Key Tronic Corporation Announces Results for the Second Quarter of Fiscal Year 2017

January 31 2017 - 4:01PM

New Customer

Wins;Investing for Growth in Coming

Quarters

Key Tronic Corporation (Nasdaq:KTCC), a

provider of electronic manufacturing services (EMS), today

announced its results for the quarter ended December 31, 2016.

For the second quarter of fiscal year 2017, Key Tronic reported

total revenue of $118.5 million, up 2% from $116.4 million in the

same period of fiscal year 2016. For the first six months of fiscal

year 2017, total revenue was $235.7 million, compared to $242.6

million in the same period of fiscal year 2016.

Net income for the second quarter of fiscal year 2017 was $1.5

million or $0.14 per share, compared to $1.8 million or $0.16 per

share for the second quarter of fiscal year 2016. For the first six

months of fiscal year 2017, net income was $3.3 million or $0.30

per share, up 27% from $2.6 million or $0.23 per share for the same

period of fiscal year 2016.

For the second quarter of fiscal year 2017, gross margin was

8.1% and operating margin was 2.1%, compared to 7.8% and 2.1%,

respectively, in the same period of fiscal 2016.

“During the second quarter of fiscal 2017, our new programs

continued to ramp, more than offsetting a modest slowdown in demand

from a few longstanding customers, which is consistent with EMS

industry-wide experience,” said Craig Gates, President and Chief

Executive Officer. “At the same time, we captured significant new

business from other EMS competitors, including established programs

that will begin generating revenue before the end of fiscal

2017.”

“We recently won new programs involving inventory automation

systems and commercial lighting. Moving into the third quarter, we

continue to see a robust pipeline of potential new business and our

new programs continue to ramp, effectively offsetting softening

sales demand in some current programs. In preparation for future

growth, we continue to invest in expanding our SMT, sheet metal and

plastic molding capabilities.”

Business Outlook

For the third quarter of fiscal year 2017, the Company expects

to report revenue in the range of $115 million to $120 million, and

earnings in the range of $0.11 to $0.16 per diluted share. These

expected results assume an effective tax rate of 20% in the

quarter.

Conference Call

Key Tronic will host a conference call today to discuss its

financial results at 2:00 PM Pacific (5:00 PM Eastern). A broadcast

of the conference call will be available at

www.keytronic.com under “Investor Relations” or by calling

888-224-1075 or +1-913-312-0977 (Access Code: 7228474). A

replay will be available by calling 888-203-1112 or +1-719-457-0820

(Access Code: 7228474).

About Key Tronic

Key Tronic is a leading contract manufacturer offering

value-added design and manufacturing services from its facilities

in the United States, Mexico and China. The Company provides its

customers full engineering services, materials management,

worldwide manufacturing facilities, assembly services, in-house

testing, and worldwide distribution. Its customers include some of

the world’s leading original equipment manufacturers. For more

information about Key Tronic visit: www.keytronic.com.

Some of the statements in this press release are forward-looking

statements within the meaning of the Private Securities Litigation

Reform Act of 1995. Forward-looking statements include all passages

containing verbs such as aims, anticipates, believes, estimates,

expects, hopes, intends, plans, predicts, projects or targets or

nouns corresponding to such verbs. Forward-looking statements also

include other passages that are primarily relevant to expected

future events or that can only be fully evaluated by events that

will occur in the future. Forward-looking statements in this

release include, without limitation, the Company’s statements

regarding its expectations with respect to quarterly revenue and

earnings during fiscal year 2017. There are many factors, risks and

uncertainties that could cause actual results to differ materially

from those predicted or projected in forward-looking statements,

including but not limited to the future of the global economic

environment and its impact on our customers and suppliers, the

availability of parts from the supply chain, the accuracy of

customers’ forecasts; success of customers’ programs; timing of new

programs; success of new-product introductions; acquisitions or

divestitures of operations or facilities; technology advances;

changes in pricing policies by the Company, its competitors,

customers or suppliers; and the other risks and uncertainties

detailed from time to time in the Company’s SEC filings.

|

|

| KEY TRONIC CORPORATION AND

SUBSIDIARIES |

| CONSOLIDATED STATEMENTS OF INCOME |

| (In thousands, except per share amounts) |

| (Unaudited) |

| |

|

|

|

| |

Three Months Ended |

|

Six Months Ended |

| |

December 31, 2016 |

|

December 26, 2015 |

|

December 31, 2016 |

|

December 26, 2015 |

| Net sales |

$ |

118,517 |

|

|

$ |

116,403 |

|

|

$ |

235,652 |

|

|

$ |

242,612 |

|

| Cost of sales |

108,905 |

|

|

107,293 |

|

|

216,331 |

|

|

224,583 |

|

| Gross

profit |

9,612 |

|

|

9,110 |

|

|

19,321 |

|

|

18,029 |

|

| Research, development

and engineering expenses |

1,603 |

|

|

1,506 |

|

|

3,187 |

|

|

3,062 |

|

| Selling, general and

administrative expenses |

5,462 |

|

|

5,201 |

|

|

10,797 |

|

|

10,784 |

|

| Total

operating expenses |

7,065 |

|

|

6,707 |

|

|

13,984 |

|

|

13,846 |

|

| Operating

income |

2,547 |

|

|

2,403 |

|

|

5,337 |

|

|

4,183 |

|

| Interest expense,

net |

552 |

|

|

521 |

|

|

1,141 |

|

|

1,054 |

|

| Income

before income taxes |

1,995 |

|

|

1,882 |

|

|

4,196 |

|

|

3,129 |

|

| Income tax

provision |

467 |

|

|

95 |

|

|

876 |

|

|

525 |

|

| Net

income |

$ |

1,528 |

|

|

$ |

1,787 |

|

|

$ |

3,320 |

|

|

$ |

2,604 |

|

| Net

income per share — Basic |

$ |

0.14 |

|

|

$ |

0.17 |

|

|

$ |

0.31 |

|

|

$ |

0.24 |

|

| Weighted

average shares outstanding — Basic |

10,758 |

|

|

10,710 |

|

|

10,753 |

|

|

10,708 |

|

| Net

income per share — Diluted |

$ |

0.14 |

|

|

$ |

0.16 |

|

|

$ |

0.30 |

|

|

$ |

0.23 |

|

| Weighted

average shares outstanding — Diluted |

10,968 |

|

|

11,418 |

|

|

10,919 |

|

|

11,279 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| KEY TRONIC CORPORATION AND

SUBSIDIARIES |

| CONSOLIDATED BALANCE SHEETS |

| (In thousands) |

| (Unaudited) |

| |

|

|

|

|

| |

|

December 31, 2016 |

|

July 2, 2016 |

|

ASSETS |

|

|

|

|

| Current assets: |

|

|

|

|

| Cash and

cash equivalents |

|

$ |

1,280 |

|

|

$ |

1,018 |

|

| Trade

receivables, net of allowance for doubtful accounts of $134 and

$135 |

|

66,444 |

|

|

61,678 |

|

|

Inventories |

|

98,106 |

|

|

107,006 |

|

|

Other |

|

10,892 |

|

|

11,757 |

|

| Total

current assets |

|

176,722 |

|

|

181,459 |

|

| Property, plant and

equipment, net |

|

29,938 |

|

|

27,925 |

|

| Other assets: |

|

|

|

|

| Deferred

income tax asset |

|

11,050 |

|

|

8,982 |

|

|

Goodwill |

|

9,957 |

|

|

9,957 |

|

| Other

intangible assets |

|

5,364 |

|

|

5,928 |

|

|

Other |

|

1,471 |

|

|

1,673 |

|

| Total

other assets |

|

27,842 |

|

|

26,540 |

|

| Total assets |

|

$ |

234,502 |

|

|

$ |

235,924 |

|

| LIABILITIES AND

SHAREHOLDERS’ EQUITY |

|

|

|

|

| Current

liabilities: |

|

|

|

|

| Accounts

payable |

|

$ |

51,178 |

|

|

$ |

58,967 |

|

| Accrued

compensation and vacation |

|

7,695 |

|

|

9,571 |

|

| Current

portion of debt |

|

5,841 |

|

|

5,000 |

|

|

Other |

|

14,292 |

|

|

10,572 |

|

| Total

current liabilities |

|

79,006 |

|

|

84,110 |

|

| Long-term

liabilities: |

|

|

|

|

| Term loan

- long term |

|

21,693 |

|

|

21,250 |

|

| Revolving

loan |

|

18,930 |

|

|

18,073 |

|

| Other

long-term obligations |

|

7,998 |

|

|

6,909 |

|

| Total

long-term liabilities |

|

48,621 |

|

|

46,232 |

|

| Total liabilities |

|

127,627 |

|

|

130,342 |

|

| Shareholders’

equity: |

|

|

|

|

| Common

stock, no par value—shares authorized 25,000; issued and

outstanding 10,758 and 10,725 shares, respectively |

|

45,466 |

|

|

45,227 |

|

| Retained

earnings |

|

71,248 |

|

|

67,928 |

|

|

Accumulated other comprehensive loss |

|

(9,839 |

) |

|

(7,573 |

) |

| Total

shareholders’ equity |

|

106,875 |

|

|

105,582 |

|

| Total liabilities and

shareholders’ equity |

|

$ |

234,502 |

|

|

$ |

235,924 |

|

| |

|

|

|

|

|

|

|

|

CONTACTS:

Brett Larsen

Chief Financial Officer

Key Tronic Corporation

(509) 927-5500

Michael Newman

Investor Relations

StreetConnect

(206) 729-3625

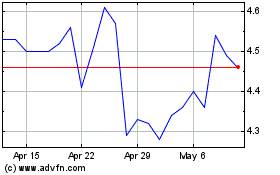

KeyTronic (NASDAQ:KTCC)

Historical Stock Chart

From Oct 2024 to Nov 2024

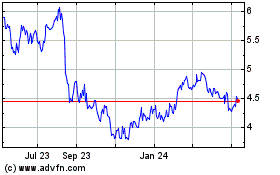

KeyTronic (NASDAQ:KTCC)

Historical Stock Chart

From Nov 2023 to Nov 2024