examined by us are authentic and complete; |

| (b) | all copy documents examined by us (whether in facsimile, electronic

or other form) conform to the originals and those originals are authentic and complete; |

| (c) | all signatures, seals, dates, stamps and markings (whether

on original or copy documents) are genuine; |

| (d) | each of the Good Standing Certificate and the Registers is

accurate and complete as at the date of this opinion; |

| (e) | the Memorandum and Articles provided to you are in full force

and effect and have not been amended, varied, supplemented or revoked in any respect; |

| (f) | the Prospectus Supplement is true and correct copies and the

Prospectus Supplement conforms in every material respect to the latest drafts of the same produced to us and, where the Prospectus Supplement

has been provided to us in successive drafts marked-up to indicate changes to such documents, all such changes have been so indicated; |

| (g) | the Board Resolutions remain in full force and effect and

have not been, and will not be, rescinded or amended, and each of the directors of the Company has acted in good faith with a view to

the best interests of the Company and has exercised the standard of care, diligence and skill that is required of him or her in approving

the transactions set out in the Board Resolutions and no director has a financial interest in or other relationship to a party of the

transactions contemplated therein which has not been properly disclosed in the Board Resolutions; |

Page 3

of 9

| (h) | neither the directors and shareholders of the Company have

taken any steps to wind up the Company or to appoint a liquidator of the Company and no receiver has been appointed over any of the Company’s

property or assets; |

| (i) | the issuance of the CN Shares will not exceed the Company’s

authorised share capital to at the time of issuance and upon the issuance of the CN Shares, the Company will receive consideration for

the full issue/conversion price thereof which shall be equal to at least the par value thereof; |

| (j) | the Company will issue the Securities in furtherance of its

objects as set out in its Memorandum; |

| (k) | the Company will have sufficient authorized but unissued share

capital to effect the issue of any of the CN Shares at the time of issuance on the conversion of any Convertible Notes; |

| (l) | the form and terms of any and all Securities, the issuance

and sale thereof by the Company, and the Company’s incurrence and performance of its obligations thereunder or in respect thereof

(including, without limitation, its obligations under any related agreement, indenture or supplement thereto) in accordance with the

terms thereof will not violate the Memorandum and the Articles nor any applicable law, regulation, order or decree in the Cayman Islands; |

| (m) | no invitation has been or will be made by or on behalf of

the Company to the public in the Cayman Islands to subscribe for any Security and none of the Securities have been offered or issued

to residents of the Cayman Islands; |

| (n) | all necessary corporate action will be taken to authorize

and approve any issuance of Securities and the terms of the offering of such Securities thereof and any other related matters and that

the applicable definitive purchase, underwriting or similar agreement will be duly approved, executed and delivered by or on behalf of

the Company and all other parties thereto; |

| (o) | upon the issue of any Ordinary Shares, the Company will receive

consideration for the full issue price thereof which shall be equal to at least the par value thereof; |

| (p) | the capacity, power and authority of all parties other than

the Company to enter into and perform their obligations under any and all documents entered into by such parties in connection with the

issuance of the Securities, and the due execution and delivery thereof by each party thereto; |

| (q) | the Company is, and after the allotment (where applicable)

and issuance of any Security will be, able to pay its liabilities as they fall due; and |

| (r) | there is no provision of the law of any jurisdiction, other

than the Cayman Islands, which would have any implication in relation to the opinions expressed herein. |

On the basis of the examinations and

assumptions referred to above and subject to the limitations and qualifications set forth in paragraph 4 below, we are of the opinion

that:

Corporate

status

| (a) | The Company has been duly incorporated as an exempted company

with limited liability and is validly existing and in good standing with the Registrar. The Company is a separate legal entity and is

subject to suit in its own name. |

Page 4

of 9

Authorised

Share capital

| (b) | The authorised share capital of the Company is US$50,000 divided

into (i) 80,000,000 Ordinary Shares with a par value of US$0.0005 each and (ii) 20,000,000 preferred shares with a par value of US$0.0005

each. |

Valid Issuance

of CN Shares

| (c) | When the Convertible Notes are converted into CN Shares under

the terms of the applicable definitive agreement (the Definitive Agreements) approved by the board of directors of the Company

(the Board) as referred to within the Prospectus Supplement, and when: |

| (i) | the Board has taken all necessary corporate action to approve the issuance and allotment of the CN Shares

and the Definitive Agreements; |

| (ii) | the terms of such security, the memorandum and articles of association then in effect or the instrument

governing such security providing for such conversion for CN Shares, as approved by the Board, have been satisfied and the consideration

approved by the Board (being not less than the par value of the CN Shares) received; and |

| (iii) | valid entry have been made in the register of members of the Company reflecting such issuance of CN Shares

as fully paid shares, |

the CN Shares will

be recognised as having been duly authorised and validly issued, fully paid and non-assessable.

| (d) | The statements contained or the opinion incorporated in the section headed “Cayman Islands Taxation”

of the Prospectus Supplement, in so far as they purport to summarise the laws or regulations of the Cayman Islands, are accurate in all

material respects and that such statements constitute our opinion.. |

| 4 | Limitations and Qualifications |

| (a) | as to any laws other than the laws of the Cayman Islands,

and we have not, for the purposes of this opinion, made any investigation of the laws of any other jurisdiction, and we express no opinion

as to the meaning, validity, or effect of references in the Prospectus Supplement to statutes, rules, regulations, codes or judicial

authority of any jurisdiction other than the Cayman Islands; |

| (b) | except to the extent that this opinion expressly provides

otherwise, as to the commercial terms of, or the validity, enforceability or effect of the Prospectus Supplement, the accuracy of representations,

the fulfilment of warranties or conditions, the occurrence of events of default or terminating events or the existence of any conflicts

or inconsistencies among the Prospectus Supplement and any other agreements into which the Company may have entered or any other documents;

or |

Page 5

of 9

| (c) | as to whether the acceptance execution or performance of the

Company’s obligations under the Prospectus Supplement or Definitive Agreements will result in the breach of or infringe any other

agreement, deed or document (other than the Memorandum and Articles) entered into by or binding on the Company. |

| 4.2 | Under the Companies Act (Revised) (Companies Act) of the Cayman Islands annual returns in respect

of the Company must be filed with the Registrar of Companies in the Cayman Islands, together with payment of annual filing fees. A failure

to file annual returns and pay annual filing fees may result in the Company being struck off the Register of Companies, following which

its assets will vest in the Financial Secretary of the Cayman Islands and will be subject to disposition or retention for the benefit

of the public of the Cayman Islands. |

| 4.3 | In good standing means only that as of the date of this opinion the Company is up-to-date with

the filing of its annual returns and payment of annual fees with the Registrar of Companies. We have made no enquiries into the Company’s

good standing with respect to any filings or payment of fees, or both, that it may be required to make under the laws of the Cayman Islands

other than the Companies Act. |

| 5 | Governing law of this opinion |

| (a) | governed by, and shall be construed in accordance with, the

laws of the Cayman Islands; |

| (b) | limited to the matters expressly stated in it; and |

| (c) | confined to, and given on the basis of, the laws and practice

in the Cayman Islands at the date of this opinion. |

| 5.2 | Unless otherwise indicated, a reference to any specific Cayman Islands legislation is a reference to that

legislation as amended to, and as in force at, the date of this opinion. |

| 7 | We hereby consent to the filing of this opinion as an exhibit to the

Prospectus Supplement and also consent to the reference to our firm under the headings “Enforceability of Civil Liabilities”

and “Legal Matters” of the Prospectus Supplement. |

Yours faithfully

/s/ Ogier

Ogier

Page

6 of 9

Date: January 2, 2024

Ogier

11th Floor, Central Tower

28 Queen’s Road Central

Central

Hong Kong

Dear Sirs

Director’s Certificate

Meihua International Medical Technologies Co., Ltd. 美华国际医疗科技有限公司

(the Company)

We have acted as Cayman Islands counsel to the

Company in connection with the Company’s offering of an aggregate of $6,000,000 in principal amount of senior convertible notes of the

Company (the Convertible Notes) convertible into up to 2,191,381 ordinary shares of a par value $0.0005 each (the Ordinary Shares)

of the Company, pursuant to the securities purchase agreement dated 27 December 2023 entered into by and among the Company, Anson Investments

Master Fund LP and Anson East Master Fund LP (the Securities Purchase Agreement), and warrants (the Warrants, and together

with the Convertible Notes, the Offering Securities) to purchase up to 1,205,255 Ordinary Shares, pursuant to the placement agency

agreement dated 27 December 2023 entered into by and between the Company and Maxim Group LLC (the Placement Agency Agreement).

I acknowledge that your opinion will be given

in reliance upon the information set out in this certificate.

I hereby certify that as at the date hereof:

| 1 | you have been provided by us with true and complete copies of: |

| (a) | the certificate of incorporation of the Company dated 10 November 2020 issued

by the Registrar of Companies of the Cayman Islands (the Registrar); |

| (b) | the amended and restated memorandum and articles of association of the Company

adopted by special resolutions dated 21 December 2020 (the Memorandum and Articles); |

| (c) | a certificate of good standing dated 28 December 2023 (the Good Standing

Certificate) issued by the Registrar in respect of the Company; |

| (d) | the register of directors and officers of the Company provided to us on

16 August 2023 (the ROD); |

| (e) | the certified shareholder list of the Company as of 2 Janaury 2024 provided

to us by the Company on 2 Janaury 2024 (the ROM, and together with the Register of Directors, the Registers); |

| (f) | a copy of the written resolutions of all of the directors of the Company

dated 18 August 2023 and 2 Janaury 2024 (the Board Resolutions); |

Page 7 of 9

| (a) | the Securities Purchase Agreement; |

| (b) | the Placement Agency Agreement; |

| (c) | the convertible notes dated 2 Janaury 2024

issued by the Company on to Anson Investments Master Fund LP and Anson East Master Fund LP, respectively; |

| (d) | the warrants dated 2 Janaury 2024 issued by the Company to Anson

Investments Master Fund LP and Anson East Master Fund LP, respectively; and |

| (g) | An effective ’shelf’ registration statement on Form F-3 (File No. 333-274194)

that was previously filed by the Company with the United States Securities and Exchange Commission (the Commission) and declared

effective by the Commission on 29 September 2023 under the U.S. Securities Act of 1933, as amended (the Securities Act), and the

prospectus supplement dated 27 December 2023 filed by the Company with the Commission under the Securities Act (the Prospectus Supplement,

and together with the Form F-3 registration statement, the Registration Statement). |

| 2 | the Memorandum and Articles provided to you are in full force and effect and have not been amended,

varied, supplemented or revoked in any respect, and shall remain in full force and effect after completion of the Offering; |

| 3 | no steps have been taken by the Company to wind up the Company and no resolutions have been passed

by the shareholders of the Company (the Shareholders) to wind up the Company; |

| 4 | the Company is not subject to any legal, arbitral, administration or other proceedings and no notice

of an application or order for the appointment of a liquidator, trustee in bankruptcy, restructuring officer, or receiver of the Company

or any of its assets or of a winding-up of the Company has been received by the Company; |

| 5 | the powers and authority of the directors of the Company (the Directors) as set out in the

memorandum and articles of association of the Company have not been varied or restricted by resolution or direction of the Shareholders; |

| 6 | there have been no sealing regulations made by the Directors, any committee of the Directors or the

Shareholders pursuant to the memorandum and articles of the Company which vary, restrict, override or conflict with the sealing regulations

set out in the Board Resolutions; |

| 7 | the Board Resolutions have been duly signed by all the Directors and were passed in accordance with

the Company’s articles of association; |

| 8 | each of

the Directors and their alternates has disclosed to the Company (if any) all of his or her direct or indirect interests that conflict

or may conflict to a material extent with the interests of the Company; |

Page 8 of 9

| 9 | the Board Resolutions are in full force and effect, have not been amended, revoked or rescinded in

any way and are the only resolutions passed by the Directors relating to the matters referred to therein; |

| 10 | prior to, at the time of, and immediately following execution of any document(s) approved in, the

Board Resolutions (the Document(s)), the Company was able to pay its debts as they fell due and it entered into the Document(s)

for proper value and not with an intention to defraud or hinder its creditors or by way of undue or fraudulent preference; |

| 11 | the Company has no direct or indirect interest in Cayman Islands real property; |

| 12 | each of the Directors has acted bona fide in the interests of the Company and for proper purposes

in relation to the transactions mentioned in the Board Resolutions; |

| 13 | none of the transactions contemplated by the Document(s) relate to any shares, voting rights or

other rights that are subject to a restrictions notice issued pursuant to the Companies Act (Revised) or the Limited Liability Companies

Act (Revised) of the Cayman Islands; and |

| 14 | the Directors/persons authorised to execute the Documents on behalf of the Company pursuant to the

Board Resolutions did in fact execute the Documents for and on behalf of the Company |

I am duly authorised

to execute and deliver this certificate on behalf of the Company. I confirm that you may continue to rely on this Certificate as being

true and correct on the day that you issue the Opinion unless I shall have personally notified you to the contrary.

Page 9 of 9

Yours faithfully

For and on behalf of

Meihua International Medical Technologies Co., Ltd.

美华国际医疗科技有限公司

| /s/ Liu Yongjun |

|

/s/ Xiaoming E |

| LIU Yongjun |

|

Xiaoming E |

| Diretor |

|

Director |

| /s/ Wenzhang Jia |

|

| Wenzhang Jia |

|

| Director |

|

| /s/ Xin Wang |

|

| Xin Wang |

|

| Director |

|

| /s/ Huijuan Zhao |

|

| Huijuan Zhao |

|

| Director |

|

Exhibit 99.1

Meihua International Medical Technologies Co., Ltd.

Announces Closing of Initial $6 Million Tranche

of Potential $50.5 Million Maximum Offering

YANGZHOU, China, January 2, 2024 /PRNewswire/ --

Meihua International Medical Technologies Co., Ltd. (“MHUA” or the “Company”) (NASDAQ: MHUA), a reputable

manufacturer and provider of Class I, II and III disposable medical devices with operating subsidiaries in China, today announced the closing of its previously disclosed registered direct offering with certain accredited institutional investors to purchase

an initial $6 million tranche in the offering of up to $50.5 million of its 7% Original Issue Discount

Senior Convertible Promissory Notes (the “Initial Notes”), and five-year ordinary share purchase warrants to purchase

1,205,255 ordinary shares of the Company (the “Initial Warrants”), exercisable at $2.9869 per ordinary share, in a

concurrent private placement, for gross proceeds of approximately $5,580,000.

After deducting the placement agent’s

commission and other offering expenses payable by the Company, the net proceeds to the Company were approximately $4,800,000. The

Company intends to use the net proceeds for general working capital purposes.

Maxim Group LLC is acting as the sole placement agent

for the offering.

The Initial Notes and the ordinary shares issuable

upon conversion of the Initial Notes are being sold pursuant to a shelf registration statement on Form F-3 (File No. 333-274194), initially

filed with the U.S. Securities and Exchange Commission (the “SEC”) on August 24, 2023, amended on September 25, 2023 and September

29, 2023, and declared effective on September 29, 2023. Such securities were offered only by means of a prospectus supplement to such registration

statement. Such prospectus supplement and accompanying base prospectus relating to and describing the terms of the registered direct offering

were filed with the SEC on January 2, 2024. When available, copies of such prospectus supplement and accompanying base prospectus

may be obtained at the SEC’s website www.sec.gov or by contacting Maxim Group LLC, 300 Park Avenue, 16th Floor, New York, NY 10022, at

212-895-3745.

The Initial Warrants, and the ordinary shares issuable

upon exercise of the Initial Warrants, were sold in a concurrent private placement pursuant to an exemption from registration in accordance

with Section 4(a)(2) of the Securities Act, as amended, and/or Regulation D promulgated thereunder.

This press release does not constitute an offer to

sell or a solicitation of an offer to buy these securities, nor shall there be any sale of these securities in any state or other jurisdiction

in which such offer, solicitation or sale would be unlawful prior to the registration or qualification under the securities laws of any

such state or other jurisdiction.

About Meihua International Medical Technologies

Co., Ltd.

Meihua International Medical Technologies is a reputable

manufacturer and provider of Class I, II and III disposable medical devices with operating subsidiaries in China. The Company manufactures

and sells Class I disposable medical devices, such as HDPE bottles for tablets and LDPE bottles for eye drops, throat strips, and anal

bags, and Class II and III disposable medical devices, such as disposable identification bracelets, gynecological examination kits, inspection

kits, surgical kits, medical brushes, medical dressing, medical catheters, uterine tissue suction tables, virus sampling tubes, disposable

infusion pumps, electronic pumps and anesthesia puncture kits, among other products which are sold under Meihua’s own brands and are also

sourced and distributed from other manufacturers. The Company has received an international “CE” certification and ISO 13485

system certification and has also registered with the FDA (registration number: 3006554788) for over 20 Class I products. The Company

has served hospitals, pharmacies, medical institutions and medical equipment companies for more than 30 years, providing over 1,000 types

of products for domestic sales, as well as over 120 products which are exported to more than 30 countries internationally across Europe,

North America, South America, Asia, Africa and Oceania. For more information, please visit www.meihuamed.com.

Forward-Looking Statements

This press release contains forward-looking statements

as defined by the Private Securities Litigation Reform Act of 1995. Forward-looking statements include statements concerning plans, objectives,

goals, strategies, future events or performance, and underlying assumptions and other statements that are other than statements of historical

facts. When the Company uses words such as “may,” “will,” “intend,” “should,” “believe,”

“expect,” “anticipate,” “project,” “estimate” or similar expressions that do not relate solely

to historical matters, it is making forward-looking statements. Forward-looking statements are not guarantees of future performance and

involve risks and uncertainties that may cause the actual results to differ materially from the Company’s expectations discussed in the

forward-looking statements. These statements are subject to uncertainties and risks including, but not limited to, the following: the

Company’s ability to achieve its goals and strategies, its ability to raise funds pursuant to such securities purchase agreement described

above, the Company’s future business development and plans of future business development, including its ability to successfully develop

robotic assisted surgery systems and obtain licensure and certification for such systems, financial conditions and results of operations,

product and service demand and acceptance, reputation and brand, the impact of competition and pricing, changes in technology, government

regulations, fluctuations in general economic and business conditions in China, and assumptions underlying or related to any of the foregoing

and other risks contained in reports filed by the Company with the U.S. Securities and Exchange Commission (“SEC”). For these

reasons, among others, investors are cautioned not to place undue reliance upon any forward-looking statements in this press release.

Additional factors are discussed in the Company’s filings with the SEC, including under the section entitled “Risk Factors”

in its annual report on Form 20-F, as amended, filed with the SEC on August 29, 2023, as well as its current reports on Form 6-K and other

filings, all of which are available for review at www.sec.gov. The Company undertakes no obligation to publicly revise these forward-looking

statements to reflect events or circumstances that arise after the date hereof.

For more information, please contact:

Janice Wang

Wealth Financial Services LLC

Phone:

+86 13811768599

+1 628 283 9214

Email: services@wealthfsllc.com

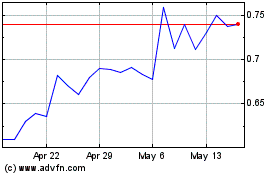

Meihua International Med... (NASDAQ:MHUA)

Historical Stock Chart

From Jun 2024 to Jul 2024

Meihua International Med... (NASDAQ:MHUA)

Historical Stock Chart

From Jul 2023 to Jul 2024