Longeveron Inc. (NASDAQ: LGVN) (“Longeveron” or

the “Company”), a clinical stage biotechnology company

developing cellular therapies for life-threatening and chronic

aging-related conditions such as hypoplastic left heart syndrome

(HLHS), Alzheimer’s disease and Aging-related Frailty, today

announced that it has entered into definitive agreements for the

exercise of certain existing warrants to purchase an aggregate of

2,399,744 shares of its Class A common stock having an exercise

price of $2.35 per share, originally issued in October 2023 and

April 2024. The issuance or resale of the shares of Class A common

stock issuable upon exercise of the existing warrants, as

applicable, are registered pursuant to effective registration

statements on Form S-1 (File Nos. 333-275578 and 333-278073). The

gross proceeds to the Company from the exercise of the existing

warrants are expected to be approximately $6.2 million, prior to

deducting placement agent fees and estimated offering expenses

payable by the Company.

H.C. Wainwright & Co. is acting as the

exclusive placement agent for the offering.

In consideration for the immediate exercise of

the existing warrants for cash and the payment of $0.125 per new

warrant, the Company will issue new unregistered warrants to

purchase up to an aggregate of 4,799,488 shares of Class A common

stock. The new warrants will be immediately exercisable at an

exercise price of $2.35 per share. The new warrants to purchase

2,399,744 shares of Class A common stock will have a term of five

years from the issuance date, and the new warrants to purchase

2,399,744 shares of Class A common stock have a term of twenty-four

months from the issuance.

The offering is expected to close on or about

April 18, 2024, subject to satisfaction of customary closing

conditions. The Company intends to use the net proceeds from the

offering for its ongoing clinical and regulatory development of

Lomecel-B™ for the treatment of several disease states and

indications, including HLHS and Alzheimer’s disease, obtaining

regulatory approvals, capital expenditures, working capital and

other general corporate purposes.

The new warrants described above are being

offered in a private placement under Section 4(a)(2) of the

Securities Act of 1933, as amended (the “Securities Act”), and

Regulation D promulgated thereunder and, along with the shares of

Class A common stock issuable upon exercise of the new warrants,

have not been registered under the Securities Act, or applicable

state securities laws. Accordingly, the new warrants issued in the

private placement and the shares of Class A common stock underlying

the new warrants may not be offered or sold in the United States

except pursuant to an effective registration statement or an

applicable exemption from the registration requirements of the

Securities Act and such applicable state securities laws. The

Company has agreed to file a registration statement with the

Securities and Exchange Commission covering the resale of the

shares of Class A common stock issuable upon the exercise of the

new warrants.

This press release does not constitute an offer

to sell or a solicitation of an offer to buy these securities, nor

shall there be any sale of these securities in any state or other

jurisdiction in which such offer, solicitation or sale would be

unlawful prior to the registration or qualification under the

securities laws of any such state or other jurisdiction.

About Longeveron Inc.

Longeveron is a clinical stage biotechnology

company developing regenerative medicines to address unmet medical

needs. The Company’s lead investigational product is Lomecel-B™, an

allogeneic medicinal signaling cell (MSC) therapy product isolated

from the bone marrow of young, healthy adult donors. Lomecel-B™ has

multiple potential mechanisms of action encompassing pro-vascular,

pro-regenerative, anti-inflammatory, and tissue repair and healing

effects with broad potential applications across a spectrum of

disease areas. Longeveron is currently pursuing three pipeline

indications: hypoplastic left heart syndrome (HLHS), Alzheimer’s

disease, and Aging-related Frailty. Additional information about

the Company is available at www.longeveron.com.

Forward-Looking Statements

Certain statements in this letter that are not

historical facts are forward-looking statements made pursuant to

the safe harbor provisions of the Private Securities Litigation

Reform Act of 1995, which reflect management’s current

expectations, assumptions, and estimates of future operations,

performance and economic conditions, and involve risks and

uncertainties that could cause actual results to differ materially

from those anticipated by the statements made herein.

Forward-looking statements are generally identifiable by the use of

forward-looking terminology such as “believe,” “expects,” “may,”

“looks to,” “will,” “should,” “plan,” “intend,” “on condition,”

“target,” “see,” “potential,” “estimates,” “preliminary,” or

“anticipates” or the negative thereof or comparable terminology, or

by discussion of strategy or goals or other future events,

circumstances, or effects and include, but are not limited to,

statements regarding the completion of the private placement, the

satisfaction of customary closing conditions related to the private

placement and the anticipated use of proceeds from the private

placement. Factors that could cause actual results to differ

materially from those expressed or implied in any forward-looking

statements in this release include, but are not limited to, market

and other conditions, our limited operating history and lack of

products approved for commercial sale; adverse global conditions,

including macroeconomic uncertainty; inability to raise additional

capital necessary to continue as a going concern; our history of

losses and inability to achieve profitability going forward; the

absence of FDA-approved allogenic, cell-based therapies for

Aging-related Frailty, AD, or other aging-related conditions, or

for HLHS or other cardiac-related indications; ethical and other

concerns surrounding the use of stem cell therapy or human tissue;

our exposure to product liability claims arising from the use of

our product candidates or future products in individuals, for which

we may not be able to obtain adequate product liability insurance;

the adequacy of our trade secret and patent position to protect our

product candidates and their uses: others could compete against us

more directly, which could harm our business and have a material

adverse effect on our business, financial condition, and results of

operations; if certain license agreements are terminated, our

ability to continue clinical trials and commercially market

products could be adversely affected; the inability to protect the

confidentiality of our proprietary information, trade secrets, and

know-how; third-party claims of intellectual property infringement

may prevent or delay our product development efforts; intellectual

property rights do not necessarily address all potential threats to

our competitive advantage; the inability to successfully develop

and commercialize our product candidates and obtain the necessary

regulatory approvals; we cannot market and sell our product

candidates in the U.S. or in other countries if we fail to obtain

the necessary regulatory approvals; final marketing approval of our

product candidates by the FDA or other regulatory authorities for

commercial use may be delayed, limited, or denied, any of which

could adversely affect our ability to generate operating revenues;

we may not be able to secure and maintain research institutions to

conduct our clinical trials; ongoing healthcare legislative and

regulatory reform measures may have a material adverse effect on

our business and results of operations; if we receive regulatory

approval of Lomecel-B™ or any of our other product candidates, we

will be subject to ongoing regulatory requirements and continued

regulatory review, which may result in significant additional

expense; being subject to penalties if we fail to comply with

regulatory requirements or experience unanticipated problems with

our therapeutic candidates; reliance on third parties to conduct

certain aspects of our preclinical studies and clinical trials;

interim, “topline” and preliminary data from our clinical trials

that we announce or publish from time to time may change as more

data become available and are subject to audit and verification

procedures that could result in material changes in the final data;

the volatility of price of our Class A common stock; we could lose

our listing on the Nasdaq Capital Market; provisions in our

certificate of incorporation and bylaws and Delaware law might

discourage, delay or prevent a change in control of our company or

changes in our management and, therefore, depress the market price

of our Class A common stock; we have never commercialized a product

candidate before and may lack the necessary expertise, personnel

and resources to successfully commercialize any products on our own

or together with suitable collaborators; and in order to

successfully implement our plans and strategies, we will need to

grow our organization, and we may experience difficulties in

managing this growth. Further information relating to factors that

may impact the Company’s results and forward-looking statements are

disclosed in the Company’s filings with the Securities and Exchange

Commission, including Longeveron’s Annual Report on Form 10-K for

the year ended December 31, 2023, filed with the Securities and

Exchange Commission on February 27, 2024, as amended by the Annual

Report on Form 10-K/A filed March 11, 2024, its Quarterly Reports

on Form 10-Q, and its Current Reports on Form 8-K. The

forward-looking statements contained in this letter are made as of

the date of this press release, and the Company disclaims any

intention or obligation, other than imposed by law, to update or

revise any forward-looking statements, whether as a result of new

information, future events, or otherwise.

Investor ContactDerek ColeInvestor

Relations Advisory Solutionsderek.cole@iradvisory.com

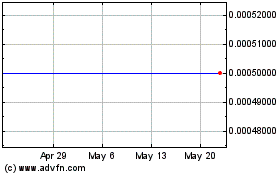

Longeveron (NASDAQ:LGVNR)

Historical Stock Chart

From Oct 2024 to Nov 2024

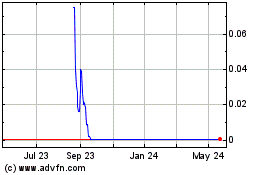

Longeveron (NASDAQ:LGVNR)

Historical Stock Chart

From Nov 2023 to Nov 2024