0001412100false00014121002024-05-092024-05-09

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

May 9, 2024 (May 9, 2024)

MAIDEN HOLDINGS, LTD.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Bermuda | | 001-34042 | | 98-0570192 |

(State or other jurisdiction of incorporation) | |

(Commission File Number) | |

(IRS Employer Identification No.) |

94 Pitts Bay Road, Pembroke HM08, Bermuda

(Address of principal executive offices and zip code)

(441) 298-4900

(Registrant's telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | | | | | | | | | | |

| | ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

| | |

| | ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

| | |

| | ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

| | |

| | ☒ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) | | |

Indicate by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of Each Class | | Trading symbol(s) | | Name of Each Exchange on Which Registered |

| Common Shares, par value $0.01 per share | | MHLD | | NASDAQ Capital Market |

| | | | | |

| Item 2.02 | Results of Operations and Financial Condition. |

On May 9, 2024, the Company issued a press release announcing its results of operations for the three months ended March 31, 2024. A copy of the press release is furnished herewith as Exhibit 99.1 and incorporated herein by reference.

The information contained in this Item 2.02 and in the accompanying exhibit shall not be deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the "Exchange Act") or otherwise subject to the liabilities of that section or incorporated by reference in any filing under the Exchange Act or the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such filing.

On May 9, 2024, the Company posted the Maiden Holdings, Ltd. Investor Update Presentation, May 2024 via its investor relations website at https://www.maiden.bm/investor_relations, which presentation is included as Exhibit 99.3 to this Current Report on Form 8-K.

The information under Item 7.01 and the Investor Presentation included to this Form 8-K as Exhibit 99.3 shall be deemed to be “furnished” and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act. The furnishing of the information in this report is not intended to, and does not, constitute a determination or admission by the Company that the information in this report is material or complete, or that investors should consider this information before making an investment decision with respect to any security of the Company.

On May 9, 2024, the Company issued a press release announcing its results of operations for the three months ended March 31, 2024 via its investor relations website at https://www.maiden.bm/investor_relations, which press release is included as Exhibit 99.2 to this Current Report on Form 8-K and incorporated herein by reference.

On May 6, 2024, the Company issued a press release announcing that it had entered into a renewal rights transaction with AmTrust Nordic AB, a Swedish unit of AmTrust Financial Services, Inc. (“AmTrust”) via its investor relations website at https://www.maiden.bm/investor_relations, which press release is included as Exhibit 99.4 to this Current Report on Form 8-K and incorporated herein by reference. The transaction is expected to cover the majority of its primary business written through its Swedish subsidiaries, Maiden General Försäkrings (“Maiden GF”) and Maiden Life Försäkrings (“Maiden LF”) in Sweden, Norway and other Nordic countries.

| | | | | |

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibit

| | | | | | | | |

| Exhibit | | |

| No. | | Description |

| | | |

| 99.1 | | |

| 99.2 | | |

| 99.3 | | |

| 99.4 | | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| Date: | May 9, 2024 | MAIDEN HOLDINGS, LTD. |

| | | | |

| | | By: | /s/ Lawrence F. Metz |

| | | | Lawrence F. Metz

Executive Vice Chairman and Group President |

| | | | |

EXHIBIT INDEX

| | | | | | | | |

| Exhibit | | |

| No. | | Description |

| | | |

| 99.1 | | |

| 99.2 | | |

| 99.3 | | |

| 99.4 | | |

Exhibit 99.1

PRESS RELEASE

Maiden Holdings, Ltd. Announces

First Quarter 2024 Financial Results

PEMBROKE, Bermuda, May 9, 2024 - Maiden Holdings, Ltd. (NASDAQ: MHLD) ("Maiden" or the "Company") today reported its results for the first quarter of 2024 which included the following highlights:

•Book value per common share remained stable at $2.48 while positive non-GAAP first quarter 2024 results caused adjusted book value per common share to increase to $3.24 per common share at March 31, 2024.

•Net income available to Maiden common shareholders of $1.5 million or $0.01 per diluted common share for the first quarter of 2024.

•Adjusted non-GAAP operating earnings were $4.4 million or $0.04 per diluted common share for the first quarter of 2024.

•Investment results increased to $17.1 million in 2024 compared to $10.5 million in 2023 including a 3.4% return on the alternative asset portfolio in the first quarter of 2024.

•Deferred gain on LPT/ADC Agreement increased to $75.9 million as of March 31, 2024, which is expected to be recoverable over time as future GAAP income under LPT/ADC Agreement with $79.1 million remaining in additional limit.

•Recoveries under LPT/ADC Agreement (and associated GAAP income recognition) expected to begin before the end of 2024.

•Deferred tax asset of $1.17 per common share still not yet recognized in book value per share, with approximately 45% of NOL carryforwards having no expiry date.

•On May 3, 2024, Maiden entered into a renewal rights transaction with a Swedish unit of AmTrust Financial Services, Inc. ("AmTrust") for the majority of Maiden’s international primary insurance business. Ultimate divestment of the platform will reduce the Company's annual operating expenses by up to $6 million within 12 to 24 months.

Patrick J. Haveron, Maiden’s Chief Executive Officer commented on the first quarter of 2024 financial results: "The effects of our continued positive investment results and the stabilizing effects of our LPT/ADC Agreement led to an increase in our adjusted book value, which we believe represents Maiden's true economic value, to $3.24 per share as of March 31, 2024."

Mr. Haveron added, "The continued improvement in our investment performance was principally the result of higher net investment gains on our alternative asset portfolio, primarily in the private equity asset class where unrealized gains of $7.9 million were recognized across a series of investments. During the first quarter of 2024, our alternative asset portfolio produced a return of 3.4%, which continues to be well above our benchmark cost of debt capital on an annualized basis. As these results continue to increasingly demonstrate, we believe our alternative investment portfolio remains well positioned to achieve its targeted longer-term returns."

"We continue to actively evaluate our strategies as we look to build a more consistent base of revenue and profits while leveraging our experience in insurance and reinsurance markets, including through fee-based and distribution channels in the insurance and reinsurance industry. Our active pursuit of these paths should further enable us to ultimately recognize and realize the significant deferred tax asset we have. Our recently announced IIS renewal rights transaction with AmTrust should serve to further simplify our balance sheet while ultimately reducing our operating expenses by up to $6 million over the next 12 to 24 months. As we evaluate these options and move forward, we have limited our commitments to new alternative investment opportunities."

"While our GAAP income statement continues to be impacted by adverse loss development, it’s important to note that much of this volatility is expected to be temporary as significant shares of the loss development reported are expected to be covered by our LPT/ADC Agreement with Cavello. During the first quarter ended March 31, 2024, nearly 76% of the total reported prior

year loss development is expected to be covered by the LPT/ADC Agreement and is expected to ultimately return over time to Maiden as future GAAP income, subject to certain thresholds in the LPT/ADC Agreement and the applicable GAAP accounting rules. We continue to expect to meet the thresholds to begin recoveries under the LPT/ADC Agreement late in 2024."

"As the benefits of the LPT/ADC Agreement begin to be amortized though our GAAP income statement, it reinforces why adjusted book value, which includes the $75.9 million deferred gain presently on the balance sheet, is a key metric in evaluating Maiden’s value. It's also worth noting that under the provisions of the LPT/ADC Agreement, we still have an additional $79.1 million in available limit to absorb subject loss development should it occur in the future."

"As noted, our consolidated balance sheet at March 31, 2024 does not reflect $117.3 million or $1.17 per common share in net U.S. deferred tax assets which still maintains a full valuation allowance. It’s important to note that of $334.0 million in net operating loss carryforwards that we hold, approximately $151.2 million or 45.3% of these loss carryforwards have no expiry date. Despite the recent adverse reserve development which has delayed the timing related to ultimately recognizing this asset, we believe the factors that will enable us to ultimately recognize these tax assets in the future, including our current strategic initiatives, continues to accumulate, particularly with our asset portfolio producing more current income."

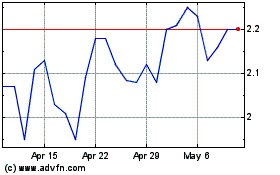

Mr. Haveron concluded, "Finally, during both the first quarter and in the second quarter via a 10b-5 trading plan implemented prior to March 31, 2024, we continued our long-term capital management strategy and repurchased 590,995 common shares at an average price per share of $2.01 under our share repurchase plan. We expect to continue a disciplined and prudent approach to share repurchases as part of this program, particularly in periods of share weakness relative to our book value."

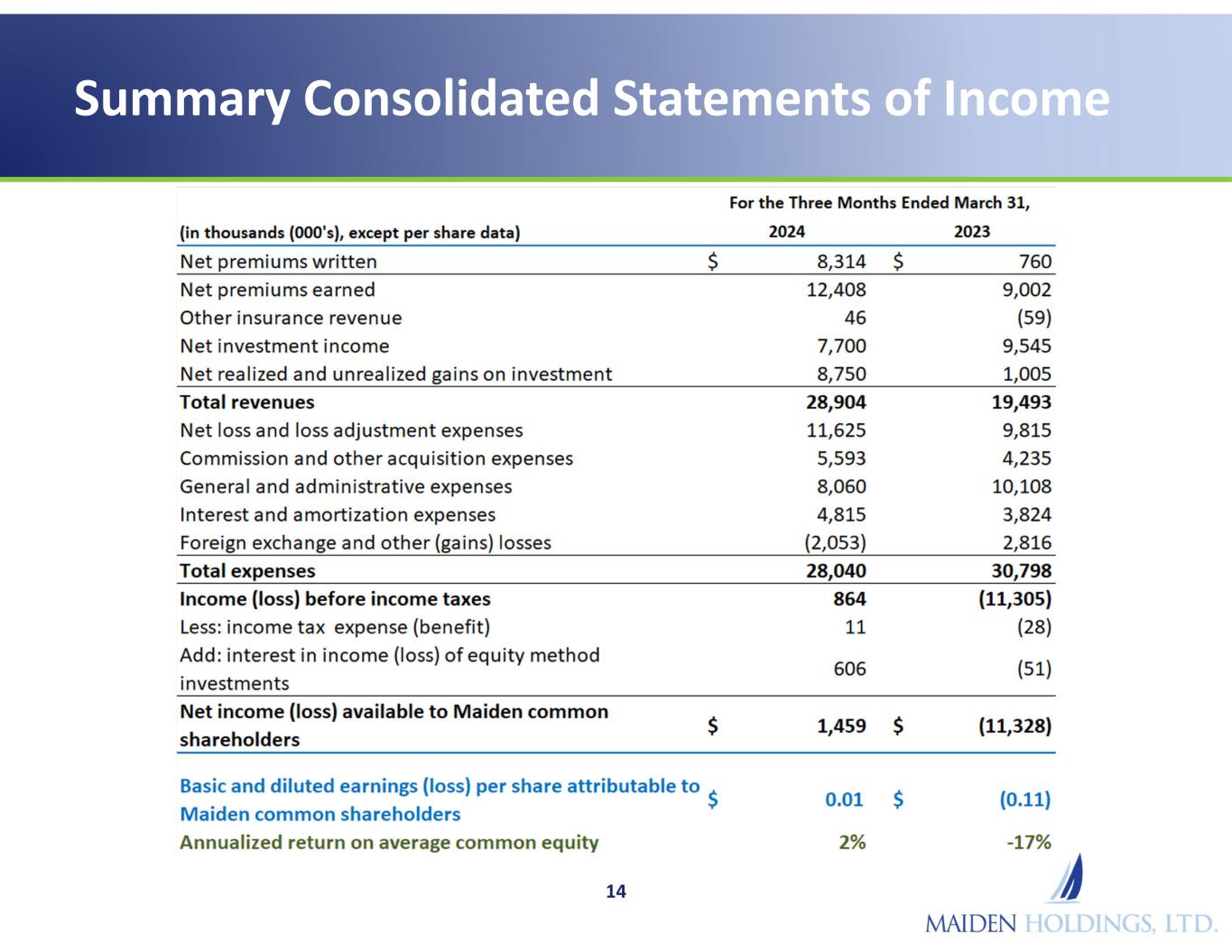

Consolidated Results for the Quarter Ended March 31, 2024

Net income for the three months ended March 31, 2024 was $1.5 million, compared to net loss of $11.3 million for the same respective period in 2023 largely due to the following:

•higher total income from investment activities of $17.1 million for the three months ended March 31, 2024 compared to $10.5 million for the same period in 2023 which was comprised of:

•net investment income of $7.7 million for the three months ended March 31, 2024 compared to $9.5 million for the same period in 2023;

•net realized and unrealized investment gains of $8.8 million for the three months ended March 31, 2024 compared to net realized and unrealized investment gains of $1.0 million for the same period in 2023; and

•interest in income of equity method investments of $0.6 million for the three months ended March 31, 2024 compared to loss of $0.1 million for the same period in 2023.

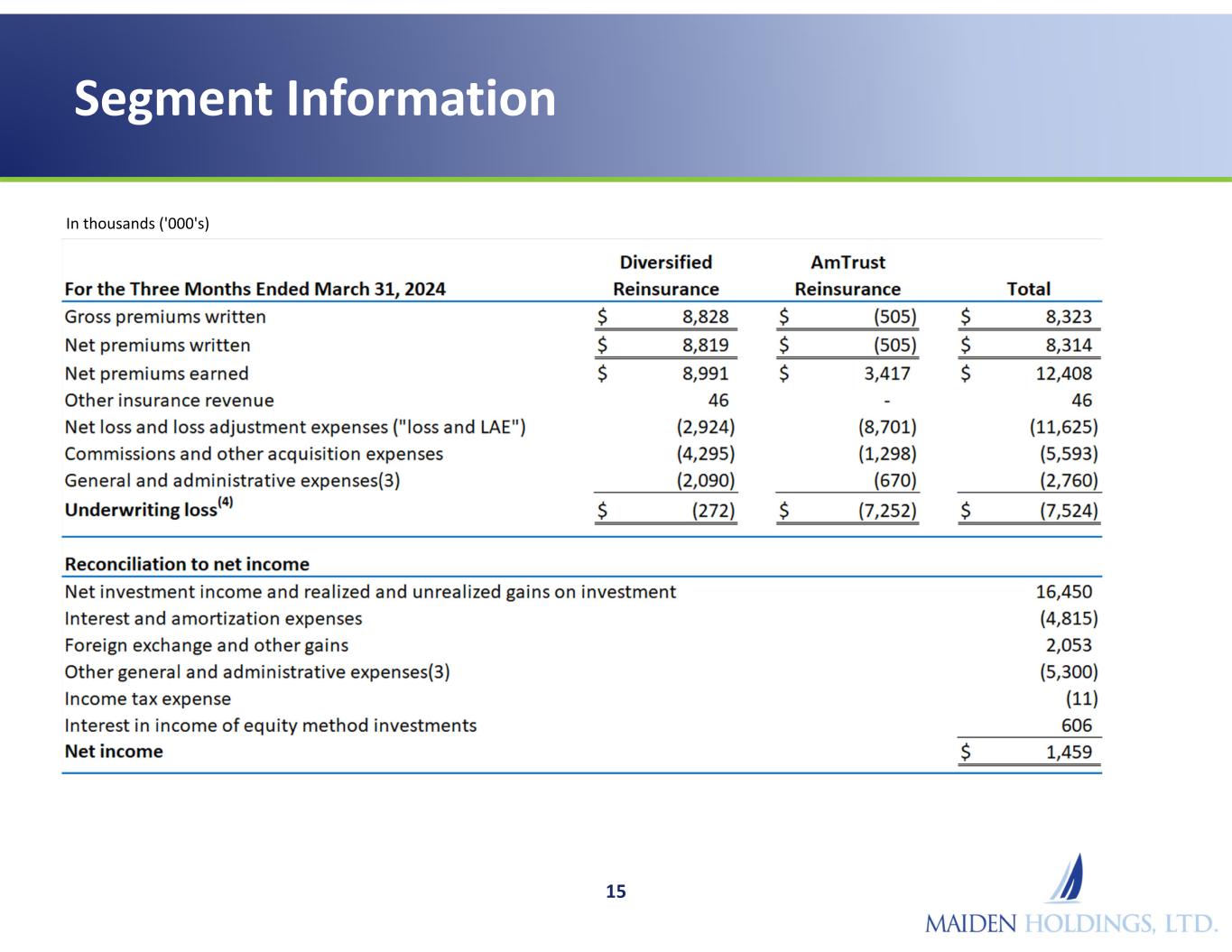

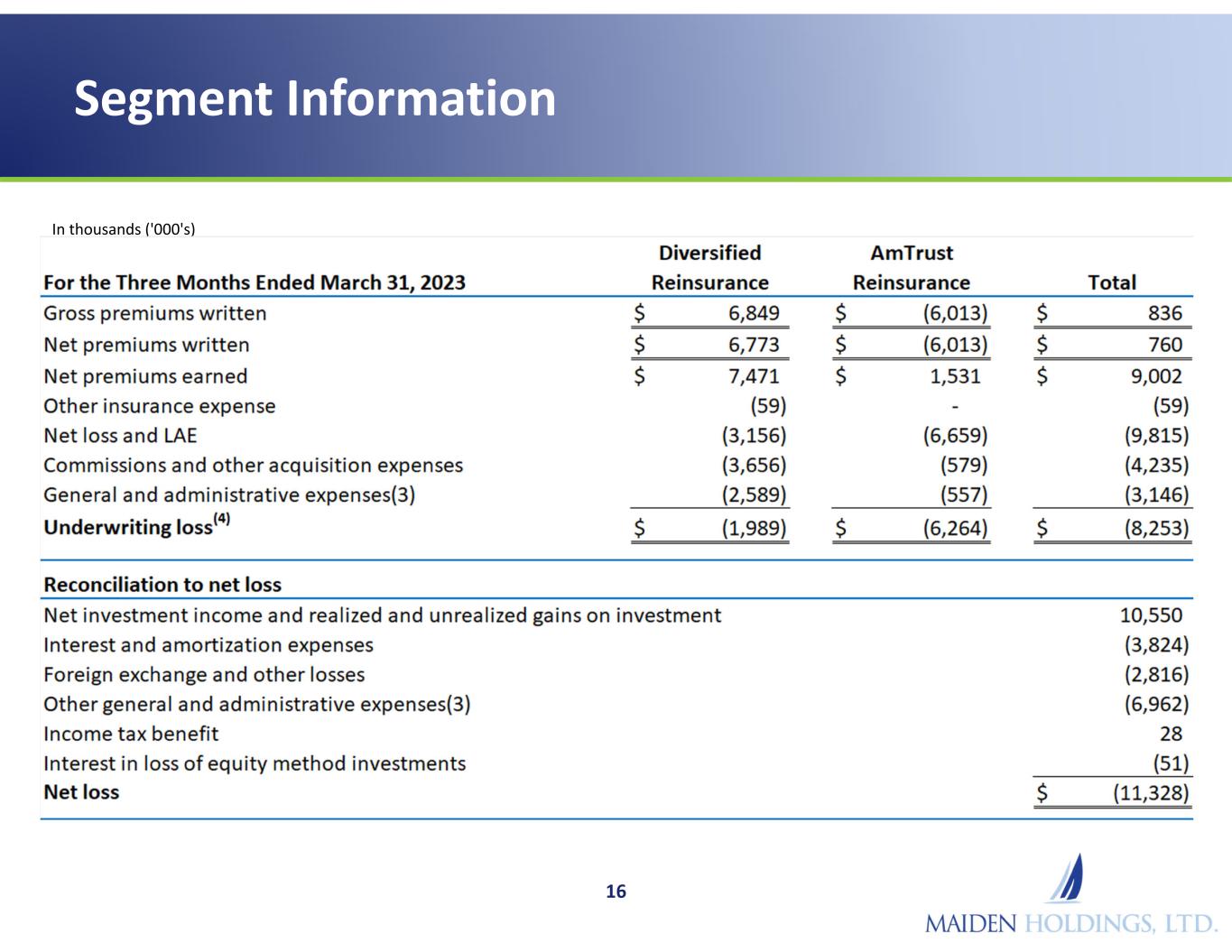

•lower underwriting loss(4) which was $7.5 million in the first quarter of 2024 compared to an underwriting loss of $8.3 million in the same period in 2023 which was influenced by:

•adverse prior year loss development of $6.6 million in the first quarter of 2024 compared to adverse prior year loss development of $3.7 million during the same period in 2023; and

•on a current accident year basis, underwriting loss of $1.0 million for the three months ended March 31, 2024 compared to an underwriting loss of $4.6 million for the same period in 2023.

•corporate general and administrative expenses decreased to $5.3 million for the three months ended March 31, 2024 compared to $7.0 million for the same period in 2023; and

•foreign exchange and other gains of $2.1 million during the three months ended March 31, 2024, compared to foreign exchange and other losses of $2.8 million for the same period in 2023.

Net premiums written for the three months ended March 31, 2024 were $8.3 million compared to $0.8 million for the same period in 2023. Net written premiums in our AmTrust Reinsurance segment were $(0.5) million in the three months ended March 31, 2024 compared to net premiums of $(6.0) million for the same period in 2023 which included negative gross and net premiums written of $6.1 million due to the cancellation of cases in a certain program within Specialty Risk and Extended Warranty.

Net premiums written in the Diversified Reinsurance segment increased by $2.0 million or 30.2% for the three months ended March 31, 2024 compared to 2023 due to growth in direct premiums for Credit Life programs written by wholly owned Swedish subsidiaries Maiden Life Försäkrings AB ("Maiden LF") and Maiden General Försäkrings AB ("Maiden GF"). As announced on May 6, 2024, the Company has entered into a renewal rights transaction with AmTrust Nordic AB, a Swedish unit of AmTrust. This transaction is expected to cover the majority of its primary business written through Maiden GF and Maiden LF in Sweden, Norway and other Nordic countries; and is part of a broader plan to divest of the International Insurance Services (“IIS”) business as a result of the Company's recently concluded strategic review of the IIS business platform.

Net premiums earned increased by $3.4 million for the three months ended March 31, 2024 compared to the same period in 2023 due to higher earned premiums for Specialty Risk business in the AmTrust Reinsurance segment and Diversified Reinsurance segment due to growth in Credit Life programs written by Maiden LF and Maiden GF.

Net investment income decreased by $1.8 million or 19.3% for the three months ended March 31, 2024 compared to the same period in 2023 primarily due to lower interest income earned on our funds withheld balance with AmTrust in the first quarter of 2024 as loss reserves continued to be settled using the funds withheld receivable. Average aggregate fixed income assets decreased by 39.0% due to continued run-off of our reinsurance liabilities previously written on prospective risks primarily through the funds withheld receivable. During the first quarter of 2024, we experienced positive operating cash flows due to excess collateral released by AmTrust through the funds withheld receivable.

The decrease in investment income from fixed income assets was partially offset by higher annualized average book yields from fixed income assets, which include available-for-sale ("AFS") securities, cash and restricted cash, funds withheld receivable, and loan to related party. The yield on these assets increased to 4.6% for the three months ended March 31, 2024 compared to 3.7% for the same period in 2023. Our average fixed income assets are an average of the amounts disclosed in our quarterly U.S. GAAP consolidated financial statements.

Annualized yields on fixed income assets (including our related party loan) continue to rise partly due to 43.2% of our fixed income investments as of March 31, 2024 being invested in floating rate assets which enabled this component of our asset portfolio to respond to the current higher interest rate environment. The weighted average interest rate on our related party loan increased to 7.3% during the three months ended March 31, 2024, compared to 6.4% for the same period in 2023.

Net realized and unrealized investment gains for the three months ended March 31, 2024 were $8.8 million compared to net gains of $1.0 million for the same period in 2023. This included net unrealized investment gains on alternative investments of $9.0 million for the first quarter of 2024 compared to net realized and unrealized gains of $1.0 million for the first quarter of 2023. Total net realized and unrealized investment gains increased by $7.7 million for the three months ended March 31, 2024 compared to the same period in 2023 primarily due to unrealized gains in the private equity asset class of $7.9 million during the current year period.

Net loss and LAE increased by $1.8 million during the three months ended March 31, 2024 compared to the same period in 2023. Net loss and LAE for the first quarter of 2024 was impacted by net adverse prior year reserve development of $6.6 million compared to net adverse development of $3.7 million for the first quarter of 2023. The AmTrust Reinsurance segment had adverse prior year reserve development of $7.2 million in the first quarter of 2024 compared to adverse development of $2.9 million for the first quarter of 2023. The Diversified Reinsurance segment had favorable prior year reserve development of $0.7 million in the first quarter of 2024 compared to adverse development of $0.8 million for the first quarter of 2023.

Of the total adverse development experienced in the AmTrust Reinsurance segment for the three months ended March 31, 2024 and 2023, $5.0 million and $1.6 million respectively, are expected to be recoverable under the LPT/ADC Agreement and are further expected to be recognized as future GAAP income over time as recoveries are received subject to the provisions of the LPT/ADC Agreement and the applicable GAAP accounting rules. This represents approximately 76.2% and 43.0% of the Company's total adverse development experienced for the three months ended March 31, 2024 and 2023, respectively.

Commission and other acquisition expenses were $5.6 million for the three months ended March 31, 2024 compared to $4.2 million for the same period in 2023. Total general and administrative expenses decreased by $2.0 million, or 20.3% for the three months ended March 31, 2024, compared to the same period in 2023 due to lower incentive compensation costs.

Operating Results for the three months ended March 31, 2024

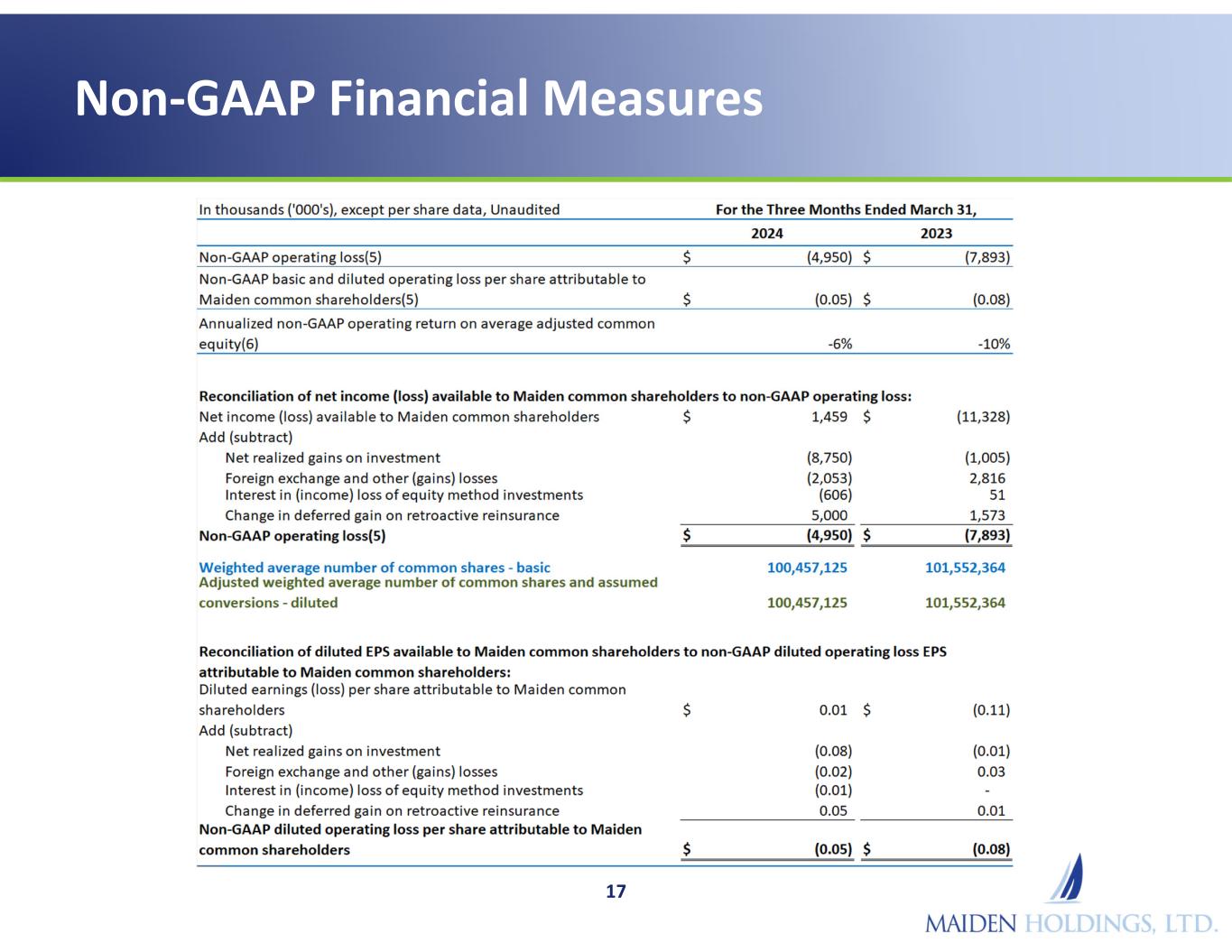

In addition to other adjustments, management adjusts reported GAAP net (income) loss and underwriting results by excluding incurred losses and LAE covered by the LPT/ADC Agreement with Cavello. Such losses are fully recoverable from Cavello, and are expected to be reported as future GAAP income over time as recoveries are received subject to both the provisions of the LPT/ADC Agreement and the applicable GAAP accounting rules, therefore adjusting for these losses shows the ultimate economic benefit of the LPT/ADC Agreement to Maiden. Management presently expects recoveries under the LPT/ADC Agreement to begin before the end of 2024.

Non-GAAP operating loss was $5.0 million or $0.05 per diluted common share for the first quarter of 2024 compared to non-GAAP operating loss of $7.9 million or $0.08 per diluted common share for the first quarter of 2023. Adjusted to include net realized and unrealized investment gains and the interest in income (loss) of equity method investments which are recurring parts of investment results with the Company’s underwriting activities in run-off, the non-GAAP operating earnings was $4.4 million or $0.04 per diluted common share for the first quarter of 2024, compared to non-GAAP operating loss of $6.9 million or $0.07 per diluted common share for the first quarter of 2023.

The unamortized deferred gain on retroactive reinsurance under the LPT/ADC Agreement with Cavello was $75.9 million as of March 31, 2024, an increase of $5.0 million compared to $70.9 million at December 31, 2023, driven by adverse prior year loss

development of $5.0 million reported for policies under the AmTrust Quota Share for the three months ended March 31, 2024. These losses are recoverable under the LPT/ADC Agreement and are expected to be recognized as future GAAP income over time as recoveries are received under the provisions of the LPT/ADC Agreement and the applicable GAAP accounting rules.

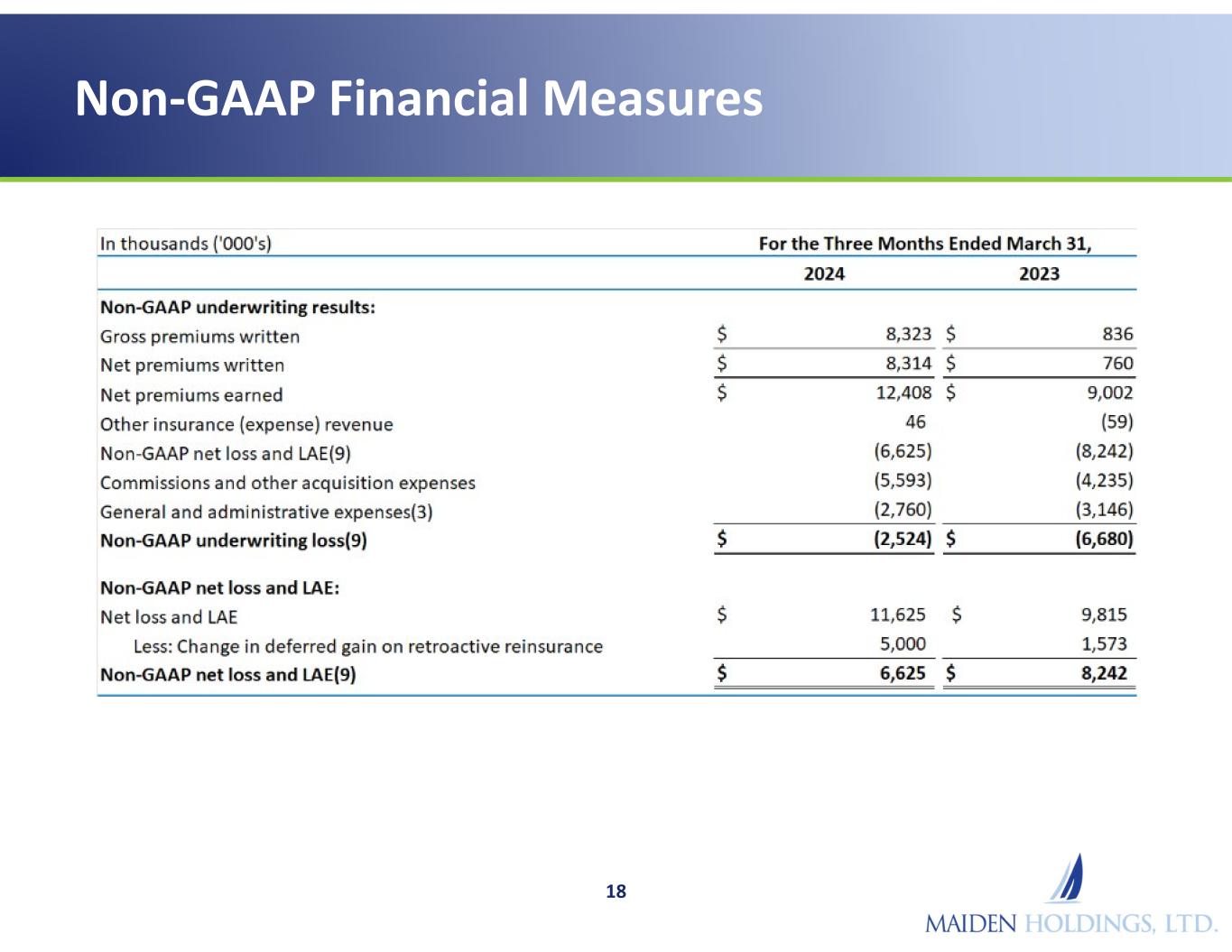

Adjusted for prior year reserve development under the AmTrust Quota Share which is fully recoverable from Cavello under the LPT/ADC Agreement, the non-GAAP net loss and LAE decreased by $5.0 million and $1.6 million for the three months ended March 31, 2024 and 2023, respectively. The non-GAAP underwriting loss(9) was $2.5 million for the three months ended March 31, 2024 compared to a non-GAAP underwriting loss of $6.7 million for the three months ended March 31, 2023.

The non-GAAP underwriting loss for the three months ended March 31, 2024 and 2023 included loss development in the AmTrust Reinsurance segment not covered by the LPT/ADC Agreement, specifically the run-off of the AmTrust Quota Share with losses occurring after December 31, 2018, as well as adverse loss development of $2.5 million for the European Hospital Liability Quota Share for the first quarter of 2024. The results also included an underwriting loss in the Diversified Reinsurance segment of $0.3 million for the three months ended March 31, 2024 compared to an underwriting loss of $2.0 million for the same respective period in 2023. Please refer to the Non-GAAP Financial Measures tables in this earnings release for additional information on these non-GAAP financial measures and reconciliation of these measures to the appropriate GAAP measures.

Quarterly Report on Form 10-Q for the Period Ended March 31, 2024 and Other Financial Matters

The Company’s Quarterly Report on Form 10-Q for the three months ended March 31, 2024 was filed with the U.S. Securities and Exchange Commission on May 9, 2024. Additional information on the matters reported in this news release along with other required disclosures can be found in that filing.

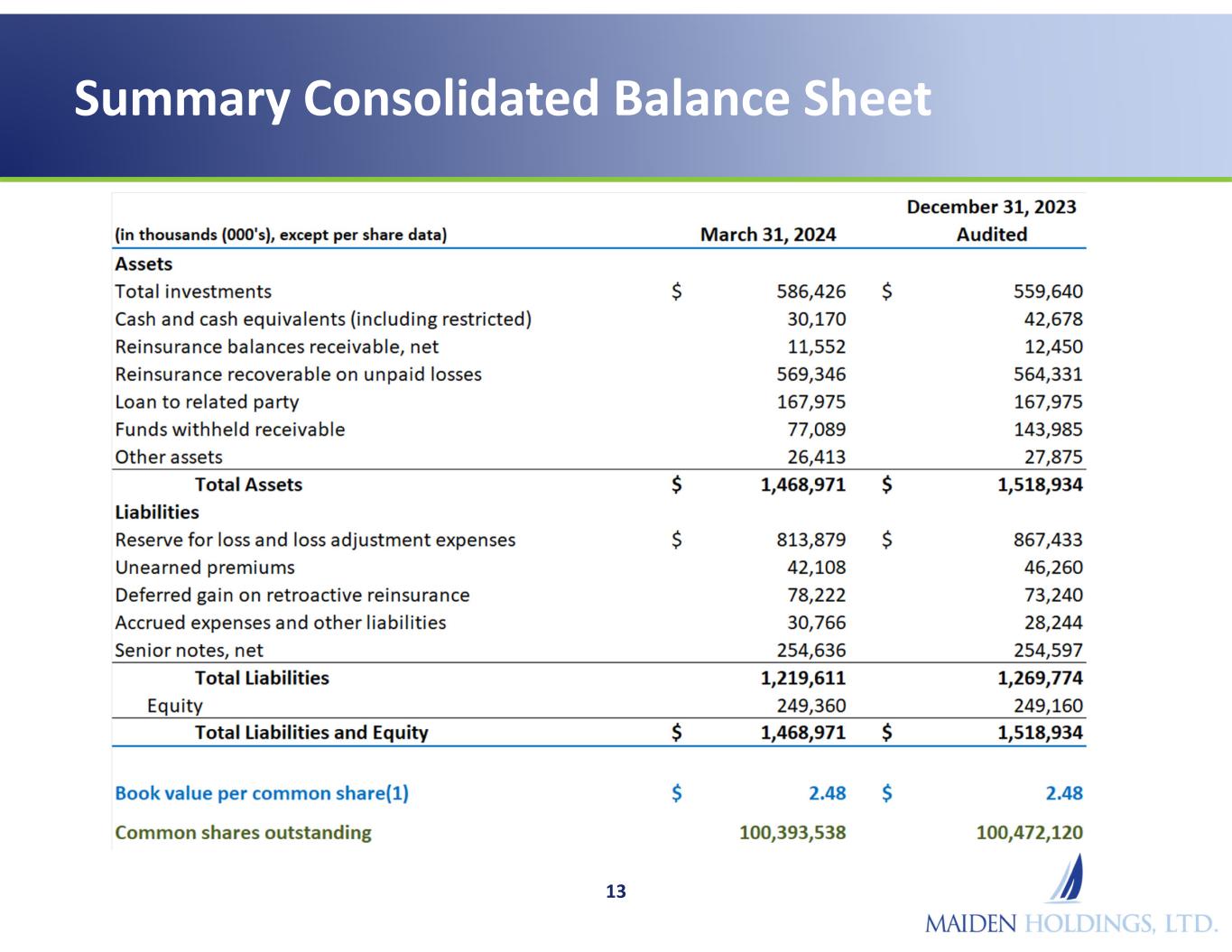

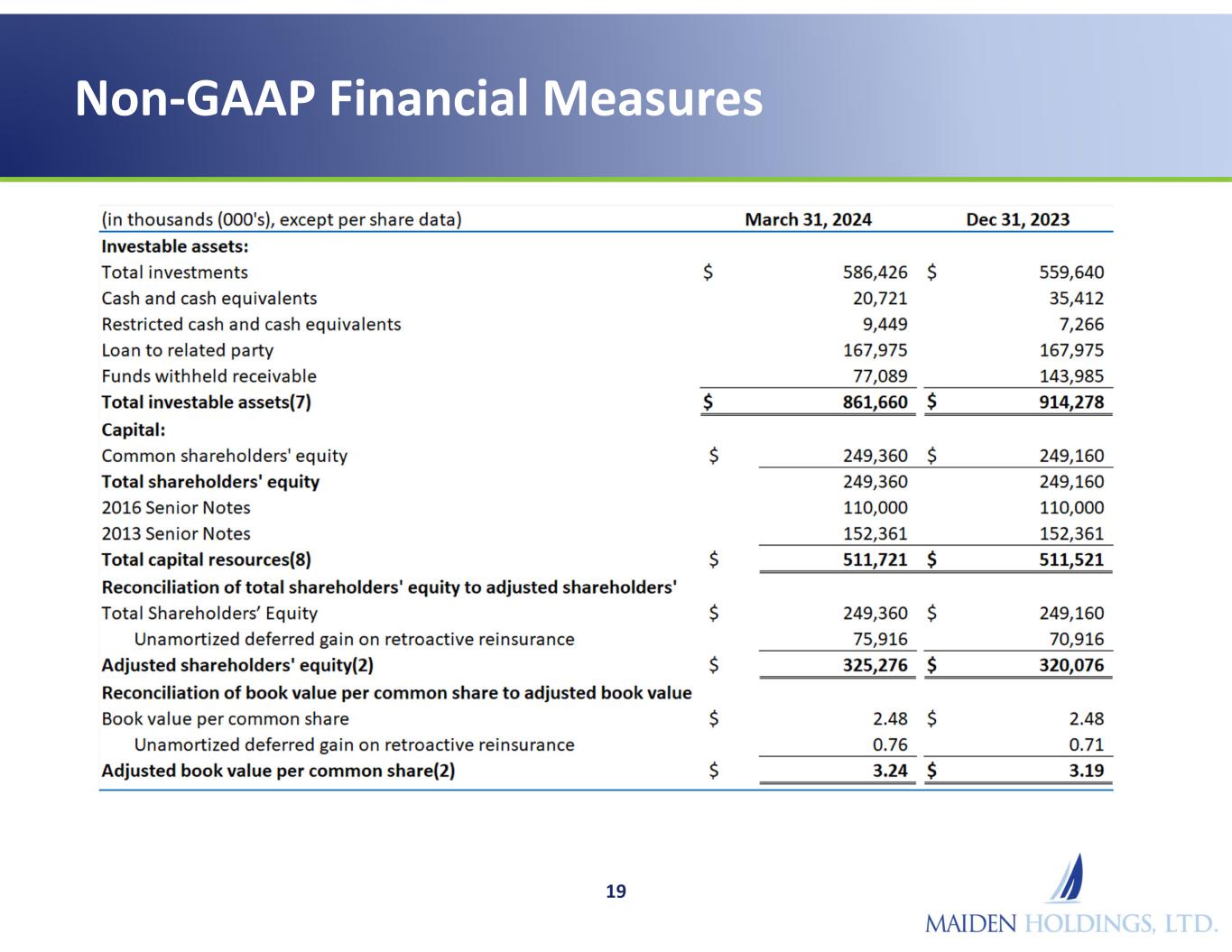

Total assets were $1.5 billion at March 31, 2024 which decreased by $50.0 million compared to December 31, 2023 largely due to the continuing run-off of the Company's prior reinsurance liabilities. Shareholders' equity was $249.4 million at March 31, 2024 compared to $249.2 million at December 31, 2023.

Adjusted shareholders' equity(2) was $325.3 million at March 31, 2024 compared to $320.1 million at December 31, 2023, which includes an unamortized deferred gain under the LPT/ADC Agreement of $75.9 million at March 31, 2024 and $70.9 million at December 31, 2023.

During the three months ended March 31, 2024 and through May 8, 2024, Maiden Reinsurance continued its long-term capital management strategy via its previously implemented Rule 10b-5 trading plan and repurchased 590,995 common shares at an average price per share of $2.01. The Company had $70.4 million remaining for authorized common share repurchases at May 8, 2024 under the Company's $100.0 million share repurchase plan, which was approved by the Company's Board of Directors on February 21, 2017.

On May 3, 2023, the Company's Board of Directors approved the repurchase, including the repurchase by Maiden Reinsurance in accordance with its investment guidelines, of up to $100.0 million of the Company's Senior Notes from time to time at market prices in open market purchases or as may be privately negotiated. The Company's current remaining authorization is $99.9 million for Senior Notes repurchases.

As of March 31, 2024, GLS and its subsidiaries have insurance related liabilities of $24.3 million which mainly consisted of total reserves of $18.1 million, an underwriting-related derivative liability of $4.0 million, and net deferred gains on retroactive reinsurance of $2.3 million. The Company presently does not anticipate any further contracts in the GLS legacy management segment, and no longer considers it part of its strategy to produce acceptable shareholder returns therefore no additional capital will be committed to new accounts in this segment. The Company is currently running off the small number of accounts GLS underwrote since its formation as previously reported in our Annual Report on Form 10-K for the year ended December 31, 2023.

The Company's wholly owned subsidiary, Maiden Holdings North America, Ltd., holds net operating loss carryforwards ("NOLs") which were $334.0 million as of March 31, 2024. Approximately $151.2 million or 45.3% of the Company's NOL carryforwards have no expiry date under the relevant U.S. tax law. These NOLs, in combination with additional net deferred tax assets primarily related to our insurance liabilities, result in a net U.S. deferred tax asset (before valuation allowance) of $117.3 million or $1.17 per common share as of March 31, 2024. The net deferred tax assets are not presently recognized on the Company’s balance sheet as a full valuation allowance is carried against them.

The Company no longer presents certain non-GAAP measures such as combined ratio and its related components in its news release or quarterly reports, as it believes that as the run-off of its reinsurance portfolios progresses, such ratios are increasingly not meaningful and of less value to readers as they evaluate our financial results.

Quarterly Dividends

The Company's Board of Directors did not authorize any quarterly dividends on its common shares during the three months ended March 31, 2024 and 2023.

About Maiden Holdings, Ltd.

Maiden Holdings, Ltd. is a Bermuda-based holding company formed in 2007. Maiden creates shareholder value by actively managing and allocating our assets and capital, including through ownership and management of businesses and assets mostly in the insurance and related financial services industries where we can leverage our deep knowledge of those markets.

(1)(2)(4)(5)(9) Please refer to the Non-GAAP Financial Measures tables for additional information on these non-GAAP financial measures and reconciliation of these measures to GAAP measures.

Special Note about Forward Looking Statements

Certain statements in this press release, other than purely historical information, including estimates, projections, statements relating to the Company’s business plans, objectives and expected operating results and the assumptions upon which those statements are based are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements include general statements both with respect to the Company and the insurance industry and generally are identified with the words "anticipate", "believe", "expect", "predict", "estimate", "intend", "plan", "project", "seek", "potential", "possible", "could", "might", "may", "should", "will", "would", "will be", "will continue", "will likely result" and similar expressions. In light of the risks and uncertainties inherent in all forward-looking statements, the inclusion of such statements in this press release should not be considered as a representation by the Company or any other person that the Company’s objectives or plans or other matters described in any forward-looking statement will be achieved. These statements are based on current plans, estimates, assumptions and expectations. Actual results may differ materially from those projected in such forward-looking statements and therefore, you should not place undue reliance on them. Important factors that could cause actual results to differ materially from those in such forward-looking statements are set forth in Item 1A "Risk Factors" in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023. COVID-19 triggered a period of increased volatility with respect to global economic conditions. During the year ended December 31, 2023, inflation became unusually high in many parts of the world, and central banks in the U.S. and other countries aggressively raised interest rates to counter inflation by slowing economic activity. Monetary policy tightening actions are ongoing at March 31, 2024, and their long-term impact on financial markets and the real economy is currently uncertain. Please also see additional risks described in "Part I, Item 1A, Risk Factors" of our Annual Report on Form 10-K for the year ended December 31, 2023.

The Company cautions that the list of important risk factors in its Annual Report on Form 10-K for the year ended December 31, 2023 is not intended to be and is not exhaustive. The Company undertakes no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required by law, and all subsequent written and oral forward-looking statements attributable to the Company or individuals acting on the Company’s behalf are expressly qualified in their entirety by this paragraph. If one or more risks or uncertainties materialize, or if the Company’s underlying assumptions prove to be incorrect, the Company’s actual results may vary materially from what was projected. Any forward-looking statements in this press release reflect the Company’s current view with respect to future events and are subject to these and other risks, uncertainties and assumptions relating to the Company’s operations, results of operations, growth, strategy and liquidity. Readers are cautioned not to place undue reliance on the forward-looking statements which speak only as of the dates of the documents in which such statements were made.

Any discrepancies between the amounts included in the results of operations discussion and the consolidated financial statement tables are due to rounding.

CONTACT:

FGS Global

Maiden@fgsglobal.com

MAIDEN HOLDINGS, LTD.

CONSOLIDATED BALANCE SHEETS

(In thousands of U.S. dollars, except share and per share data)

| | | | | | | | | | | | | | |

| | March 31,

2024 | | December 31, 2023 |

| | (Unaudited) | | (Audited) |

| ASSETS |

| Investments: | | | | |

Fixed maturities, available-for-sale, at fair value (amortized cost 2024 - $266,368; 2023 - $258,536) | | $ | 259,451 | | | $ | 250,601 | |

| Equity securities, at fair value | | 44,428 | | | 45,299 | |

| Equity method investments | | 82,159 | | | 80,929 | |

| Other investments | | 200,388 | | | 182,811 | |

| Total investments | | 586,426 | | | 559,640 | |

| Cash and cash equivalents | | 20,721 | | | 35,412 | |

| Restricted cash and cash equivalents | | 9,449 | | | 7,266 | |

| Accrued investment income | | 3,927 | | | 4,532 | |

| Reinsurance balances receivable, net | | 11,552 | | | 12,450 | |

| Reinsurance recoverable on unpaid losses | | 569,346 | | | 564,331 | |

| Loan to related party | | 167,975 | | | 167,975 | |

| Deferred commission and other acquisition expenses, net | | 15,990 | | | 17,566 | |

| Funds withheld receivable | | 77,089 | | | 143,985 | |

| Other assets | | 6,496 | | | 5,777 | |

| | | | |

| Total assets | | $ | 1,468,971 | | | $ | 1,518,934 | |

| LIABILITIES |

| Reserve for loss and loss adjustment expenses | | $ | 813,879 | | | $ | 867,433 | |

| Unearned premiums | | 42,108 | | | 46,260 | |

| Deferred gain on retroactive reinsurance | | 78,222 | | | 73,240 | |

| | | | |

| Accrued expenses and other liabilities | | 30,766 | | | 28,244 | |

| Senior notes - principal amount | | 262,361 | | | 262,361 | |

| Less: unamortized debt issuance costs | | 7,725 | | | 7,764 | |

| Senior notes, net | | 254,636 | | | 254,597 | |

| | | | |

| Total liabilities | | 1,219,611 | | | 1,269,774 | |

| Commitments and Contingencies | | | | |

| EQUITY |

| | | | |

| Common shares | | 1,501 | | | 1,497 | |

| Additional paid-in capital | | 886,432 | | | 886,072 | |

| Accumulated other comprehensive loss | | (32,191) | | | (31,469) | |

| Accumulated deficit | | (485,486) | | | (486,945) | |

| Treasury shares, at cost | | (120,896) | | | (119,995) | |

| | | | |

| | | | |

| Total Equity | | 249,360 | | | 249,160 | |

| Total Liabilities and Equity | | $ | 1,468,971 | | | $ | 1,518,934 | |

| | | | |

Book value per common share(1) | | $ | 2.48 | | | $ | 2.48 | |

| | | | |

| Common shares outstanding | | 100,393,538 | | | 100,472,120 | |

MAIDEN HOLDINGS, LTD.

CONSOLIDATED STATEMENTS OF INCOME (Unaudited)

(In thousands of U.S. dollars, except share and per share data)

| | | | | | | | | | | | | | | | | | |

| | | | For the Three Months Ended March 31, |

| | | | | | 2024 | | 2023 |

| Revenues: | | | | | | | | |

| Gross premiums written | | | | | | $ | 8,323 | | | $ | 836 | |

| Net premiums written | | | | | | $ | 8,314 | | | $ | 760 | |

| Change in unearned premiums | | | | | | 4,094 | | | 8,242 | |

| Net premiums earned | | | | | | 12,408 | | | 9,002 | |

| Other insurance revenue (expense), net | | | | | | 46 | | | (59) | |

| Net investment income | | | | | | 7,700 | | | 9,545 | |

| Net realized and unrealized investment gains | | | | | | 8,750 | | | 1,005 | |

| | | | | | | | |

| Total revenues | | | | | | 28,904 | | | 19,493 | |

| Expenses: | | | | | | | | |

| Net loss and loss adjustment expenses | | | | | | 11,625 | | | 9,815 | |

| Commission and other acquisition expenses | | | | | | 5,593 | | | 4,235 | |

| General and administrative expenses | | | | | | 8,060 | | | 10,108 | |

| Total expenses | | | | | | 25,278 | | | 24,158 | |

| Other expenses | | | | | | | | |

| Interest and amortization expenses | | | | | | 4,815 | | | 3,824 | |

| | | | | | | | |

| | | | | | | | |

| Foreign exchange and other (gains) losses | | | | | | (2,053) | | | 2,816 | |

| Total other expenses | | | | | | 2,762 | | | 6,640 | |

| Income (loss) before income taxes | | | | | | 864 | | | (11,305) | |

| Less: income tax expense (benefit) | | | | | | 11 | | | (28) | |

| Interest in income (loss) of equity method investments | | | | | | 606 | | | (51) | |

| | | | | | | | |

| | | | | | | | |

| Net income (loss) | | | | | | 1,459 | | | (11,328) | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Basic and diluted earnings (loss) per share available (attributable) to common shareholders | | | | | | $ | 0.01 | | | $ | (0.11) | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Annualized return on average common equity | | | | | | 2.4 | % | | (16.5) | % |

| Weighted average number of common shares - basic and diluted | | | | | | 100,457,125 | | 101,552,364 |

| | | | | | | | |

MAIDEN HOLDINGS, LTD.

SUPPLEMENTAL FINANCIAL DATA - SEGMENT INFORMATION (Unaudited)

(in thousands of U.S. dollars)

| | | | | | | | | | | | | | | | | | | | | | |

| For the Three Months Ended March 31, 2024 | | Diversified Reinsurance | | AmTrust Reinsurance | | | | Total |

Gross premiums written | | $ | 8,828 | | | $ | (505) | | | | | $ | 8,323 | |

Net premiums written | | $ | 8,819 | | | $ | (505) | | | | | $ | 8,314 | |

Net premiums earned | | $ | 8,991 | | | $ | 3,417 | | | | | $ | 12,408 | |

| Other insurance expense | | 46 | | | — | | | | | 46 | |

Net loss and loss adjustment expenses ("loss and LAE") | | (2,924) | | | (8,701) | | | | | (11,625) | |

Commission and other acquisition expenses | | (4,295) | | | (1,298) | | | | | (5,593) | |

General and administrative expenses(3) | | (2,090) | | | (670) | | | | | (2,760) | |

Underwriting loss (4) | | $ | (272) | | | $ | (7,252) | | | | | (7,524) | |

Reconciliation to net income | | | | | | | | |

Net investment income and net realized and unrealized investment gains | | | | | | | | 16,450 | |

| | | | | | | | |

Interest and amortization expenses | | | | | | | | (4,815) | |

| | | | | | | | |

| | | | | | | | |

Foreign exchange and other gains, net | | | | | | | | 2,053 | |

Other general and administrative expenses(3) | | | | | | | | (5,300) | |

Income tax expense | | | | | | | | (11) | |

Interest in income of equity method investments | | | | | | | | 606 | |

Net income | | | | | | | | $ | 1,459 | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | |

| For the Three Months Ended March 31, 2023 | | Diversified Reinsurance | | AmTrust Reinsurance | | | | Total |

Gross premiums written | | $ | 6,849 | | | $ | (6,013) | | | | | $ | 836 | |

Net premiums written | | $ | 6,773 | | | $ | (6,013) | | | | | $ | 760 | |

Net premiums earned | | $ | 7,471 | | | $ | 1,531 | | | | | $ | 9,002 | |

| Other insurance revenue | | (59) | | | — | | | | | (59) | |

Net loss and LAE | | (3,156) | | | (6,659) | | | | | (9,815) | |

Commission and other acquisition expenses | | (3,656) | | | (579) | | | | | (4,235) | |

General and administrative expenses(3) | | (2,589) | | | (557) | | | | | (3,146) | |

Underwriting loss(4) | | $ | (1,989) | | | $ | (6,264) | | | | | (8,253) | |

Reconciliation to net loss | | | | | | | | |

Net investment income and net realized and unrealized investment gains | | | | | | | | 10,550 | |

| | | | | | | | |

Interest and amortization expenses | | | | | | | | (3,824) | |

| | | | | | | | |

| | | | | | | | |

Foreign exchange and other losses, net | | | | | | | | (2,816) | |

Other general and administrative expenses(3) | | | | | | | | (6,962) | |

Income tax benefit | | | | | | | | 28 | |

Interest in loss of equity method investments | | | | | | | | (51) | |

Net loss | | | | | | | | $ | (11,328) | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

MAIDEN HOLDINGS, LTD.

NON-GAAP FINANCIAL MEASURES (Unaudited)

(In thousands of U.S. dollars, except share and per share data)

| | | | | | | | | | | | | | | | | | |

| | For the Three Months Ended March 31, | | |

| | 2024 | | 2023 | | | | |

Non-GAAP operating loss (5) | | $ | (4,950) | | | $ | (7,893) | | | | | |

Non-GAAP basic and diluted operating loss per common share attributable to Maiden common shareholders(5) | | $ | (0.05) | | | $ | (0.08) | | | | | |

| | | | | | | | |

Annualized non-GAAP operating return on average adjusted common equity(6) | | (6.2) | % | | (9.9) | % | | | | |

Reconciliation of net income (loss) to non-GAAP operating loss: | | | | | | | | |

| Net income (loss) | | $ | 1,459 | | | $ | (11,328) | | | | | |

| Add (subtract): | | | | | | | | |

| Net realized and unrealized investment gains | | (8,750) | | | (1,005) | | | | | |

| | | | | | | | |

| Foreign exchange and other (gains) losses | | (2,053) | | | 2,816 | | | | | |

| Interest in (income) loss of equity method investments | | (606) | | | 51 | | | | | |

| | | | | | | | |

| Change in deferred gain on retroactive reinsurance under the LPT/ADC Agreement | | 5,000 | | | 1,573 | | | | | |

| | | | | | | | |

| | | | | | | | |

Non-GAAP operating loss (5) | | $ | (4,950) | | | $ | (7,893) | | | | | |

| | | | | | | | |

| | | | | | | | |

| Weighted average number of common shares - basic and diluted | | 100,457,125 | | | 101,552,364 | | | | | |

| | | | | | | | |

Reconciliation of diluted earnings (loss) per share available (attributable) to Maiden common shareholders to non-GAAP diluted operating loss per share attributable to Maiden common shareholders: | | | | |

| Diluted earnings (loss) per share available (attributable) to common shareholders | | $ | 0.01 | | | $ | (0.11) | | | | | |

| Add (subtract): | | | | | | | | |

| Net realized and unrealized investment gains | | (0.08) | | | (0.01) | | | | | |

| | | | | | | | |

| Foreign exchange and other (gains) losses | | (0.02) | | | 0.03 | | | | | |

| Interest in (income) loss of equity method investments | | (0.01) | | | — | | | | | |

| | | | | | | | |

| Change in deferred gain on retroactive reinsurance under the LPT/ADC Agreement | | 0.05 | | | 0.01 | | | | | |

| | | | | | | | |

| | | | | | | | |

| Non-GAAP diluted operating loss per share attributable to common shareholders | | $ | (0.05) | | | $ | (0.08) | | | | | |

| | | | | | | | |

| Non-GAAP Underwriting Results and Non-GAAP Net Loss and LAE | | | | | | |

| Gross premiums written | | $ | 8,323 | | | $ | 836 | | | | | |

| Net premiums written | | $ | 8,314 | | | $ | 760 | | | | | |

| Net premiums earned | | $ | 12,408 | | | $ | 9,002 | | | | | |

| Other insurance revenue (expense), net | | 46 | | | (59) | | | | | |

Non-GAAP net loss and LAE(9) | | (6,625) | | | (8,242) | | | | | |

| Commission and other acquisition expenses | | (5,593) | | | (4,235) | | | | | |

General and administrative expenses(3) | | (2,760) | | | (3,146) | | | | | |

Non-GAAP underwriting loss(9) | | $ | (2,524) | | | $ | (6,680) | | | | | |

| | | | | | | | |

| Net loss and LAE | | $ | 11,625 | | | $ | 9,815 | | | | | |

Less: adverse prior year loss development covered under the LPT/ADC Agreement | | 5,000 | | | 1,573 | | | | | |

Non-GAAP net loss and LAE(9) | | $ | 6,625 | | | $ | 8,242 | | | | | |

MAIDEN HOLDINGS, LTD.

NON-GAAP FINANCIAL MEASURES (Unaudited)

(In thousands of U.S. dollars, except share and per share data)

| | | | | | | | | | | |

| March 31, 2024 | | December 31, 2023 |

| Investable assets: | | | |

| Total investments | $ | 586,426 | | | $ | 559,640 | |

| Cash and cash equivalents | 20,721 | | | 35,412 | |

| Restricted cash and cash equivalents | 9,449 | | | 7,266 | |

| Loan to related party | 167,975 | | | 167,975 | |

| Funds withheld receivable | 77,089 | | | 143,985 | |

Total investable assets(7) | $ | 861,660 | | | $ | 914,278 | |

| | | |

| Capital: | | | |

| | | |

| | | |

Total shareholders' equity | $ | 249,360 | | | $ | 249,160 | |

2016 Senior Notes | 110,000 | | | 110,000 | |

2013 Senior Notes | 152,361 | | | 152,361 | |

Total capital resources(8) | $ | 511,721 | | | $ | 511,521 | |

| | | |

Reconciliation of total shareholders' equity to adjusted shareholders' equity: | | | |

Total Shareholders’ Equity | $ | 249,360 | | | $ | 249,160 | |

| | | |

| Unamortized deferred gain on LPT/ADC Agreement | 75,916 | | | 70,916 | |

Adjusted shareholders' equity(2) | $ | 325,276 | | | $ | 320,076 | |

| | | |

Reconciliation of book value per common share to adjusted book value per common share: | | | |

Book value per common share | $ | 2.48 | | | $ | 2.48 | |

| | | |

| Unamortized deferred gain on LPT/ADC Agreement | 0.76 | | | 0.71 | |

Adjusted book value per common share(2) | $ | 3.24 | | | $ | 3.19 | |

| | | | | | | | |

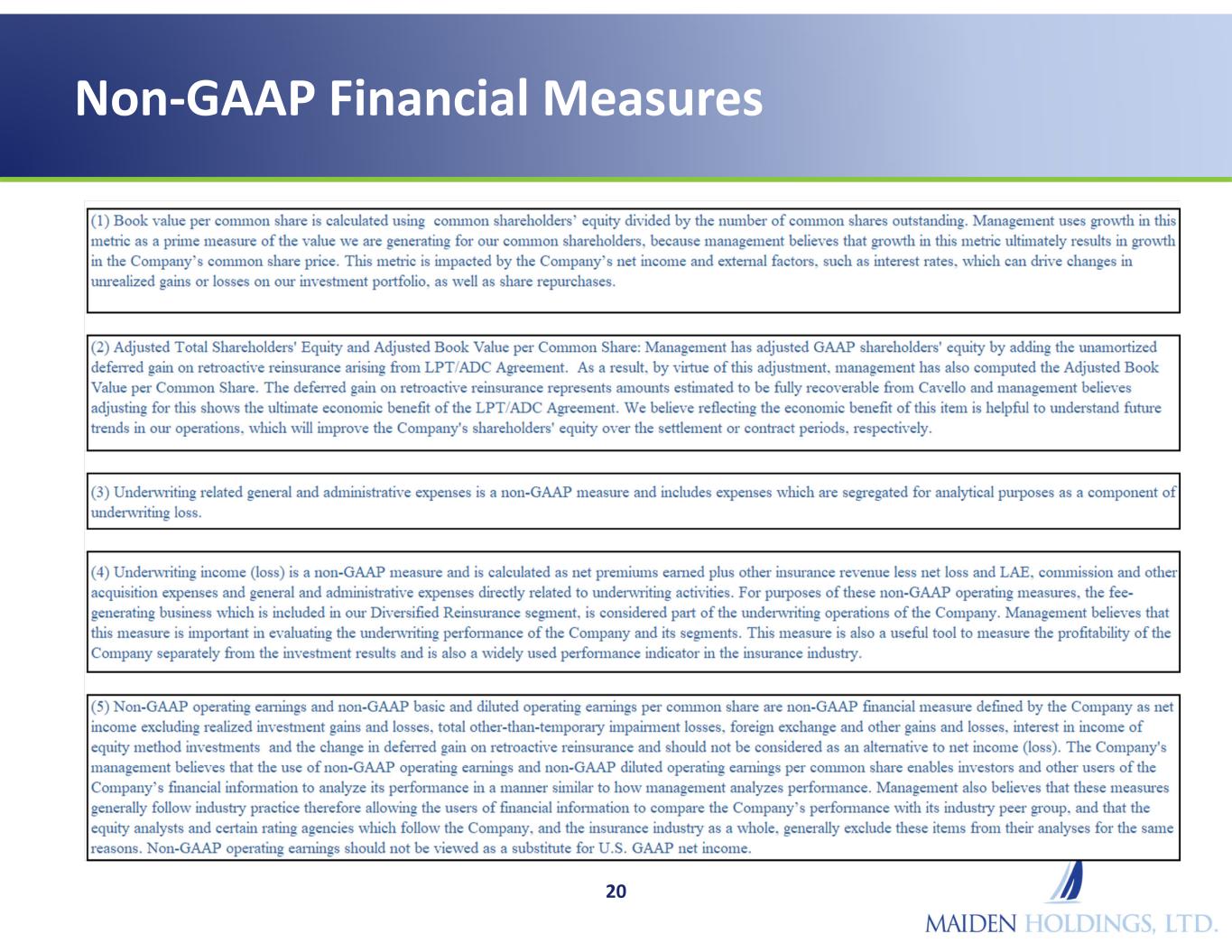

| (1) Book value per common share is calculated using shareholders’ equity divided by the number of common shares outstanding. Management uses growth in this metric as a prime measure of the value we are generating for our common shareholders, because management believes that growth in this metric ultimately results in growth in the Company’s common share price. This metric is impacted by the Company’s net income and external factors, such as interest rates, which can drive changes in unrealized gains or losses on our investment portfolio, as well as share repurchases. |

| | | |

| (2) Adjusted Total Shareholders' Equity and Adjusted Book Value per Common Share: Management has adjusted GAAP shareholders' equity by adding the unamortized deferred gain on retroactive reinsurance arising from the LPT/ADC Agreement. As a result, by virtue of this adjustment, management has also computed the Adjusted Book Value per Common Share. The deferred gain on retroactive reinsurance represents amounts estimated to be fully recoverable from Cavello and management believes adjusting for this shows the ultimate economic benefit of the LPT/ADC Agreement. We believe reflecting this economic benefit is helpful to understand future trends in our operations, which will improve the Company's shareholders' equity over the settlement period. |

| | |

| (3) Underwriting related general and administrative expenses is a non-GAAP measure and includes expenses which are segregated for analytical purposes as a component of underwriting income (loss). |

| | |

| (4) Underwriting income or loss is a non-GAAP measure and is calculated as net premiums earned plus other insurance revenue less net loss and LAE, commission and other acquisition expenses and general and administrative expenses directly related to underwriting activities. For purposes of these non-GAAP operating measures, the fee-generating business, which is included in our Diversified Reinsurance segment, is considered part of the underwriting operations of the Company. Management believes that this measure is important in evaluating the underwriting performance of the Company and its segments. This measure is also a useful tool to measure the profitability of the Company separately from the investment results and is also a widely used performance indicator in the insurance industry. |

| | |

| (5) Non-GAAP operating earnings (loss) and non-GAAP basic and diluted operating earnings (loss) per common share are non-GAAP financial measure defined by the Company as net income (loss) excluding realized investment gains and losses, foreign exchange and other gains and losses, interest in income (loss) of equity method investment, and (favorable) adverse prior year loss development subject to LPT/ADC Agreement and should not be considered as an alternative to net income (loss). The Company's management believes that the use of non-GAAP operating earnings (loss) and non-GAAP diluted operating earnings (loss) per common share enables investors and other users of the Company’s financial information to analyze its performance in a manner similar to how management analyzes performance. Management also believes that these measures generally follow industry practice therefore allowing the users of financial information to compare the Company’s performance with its industry peer group, and that the equity analysts and certain rating agencies which follow the Company, and the insurance industry as a whole, generally exclude these items from their analyses for the same reasons. Non-GAAP operating earnings should not be viewed as a substitute for U.S. GAAP net income. |

| | |

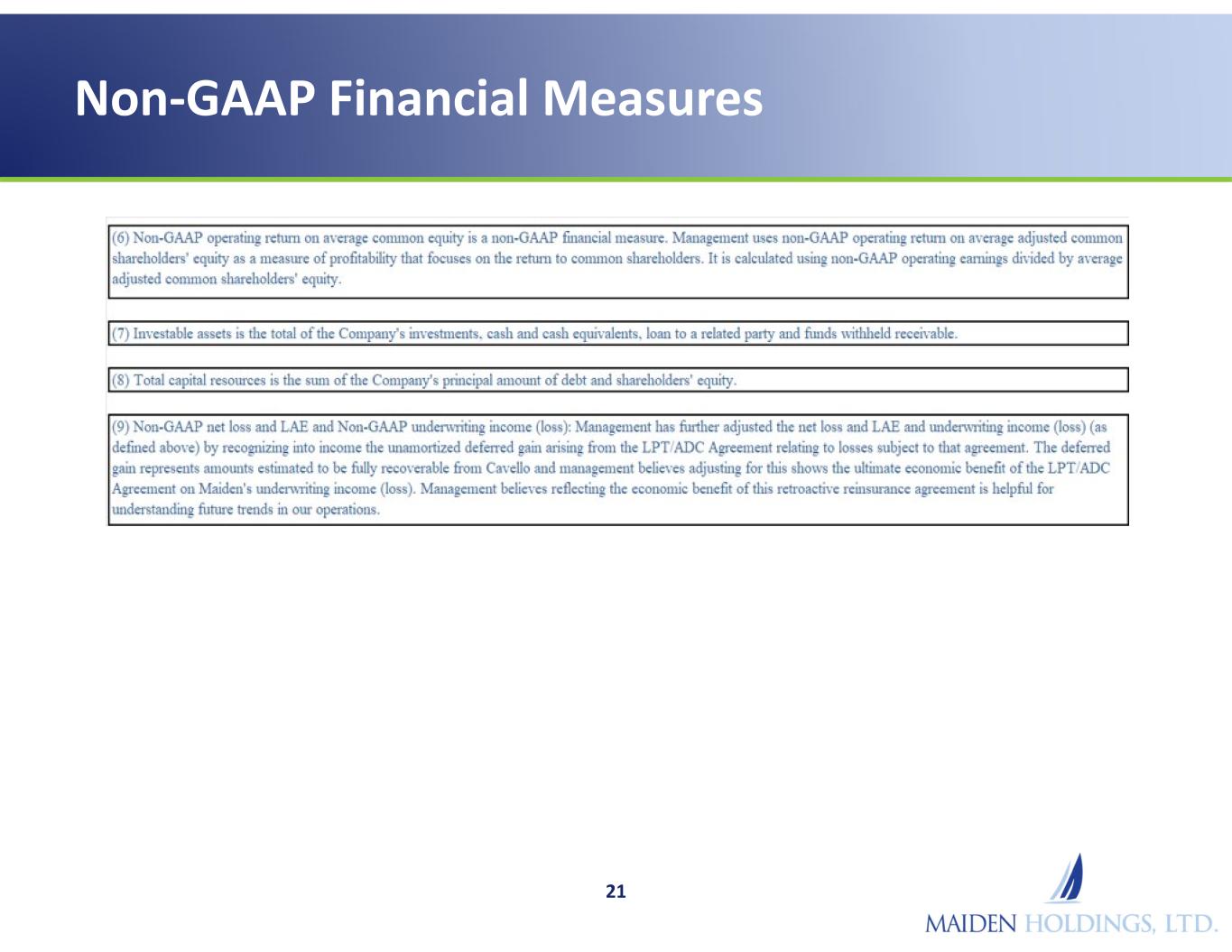

| (6) Non-GAAP operating return on average adjusted shareholders' equity is a non-GAAP financial measure. Management uses non-GAAP operating return on average adjusted shareholders' equity as a measure of profitability that focuses on the return to common shareholders. It is calculated using non-GAAP operating earnings divided by average adjusted shareholders' equity adjusted for the deferred gain on LPT/ADC Agreement. |

| | |

| (7) Investable assets are the total of the Company's investments, cash and cash equivalents, loan to a related party and funds withheld receivable. |

| | |

| (8) Total capital resources are the sum of the Company's principal amount of debt and shareholders' equity. |

| | |

| (9) Non-GAAP net loss and LAE and Non-GAAP underwriting income (loss): Management has further adjusted the net loss and LAE and underwriting income (loss) (as defined above) by recognizing into income the (favorable) adverse prior year loss development subject to LPT/ADC Agreement relating to losses subject to that agreement. The deferred gain represents amounts estimated to be fully recoverable from Cavello and management believes adjusting for this shows the ultimate economic benefit of the LPT/ADC Agreement on Maiden's underwriting income (loss). Management believes reflecting the economic benefit of this retroactive reinsurance agreement is helpful for understanding future trends in our operations. |

| | | | | | |

| | | | | | |

Exhibit 99.2

PRESS RELEASE

Maiden Holdings, Ltd. Releases

First Quarter 2024 Financial Results

PEMBROKE, Bermuda, May 9, 2024 (BUSINESS WIRE) -- Maiden Holdings, Ltd. (NASDAQ:MHLD) ("Maiden") has released its first quarter 2024 financial results via its investor relations website. Concurrent with releasing its results, Maiden also published an investor update presentation. Both documents are posted at https://www.maiden.bm/investor_relations.

About Maiden Holdings, Ltd.

Maiden Holdings, Ltd. is a Bermuda-based holding company formed in 2007. Maiden creates shareholder value by actively managing and allocating our assets and capital, including through ownership and management of businesses and assets mostly in the insurance and related financial services industries where we can leverage our deep knowledge of those markets.

CONTACT:

FGS Global

Maiden@fgsglobal.com

Exhibit 99.4

PRESS RELEASE

Maiden Holdings, Ltd. Announces

Renewal Rights Transaction for International Primary Business

PEMBROKE, Bermuda, May 6, 2024 (BUSINESS WIRE) – Maiden Holdings, Ltd. (NASDAQ: MHLD) (“Maiden”) today announced it had entered into a renewal rights transaction with AmTrust Nordic AB, a Swedish unit of AmTrust Financial Services, Inc. (“AmTrust”). The transaction is expected to cover the majority of its primary business written through its Swedish subsidiaries, Maiden General Försäkrings (“Maiden GF”) and Maiden Life Försäkrings (“Maiden LF”) in Sweden, Norway and other Nordic countries. Maiden also reported that it anticipates entering into additional renewal rights agreements with other AmTrust entities for certain business written by Maiden GF and Maiden LF in the United Kingdom and Ireland.

Under these agreements, AmTrust Nordic AB in collaboration with existing Maiden GF and Maiden LF distribution partners, will offer renewals to select policyholders in exchange for a fee at standard market terms for business successfully renewed.

Maiden reported that these transactions were part of a broader plan to divest its International Insurance Services (“IIS”) businesses as a result of its recently concluded and previously reported strategic review of the IIS business platform. As part of these conclusions, Maiden expects to enter into additional transactions to either sell or wind-up Maiden GF and Maiden LF during 2024 and is actively evaluating potential transactions currently.

Patrick J. Haveron, Maiden’s Chief Executive Officer commented, “Our IIS unit had made considerable strides in growing the premium produced by the business. However, the business is not at scale for Maiden, and we concluded that the prospects to achieve an acceptable return were ultimately challenging and limited. Our agreements today with AmTrust were entered into after an extensive market clearing process that sought to divest the business either as a whole, or in a series of transactions. We concluded this path will ultimately preserve the greatest amount of capital previously committed to the business which we can reallocate to other initiatives with greater return prospect while retaining options to enter into additional transactions currently under evaluation. When we ultimately divest these subsidiaries and the entirety of the business, we expect our Group operating expenses to be reduced by up to $6 million annually. We will report further on these transactions as we finalize and complete them.”

Axel Wibom, Chief Executive Officer, AmTrust Nordics AB, commented: “AmTrust Nordics is excited by the prospect of working with Maiden’s exceptional distribution partners and the possibility of offering an alternative insurance solution to Maiden policyholders. We are focused on empowering our distribution partners with solutions that provide significant value to their customers and look forward to adding this business to our market-leading Nordics franchise.”

About Maiden Holdings, Ltd.

Maiden Holdings, Ltd. is a Bermuda-based holding company formed in 2007. Maiden creates shareholder value by actively managing and allocating our assets and capital, including through ownership and management of businesses and assets mostly in the insurance and related financial services industries where we can leverage our deep knowledge of those markets.

CONTACT:

FGS Global

Maiden@fgsglobal.com

Maiden Holdings, Ltd. First Quarter 2024 Investor Presentation May 2024

Investor Disclosures 2 Forward Looking Statements This presentation contains "forward-looking statements" which are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. The forward-looking statements are based on Maiden Holdings, Ltd.’s (the “Company”) future developments and their potential effects on the Company. There can be no assurance that actual developments will be those anticipated by the Company. Actual results may differ materially from those projected as a result of significant risks and uncertainties, including non-receipt of the expected payments, changes in interest rates, effect of the performance of financial markets on investment income and fair values of investments, developments of claims and the effect on loss reserves, accuracy in projecting loss reserves, the impact of competition and pricing environments, changes in the demand for the Company's products, the effect of general economic conditions and unusual frequency of storm activity, adverse state and federal legislation, regulations and regulatory investigations into industry practices, developments relating to existing agreements, heightened competition, changes in pricing environments, and changes in asset valuations. Additional information about these risks and uncertainties, as well as others that may cause actual results to differ materially from those projected is contained in Item 1A, Risk Factors in the Company's Annual Report on Form 10-K for the year ended December 31, 2023, filed with the SEC on March 12, 2024. The Company undertakes no obligation to publicly update any forward- looking statements, except as may be required by law. Any discrepancies between the amounts included in this presentation and amounts included in the Company’s Form 10-Q for the three months ended March 31, 2024, filed with the SEC are due to rounding. Non-GAAP Financial Measures In addition to the Summary Consolidated Balance Sheets and Consolidated Statements of Income, management uses certain key financial measures, some of which are non-GAAP measures, to evaluate the Company's financial performance and the overall growth in value generated for the Company’s common shareholders. Management believes that these measures, which may be defined differently by other companies, explain the Company’s results to investors in a manner that allows for a more complete understanding of the underlying trends in the Company’s business. The non-GAAP measures should not be viewed as a substitute for those determined in accordance with U.S. GAAP. See the Appendix of this presentation for a reconciliation of the Company’s non-GAAP measures to the nearest GAAP measure.

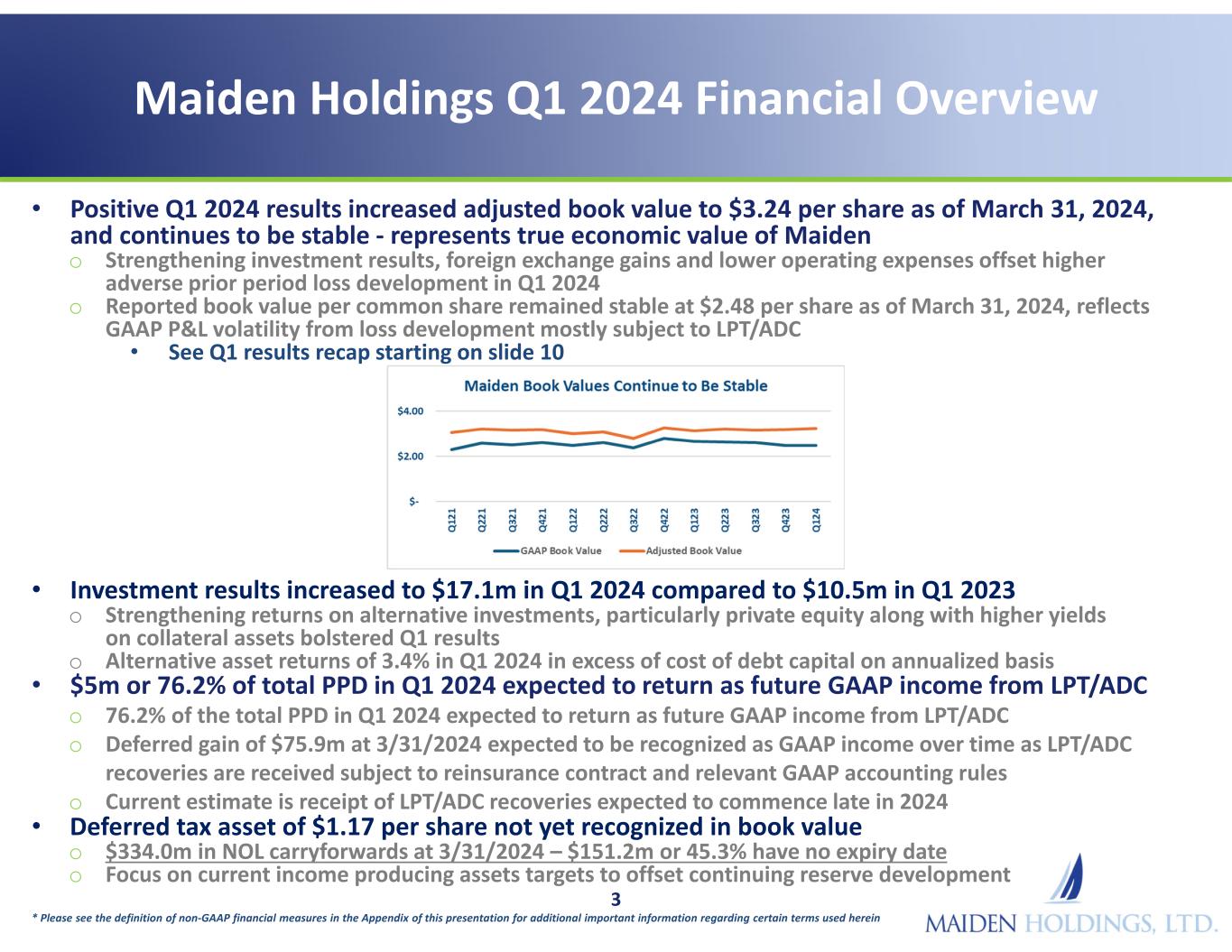

Maiden Holdings Q1 2024 Financial Overview 3 • Positive Q1 2024 results increased adjusted book value to $3.24 per share as of March 31, 2024, and continues to be stable - represents true economic value of Maiden o Strengthening investment results, foreign exchange gains and lower operating expenses offset higher adverse prior period loss development in Q1 2024 o Reported book value per common share remained stable at $2.48 per share as of March 31, 2024, reflects GAAP P&L volatility from loss development mostly subject to LPT/ADC • See Q1 results recap starting on slide 10 • Investment results increased to $17.1m in Q1 2024 compared to $10.5m in Q1 2023 o Strengthening returns on alternative investments, particularly private equity along with higher yields on collateral assets bolstered Q1 results o Alternative asset returns of 3.4% in Q1 2024 in excess of cost of debt capital on annualized basis • $5m or 76.2% of total PPD in Q1 2024 expected to return as future GAAP income from LPT/ADC o 76.2% of the total PPD in Q1 2024 expected to return as future GAAP income from LPT/ADC o Deferred gain of $75.9m at 3/31/2024 expected to be recognized as GAAP income over time as LPT/ADC recoveries are received subject to reinsurance contract and relevant GAAP accounting rules o Current estimate is receipt of LPT/ADC recoveries expected to commence late in 2024 • Deferred tax asset of $1.17 per share not yet recognized in book value o $334.0m in NOL carryforwards at 3/31/2024 – $151.2m or 45.3% have no expiry date o Focus on current income producing assets targets to offset continuing reserve development * Please see the definition of non-GAAP financial measures in the Appendix of this presentation for additional important information regarding certain terms used herein

Maiden Holdings Business Strategy 4 • We create shareholder value by actively managing and allocating our assets and capital o We leverage our deep knowledge of the insurance and related financial services industries into ownership and management of businesses and assets with the opportunity for increased returns o Our strategy allows us to more flexibly allocate capital to activities we believe will produce the greatest returns for our common shareholders • Our strategy currently has two principal areas of focus o Asset management – investing in assets and asset classes in a prudent but expansive manner in order to maximize investment returns We limit the insurance risk we assume relative to the assets we hold and maintain required regulatory capital at very strong levels to manage our aggregate risk profile o Capital management - effectively managing capital and when appropriate, repurchasing securities or returning capital to enhance common shareholder returns • Strategic focus continues to evolve – legacy underwriting now in run-off o Developing more predictable areas of revenue and profit a priority – actively exploring fee-based and distribution insurance opportunities, possibly supplemented by deploying limited reinsurance capacity o Completed IIS Renewal Rights transaction with AmTrust as part of broader plan to ultimately divest of International primary business – expect additional transactions currently being evaluated Anticipate annual operating expenses will ultimately be reduced by up to $6m over next 12 to 24 months o Capital commitment to GLS has been completed and no additional capital commitments to new legacy deals will occur – will run-off existing deals • We believe these areas of strategic focus will enhance our profitability o We believe our strategy increases the likelihood of fully utilizing the significant tax NOL carryforwards which would create additional common shareholder value o Expected returns from each strategic pillar are evaluated relative to our cost of debt capital

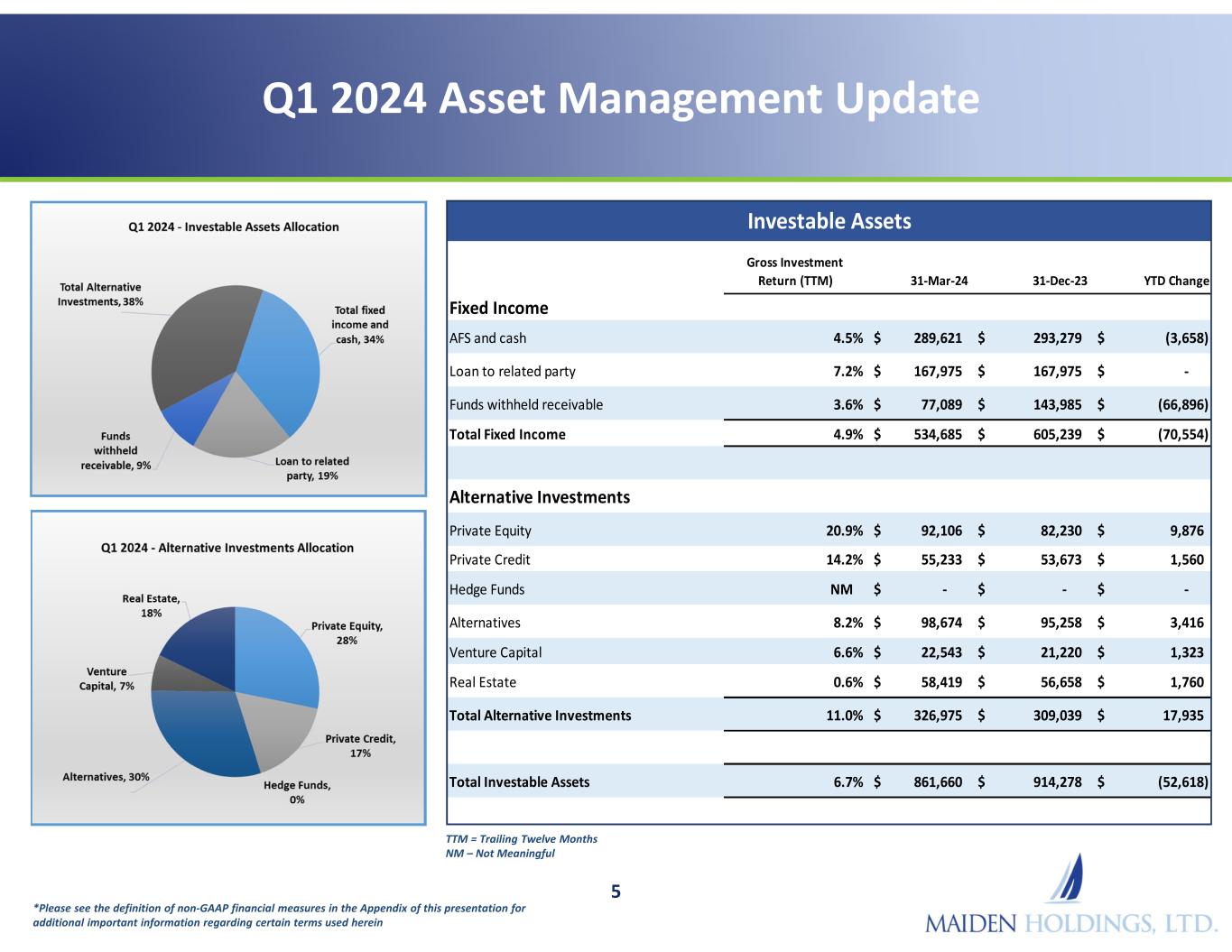

Q1 2024 Asset Management Update 5 *Please see the definition of non-GAAP financial measures in the Appendix of this presentation for additional important information regarding certain terms used herein TTM = Trailing Twelve Months NM – Not Meaningful Gross Investment Return (TTM) 31-Mar-24 31-Dec-23 YTD Change Fixed Income AFS and cash 4.5% 289,621$ 293,279$ (3,658)$ Loan to related party 7.2% 167,975$ 167,975$ -$ Funds withheld receivable 3.6% 77,089$ 143,985$ (66,896)$ Total Fixed Income 4.9% 534,685$ 605,239$ (70,554)$ Alternative Investments Private Equity 20.9% 92,106$ 82,230$ 9,876$ Private Credit 14.2% 55,233$ 53,673$ 1,560$ Hedge Funds NM -$ -$ -$ Alternatives 8.2% 98,674$ 95,258$ 3,416$ Venture Capital 6.6% 22,543$ 21,220$ 1,323$ Real Estate 0.6% 58,419$ 56,658$ 1,760$ Total Alternative Investments 11.0% 326,975$ 309,039$ 17,935$ Total Investable Assets 6.7% 861,660$ 914,278$ (52,618)$ Investable Assets

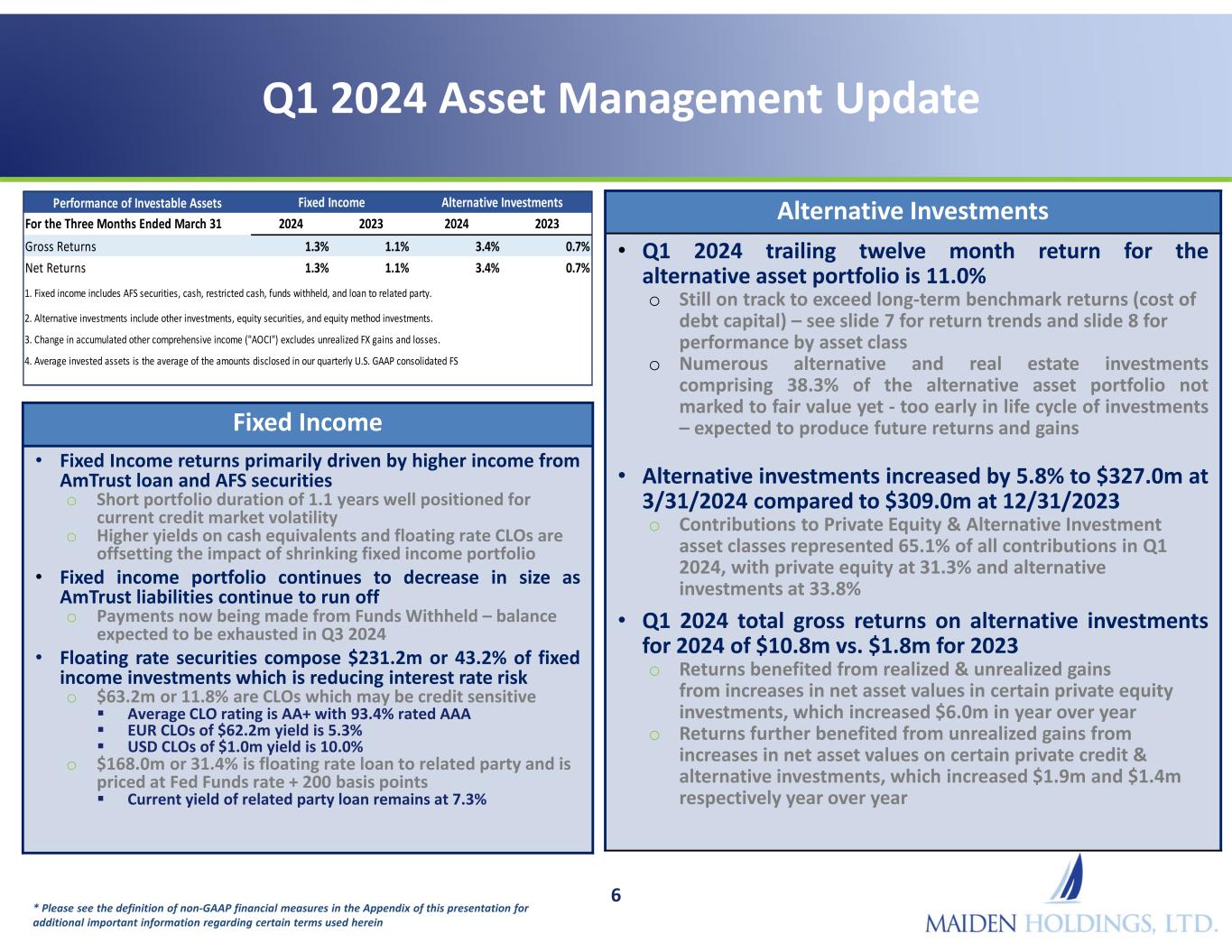

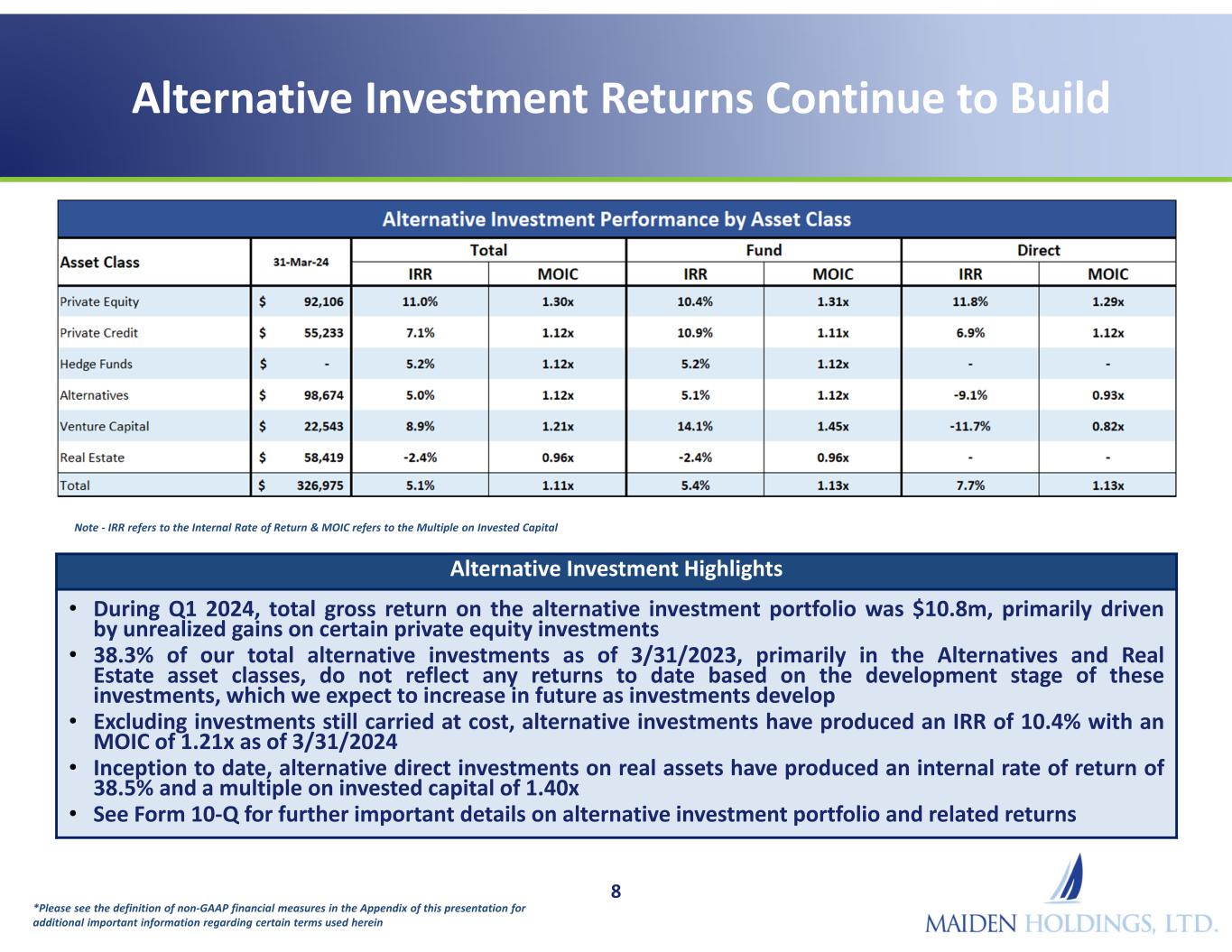

Q1 2024 Asset Management Update 6 * Please see the definition of non-GAAP financial measures in the Appendix of this presentation for additional important information regarding certain terms used herein Alternative Investments • Q1 2024 trailing twelve month return for the alternative asset portfolio is 11.0% o Still on track to exceed long-term benchmark returns (cost of debt capital) – see slide 7 for return trends and slide 8 for performance by asset class o Numerous alternative and real estate investments comprising 38.3% of the alternative asset portfolio not marked to fair value yet - too early in life cycle of investments – expected to produce future returns and gains • Alternative investments increased by 5.8% to $327.0m at 3/31/2024 compared to $309.0m at 12/31/2023 o Contributions to Private Equity & Alternative Investment asset classes represented 65.1% of all contributions in Q1 2024, with private equity at 31.3% and alternative investments at 33.8% • Q1 2024 total gross returns on alternative investments for 2024 of $10.8m vs. $1.8m for 2023 o Returns benefited from realized & unrealized gains from increases in net asset values in certain private equity investments, which increased $6.0m in year over year o Returns further benefited from unrealized gains from increases in net asset values on certain private credit & alternative investments, which increased $1.9m and $1.4m respectively year over year Fixed Income • Fixed Income returns primarily driven by higher income from AmTrust loan and AFS securities o Short portfolio duration of 1.1 years well positioned for current credit market volatility o Higher yields on cash equivalents and floating rate CLOs are offsetting the impact of shrinking fixed income portfolio • Fixed income portfolio continues to decrease in size as AmTrust liabilities continue to run off o Payments now being made from Funds Withheld – balance expected to be exhausted in Q3 2024 • Floating rate securities compose $231.2m or 43.2% of fixed income investments which is reducing interest rate risk o $63.2m or 11.8% are CLOs which may be credit sensitive Average CLO rating is AA+ with 93.4% rated AAA EUR CLOs of $62.2m yield is 5.3% USD CLOs of $1.0m yield is 10.0% o $168.0m or 31.4% is floating rate loan to related party and is priced at Fed Funds rate + 200 basis points Current yield of related party loan remains at 7.3% Performance of Investable Assets For the Three Months Ended March 31 2024 2023 2024 2023 Gross Returns 1.3% 1.1% 3.4% 0.7% Net Returns 1.3% 1.1% 3.4% 0.7% 4. Average invested assets is the average of the amounts disclosed in our quarterly U.S. GAAP consolidated FS Fixed Income Alternative Investments 1. Fixed income includes AFS securities, cash, restricted cash, funds withheld, and loan to related party. 2. Alternative investments include other investments, equity securities, and equity method investments. 3. Change in accumulated other comprehensive income ("AOCI") excludes unrealized FX gains and losses.

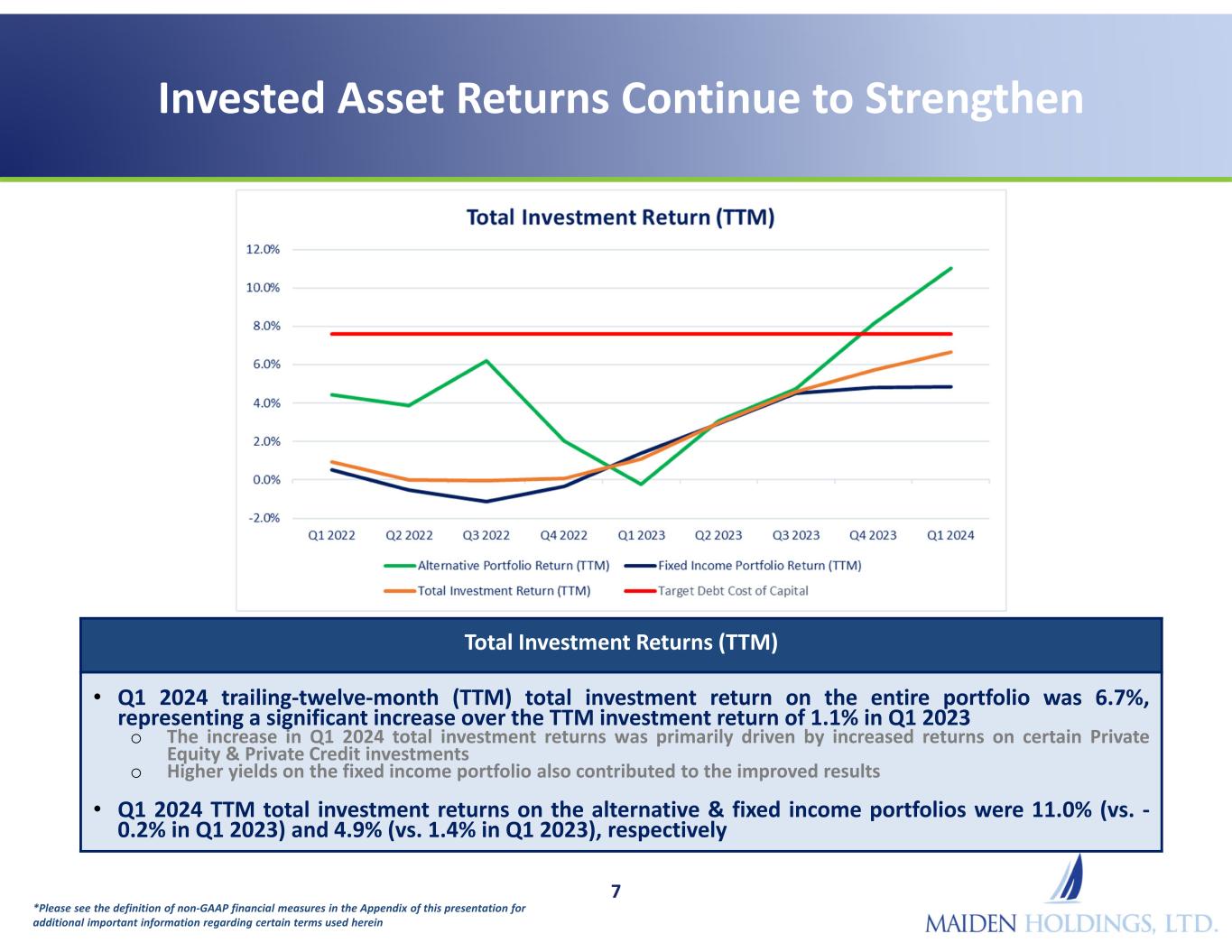

Invested Asset Returns Continue to Strengthen 7 *Please see the definition of non-GAAP financial measures in the Appendix of this presentation for additional important information regarding certain terms used herein Total Investment Returns (TTM) • Q1 2024 trailing-twelve-month (TTM) total investment return on the entire portfolio was 6.7%, representing a significant increase over the TTM investment return of 1.1% in Q1 2023 o The increase in Q1 2024 total investment returns was primarily driven by increased returns on certain Private Equity & Private Credit investments o Higher yields on the fixed income portfolio also contributed to the improved results • Q1 2024 TTM total investment returns on the alternative & fixed income portfolios were 11.0% (vs. - 0.2% in Q1 2023) and 4.9% (vs. 1.4% in Q1 2023), respectively

Alternative Investment Returns Continue to Build 8 *Please see the definition of non-GAAP financial measures in the Appendix of this presentation for additional important information regarding certain terms used herein Alternative Investment Highlights • During Q1 2024, total gross return on the alternative investment portfolio was $10.8m, primarily driven by unrealized gains on certain private equity investments • 38.3% of our total alternative investments as of 3/31/2023, primarily in the Alternatives and Real Estate asset classes, do not reflect any returns to date based on the development stage of these investments, which we expect to increase in future as investments develop • Excluding investments still carried at cost, alternative investments have produced an IRR of 10.4% with an MOIC of 1.21x as of 3/31/2024 • Inception to date, alternative direct investments on real assets have produced an internal rate of return of 38.5% and a multiple on invested capital of 1.40x • See Form 10-Q for further important details on alternative investment portfolio and related returns Note - IRR refers to the Internal Rate of Return & MOIC refers to the Multiple on Invested Capital

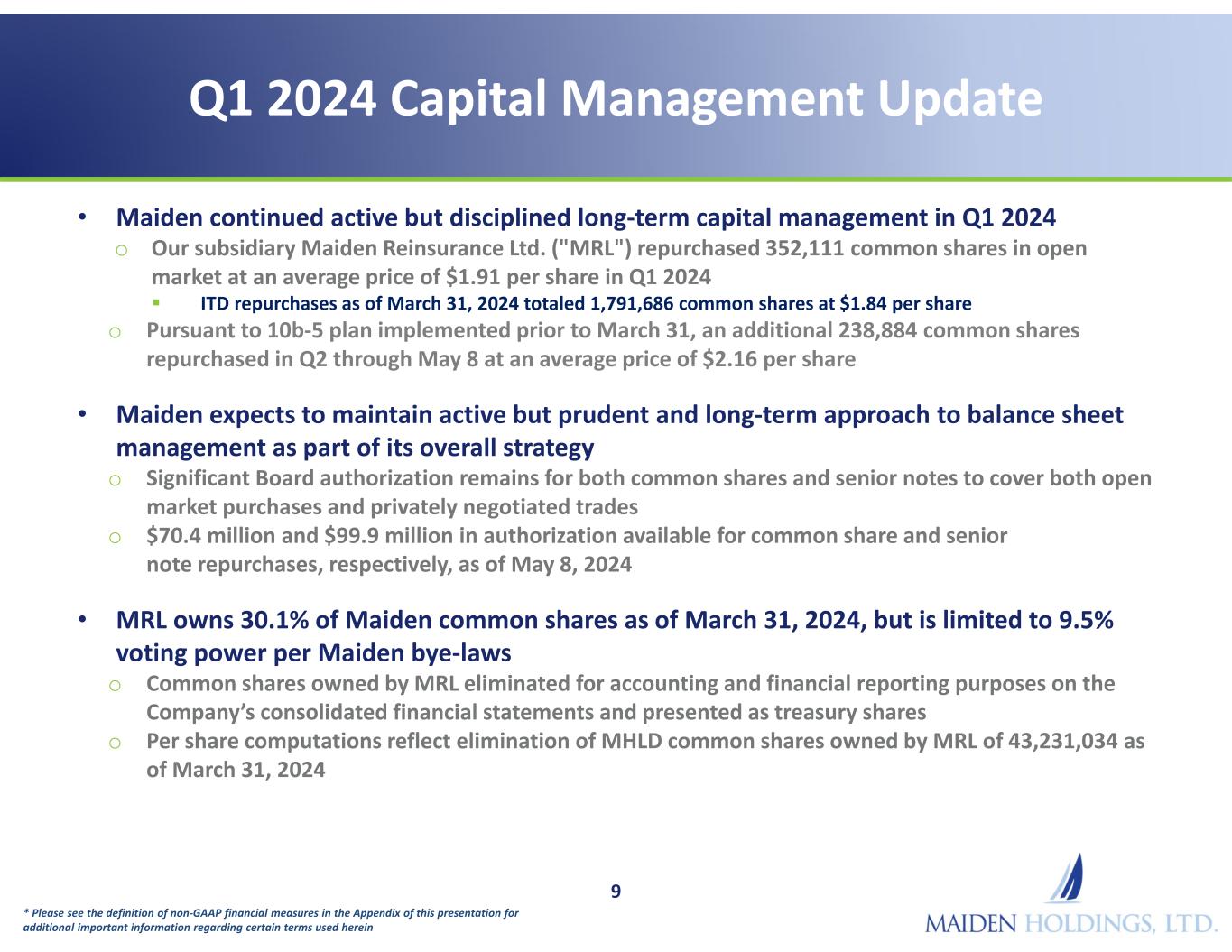

Q1 2024 Capital Management Update • Maiden continued active but disciplined long-term capital management in Q1 2024 o Our subsidiary Maiden Reinsurance Ltd. ("MRL") repurchased 352,111 common shares in open market at an average price of $1.91 per share in Q1 2024 ITD repurchases as of March 31, 2024 totaled 1,791,686 common shares at $1.84 per share o Pursuant to 10b-5 plan implemented prior to March 31, an additional 238,884 common shares repurchased in Q2 through May 8 at an average price of $2.16 per share • Maiden expects to maintain active but prudent and long-term approach to balance sheet management as part of its overall strategy o Significant Board authorization remains for both common shares and senior notes to cover both open market purchases and privately negotiated trades o $70.4 million and $99.9 million in authorization available for common share and senior note repurchases, respectively, as of May 8, 2024 • MRL owns 30.1% of Maiden common shares as of March 31, 2024, but is limited to 9.5% voting power per Maiden bye-laws o Common shares owned by MRL eliminated for accounting and financial reporting purposes on the Company’s consolidated financial statements and presented as treasury shares o Per share computations reflect elimination of MHLD common shares owned by MRL of 43,231,034 as of March 31, 2024 9 * Please see the definition of non-GAAP financial measures in the Appendix of this presentation for additional important information regarding certain terms used herein

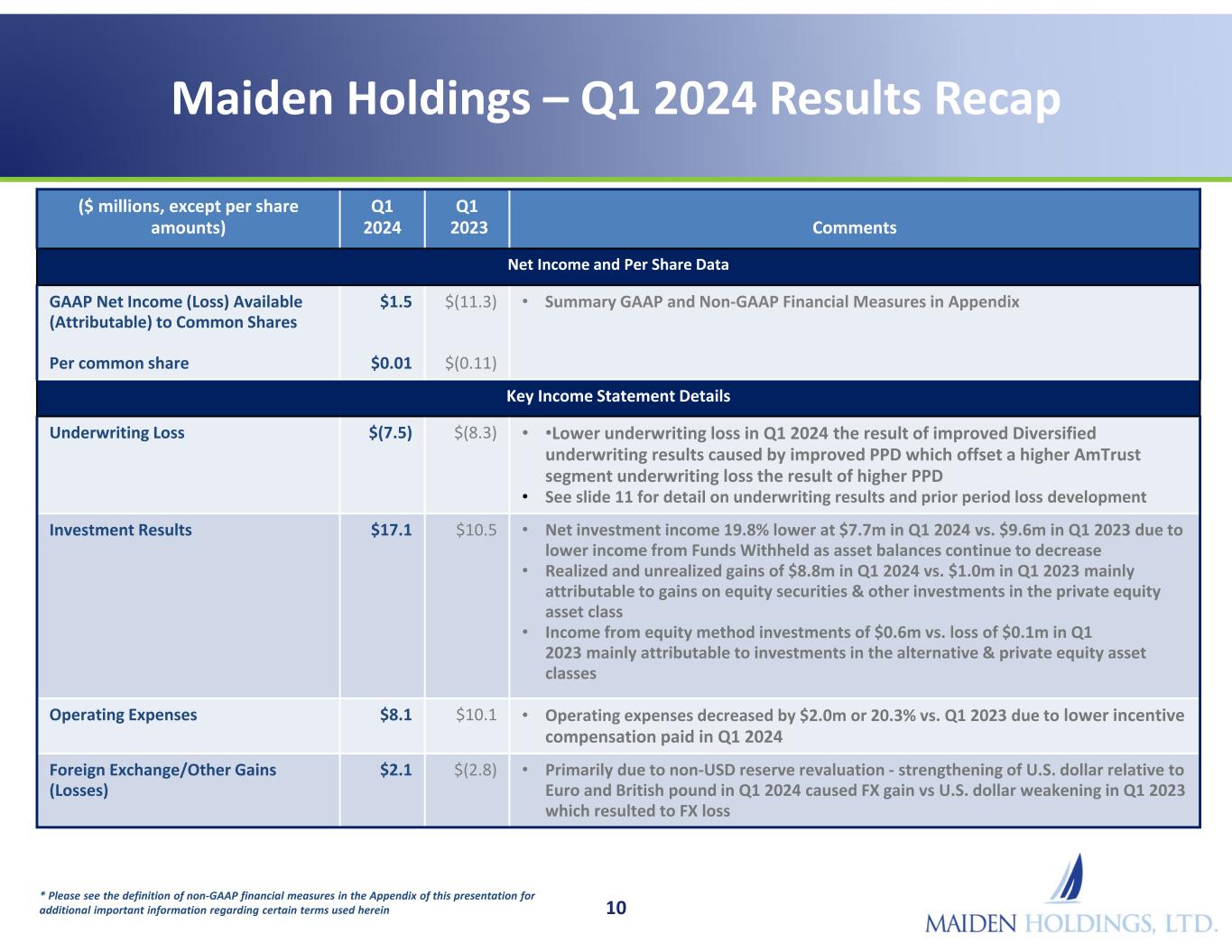

Maiden Holdings – Q1 2024 Results Recap 10 * Please see the definition of non-GAAP financial measures in the Appendix of this presentation for additional important information regarding certain terms used herein Comments Q1 2023 Q1 2024 ($ millions, except per share amounts) Net Income and Per Share Data • Summary GAAP and Non-GAAP Financial Measures in Appendix$(11.3) $(0.11) $1.5 $0.01 GAAP Net Income (Loss) Available (Attributable) to Common Shares Per common share Key Income Statement Details • •Lower underwriting loss in Q1 2024 the result of improved Diversified underwriting results caused by improved PPD which offset a higher AmTrust segment underwriting loss the result of higher PPD • See slide 11 for detail on underwriting results and prior period loss development $(8.3)$(7.5)Underwriting Loss • Net investment income 19.8% lower at $7.7m in Q1 2024 vs. $9.6m in Q1 2023 due to lower income from Funds Withheld as asset balances continue to decrease • Realized and unrealized gains of $8.8m in Q1 2024 vs. $1.0m in Q1 2023 mainly attributable to gains on equity securities & other investments in the private equity asset class • Income from equity method investments of $0.6m vs. loss of $0.1m in Q1 2023 mainly attributable to investments in the alternative & private equity asset classes $10.5$17.1Investment Results • Operating expenses decreased by $2.0m or 20.3% vs. Q1 2023 due to lower incentive compensation paid in Q1 2024 $10.1$8.1Operating Expenses • Primarily due to non-USD reserve revaluation - strengthening of U.S. dollar relative to Euro and British pound in Q1 2024 caused FX gain vs U.S. dollar weakening in Q1 2023 which resulted to FX loss $(2.8)$2.1Foreign Exchange/Other Gains (Losses)

Q1 2024 UW Results and Loss Development • Underwriting loss of $7.5m in Q1 2024 vs.$8.3m in Q1 2023 o Higher adverse prior year loss development of $6.6m in Q1 2024 compared to $3.7m of adverse prior year loss development in Q1 2023 o AmTrust had higher adverse loss development of $7.2m in Q1 2024 compared to $2.9m in Q1 2023 Net adverse prior year loss development in Q1 2024 primarily emerged from the following Lines of business: Program business adverse development of $9.0m, Hospital Liability adverse development of $2.5m while workers' compensation favorable development of $4.0m continued and partly offset the adverse development. $5.0m or 69.3% of adverse loss development experienced in the AmTrust segment in Q1 2024 is covered by the Enstar LPT/ADC and is expected to be recognized as future GAAP income over time as LPT/ADC recoveries are received subject to relevant GAAP accounting rules Recoveries from Enstar LPT/ADC presently anticipated to commence in late 2024 o Diversified had favorable adverse loss development of $0.7m in Q1 2024 compared to adverse development of $0.8m in Q1 2023 Positive prior year development mostly due to GLS and Motors reduction in credit loss reserve partly offset by IIS negative development 11

Maiden Holdings, Ltd. First Quarter 2024 Investor Presentation - Appendix Financial Data for Period Ended March 31, 2024

Summary Consolidated Balance Sheet 13

Summary Consolidated Statements of Income 14

Segment Information 15 In thousands ('000's)

Segment Information 16 In thousands ('000's)

Non-GAAP Financial Measures 17

Non-GAAP Financial Measures 18

Non-GAAP Financial Measures 19

Non-GAAP Financial Measures 20

Non-GAAP Financial Measures 21

v3.24.1.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |