false

2024-11-05

0001041514

Lesaka Technologies, Inc.

0001041514

2024-11-05

2024-11-05

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

November 5, 2024

LESAKA TECHNOLOGIES, INC.

(Exact name of registrant as specified in its charter)

|

Florida

|

000-31203

|

98-0171860

|

| (State or other jurisdiction |

(Commission |

(IRS Employer |

| of incorporation) |

File Number) |

Identification No.) |

President Place, 4th Floor, Cnr.

Jan Smuts Avenue and Bolton Road

Rosebank, Johannesburg, South Africa

(Address of principal executive offices) (ZIP Code)

Registrant’s telephone number, including area code: 011-27-11-343-2000

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbols |

|

Name of each exchange on which registered |

|

Common Shares

|

|

LSAK

|

|

NASDAQ Global Select Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b -2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

The following information is furnished pursuant to Item 2.02, "Results of Operations and Financial Condition".

On November 6, 2024, Lesaka Technologies, Inc., a Florida corporation (the "Company"), issued a press release setting forth its financial results for the first quarter ended September 30, 2024.

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On November 5, 2024, our Remuneration Committee adopted cash incentive awards for fiscal 2025 for Messrs. Naeem Kola, Steven Heilbron, and Lincoln Mali and Dan Smith.

Cash Incentive Awards for Fiscal 2025

Under the cash incentive awards, each of Messrs. Kola, Heilbron, Mali and Smith will be eligible to earn a cash incentive award based on a number of quantitative factors based on our fiscal 2025 financial performance and his individual contribution toward the achievement of certain objectives described under "Qualitative Portion of the Cash Incentive Awards" below. The terms of the cash incentive awards are summarized below.

Mr. Naeem Kola

Mr. Kola's cash incentive award provides for an expected performance range cash incentive award of between 20% and 120% of his annual base salary of $400,000 for fiscal 2025. A 60% weighting is applied to quantitative performance factors and 40% is based on qualitative factors. The award could amount to a maximum of 120% of Mr. Kola's base salary based on the assessment of performance against both quantitative and qualitative targets.

Mr. Kola's maximum award represents 120% of his fiscal 2025 base salary, or $480,000.

Mr. Steven Heilbron

Mr. Heilbron's cash incentive award provides for an expected performance range cash incentive award of between 20% and 120% of his annual base salary of $400,000 for fiscal 2025. A 30% weighting is applied to quantitative performance factors and 70% is based on qualitative factors. The award could amount to a maximum of 120% of Mr. Heilbron's base salary based on the assessment of performance against both quantitative and qualitative targets.

Mr. Heilbron's maximum award represents 120% of his fiscal 2025 base salary, or $480,000.

Mr. Lincoln Mali

Mr. Mali's cash incentive award provides for an expected performance range cash incentive award of between 20% and 120% of his annual base salary of ZAR 7,500,000 for fiscal 2025. A 40% weighting is applied to quantitative performance factors and 60% is based on qualitative factors. The award could increase to a maximum of 120% of Mr. Mali's base salary, based on the assessment of performance against both quantitative and qualitative targets.

Mr. Mali's maximum award represents 120% of his fiscal 2025 base salary, or ZAR 9,000,000 ($509,915, translated at a $:ZAR exchange rate of $1: ZAR 17.65).

Mr. Dan Smith

Mr. Smith's cash incentive award provides for an expected performance range cash incentive award of between 20% and 120% of his annual base salary of ZAR 6,00,00,000 for fiscal 2025. A 40% weighting is applied to quantitative performance factors and 60% is based on qualitative factors. The award could amount to a maximum of 120% of Mr. Smith's base salary based on the assessment of performance against both quantitative and qualitative targets.

Mr. Smith's maximum award represents 120% of his fiscal 2025 base salary, or ZAR 7,200,000 ($407,932, translated at a $:ZAR exchange rate of $1: ZAR 17.65)

Quantitative Portion of the Cash Incentive Awards

Mr. Kola will be eligible to receive an amount up to 72% of his annual base salary, Mr. Heilbron will be eligible to receive an amount up to 36% of his annual base salary, and each of Messrs. Mali and Smith will be eligible to receive an amount up to 48% of their individual annual base salary if specified quantitative targets are achieved.

The quantitative targets are as follows:

| |

|

Allocation of quantitative portion to quantitative targets |

|

| Quantitative targets: |

|

Kola |

|

|

Heilbron |

|

|

Mali |

|

|

Smith |

|

| F2025 financial targets |

|

10% |

|

|

20% |

|

|

15% |

|

|

15% |

|

| M&A post-acquisition financial targets |

|

25% |

|

|

- |

|

|

- |

|

|

- |

|

| F2025 Group synergies |

|

20% |

|

|

- |

|

|

- |

|

|

- |

|

| Net debt/ EBITDA target |

|

- |

|

|

- |

|

|

- |

|

|

10% |

|

| Free cash flow conversion |

|

- |

|

|

- |

|

|

- |

|

|

5% |

|

| F2025 Consumer financial targets |

|

- |

|

|

- |

|

|

25% |

|

|

5% |

|

| F2025 Merchant financial targets |

|

5% |

|

|

10% |

|

|

- |

|

|

5% |

|

| Total quantitative portion of cash incentive awards |

|

60% |

|

|

30% |

|

|

40% |

|

|

40% |

|

The Remuneration Committee may award between:

- 0% and 72% of Mr. Kola's annual base salary,

- 0% and 36% of Mr. Heilbron's annual base salary,

- 0% and 48% of Mr. Mali's annual base salary,

- 0% and 48% of Mr. Smith's annual base salary,

based on its assessment of each executive's achievement against these quantitative targets.

Qualitative Portion of the Cash Incentive Awards

Mr. Kola will be eligible to receive an amount up to 48% of his annual base salary based on his contribution towards enhancing shareholder value through performance criteria, which include (with agreed weighting as a percent of total qualitative award (40%) in parentheses):

- Supporting the financial function handover to Mr. Smith (5%);

- Driving customer and product centricity across the organization (5%);

- Overseeing Lesaka's investor relations, corporate governance, legal and company secretarial functions (20%);

- Delivering on the company's broad-based black economic empowerment and environment, social and governance objectives (5%); and

- Embedding Lesaka-value's system and high-performance corporate culture into Lesaka Enterprise pillar (5%).

Mr. Heilbron will be eligible to receive an amount up to 84% of his annual base salary based on his contribution towards enhancing shareholder value through performance criteria, which include (with agreed weighting as a percent of total qualitative award (70%) in parentheses):

- Delivering on any potential M&A objectives in fiscal 2025 (45%); and

- Creating an integrated Merchant pillar, augmentation of the leadership team for the next iteration of growth in Merchant, and developing strategies to deliver Merchant growth ambitions (20%).

- Embedding Lesaka's high-performance corporate culture across the organization (5%);

Mr. Mali will be eligible to receive an amount up to 72% of his annual base salary based on his contribution towards enhancing shareholder value through performance criteria, which include (with agreed weighting as a percent of total qualitative award (60%) in parentheses):

- Leading change in Lesaka's value's system, which are caring and inclusive, and driving a high-performance corporate culture throughout the organization (20%);

- Promoting a customer centric mindset across the organization (5%);

- Participating in policy reforms in the regulatory environments in which Lesaka operates (15%); and

- Driving communication, public relations, brand management and key stakeholder relationships (20%).

Mr. Smith will be eligible to receive an amount up to 72% of his annual base salary based on his contribution towards enhancing shareholder value through performance criteria, which include (with agreed weighting as a percent of total qualitative award (60%) in parentheses):

- Executing various finance function improvement plans in fiscal 2025 (35%);

- Developing and managing various treasury and funding processes in fiscal 2025 (20%); and

- Evolving to a performance culture with collaborative and cohesive culture in the finance function across the organization (5%).

The Remuneration Committee may award between:

- 0% and 48% of Mr. Kola's annual base salary,

- 0% and 84% of Mr. Heilbron's annual base salary,

- 0% and 72% of Mr. Mali's annual base salary,

- 0% and 72% of Mr. Smith's annual base salary,

based on its assessment of each executive's progress against these qualitative targets.

Item 9.01. Financial Statements and Exhibits

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

LESAKA TECHNOLOGIES, INC. |

| |

|

|

| Date: November 6, 2024 |

By: |

/s/ Dan L. Smith |

| |

Name: |

Dan L. Smith |

| |

Title: |

Group Chief Financial Officer |

Exhibit 99.1

Lesaka Q1 2025 Results: Lesaka continues building operational momentum achieving Revenue and Profitability guidance

JOHANNESBURG, November 6, 2024 - Lesaka Technologies, Inc. (Nasdaq: LSAK; JSE: LSK) today released results for the first quarter of fiscal 2025 ("Q1 2025").

Q1 2025 performance:

- Revenue of $145.5 million (ZAR 2.6 billion) was at the mid-point of our revenue guidance and compares to $136.1 million (ZAR 2.5 billion) in Q1 2024.

- Operating loss of $0.05 million (ZAR 0.3 million) compares to operating income of $0.2 million (ZAR 4.2 million) in Q1 2024. The current quarter includes $1.7 million (ZAR 30.0 million) of one-off transaction costs relating to the acquisition of Adumo. Excluding the impact of these transaction costs, operating income would have been $1.7 million (ZAR 29.7 million).

- Net loss, including $1.7 million (ZAR 30.0 million) of one-off Adumo transaction costs, improved 23% in ZAR, to a net loss of $4.5 million (ZAR 81.0 million) in Q1 2025.

- GAAP loss per share improved 24% in ZAR to $0.07 (ZAR 1.26) from $0.09 (ZAR 1.66) in Q1 2024.

- Group Adjusted EBITDA (a non-GAAP measure) of $9.4 million (ZAR 168.1 million) was at the mid-point of our guidance range, improving 12% in ZAR from $8.0 million (ZAR 149.5 million) in Q1 2024.

- Fundamental earnings per share (a non-GAAP measure) of $0.04 (ZAR 0.66) improved by $0.04 (ZAR 0.74) compared to a fundamental loss per share of $0.00 (ZAR 0.08) in Q1 2024.

- Consumer Division revenue increased 30% in ZAR to $21.1 million (ZAR 378.1 million) and Segment Adjusted EBITDA increased 99% in ZAR, to $4.4 million (ZAR 78.7 million).

- Merchant Division revenue of $125.3 million (ZAR 2.3 billion) remained flat in ZAR and Segment Adjusted EBITDA contracted marginally, by 1% in ZAR, to $7.9 million (ZAR 142.1 million).

(1) Average exchange rates applicable for the quarter: ZAR 17.72 to $1 for Q1 2025, ZAR 18.71 to $1 for Q1 2024. The ZAR strengthened 5.3% against the U.S. dollar during Q1 2025 when compared to Q1 2024.

Lesaka Chairman Ali Mazanderani said: “We continue to invest in building the Lesaka platform and to scale as Southern Africa’s leading independent fintech. We achieved the mid-point of our revenue and Group Adjusted EBITDA guidance for Q1 2025. We have now delivered on our Group Adjusted EBITDA guidance for nine successive quarters and reaffirm our FY 2025 revenue guidance of ZAR 10 billion to ZAR 11 billion and FY2025 Group Adjusted EBITDA guidance of ZAR 900 million to ZAR 1 billion. Our Net Revenue guidance of ZAR 5.2 million to ZAR 5.6 million for FY 2025 implies 35% year-on year growth at the midpoint of this range. Our Group Adjusted EBITDA guidance for FY 2025 implies 37% growth, year-on-year, at the midpoint of the range.”

Outlook: Second Quarter 2025 ("Q2 2025") and reaffirming Full Fiscal Year 2025 ("FY 2025") outlook

While we report our financial results in USD, we measure our operating performance in ZAR, and as such we provide our guidance accordingly.

We have included guidance for Net Revenue, a non-GAAP measure, for the first time. This primarily eliminates the effect of changes in revenue mix between agency and principal sales of airtime, which can be material. Refer below to “Use of Non-GAAP Measures” for additional information.

For Q2 2025, the quarter ending December 31, 2024 we expect:

- Revenue between ZAR 2.4 billion and ZAR 2.6 billion.

- Net Revenue between ZAR 1.2 billion and ZAR 1.4 billion.

- Group Adjusted EBITDA between ZAR 190 million and ZAR 210 million.

Guidance For FY 2025, the year ending June 30, 2025, we expect:

- Revenue between ZAR 10.0 billion and ZAR 11.0 billion.

- Net Revenue between ZAR 5.2 billion and ZAR 5.6 billion.

- Group Adjusted EBITDA between ZAR 900 million and ZAR 1 billion

Our outlook provided:

- Includes the impact of the acquisition of Adumo, which closed in October 2024 (in Q2 2025).

- Excludes the impact of unannounced mergers and acquisitions that we may conclude.

The mid-point of the FY 2025 Group Adjusted EBITDA guidance implies a growth rate of more than 30% on a like-for-like basis (excluding Adumo and the allocation of interest expense charges directly related to the consumer loan book).

Management has provided its outlook regarding Net Revenue and Group Adjusted EBITDA, which are non-GAAP financial measures and excludes certain revenue and charges. Management has not reconciled these non-GAAP financial measures to the corresponding GAAP financial measures because guidance for the various reconciling items is not provided. Management is unable to provide guidance for these reconciling items because they cannot determine their probable significance, as certain items are outside of the company's control and cannot be reasonably predicted since these items could vary significantly from period to period. Accordingly, reconciliations to the corresponding GAAP financial measure are not available without unreasonable effort.

Earnings Presentation for Q1 2025 Results

Our earnings presentation will be posted to the Investor Relations page of our website prior to our earnings call.

Webcast and Conference Call

Lesaka will host a webcast and conference call to review results on November 7, 2024, at 8:00 a.m. Eastern Time which is 3:00 p.m. South Africa Standard Time ("SAST"). A replay of the results presentation webcast will be available on the Lesaka investor relations website following the conclusion of the live event.

Presentation webcast via Zoom:

Link to access the results webcast: https://bit.ly/3BB5RHG.

Participants using the webcast will be able to ask questions by raising their hand and then asking the question "live."

Conference call dial-in:

- US Toll-Free: +1 929 205 6099 or +1 253 205 0468 or +1 253 215 8782

- South Africa Toll-Free: +27 21 426 8190 or +27 21 426 8191 or +27 87 550 3946

Participants using the conference call dial-in will be unable to ask questions.

A replay of the results presentation webcast will be available on the Lesaka investor relations website following the conclusion of the live event.

Our Form 10-Q for the quarter ended September 30, 2024, as filed with the SEC, is available on our company website at www.lesakatech.com.

Use of Non-GAAP Measures

U.S. securities laws require that when we publish any non-GAAP measures, we disclose the reason for using these non-GAAP measures and provide reconciliations to the most directly comparable GAAP measures. The presentation of Group Adjusted EBITDA, Group Adjusted EBITDA margin, Net Revenue, fundamental net (loss) income, fundamental (loss) earnings per share, and headline (loss) earnings per share are non-GAAP measures. Refer to Attachment A for a reconciliation of these non-GAAP measures.

Non-GAAP Measures

Group adjusted EBITDA

Group Adjusted EBITDA is net loss before interest, taxes, depreciation and amortization, adjusted for non-operational transactions (including loss on disposal of equity-accounted investments), loss from equity-accounted investments, stock-based compensation charges and once-off items. Once-off items represents non-recurring expense items, including costs related to acquisitions and transactions consummated or ultimately not pursued. Group Adjusted EBITDA margin is Group Adjusted EBITDA divided by revenue.

Net Revenue

We generate revenue from the provision of transaction-processing services through our various platforms and service offerings. We use these platforms to (a) sell prepaid airtime vouchers which was held as inventory, and (b) distribute VAS, including prepaid airtime vouchers (which we do not hold as inventory), prepaid electricity, gaming vouchers, and other products, to users of our platforms. We act as a principal when we sell airtime vouchers that were held as inventory and record revenue and cost of sales on a gross basis when sold. We act as an agent in a transaction when we provide VAS products through our various platforms and services offerings because we do not control the good or service to be provided and we recognize revenue based on the amount that we are contractually entitled to receive for performing the distribution service on behalf of our customers using our platform. Our revenue under GAAP can fluctuate materially due to changes in the revenue mix between these revenue categories. Net Revenue is a non-GAAP measure and is calculated as revenue presented under GAAP less (i) the cost of prepaid airtime vouchers sold by us, and (ii) commissions paid to third parties selling all other agency-based VAS products (including pinless airtime, electricity and other products) provided through our distribution channels. We believe that the use of Net Revenue is meaningful to users of financial information because it seeks to eliminate the impact of the change in the revenue mix from the revenue categories over the periods presented.

Fundamental net earnings (loss) and fundamental earnings (loss) per share

Fundamental net earnings (loss) and earnings (loss) per share is GAAP net loss and loss per share adjusted for the amortization of acquisition-related intangible assets (net of deferred taxes), stock-based compensation charges, and unusual non-recurring items, including costs related to acquisitions and transactions consummated or ultimately not pursued.

Fundamental net earnings (loss) and earnings (loss) per share for fiscal 2024 also includes an impairment loss related to an equity-accounted investment, and a reversal of allowance for doubtful loan receivable.

Management believes that the Group Adjusted EBITDA, fundamental net earnings (loss) and fundamental earnings (loss) per share metrics enhance its own evaluation, as well as an investor's understanding, of our financial performance. Attachment A presents the reconciliation between GAAP net loss attributable to Lesaka and these non-GAAP measures.

Headline (loss) earnings per share ("H(L)EPS")

The inclusion of H(L)EPS in this press release is a requirement of our listing on the JSE. H(L)EPS basic and diluted is calculated using net (loss) income which has been determined based on GAAP. Accordingly, this may differ to the headline (loss) earnings per share calculation of other companies listed on the JSE as these companies may report their financial results under a different financial reporting framework, including but not limited to, International Financial Reporting Standards.

H(L)EPS basic and diluted is calculated as GAAP net (loss) income adjusted for the impairment losses related to our equity-accounted investments and (profit) loss on sale of property, plant and equipment. Attachment C presents the reconciliation between our net (loss) income used to calculate (loss) earnings per share basic and diluted and H(L)EPS basic and diluted and the calculation of the denominator for headline diluted (loss) earnings per share.

About Lesaka (www.lesakatech.com)

Lesaka Technologies, (Lesaka™) is a South African Fintech company driven by a purpose to provide financial services and software to Southern Africa's underserviced consumers (B2C) and merchants (B2B), improving people's lives and increasing financial inclusion in the markets in which we operate. We offer a wide range of integrated payment solutions including transactional accounts (banking), lending, insurance, payouts, cash management solutions, card acceptance, supplier payments, software services and bill payments. By providing a full-service fintech platform in our connected ecosystem, we facilitate the digitization of commerce in our markets.

Lesaka has a primary listing on NASDAQ (NasdaqGS: LSAK) and a secondary listing on the Johannesburg Stock Exchange (JSE: LSK). Visit www.lesakatech.com for additional information about Lesaka Technologies (Lesaka ™).

Forward-Looking Statements

This press release contains certain statements that may be considered forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, and such statements are subject to the safe harbor created by those sections and the Private Securities Litigation Reform Act of 1995, as amended. Such statements may be identified by their use of terms or phrases such as "expects," "estimates," "projects," "believes," "anticipates," "plans," "could," "would," "may," "will," "intends," "outlook," "focus," "seek," "potential," "mission," "continue," "goal," "target," "objective," derivations thereof, and similar terms and phrases. Forward-looking statements are based upon the current beliefs and expectations of our management and are inherently subject to risks and uncertainties, some of which cannot be predicted or quantified, which could cause future events and actual results to differ materially from those set forth in, contemplated by, or underlying the forward-looking statements. In this press release, statements relating to future financial results and future financing and business opportunities are forward-looking statements. Additional information concerning factors that could cause actual events or results to differ materially from those in any forward-looking statement is contained in our Form 10-K for the fiscal year ended June 30, 2024, as filed with the SEC, as well as other documents we have filed or will file with the SEC. We assume no obligation to update the information in this press release, to revise any forward-looking statements or to update the reasons actual results could differ materially from those anticipated in forward-looking statements.

Investor Relations and Media Relations Contacts:

Phillipe Welthagen

Email: phillipe.welthagen@lesakatech.com

Mobile: +27 84 512 5393

Media Relations Contact:

Ian Harrison

Email: Ian@thenielsennetwork.com

Lesaka Technologies, Inc.

Attachment A

Reconciliation of GAAP loss attributable to Lesaka to Group Adjusted EBITDA loss:

Three months and year ended September 30, 2024 and 2023 and June 30, 2024

| |

|

Three months ended |

|

| |

|

September 30, |

|

|

June 30, |

|

| |

|

2024 |

|

|

2023 |

|

|

2024 |

|

| Loss attributable to Lesaka - GAAP |

$ |

(4,542 |

) |

$ |

(5,651 |

) |

$ |

(5,035 |

) |

| Loss from equity accounted investments |

|

(27 |

) |

|

1,405 |

|

|

(40 |

) |

| Net loss before (earnings) loss from equity-accounted investments |

|

(4,569 |

) |

|

(4,246 |

) |

|

(5,075 |

) |

| Income tax (benefit) expense |

|

78 |

|

|

264 |

|

|

1,482 |

|

| Loss before income tax expense |

|

(4,491 |

) |

|

(3,982 |

) |

|

(3,593 |

) |

| Reversal of allowance for doubtful EMI loans receivable |

|

- |

|

|

(250 |

) |

|

- |

|

| Unrealized (gain) loss FV for currency adjustments |

|

(219 |

) |

|

102 |

|

|

(184 |

) |

| Operating income/(loss) after PPA amortization and net interest (non-GAAP) |

|

(4,710 |

) |

|

(4,130 |

) |

|

(3,777 |

) |

| PPA amortization (amortization of acquired intangible assets) |

|

3,747 |

|

|

3,608 |

|

|

3,657 |

|

| Operating income/(loss) before PPA amortization after net interest (non-GAAP) |

|

(963 |

) |

|

(522 |

) |

|

(120 |

) |

| Interest expense |

|

5,032 |

|

|

4,909 |

|

|

4,620 |

|

| Interest income |

|

(586 |

) |

|

(449 |

) |

|

(732 |

) |

| Operating income/(loss) before PPA amortization and net interest (non-GAAP) |

|

3,483 |

|

|

3,938 |

|

|

3,768 |

|

| Depreciation (excluding amortization of intangibles) |

|

2,529 |

|

|

2,248 |

|

|

2,548 |

|

| Interest adjustment |

|

(831 |

) |

|

- |

|

|

- |

|

| Stock-based compensation charges |

|

2,377 |

|

|

1,759 |

|

|

2,258 |

|

| Once-off items |

|

1,805 |

|

|

78 |

|

|

1,684 |

|

| Group Adjusted EBITDA - Non-GAAP |

$ |

9,363 |

|

$ |

8,023 |

|

$ |

10,258 |

|

| |

|

Three months ended |

|

| |

|

September 30, |

|

|

Jun 30, |

|

| |

|

2024 |

|

|

2023 |

|

|

2024 |

|

| Once-off items comprises: |

|

|

|

|

|

|

|

|

|

| Transaction costs |

$ |

103 |

|

$ |

78 |

|

$ |

56 |

|

| Transaction costs related to Adumo acquisition |

|

1,702 |

|

|

- |

|

|

1,628 |

|

| |

$ |

1,805 |

|

$ |

78 |

|

$ |

1,684 |

|

Once-off items are non-recurring in nature, however, certain items may be reported in multiple quarters. For instance, transaction costs include costs incurred related to acquisitions and transactions consummated or ultimately not pursued. The transactions can span multiple quarters, for instance in fiscal 2025 we incurred significant transaction costs related to the acquisition of Adumo over a number of quarters, and the transactions are generally non-recurring.

Reconciliation of revenue under GAAP to Net Revenue:

Three months and year ended September 30, 2024 and 2023 and June 30, 2024

| |

|

Three months ended |

|

| |

|

September 30, |

|

|

June 30, |

|

| |

|

2024 |

|

|

2023 |

|

|

2024 |

|

| Revenue - GAAP |

$ |

145,546 |

|

$ |

136,089 |

|

$ |

146,046 |

|

| Cost of prepaid airtime vouchers sold by us & commissions paid to third parties selling all other agency-based products |

|

(86,737 |

) |

|

(87,326 |

) |

|

(91,274 |

) |

| Net Revenue (non-GAAP) |

$ |

58,809 |

|

$ |

48,763 |

|

$ |

54,772 |

|

| Net Revenue / revenue |

|

40% |

|

|

36% |

|

|

38% |

|

Reconciliation of GAAP net loss and loss per share, basic, to fundamental net earnings (loss) and earnings (loss) per share, basic:

Three months ended September 30, 2024 and 2023

| |

|

Net (loss) income

(USD '000) |

|

|

(L)PS, basic

(USD) |

|

|

Net (loss) income

(ZAR '000) |

|

|

(L)PS, basic

(ZAR) |

|

| |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

| GAAP |

|

(4,542 |

) |

|

(5,651 |

) |

|

(0.07 |

) |

|

(0.09 |

) |

|

(81,023 |

) |

|

(105,635 |

) |

|

(1.26 |

) |

|

(1.66 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Intangible asset amortization, net |

|

2,735 |

|

|

2,625 |

|

|

|

|

|

|

|

|

49,173 |

|

|

49,104 |

|

|

|

|

|

|

|

| Stock-based compensation charge |

|

2,377 |

|

|

1,759 |

|

|

|

|

|

|

|

|

42,691 |

|

|

32,797 |

|

|

|

|

|

|

|

| Impairment of equity method investment |

|

- |

|

|

1,167 |

|

|

|

|

|

|

|

|

- |

|

|

22,084 |

|

|

|

|

|

|

|

| Reversal of allowance for doubtful EMI loans receivable |

|

- |

|

|

(250 |

) |

|

|

|

|

|

|

|

- |

|

|

(4,741 |

) |

|

|

|

|

|

|

| Transaction costs |

|

1,805 |

|

|

78 |

|

|

|

|

|

|

|

|

31,828 |

|

|

1,465 |

|

|

|

|

|

|

|

| Fundamental |

|

2,375 |

|

|

(272 |

) |

|

0.04 |

|

|

- |

|

|

42,669 |

|

|

(4,926 |

) |

|

0.66 |

|

|

(0.08 |

) |

Attachment B

Unaudited Condensed Consolidated Financial Statements

| LESAKA TECHNOLOGIES, INC. |

|

| Unaudited Condensed Consolidated Statements of Operations |

|

| |

|

Unaudited |

|

| |

|

Three months ended |

|

| |

|

September 30, |

|

| |

|

2024 |

|

|

2023 |

|

| |

|

(In thousands) |

|

| |

|

|

|

|

|

|

| REVENUE |

$ |

145,546 |

|

$ |

136,089 |

|

| |

|

|

|

|

|

|

| EXPENSE |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| Cost of goods sold, IT processing, servicing and support |

|

110,887 |

|

|

107,490 |

|

| Selling, general and administration |

|

26,726 |

|

|

22,515 |

|

| Depreciation and amortization |

|

6,276 |

|

|

5,856 |

|

| Transaction costs related to Adumo acquisition |

|

1,702 |

|

|

- |

|

| |

|

|

|

|

|

|

| OPERATING (LOSS) INCOME |

|

(45 |

) |

|

228 |

|

| |

|

|

|

|

|

|

| REVERSAL OF ALLOWANCE FOR DOUBTFUL EMI LOAN RECEIVABLE |

|

- |

|

|

250 |

|

| |

|

|

|

|

|

|

| INTEREST INCOME |

|

586 |

|

|

449 |

|

| |

|

|

|

|

|

|

| INTEREST EXPENSE |

|

5,032 |

|

|

4,909 |

|

| |

|

|

|

|

|

|

| LOSS BEFORE INCOME TAX EXPENSE (BENEFIT) |

|

(4,491 |

) |

|

(3,982 |

) |

| |

|

|

|

|

|

|

| INCOME TAX EXPENSE (BENEFIT) |

|

78 |

|

|

264 |

|

| |

|

|

|

|

|

|

| NET LOSS BEFORE EARNINGS (LOSS) FROM EQUITY-ACCOUNTED INVESTMENTS |

|

(4,569 |

) |

|

(4,246 |

) |

| |

|

|

|

|

|

|

| EARNINGS (LOSS) FROM EQUITY-ACCOUNTED INVESTMENTS |

|

27 |

|

|

(1,405 |

) |

| |

|

|

|

|

|

|

| NET LOSS ATTRIBUTABLE TO LESAKA |

$ |

(4,542 |

) |

$ |

(5,651 |

) |

| |

|

|

|

|

|

|

| Net loss per share, in United States dollars: |

|

|

|

|

|

|

| Basic loss attributable to Lesaka shareholders |

$ |

(0.07 |

) |

$ |

(0.09 |

) |

| Diluted loss attributable to Lesaka shareholders |

$ |

(0.07 |

) |

$ |

(0.09 |

) |

| LESAKA TECHNOLOGIES, INC. |

|

| Unaudited Condensed Consolidated Statements of Cash Flows |

|

| |

|

Unaudited |

|

| |

|

Three months ended |

|

| |

|

September 30, |

|

| |

|

2024 |

|

|

2023 |

|

| |

|

(In thousands) |

|

| Cash flows from operating activities |

|

|

|

|

|

|

| Net loss |

$ |

(4,542 |

) |

$ |

(5,651 |

) |

| Depreciation and amortization |

|

6,276 |

|

|

5,856 |

|

| Movement in allowance for doubtful accounts receivable and finance loans receivable |

|

1,499 |

|

|

1,525 |

|

| Movement in interest payable |

|

1,693 |

|

|

1,764 |

|

| Fair value adjustment related to financial liabilities |

|

190 |

|

|

(34 |

) |

| (Gain) Loss from equity-accounted investments |

|

(27 |

) |

|

1,405 |

|

| Reversal of allowance for doubtful loans receivable |

|

- |

|

|

(250 |

) |

| Profit on disposal of property, plant and equipment |

|

(27 |

) |

|

(36 |

) |

| Facility fee amortized |

|

69 |

|

|

227 |

|

| (Profit)/loss on disposal of business |

|

|

|

|

|

|

| Stock-based compensation charge |

|

2,377 |

|

|

1,759 |

|

| Decrease (Increase) in accounts receivable and other receivables |

|

7,692 |

|

|

(2,345 |

) |

| Increase in finance loans receivable |

|

(1,590 |

) |

|

(488 |

) |

| (Increase) Decrease in inventory |

|

(889 |

) |

|

(479 |

) |

| (Decrease) Increase in accounts payable and other payables |

|

(17,177 |

) |

|

375 |

|

| Increase in taxes payable |

|

765 |

|

|

308 |

|

| Decrease in deferred taxes |

|

(446 |

) |

|

(562 |

) |

| Net cash (used in) provided by operating activities |

|

(4,137 |

) |

|

3,374 |

|

| |

|

|

|

|

|

|

| Cash flows from investing activities |

|

|

|

|

|

|

| Capital expenditures |

|

(3,965 |

) |

|

(2,809 |

) |

| Proceeds from disposal of property, plant and equipment |

|

850 |

|

|

284 |

|

| Acquisition of intangible assets |

|

(173 |

) |

|

(135 |

) |

| Net change in settlement assets |

|

3,570 |

|

|

(11,237 |

) |

| Net cash provided by (used in) investing activities |

|

282 |

|

|

(13,897 |

) |

| |

|

|

|

|

|

|

| Cash flows from financing activities |

|

|

|

|

|

|

| Proceeds from bank overdraft |

|

23,893 |

|

|

59,574 |

|

| Repayment of bank overdraft |

|

(31,028 |

) |

|

(62,793 |

) |

| Long-term borrowings utilized |

|

774 |

|

|

2,471 |

|

| Repayment of long-term borrowings |

|

(5,472 |

) |

|

(2,629 |

) |

| Proceeds from issue of shares |

|

- |

|

|

21 |

|

| Net change in settlement obligations |

|

(3,648 |

) |

|

10,696 |

|

| Net (used in) cash provided by financing activities |

|

(15,481 |

) |

|

7,340 |

|

| |

|

|

|

|

|

|

| Effect of exchange rate changes on cash |

|

3,226 |

|

|

(443 |

) |

| Net decrease in cash, cash equivalents and restricted cash |

|

(16,110 |

) |

|

(3,626 |

) |

| Cash, cash equivalents and restricted cash - beginning of period |

|

65,919 |

|

|

58,632 |

|

| Cash, cash equivalents and restricted cash - end of period |

$ |

49,809 |

|

$ |

55,006 |

|

| LESAKA TECHNOLOGIES, INC. |

|

| Unaudited Condensed Consolidated Balance Sheets |

|

| |

|

Unaudited |

|

|

(A) |

|

| |

|

September 30, |

|

|

June 30, |

|

| |

|

2024 |

|

|

2024 |

|

| |

|

(In thousands, except share data) |

|

| ASSETS |

|

|

|

|

|

|

| CURRENT ASSETS |

|

|

|

|

|

|

| Cash and cash equivalents |

$ |

49,687 |

|

$ |

59,065 |

|

| Restricted cash |

|

122 |

|

|

6,853 |

|

| Accounts receivable, net of allowance of - September: $1,486; June: $1,241 and other receivables |

|

29,825 |

|

|

36,667 |

|

| Finance loans receivable, net of allowance of - September: $5,214; June: $4,644 |

|

47,017 |

|

|

44,058 |

|

| Inventory |

|

20,194 |

|

|

18,226 |

|

| Total current assets before settlement assets |

|

146,845 |

|

|

164,869 |

|

| Settlement assets |

|

20,469 |

|

|

22,827 |

|

| Total current assets |

|

167,314 |

|

|

187,696 |

|

| PROPERTY, PLANT AND EQUIPMENT, net of accumulated depreciation of - September: $50,532; June: $49,762 |

|

34,481 |

|

|

31,936 |

|

| OPERATING LEASE RIGHT-OF-USE |

|

7,411 |

|

|

7,280 |

|

| EQUITY-ACCOUNTED INVESTMENTS |

|

245 |

|

|

206 |

|

| GOODWILL |

|

146,577 |

|

|

138,551 |

|

| INTANGIBLE ASSETS, net of accumulated amortization of - September: $52,853; June: $46,200 |

|

114,052 |

|

|

111,353 |

|

| DEFERRED INCOME TAXES |

|

3,734 |

|

|

3,446 |

|

| OTHER LONG-TERM ASSETS, including equity securities |

|

78,075 |

|

|

77,982 |

|

| TOTAL ASSETS |

|

551,889 |

|

|

558,450 |

|

| |

|

|

|

|

|

|

| LIABILITIES |

|

|

|

|

|

|

| CURRENT LIABILITIES |

|

|

|

|

|

|

| Short-term credit facilities for ATM funding |

|

- |

|

|

6,737 |

|

| Short-term credit facilities |

|

9,895 |

|

|

9,351 |

|

| Accounts payable |

|

12,815 |

|

|

16,674 |

|

| Other payables |

|

45,923 |

|

|

56,051 |

|

| Operating lease liability - current |

|

2,600 |

|

|

2,343 |

|

| Current portion of long-term borrowings |

|

3,841 |

|

|

3,878 |

|

| Income taxes payable |

|

1,488 |

|

|

654 |

|

| Total current liabilities before settlement obligations |

|

76,562 |

|

|

95,688 |

|

| Settlement obligations |

|

19,899 |

|

|

22,358 |

|

| Total current liabilities |

|

96,461 |

|

|

118,046 |

|

| DEFERRED INCOME TAXES |

|

39,345 |

|

|

38,128 |

|

| OPERATING LEASE LIABILITY - LONG TERM |

|

4,968 |

|

|

5,087 |

|

| LONG-TERM BORROWINGS |

|

144,679 |

|

|

139,308 |

|

| OTHER LONG-TERM LIABILITIES, including insurance policy liabilities |

|

2,790 |

|

|

2,595 |

|

| TOTAL LIABILITIES |

|

288,243 |

|

|

303,164 |

|

| REDEEMABLE COMMON STOCK |

|

79,429 |

|

|

79,429 |

|

| |

|

|

|

|

|

|

| EQUITY |

|

|

|

|

|

|

| LESAKA EQUITY: |

|

|

|

|

|

|

| COMMON STOCK |

|

|

|

|

|

|

| Authorized: 200,000,000 with $0.001 par value; |

|

|

|

|

|

|

| Issued and outstanding shares, net of treasury: September: 64,301,943; June: 64,272,243 |

|

83 |

|

|

83 |

|

| PREFERRED STOCK |

|

|

|

|

|

|

| Authorized shares: 50,000,000 with $0.001 par value; |

|

|

|

|

|

|

| Issued and outstanding shares, net of treasury: September: -; June: - |

|

- |

|

|

- |

|

| ADDITIONAL PAID-IN-CAPITAL |

|

346,016 |

|

|

343,639 |

|

| TREASURY SHARES, AT COST: September: 25,563,808; June: 25,563,808 |

|

(289,733 |

) |

|

(289,733 |

) |

| ACCUMULATED OTHER COMPREHENSIVE LOSS |

|

(177,830 |

) |

|

(188,355 |

) |

| RETAINED EARNINGS |

|

305,681 |

|

|

310,223 |

|

| TOTAL LESAKA EQUITY |

|

184,217 |

|

|

175,857 |

|

| NON-CONTROLLING INTEREST |

|

- |

|

|

- |

|

| TOTAL EQUITY |

|

184,217 |

|

|

175,857 |

|

| TOTAL LIABILITIES, REDEEMABLE COMMON STOCK AND SHAREHOLDERS' EQUITY |

$ |

551,889 |

|

$ |

558,450 |

|

(A) Derived from audited consolidated financial statements.

Lesaka Technologies, Inc.

Attachment C

Reconciliation of net loss used to calculate loss per share basic and diluted and headline loss per share basic and diluted:

Three months ended September 30, 2024 and 2024

| |

|

2024 |

|

|

2023 |

|

| |

|

|

|

|

|

|

| Net loss (USD'000) |

|

(4,542 |

) |

|

(5,651 |

) |

| Adjustments: |

|

|

|

|

|

|

| Impairment of equity method investments |

|

- |

|

|

1,167 |

|

| Profit on sale of property, plant and equipment |

|

(27 |

) |

|

(36 |

) |

| Tax effects on above |

|

7 |

|

|

10 |

|

| Net loss used to calculate headline loss (USD'000) |

|

(4,562 |

) |

|

(4,510 |

) |

| Weighted average number of shares used to calculate net loss per share basic loss and headline loss per share basic loss ('000) |

|

64,293 |

|

|

63,805 |

|

| Weighted average number of shares used to calculate net loss per share diluted loss and headline loss per share diluted loss ('000) |

|

64,293 |

|

|

63,805 |

|

| Headline loss per share: |

|

|

|

|

|

|

| Basic, in USD |

|

(0.07 |

) |

|

(0.07 |

) |

| Diluted, in USD |

|

(0.07 |

) |

|

(0.07 |

) |

Calculation of the denominator for headline diluted loss per share

| |

|

Three months ended

March 31, |

|

| |

|

2024 |

|

|

2023 |

|

| Basic weighted-average common shares outstanding and unvested restricted shares expected to vest under GAAP |

|

64,293 |

|

|

63,805 |

|

| Denominator for headline diluted loss per share |

|

64,293 |

|

|

63,805 |

|

Weighted average number of shares used to calculate headline diluted loss per share represents the denominator for basic weighted-average common shares outstanding and unvested restricted shares expected to vest plus the effect of dilutive securities under GAAP. We use this number of fully diluted shares outstanding to calculate headline diluted loss per share because we do not use the two-class method to calculate headline diluted loss per share.

v3.24.3

Document and Entity Information Document

|

Nov. 05, 2024 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Document Creation Date |

Nov. 05, 2024

|

| Document Period End Date |

Nov. 05, 2024

|

| Amendment Flag |

false

|

| Entity Registrant Name |

Lesaka Technologies, Inc.

|

| Entity Address, Address Line One |

President Place, 4th Floor, Cnr.

|

| Entity Address, Address Line Two |

Jan Smuts Avenue and Bolton Road

|

| Entity Address, City or Town |

Rosebank, Johannesburg

|

| Entity Address, Country |

ZA

|

| Entity Address, Postal Zip Code |

|

| Entity Incorporation, State Country Name |

FL

|

| City Area Code |

11

|

| Region code of country |

27

|

| Local Phone Number |

343-2000

|

| Entity File Number |

000-31203

|

| Entity Central Index Key |

0001041514

|

| Entity Emerging Growth Company |

false

|

| Entity Tax Identification Number |

98-0171860

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Shares

|

| Trading Symbol |

LSAK

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe date the document was made available and submitted, in YYYY-MM-DD format. The date of submission, date of acceptance by the recipient, and the document effective date are all potentially different.

| Name: |

dei_DocumentCreationDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

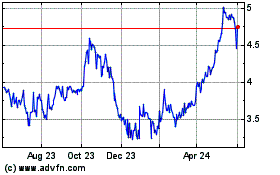

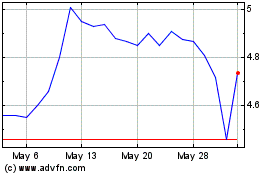

Lesaka Technologies (NASDAQ:LSAK)

Historical Stock Chart

From Jan 2025 to Feb 2025

Lesaka Technologies (NASDAQ:LSAK)

Historical Stock Chart

From Feb 2024 to Feb 2025