Krystal Biotech, Inc. (the “Company”) (NASDAQ: KRYS), a

commercial-stage biotechnology company, today reported financial

results and key business updates for the first quarter ending March

31, 2024.

“With strong uptake of VYJUVEK and accelerating

enrollment across our growing clinical pipeline, we made great

progress this quarter on our mission to deliver transformational

genetic medicines to patients with rare and serious diseases,” said

Krish S. Krishnan, Chairman and CEO of Krystal Biotech. “Our U.S.

VYJUVEK launch continues to progress well, delivering quarter over

quarter revenue growth, and is underpinned by robust demand, rapid

growth in reimbursement approvals, and high patient compliance.

Momentum outside of the U.S. is also accelerating with the

successful completion of our clinical study in Japan putting us on

a path for our second ex-U.S. regulatory filing before year end.

Our focus looking ahead is to continue expanding VYJUVEK access

both in the U.S. and abroad, while progressing our deep clinical

pipeline through to key data readouts expected to start later this

year.”

VYJUVEK for the treatment of Dystrophic

Epidermolysis Bullosa (DEB)

- The Company recorded

$45.3 million in VYJUVEK net product revenue for the first quarter

of 2024. Gross margin for the quarter was 95%.

- As of April, the

Company has secured over 330 reimbursement approvals for VYJUVEK in

the U.S. and positive access has been achieved for 96% of lives

covered under commercial and Medicaid plans. In January, the

Company received a permanent J-code for VYJUVEK, which facilitates

efficient and accurate billing and reimbursement, including under

U.S Medicaid plans.

- Patient compliance

with once weekly treatment while on drug remains high at 91% as of

the end of the quarter.

- In February, the

European Medicines Agency (EMA) completed inspections of the

Company’s manufacturing facility as part of the EMA’s review of the

Company’s Marketing Authorization Application (MAA) for B-VEC for

the treatment of DEB in patients from birth. GMP certification and

a decision on the MAA are both anticipated in 2H 2024.

- The Company remains on

track to file a Japan New Drug Application in 2H 2024, following

completion of the efficacy portion of the Japan open label

extension study of B-VEC in April, and anticipates a potential

authorization in 2025. In December 2023, B-VEC was granted Orphan

Drug Designation (ODD) status for the treatment of DEB by the Japan

Ministry of Health, Labour and Welfare, a designation which confers

specific benefits, including priority review of applications,

extended registration validity, and reduced development costs.

Respiratory

KB407 for the treatment of cystic fibrosis (CF)

- In March, the Company completed dosing

in Cohort 2 of the Phase 1 CORAL-1 study. CORAL-1 is a

multi-center, dose escalation study evaluating KB407 in patients

with CF, regardless of their underlying genotype. The Company

intends to initiate the third and final cohort in 2Q 2024. Details

of the Phase 1 study can be found at www.clinicaltrials.gov under

NCT identifier NCT05504837.

KB408 for the treatment of alpha-1 antitrypsin

deficiency (AATD)

- In February, the

Company dosed the first patient in the KB408 Phase 1 SERPENTINE-1

study. SERPENTINE-1 is a Phase 1 open label, single dose escalation

study in adult patients with AATD with a PI*ZZ genotype.

Recruitment is ongoing and details about the Phase 1 study can be

found at www.clinicaltrials.gov under NCT identifier: NCT06049082.

The Company remains on track to report interim data from the study

in 2H 2024.

Ophthalmology

B-VEC eyedrops for ocular complications of DEB

- In February, the Company announced the

publication in the New England Journal of Medicine of clinical data

on the compassionate use of B-VEC, administered as an eyedrop, to

treat a patient suffering from ocular complications of DEB.

- In February, the Company aligned with

the U.S. Food and Drug Administration (FDA) on the proposed single

arm, open label study in approximately 10 patients to enable

approval of B-VEC eyedrops to treat ocular complications which are

thought to affect over 25% of DEB patients. The Company plans to

initiate this study in 2H 2024.

- In January, the United States Patent

and Trademark Office, or USPTO, issued U.S. Patent No. 11,865,148,

covering methods of delivering human transgenes to the eye using

replication-incompetent HSV-1.

Pipeline expansion

- On May 7, 2024, the

Company will be presenting preclinical data at the Association for

Research in Vision & Ophthalmology 2024 Annual Meeting

highlighting the potential of the Company’s HSV-1-based gene

delivery platform for back of the eye gene delivery.

- The Company is

actively evaluating multiple, preclinical-stage genetic medicine

candidates for the treatment of diseases of the front and back of

the eye.

Oncology

Inhaled KB707 for the treatment of solid tumors of

the lung

- In April, the Company dosed the first

patient in the open label, multi-center, monotherapy, dose

escalation and expansion Phase 1 KYANITE-1 clinical study in

patients with locally advanced or metastatic solid tumors of the

lung. Recruitment is ongoing and details of the study can be found

at www.clinicaltrials.gov under NCT identifier NCT06228326.

- In February, the FDA granted Fast Track

Designation for inhaled KB707 for the treatment of patients with

solid tumors with pulmonary metastases that are relapsed or

refractory to standard of care therapy. This is the second Fast

Track Designation for the KB707 program. Previously, in July 2023,

the FDA granted intratumoral KB707 Fast Track Designation for the

treatment of anti-PD-1 relapsed/refractory locally advanced or

metastatic melanoma.

Intratumoral KB707 for the treatment of injectable

solid tumors

- In April, the Company

successfully completed enrollment in Cohort 3 of the Phase 1 OPAL-1

clinical study in patients with locally advanced or metastatic

solid tumor malignancies. The first two dose escalation cohorts of

the OPAL-1 study have been cleared and KB707 has been generally

well tolerated to date with no study patients experiencing

dose-limiting toxicities or drug-related grade ≥3 adverse events.

Based on the current rate of enrollment, the Company expects to

report interim data in 2H 2024. Details of the study can be found

at www.clinicaltrials.gov under NCT identifier NCT05970497.

- Preclinical data

generated in syngeneic mouse models using murine equivalents to

KB707 were presented at the American Association for Cancer

Research 2024 Annual Meeting that was held in April. Study results

demonstrated that interleukin-12 and interleukin-2, delivered

intratumorally using the Company’s HSV-1-based gene delivery

platform, enhanced local and systemic T-cell effector responses

consistent with previously reported anti-tumor activity.

Aesthetics

KB301 for the treatment of aesthetic indications

- In January, Jeune Aesthetics, Inc.

(“Jeune Aesthetics”), a wholly-owned subsidiary of the Company,

initiated Cohort 4 of the Phase 1 PEARL-1 study, to evaluate KB301

for the improvement of dynamic wrinkles of the décolleté in up to

20 subjects. Cohort 4 is running simultaneously with PEARL-1 Cohort

3 evaluating KB301 for the improvement of lateral canthal lines at

rest and Jeune Aesthetics expects to announce results from both

cohorts in mid-2024. Details of the Phase 1 study can be found at

www.clinicaltrials.gov under NCT identifier NCT04540900.

Financial Results for the Quarter Ended

March 31, 2024:

- Cash, cash

equivalents, and investments totaled $622.3 million on

March 31, 2024.

- The Company recorded its first sales for patients that began

treatment in August 2023 and the resulting product revenue, net

totaled $45.3 million for the quarter ended March 31,

2024.

- Cost of goods sold totaled $2.4 million for the quarter ended

March 31, 2024. Prior to receiving FDA approval for VYJUVEK in

May 2023, costs associated with the manufacturing of VYJUVEK were

expensed as research and development expense.

- Research and development expenses

for the quarter ended March 31, 2024 were $11.0 million,

inclusive of $1.9 million of stock-based compensation, compared to

$12.3 million, inclusive of stock-based compensation of $2.5

million for the quarter ended March 31, 2023.

- Selling, general, and administrative

expenses for the quarter ended March 31, 2024 were $26.1

million, inclusive of stock-based compensation of $7.4 million,

compared to $24.0 million, inclusive of stock-based compensation of

$7.9 million, for the quarter ended March 31, 2023.

- Net income for the quarter ended

March 31, 2024 was $0.9 million, or $0.03 per common share

(basic and diluted). Net loss for the quarter ended March 31,

2023 was $45.3 million, or $1.76 per common share (basic and

diluted).

- For additional information on the Company’s financial results

for the quarter ended March 31, 2024, please refer to the Form

10-Q filed with the SEC.

Financial Guidance

For the year ending December 31, 2024, we continue to anticipate

approximately $150 million to $175 million of Non-GAAP Research and

Development (“R&D”) and Selling, General and Administrative

(“SG&A”) expense. Non-GAAP combined R&D and SG&A

expense guidance does not include stock-based compensation as we

are currently unable to confidently estimate Full Year 2024

stock-based compensation expense. As such, we have not provided a

reconciliation from forecasted non-GAAP to forecasted GAAP combined

R&D and SG&A Expense. This could materially affect the

calculation of forward-looking GAAP combined R&D and SG&A

Expense as it is inherently uncertain. Refer to Non-GAAP Financial

Measures section below for additional information.

Conference Call

The Company will host an investor webcast on May 6, 2024, at

8:30 am ET.

Investors and the general public can access the live webcast at:

https://www.webcaster4.com/Webcast/Page/3018/50407

For those unable to listen to the live conference call, a replay

will be available for 30 days on the Investors section of the

Company’s website at www.krystalbio.com.

About VYJUVEK

VYJUVEK is a non-invasive, topical, redosable gene therapy

designed to deliver two copies of the COL7A1 gene when applied

directly to DEB wounds. VYJUVEK was designed to treat DEB at the

molecular level by providing the patient’s skin cells the template

to make normal COL7 protein, thereby addressing the fundamental

disease-causing mechanism.

Indication

VYJUVEK is a herpes-simplex virus type 1 (HSV-1) vector-based

gene therapy indicated for the treatment of wounds in patients six

months of age and older with dystrophic epidermolysis bullosa with

mutation(s) in the collagen type VII alpha 1 chain (COL7A1)

gene.

IMPORTANT SAFETY INFORMATION

Adverse Reactions

The most common adverse drug reactions (incidence >5%) were

itching, chills, redness, rash, cough, and runny nose. These are

not all the possible side effects with VYJUVEK. Call your

healthcare provider for medical advice about side effects.

To report SUSPECTED ADVERSE REACTIONS, contact Krystal Biotech,

Inc. at 1-844-557-9782 or FDA at 1-800-FDA-1088 or

http://www.fda.gov/medwatch.

Contraindications

None.

Warnings and Precautions

VYJUVEK gel must be applied by a healthcare provider.

After treatment, patients and caregivers should be careful not

to touch treated wounds and dressings for 24 hours.

Wash hands and wear protective gloves when changing wound

dressings. Disinfect bandages from the first dressing change with a

virucidal agent, and dispose of the disinfected bandages in a

separate sealed plastic bag in household waste. Dispose of the

subsequent used dressings in a sealed plastic bag in household

waste.

Patients should avoid touching or scratching wound sites or

wound dressings.

In the event of an accidental exposure flush with clean water

for at least 15 minutes.

For more information, see full U.S. Prescribing Information.

About Orphan Drug Designation

Orphan Drug Designation is granted by the U.S. FDA to

investigational therapies addressing rare medical diseases or

conditions that affect fewer than 200,000 people in the U.S. Orphan

drug status provides benefits to drug developers, including

assistance in the drug development process, tax credits for

clinical costs, exemptions from certain U.S. FDA fees and seven

years of post-approval marketing exclusivity.

The orphan drug designation system in Japan aims to support the

development of drugs for diseases that affect fewer than 50,000

patients in Japan, for which significant unmet medical need exists.

An investigational therapy is eligible to qualify for ODD if there

is no approved alternative treatment option or if there is high

efficacy or safety compared to existing treatment options

expected. Specific measures to support the development of

orphan drugs include subsidies for research and development

expenditures, prioritized consultation regarding clinical

development, reduced consultation fees, tax incentives, priority

review of applications, reduced application fees, and extended

registration validity period.

About Fast Track Designation

Fast Track Designation is designed to facilitate the development

and expedite the review of drugs to treat serious conditions and

treat a serious or unmet medical need, enabling drugs to reach

patients sooner. Clinical programs with Fast Track Designation may

benefit from early and frequent communication with the FDA

throughout the regulatory review process, and such clinical

programs may be eligible to apply for Accelerated Approval and

Priority Review if relevant criteria are met.

About Krystal Biotech, Inc.

Krystal Biotech, Inc. (NASDAQ: KRYS) is a commercial-stage

biotechnology company focused on the discovery, development and

commercialization of genetic medicines to treat diseases with high

unmet medical needs. VYJUVEK® is the Company’s first commercial

product, the first-ever redosable gene therapy, and the first

medicine approved by the FDA for the treatment of dystrophic

epidermolysis bullosa. The Company is rapidly advancing a robust

preclinical and clinical pipeline of investigational genetic

medicines in respiratory, oncology, dermatology, ophthalmology, and

aesthetics. Krystal Biotech is headquartered in Pittsburgh,

Pennsylvania. For more information, please visit

http://www.krystalbio.com, and follow @KrystalBiotech on LinkedIn

and X (formerly Twitter).

About Jeune Aesthetics, Inc.

Jeune Aesthetics, Inc., a wholly-owned subsidiary of Krystal

Biotech, Inc., is a biotechnology company leveraging a clinically

validated gene delivery platform to develop products to

fundamentally address – and reverse – the biology of aging and/or

damaged skin. For more information, please visit

http://www.jeuneinc.com.

Forward-Looking Statements

Any statements in this press release about future expectations,

plans and prospects for Krystal Biotech, Inc. or Jeune Aesthetics,

Inc., including statements about the Company’s commercial launch of

VYJUVEK in the United States; the Company’s beliefs about the

timing of potential decisions from the EMA in connection with the

Company’s MAA for B-VEC for the treatment of DEB in patients from

birth; the Company’s beliefs about the timing of filing a Japanese

New Drug Application for B-VEC for the treatment of DEB patients

and a potential Japanese authorization; the Company’s expectation

regarding the timing of initiating Cohort 3 of its CORAL-1 study

evaluating KB407 in patients with cystic fibrosis; the Company’s

plans to initiate its study of B-VEC eyedrops to treat ocular

complications of DEB in 2H 2024; the timing of Jeune Aesthetics’

plans to announce results of Cohort 3 and Cohort 4 of its Phase 1

clinical study to evaluate KB301; the expected timing of key data

readouts; and other statements containing the words “anticipate,”

“believe,” “estimate,” “expect,” “intend,” “may,” “plan,”

“predict,” “project,” “target,” “potential,” “likely,” “will,”

“would,” “could,” “should,” “continue,” and similar expressions,

constitute forward-looking statements within the meaning of The

Private Securities Litigation Reform Act of 1995. Actual results

may differ materially from those indicated by such forward-looking

statements as a result of various important factors, including:

uncertainties associated with regulatory review of clinical trials

and applications for marketing approvals; the availability or

commercial potential of VYJUVEK or product candidates; the

sufficiency of cash resources and need for additional financing;

and such other important factors as are set forth under the caption

“Risk Factors” in the Company’s annual and quarterly reports on

file with the U.S. Securities and Exchange Commission. In addition,

the forward-looking statements included in this press release

represent the Company’s views as of the date of this press release.

The Company anticipates that subsequent events and developments

will cause its views to change. However, while the Company may

elect to update these forward-looking statements at some point in

the future, it specifically disclaims any obligation to do so.

These forward-looking statements should not be relied upon as

representing the Company’s views as of any date subsequent to the

date of this press release.

Non-GAAP Financial Measures

This press release includes forward-looking combined R&D and

SG&A expense guidance that is not required by, or presented in

accordance with, U.S. GAAP and should not be considered as an

alternative to R&D and SG&A expense or any other

performance measure derived in accordance with GAAP. The Company

defines non-GAAP combined R&D and SG&A expense as GAAP

combined R&D and SG&A expense excluding stock-based

compensation. The Company cautions investors that amounts presented

in accordance with its definition of non-GAAP combined R&D and

SG&A expense may not be comparable to similar measures

disclosed by competitors because not all companies calculate this

non-GAAP financial measure in the same manner. The Company presents

this non-GAAP financial measure because it considers this measure

to be an important supplemental measure and believes it is

frequently used by securities analysts, investors, and other

interested parties in the evaluation of companies in the Company’s

industry. Management believes that investors’ understanding of the

Company’s performance is enhanced by including this forward-looking

non-GAAP financial measure as a reasonable basis for comparing the

Company’s ongoing results of operations. Management uses this

non-GAAP financial measure for planning purposes, including the

preparation of the Company’s internal annual operating budget and

financial projections; to evaluate the performance and

effectiveness of the Company’s operational strategies; and to

evaluate the Company’s capacity to expand its business. This

non-GAAP financial measure has limitations as an analytical tool,

and should not be considered in isolation, or as an alternative to,

or a substitute for R&D and SG&A expense or other financial

statement data presented in accordance with GAAP in the Company’s

consolidated financial statements. The Company has not provided a

quantitative reconciliation of forecasted non-GAAP combined R&D

and SG&A expense to forecasted GAAP combined R&D and

SG&A expense because the Company is unable, without making

unreasonable efforts, to calculate the reconciling item,

stock-based compensation expenses, with confidence. This item,

which could materially affect the computation of forward-looking

GAAP combined R&D and SG&A expense, is inherently uncertain

and depends on various factors, some of which are outside of the

Company’s control.

CONTACTInvestors and

Media: Stéphane Paquette,

PhDKrystal Biotechspaquette@krystalbio.com

Condensed Consolidated Balance Sheet

Data:

|

(in thousands) |

March 31,2024 |

|

December 31,2023 |

|

| |

(unaudited) |

|

|

|

|

|

Balance sheet data: |

|

|

|

|

|

|

|

Cash and cash equivalents |

$ |

359,006 |

|

$ |

358,328 |

|

|

Short-term investments |

|

179,253 |

|

|

173,850 |

|

|

Long-term investments |

|

83,996 |

|

|

61,954 |

|

|

Total assets |

|

853,296 |

|

|

818,355 |

|

|

Total liabilities |

|

54,054 |

|

|

39,714 |

|

|

Total stockholders’ equity |

$ |

799,242 |

|

$ |

778,641 |

|

|

|

Condensed Consolidated Statements of

Operations:

| |

Three Months Ended March 31, |

|

|

|

| |

2024 |

|

2023 |

|

Change |

|

|

(in thousands, except per share data) |

(unaudited) |

|

|

|

|

|

|

Revenue |

|

|

|

|

|

|

|

|

|

|

|

|

|

Product revenue, net |

$ |

45,250 |

|

|

$ |

— |

|

|

$ |

45,250 |

|

|

|

Expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of goods sold |

|

2,419 |

|

|

|

— |

|

|

|

2,419 |

|

|

|

Research and development |

|

10,957 |

|

|

|

12,288 |

|

|

|

(1,331 |

) |

|

|

Selling, general, and administrative |

|

26,058 |

|

|

|

24,035 |

|

|

|

2,023 |

|

|

|

Litigation settlement |

|

12,500 |

|

|

|

12,500 |

|

|

|

— |

|

|

|

Total operating expenses |

|

51,934 |

|

|

|

48,823 |

|

|

|

3,111 |

|

|

|

Loss from operations |

|

(6,684 |

) |

|

|

(48,823 |

) |

|

|

42,139 |

|

|

|

Other income |

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest and other income, net |

|

7,616 |

|

|

|

3,526 |

|

|

|

4,090 |

|

|

|

Net income (loss) |

$ |

932 |

|

|

$ |

(45,297 |

) |

|

$ |

46,229 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss) per common share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

$ |

0.03 |

|

|

$ |

(1.76 |

) |

|

|

|

|

|

|

Diluted |

$ |

0.03 |

|

|

$ |

(1.76 |

) |

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted-average common shares outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

28,295 |

|

|

|

25,712 |

|

|

|

|

|

|

|

Diluted |

|

29,291 |

|

|

|

25,712 |

|

|

|

|

|

|

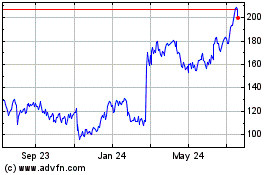

Krystal Biotech (NASDAQ:KRYS)

Historical Stock Chart

From Oct 2024 to Nov 2024

Krystal Biotech (NASDAQ:KRYS)

Historical Stock Chart

From Nov 2023 to Nov 2024