Amended Statement of Ownership: Private Transaction (sc 13e3/a)

October 25 2019 - 11:47AM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 13E-3

(Amendment No. 3)

RULE 13E-3 TRANSACTION STATEMENT UNDER SECTION 13(E)

OF THE SECURITIES EXCHANGE ACT OF 1934

Isramco, Inc.

(NAME OF THE ISSUER)

Isramco, Inc.

Haim Tsuff

United Kingsway Ltd.

YHK General Manager Ltd.

YHK Investment LP

Equital, Ltd.

J.O.E.L. Jerusalem Oil Exploration Ltd.

Naphtha Israel Petroleum Corporation, Ltd.

Naphtha Holding Ltd.

I.O.C. - Israel Oil Company, Ltd.

(Names of Person(s) Filing Statement)

Common Stock, par value $0.01 per share

(Title of Class of Securities)

465141406

(CUSIP Number of Class of Securities)

|

Isramco, Inc.

Attn: Anthony James

1001 West Loop South, Suite 750

Houston, Texas 77027

United States of America

(713) 621-3882

|

|

Naphtha Israel Petroleum Corporation, Ltd.

Attn: Noa Lendner

8, Granit Street, P. O. Box 2695

Petach Tikva, 4951407

Israel

+972-3-922-9225

|

(Name, Address, and Telephone Numbers of Person Authorized to Receive Notices and Communications on Behalf of the Persons Filing Statement)

With copies to

|

Lior O. Nuchi

Norton Rose Fulbright US LLP

555 California Street

San Francisco, California 94104

(628) 231-6817

|

|

Andrew J. Ericksen

Baker Botts L.L.P.

910 Louisiana Street

Houston, Texas 77002

(713) 229-1234

|

This statement is filed in connection with (check the appropriate box):

|

|

|

|

|

|

|

a.

|

|

☒

|

|

The filing of solicitation materials or an information statement subject to Regulation 14A, Regulation 14C or Rule 13e-3(c) under the Securities Exchange Act of 1934.

|

|

|

|

|

|

b.

|

|

☐

|

|

The filing of a registration statement under the Securities Act of 1933.

|

|

|

|

|

|

c.

|

|

☐

|

|

A tender offer.

|

|

|

|

|

|

d.

|

|

☐

|

|

None of the above.

|

Check the following box if the soliciting materials or information statement referred to in checking box (a) are preliminary copies: ☐

Check the following box if the filing is a final amendment reporting the results of the transaction: ☒

Calculation of Filing Fee

|

Transaction valuation*

|

|

Amount of filing fee**

|

|

$96,528,903.40

|

|

$11,699.30

|

|

*

|

Calculated solely for determining the filing fee in accordance with Rule 0-11(b)(1) under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The transaction valuation was calculated by multiplying the 795,131 outstanding shares of Common Stock to which the transaction applies by the per share merger consideration of $121.40.

|

|

**

|

In accordance with Rule 0-11(b)(1) under the Exchange Act and Fee Rate Advisory No. 1 for Fiscal Year 2019, issued August 24, 2018, the filing fee of $11,699.30 was determined by multiplying 0.0001212 by the transaction valuation of $96,528,903.40.

|

|

☒

|

Check the box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing with which the offsetting fee was previously paid. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

Amount Previously Paid: $11,699.30

|

|

Filing Party: Isramco, Inc.

|

|

|

|

|

Form or Registration No.: Schedule 14A

|

|

Date Filed: August 1, 2019

|

Introduction

This Amendment No. 3 to Rule 13E-3 Transaction Statement on Schedule 13E-3 (as amended, this “Transaction Statement”) amends and supersedes the Rule 13E-3 Transaction Statement on Schedule 13E-3 originally filed on August 1, 2019, Amendment No. 1 thereto, filed on August 22, 2019 and Amendment No. 2 thereto, filed on September 6, 2019, which Transaction Statement, together with the exhibits hereto, is being filed with the Securities and Exchange Commission (the “SEC”) as a final amendment pursuant to Section 13(e) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), by: (i) Isramco, Inc., a Delaware corporation (the “Company”), and the issuer of the shares of common stock, par value $0.01 per share (the “Common Stock”) that are subject to the Rule 13e-3 transaction; (ii) Naphtha Israel Petroleum Corporation Ltd., an Israeli public company (“Naphtha”); (iii) Naphtha Holding Ltd, an Israeli private company and a direct wholly owned subsidiary of Naphtha (“NHL”); (iv) I.O.C. - Israel Oil Company, Ltd., an Israeli private company and a subsidiary of Naphtha (“Parent”); (v) J.O.E.L. Jerusalem Oil Exploration Ltd., an Israeli private company; (vi) Equital, Ltd., an Israeli public company; (vii) YHK Investment LP, an Israeli private limited partnership; (viii) YHK General Manager Ltd., an Israeli private company; (ix) United Kingsway Ltd., a private company formed under the laws of the Commonwealth of the Bahamas; and (x) Haim Tsuff, and individual. Collectively, the persons filing this Transaction Statement are referred to as the “filing persons.” Pursuant to the Merger (as defined below), Naphtha US Oil, Inc., a Delaware corporation and a direct wholly owned subsidiary of Parent (“Merger Sub” and, together with Naphtha, NHL and Parent, the “Purchaser Parties”), ceased to exist, and therefore, is no longer a filing person.

This Transaction Statement relates to the Agreement and Plan of Merger, dated May 20, 2019 (the “Merger Agreement”) by and among the Company and the Purchaser Parties providing that Merger Sub will be merged with and into the Company and each share of Common Stock outstanding at the effective time of the merger (other than certain shares as set forth in the Merger Agreement) will be cancelled and converted into the right to receive $121.40 in cash per share, without interest and less any applicable withholding taxes (the “Merger”).

On September 6, 2019, the Company filed with the SEC a definitive proxy statement (the “Definitive Proxy Statement”) under Regulation 14A of the Exchange Act, pursuant to which the Board of Directors of the Company solicited proxies from the stockholders of the Company in connection with the Merger.

The information set forth in the Definitive Proxy Statement, including all annexes thereto and information incorporated therein, is hereby incorporated herein by reference, and the responses to each such item in this Transaction Statement are qualified in its entirety by the information contained in the Definitive Proxy Statement and the annexes thereto.

This final amendment is being filed pursuant to Rule 13e-3(d)(3) to report the results of the transaction that is the subject of this Transaction Statement. All information set forth in this final amendment should be read in conjunction with the information contained or incorporated by reference in this Transaction Statement.

All information concerning the Company contained in, or incorporated by reference into, this Transaction Statement was supplied by the Company. Similarly, all information concerning each other filing person contained in, or incorporated by reference into, this Transaction Statement was supplied by such filing person.

|

Item 15.

|

Additional Information

|

Item 15(c) is hereby amended and supplemented as follows:

On October 22, 2019, at a special meeting of stockholders (the “Special Meeting”), the Company’s stockholders voted to approve the proposal to adopt the Merger Agreement by the affirmative vote of the holders of (a) a majority of the aggregate voting power of the issued and outstanding shares of Common Stock and (b) a majority of the outstanding shares of Common Stock not beneficially owned by the Purchaser Parties, any affiliate of the Purchaser Parties or any officer of the Company (determined in accordance with Section 16(a) of the Exchange Act).

On October 25, 2019, the Company filed a Certificate of Merger with the Secretary of State of the State of Delaware, pursuant to which Merger Sub was merged with and into the Company, with the Company as the surviving corporation. As a result of the Merger, the Company became an indirect wholly-owned subsidiary of Naphtha. At the effective time of the Merger, each share of Common Stock outstanding (other than certain shares as set forth in the Merger Agreement) was converted into the right to receive the merger consideration of $121.40 in cash, without interest and less any applicable withholding taxes.

As a result of the Merger, the Common Stock has ceased to trade on the NASDAQ Capital Market (“NASDAQ”) prior the open of trading on October 25, 2019 and became eligible for delisting from NASDAQ and termination of registration under the Exchange Act. The Company has requested that NASDAQ file with the SEC a Form 25 to remove the Common Stock from listing on the NASDAQ and to deregister the Common Stock pursuant to Section 12(b) of the Exchange Act. Additionally, the Company intends to file with the SEC a Form 15 requesting the termination of registration of the Common Stock under Section 12(g) of the Exchange Act and the suspension of the Company’s reporting obligations under Section 13 and 15(d) of the Exchange Act.

In addition, on October 25, 2019, the Company issued a press release announcing the consummation of the Merger and such press release is filed as Exhibit (a)(9) hereto.

Regulation M-A Item 1016

|

|

(c) (10)

|

Reserve Report, prepared by Netherland, Sewell & Associates, Inc., estimating the proved, probable, and possible reserves and future revenue, to the Isramco Negev 2 Limited Partnership working interest in certain gas properties located in Tamar and Tamar Southwest Fields, Tamar Lease I/12, offshore Israel, as of December 31, 2018. (incorporated herein by reference to Exhibit (c)(10) of the Original Transaction Statement).

|

|

|

(c) (11)

|

Reserve Report, prepared by Cawley, Gillespie & Associates, Inc., including estimates of proved developed producing reserves and forecasts of economics attributable to Isramco Energy, LLC, Isramco Resources, LLC, and Jay Petroleum, L.L.C., as of December 31, 2018 (filed as Exhibit 10.1 to Isramco, Inc.’s Current Report on Form 8-K, filed February 11, 2019 and incorporated herein by reference).

|

SIGNATURes

After due inquiry and to the best of each of the undersigned’s knowledge and belief, each of the undersigned certifies that the information set forth in this statement is true, complete and correct.

Dated: October 25, 2019

|

ISRAMCO, INC.

|

|

|

|

|

|

|

By:

|

|

/s/ Edy Francis

|

|

Name:

|

|

Edy Francis

|

|

Title:

|

|

Co-Chief Executive Officer / Chief

|

|

|

|

Financial Officer

|

|

|

|

|

|

By:

|

|

/s/ Anthony James

|

|

Name:

|

|

Anthony James

|

|

Title:

|

|

General Counsel and Corporate

|

|

|

|

Secretary

|

|

|

|

|

NAPHTHA ISRAEL PETROLEUM CORPORATION, LTD.

|

|

|

|

|

|

|

By:

|

|

/s/ Eran Saar

|

|

|

Name:

|

|

Eran Saar

|

|

|

Title:

|

|

Chief Executive Officer

|

|

|

|

|

|

|

|

By:

|

|

/s/ Noa Lendner

|

|

|

Name:

|

|

Noa Lendner

|

|

|

Title:

|

|

General Counsel

|

|

|

NAPHTHA HOLDING LTD.

|

|

|

|

|

|

|

By:

|

|

/s/ Eran Saar

|

|

|

Name:

|

|

Eran Saar

|

|

|

Title:

|

|

Chief Executive Officer

|

|

|

|

|

|

|

|

By:

|

|

/s/ Noa Lendner

|

|

|

Name:

|

|

Noa Lendner

|

|

|

Title:

|

|

General Counsel

|

|

|

I.O.C. - ISRAEL OIL COMPANY, LTD.

|

|

|

|

|

|

|

By:

|

|

/s/ Eran Saar

|

|

|

Name:

|

|

Eran Saar

|

|

|

Title:

|

|

Chief Executive Officer

|

|

|

|

|

|

|

|

By:

|

|

/s/ Noa Lendner

|

|

|

Name:

|

|

Noa Lendner

|

|

|

Title:

|

|

General Counsel

|

|

|

J.O.E.L. Jerusalem Oil Exploration Ltd.

|

|

|

|

|

|

|

By:

|

|

/s/ Eran Saar

|

|

|

Name:

|

|

Eran Saar

|

|

|

Title:

|

|

Chief Executive Officer

|

|

|

By:

|

|

/s/ Noa Lendner

|

|

|

Name:

|

|

Noa Lendner

|

|

|

Title:

|

|

General Counsel

|

|

|

EQUITAL, LTD.

|

|

|

|

|

|

|

By:

|

|

/s/ Eran Saar

|

|

|

Name:

|

|

Eran Saar

|

|

|

Title:

|

|

Chief Executive Officer

|

|

|

|

|

|

|

|

By:

|

|

/s/ Noa Lendner

|

|

|

Name:

|

|

Noa Lendner

|

|

|

Title:

|

|

General Counsel

|

|

|

|

|

|

YHK INVESTMENT LP

By: YHK GENERAL MANAGER LTD.,

its general partner

|

|

|

|

|

|

|

By:

|

|

/s/ Haim Tsuff

|

|

|

Name:

|

|

Haim Tsuff

|

|

|

Title:

|

|

Director

|

|

|

|

|

|

|

|

By:

|

|

/s/ Boaz Tsuff

|

|

|

Name:

|

|

Boaz Tsuff

|

|

|

Title:

|

|

Director

|

|

|

YHK GENERAL MANAGER LTD.

|

|

|

|

|

|

|

By:

|

|

/s/ Haim Tsuff

|

|

|

Name:

|

|

Haim Tsuff

|

|

|

Title:

|

|

Director

|

|

|

|

|

|

|

|

By:

|

|

/s/ Boaz Tsuff

|

|

|

Name:

|

|

Boaz Tsuff

|

|

|

Title:

|

|

Director

|

|

|

UNITED KINGSWAY LTD.

|

|

|

|

|

|

|

By:

|

|

/s/ Haim Tsuff

|

|

|

Name:

|

|

Haim Tsuff

|

|

|

Title:

|

|

Director

|

|

|

HAIM TSUFF

|

|

|

|

|

|

|

/s/ Haim Tsuff

|

|

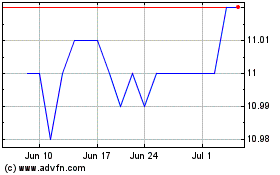

Israel Acquisitions (NASDAQ:ISRL)

Historical Stock Chart

From Apr 2024 to May 2024

Israel Acquisitions (NASDAQ:ISRL)

Historical Stock Chart

From May 2023 to May 2024