Mixed 3Q at Pool; Guides Higher - Analyst Blog

October 22 2012 - 5:10AM

Zacks

Pool Corp.’s

(POOL) third quarter 2012

adjusted earnings per share of 59 cents were ahead of the Zacks

Consensus Estimate of 56 cents and 18% above the year-ago

level. One less selling day than the third quarter of 2011

led to a tough comparison in the quarter under review.

The year-over-year increase in earnings was mainly driven by modest

top-line growth as well as reduced cost structure. Net sales in the

reported quarter increased 5.0% year over year to $528.0 million

but lagged the Zacks Consensus Estimate of $531.0 million.

Inside the Headline Numbers

Overall Base business sales of Pool improved 3% year over year.

Sales from swimming pool side business increased only 3% in the

quarter, while sales from irrigation business were up 8%. Results

were benefited by market share gains, offset somewhat by 1% decline

by adverse currency translation.

Among the three largest markets of swimming pool side business,

Florida performed relatively better while California and Texas were

a little lower than the company average. In those markets,

year-over-year comparison made a crucial difference to sales

growth.

Gross profit grew 2% year over year to $151.5 million but gross

margin fell 70 basis points (bps) to 28.7% due to cut-throat

competition, tough year-over-year comparison owing to vendor price

increases last year and an adverse customer mix. Operating margin

fell 30 bps to 7.8%.

Liquidity

Cash and cash equivalents increased 40% year over year to $28.8

million. Net receivables climbed 9% from the prior-year period to

$175.5 million.

The inventory level escalated 3% year over year to $349.3 million

at the end of the third quarter. Total long-term debt was $214.3

million versus $268.7 million in the year-ago quarter.

Guidance

After slashing the full-year earnings per share guidance in the

last quarter, management raised it this time to the range of

$1.80–$1.83 from $1.75–$1.82.

Our Take

Management still expects earnings per share to grow over 20% this

year, which if achieved, will mark the third consecutive year of

earnings growth. However, tough seasonality in the fourth quarter

and faltering consumer confidence mainly in Europe, representing 6%

of Pool’s total sales are some causes of concern.

However, on a positive note, there are some commendable attributes

in the stock like efficient cost containment efforts, a steady

turnaround of the Green business, which was once struggling, and

market share gains. The increase in full-year guidance also

portrays the company’s inherent strength.

Pool, which competes with the likes of Johnson Outdoors

Inc. (JOUT), holds a Zacks #1 Rank

(short-term Strong Buy recommendation). We reiterate our long-term

Neutral recommendation on the stock.

JOHNSON OUTDOOR (JOUT): Free Stock Analysis Report

POOL CORP (POOL): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

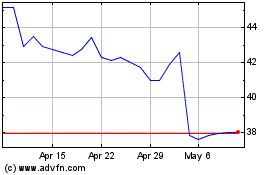

Johnson Outdoors (NASDAQ:JOUT)

Historical Stock Chart

From Jun 2024 to Jul 2024

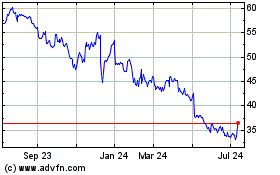

Johnson Outdoors (NASDAQ:JOUT)

Historical Stock Chart

From Jul 2023 to Jul 2024