0001805651FalseAugust 9, 2024BaltimoreMaryland21201August 9, 2024August 9, 202400018056512024-08-092024-08-09

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 9, 2024

MarketWise, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

Delaware | 001-39405 | 87-1767914 |

(State or other jurisdiction

of incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

| | |

| 1125 N. Charles St. |

| Baltimore, Maryland 21201 | |

| (Address of principal executive offices, including zip code) |

(888) 261-2693

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act |

| | | | | | | | | | | | | | |

Securities registered pursuant to Section 12(b) of the Act: |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Class A common stock, $0.0001 par value per share | | MKTW | | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02. Departure of Directors or Principal Officers; Election of Directors; Appointment of Principal Officers.

F. Porter Stansberry Resigns as Chief Executive Officer and Chairman of the Board of Directors

On August 9, 2024, F. Porter Stansberry resigned from his positions as Chairman of the Board of Directors (the “Board”) and Chief Executive Officer of MarketWise, Inc. (the “Company”), effective immediately. These actions were not related to any matter regarding the Company’s financial condition, results of operations, internal controls, disclosure controls and procedures, policies or practices. Mr. Stansberry will continue to serve as a director on the Board.

Appointment of Dr. David Eifrig as Interim Chief Executive Officer

On August 10, 2024, the Board appointed Dr. David Eifrig, currently a director of the Company, to serve as interim Chief Executive Officer, effective immediately. In connection with Dr. Eifrig’s appointment, the Company and Dr. Eifrig are currently negotiating the terms of his compensation as interim Chief Executive Officer.

Dr. David Eifrig, age 65, has served as a member of the Board since May 2023. Dr. Eifrig joined the Company in 2008 and remains one of its most prolific editors. After receiving his Bachelor of Arts from the Carleton College in Minnesota, Dr. Eifrig later received a Master of Business Administration degree from Northwestern University’s Kellogg School of Management, graduating with a double major in finance and international business. Dr. Eifrig subsequently earned his M.D. from the University of North Carolina at Chapel Hill.

Appointment of Matthew Turner as Acting Chairman of the Board

On August 10, 2024, the Board appointed Matthew Turner, currently a director of the Company, to serve as Acting Chairman of the Board, effective immediately. Matthew Turner, age 58, has served as a member of the Board since May 2023. Mr. Turner has also served as a member of the board of directors of our largest shareholder, Monument & Cathedral Holdings, LLC, since September 2015, and previously served as the General Counsel of Monument & Cathedral Holdings, LLC from 1997 until 2022. Mr. Turner received his Juris Doctor from Catholic University and a Bachelor of Arts in English from Loyola University, Maryland.

Item 7.01. Regulation FD Disclosure.

On August 9, 2024, F. Porter Stansberry publicly shared his resignation letter through X (formerly known as Twitter). The resignation letter is furnished hereto as Exhibit 99.1.

The information in Item 7.01 to this Current Report on Form 8-K, including Exhibit 99.1, is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such filing.

Cautionary Statement Regarding Forward-Looking Statements

The communication furnished hereto as Exhibit 99.1 contains forward-looking statements within the meaning of the federal securities laws, including statements regarding the Company’s future acquisitions and operations. These forward-looking statements generally are identified by the words “believe,” “project,” “expect,” “anticipate,” “estimate,” “intend,” “strategy,” “future,” “opportunity,” “plan,” “may,” “should,” “will,” “would,” “will be,” “will continue,” “will likely result,” and similar expressions, but the absence of these words does not mean that a statement is not forward-looking. Forward-looking statements are predictions, projections, and other statements about future events that are based on current expectations and assumptions and, as a result, are subject to risks and uncertainties. Many factors could cause actual future events to differ materially from the forward-looking statements in Exhibit 99.1, including those described in the “Risk Factors” section of our filings with the U.S. Securities and Exchange Commission (the “SEC”), including our Annual Report on Form 10-K for the year ended December 31, 2023.

Item 8.01. Other Events.

On August 9, 2024, F. Porter Stansberry and the Company terminated negotiations regarding the potential acquisition by the Company of 100% of the issued and outstanding membership interests of Porter & Company, LLC. The Company previously announced the agreement of a non-binding term sheet regarding the potential acquisition on July 9, 2024.

Item 9.01. Financial Statements and Exhibits.

(d)Exhibits.

| | | | | | | | |

| Exhibit No. | | Description |

| | |

| | |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| MarketWise, Inc. |

| | |

Date: August 12, 2024 | By: | /s/ Scott Forney |

| Name: | Scott Forney |

| Title: | General Counsel |

August 9, 2024

Dear Board of Directors —

It is with frustration and genuine sadness that I resign as MarketWise’s Chief Executive Officer.

In addition, I would like to resign as Chairman of the Board (while retaining my board seat, at least until I’m able to sell my stake in the company.)

I sincerely hope that we can find new leadership that’s capable of continuing the work I began — to bring in new, high quality editorial talent (like I have done with Jeff Brown and Brad Thomas), to continue treating our shareholders well, with ongoing dividends and with sensible return on invested capital guidelines for all of our businesses, and, most of all, to ensure that MarketWise never again tolerates the kind of marketing abuses and lack of editorial control that existed while I was away from the company.

I am resigning because after ten months of negotiating for the sale of my company, Porter & Co., to MarketWise we have been unable to come to terms. As you know, once the board delegated its authority to acquire Porter & Co. to a special committee of independent directors, that special committee became bound to follow the legal direction of its outside counsel, lest the members of the special committee subject themselves to personal liability by closing the deal without counsel’s endorsement. As result, I never had the opportunity to negotiate fairly with my partners. Instead, I was left trying to negotiate a “friendly transaction” with what appear to be some of the fiercest litigators in the United States.

It was like trying to share a ham sandwich with a pit bull.

It is a mystery to me why the special committee has found itself unable to work with its counsel in a manner that would allow this deal to close on mutually agreeable terms in a timely manner. It was abundantly clear that the acquisition had the support of the overwhelming majority of shareholders and is manifestly in the best interest of the company.

After all, the opportunity to purchase for only $10 million up front (25% of the purchase price), a business with more than 25,000 customers that produced $28 million in billings in 2023, that boasted a $1,999 ARPU that year, and that is on track this year to grow its subscriber base by 30% — shouldn’t have been a hard sell. My company, its employees, its products, its business practices and its financial results were all known directly by the owners of MarketWise. We’ve been business partners for almost 30 years.

The fact is, Porter & Co. is a better business, per subscriber, than any business that MarketWise currently owns. I was willing to sell 100% of this business to MarketWise for less than the cash it’s likely to produce during the payment period. In short, I was going to give you a great business, that would pay for itself.

All you had to do was say yes.

And yet, after signing a letter of intent on November 3rd of last year (!), the committee and its counsel have been unable – or unwilling – to allow this acquisition to close. After spending more than half a

million dollars on this deal (and after working for you for free for 10 months) I simply cannot continue this process.

Regrettably, I must, and hereby do, resign as Chairman and CEO of MarketWise.

Sincerely,

Porter Stansberry

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

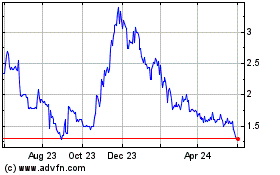

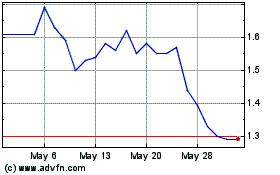

MarketWise (NASDAQ:MKTW)

Historical Stock Chart

From Jan 2025 to Feb 2025

MarketWise (NASDAQ:MKTW)

Historical Stock Chart

From Feb 2024 to Feb 2025