0001654595

false

0001654595

2023-07-18

2023-07-18

0001654595

us-gaap:CommonStockMember

2023-07-18

2023-07-18

0001654595

MDRR:SeriesACumulativeRedeemablePreferredStock8.0PercentMember

2023-07-18

2023-07-18

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of

earliest event reported): July 18, 2023

Medalist Diversified REIT, Inc.

(Exact Name of Registrant as Specified in Its Charter)

| Maryland | |

001-38719 | |

47-5201540 |

(State or other

jurisdiction of incorporation

or organization) | |

(Commission File Number) | |

(I.R.S. Employer

Identification No.) |

1051 E. Cary Street Suite 601

James Center Three

Richmond, VA, 23219

(Address

of principal executive offices)

(804) 344-4435

(Registrant’s telephone number, including area code)

None

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant

to Section 12(b) of the Act:

| Title of Each Class |

|

Name of each Exchange

on Which

Registered |

|

Trading

Symbol(s) |

| Common Stock, $0.01 par value |

|

Nasdaq Capital Market |

|

MDRR |

| 8.0% Series A Cumulative Redeemable Preferred Stock, $0.01 par value |

|

Nasdaq Capital Market |

|

MDRRP |

Indicate by check mark whether

the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2

of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging

Growth Company ¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Introductory Note

On July 18, 2023, Medalist Diversified REIT,

Inc. (the “Company”) commenced the internalization of the Company’s management function (the “Internalization”).

Since 2016, the Company has been externally managed by Medalist Fund Manager, Inc. (the “Manager”), with the Manager responsible

for managing the Company’s operations, subject to the supervision of the Company’s Board of Directors (the “Board”),

pursuant to a Management Agreement dated March 15, 2016 (as amended from time to time, the “Management Agreement”). As described

in more detail below, the Company agreed with the Manager to terminate the Management Agreement. Going forward, the Company will be self-managed

under the executive leadership of Francis P. Kavanaugh, who was appointed by the Board as interim-Chief Executive Officer and President

concurrent with the Internalization.

| Item 1.01 |

Entry into a Material Definitive Agreement. |

On July 18, 2023,

the Company and Medalist Diversified Holdings, L.P., a Delaware limited partnership (the “Operating Partnership”), entered

into a Termination Agreement (the “Termination Agreement”) with the Manager, William R. Elliott and Thomas E. Messier, which

provides for the immediate termination of the Management Agreement. The Termination Agreement also provides for, among other things,

aggregate payments of $1,602,717 in settlement of all amounts payable under the Management Agreement, the resignation of each of Messrs.

W. Elliott and Messier from any and all employment, officer, director and other positions at the Company or the Operating Partnership,

Messrs. W. Elliott and Messier’s release of all rights and claims against the Company and the Operating Partnership, the survival

of certain indemnification obligations with respect to Messrs. W. Elliott and Messier, the Company’s agreement to take all commercially

reasonable steps to cause Messrs. W. Elliott and Messier to be released promptly from all obligations under certain guaranty arrangements

made by Messrs. W. Elliott and/or Messier, Messrs W. Elliott and Messier's agreement to cooperate in a commercially reasonable manner with the Company and the Operating Partnership's

efforts to sell certain of the Company's properties, and the retention of certain confidentiality obligations by the Manager.

The terms of the Termination

Agreement described under this Item 1.01, and the transactions contemplated thereby, were negotiated and unanimously approved by a committee

of independent members of the Board (the “Special Committee”), all of whom are independent and disinterested members of the

Board. The Special Committee was formed in March 2023 in order to evaluate strategic alternatives available to the Company.

The foregoing description

of the Termination Agreement and the transactions contemplated thereby do not purport to be complete and are qualified in their entirety

by reference to the Termination Agreement, a copy of which is filed herewith as Exhibit 10.1 and incorporated by reference herein. Each

of the Management Agreement and the relationship between the Company and the Manager is more fully described in the Company’s Annual

Report on Form 10-K for the fiscal year ended December 31, 2022 under the heading “Certain Relationships and Related Transactions,

and Director Independence,” which information is incorporated by reference in this Item 1.01.

| Item 1.02 |

Termination of a Material Definitive

Agreement. |

The information set

forth in Item 1.01 with respect to the termination of the Management Agreement is incorporated by reference into this Item 1.02.

| Item 5.02 |

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory

Arrangements of Certain Officers. |

In connection with the

Internalization and pursuant to the Termination Agreement, each of Messrs. W. Elliott and Messier provided notice of their respective

resignations as director, Chairman & Chief Executive Officer and director, Vice Chairman, President & Chief Operating Officer,

effectively immediately upon the Internalization. The information set forth in Item 1.01 with respect to the termination of the Management

Agreement is incorporated by reference into this Item 5.02.

Effective upon the Internalization,

the Board appointed Francis P. Kavanaugh as the Company’s interim Chief Executive Officer and President. Mr. Kavanaugh, age 63,

currently serves as an independent member of the Board and was appointed effective May 24, 2023. Mr. Kavanaugh is the co-founder of Fort

Ashford Funds, LLC, a privately held investment firm, and has served as its Managing Director since its inception in 2004. He also serves

in a leadership role at New Patriots Holdings, Inc., a professional employer organization. Mr. Kavanaugh has over 30 years of diverse

experience in real estate investment, business restructuring, and operational leadership. He has been actively involved with the restructuring

of over 20 businesses in the public and private sectors and is adept at navigating complexity and implementing strategic changes.

Additionally, on July

18, 2023, Colin M. Elliott, Vice President of the Company, notified the Company of his intent to resign as an employee of Gunston Consulting,

LLC and consequently as Vice President of the Company and from all other positions held with the Company and the Operating Partnership.

The Company and Mr. C. Elliott are currently negotiating the effective date of his resignation and other material terms in connection

therewith.

| Item 7.01 |

Regulation FD Disclosure. |

On July 18, 2023,

the Company issued a press release, a copy of which is furnished as Exhibit 99.1 to this Current Report on Form 8-K. The information,

including the press release, furnished under this Item 7.01 shall not be deemed “filed” for the purposes of Section 18 of

the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section,

and shall not be deemed incorporated by reference into any other filing by the Company under the Exchange Act or the Securities Act of

1933, as amended, except as otherwise expressly stated in such filing.

Effective upon the Internalization,

the Board appointed Timothy O’Brien as non-executive Chairman of the Board. Mr. O’Brien has served as an independent director

since June 21, 2021.

| Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits

* The Company has redacted provisions or terms

of this exhibit pursuant to Item 601(b)(10)(iv) of Regulation S-K. The Company agrees to furnish an unredacted copy of the exhibit to

the Securities and Exchange Commission upon its request.

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

| |

MEDALIST DIVERSIFIED REIT, INC. |

| |

|

|

| Dated: July 18, 2023 |

By: |

/s/ C. Brent Winn, Jr. |

| |

|

C. Brent Winn, Jr. |

| |

|

Chief Financial Officer |

Exhibit 10.1

CERTAIN CONFIDENTIAL INFORMATION CONTAINED IN

THIS AGREEMENT HAS BEEN OMITTED BY MEANS OF REDACTING A PORTION OF THE TEXT AND REPLACING IT WITH [REDACTED], PURSUANT TO REGULATION S-K

ITEM 601(B) OF THE SECURITIES ACT OF 1933, AS AMENDED. CERTAIN CONFIDENTIAL INFORMATION HAS BEEN EXCLUDED FROM THE EXHIBIT BECAUSE IT

IS NOT MATERIAL AND IS A TYPE OF INFORMATION THAT THE REGISTRANT TREATS AS PRIVATE OR CONFIDENTIAL.

TERMINATION AGREEMENT

This Termination Agreement

(the “Agreement”), made this 18th day of July, 2023 (the “Effective Date”), is knowingly, willingly,

and voluntarily entered into among Medalist Diversified REIT, Inc., a Maryland corporation (the “REIT”), Medalist Diversified

Holdings, L.P., a Delaware limited partnership (“OP” and collectively with REIT, the “REIT Parties”), Medalist

Fund Manager, Inc., a Virginia corporation (“Manager”), William R. Elliott, a Virginia resident (“Elliott”), Thomas

E. Messier (“Messier” and collectively with Manager and Elliott, “Manager Parties”). Each of the REIT Parties

and the Manager Parties are individually referred to as a “Party” and collectively as “Parties.” The Parties recite

and agree as follows:

RECITALS

WHEREAS, Manager and the REIT

Parties are party to that certain Management Agreement dated as of March 15, 2016, as amended and supplemented from time to time (the

“Management Agreement”);

WHEREAS, on or about March

19, 2021, Manager agreed to defer certain Acquisition Fees (as defined in the Management Agreement) pursuant to that certain letter agreement,

which total $352,717 as of the Effective Date (the “Deferred Acquisition Fees”);

WHEREAS, Messier and Elliott

are officers and directors of the REIT;

WHEREAS, the Parties now desire

to terminate the Management Agreement on the terms set forth herein; and

WHEREAS, Elliott and Messier

intend to resign as officers and directors of the REIT (as well as from all other positions associated with the REIT Parties).

NOW, THEREFORE, in consideration

of and reliance upon the mutual covenants, promises, acknowledgements, warranties, representations, payments, and other obligations provided

for herein, and other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, and intending to

be legally bound hereby, the Parties mutually agree as follows:

1. Termination of Management Agreement. The Management Agreement and all other agreements between the REIT Parties, on one hand,

and the Manager Parties, on the other hand, are hereby terminated on the Effective Date; provided, however, Section 5 of the Management

Agreement shall survive its termination. For the avoidance of doubt, the Manager Parties shall preserve and promptly return all property

of the REIT Parties promptly following the Effective Date, including, any Confidential Information (as defined in the Management Agreement)

and related records of the REIT Parties in possession of the Manager Parties.

2. Resignations. As of the Effective Date, Messier and Elliott shall deliver written resignations to REIT substantially in the

form attached here to as Exhibit A.

3. Deferred Acquisition Fee and Termination Fee. Immediately upon execution of this Agreement, the REIT shall pay the Deferred

Acquisition Fee. Within seven (7) calendar days of the Effective Date, the REIT shall pay the Manager $1,250,000 (the “Termination

Fee”). The Deferred Acquisition Fee and Termination Fee shall be paid by wire transfer of immediately available funds to an account

designated in writing by the Manager.

4. Releases.

a. In consideration of the payments pursuant to Section 3 and the other terms and conditions of this Agreement, each of the Manager Parties,

willingly, and voluntarily release, discharge, and waive all rights, claims, lawsuits, liabilities, actions, disputes, causes of action,

damages (including, but not limited to, liquidated damages, compensatory damages, or punitive damages, attorney’s fees and litigation

costs), demands, obligations to date, known or unknown (hereinafter “Rights and Claims”) against the REIT Parties, and all

persons acting by, through or under the REIT Parties (including the REIT Parties’ subsidiaries, related companies (other than the

Manager Parties), and their current or former officers, directors, agents, assigns, employees, representatives, successors, subcontractors,

suppliers, and any other persons or entities acting on behalf of the REIT), for all events occurring prior to, and including, the Effective

Date of this Agreement. The Rights and Claims for purposes of this Agreement include, but are not limited to, breach of contract, warranty,

and any or all rights or claims for promissory estoppel, invasion of privacy, negligence, defamation, fraud, and any or all rights or

claims under any other federal, state, county, city, or local statutes, or under common law.

b. In consideration of the termination and resignations in Section 1 and Section 2 and the other terms and conditions of this Agreement,

each of the REIT Parties, willingly, and voluntarily release, discharge, and waive all Rights and Claims against the Manager Parties,

and all of Manager’s current or former officers, directors, agents, assigns, employees, representatives, successors, subcontractors,

suppliers, and any other persons or entities acting on behalf of the Manager, for all events occurring prior to, and including, the Effective

Date of this Agreement.

c. Except as specifically provided in this Agreement, after the Effective Date the REIT Parties shall have no further obligations to the

Manager Parties. Except as specifically provided in this Agreement, after the Effective Date the Manager Parties shall have no further

obligations to the REIT Parties.

5. Director and Officer Indemnification of Messier and Elliott.

a. Notwithstanding Section 4 above, the Parties specifically acknowledge and agree that Messier and Elliott have not released and specifically

retain any and all rights they had prior to the Effective Date to receive indemnification from the REIT (including right to advancement

attendant thereto) in their capacities as officers and directors of the REIT under Maryland law and the REIT’s articles of incorporation

or bylaws.

b. In addition, for three (3) years following the Effective Date:

i. The REIT shall provide indemnification to Messier and Elliott, as and to the same extent provided to the REIT’s directors and officers.

ii. If the REIT adopts a director and officer indemnification agreement, the REIT covenants and agrees to offer such indemnification agreement

to Messier and Elliott on the same terms as the other officers and directors except that such agreement will only apply with respect to

Messier and Elliott for periods prior to the Effective Date.

iii. The REIT shall maintain directors and officers insurance equivalent to its current coverages (in the aggregate) and in the event of a

Change of Control or liquidation of the REIT, shall obtain or cause to be obtained a customary tail policy for the balance of such three

(3) year period. For purposes hereof, a “Change of Control,” means a merger, stock sale or share exchange the result of which

is the shareholders before such transaction hold fewer than 50% of the shares following the consummation of such transaction or where

the members of the board of directors serving before such transaction do not represent the majority of the board directors following the

consummation of such transaction.

c. If either Messier or Elliott (each, an “Indemnitee”) is made party to any proceeding and incurs expenses that may be indemnifiable

under the terms of Section 5(a) above, the REIT shall advance all reasonable third-party expenses incurred by or on behalf of Indemnitee

in connection with such proceeding. Such advance or advances shall be made within fifteen (15) days after the receipt by the REIT of a

statement or statements requesting such advance or advances from time to time, whether prior to or after final disposition of such proceeding,

and may be in the form of, in the reasonable discretion of Indemnitee (but without duplication): (i) payment of such expenses directly

to third parties on behalf of Indemnitee; (ii) advancement to Indemnitee of funds in an amount sufficient to pay such expenses; or (iii)

reimbursement to Indemnitee for Indemnitee’s payment of such expenses. Such statement or statements shall reasonably evidence the

expenses incurred by Indemnitee (including, without limitation, copies of all applicable third party invoices) and shall include or be

preceded or accompanied by a written affirmation and undertaking by or on behalf of Indemnitee in such form as may be reasonably requested

by the REIT or required under applicable law as in effect at the time of the execution thereof, to reimburse the portion (if any) of any

expenses advanced to Indemnitee relating to claims, issues or matters in the proceeding as to which it shall ultimately be adjudged, that

the applicable standard of conduct has not been met by Indemnitee. The undertaking shall be an unlimited general obligation by or on behalf

of Indemnitee and shall be accepted without reference to Indemnitee’s financial ability to repay such advanced expenses and without

any requirement to post security therefor.

6. Personal Guarantees.

a. The REIT or the OP, as applicable, is the direct or indirect beneficiary of the following guaranty arrangements made by Messier and/or

Elliott:

i. The Limited Recourse Guaranty Arrangement dated November 1, 2021 given by the REIT, Messier and Elliot, and certain other parties thereto

for the benefit of TIAA, FSB in connection with certain loans to PMI Parkway, LLC and MDR Parkway, LLC (the “Parkway Guaranty”);

ii. Commercial Guaranty dated May 18, 2017 given by Messier for the benefit of Langley Federal Credit Union in connection with certain loans

to MDR Hanover Square, LLC and Commercial Guaranty dated May 18, 2017 given by Elliott for the benefit of Langley Federal Credit Union

in connection with certain loans to MDR Hanover Square, LLC (collectively, the “Hanover Square Guarantees”);

iii. Indemnity and Guaranty Agreement dated October 2, 2019 given by Messier and Elliott for the benefit of CIBC INC. in connection with a

certain loan to MDR Brookfield, LLC (the “Brookfield Guaranty”); and

iv. Guaranty Agreement (Loan 3450529) dated August 30, 2019 given by Messier and Elliott for the benefit of Bank of America, N.A. in connection

with certain loans to MDR Ashley Plaza, LLC (the “Ashley Plaza Guaranty,” and collectively with the Parkway Guaranty, the

Hanover Square Guarantees and the Brookfield Guaranty, the “Guarantees”).

b. The REIT shall use commercially reasonable efforts to cause each of the Guarantees to be terminated or replaced as promptly as possible

such that each of Messier and Elliott shall have no personal liability under such Guarantees. In furtherance of the foregoing, but not

as a limitation thereto, the REIT shall engage Jones Lang Lasalle (at the REIT’s sole cost) to promptly contact each lender with

regard to the Guarantees and cause Messier and Elliott to be released from all obligations under the Guarantees. The REIT shall not increase

the credit availability under the loans to which the Guarantees apply unless the Guarantees have been released. The Manager Parties shall

not take any action that interferes with the REIT’s efforts to get the Guarantees Released.

c. The REIT shall defend, indemnify and hold harmless Messier and Elliott from any and all claims, liabilities or charges incurred by them

under the Guarantees, to the extent that such claim does not arise from the bad faith, gross negligence, or willful misconduct of the

Party seeking indemnity under this paragraph.

d. If the Hanover Square Guaranty has not been released by the one-year anniversary of the Effective Date (either by virtue of the sale of

the underlying real property and payment in full of the underlying loan or otherwise), the REIT shall cause the loan secured by the Hanover

Square Guaranty to be refinanced and repaid.

7.

Cooperation on Sale of Properties.

a. The REIT intends to sell the real property commonly referred to as:

i. [REDACTED];

ii. [REDACTED];

iii. [REDACTED]; and

iv. [REDACTED],

with (i) through (iv) collectively referred to

herein as the “For Sale Properties.”

b. The Manager Parties shall cooperate in a commercially reasonable manner with the REIT Parties’ efforts to sell the “For Sale

Properties.” This shall include, without limitation, on request of the REIT the participation by the Manager Parties in the preparation,

completion and documentation of the purchase and sale documents related to the sale of the For Sale Properties without charge by the Manager

Parties to the REIT Parties; provided, however, the Manager Parties shall not be required to incur any out of pocket costs in connection

with this covenant.

8. Retained Obligations. The Manager shall retain any and all obligations related to the employment of Messier and Elliott and

the obligation with respect to the lease for 1051 E. Cary Street Suite 601, James Center Three, Richmond, VA, 23219.

9. Confidentiality; Press Releases; Non-Disparagement.

a. The Parties agree that promptly after the execution of this Agreement the REIT Parties shall (i) prepare a Form 8-K in compliance with

applicable law summarizing this Agreement, (ii) with such Form 8-K, disclose this Agreement with Section 7 redacted to remove reference

to the specific properties and (iii) issue and attach to such form 8-K the Press Release enclosed as Exhibit B (with (i),

(ii) and (iii) collectively, referred to as the “Agreed Disclosures”) without any further need for review and comment by the

Manager Parties. The REIT has agreed to include the following quote, attributed to Messier and Elliott, in the Press Release included

in and as part of the Agreed Disclosures:

“Since Medalist Diversified REIT’s

founding, we have worked to build an outstanding diversified real estate portfolio that is now 98 percent leased, has consistently produced

positive cash flow, and performed throughout the COVID-19 pandemic. We are proud that Medalist has paid dividends to its shareholders

for nine consecutive quarters, even as the REIT industry in general, and microcap REITs in particular, have been impacted by market forces

that are causing REITS to trade at a fraction of their worth. We believe Medalist, which is traded on NASDAQ, has a strong platform and

portfolio that is well positioned for the future.”

Except for the Agreed Disclosures or as provided

in this Section 9, each Party agrees to keep any prior negotiations of terms and conditions and discussions with the Parties regarding

this Agreement confidential and shall not disclose them to any other person or entity or publish them in any forum. Except for the Agreed

Disclosures, no Party shall directly or indirectly, issue any press release or other public statement relating to the terms of this Agreement

or use the REIT Parties’ or Manager’s name or refer to the REIT Parties or the Manager Parties or any of their respective

subsidiaries directly or indirectly in any media interview, advertisement, news release, press release or professional or trade publication,

or in any print media, whether or not in response to an inquiry, in the case of a statement or release by the Manager Parties, without

the prior written approval of the REIT, and in a case of a statement or release by the REIT Parties; provided, however in response to

any inquiries by media or other third parties, the Parties may refer such questions to the Agreed Disclosures.

b. Notwithstanding the foregoing, (i) the REIT Parties’ obligations under the Section 9(a) shall expire on the six (6) month anniversary

of the Effective Date and (ii) during the six (6) month period where the REIT Parties are bound by Section 9(a), the REIT Parties may

make such statements or releases to the extent required by applicable law or listing standards of the Nasdaq Capital Marking or other

exchange where the REIT’s shares may be listed from time to time, after providing the Manager Parties a reasonable period (not to

exceed 1 business day) to review and comment on such releases; provided, however, if the REIT Parties do not accept reasonable comments

from the Manager Parties, the Manager Parties may publish a release related to the subject matter of such comments. After the six (6)

month anniversary of the Effective Date, if the REIT Parties issue any press release or other public statement relating to the terms of

this Agreement other than referring inquiries to the Agreed Disclosures, the Management Agreement or the Manager Parties, the Manager

Parties may make or publish any statements reasonably related to the subject matter of statement.

c. The REIT Parties agree to keep confidential, not use and promptly return to Manager or destroy (at the option of Manager) all records

specific to the Manager and its owners, as distinguished from Confidential Information (as defined in the Management Agreement) of the

REIT, including, but not limited to, the Manager’s tax returns, financial records, books and records pertaining to any private funds

previously advised by Manager (including the identify and other personally identifiable information pertaining to limited partners therein),

email correspondence by and among Manager, email correspondence involving the Law Firm (as defined below) and K-1, tax returns or other

information specific to the owners of Manager, that Manager or the Manager Parties may have provided to the REIT Parties or that was included

in the so-called “share drive” utilized by the REIT and the Manager (collectively, the “Manager Information”).

The obligations of the REIT Parties shall survive for three years following the Effective Date; provided that the Parties will maintain

trade secrets of the other party identified in writing as trade secrets, and which in fact constitute trade secrets, for a period of no

longer than five (5) years thereafter Nothing herein shall prevent the REIT Parties from disclosing Manager

Information (i) upon the order of any court or administrative agency, (ii) upon the request or demand of, or pursuant to any law or regulation

to, any regulatory agency or authority, (iii) to the extent reasonably required in connection with the exercise of any remedy hereunder,

or (iv) to its legal counsel or independent auditors; provided, however that with respect to clauses (i) and (ii), it is agreed

that, so long as not legally prohibited, the REIT Parties will provide the Company with prompt written notice of such order, request or

demand so that the Company may seek, at its sole expense, an appropriate protective order and/or waive the REIT Parties’ compliance

with the provisions of this Agreement. If, failing the entry of a protective order or the receipt of a waiver hereunder, one of the REIT

Parties is required to disclose Manager Information, such REIT Party may disclose only that portion of such information that is legally

required without liability hereunder; provided, that each REIT Party agrees to exercise its reasonable best efforts to obtain reliable

assurance that confidential treatment will be accorded such information. Notwithstanding anything herein to the contrary, each of the

following shall be deemed to be excluded from the provisions of this Section 9(c): any Manager Information that (A) is available to the

public from a source other than the REIT Parties (other than to the extent such information has been made public by one of the REIT Parties

in breach of this Agreement), (B) is released in writing by the Manager Parties to the public or to persons who are not under similar

obligation of confidentiality to the Manager Parties, or (C) was obtained by the REIT Parties from a third party where such disclosure,

to the best of the REIT Parties’ knowledge, does not constitute a breach by such third party of an obligation of confidence with

respect to the Manager Information disclosed.

d. Each Party agrees not to verbally or in writing, make disparaging, false or misleading statements with regard to the other Parties to

this Agreement.

e. The Parties agree that nothing in this Agreement (including, without limitation, Section 9(a), Section 9(c) or Section 9(d)) shall prohibit

any other Party from responding to legal process or be construed to prohibit the exercise of any rights by any Party that such Party may

not waive as a matter of law. If compelled to do so by law, the Parties will tell the truth.

10. No Acquisition of Equity. Each of the Manager Parties agrees that, for a period of three (3) years after the Effective Date,

such parties shall not voluntarily acquire any shares of capital stock, options, warrants, limited partnership interest or other debt

or equity interest in, or rights convertible into, debt or equity interests of the REIT or OP or their respective subsidiaries. Notwithstanding

the foregoing, the Parties agree and acknowledge that Messier and Elliott own certain shares of common stock of REIT as of the Effective

Date and nothing in this Section 10 shall prohibit Messier and Elliott from accepting or exercising any rights, distribution, dividend,

rights or similar payment or grant attendant to such shares.

11. Responsibility for Costs and Fees. Each of the Parties specifically agrees that it will be responsible for its own attorneys’

fees and any costs incurred in connection with this Agreement and the negotiations giving rise to this Agreement.

12. No Future Lawsuits. Each of the Parties promise never to file a lawsuit or demand for arbitration asserting any claims that

are released in Paragraph 4 of this Agreement. In the event a Party breaches this Section 12, such Party shall pay to any other Party

incurring expenses in connection with such breach all of its expenses incurred as a result of such breach, including but not limited to,

reasonable attorney’s fees and expenses.

13. Attempts to Avoid or Set Aside. For the avoidance of doubt, each of the Parties specifically waives any claim or cause of action

to avoid or set aside this Agreement (including, but not limited to, fraud in the inducement or any similar equitable basis). If any Party

attempts to avoid or set aside the terms of this Agreement and is unsuccessful, the opposing Party or Parties shall be entitled to their

reasonable costs and attorneys’ fees incurred in defending against such action.

14. Enforcement of this Agreement. If any action is brought to enforce or interpret the terms of this Agreement, the prevailing

party in such action shall be entitled to reasonable attorneys’ fees, costs, and necessary disbursements, in addition to any other

relief to which a court of competent jurisdiction may order.

15. Entire Agreement. This Agreement contains the entire understanding of the Parties concerning the subjects it covers and it

supersedes all prior understandings and representations. Neither Party has made promises to the other Party other than those set forth

herein. This Agreement is an integrated agreement. The terms of this Agreement are contractual and not mere recitals.

16. Amendment of this Agreement. This Agreement, including this Section, may not and shall not be modified, altered, or amended

except by the mutual consent and agreement of each signatory to this agreement, with such mutual consent and agreement to be expressed

in writing and signed by representatives of the entities having actual authority to do so.

17. Severability. Should any provision of this Agreement subsequently be held to be unlawful, invalid, or unenforceable under any

present or future laws or judicial decisions, such provision shall be fully severable from the remainder of the Agreement. The remainder

of the provisions of this Agreement shall not be affected thereby and shall continue to be enforceable to the full extent permitted by

law.

18. Governing Law. This Agreement has been executed and accepted within the Commonwealth of Virginia. The validity, effect, construction,

interpretation, and administration of this Agreement, as well as the validity, effect, construction, interpretation, and administration

of any modification, alteration, or amendment or attempted modification, alteration, or amendment hereto, shall be governed by the substantive

law of the Commonwealth of Virginia, without regard to the Commonwealth’s conflicts of law principles.

19. Authority of the Parties. As an inducement to each Party to enter into this Agreement, each Party represents and warrants that

there exists no impediment or restraint, contractual or otherwise, on its powers, rights, or abilities, and that each has the requisite

authority to enter into this Agreement and to perform its duties and obligations herein. Each of Messier and Elliott represent and warrant

to the other Parties that they have the capacity to enter into this Agreement. Each Party further warrants that it is the sole owner of

the claims, demands, and causes of action released by it under Section 4 of this Agreement and that it has not heretofore sold, assigned,

transferred, conveyed, or otherwise disposed of any interest or share in the claims, actions, and causes of action covered by this Agreement.

Each person or entity signing this Agreement warrants that he, she or it has actual authority to do so on behalf of the Party that he

or she represents. Each Party represents and warrants to the other Parties that this Agreement is a valid and binding obligation of such

Party, enforceable against it in accordance with its terms.

20. Intent to be Bound and Successorship. It is the intention of the Parties that the provisions hereof are binding upon the Parties,

their employees, affiliates, agents, heirs, successors and assigns forever.

21. Execution of Documents. Each signatory to this Agreement agrees promptly to execute and deliver this Agreement and all such

other documents, papers, and instruments as may be necessary to implement fully the terms and provisions of this Agreement.

22. Joint Drafting. The Parties acknowledge and agree that this Agreement has been prepared jointly by the respective counsel of

the Parties, and that no ambiguity contained herein shall be construed against either Party.

23. Notices. All written notices, demands and requests of any kind which any Party may be required or may desire to serve upon

any other Party in connection with this Agreement shall be in writing and shall be deemed received (a) on the date of delivery if personally

delivered; (b) on the seventh day following the date of mailing if delivered by registered or certified mail, in each case, return receipt

requested and postage prepaid; (c) on the delivery date if delivered by nationally recognized overnight courier with delivery confirmation

service, with all fees prepaid; or (d) on the day of delivery if delivered by electronic mail, provided that the electronic mail is promptly

followed by delivery of a hard copy of such notice via mail or overnight courier which provides written verification or receipt (each,

a “Notice”). All Notices shall be addressed to the Parties to be served as follows:

|

If to the Manager Parties:

|

Medalist Fund Manager, Inc, Inc.

1051 E. Cary Street Suite 601

James Center Three

Richmond, VA, 23219

Attention: Thomas E. Messier

Email: [REDACTED]

and

Medalist Fund Manager, Inc.

1051 E. Cary Street Suite 601

James Center Three

Richmond, VA, 23219

Attention: Bill Elliott

Email: [REDACTED] |

| |

With a copy to (which shall not constitute notice):

Miles & Stockbridge P.C.

100 Light Street

Baltimore, Maryland 21202

Attention: Scott R. Wilson, Esq.

Email: swilson@mslaw.com |

| |

|

| If to the REIT Parties: |

Medalist Diversified REIT, Inc.

[REDACTED]

Attention: C. Brent Winn, Jr., Chief Financial Officer

Email: [REDACTED] |

| |

|

| |

With a copy to (which shall not constitute notice):

Williams Mullen

200 South 10th Street, Suite 1600

Richmond, VA 23219

Attention: Brendan D. O’Toole, Esq.

Email: botoole@williamsmullen.com |

Service of any such notice

or demand so made shall be deemed complete on the day of actual delivery thereof as shown by the addressee’s registry or certification

receipt or other evidence of receipt, or refusal of delivery. Any Party may from time to time by notice in writing served upon the other

as aforesaid designate a different mailing address or a different or additional Person to which all such notices or demands hereafter

are to be addressed.

24. Manager Parties’ Counsel. Manager Parties engaged Miles & Stockbridge P.C. (the “Law Firm”) as

legal counsel in connection with the transactions contemplated by this Agreement and REIT (among other things). On its own behalf and

on behalf of the REIT Parties, REIT hereby acknowledges the same and consents to the continued representation of the Manager Parties by

the Law Firm in relation to the transactions contemplated by this Agreement and adversely to the REIT Parties. REIT further agrees that,

without the need for any further action, (a) all right, title and interest in and to all communications between any of the Manager Parties

and the Law Firm (whether utilizing the domain “medalistprop.com” or not) shall constitute attorney-client communications

belong to the Manager Parties; (b) REIT and REIT Parties have no interest in or entitlement to such communications with the Law Firm;

and (c) any and all protections from disclosure, including attorney-client privileges and work product protections, associated with or

arising from communications involving Law Firm that would have been exercisable by any person shall be vested exclusively in the Management

Parties to the exclusion of the REIT Parties. None of the REIT Parties or any person acting on any of their behalf shall, without the

prior written consent of the Manager, waive or attempt to waive any protection against disclosure pertaining to the foregoing communications,

including the attorney-client privilege or work product protection with respect to such communications.

25. Execution. This Agreement may be executed in multiple counterparts, each of which shall be deemed an original and all of which,

together, shall constitute one and the same instrument. A signature obtained and communicated via electronic signature software such as

DocuSign or a signature communicated via e-mail/PDF shall be treated as an original. Electronic copies of this Agreement shall have the

same force and effect as an original

BY EXECUTING THIS AGREEMENT

BELOW, THE PARTIES EACH ACKNOWLEDGE THAT THEY HAVE READ THIS AGREEMENT, UNDERSTAND IT, AND ARE VOLUNTARILY ENTERING INTO IT. PLEASE READ

THIS AGREEMENT CAREFULLY. IT CONTAINS A RELEASE OF ALL KNOWN AND UNKNOWN CLAIMS.

[The remainder of this page is intentionally

left blank.]

IN WITNESS WHEREOF,

each of the Parties has caused this Confidential Termination, Release and Settlement Agreement to be executed either individually or in

its entity name by its duly authorized representatives as of the Effective Date.

REIT:

Medalist Diversified REIT, Inc., a Maryland

corporation

| By: |

/s/ C. Brent Winn, Jr. |

|

| Name: C. Brent Winn, Jr. |

|

| Title: Chief Financial Officer |

|

OP:

| Medalist Diversified Holdings, L.P., a Delaware limited partnership |

|

| |

|

| By: |

Medalist Diversified REIT, Inc., its general partner |

|

| |

|

| |

By: |

/s/ C. Brent Winn, Jr. |

|

| |

Name: C. Brent Winn, Jr. |

|

| |

Title: Chief Financial Officer |

|

MANAGER:

Medalist Fund Manager, Inc., a Virginia

corporation

| By: |

/s/ Thomas E. Messier |

|

| Name: Thomas E. Messier |

|

| Title: Co-President |

|

ELLIOTT:

| /s/ William R. Elliott |

|

| William R. Elliott, a Virginia resident |

|

MESSIER:

| /s/ Thomas E. Messier |

|

| Thomas E. Messier, a Virginia resident |

|

Exhibit A

Form of Resignation

July 18, 2023

Board of Directors

Medalist Diversified REIT, Inc.

1051 E. Cary Street Suite 601

James Center Three

Richmond, VA, 23219

Gentlemen:

I hereby resign as a director

and officer of Medalist Diversified REIT, Inc., a Maryland corporation (the “REIT”), and as a director and officer of each

subsidiary of the REIT.

Sincerely,

[Name]

Exhibit B

Form 8-K and Press Release

See attached.

Exhibit 99.1

Medalist

Diversified REIT, Inc. ANNOUNCES Transition to Internalized Management AND LEADERSHIP CHANGES

RICHMOND, Va., July 18, 2023--Medalist Diversified

REIT, Inc. (NASDAQ: MDRR) (the "Company" or "Medalist"), a Virginia-based real estate investment trust that specializes

in acquiring, owning and managing commercial real estate in the Southeast region of the U.S., announced today that the Company has completed

its process to internalize management, and resultant changes to the Company’s leadership and to the Company’s Board of Directors

(the “Board”).

In connection with these actions, Thomas (Tim)

Messier and William Elliott will be leaving their respective roles with the Company effective immediately, Tim Messier, as the former

Chairman and Chief Executive Officer, and William Elliott, as the former Vice Chairman, President, and Chief Operating Officer. The Board

appreciates Messrs. Messier and Elliott’s dedicated service and substantial contributions to the Company. In the interim, Timothy

O’Brien will step in as Chairman of the Board, Francis Kavanaugh will step in as interim Chief Executive Officer, and Brent Winn

will continue in his role as Chief Financial Officer.

These changes are expected to lead to streamlined

operations, reduced costs, and increased agility. Medalist is committed to a smooth transition process and ensuring continuity of leadership,

with the primary focus on preserving and enhancing shareholder value.

Messrs. Messier and Elliott made this joint statement,

“Since Medalist Diversified REIT’s founding, we have worked to build a diversified real estate portfolio that is now approximately

98 percent leased, has consistently produced positive cash flow, and performed throughout the COVID-19 pandemic. We are proud that Medalist

has paid dividends to its shareholders for nine consecutive quarters, even as the REIT industry in general, and microcap REITs in particular,

have been impacted by market forces that are causing REITS to trade at a fraction of their worth. We believe Medalist has a strong platform

and portfolio that is well positioned for the future.”

About Medalist Diversified

REIT

Medalist Diversified

REIT Inc. is a Virginia-based real estate investment trust that specializes in acquiring, owning and managing value-add commercial real

estate in the Mid-Atlantic and Southeast regions. The Company’s strategy is to focus on value-add and opportunistic commercial

real estate which is expected to provide an attractive balance of risk and returns. Medalist utilizes a rigorous, consistent and replicable

process for sourcing and conducting due diligence of acquisitions. The Company seeks to maximize operating performance of current properties

by utilizing a hands-on approach to property management while monitoring the middle market real estate markets in the southeast for acquisition

opportunities and disposal of properties as considered appropriate. For more information on Medalist, please visit the Company website

at www.medalistreit.com.

Forward-Looking

Statements

This

press release contains statements that are “forward-looking statements” within the meaning of the Private Securities Litigation

Reform Act of 1995 and other federal securities laws. Forward looking statements are not historical and are typically identified by such

words as “believe,” “expect,” “anticipate,” “intend,” “estimate, “may,”

“will,” “should” and “could” and include statements about the transition to internalized management

and the impact, if any, of such actions on the Company and the trading price of the Company’s common stock. Forward-looking statements

are based upon the Company’s present expectations but are not guarantees or assurances as to future developments or results. Factors

that may cause actual developments or results to differ from those reflected in forward-looking statements include, without limitation,

adverse changes in the pricing of the Company’s assets, disruptions associated with management internalizations, increased costs

of, and reduced availability of, capital and those included in the Company’s most recent Annual Report on Form 10-K and in the Company’s

other filings with the Securities and Exchange Commission. Investors should not place undue reliance upon forward-looking statements.

The Company disclaims any obligation to publicly update or revise any forward-looking statements to reflect changes and new developments

except as required by law or regulation.

Contact

Brent Winn

Medalist Diversified REIT, Inc.

brent.winn@medalistprop.com

v3.23.2

Cover

|

Jul. 18, 2023 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Jul. 18, 2023

|

| Entity File Number |

001-38719

|

| Entity Registrant Name |

Medalist Diversified REIT, Inc.

|

| Entity Central Index Key |

0001654595

|

| Entity Tax Identification Number |

47-5201540

|

| Entity Incorporation, State or Country Code |

MD

|

| Entity Address, Address Line One |

1051 E. Cary Street Suite 601

|

| Entity Address, Address Line Two |

James Center Three

|

| Entity Address, City or Town |

Richmond

|

| Entity Address, State or Province |

VA

|

| Entity Address, Postal Zip Code |

23219

|

| City Area Code |

804

|

| Local Phone Number |

344-4435

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Common Stock [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Common Stock, $0.01 par value

|

| Trading Symbol |

MDRR

|

| Security Exchange Name |

NASDAQ

|

| 8.0% Series A Cumulative Redeemable Preferred Stock, $0.01 par value |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

8.0% Series A Cumulative Redeemable Preferred Stock, $0.01 par value

|

| Trading Symbol |

MDRRP

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=MDRR_SeriesACumulativeRedeemablePreferredStock8.0PercentMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

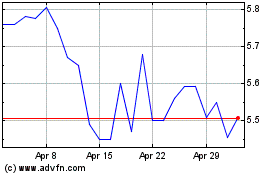

Medalist Diversified REIT (NASDAQ:MDRR)

Historical Stock Chart

From Jun 2024 to Jul 2024

Medalist Diversified REIT (NASDAQ:MDRR)

Historical Stock Chart

From Jul 2023 to Jul 2024